Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ESI Application - Specimen

Caricato da

Snigdha Singh0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

1K visualizzazioni6 pagineESI Application

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

DOC, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoESI Application

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

1K visualizzazioni6 pagineESI Application - Specimen

Caricato da

Snigdha SinghESI Application

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 6

EMPLOYERS’ REGISTRATION FORM

FORM-01

(Regulation 10-B)

*Employer’s Code No

1. Name of the Factory/

Establishment :

2. Complete Postal Address:

3. (a) Telephone No., if any:

(b) fax No., if any:

(c) E-mail address if any:

4. Location of Factory/

Establishment:

(a) State: (b) District:

(c) Municipality/ Ward:

(d) Name of Town/ Revenue

Village:

Taluka/

Tashil:

(e) Police Station:

(f) Revenue Demarcation/ Hudbast No. //Not

Applicable//

5. (a) Whether the building/

premises of

factory/ Estt is Owned or

hired:

(b) If hired or there is a

change in the

name of Unit/

Ownership,

please indicate:

(i) ESI Code No., if covered

earlier

(ii) Date form which earlier

Factory/estt. closed

down:

(iii) Terms and conditions

under which

property acquired/

taken on lease:

6. Details of Bank A/c Name of Bank and

Account No: Branch

7. (a) Income Tax PAN/ GIR No

(b) Income Tax Ward/ Circle/

Area

8. Exact nature of work/

business carried

9. Date of commencement of

factory/ Estt.

10. (a) Whether registered under

Factories/ Shop & Estt. Registered under Factories act, 1948

Other act

(Please specify)

(b) Factory licence No./ Trade Licence No. Date Licensing

Licence Authority

No./Catering Estt. Licence

No./

Shop, Estt. Registration

No./

Licence No. under

cinematography

Act etc

(c) Please give whichever is No. Date

applicable Issuing Authority

(i) Commercial Tax No.

(ii) State Sales Tax No

(iii) Central Sales Tax No.

(iv) Any other Tax No

(d) Maximum No. of persons

that can

be employed on any one

day, as per

Licence

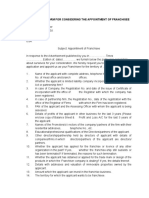

11. (a) Whether power is used

for

manufacturing process as

per

section 2(k) of the

Factories Act,

if so, since when

(b) In case of factory whether

Licence Yes

Issued under section 2(m)

(i) or

2(m)(ii) of the Factories

Act, 1948

(c) Power Connection No:

Sanction Power Load:

Issuing Authority:

12. (a) Whether it is Public or

Private Ltd.

Company/ Partnership/

Proprietorship/

Cooperative Society/

Ownership

(attach copy of Memorandum

& Articles

of Association/ Partnership

Deed/

Resolution

(b) Give Name, present & Name Designation

permanent Address

residential address of

present

Managing Director,

Directors/

Managing Partner,

Partners/

Secretary of the Co-

operative Society

13. Address of the Registered Address:

Office/ Head

Office/ Branch Office/ Sales

Office/

Administrative Office/ Other No. of Employees:

offices if Tel No.

any, with No. of employees Fax No.

attached with

each such office and person Function

responsible

for the office Person Responsible for

day to day functioning

of the office

14. (a) Whether any work/

business

carried out through

contractor/

immediate employer

(b) If yes, give nature of such

work/

business

15. EPF Code No

(If covered under EPF Act) // Not Applicable//

Issuing Authority

16. Total number of employees employed for wages directly and

through immediate employers on the date of application, (whether

manual/ clerical/ supervision, connected with the administration or

purchase of raw materials or distribution or sale of product/ service,

whether permanent or temporary)

No. of Employees

As on date Total No. of Drawing wages

Employees Rs.10,000/-

Or less

Male Femal Total Male Femal Total

e e

Employed directly by

the principal

employer

Through immediate

employer/ contractor

Total

17. Total Wages paid in preceding month

Wages paid to

Total Wages employees drawing

wage of Rs.10,000/-

Or less

To employees

employed directly by

the principal

employer

To employees

employed through

Immediate Employer/

Contractor

18. Give first date since when 10/20 ** or

More coverable employees under ESI

Act, were employed for wages

I hereby declare that the statement given above is correct to the best

of my knowledge and belief. I also undertake to intimate changes, if any, promptly

to the Regional Office/ Sub-Regional Office, ESI Corporation as soon as such

changes take place.

