Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Trifena Akm2

Caricato da

Hasanah BalatifDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Trifena Akm2

Caricato da

Hasanah BalatifCopyright:

Formati disponibili

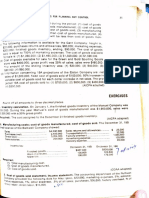

P9-1 (lcnrv) remmers company manufactures desks.

most of the company's desks are standard

models and are sold on the basis of catalog. at december 31, 2010, the following finished desks

appear in the company's inventory

finished desks a b c d

2010 catalog selling price $450 $480 $900 $1,050

fifo cost per inventory list 12/31/10 470 450 830 960

estimated cost to complete and sell 50 110 260 200

2011 catalog selling price 500 540 900 1,200

the 2010 catalog was in effect through november 2010 and the 2011 catalog is effective as of

december 1, 2010. all catalog prices are net of the usual discounts.

instructions

at what amount should each of the four desks appear in the company's december 31, 2010,

inventory, assuming that the company has adopted a lower-of-fifo-cost-or-net realizable value

approach for valuation of inventories on an individual-item basis?

p9-2 (lcnrv) garcia home improvement company installs replacement siding, windows, and

louvered glass doors for single family homes and condominium complexes in nortthern new

jersey and southern new york. the company is in the process of preparing its annual financial

statements for the fiscal year ended may 31, 2010, and jim alcide, controller for garcia, has

gathered the following data concerning inventory.

at may 31, 2010, the balance in garcia's raw material inventory account was $408,000, and

the allowance to reduce inventory to nrv had a credit balance of $27,500. alcide summarized the

relevant inventory cost and market data at may 31, 2010, in the schedule below.

alcide assigned patricia devereaux, an intern from a local college, the task of calculating

the amount that should appear on garcia's may 31, 2010, financial statements for inventory

under the lcnrv rule as applied to each item in inventory. devereaux expressed concern over

departing from the cost principle.

cost sales price net realizable

value

alumunium siding $ 70.000 $ 64,000 $ 56,000

cedar shake siding 86.000 94,000 84,800

louvered glass doors 112.000 186,400 168,300

thermal windows 140,000 154,800 140,000

total $408,000 $499,200 $449,100

inscructions

(a) (1) determine the balance in the allowance to reduce inventory to net realizable value at

may, 31, 2010.

(2) for the fiscal year ended may 31, 2010, determine the amount of the gain or loss that

would be recorded (using the loss method) due to the change in the allowance to reduce

inventory to net realizable value.

(b) explain the rationale for the use of the lcnrv rule as it applies to inventories.

prepare a schedule computing the amount of inventory fire loss. the supporting schedule of the

computation of the gross profit should be in good form.

p9-7 (retail inventory method) the records for the clothing department of wei's discount store

are summarized below for the month of january (000 omitted).

inventory january 1 : at retail hk$25,000; at cost hk$17,000

purchase in january : at retail hk$137,000; at cost hk$82,500

freight-in : hk$7,000

purchase returns : at retail hk$3,000; at cost hk$2,300

transfers in from suburban branch : at retail hk$13,000; at cost

hk$9,200

net markups : hk$8,000

net markdowns : hk$4,000

inventory losses due to normal breakage, etc : at retail hk$400

sales at retail : hk$95,000

sales returns : hk$2,400

instructions

(a) compute the inventory for this department as of january 31, at retail prices.

(b) compute the ending inventory using lower-of-average-cost-or-net realizable value.

p9-8 (retail inventory method) presented below is information related to waveland inc.

cost retail

inventory, 12/31/10 $250,000 $ 390.000

purchases 914,500 1,460,000

purchase returns 60,000 80,000

purchase discounts 18,000 -

gross sales - 1,410,000

sales returns - 97,500

markups - 120,000

markup cancellations - 40,000

markdowns - 45,000

markup cancellations - 20,000

freight-in 42,000 -

employee discounts granted - 8,000

loss from breakage (normal) - 4,500

instrctions

assuming that waveland inc, uses the conventional retail inventory method, compute the cost of

its ending inventory at december 31, 2011.

