Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Modeling PL and BS Items

Caricato da

Jose Ramon VillatuyaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Modeling PL and BS Items

Caricato da

Jose Ramon VillatuyaCopyright:

Formati disponibili

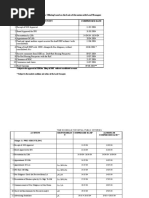

Forecasting P&L items

Financial modeling made easy

P&L Item Forecast as

Revenues Perform a top-down and bottom-up forecast; Research

expected industry growth from Consulting reports; Calculate

the firms historical growth rate

Cost of goods sold As a % of Revenues

Operating expenses As a % of Revenues

Depreciation & Amortization As a % of Fixed Assets; Build a detailed fixed assets roll

forward schedule

Interest expenses Interest rate * Financial Liabilities outstanding

Extraordinary items Should be equal to 0 in your model

Taxes Marginal tax rate * EBT

Forecasting Balance Sheet items

Financial modeling made easy

BS Item Forecast as

Cash Ending Cash = Beginning Cash + Net Cash Flow; Use the Cash

Flow statement

Trade receivables Calculate historical DSO (Days Sales Outstanding) and model

as the average number of DSO observed historically

Inventory Calculate historical DIO (Days Inventory Outstanding) and

model as the average number of DIO observed historically

Property, plant & equipment Build a detailed fixed asset roll forward; Ending PP&E =

Beginning PP&E + Capex D&A

Capex Calculate historical Capex expenditure and model as a % of

the average historical Capex expenditure

Other assets As a % of Revenues

Trade payables Calculate historical DPO (Days Payables Outstanding) and

model as the average number of DIO observed historically

Other liabilities As a % of Revenues

Financial liabilities Build a detailed debt schedule; Debt Outstanding = Debt at

Beginning + Debt drawdowns Debt repayment

Shareholders equity Ending equity = Beginning Equity + Increases in capital

Dividend payments +(/-) Net Income (Loss)

Potrebbero piacerti anche

- Financial Accounting and Reporting Study Guide NotesDa EverandFinancial Accounting and Reporting Study Guide NotesValutazione: 1 su 5 stelle1/5 (1)

- III Business Plan - Elements - Elements 3th PartDocumento30 pagineIII Business Plan - Elements - Elements 3th PartefrenNessuna valutazione finora

- 60 BIWS Bank Projections Reference PDFDocumento5 pagine60 BIWS Bank Projections Reference PDFAnish ShahNessuna valutazione finora

- Financial Analysis1Documento21 pagineFinancial Analysis1Umay PelitNessuna valutazione finora

- 2 FinmodelingTheory - FMDocumento49 pagine2 FinmodelingTheory - FMАндрій ХмиренкоNessuna valutazione finora

- 01 Accounting Study NotesDocumento8 pagine01 Accounting Study NotesJonas ScheckNessuna valutazione finora

- Review SessionDocumento25 pagineReview SessionK60 Bùi Phương AnhNessuna valutazione finora

- Chap009 - Analysis BS IsDocumento56 pagineChap009 - Analysis BS IsEvangelystha Lumban TobingNessuna valutazione finora

- Topic 02 Accounting Statements and Cash FlowDocumento23 pagineTopic 02 Accounting Statements and Cash FlowVictorNessuna valutazione finora

- Chapter 12 HighlightsDocumento2 pagineChapter 12 HighlightsJoshua ZamarripaNessuna valutazione finora

- Session 7: Estimating Cash Flows: Aswath DamodaranDocumento15 pagineSession 7: Estimating Cash Flows: Aswath Damodaranthomas94josephNessuna valutazione finora

- Lecture 6Documento64 pagineLecture 6Zixin Gu100% (1)

- Chapter 10PPTBBDocumento49 pagineChapter 10PPTBBAnihaNessuna valutazione finora

- Accrual AccountingDocumento44 pagineAccrual AccountingSophia LynchNessuna valutazione finora

- Financial Projection Example1Documento29 pagineFinancial Projection Example1Mateo HysaNessuna valutazione finora