Date: 07-04-2010 Name and Signature

Place: Hyderabad Designation with seal

* Please mention the Employer’s code No., if previously allotted in case the factory/

establishment was covered under the ESI Act.

* Score out whichever is not applicable. In case of factory/ an establishment using

power in the manufacturing process the number applicable is 10 persons or more.

In the case of a factory not using power or an establishment engaged in

manufacturing process without using power or any other establishment, the

number applicable is 20 or more persons.

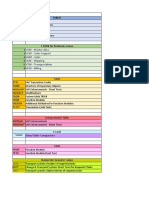

INSTRUCTIONS

Note 1: Please enclose photocopy of the following deeds/ agreements/ documents/

certificate:

a) Registration Certificate/ Licence issued under Shops and Establishment Act

or Factories Act.

b) Latest rent Bill of the premises you are occupying indicating the capacity in

which the premises is occupied, if applicable.

c) Latest building Tax/ Property Tax receipt (Zerox).

d) Memorandum and Articles of Association/ Partnership deed/ Trust deed

e) Zerox copy of certificate of commencement of production and / or

Registration No. of CST/ST

Potrebbero piacerti anche

- ESIGF01Documento11 pagineESIGF01dayanandarya95Nessuna valutazione finora

- Employee Registration FormDocumento4 pagineEmployee Registration FormjasmeenNessuna valutazione finora

- WorksManual RegFormDocumento3 pagineWorksManual RegFormapi-3779088Nessuna valutazione finora

- Registration ApplicationDocumento18 pagineRegistration ApplicationShri swamiNessuna valutazione finora

- Documentation Requirement For EmpanelmentDocumento6 pagineDocumentation Requirement For EmpanelmentMinal MimaniNessuna valutazione finora

- Annex C FNC FormDocumento5 pagineAnnex C FNC FormSudhir Kochhar Fema AuthorNessuna valutazione finora

- All FormsDocumento27 pagineAll FormsSathyanarayana Reddy Antham100% (1)

- Guidelines On Labour LawsDocumento29 pagineGuidelines On Labour LawsSARANYAKRISHNAKUMARNessuna valutazione finora

- Rule 1020 Establishment RegistrationDocumento1 paginaRule 1020 Establishment RegistrationJoshua GonzagaNessuna valutazione finora

- Blank Distributor Application Form TemplateDocumento10 pagineBlank Distributor Application Form TemplateasheeshkushalNessuna valutazione finora

- Trade LicenseDocumento4 pagineTrade LicensearjunsridharurNessuna valutazione finora

- Application Form Panel FirmDocumento36 pagineApplication Form Panel FirmanireethNessuna valutazione finora

- Form 2 ApplicationDocumento4 pagineForm 2 ApplicationAJAY KUMAR JAIN0% (1)

- GNFC Supplier Registration FormDocumento5 pagineGNFC Supplier Registration Formshreeket3953Nessuna valutazione finora

- Business Permit Application FormDocumento1 paginaBusiness Permit Application FormLuckii Jabonete HernandezNessuna valutazione finora

- For Resident Companies Registering For Tax in Ireland: General Details Part ADocumento8 pagineFor Resident Companies Registering For Tax in Ireland: General Details Part ANaitik singalNessuna valutazione finora

- Rule 1020 Establishment Registration TEMPLATE FORMDocumento1 paginaRule 1020 Establishment Registration TEMPLATE FORMLeo Angelo Luyon100% (1)

- Esic Form01 Employers Registration FormDocumento4 pagineEsic Form01 Employers Registration Formjhaji24Nessuna valutazione finora

- Vendor Registration Form GuideDocumento7 pagineVendor Registration Form GuideGautam NegiNessuna valutazione finora

- GOODDDDocumento12 pagineGOODDDPeeyush JainNessuna valutazione finora

- Business Permit Application With Checklist of Requirements LipaDocumento3 pagineBusiness Permit Application With Checklist of Requirements LipaMarlene MoralesNessuna valutazione finora

