Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fs SP 500 Top 50

Caricato da

Terence LaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fs SP 500 Top 50

Caricato da

Terence LaCopyright:

Formati disponibili

Equity

S&P 500 TOP 50

Description

The S&P 500 Top 50 consists of 50 of the largest companies from the S&P 500, reflecting U.S. mega-cap performance. Index

constituents are weighted by float-adjusted market capitalization.

Quick Facts

WEIGHTING METHOD Annually

REBALANCING FREQUENCY Float-adjusted market cap weighted

CALCULATION FREQUENCY Real time

CALCULATION CURRENCIES USD

LAUNCH DATE November 30, 2015

FIRST VALUE DATE June 30, 2005

For more information, including the complete methodology document, please visit:

http://www.spindices.com/indices/equity/sp-500-top-50

All information for an index prior to its Launch Date is back-tested, based on the methodology that was in effect on the Launch Date. Back-tested performance, which is

hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index methodology and selection of index constituents in

hindsight. No theoretical approach can take into account all of the factors in the markets in general and the impact of decisions that might have been made during the actual

operation of an index. Actual returns may differ from, and be lower than, back-tested returns.

Historical Performance

Static text

S&P 500 Top 50

AS OF OCTOBER 31, 2017 spdji.com index_services@spglobal.com

Equity

S&P 500 TOP 50

Performance

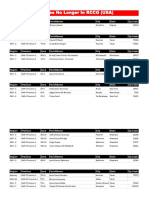

INDEX LEVEL RETURNS ANNUALIZED RETURNS

1 MO 3 MOS YTD 1 YR 3 YRS 5 YRS 10 YRS

TOTAL RETURNS

2,728.25 2.87% 5.50% 18.28% 24.72% 11.54% 14.67% 7.29%

PRICE RETURNS

2,033.54 2.74% 4.94% 16.20% 21.97% 8.99% 12.01% 4.73%

NET TOTAL RETURNS

2,498.04 2.83% 5.33% 17.65% 23.89% 10.77% 13.87% 6.52%

Calendar Year Performance

2016 2015 2014 2013 2012 2011 2010 2009 2008 2007

TOTAL RETURNS

11.29% 4.21% 12.25% 29.09% 15.95% 4.86% 10.91% 19.95% -34.03% 5.40%

PRICE RETURNS

8.68% 1.80% 9.68% 26.02% 13.09% 2.40% 8.42% 16.80% -35.82% 3.05%

NET TOTAL RETURNS

10.50% 3.48% 11.48% 28.16% 15.08% 4.12% 10.16% 19.00% -34.57% 4.69%

Risk

ANNUALIZED RISK ANNUALIZED RISK-ADJUSTED RETURNS

3 YRS 5 YRS 10 YRS 3 YRS 5 YRS 10 YRS

STD DEV

10.58% 9.66% 14.27% 1.09 1.52 0.51

Risk is defined as standard deviation calculated based on total returns using monthly values.

Fundamentals

P/E (TRAILING) P/E (PROJECTED) P/B INDICATED DIV YIELD P/SALES P/CASH FLOW

21.25 18.43 3.38 2.09% 2.71 22.10

P/E (Projected) and Dividend Yield are as of October 31, 2017; P/E (Trailing), P/B, P/Sales, and P/Cash Flow are as of June 30, 2017. Fundamentals are updated on

approximately the fifth business day of each month.

AS OF OCTOBER 31, 2017 spdji.com index_services@spglobal.com

Equity

S&P 500 TOP 50

Index Characteristics

NUMBER OF CONSTITUENTS 51

CONSTITUENT MARKET [USD MILLION]

MEAN TOTAL MARKET CAP 221,279.57

LARGEST TOTAL MARKET CAP 873,130.14

SMALLEST TOTAL MARKET CAP 78,993.98

MEDIAN TOTAL MARKET CAP 174,544.19

WEIGHT LARGEST CONSTITUENT [%] 8.1

WEIGHT TOP 10 CONSTITUENTS [%] 41.3

ESG Characteristics

CARBON FOOTPRINT (METRIC TONS CO2e/$1M INVESTED)* 45.52

CARBON EFFICIENCY (METRIC TONS CO2e/$1M REVENUES)* 153.46

FOSSIL FUEL RESERVE EMISSIONS (METRIC TONS CO2/$1M INVESTED) 968.03

*Operational and first-tier supply chain greenhouse gas emissions.

