Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Insurance Sector in India: An Overview

Caricato da

Rakesh HaldarDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Insurance Sector in India: An Overview

Caricato da

Rakesh HaldarCopyright:

Formati disponibili

RESEARCH PAPER ECONOMICS VOLUME : 1/ISSUE : 4/ JULY 2013/ ISSN 2320 - 7620

Insurance Sector in India:

An Overview

KEYWORDS Regulatory role, Business Growth, Business Potential, Threat to public sector insurance companies.

NISHA K. SHARMA

Ph.d Scholar (KSV University)

ABSTRACT

India insuranceis a flourishing industry, with several national and international players competing and growing at rapid

rates. Thanks to reforms and the easing of policy regulations, the Indian insurance sector been allowed to flourish, and

as Indians become more familiar with different insurance products, this growth can only increase, with the period from

2010 - 2015 projected to be the Golden Age for the Indian insurance industry. Together with banking services, it

contributes to about 7 per cent to the countrys GDP. This lifted entry restrictions for private players and allowed

foreign players to enter the market with some limits on direct foreign ownership. There is a 26 percent equity cap for

foreign partners in an insurance company and a proposal to increase this limit to 49 percent. The opening up of the

insurance sector has led to rapid growth of the sector. The potential for growth of insurance industry in India is immense

as nearly 80 per cent of Indian population is without life insurance cover while health insurance and non-life insurance

continues to be well below international standards. The insurance sector in India has come up with a full circle from

being an open competitive market to nationalization and back to a liberalized market again.

INTRODUCTION

The Insurance sector inIndiagoverned by Insurance Act, 1938, the Life Insurance Corporation Act, 1956 and General

Insurance Business (Nationalisation) Act, 1972, Insurance Regulatory and Development Authority (IRDA) Act, 1999 and

other related Acts. With such a large population and the untapped market area of this population Insurance happens to be

a very big opportunity inIndia. Today it stands as a business growing at the rate of 15-20 per cent annually. Together with

banking services, it adds about 7 per cent to the countrys GDP .In spite of all this growth the statistics of the penetration

of the insurance in the country is very poor. Nearly 80% of Indian populations are without Life insurance cover and the

Health insurance. This is an indicator that growth potential for the insurance sector is immense inIndia. It was due to this

im mense growth that the regulations were introduced in the insurance sector and in continuation

MalhotraCommitteewas constituted by the government in 1993 to examine the various aspects of the industry. The

key element of the reform process was Participation of overseas insurance companies with 26% capital. Creating a more

efficient and competitive financial system suitable for the requirements of the economy was the main idea behind this

reform.

INSURANCE MARKET- PRESENT :

The insurance sector was opened up for private participation four years ago. For years now, the private players are

active in the liberalized environment. The insurance market have witnessed dynamic changes which includes presence

of a fairly large number of insurers both life and non-life segment. Most of the private insurance companies have formed

joint venture partnering well recognized foreign players across the globe. There are now 29 insurance companies

operating in the Indian market 14 private life insurers, nine private non-life insurers and six public sector companies.

There is pressure from both within the country and outside on the Government to increase the foreign direct investment

(FDI) limit from the current 26% to 49%, which would help JV partners to bring in funds for expansion.There are

opportunities in the pensions sector where regulations are being framed. Less than 10 % of Indians above the age of 60

receive pensions. The IRDA has issued the first licence for a standalone health company in the country as many more

players wait to enter. The health insurance sector has tremendous growth potential, and as it matures and new players

enter, product innovation and enhancement will increase. The deepening of the health database over time will also allow

players to develop and price products for larger segments of society.

INSURANCE SECTOR REFORMS:

In 1993, Malhotra Committee headed by former Finance Secretary and RBI Governor R.N. Malhotra was formed to evaluate

the Indian insurance industry and recommend its future direction. The Malhotra committee was set up with the objective

of complementing the reforms initiated in the financial sector. The reforms were aimed at creating a more efficient and

competitive financial system suitable for the requirements of the economy keeping in mind the structural changes currently

underway and recognizing that insurance is an important part of the overall financial system where it was necessary to

address the need for similar reforms In 1994, the committee submitted the report.The Authority has notified 27 Regulations

on various issues which include Registration of Insurers, Regulation on insurance agents, Solvency Margin, Re-insurance,

Obligation of Insurers to Rural and Social sector, Investment and Accounting Procedure, Protection of policy holders

interest etc. Some of the important milestones in the life insurance business in India are:

1912: The Indian Life Assurance Companies Act enacted as the first statute to regulate the life insurance

View of Space : International Multidisciplinary Journal of Applied Research 129

RESEARCH PAPER VOLUME : 1/ISSUE : 4/ JULY 2013/ ISSN 2320 - 7620

business.