- Mah S e Form DDocumento5 pagineMah S e Form DArun IyerNessuna valutazione finora

- Register Shops & Establishments OnlineDocumento3 pagineRegister Shops & Establishments OnlinepujamrangelNessuna valutazione finora

- Appform Interest Subsidy MsmeDocumento5 pagineAppform Interest Subsidy MsmeKandarp TrivediNessuna valutazione finora

- RegistrationDocumento4 pagineRegistrationMohit DadooNessuna valutazione finora

- Tender Contractor PDFDocumento11 pagineTender Contractor PDFJob ManpowerNessuna valutazione finora

- Taxi and Private Hire Booking Office Licence Renewal Application ChecklistDocumento8 pagineTaxi and Private Hire Booking Office Licence Renewal Application ChecklistAr. RajaNessuna valutazione finora

- ANF PROFILEDocumento10 pagineANF PROFILEtasneem89Nessuna valutazione finora

- Registration for Government Purchase ProgramDocumento6 pagineRegistration for Government Purchase Programauritro tarafdarNessuna valutazione finora

- Application Form For Registration of Vendors in DRDODocumento9 pagineApplication Form For Registration of Vendors in DRDOSafiya SayeedNessuna valutazione finora

- Equipme Plant Hire CREDIT APPDocumento12 pagineEquipme Plant Hire CREDIT APPtapiwanaishe maunduNessuna valutazione finora

- Form ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFDocumento3 pagineForm ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFFirstBusiness.inNessuna valutazione finora

- I. Documentary Requirements A. DTI Business Name Registration System - SOLE Proprietorship RegistrationDocumento4 pagineI. Documentary Requirements A. DTI Business Name Registration System - SOLE Proprietorship RegistrationAdi CruzNessuna valutazione finora

- Contract Labour Application For LicenseDocumento2 pagineContract Labour Application For LicenseDipak Ranjan MukherjeeNessuna valutazione finora

- Business Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Documento2 pagineBusiness Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Ren Michelle Villaverde PaleracioNessuna valutazione finora

- Word - ISS Application For Authorized Persons - BSE - 01-JULY-2015Documento35 pagineWord - ISS Application For Authorized Persons - BSE - 01-JULY-2015meera nNessuna valutazione finora

- Application For Licence: Form IvDocumento2 pagineApplication For Licence: Form IvNasir AhmedNessuna valutazione finora

- Form Iv & VDocumento3 pagineForm Iv & VShagir AliNessuna valutazione finora

- Booking Office 3124Documento8 pagineBooking Office 3124m227765hNessuna valutazione finora

- Esic New Form01Documento4 pagineEsic New Form01pjsudhanNessuna valutazione finora

- Contract Labour Rules Forms in Word FormatDocumento38 pagineContract Labour Rules Forms in Word FormatAshwinSiddaramaiahNessuna valutazione finora

- Rule 1020 New Establishment RegistrationDocumento1 paginaRule 1020 New Establishment RegistrationFrancisco TaquioNessuna valutazione finora

- MORONG Business Permit Form ARTADocumento2 pagineMORONG Business Permit Form ARTAAz Khylle AlamonNessuna valutazione finora

- App. Form SPRS Form 3.8.2018-1Documento20 pagineApp. Form SPRS Form 3.8.2018-1Harshit BaheriaNessuna valutazione finora

- Department of Labor and Employment: BWC-IP3-rev - 2011Documento1 paginaDepartment of Labor and Employment: BWC-IP3-rev - 2011Mario Labitad Anore Jr.Nessuna valutazione finora

- Public Works EnlistmentDocumento8 paginePublic Works EnlistmentRefat ahmedNessuna valutazione finora

- Lwa For 5 Yrs. FormDocumento2 pagineLwa For 5 Yrs. Formaryaarun3481Nessuna valutazione finora

- Advance RulingProcedureDocumento13 pagineAdvance RulingProcedureshubhamt25Nessuna valutazione finora

- Regd. With A.D. C-11 Panchdeep Bhavan, Site No.689/690, Bibewadi, PuneDocumento2 pagineRegd. With A.D. C-11 Panchdeep Bhavan, Site No.689/690, Bibewadi, PuneGopal KadNessuna valutazione finora