For more information, please visit: www.spdji.com/esg-metrics.

Top 10 Constituents By Index Weight

CONSTITUENT SYMBOL SECTOR*

Apple Inc. AAPL Information Technology

Microsoft Corp MSFT Information Technology

Amazon.com Inc AMZN Consumer Discretionary

Facebook Inc A FB Information Technology

Johnson & Johnson JNJ Health Care

Berkshire Hathaway B BRK.B Financials

JP Morgan Chase & Co JPM Financials

Exxon Mobil Corp XOM Energy

Alphabet Inc A GOOGL Information Technology

Alphabet Inc C GOOG Information Technology

*Based on GICS sectors

AS OF OCTOBER 31, 2017 spdji.com index_services@spglobal.com

Equity

S&P 500 TOP 50

Sector* Breakdown

*Based on GICS sectors

The weightings for each sector of the index are rounded to the nearest tenth of a percent; therefore, the aggregate weights for the index may not equal 100%.

Country Breakdown

COUNTRY NUMBER OF CONSTITUENTS TOTAL MARKET CAP [USD MILLION] INDEX WEIGHT [%]

United States 51 11,285,258.16 100.0

Based on index constituents country of domicile.

Tickers

TICKER REUTERS

PRICE RETURNS N/A .SP5T5

TOTAL RETURNS N/A .SP5T5T

Static text

Related Products

This list includes investable products traded on certain exchanges currently linked to this selection of indices. While we have tried

to include all such products, we do not guarantee the completeness or accuracy of such lists. Please refer to the disclaimers at the

end of this document or here for more information about S&P Dow Jones Indices' relationship to such third party product offerings.

PRODUCT NAME PRODUCT TYPE EXCHANGE TICKER

Guggenheim S&P 500 Top 50 ETF ETF NYSE Arca XLG

AS OF OCTOBER 31, 2017 spdji.com index_services@spglobal.com

Equity

S&P 500 TOP 50

CONTACT US

spdji.com New York Dubai Tokyo

index_services@spglobal.com 1 212 438 7354 971 (0)4 371 7131 81 3 4550 8564

1 877 325 5415

S&P Dow Jones Custom Indices

Mexico City Beijing Sydney

customindices@spglobal.com

52 (55) 1037 5290 86.10.6569.2770 61 2 9255 9802

London Hong Kong

44 207 176 8888 852 2532 8000

DISCLAIMER

Source: S&P Dow Jones Indices LLC, a division of S&P Global.

The launch date of the S&P 500 Top 50 was November 30, 2015.

All information presented prior to the index launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations

are based on the same methodology that was in effect when the index was officially launched. Past performance is not an indication or guarantee of future results. Please

see the Performance Disclosure at http://www.spindices.com/regulatory-affairs-disclaimers/ for more information regarding the inherent limitations associated with back-

tested performance.

Copyright 2017 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written

permission. STANDARD & POORS and S&P are registered trademarks of Standard & Poors Financial Services LLC, a division of S&P Global (S&P); DOW JONES is a

registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC. S&P Dow Jones

Indices LLC, Dow Jones, S&P and their respective affiliates (S&P Dow Jones Indices) and third party licensors makes no representation or warranty, express or implied, as

to the ability of any index to accurately represent the asset class or market sector that it purports to represent and S&P Dow Jones Indices and its third party licensors shall

have no liability for any errors, omissions, or interruptions of any index or the data included therein. Past performance of an index is not an indication or guarantee of future