Potrebbero piacerti anche

- Ch9 ExercisesDocumento15 pagineCh9 ExercisesMarshanda BerliantiNessuna valutazione finora

- 8-Inventory EstimationDocumento5 pagine8-Inventory EstimationYulrir Alesteyr HiroshiNessuna valutazione finora

- Assigment Accounting Meeting 11Documento22 pagineAssigment Accounting Meeting 11cecilia angelNessuna valutazione finora

- Assignment InventoriesDocumento7 pagineAssignment InventoriesKristine TiuNessuna valutazione finora

- 9 Stock ValuationDocumento15 pagine9 Stock ValuationDayaan ANessuna valutazione finora

- P6-10A Compute Gross Profit Rate and Inventory Loss Using Gross Profit MethodDocumento4 pagineP6-10A Compute Gross Profit Rate and Inventory Loss Using Gross Profit MethodMellaniNessuna valutazione finora

- E8-29 Segmented Income Statement: Conceptual ConnectionDocumento5 pagineE8-29 Segmented Income Statement: Conceptual ConnectionDhiva Rianitha Manurung100% (1)

- Nama: Christian Candra Wijaya NIM: F0321067 Kelas: C: InstructionsDocumento6 pagineNama: Christian Candra Wijaya NIM: F0321067 Kelas: C: InstructionswijayaNessuna valutazione finora

- Chapter 7 Extra Questions & SolutionsDocumento8 pagineChapter 7 Extra Questions & Solutionsandrew.yerokhin1Nessuna valutazione finora

- Financial Control - 2 - Variances - Additional Exercises With SolutionDocumento9 pagineFinancial Control - 2 - Variances - Additional Exercises With SolutionQuang Nhựt100% (1)

- AC and VC Plus CVPDocumento6 pagineAC and VC Plus CVPEunice CoronadoNessuna valutazione finora

- E6.21 - Determine Ending Inventory at Cost Using Retail MethodDocumento15 pagineE6.21 - Determine Ending Inventory at Cost Using Retail MethodWita SaraswatiNessuna valutazione finora

- ACG016 Variable CostingDocumento5 pagineACG016 Variable CostingMicay FuensalidaNessuna valutazione finora

- Inventory (Questions) : Question No. H-1Documento4 pagineInventory (Questions) : Question No. H-1manadish nawazNessuna valutazione finora

- Basic Inventory CalculationsDocumento4 pagineBasic Inventory CalculationsLongtan JingNessuna valutazione finora

- ACCTDocumento23 pagineACCTLê Việt HoàngNessuna valutazione finora

- Dari GoogleDocumento6 pagineDari Googleabc defNessuna valutazione finora

- Chapter 8 Inventory EstimationDocumento5 pagineChapter 8 Inventory EstimationJharam TolentinoNessuna valutazione finora

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocumento2 pagineExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNessuna valutazione finora

- Company: ManufacturingDocumento8 pagineCompany: Manufacturingzain khalidNessuna valutazione finora

- ACC 301 CH 9 NO AnswersDocumento6 pagineACC 301 CH 9 NO AnswersCarl Angelo0% (1)

- Intermediate Accounting 1 - Meeting 2 (Answers Sheets)Documento4 pagineIntermediate Accounting 1 - Meeting 2 (Answers Sheets)WILLIAM CHANDRANessuna valutazione finora

- Module 8 - Inventory EstimationDocumento10 pagineModule 8 - Inventory Estimationmarvy AndayaNessuna valutazione finora

- Chapter 4Documento8 pagineChapter 4Châu Ánh ViNessuna valutazione finora

- Cpa Review School of The Philippines Mani LaDocumento2 pagineCpa Review School of The Philippines Mani LaGuinevereNessuna valutazione finora

- FA2 Inventories - QDocumento8 pagineFA2 Inventories - Qmiss ainaNessuna valutazione finora

- Chapter 23 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesDocumento3 pagineChapter 23 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesTien Thanh DangNessuna valutazione finora

- Ia 450 455Documento6 pagineIa 450 455Christine HingcoNessuna valutazione finora

- Exercise5 With SolutionDocumento5 pagineExercise5 With SolutionRexmar Christian Bernardo71% (7)

- Inventory With SolutionDocumento11 pagineInventory With SolutionjjabarquezNessuna valutazione finora

- Prob9 4 PDFDocumento1 paginaProb9 4 PDFirma cahyani kawiNessuna valutazione finora