- Appendix-6E Form of Legal Agreement For Eou/Ehtp/Stp/BtpDocumento12 pagineAppendix-6E Form of Legal Agreement For Eou/Ehtp/Stp/BtpNITINNessuna valutazione finora

- Earnest Money Deposit (EMD) and Security Deposit Exemption PDFDocumento3 pagineEarnest Money Deposit (EMD) and Security Deposit Exemption PDFdasuyaNessuna valutazione finora

- Contract Labour FORM IVDocumento2 pagineContract Labour FORM IVhdpanchal86Nessuna valutazione finora

- Vendor Registration Form for IndcoserveDocumento9 pagineVendor Registration Form for IndcoservesubragmNessuna valutazione finora

- Applicatoin For LicenceDocumento2 pagineApplicatoin For LicenceAmeet RanjanNessuna valutazione finora

- F1Documento2 pagineF1TendersNessuna valutazione finora

- APPLY FRANCHISEDocumento2 pagineAPPLY FRANCHISEVIRTUAL WORLDNessuna valutazione finora

- Employment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionDa EverandEmployment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionNessuna valutazione finora

- Simple Guide for Drafting of Civil Suits in IndiaDa EverandSimple Guide for Drafting of Civil Suits in IndiaValutazione: 4.5 su 5 stelle4.5/5 (4)

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDa EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNessuna valutazione finora

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Da EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Nessuna valutazione finora

- The Political and Legal Environments Facing BusinessDocumento23 pagineThe Political and Legal Environments Facing BusinessSnigdha SinghNessuna valutazione finora

- Success Is A PhenomenaDocumento5 pagineSuccess Is A PhenomenaSnigdha SinghNessuna valutazione finora

- 2482012Documento29 pagine2482012Snigdha SinghNessuna valutazione finora

- HR Incentive MatrixDocumento3 pagineHR Incentive MatrixSnigdha SinghNessuna valutazione finora

- Special Provision of SICA and BIFR BY Snigdha SinghDocumento16 pagineSpecial Provision of SICA and BIFR BY Snigdha SinghSnigdha SinghNessuna valutazione finora

- Models of Consumer Behaviour: EBM, Nicosia and MoreDocumento6 pagineModels of Consumer Behaviour: EBM, Nicosia and MoreSnigdha SinghNessuna valutazione finora

- Chapter 19Documento25 pagineChapter 19Snigdha SinghNessuna valutazione finora

- Time ManagementDocumento25 pagineTime ManagementR Ramesh100% (2)

- A Project Report ON: "Comparative Study of Equity Mutual Funds & Financials Systems With An Introduction To Ipo"Documento62 pagineA Project Report ON: "Comparative Study of Equity Mutual Funds & Financials Systems With An Introduction To Ipo"Snigdha Singh100% (3)

- A Project Report On "Analysis of Mutual Funds Schemes": KARVY Stock Broking LTDDocumento46 pagineA Project Report On "Analysis of Mutual Funds Schemes": KARVY Stock Broking LTDSnigdha SinghNessuna valutazione finora

- Srinivas Akula College of Management Research & Engineering, Pune-52 1Documento74 pagineSrinivas Akula College of Management Research & Engineering, Pune-52 1Snigdha SinghNessuna valutazione finora

- A Project Report On: Mutual Funds For Individual Investors in India Conducted For Karvy Stock Broking LTDDocumento71 pagineA Project Report On: Mutual Funds For Individual Investors in India Conducted For Karvy Stock Broking LTDSnigdha Singh67% (3)

- A Project Report ON: Awareness of Mutual Fund and Its ScopeDocumento64 pagineA Project Report ON: Awareness of Mutual Fund and Its ScopeSnigdha Singh100% (3)

- Property CasesDocumento95 pagineProperty CasesJohn Adrian MaulionNessuna valutazione finora

- Intermediate Accounting III ReviewerDocumento3 pagineIntermediate Accounting III ReviewerRenalyn PascuaNessuna valutazione finora

- Assessment ProcedureDocumento8 pagineAssessment ProcedureAbhishek SharmaNessuna valutazione finora