results. This document does not constitute an offer of any services. Except for certain custom index calculation services, all information provided by S&P Dow Jones Indices

is general in nature and not tailored to the needs of any person, entity or group of persons. S&P Dow Jones Indices receives compensation in connection with licensing its

indices to third parties and providing custom calculation services. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be

available through investable instruments offered by third parties that are based on that index. S&P Dow Jones Indices does not sponsor, endorse, sell, promote or manage

any investment fund or other investment product or vehicle that seeks to provide an investment return based on the performance of any Index. S&P Dow Jones Indices LLC is

not an investment or tax advisor. S&P Dow Jones Indices makes no representation regarding the advisability of investing in any such investment fund or other investment

product or vehicle. A tax advisor should be consulted to evaluate the impact of any tax-exempt securities on portfolios and the tax consequences of making any particular

investment decision. Credit-related information and other analyses, including ratings, are generally provided by licensors and/or affiliates of S&P Dow Jones Indices. Any

credit-related information and other related analyses and statements are opinions as of the date they are expressed and are not statements of fact. S&P Dow Jones Indices

LLC is analytically separate and independent from any other analytical department. For more information on any of our indices please visit www.spdji.com.

AS OF OCTOBER 31, 2017 spdji.com index_services@spglobal.com

Potrebbero piacerti anche

- Cheat Sheet CARDS PUADocumento2 pagineCheat Sheet CARDS PUAmstags75% (12)

- Abramson, Glenda (Ed.) - Oxford Book of Hebrew Short Stories (Oxford, 1996) PDFDocumento424 pagineAbramson, Glenda (Ed.) - Oxford Book of Hebrew Short Stories (Oxford, 1996) PDFptalus100% (2)

- Immediate Life Support PDFDocumento128 pagineImmediate Life Support PDFShilin-Kamalei Llewelyn100% (2)

- 360-Degree FeedbackDocumento24 pagine360-Degree Feedbackanhquanpc100% (1)

- 2017 - The Science and Technology of Flexible PackagingDocumento1 pagina2017 - The Science and Technology of Flexible PackagingDaryl ChianNessuna valutazione finora

- Theo Hermans (Cáp. 3)Documento3 pagineTheo Hermans (Cáp. 3)cookinglike100% (1)

- Europe Landmarks Reading Comprehension Activity - Ver - 1Documento12 pagineEurope Landmarks Reading Comprehension Activity - Ver - 1Plamenna Pavlova100% (1)

- Fs SP 500 PDFDocumento9 pagineFs SP 500 PDFSajad AhmadNessuna valutazione finora

- Fs SP 500Documento7 pagineFs SP 500sohbifayrouzNessuna valutazione finora

- Fs SP 500 PDFDocumento8 pagineFs SP 500 PDFAndrés EscobarNessuna valutazione finora

- S&P 500 FactsheetDocumento8 pagineS&P 500 FactsheetSurre BankéNessuna valutazione finora

- Description: S&P 500 Dividend and Free Cash Flow Yield IndexDocumento6 pagineDescription: S&P 500 Dividend and Free Cash Flow Yield IndexKOMATSU SHOVELNessuna valutazione finora

- Fs SP 2Documento13 pagineFs SP 2FuboNessuna valutazione finora

- Fs SP TSX 60 IndexDocumento7 pagineFs SP TSX 60 Indexjaya148kurupNessuna valutazione finora

- Description: S&P BSE 100Documento5 pagineDescription: S&P BSE 100deepak sadanandanNessuna valutazione finora

- Fs SP 500 GrowthDocumento7 pagineFs SP 500 GrowthDynand PLNNessuna valutazione finora

- Fs SP 500 Financials SectorDocumento7 pagineFs SP 500 Financials SectorJeffrey NguyenNessuna valutazione finora

- Fs SP 500 CadDocumento7 pagineFs SP 500 Cadalt.sa-33bwuogNessuna valutazione finora