1928: The Indian Insurance Companies Act enacted to enable the government to collect statistical information

about both life and non-life insurance businesses.

1938: Earlier legislation consolidated and amended to by the Insurance Act with the objective of protecting the

interests of the insuring public.

1956: 245 Indian and foreign insurers and provident societies taken over by the central government and

nationalised. LIC formed by an Act of Parliament, viz. LIC Act, 1956, with a capital contribution of Rs. 5 crore from the

Government of India.

The General insurance business in India, on the other hand, can trace its roots to the Triton Insurance Company Ltd., the

first general insurance company established in the year 1850 in Calcutta by the British.

INSURANCE SECTOR OVERVIEW: STATUS AND GROWTH

After privatization, insurance industry has seen significant growth. Due to low penetration and huge potential, many

foreign and domestic players have entered the sector. Moreover, several reforms and policy measures have provided a

favorable environment for insurance companies to flourish in the country.

The insurance sector in India is primarily divided into life and non-life, apart from a very small segment comprising re-

insurance. Both the life and non-life insurance segments, which were nationalized in the 1950s and 1960s, respectively,

witnessed an across-the-board liberalization process in 2000. After the reforms, the number of players has increased

from one in life insurance and four in non-life insurance in 2000 to 23 players in each segment till May 2010 (including one

re-insurer in the non-life segment) (as per the IRDA website).

The reasons for the strong foundation for insurance services in India are: growing middle class segment, rising incomes,

increasing awareness of insurance, as well as investments and infrastructure spending.

GROWTH IN TOTAL INSURANCE PREMIUMS

Strong economic growth of India has led to increased penetration of insurance in the country. Premium income as a

percentage of GDP has increased from 3.3% in FY03 to 7.6% in FY09. However, the penetration level is still low as

compared to other developed and developing economies. Many foreign companies have shown an interest in investing in

Indian insurance companies, in spite of the FDI limit, which is fixed at 26% for the life and non-life sectors.

The Life Insurance Council has projected 18% growth in total premium income for the life insurance industry in the financial

year 2009-10.

Although final figures, released by the Insurance Regulatory Development Authority, are being compiled, Life Insurance

Council secretary general SB Mathur told The Economic Times in April 2010 in an interview: During 2008-09, the life

insurance segment had mopped up a first premium income of Rs 88,000 crore while in 2009-10, there was an approximately

10-12% growth, which means that first premium income in the year just gone by is expected to be around Rs 1 lakh crore.

According to data released by the Insurance Regulatory Development Authority for 2008-09, total accumulated losses

stood at Rs 14,421 crore while the total equity infused by all companies put together was Rs 18,253 till March 2009.

Table - 1

130 View of Space : International Multidisciplinary Journal of Applied Research

RESEARCH PAPER VOLUME : 1/ISSUE : 4/ JULY 2013/ ISSN 2320 - 7620

MARKET SHARE OF INDIAN INSURANCE INDUSTRY

The introduction of private players in the industry has added value to the industry. The initiatives taken by the private

players are very competitive and have given immense competition to the on time monopoly of the market LIC. Since the

advent of the private players in the market the industry has seen new and innovative steps taken by the players in this

sector. The new players have improved the service quality of the insurance. As a result LIC down the years have seen

the declining phase in its career. The market share was distributed among the private players. Though LIC still holds the

75% of the insurance sector but the upcoming natures of these private players are enough to give more competition to LIC

in the near future. LIC market share has decreased from 95% (2002-03) to 81 %( 2004-05).

INDIA IN THE INTERNATIONAL CONTEXT :

The Indian insurance market is the 19th largest globally and ranks 5th in Asia, after Japan, South Korea, China and Taiwan.

In 2003, total gross premiums collected amount to USD 17.3 billion,representing just under 0.6% of world premiums. Similar

to the pattern observed in other regional markets, and reflecting the countrys high savings rate, life insurance business

accounted for 78.5% of total gross premiums collected in the year, against 21.5% for non-life insurance business.

