Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Qualification Structure 2016

Caricato da

Jia SyuenCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Qualification Structure 2016

Caricato da

Jia SyuenCopyright:

Formati disponibili

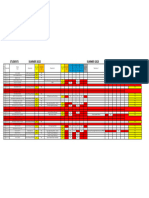

IFoA Education Curriculum 2019

Qualification Structure

Qualification: Fellow

Alternative Health & Care Life Insurance Pensions and Investment and Investment and Enterprise Risk

General Insurance

Finance Finance

Pass one SA

other benefits Management

Advanced

Specialist

subject

Health and Care Life Insurance

SA0 Pensions and other Investment and General Insurance

Advanced Advanced

Research Masters benefits Finance Advanced

SA1 SA2

Level Thesis Advanced Advanced SA3

3hr paper-based 3hr paper-based

SA4 SA7 3hr paper-based

3hr paper-based 3hr paper-based

General Insurance:

Reserving and Capital

Pass two SP

Modelling Principles

Pensions and other Enterprise Risk

subjects

SP7

Principles

Specialist

Health and Care Investment and

Life Insurance benefits Financial Derivatives 3hr paper-based Management

SP0 Principles Finance

Principles Principles Principles Principles

Masters Level SP1 Principles

SP2 SP4 SP6 General Insurance Pricing SP9

Dissertation SP5

Personal and Professional Development (PPD)

3hr paper-based 3hr paper-based 3hr paper-based 3hr paper-based Principles 3hr paper-based

3hr paper-based SP8

3hr paper-based

Qualification: Associate

Actuarial Practice Modelling Practice Communication Practice

Core Practices

Pass all Core Principles and Core Practice exams

Actuarial Practice Actuarial Practice Modelling Practice Modelling Practice

(CP1) (CP1) (CP2) (CP2)

Paper 1 Paper 2 Paper 1 Paper 2 Communication Practice

3hr paper-based 3hr paper-based 3hr computer-based 3hr computer-based (CP3)

3hr computer-based

Must pass both papers together Must pass both papers together

Actuarial Statistics Actuarial Mathematics Business

Business Finance

Actuarial Statistics 1 Actuarial Statistics 2 Actuarial Mathematics 1 Actuarial Mathematics 2 (CB1)

Core Principles

(CS1A) (CS2A) (CM1A) (CM2A) 3hr - paper-based

Theoretical Exam Theoretical Exam Theoretical Exam Theoretical Exam

3hr paper-based 3hr paper-based 3hr paper-based 3hr paper-based

Business Economics

(CB2)

Actuarial Statistics 1 Actuarial Statistics 2 Actuarial Mathematics 1 Actuarial Mathematics 2 3hr paper-based

(CS1B) (CS2B) (CM1B) (CM2B)

Computer-based Computer-based Computer-based Computer-based Business Management

1.5hr R 1.5hr R 1.5hr Excel 1.5hr Excel (CB3)

3hr paper-based

Examinations can be taken independently of each other Examinations can be taken independently of each other Exams can be sat in any order

*NOTE: There are no restrictions on the order in which modules and examinations may be taken.

09 September 2016

Potrebbero piacerti anche

- Qualification Structure Final - 1 PageDocumento1 paginaQualification Structure Final - 1 Pagearcanum78Nessuna valutazione finora

- CFP BrochureDocumento2 pagineCFP BrochureAnupam Sinha100% (2)

- FNA - Product Mapping - Individual - Corporate - Hot Product - June 2020Documento1 paginaFNA - Product Mapping - Individual - Corporate - Hot Product - June 2020Steven CW CheungNessuna valutazione finora

- Department: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsDocumento3 pagineDepartment: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsCharlesNessuna valutazione finora

- MarketLine Advantage - Company Report Generator - Master Company Report (Nestle India LTD)Documento7 pagineMarketLine Advantage - Company Report Generator - Master Company Report (Nestle India LTD)Abhishek BishtNessuna valutazione finora