- Ch09 Inventories - Additional Valuation IssuesDocumento31 pagineCh09 Inventories - Additional Valuation IssuesNela Nafaza100% (1)

- Final ExamDocumento5 pagineFinal ExamMishalm96Nessuna valutazione finora

- Cost Ass 3Documento1 paginaCost Ass 3Adugna MegenasaNessuna valutazione finora

- Income Statement & Closing Entries ProblemDocumento1 paginaIncome Statement & Closing Entries ProblemLiwliwa BrunoNessuna valutazione finora

- Retail Method: Problem 20-1 (AICPA Adapted)Documento9 pagineRetail Method: Problem 20-1 (AICPA Adapted)Anne EstrellaNessuna valutazione finora

- 04 Inventory EstimationDocumento5 pagine04 Inventory EstimationWinnie ToribioNessuna valutazione finora

- Chapter 31 - Lower of Cost and Net Realizable Value: Purchase CommitmentDocumento21 pagineChapter 31 - Lower of Cost and Net Realizable Value: Purchase CommitmentKimberly Claire Atienza100% (5)

- Chapter 7 Practice QuestionsDocumento12 pagineChapter 7 Practice QuestionsZethu JoeNessuna valutazione finora

- Sol Invty I ActivitiesDocumento13 pagineSol Invty I ActivitiesKelsey VersaceNessuna valutazione finora

- Manual Solution CH 9Documento6 pagineManual Solution CH 9Biem PrimaNessuna valutazione finora

- Account For Home Office and Branch Transactions. ProblemDocumento2 pagineAccount For Home Office and Branch Transactions. ProblemDevine Grace A. MaghinayNessuna valutazione finora

- ABC Practice Question 2 With SolutionDocumento5 pagineABC Practice Question 2 With SolutionBennie KingNessuna valutazione finora

- Chapter 9Documento6 pagineChapter 9Khoa VoNessuna valutazione finora

- Practice Questions Inventories # 2Documento4 paginePractice Questions Inventories # 2IzzahIkramIllahiNessuna valutazione finora

- Chapter 7 ExtraDocumento8 pagineChapter 7 ExtraMai Lâm LêNessuna valutazione finora

- IAS-2 Inventories-StudentsDocumento8 pagineIAS-2 Inventories-StudentsButt ArhamNessuna valutazione finora

- Exercise of VariableDocumento10 pagineExercise of VariableAqoon Kaab ChannelNessuna valutazione finora

- Assignment On LCNRV and GP MethodDocumento6 pagineAssignment On LCNRV and GP MethodAdam CuencaNessuna valutazione finora

- Cost of Goods Available For SaleDocumento4 pagineCost of Goods Available For SaleColeen RamosNessuna valutazione finora

- Chapter 12 Lower Cost and Net Realizable ValueDocumento13 pagineChapter 12 Lower Cost and Net Realizable ValueRNessuna valutazione finora

- Hà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICEDocumento7 pagineHà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICE31231020411Nessuna valutazione finora

- Chapter 7 Problems PDFDocumento18 pagineChapter 7 Problems PDFArham Sheikh100% (1)

- Nudjpia Far and Afar Solutions - InventoriesDocumento6 pagineNudjpia Far and Afar Solutions - InventoriesKyla Artuz Dela CruzNessuna valutazione finora

- Pengantar Akutansi Bab5Documento7 paginePengantar Akutansi Bab5Titus SitorusNessuna valutazione finora

- Examples FMA - 5Documento10 pagineExamples FMA - 5DaddyNessuna valutazione finora

- Intacc Cash Flow SolutionDocumento3 pagineIntacc Cash Flow SolutionMila MercadoNessuna valutazione finora

- Inventories and Related Expenses: Multiple Choice - TheoryDocumento14 pagineInventories and Related Expenses: Multiple Choice - TheoryMadielyn Santarin MirandaNessuna valutazione finora

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocumento5 pagineSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aYamateNessuna valutazione finora

- The Investment Detective PDFDocumento2 pagineThe Investment Detective PDFAroosa KhawajaNessuna valutazione finora

- DUBAI BusinessDocumento34 pagineDUBAI BusinessHassan Md RabiulNessuna valutazione finora