- IRS Audit Guide For Contractors and The Construction IndustryDocumento196 pagineIRS Audit Guide For Contractors and The Construction IndustrySpringer Jones, Enrolled Agent100% (2)

- Ultimate Guide To SIP in Pakistan Ebook FinalDocumento39 pagineUltimate Guide To SIP in Pakistan Ebook FinalbisaxNessuna valutazione finora

- Assignment 01 Capital BudgetingDocumento1 paginaAssignment 01 Capital BudgetingChrisNessuna valutazione finora

- Vidal-de-Roces-vs.-PosadasDocumento9 pagineVidal-de-Roces-vs.-PosadasChristle CorpuzNessuna valutazione finora

- Which of The Following Is The Correct Tax Implication of The Foregoing Data With Respect To Payment of Income Tax?Documento3 pagineWhich of The Following Is The Correct Tax Implication of The Foregoing Data With Respect To Payment of Income Tax?ROSEMARIE CRUZNessuna valutazione finora

- MGT211 A Mega File of Final Term Exams QuizesDocumento101 pagineMGT211 A Mega File of Final Term Exams Quizesfarhan.hasni46% (26)

- Penalty ChargesDocumento17 paginePenalty ChargesShashi BorichaNessuna valutazione finora

- GST 101st Amendment Act SummaryDocumento4 pagineGST 101st Amendment Act Summaryshivani yadavNessuna valutazione finora

- Sec 443Documento11 pagineSec 443Mubeen NavazNessuna valutazione finora

- Raus IAS Prelims Compass 2020 Budget and Economic Survey PDFDocumento98 pagineRaus IAS Prelims Compass 2020 Budget and Economic Survey PDFSoft CrazeNessuna valutazione finora

- General Principles of Taxation: Tax 111 - Income Taxation Ferdinand C. Importado Cpa, MbaDocumento22 pagineGeneral Principles of Taxation: Tax 111 - Income Taxation Ferdinand C. Importado Cpa, Mbaangelo_maranan100% (1)

- Buisness Plan CafeDocumento25 pagineBuisness Plan CafeIsrael Elias100% (1)

- Angeles City Vs Angeles City Electric CorporationDocumento1 paginaAngeles City Vs Angeles City Electric CorporationJesse MoranteNessuna valutazione finora

- New Microsoft Word DocumentDocumento2 pagineNew Microsoft Word DocumentAnonymous e9EIwbUY9Nessuna valutazione finora

- Chapter 7 - Forecasting Financial StatementsDocumento23 pagineChapter 7 - Forecasting Financial Statementsamanthi gunarathna95Nessuna valutazione finora

- Assignment # 01Documento6 pagineAssignment # 01HammadNessuna valutazione finora

- Tables s4 HanaDocumento68 pagineTables s4 Hanasurajit biswas100% (5)

- 12 Economics Eng PP 2023 24 1Documento8 pagine12 Economics Eng PP 2023 24 1Shivansh JaiswalNessuna valutazione finora

- 73 153 1 PBDocumento18 pagine73 153 1 PBTataNessuna valutazione finora

- Employee's Withholding Certificate 2020Documento4 pagineEmployee's Withholding Certificate 2020CNBC.comNessuna valutazione finora

- Tax Digest (Siao Tiao Hong V Cir)Documento2 pagineTax Digest (Siao Tiao Hong V Cir)Alex CustodioNessuna valutazione finora

- Project Report (ABBOTT)Documento29 pagineProject Report (ABBOTT)MohsIn IQbalNessuna valutazione finora

- Settlement Commissionb Tax FDDocumento15 pagineSettlement Commissionb Tax FDhani diptiNessuna valutazione finora

- Public Sector Vs pu-WPS OfficeDocumento8 paginePublic Sector Vs pu-WPS OfficeDawit TilahunNessuna valutazione finora

- PCSO Vigilant Enterprise Service Agreement For "COVERT LPR TRAILERS"Documento13 paginePCSO Vigilant Enterprise Service Agreement For "COVERT LPR TRAILERS"James McLynasNessuna valutazione finora

- Iphone InvoiceDocumento1 paginaIphone InvoiceKalai ManiNessuna valutazione finora

- Evaluation of StakeholderDocumento3 pagineEvaluation of StakeholderTalha KhanNessuna valutazione finora