- PACRA-United Insurance RatingDocumento5 paginePACRA-United Insurance RatingRaja HaroonNessuna valutazione finora

- 2023 HSC Study Guide WebDocumento33 pagine2023 HSC Study Guide WebDarpan AcharyaNessuna valutazione finora

- SplitOneFile 1663009932Documento1 paginaSplitOneFile 1663009932Mohd ZubairNessuna valutazione finora

- Career Path For DisabilityDocumento1 paginaCareer Path For Disabilityannegordon141Nessuna valutazione finora

- Financial 04.2020 v.2Documento2 pagineFinancial 04.2020 v.2elizaNessuna valutazione finora

- Business Owners Super Suite Education BrochureDocumento2 pagineBusiness Owners Super Suite Education BrochureHihiNessuna valutazione finora

- "Training & Recruitment OF Life Insurance Agent": Darwin School of Business, Guwahati, AssamDocumento58 pagine"Training & Recruitment OF Life Insurance Agent": Darwin School of Business, Guwahati, AssamSangeeta DuaNessuna valutazione finora

- Brochure - FINAL - LOW-RES - InsetaDocumento12 pagineBrochure - FINAL - LOW-RES - Insetairene hulkNessuna valutazione finora

- CoverDocumento1 paginaCoverNur SeftihaniNessuna valutazione finora

- Pharmacy Daily 13th Oct 2023Documento2 paginePharmacy Daily 13th Oct 2023Marinero CzarNessuna valutazione finora

- PDF Risk Intelligence Map Health Care Compliance AssociationDocumento1 paginaPDF Risk Intelligence Map Health Care Compliance AssociationDeborah CardosoNessuna valutazione finora

- DH&FWSDocumento6 pagineDH&FWSDULAL FAHADNessuna valutazione finora

- Business Owners Super Suite Light Industries BrochureDocumento2 pagineBusiness Owners Super Suite Light Industries BrochureHihiNessuna valutazione finora

- BP 201 A PSDocumento2 pagineBP 201 A PSCharlesNessuna valutazione finora

- ACCA - Start Your JourneyDocumento1 paginaACCA - Start Your Journeyvstan9100% (1)

- Mumbai SalaryDocumento8 pagineMumbai SalarySunny SinghNessuna valutazione finora

- PremiumDocumento1 paginaPremiumosamaNessuna valutazione finora

- ACCA Qualification Structure DiagramDocumento1 paginaACCA Qualification Structure DiagramAbdul Hadi SaleemNessuna valutazione finora

- Old Mutual SAQuoted Property FundDocumento2 pagineOld Mutual SAQuoted Property FundMarlvinNessuna valutazione finora

- The Road To The Future of Higher Education: Glenda MorganDocumento30 pagineThe Road To The Future of Higher Education: Glenda MorganChico NetoNessuna valutazione finora

- Ilovepdf MergedDocumento14 pagineIlovepdf MergedGulnaz SalmaniNessuna valutazione finora

- AR Pupuk Indonesia 2 Agustus LR Sore Compressed1628063403Documento770 pagineAR Pupuk Indonesia 2 Agustus LR Sore Compressed1628063403Nailur Rosyad AlghifariNessuna valutazione finora

- Cpaic Corporate Governance Report 2019Documento4 pagineCpaic Corporate Governance Report 2019Theo AgustinoNessuna valutazione finora

- The CISI's Qualifications and Membership Framework: Foundation Qualifying Qualifying Advanced Postgraduate ProfessionalDocumento2 pagineThe CISI's Qualifications and Membership Framework: Foundation Qualifying Qualifying Advanced Postgraduate ProfessionalAbass GblaNessuna valutazione finora

- QualsstructureDocumento2 pagineQualsstructureJithin AbrahamNessuna valutazione finora

- CISI QualificationsDocumento1 paginaCISI QualificationsGhadiNessuna valutazione finora