- Fs SP TSX Composite IndexDocumento6 pagineFs SP TSX Composite Indexalt.sa-33bwuogNessuna valutazione finora

- Description: S&P Biotechnology Select Industry IndexDocumento7 pagineDescription: S&P Biotechnology Select Industry IndexRandom LifeNessuna valutazione finora

- Fs SP TSX Composite Index UsdDocumento6 pagineFs SP TSX Composite Index Usdjaya148kurupNessuna valutazione finora

- Trade Chart Patterns Like The Pros026Documento64 pagineTrade Chart Patterns Like The Pros026VERO NICANessuna valutazione finora

- Description: S&P Bse TeckDocumento5 pagineDescription: S&P Bse TeckNeelkanth DaveNessuna valutazione finora

- Trade Chart Patterns Like The Pros025Documento61 pagineTrade Chart Patterns Like The Pros025VERO NICANessuna valutazione finora

- Description: S&P 500 Dividend AristocratsDocumento7 pagineDescription: S&P 500 Dividend AristocratsCalvin YeohNessuna valutazione finora

- Description: S&P/Asx All Technology IndexDocumento6 pagineDescription: S&P/Asx All Technology IndexSuhasNessuna valutazione finora

- Fs SP Bse Capital GoodsDocumento5 pagineFs SP Bse Capital GoodsyaarthNessuna valutazione finora

- Fs SP 500Documento13 pagineFs SP 500AbudNessuna valutazione finora

- Fs SP Bse MidcapDocumento7 pagineFs SP Bse MidcapRavishankarNessuna valutazione finora

- Fs SP Pan Arab CompositeDocumento6 pagineFs SP Pan Arab CompositeMarNessuna valutazione finora

- Description: S&P/BMV Mining & Agriculture IndexDocumento5 pagineDescription: S&P/BMV Mining & Agriculture Indextmayur21Nessuna valutazione finora

- Description: S&P Retail Select Industry IndexDocumento7 pagineDescription: S&P Retail Select Industry IndexAndrew KimNessuna valutazione finora

- Fs SP Uk Investment Grade Corporate Bond IndexDocumento4 pagineFs SP Uk Investment Grade Corporate Bond IndexAlokNessuna valutazione finora

- Fs SP 500Documento13 pagineFs SP 500alt.sa-33bwuogNessuna valutazione finora

- Fs SP 500 Industrials SectorDocumento6 pagineFs SP 500 Industrials SectorLuella LukenNessuna valutazione finora

- Fs SP Bse Sensex 50Documento5 pagineFs SP Bse Sensex 50Samriddh DhareshwarNessuna valutazione finora

- Trade Chart Patterns Like The Pros024Documento56 pagineTrade Chart Patterns Like The Pros024VERO NICANessuna valutazione finora

- Fs SP Global 1200Documento8 pagineFs SP Global 1200prathap.hcuNessuna valutazione finora

- Fs Dow Jones Us Completion Total Stock Market IndexDocumento6 pagineFs Dow Jones Us Completion Total Stock Market IndexparaoaltoeavanteNessuna valutazione finora

- Description: S&P/BMV Commercial Services IndexDocumento5 pagineDescription: S&P/BMV Commercial Services Indextmayur21Nessuna valutazione finora

- Fs SP 500 Information Technology SectorDocumento8 pagineFs SP 500 Information Technology SectorAbudNessuna valutazione finora

- Fs Dow Jones Us Basic Materials IndexDocumento5 pagineFs Dow Jones Us Basic Materials Indexsilva.mathew29Nessuna valutazione finora

- Fs SP Smallcap 600 Equal Weighted IndexDocumento5 pagineFs SP Smallcap 600 Equal Weighted Indexchintu2005Nessuna valutazione finora

- Fs SP 500 Shariah IndexDocumento8 pagineFs SP 500 Shariah IndexJimot DLangapaNessuna valutazione finora