- POITRAS EarlyExercisePremiumAmericanCurrencyOptionsDocumento23 paginePOITRAS EarlyExercisePremiumAmericanCurrencyOptionsLameuneNessuna valutazione finora

- Revival Investments & Financial Solutions v1Documento13 pagineRevival Investments & Financial Solutions v1robitrevivalNessuna valutazione finora

- Sambhavi's Project WorkDocumento81 pagineSambhavi's Project WorkPriti SahayNessuna valutazione finora

- LN-Session 2-Chapter 3-How Securities Are TradedDocumento72 pagineLN-Session 2-Chapter 3-How Securities Are Tradedchaudhari vishalNessuna valutazione finora

- Port PricingDocumento6 paginePort PricingMahin1977Nessuna valutazione finora

- Laurence Connors - Bollinger Bands Trading Strategies That WorkDocumento32 pagineLaurence Connors - Bollinger Bands Trading Strategies That Work3dvg 10% (1)

- WP Stock Market WorthDocumento5 pagineWP Stock Market WorthGeorge AllenNessuna valutazione finora

- Valu TraderDocumento16 pagineValu TraderRichard SuttmeierNessuna valutazione finora

- Debreifing HDFC BankDocumento8 pagineDebreifing HDFC BankTanvi RastogiNessuna valutazione finora

- A Wealth Management Course - : Tailor - Made For Your AmbitionsDocumento14 pagineA Wealth Management Course - : Tailor - Made For Your AmbitionsDipak C BangarNessuna valutazione finora

- Financial ManagementDocumento24 pagineFinancial ManagementozalmistryNessuna valutazione finora

- Malaysian TextileDocumento28 pagineMalaysian TextileDato NJNessuna valutazione finora

- Nirakka 2Documento9 pagineNirakka 2莫愁Nessuna valutazione finora

- CapitalGain Summary Report - 1658151067650 - 11Documento1 paginaCapitalGain Summary Report - 1658151067650 - 11honey mittalNessuna valutazione finora

- Shift The Narrative by Russell RedenbaughDocumento1 paginaShift The Narrative by Russell RedenbaughEddie Vigil VNessuna valutazione finora

- Finland Tax SystemDocumento4 pagineFinland Tax SystemHitesh ChintuNessuna valutazione finora

- Project Final SwatiDocumento78 pagineProject Final SwatiSarah MitchellNessuna valutazione finora

- Audit Planning and Analytical ProceduresDocumento47 pagineAudit Planning and Analytical Procedureselvi1Nessuna valutazione finora

- FT Annual - Report - 2016Documento120 pagineFT Annual - Report - 2016Meruţ ŞtefanNessuna valutazione finora

- 20 Tips - How To Top The Real Estate Brokers' Licensure ExamDocumento7 pagine20 Tips - How To Top The Real Estate Brokers' Licensure ExamhannaNessuna valutazione finora

- Assignment Financial Market Regulations: Mdu-CpasDocumento10 pagineAssignment Financial Market Regulations: Mdu-CpasTanuNessuna valutazione finora

- Retail Research: Systematic Investment Plan in Hybrid - Equity Oriented Funds vs. Recurring DepositDocumento3 pagineRetail Research: Systematic Investment Plan in Hybrid - Equity Oriented Funds vs. Recurring DepositDhuraivel GunasekaranNessuna valutazione finora

- Corporate Valuation - 16th October 2021Documento2 pagineCorporate Valuation - 16th October 2021Shivam ChoudharyNessuna valutazione finora

- Alasdair Macleod Sound Money 555Documento5 pagineAlasdair Macleod Sound Money 555Kevin CreaseyNessuna valutazione finora

- Transaction Cycle and Substantive TestingDocumento5 pagineTransaction Cycle and Substantive TestingZaira PangesfanNessuna valutazione finora

- Dieckmann's Solar Photovoltaic Calculation ModelDocumento2 pagineDieckmann's Solar Photovoltaic Calculation ModelRafyss RodriguezNessuna valutazione finora

- Examination Prep Guide: Certified Treasury ProfessionalDocumento24 pagineExamination Prep Guide: Certified Treasury ProfessionalmanishaNessuna valutazione finora

- Rahul Shah 21bsp3195Documento24 pagineRahul Shah 21bsp3195Charvi GosaiNessuna valutazione finora