- 2017 Wtwds Compensation Surveys Philippines FlyerDocumento2 pagine2017 Wtwds Compensation Surveys Philippines FlyerJohn MarkNessuna valutazione finora

- 2021/2022 Benchmark Select Compensation Reports HR and Benefits Design Policies and PracticesDocumento4 pagine2021/2022 Benchmark Select Compensation Reports HR and Benefits Design Policies and PracticesGloriya DominicNessuna valutazione finora

- Result May 2022 Mpmsu MbbsDocumento22 pagineResult May 2022 Mpmsu MbbsSiya PatilNessuna valutazione finora

- LGU CALAYAN Physician DataDocumento1 paginaLGU CALAYAN Physician DataInfirmaryNessuna valutazione finora

- Insurance Financial and Actuarial AnalysisDocumento12 pagineInsurance Financial and Actuarial AnalysisKamal UddinNessuna valutazione finora

- MIT Sloan - 5pgs PDFDocumento5 pagineMIT Sloan - 5pgs PDFJai KamdarNessuna valutazione finora

- CISI Qualifications PathDocumento2 pagineCISI Qualifications PathLoucas LoucaNessuna valutazione finora

- Institute and Faculty (Ifoa) Exams Passed Waivers From Soa ExaminationDocumento1 paginaInstitute and Faculty (Ifoa) Exams Passed Waivers From Soa ExaminationtitooluwaNessuna valutazione finora

- Grading Matrix SalesDocumento1 paginaGrading Matrix SalesJosep Lluís Marrugat ViñaNessuna valutazione finora

- Finance Introductin FormatDocumento3 pagineFinance Introductin FormatSuresh JakkaNessuna valutazione finora

- Faculty Profile PGP ARM VIZAGDocumento2 pagineFaculty Profile PGP ARM VIZAGPUTTU GURU PRASAD SENGUNTHA MUDALIARNessuna valutazione finora

- 0 e 8 A 5 NoticeDocumento2 pagine0 e 8 A 5 NoticeHari At AmityNessuna valutazione finora

- Supriya RaiDocumento6 pagineSupriya RaisushrithakalburgiNessuna valutazione finora

- Federal Urdu University of Arts, Science & Technology, IslamabadDocumento1 paginaFederal Urdu University of Arts, Science & Technology, IslamabadUmer AhmedNessuna valutazione finora

- Evidence Mapping DocumentDocumento1 paginaEvidence Mapping Documentapi-257427896Nessuna valutazione finora

- SSU VPSAS FR 011 Plans and ProgramsDocumento6 pagineSSU VPSAS FR 011 Plans and ProgramsMelquiades SeparaNessuna valutazione finora

- 05 Preferred CompaniesDocumento3 pagine05 Preferred CompaniesAbhijit SinhaNessuna valutazione finora

- Oracle Benefit - Tech PDFDocumento12 pagineOracle Benefit - Tech PDFChary MadarapuNessuna valutazione finora

- FR-HSE-65 Need Training AnalysisDocumento1 paginaFR-HSE-65 Need Training Analysishse grogolNessuna valutazione finora

- PGT - June 14 2019 PDFDocumento2 paginePGT - June 14 2019 PDFKamilleNessuna valutazione finora

- Perrigo Investor Presentation 02-2023 - V - FINALDocumento168 paginePerrigo Investor Presentation 02-2023 - V - FINALdillidudeNessuna valutazione finora

- PWC UK AIMS - Vacancy DescriptionDocumento14 paginePWC UK AIMS - Vacancy DescriptionJyotirmoy BhattaNessuna valutazione finora

- Internship Status - Session 2020Documento1 paginaInternship Status - Session 2020Saadii MalikNessuna valutazione finora

- Competency Skill Matrix - Jakkanpur SiteDocumento5 pagineCompetency Skill Matrix - Jakkanpur SiteNitish SinghNessuna valutazione finora