- Description: S&P/BMV Total Mexico Esg Index (MXN)Documento7 pagineDescription: S&P/BMV Total Mexico Esg Index (MXN)tmayur21Nessuna valutazione finora

- Description: S&P Bse Financials Ex-Banks 30 IndexDocumento6 pagineDescription: S&P Bse Financials Ex-Banks 30 IndexKamal joshiNessuna valutazione finora

- Fs SP Bse Low Volatility IndexDocumento5 pagineFs SP Bse Low Volatility Indexd.a.m.ari.onjua.re.z5.98Nessuna valutazione finora

- Fs SP Bric 40 IndexDocumento7 pagineFs SP Bric 40 IndexHARSH KATARE MA ECO KOL 2021-23Nessuna valutazione finora

- Description: S&P/BMV Mexico-Brazil IndexDocumento6 pagineDescription: S&P/BMV Mexico-Brazil Indextmayur21Nessuna valutazione finora

- Fs SP Epac Largemidcap UsdDocumento7 pagineFs SP Epac Largemidcap UsdNguoi KoNessuna valutazione finora

- Fs Dow Jones Sustainability World IndexDocumento7 pagineFs Dow Jones Sustainability World IndexDhanrajPatelNessuna valutazione finora

- Fs SP Asx 200 Utilities SectorDocumento5 pagineFs SP Asx 200 Utilities SectorRaymond LauNessuna valutazione finora

- Fs Dow Jones Us Total Stock Market IndexDocumento6 pagineFs Dow Jones Us Total Stock Market IndexAK LHNessuna valutazione finora

- Fs SP Bse Momentum IndexDocumento5 pagineFs SP Bse Momentum Indexpriya.sunderNessuna valutazione finora

- Fs SP BMV Construction IndexDocumento6 pagineFs SP BMV Construction Indextmayur21Nessuna valutazione finora

- Description: S&P Cryptocurrency Largecap IndexDocumento5 pagineDescription: S&P Cryptocurrency Largecap IndexAJ MagtotoNessuna valutazione finora

- Fs Dow Jones Islamic Market World IndexDocumento8 pagineFs Dow Jones Islamic Market World IndexOğuzhan ÖzçelebiNessuna valutazione finora

- Description: S&P/BMV Retail & Distributors IndexDocumento6 pagineDescription: S&P/BMV Retail & Distributors Indextmayur21Nessuna valutazione finora

- Fs Dow Jones Us High Beta IndexDocumento6 pagineFs Dow Jones Us High Beta IndexishaanNessuna valutazione finora

- Fs Dow Jones Us Semiconductors IndexDocumento5 pagineFs Dow Jones Us Semiconductors IndexRakesh SNessuna valutazione finora

- Fs Energy Select Sector IndexDocumento7 pagineFs Energy Select Sector IndexdanieldebestNessuna valutazione finora

- Ebay PPDocumento33 pagineEbay PPsinghsarabjeetNessuna valutazione finora

- Fs SP Composite 1500 Industrials SectorDocumento7 pagineFs SP Composite 1500 Industrials SectorcocololoNessuna valutazione finora

- Fs SP Equity Commodity Energy IndexDocumento4 pagineFs SP Equity Commodity Energy Indexinezpt29Nessuna valutazione finora

- Fact SheetDocumento4 pagineFact SheetmacondocococoocNessuna valutazione finora

- Fs SP Us Treasury Principal Strips IndexDocumento5 pagineFs SP Us Treasury Principal Strips IndexMbusoThabetheNessuna valutazione finora

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosDa EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNessuna valutazione finora

- CMO Spend 2019 2020 ResearchDocumento34 pagineCMO Spend 2019 2020 ResearchTerence LaNessuna valutazione finora

- 2017 ConeCSRReportDocumento21 pagine2017 ConeCSRReportTerence LaNessuna valutazione finora

- Dashboard Factor 2016 q3Documento9 pagineDashboard Factor 2016 q3Terence LaNessuna valutazione finora