- Aswath Damodaran Financial Statement AnalysisDocumento18 pagineAswath Damodaran Financial Statement Analysisshamapant7955100% (2)

- Financial Statement: - Balance Sheet - Profit & LossDocumento56 pagineFinancial Statement: - Balance Sheet - Profit & LossPravin KumarNessuna valutazione finora

- Lecture NotesDocumento100 pagineLecture Notesgrace.kokhcNessuna valutazione finora

- Cash Flow StatementsDocumento4 pagineCash Flow StatementsUnbeatable 9503Nessuna valutazione finora

- Chapter-02-Cash Flow SatementDocumento21 pagineChapter-02-Cash Flow SatementSafeen LabibNessuna valutazione finora

- CHAPTER 11 - AnswerDocumento16 pagineCHAPTER 11 - Answernash100% (1)

- 02 Accounting 3 Statements Linking GuideDocumento2 pagine02 Accounting 3 Statements Linking GuideGus MarNessuna valutazione finora

- Financial ReportsDocumento36 pagineFinancial ReportsbehanzinlufrancheNessuna valutazione finora

- BIWS REIT Projection ReferenceDocumento3 pagineBIWS REIT Projection ReferenceLisaNessuna valutazione finora

- Liability Share Capital Loan Debentures Customer Advance Internal FundsDocumento1 paginaLiability Share Capital Loan Debentures Customer Advance Internal FundsDeepak VindalNessuna valutazione finora

- Unit 2 (I)Documento44 pagineUnit 2 (I)martaNessuna valutazione finora

- Forecasting Short - Term Operating Financial Requirement: Pretzel L. Ragonjan BA 217Documento24 pagineForecasting Short - Term Operating Financial Requirement: Pretzel L. Ragonjan BA 217PRETZEL RAGONJANNessuna valutazione finora

- 02 BIWS Projections Quick ReferenceDocumento3 pagine02 BIWS Projections Quick ReferencecarminatNessuna valutazione finora

- EVA y CFROIDocumento16 pagineEVA y CFROIAyr PerroneNessuna valutazione finora

- Chapter - 1 & 2 (Presentations On Introduction To Accounting & The Accounting Equation)Documento52 pagineChapter - 1 & 2 (Presentations On Introduction To Accounting & The Accounting Equation)Sattaki RoyNessuna valutazione finora

- AssumptionsDocumento2 pagineAssumptionsAish VarmaNessuna valutazione finora

- Chapter 2 - A Further Look at Financial StatementsDocumento18 pagineChapter 2 - A Further Look at Financial StatementsCông Hoàng ĐìnhNessuna valutazione finora

- Business Valuation: Presented By: Varun DawarDocumento9 pagineBusiness Valuation: Presented By: Varun DawarakshitNessuna valutazione finora

- 1.0 CFI - FS Primer PDFDocumento10 pagine1.0 CFI - FS Primer PDFSarthak NautiyalNessuna valutazione finora

- Financial Planning and Forecasting Financial StatementsDocumento70 pagineFinancial Planning and Forecasting Financial StatementsAziz Hotelwala100% (1)

- 7.2 Financial Ratio AnalysisDocumento31 pagine7.2 Financial Ratio AnalysisteeeNessuna valutazione finora

- Class 2 PDFDocumento17 pagineClass 2 PDFRajat AgrawalNessuna valutazione finora

- Financial ModelingDocumento21 pagineFinancial ModelingLAMOUCHI RIMNessuna valutazione finora

- Cash Flow StatementDocumento17 pagineCash Flow StatementanuhyaextraNessuna valutazione finora

- General Accounting Principles - PRUDocumento41 pagineGeneral Accounting Principles - PRUerjuniorsanjipNessuna valutazione finora

- ECH 158A Economic Analysis and Design: Chemical Engineering EconomicsDocumento22 pagineECH 158A Economic Analysis and Design: Chemical Engineering EconomicsLe Anh QuânNessuna valutazione finora