- What Should Depositors Do When Fixed Deposit (FD) Rates Are Low and Falling?Documento11 pagineWhat Should Depositors Do When Fixed Deposit (FD) Rates Are Low and Falling?vonnigNessuna valutazione finora

- Training & Recruitment OF Life Insurance Agent": Md. Riyaj Shah Roll No. 059/MFW Batch No. 2010-2012 (MBA 2 Sem.)Documento57 pagineTraining & Recruitment OF Life Insurance Agent": Md. Riyaj Shah Roll No. 059/MFW Batch No. 2010-2012 (MBA 2 Sem.)Priyanka DuaNessuna valutazione finora

- Business Strategy Research by Value AddDocumento11 pagineBusiness Strategy Research by Value AddValueadd ResearchNessuna valutazione finora

- QualsstructureDocumento2 pagineQualsstructureAgnes BofillNessuna valutazione finora

- Texit Cheatsheet PDFDocumento1 paginaTexit Cheatsheet PDFJia SyuenNessuna valutazione finora

- Derivatives Market in ChinaDocumento11 pagineDerivatives Market in ChinaJia SyuenNessuna valutazione finora

- Impact On The Expected Credit LossDocumento21 pagineImpact On The Expected Credit LossJia SyuenNessuna valutazione finora

- Marvel Comics Timeline Classic Origins Timelines Reading OrdersDocumento10 pagineMarvel Comics Timeline Classic Origins Timelines Reading OrdersJia SyuenNessuna valutazione finora

- DeductibleDocumento62 pagineDeductibleJia SyuenNessuna valutazione finora

- China's Economy Grew 6.6% in 2018, The Lowest Pace in 28 YearsDocumento4 pagineChina's Economy Grew 6.6% in 2018, The Lowest Pace in 28 YearsJia SyuenNessuna valutazione finora

- IandF ST8 201709 ExamDocumento9 pagineIandF ST8 201709 ExamJia SyuenNessuna valutazione finora

- Weaam - 215 Lectures - Print6Documento96 pagineWeaam - 215 Lectures - Print6Jia SyuenNessuna valutazione finora

- MASTER TIMETABLE (JANUARY - APRIL 2018) As of 22th November 2017 Faculty of Engineering (Foe) Codes Subject Day TimeDocumento4 pagineMASTER TIMETABLE (JANUARY - APRIL 2018) As of 22th November 2017 Faculty of Engineering (Foe) Codes Subject Day TimeJia SyuenNessuna valutazione finora

- EducationFees201706 PDFDocumento3 pagineEducationFees201706 PDFJia SyuenNessuna valutazione finora

- EducationFees201706 PDFDocumento3 pagineEducationFees201706 PDFJia SyuenNessuna valutazione finora

- 9709 Mathematics: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersDocumento6 pagine9709 Mathematics: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersJia SyuenNessuna valutazione finora

- Members Benefits Brochure 2017Documento16 pagineMembers Benefits Brochure 2017Jia SyuenNessuna valutazione finora

- My View To Differentiation and Integration by Victor Ong ZhangDocumento2 pagineMy View To Differentiation and Integration by Victor Ong ZhangJia SyuenNessuna valutazione finora

- 9706 Accounting: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersDocumento2 pagine9706 Accounting: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersJia SyuenNessuna valutazione finora

- Primus Industries - TOC Case StudyDocumento2 paginePrimus Industries - TOC Case StudySUJIT SONAWANENessuna valutazione finora

- D. Co Increases, But Cu Decreases. Solution: As Cost of The Product Increases, The Lost Margin (Cu) Decreases. at TheDocumento5 pagineD. Co Increases, But Cu Decreases. Solution: As Cost of The Product Increases, The Lost Margin (Cu) Decreases. at TheAbhishek BatraNessuna valutazione finora