Table 2 Major Players in the Insurance Sector Today

S.No. Date of Reg. Name of theCompany

1 23.10.2000 HDFCStandard Life InsuranceCompany Ltd.

2 23.10.2000 Royal SundaramAlliance Insurance CompanyLimited

3 23.10.2000 RelianceGeneral InsuranceCompanyLimited.

4 15.11.2000 Max NewYorkLife Insurance Co. Ltd.

5 24.11.2000 ICICI Prudential Life Insurance CompanyLtd.

6 04.12.2000 IFFCOTokio General Insurance Co. Ltd

7 10.01.2001 KotakMahindraOld Mutual LifeInsurance Limited

8 22.01.2001 TATAAIGGeneral InsuranceCompanyLtd.

9 31.01.2001 Birla Sun Life Insurance Company Ltd.

10 12.02.2001 Tata AIGLifeInsurance Company Ltd.

11 30.03.2001 SBI Life Insurance CompanyLimited.

12 02.05.2001 Bajaj Allianz General InsuranceCompanyLimited

13 02.08.2001 INGVysya Life Insurance CompanyPrivate Limited

14 03.08.2001 ICICI Lombard General Insurance Company Limited.

15 03.08.2001 Bajaj Allianz LifeInsurance Company Limited

16 06.08.2001 Metlife India InsuranceCompanyPvt. Ltd.

17 03.01.2002 AMPSanmar Life Insurance Company Limited.

18 14.05.2002 AvivaLife InsuranceCo. India Pvt. Ltd.

19 15.07.2002 CholamandalamGeneral Insurance CompanyLtd.

20 27.08.2002 Export Credit Guarantee Corporation Ltd.

21 27.08.2002 HDFC-Chubb General Insurance Co. Ltd.

22 06.02.2004 Sahara India Insurance CompanyLtd.

23 17.11.2005 ShriramLife Insurance Company Ltd.

CONCLUSION:

Indian insurance companies offer a comprehensive range of insurance plans, a range that is growing as the economy

matures and the wealth of the middle classes increases. The most common types include: term life policies, endowment

policies, joint life policies, whole life policies, loan cover term assurance policies, unit-linked insurance plans, group

insurance policies, pension plans, and annuities. General insurance plans are also available to cover motor insurance,

home insurance, travel insurance and health insurance.Due to the growing demand for insurance, more and more

insurance companies are now emerging in the Indian insurance sector. With the opening up of the economy, several

international leaders in the insurance sector are trying to venture into the India insurance industry.

REFERENCES

Ahluwalia, M. S. (2002). Economic Reforms in India since 1991: Has Gradualism Worked? Journal of Economic

Perspectives, 16, (3), 67-88.

Bhat, Ramesh.(1996).Regulation of the private health sector in India. International Journal of Health Planning and

Management.11:253-74.

Insurance in India. Service Marketing HimalayaPublishing HouseWadhawan, Sahdev. (1987). Health insurance in

India: The case for reform. International Labour Review 126(4):478.0 Potential of Indian Insurance Industry:

Reforms Insurance Regulatory and Development Authority (IRDA) (2010). Annual Report, IRDA, Mumbai.Sinha, P.K. and

Sahoo,S.C.(1994) Marketing of Life

Roy, Samit. Insurance Sector:India. Industry Sector Analysis, National Trade and DevelopmentBoard,USDepartment of

State,Washington,DC, December 1999.

World Bank (1995), The World Development Report 1994.29

Useful Websites:

14. http://www.lic.wwindia.com/ 15. http://www.asiainsurancereview.com/edsynopsis.asp

16. www.hc.wharton.upenn.edu/impactconference/presentations.html

View of Space : International Multidisciplinary Journal of Applied Research 131

Potrebbero piacerti anche

- A Study On The Growth of Indian Insurance SectorDocumento16 pagineA Study On The Growth of Indian Insurance SectorIAEME Publication100% (1)

- Insurance Awareness in India MainDocumento39 pagineInsurance Awareness in India Maintejaskamble4575% (4)

- India's Insurance Sector History and Current StateDocumento10 pagineIndia's Insurance Sector History and Current StateAman AmuNessuna valutazione finora

- Insurance Awareness in India MainDocumento34 pagineInsurance Awareness in India Maintejaskamble45Nessuna valutazione finora

- Industry Profile: Meaning of Life InsuranceDocumento72 pagineIndustry Profile: Meaning of Life InsuranceArchana AdavihallimathNessuna valutazione finora