- Acc Questions PDFDocumento4 pagineAcc Questions PDFneharajt06061Nessuna valutazione finora

- FK Kuliah 1 Laporan KeuanganDocumento21 pagineFK Kuliah 1 Laporan KeuanganGrace HerlisNessuna valutazione finora

- Chapter 2 The Accounting Equation and The Double-Entry SystemDocumento24 pagineChapter 2 The Accounting Equation and The Double-Entry SystemMarriel Fate Cullano0% (1)

- Ananta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowDocumento40 pagineAnanta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowKania SyahraNessuna valutazione finora

- Chapter-02 Statement of Cash FlowsDocumento16 pagineChapter-02 Statement of Cash Flowsmd. hasanuzzamanNessuna valutazione finora

- FSAPreRead 210728 102848Documento42 pagineFSAPreRead 210728 102848Anuj PrajapatiNessuna valutazione finora

- SAP Financial Planning v1.0Documento42 pagineSAP Financial Planning v1.0edoardo.dellaferreraNessuna valutazione finora

- Financial Statement Analysis Questions We Would Like AnsweredDocumento9 pagineFinancial Statement Analysis Questions We Would Like AnsweredthakurvinodNessuna valutazione finora

- Lecture 1 - Financial Analysis PDFDocumento84 pagineLecture 1 - Financial Analysis PDFReymark De veraNessuna valutazione finora

- Advance Financial Management - Financial Tools - Written ReportDocumento36 pagineAdvance Financial Management - Financial Tools - Written Reportgilbertson tinioNessuna valutazione finora

- Financial Model Training DeckDocumento30 pagineFinancial Model Training Decksgg97Nessuna valutazione finora

- S06-07 - FA - Handout Before 1 - Cash Flow StatementDocumento36 pagineS06-07 - FA - Handout Before 1 - Cash Flow Statementcharlesdegaulle594Nessuna valutazione finora

- Applied Corporate Finance: Class #2 Working Capital Capital EmployedDocumento21 pagineApplied Corporate Finance: Class #2 Working Capital Capital EmployedNuno LouriselaNessuna valutazione finora

- Others 1667194749455Documento17 pagineOthers 1667194749455Techboy RahulNessuna valutazione finora

- Financial Statements, Cash Flows, and TaxesDocumento27 pagineFinancial Statements, Cash Flows, and TaxeszhengcunzhangNessuna valutazione finora

- Cheat Sheet Financial Statement ModellingDocumento8 pagineCheat Sheet Financial Statement ModellingAsmitaNessuna valutazione finora

- Part III - Developing The Entrepreneurial PlanDocumento24 paginePart III - Developing The Entrepreneurial Plannivedita choudhuryNessuna valutazione finora

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Da EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Valutazione: 3.5 su 5 stelle3.5/5 (17)

- Errata BATutorial SecondEditionDocumento1 paginaErrata BATutorial SecondEditionJose Ramon VillatuyaNessuna valutazione finora

- Mathematical Algorithms For Artificial Intelligence and Big DataDocumento34 pagineMathematical Algorithms For Artificial Intelligence and Big DataJose Ramon VillatuyaNessuna valutazione finora

- 1803 09288Documento73 pagine1803 09288Jose Ramon VillatuyaNessuna valutazione finora

- CIR 941& 963 - Orientation - Apr18Documento2 pagineCIR 941& 963 - Orientation - Apr18Jose Ramon VillatuyaNessuna valutazione finora

- Anintroductiontomachinelearning: Michaelclark Centerforsocialresearch UniversityofnotredameDocumento43 pagineAnintroductiontomachinelearning: Michaelclark Centerforsocialresearch UniversityofnotredameJose Ramon VillatuyaNessuna valutazione finora

- All Exercises RDocumento21 pagineAll Exercises RJose Ramon VillatuyaNessuna valutazione finora

- GanasDocumento17 pagineGanasThinh Tran VanNessuna valutazione finora

- How To Purchase KroDocumento16 pagineHow To Purchase KroJose Ramon VillatuyaNessuna valutazione finora