- Long Thanh International Airport: Vietnam'S Number 1 Megaproject in The Next Few DecadesDocumento28 pagineLong Thanh International Airport: Vietnam'S Number 1 Megaproject in The Next Few DecadesDoyeon KimNessuna valutazione finora

- Child Care Business PlanDocumento15 pagineChild Care Business Plandeepakpinksurat100% (5)

- Prepared By: Abdulkaf Shehabo ID:7570/09 Advisor: Meaza (MSC)Documento41 paginePrepared By: Abdulkaf Shehabo ID:7570/09 Advisor: Meaza (MSC)Marshet yohannesNessuna valutazione finora

- Private Company ValuationDocumento35 paginePrivate Company ValuationShibly0% (1)

- q2 Long Quiz 002 EntreDocumento8 pagineq2 Long Quiz 002 EntreMonn Justine Sabido0% (1)

- Falcone e Osborne 2005Documento8 pagineFalcone e Osborne 2005Tamires MariaNessuna valutazione finora

- Claiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseDocumento9 pagineClaiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseErmintrudeNessuna valutazione finora

- PPCDocumento27 paginePPCPRAMATHESH PANDEY100% (1)

- Renewal NoticeDocumento1 paginaRenewal NoticeankitNessuna valutazione finora

- Retail Foods - The Hague - Netherlands - 06-30-2020Documento10 pagineRetail Foods - The Hague - Netherlands - 06-30-2020sb AgrocropsNessuna valutazione finora

- Presentation ACT110Documento34 paginePresentation ACT110Nezam MarandaNessuna valutazione finora

- Rothenberger 2006 enDocumento110 pagineRothenberger 2006 enakshayNessuna valutazione finora

- World Investor NZDocumento72 pagineWorld Investor NZAcorn123Nessuna valutazione finora

- HR Analytics - Assignment 7Documento4 pagineHR Analytics - Assignment 7Bismah AhmedNessuna valutazione finora

- Single EntryDocumento5 pagineSingle Entrysmit9993Nessuna valutazione finora

- ARES-FM-09 Meeting Sign-In SheetDocumento1 paginaARES-FM-09 Meeting Sign-In SheetInspiry TVNessuna valutazione finora

- Chapter 5 - Business To Business MarketingDocumento15 pagineChapter 5 - Business To Business MarketingHassan SiddiquiNessuna valutazione finora

- William BootmakerDocumento2 pagineWilliam Bootmakerparmeet kaurNessuna valutazione finora

- Act May20 - Full LRDocumento52 pagineAct May20 - Full LREnoc MoralesNessuna valutazione finora

- Ao239 1 PDFDocumento5 pagineAo239 1 PDFAnonymous wqT95XZ5Nessuna valutazione finora

- Blueprint For Learning and Development in A NutshellDocumento28 pagineBlueprint For Learning and Development in A NutshellPrateek KatekarNessuna valutazione finora

- Study and Analysis of Financial A ReportDocumento26 pagineStudy and Analysis of Financial A Reportpriyanka81287Nessuna valutazione finora

- FM AnalysisDocumento62 pagineFM AnalysisSofiya BayraktarovaNessuna valutazione finora

- Why I Hate Jay Abraham - EssayDocumento38 pagineWhy I Hate Jay Abraham - EssaylopeztrujiNessuna valutazione finora

- Eliminating Social Welfare Poverty TrapsDocumento9 pagineEliminating Social Welfare Poverty TrapsFFRenewalNessuna valutazione finora

- Forms of Business Organization in NepalDocumento10 pagineForms of Business Organization in Nepalsuraj banNessuna valutazione finora

- FAQ On CARPDocumento5 pagineFAQ On CARPJ. O. M. SalazarNessuna valutazione finora

- Sector Analysis of BFSI - Axis BankDocumento11 pagineSector Analysis of BFSI - Axis BankAbhishek Kumawat (PGDM 18-20)Nessuna valutazione finora