- The Great Book of Best Quotes of All Time. - OriginalDocumento204 pagineThe Great Book of Best Quotes of All Time. - OriginalAbhi Sharma100% (3)

- ZF - CH Text Escaping The Identity TrapDocumento2 pagineZF - CH Text Escaping The Identity TrapTerence LaNessuna valutazione finora

- Undertaking:-: Prime Membership Application Form (Fill With All Capital Letters)Documento3 pagineUndertaking:-: Prime Membership Application Form (Fill With All Capital Letters)Anuj ManglaNessuna valutazione finora

- Personal Training Program Design Using FITT PrincipleDocumento1 paginaPersonal Training Program Design Using FITT PrincipleDan DanNessuna valutazione finora

- Test 1Documento9 pagineTest 1thu trầnNessuna valutazione finora

- MC Donald'sDocumento30 pagineMC Donald'sAbdullahWaliNessuna valutazione finora

- Formal Letter Format Sample To Whom It May ConcernDocumento6 pagineFormal Letter Format Sample To Whom It May Concernoyutlormd100% (1)

- DLP No. 10 - Literary and Academic WritingDocumento2 pagineDLP No. 10 - Literary and Academic WritingPam Lordan83% (12)

- Introduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTDocumento27 pagineIntroduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTMelvin J. Reyes100% (2)

- Grammar For TOEFLDocumento23 pagineGrammar For TOEFLClaudia Alejandra B0% (1)

- LM213 First Exam Notes PDFDocumento7 pagineLM213 First Exam Notes PDFNikki KatesNessuna valutazione finora

- Industrial Visit Report Part 2Documento41 pagineIndustrial Visit Report Part 2Navratan JagnadeNessuna valutazione finora

- Information Security Policies & Procedures: Slide 4Documento33 pagineInformation Security Policies & Procedures: Slide 4jeypopNessuna valutazione finora

- Panera Bread Company: Case AnalysisDocumento9 paginePanera Bread Company: Case AnalysisJaclyn Novak FreemanNessuna valutazione finora

- Churches That Have Left RCCG 0722 PDFDocumento2 pagineChurches That Have Left RCCG 0722 PDFKadiri JohnNessuna valutazione finora

- Purposeful Activity in Psychiatric Rehabilitation: Is Neurogenesis A Key Player?Documento6 paginePurposeful Activity in Psychiatric Rehabilitation: Is Neurogenesis A Key Player?Utiru UtiruNessuna valutazione finora

- Custom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityDocumento1 paginaCustom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityAndrew HunterNessuna valutazione finora

- Wetlands Denote Perennial Water Bodies That Originate From Underground Sources of Water or RainsDocumento3 pagineWetlands Denote Perennial Water Bodies That Originate From Underground Sources of Water or RainsManish thapaNessuna valutazione finora

- Equivalence ProblemsDocumento2 pagineEquivalence ProblemsRomalyn GalinganNessuna valutazione finora

- HTTP Parameter PollutionDocumento45 pagineHTTP Parameter PollutionSpyDr ByTeNessuna valutazione finora

- Marriage Families Separation Information PackDocumento6 pagineMarriage Families Separation Information PackFatima JabeenNessuna valutazione finora

- Seminar On DirectingDocumento22 pagineSeminar On DirectingChinchu MohanNessuna valutazione finora

- 23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncDocumento2 pagine23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncPamelaNessuna valutazione finora

- DMSCO Log Book Vol.25 1947Documento49 pagineDMSCO Log Book Vol.25 1947Des Moines University Archives and Rare Book RoomNessuna valutazione finora

- Employer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailsDocumento2 pagineEmployer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailstheffNessuna valutazione finora

- BirdLife South Africa Checklist of Birds 2023 ExcelDocumento96 pagineBirdLife South Africa Checklist of Birds 2023 ExcelAkash AnandrajNessuna valutazione finora