- Competitive Benchmarking - Funding RaiseDocumento3 pagineCompetitive Benchmarking - Funding RaiseJose Ramon VillatuyaNessuna valutazione finora

- Jkan 43 154Documento11 pagineJkan 43 154Dnyanesh AmbhoreNessuna valutazione finora

- Deeper Understanding, Faster Calculation - Exam P Insights & Shortcuts 20th EditionDocumento28 pagineDeeper Understanding, Faster Calculation - Exam P Insights & Shortcuts 20th EditionJose Ramon VillatuyaNessuna valutazione finora

- Python ReviewDocumento5 paginePython ReviewJose Ramon VillatuyaNessuna valutazione finora

- 978 951 39 6777 2 - Vaitos21102016Documento196 pagine978 951 39 6777 2 - Vaitos21102016Jose Ramon VillatuyaNessuna valutazione finora

- Business AnalyticsDocumento4 pagineBusiness AnalyticsJose Ramon VillatuyaNessuna valutazione finora

- Python PDFDocumento168 paginePython PDFTejamoy Ghosh100% (4)

- Become An Excel Ninja: Important NotesDocumento12 pagineBecome An Excel Ninja: Important NotesJose Ramon VillatuyaNessuna valutazione finora

- Deeper Understanding, Faster Calculation - Exam P Insights & Shortcuts 20th EditionDocumento28 pagineDeeper Understanding, Faster Calculation - Exam P Insights & Shortcuts 20th EditionJose Ramon VillatuyaNessuna valutazione finora

- Mba DM Syllabus S13regDocumento8 pagineMba DM Syllabus S13regJose Ramon VillatuyaNessuna valutazione finora

- CIB5807Documento6 pagineCIB5807Jose Ramon VillatuyaNessuna valutazione finora

- DataSeer Training ProspectusDocumento25 pagineDataSeer Training ProspectusJose Ramon VillatuyaNessuna valutazione finora

- A Spreadsheet Approach To Business Quantitative MethodsDocumento16 pagineA Spreadsheet Approach To Business Quantitative MethodsJose Ramon VillatuyaNessuna valutazione finora

- 2014 Fall b6101 SyllabusDocumento6 pagine2014 Fall b6101 SyllabusJose Ramon VillatuyaNessuna valutazione finora

- CS PDFDocumento63 pagineCS PDFJose Ramon VillatuyaNessuna valutazione finora

- List of Officers SLOCPI (06!28!2017)Documento1 paginaList of Officers SLOCPI (06!28!2017)Jose Ramon VillatuyaNessuna valutazione finora

- Chapter 17 Solutions V1Documento23 pagineChapter 17 Solutions V1Badar MunirNessuna valutazione finora

- Hotel Financial Model 2013 Complete V6-Xls 2Documento59 pagineHotel Financial Model 2013 Complete V6-Xls 2AjayRathorNessuna valutazione finora

- Correlation 2Documento6 pagineCorrelation 2Just MahasiswaNessuna valutazione finora

- New Board All Set To Set Sail in 2017-2018Documento6 pagineNew Board All Set To Set Sail in 2017-2018Jose Ramon VillatuyaNessuna valutazione finora

- Today: - CalculusDocumento61 pagineToday: - CalculusJose Ramon VillatuyaNessuna valutazione finora

- Fulcrum Part Exits Specsmakers With Stellar ReturnsDocumento2 pagineFulcrum Part Exits Specsmakers With Stellar ReturnsPR.comNessuna valutazione finora

- 143 Quiz4Documento3 pagine143 Quiz4Leigh PilapilNessuna valutazione finora

- Cpale 2022 Syllabus Lecture NotesDocumento27 pagineCpale 2022 Syllabus Lecture NotesChin FiguraNessuna valutazione finora

- BLD 416 Budgeting and Financial Control 1 Lecture Note 2Documento9 pagineBLD 416 Budgeting and Financial Control 1 Lecture Note 2Oluwayomi MalomoNessuna valutazione finora