- CHAPTER - 1 GENERAL INTRODUCTIONDocumento86 pagineCHAPTER - 1 GENERAL INTRODUCTIONVenkat GVNessuna valutazione finora

- Student, Department of Management Studies, Christ UniversityDocumento13 pagineStudent, Department of Management Studies, Christ UniversitydharmarajNessuna valutazione finora

- Indian Life Insurance Industry Changing Scenario and Need For InnovationDocumento7 pagineIndian Life Insurance Industry Changing Scenario and Need For InnovationRuchitaNessuna valutazione finora

- Summer Training ReportDocumento68 pagineSummer Training ReportpriyaNessuna valutazione finora

- Factors Influencing Customer Buying Behaviour Towards InsuranceDocumento52 pagineFactors Influencing Customer Buying Behaviour Towards InsurancePriyatharshiniNessuna valutazione finora

- Indian Insurance Industry ProfileDocumento55 pagineIndian Insurance Industry ProfileTeja KaikapalliNessuna valutazione finora

- Sun Life Financial and Indian Economic Surge: Case Analysis - International BusinessDocumento9 pagineSun Life Financial and Indian Economic Surge: Case Analysis - International Businessgurubhai24Nessuna valutazione finora

- A Study on Awareness Towards Life InsuranceDocumento94 pagineA Study on Awareness Towards Life InsurancekanujkohliNessuna valutazione finora

- Business Environment Project Report: Group 4Documento13 pagineBusiness Environment Project Report: Group 4SHIVAM CHUGHNessuna valutazione finora

- Insurance Sector in India Challenges and OpportunitiesDocumento23 pagineInsurance Sector in India Challenges and Opportunitiessantosh89750% (2)

- General Insurance Black Book ProjectDocumento45 pagineGeneral Insurance Black Book Projectprasad pawle50% (10)

- 1.1 Overview of The Insurance Industry 1.2 Profile of The Organization 1.3 Problems of HDFC SLICDocumento54 pagine1.1 Overview of The Insurance Industry 1.2 Profile of The Organization 1.3 Problems of HDFC SLICTejas GaubaNessuna valutazione finora

- Challenges Faced by Public Sector InsuranceDocumento52 pagineChallenges Faced by Public Sector InsuranceMehul Anandpara100% (1)

- Aviva Life InsuranceDocumento85 pagineAviva Life InsuranceArpan SinghalNessuna valutazione finora

- Reviews: Financial Soundness of Life Insurance Companies-The Insurance Companies of India in Majorly Dominated by TheDocumento3 pagineReviews: Financial Soundness of Life Insurance Companies-The Insurance Companies of India in Majorly Dominated by TheShrutii SinghNessuna valutazione finora

- Insurance Sector of India Project ReportDocumento81 pagineInsurance Sector of India Project ReportsnehkareerNessuna valutazione finora

- Report On Recruitment of Life Advisors Bharti AXADocumento84 pagineReport On Recruitment of Life Advisors Bharti AXAmegha140190Nessuna valutazione finora

- Insurance Sector TERM PAPERDocumento54 pagineInsurance Sector TERM PAPERverma786786Nessuna valutazione finora

- HDFC Recruitment of Financial Consultant of HDFC Standard Charterd Life InsuranceDocumento98 pagineHDFC Recruitment of Financial Consultant of HDFC Standard Charterd Life InsuranceRajni MadanNessuna valutazione finora

- HISTORY OF INSURANCE IN INDIADocumento8 pagineHISTORY OF INSURANCE IN INDIANeethu B.sNessuna valutazione finora

- Indian Service SectorDocumento7 pagineIndian Service SectorAshish SharmaNessuna valutazione finora

- Fdi in InsuranceDocumento8 pagineFdi in InsuranceSanthosh KumarNessuna valutazione finora

- The Insurance Sector Reforms in India: Ashish KumarDocumento4 pagineThe Insurance Sector Reforms in India: Ashish KumartajenderNessuna valutazione finora

- A Project ReportDocumento8 pagineA Project Reportmistryjinal546790% (10)

- HDFC Insurance Project Final CheckedDocumento78 pagineHDFC Insurance Project Final CheckedMohammed ShahidNessuna valutazione finora

- BMP Assignment: Insurance IndustryDocumento6 pagineBMP Assignment: Insurance IndustrysolelyshadabNessuna valutazione finora