- Financial Model Template: Company X 31-Mar NZ$Documento6 pagineFinancial Model Template: Company X 31-Mar NZ$Bobby ChristiantoNessuna valutazione finora

- BusCom Intercompany SalesDocumento13 pagineBusCom Intercompany SalesCarmela BautistaNessuna valutazione finora

- Yes Securites Form Details PDFDocumento28 pagineYes Securites Form Details PDFShoaib AnsariNessuna valutazione finora

- Chapter 7Documento18 pagineChapter 7Kogilavani Balakrishnan0% (1)

- JSW Steel Ratio AnalysisDocumento2 pagineJSW Steel Ratio AnalysisabhisekNessuna valutazione finora

- UnauditedDocumento30 pagineUnauditedSanjay KumarNessuna valutazione finora

- Solution of Trial Balance Problem - Exam MEM-3 PDFDocumento4 pagineSolution of Trial Balance Problem - Exam MEM-3 PDFEltayeb ElhigziNessuna valutazione finora

- Homework - 2 - Reinvestment Risk - Credit RiskDocumento2 pagineHomework - 2 - Reinvestment Risk - Credit RisksinbdacutieNessuna valutazione finora

- Introduction Iasb Conceptual FrameworkDocumento55 pagineIntroduction Iasb Conceptual FrameworkEtiel Films / ኢትኤል ፊልሞችNessuna valutazione finora

- Exemplar Company - Fortunado PDFFDocumento1 paginaExemplar Company - Fortunado PDFFmitakumo uwuNessuna valutazione finora

- Stocks and StockholdersDocumento12 pagineStocks and Stockholders123Nessuna valutazione finora

- VAT (Trung Bình-Khó)Documento5 pagineVAT (Trung Bình-Khó)Thuthủy NguyễnNessuna valutazione finora

- Stockholders' Equity Accounts With Normal BalancesDocumento3 pagineStockholders' Equity Accounts With Normal BalancesMary67% (3)

- IPO ChecklistDocumento8 pagineIPO Checklistpbush998873Nessuna valutazione finora

- Spring 2020 - CET-2303-Engineering Economics - A - Morning - Both - Muhammad Usman HaiderDocumento5 pagineSpring 2020 - CET-2303-Engineering Economics - A - Morning - Both - Muhammad Usman HaiderUsman HaiderNessuna valutazione finora

- Intermediate Accounting 13ce KiesoDocumento44 pagineIntermediate Accounting 13ce Kiesofullgradestore2023Nessuna valutazione finora

- Cae08 - Activity Chapter 1Documento5 pagineCae08 - Activity Chapter 1Jr VillariezNessuna valutazione finora

- 4 5980809927537462666Documento72 pagine4 5980809927537462666antarimouad01Nessuna valutazione finora

- Meija KariukiDocumento2 pagineMeija KariukiPeter Kibelesi KukuboNessuna valutazione finora

- Product - Case AnalysisDocumento5 pagineProduct - Case AnalysisNiranjan NiruNessuna valutazione finora

- 19.12.17 PetroTal Investment AnalysisDocumento130 pagine19.12.17 PetroTal Investment AnalysispessmaurNessuna valutazione finora

- Active Share, Tracking Error and Manager Style: Quantitative ResearchDocumento16 pagineActive Share, Tracking Error and Manager Style: Quantitative ResearchAxel Boris ZABONessuna valutazione finora

- Cpa Reviewer PDFDocumento18 pagineCpa Reviewer PDFAbigail Ann PasiliaoNessuna valutazione finora

- Sadbhav Infrastructure ProjectDocumento16 pagineSadbhav Infrastructure ProjectbardhanNessuna valutazione finora

- SOFP HartaDocumento1 paginaSOFP Hartaワンピ ースNessuna valutazione finora

- CCASBCM128Documento56 pagineCCASBCM128GAJANAN MULTISERVICESNessuna valutazione finora