- Industry Profile: Introduction of Life Insurance Industry in IndiaDocumento7 pagineIndustry Profile: Introduction of Life Insurance Industry in India9125103046Nessuna valutazione finora

- Privatisation and Growth of Industry in IndiaDocumento16 paginePrivatisation and Growth of Industry in IndiaAmandeep SinghNessuna valutazione finora

- Investment Pattern of Investors in Insurance Companies: March 2012Documento15 pagineInvestment Pattern of Investors in Insurance Companies: March 2012Shahrukh KhanNessuna valutazione finora

- Review of LiteratureDocumento6 pagineReview of LiteraturePraveen SehgalNessuna valutazione finora

- Impact of Foreign Direct Investment in Life Insurance IndustryDocumento22 pagineImpact of Foreign Direct Investment in Life Insurance Industryvajaajay100% (1)

- Lic 2 PDFDocumento29 pagineLic 2 PDFDipti MaheriyaNessuna valutazione finora

- Fundamental Analysis and Its Impact On Insurance SectorDocumento103 pagineFundamental Analysis and Its Impact On Insurance Sectorsebijo8750% (6)

- MetlifeDocumento73 pagineMetlifeMusharaf MominNessuna valutazione finora

- Fundamental Analysis Impact on InsuranceDocumento104 pagineFundamental Analysis Impact on Insurancevmktpt50% (2)

- Tata AiaDocumento132 pagineTata AiaHimanshu Jadon100% (1)

- Origin of InsuranceDocumento10 pagineOrigin of Insurancebha_goNessuna valutazione finora

- Designing Training for Max New York LifeDocumento29 pagineDesigning Training for Max New York LifePriyanka SarafNessuna valutazione finora

- Life Insurance Industry in India - Current ScenarioDocumento5 pagineLife Insurance Industry in India - Current Scenariorajanityagi23Nessuna valutazione finora

- Indian Insurance Industry Challenges and ProspectsDocumento84 pagineIndian Insurance Industry Challenges and ProspectsUtsav DubeyNessuna valutazione finora

- An Empirical Study On Perception of Consumer in Insurance SectorDocumento14 pagineAn Empirical Study On Perception of Consumer in Insurance SectorVenkateshwar DayalNessuna valutazione finora

- Insurance sector growth in IndiaDocumento26 pagineInsurance sector growth in IndiaPandya DevangNessuna valutazione finora

- All Chapters-2Documento83 pagineAll Chapters-2gonep54580Nessuna valutazione finora

- Ref Sip ProjectDocumento62 pagineRef Sip ProjectAishwaryaNessuna valutazione finora

- Growth of Insurance IndustryDocumento5 pagineGrowth of Insurance IndustryGeetha RaniNessuna valutazione finora

- Malhotra CommitteeDocumento24 pagineMalhotra Committeelovleshruby67% (3)

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5Da EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5Nessuna valutazione finora

- Business Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsDa EverandBusiness Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsNessuna valutazione finora

- Development of Insurance in Angola: Case Study of a Key African Frontier Insurance MarketDa EverandDevelopment of Insurance in Angola: Case Study of a Key African Frontier Insurance MarketNessuna valutazione finora

- Emerging FinTech: Understanding and Maximizing Their BenefitsDa EverandEmerging FinTech: Understanding and Maximizing Their BenefitsNessuna valutazione finora

- State Bank of IndiaDocumento2 pagineState Bank of IndiaRakesh HaldarNessuna valutazione finora

- Future Group - WikipediaDocumento5 pagineFuture Group - WikipediaRakesh HaldarNessuna valutazione finora

- Statistics Two WorkbookDocumento67 pagineStatistics Two WorkbookRakesh Haldar100% (1)

- Insurance in India - WikipediaDocumento4 pagineInsurance in India - WikipediaRakesh HaldarNessuna valutazione finora

- Board of DirectorsDocumento4 pagineBoard of DirectorsRakesh HaldarNessuna valutazione finora

- Board of DirectorsDocumento4 pagineBoard of DirectorsRakesh HaldarNessuna valutazione finora

- Board of DirectorsDocumento4 pagineBoard of DirectorsRakesh HaldarNessuna valutazione finora

- Dave Banking Statement For September 2022 PDFDocumento2 pagineDave Banking Statement For September 2022 PDFPaiger RossNessuna valutazione finora

- Problem 1: Rizal Review CenterDocumento6 pagineProblem 1: Rizal Review CenterrenoNessuna valutazione finora

- MCQs of SalesDocumento6 pagineMCQs of SalesBeseech for Changing50% (2)

- IFT 2016 2017 All Levels CFA Program Changes PDFDocumento5 pagineIFT 2016 2017 All Levels CFA Program Changes PDFTrisha SharmaNessuna valutazione finora

- Monthly Comcast Statement Due DateDocumento2 pagineMonthly Comcast Statement Due DateCAIRONessuna valutazione finora

- Finman QuizDocumento65 pagineFinman QuizChrista LenzNessuna valutazione finora

- Socket Realty Acts As An Agent in Buying Selling RentingDocumento1 paginaSocket Realty Acts As An Agent in Buying Selling RentingM Bilal SaleemNessuna valutazione finora

- Billing Statement: Customer Name 123 Main Street Vancouver, Wa 98661Documento2 pagineBilling Statement: Customer Name 123 Main Street Vancouver, Wa 98661marcelNessuna valutazione finora

- p3246 Flexplus GuideDocumento21 paginep3246 Flexplus Guideadheera20Nessuna valutazione finora

- Learning Task 1 - Special Journals & Subsidiary Ledgers, Problem #5Documento9 pagineLearning Task 1 - Special Journals & Subsidiary Ledgers, Problem #5Feiya LiuNessuna valutazione finora

- 12 Accountancy Lyp 2020 s1Documento59 pagine12 Accountancy Lyp 2020 s1Anushka JhaNessuna valutazione finora

- UltraTech Cement PerformanceDocumento20 pagineUltraTech Cement PerformanceSarthak KumarNessuna valutazione finora

- INVESTMENT RISK AND RETURN PLANDocumento25 pagineINVESTMENT RISK AND RETURN PLANPrince Isaiah JacobNessuna valutazione finora

- Prepare and Process Financial DocsDocumento47 paginePrepare and Process Financial DocsEphraim PryceNessuna valutazione finora

- AJE Practice Problems - 2127759290Documento2 pagineAJE Practice Problems - 2127759290Nichole Joy XielSera TanNessuna valutazione finora

- ACCT 213 Exercise (Chapter 12) ReadyDocumento4 pagineACCT 213 Exercise (Chapter 12) ReadyMohammedNessuna valutazione finora

- Concept and Accounting of Depreciation: Learning OutcomesDocumento30 pagineConcept and Accounting of Depreciation: Learning OutcomesCA Kranthi Kiran100% (1)

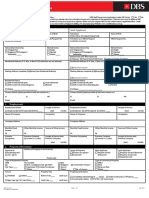

- DBS Mortgage All-In-One Application Form 2016Documento3 pagineDBS Mortgage All-In-One Application Form 2016Viola HippieNessuna valutazione finora

- Reviewer in Insurance LawDocumento35 pagineReviewer in Insurance LawshintaronikoNessuna valutazione finora

- Microfinance in India: Detailed StudyDocumento21 pagineMicrofinance in India: Detailed StudyKokila AmbigaeNessuna valutazione finora

- Services – Insomnio CapitalDocumento1 paginaServices – Insomnio Capitaljkvxctfh8hNessuna valutazione finora

- Section BDocumento56 pagineSection BForeclosure Fraud100% (1)

- Quality Furniture Company MBA 206: Case PresentationDocumento22 pagineQuality Furniture Company MBA 206: Case PresentationApol DisimulacionNessuna valutazione finora

- BF BinderDocumento7 pagineBF BinderShane VeiraNessuna valutazione finora

- Bank Negara Malaysia Guidelines Related Party TransactionDocumento12 pagineBank Negara Malaysia Guidelines Related Party TransactionYan QingNessuna valutazione finora

- Revaluation ModelDocumento7 pagineRevaluation ModelkyramaeNessuna valutazione finora

- Audit PerbankanDocumento140 pagineAudit Perbankanmuhammad firmanNessuna valutazione finora

- 67 2 2 AccountancyDocumento27 pagine67 2 2 Accountancysairamaharoof123Nessuna valutazione finora

- Fabm 1 q2 Week 6 PDFDocumento4 pagineFabm 1 q2 Week 6 PDFA.Nessuna valutazione finora

- 2014.12 2015.01 Q&ABooklet P1 EnglishDocumento24 pagine2014.12 2015.01 Q&ABooklet P1 EnglishKxlxm KxlxmNessuna valutazione finora