Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Analysis Exercises

Caricato da

Spencer Mosquisa0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

320 visualizzazioni1 paginafinancial analysis statement

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentofinancial analysis statement

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

320 visualizzazioni1 paginaFinancial Analysis Exercises

Caricato da

Spencer Mosquisafinancial analysis statement

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

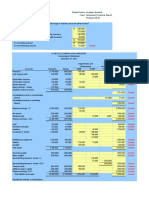

The Comparative Balance Sheets for Year 1 and Year 2 and the Year 2 Income Statement for Royal

Bros., Inc. are as follows:

Royal Bros, Inc.

Balance Sheet

December 31, Year 1 December 31, Year 2

Assets

Cash $ 54,000 $ 180,000

Accounts Receivable 540,000 360,000

Inventories 720,000 1,080,000

Property, Plant, and Equipment (net) 2,646,000 2,520,000

Total Assets $3,960,000 $4,140,000

Liabilities and Shareholders' Equity

Accounts Payable $ 900,000 $ 680,400

5% Mortgage Payable 1,494,000 1,440,000

Common Stock 1,080,000 1,080,000

Retained Earnings 486,000 939,600

Total Liabilities and Shareholders' Equity $3,960,000 $4,140,000

Royal Bros, Inc.

Income Statement

For the Year Ended December 31, Year 2

Sales on Account $3,240,000

Less Expenses:

Cost of Goods Sold (1,800,000)

Salary Expense (594,000)

Depreciation Expense (126,000)

Interest Expense (72,000)

Income before Income Taxes $ 648,000

Income Tax Expense at 35 percent (226,800)

Net Income $ 421,200

Compute the following ratios for Royal Bros., Inc. for Year 2 or on December 31, Year 2 as appropriate.

a. Current Ratio on December 31, Year 2.

b. Quick Ratio on December 31, Year 2 (inventory cannot be quickly converted to cash).

c. Debt Ratio on December 31, Year 2.

d. Total Assets Turnover Ratio for Year 2.

e. TIE Ratio for Year 2.

f. Inventory Turnover Ratio for Year 2.

g. DSO for Year 2.

h. Long-Term Debt Ratio on December 31, Year 2.

i. Fixed Asset Turnover Ratio for Year 2.

Potrebbero piacerti anche

- CH 13 Wiley Kimmel Quiz HomeworkDocumento8 pagineCH 13 Wiley Kimmel Quiz HomeworkmkiNessuna valutazione finora

- Week 13 - SoalDocumento3 pagineWeek 13 - SoalHeidi ParamitaNessuna valutazione finora

- Homework # 3 FSADocumento5 pagineHomework # 3 FSAOsayd BzootNessuna valutazione finora

- End Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying AbilityDocumento4 pagineEnd Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying Abilityawaischeema100% (1)

- Bracknell Cash Flow QuestionDocumento3 pagineBracknell Cash Flow Questionsanjay blakeNessuna valutazione finora

- Chapter 23 Statement of Cash Flows Multiple Choice With SolutionsDocumento10 pagineChapter 23 Statement of Cash Flows Multiple Choice With SolutionsHossein Parvardeh50% (2)

- Solve Cash Flow ProblemsDocumento3 pagineSolve Cash Flow ProblemsMichelle ManuelNessuna valutazione finora

- ACCO 420 Final F2020 Version 2Documento4 pagineACCO 420 Final F2020 Version 2Wasif SethNessuna valutazione finora

- Cash Flow (Exercise)Documento5 pagineCash Flow (Exercise)abhishekvora7598752100% (1)

- Finance ProjectDocumento6 pagineFinance Projectrawan joudehNessuna valutazione finora

- QuestionsDocumento13 pagineQuestionsAriaNessuna valutazione finora

- FAOMA Part 3 Quiz Complete SolutionsDocumento3 pagineFAOMA Part 3 Quiz Complete SolutionsMary De JesusNessuna valutazione finora

- ACC 203 Ch05 SolutionDocumento11 pagineACC 203 Ch05 Solutionomaritani2005Nessuna valutazione finora

- Exercises AllDocumento9 pagineExercises AllLede Ann Calipus YapNessuna valutazione finora

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocumento6 pagineHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNessuna valutazione finora

- Case 21Documento14 pagineCase 21Gabriela LueiroNessuna valutazione finora

- Ch5 Additional Q OnlyDocumento13 pagineCh5 Additional Q OnlynigaroNessuna valutazione finora

- Corporate Finance Assignment Chapter 2 PDFDocumento12 pagineCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- Mid Term November 6 2020Documento6 pagineMid Term November 6 2020old times0% (1)

- Chapter 4-Profitability Analysis: Multiple ChoiceDocumento30 pagineChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNessuna valutazione finora

- Partnership FormatDocumento2 paginePartnership FormatGlenn Taduran100% (1)

- Tarea Taller 1 FINA 503Documento4 pagineTarea Taller 1 FINA 503Hugo LombardiNessuna valutazione finora

- AC4301 FinalExam 2020-21 SemA AnsDocumento9 pagineAC4301 FinalExam 2020-21 SemA AnslawlokyiNessuna valutazione finora

- Midterm Practice QuestionsDocumento4 pagineMidterm Practice QuestionsGio RobakidzeNessuna valutazione finora

- In Class Excel - 825 - WorkingDocumento98 pagineIn Class Excel - 825 - WorkingIanNessuna valutazione finora

- Revision ExamsDocumento3 pagineRevision ExamsBandile MhlongoNessuna valutazione finora

- TESLA-financial Statement 2016-2020Documento18 pagineTESLA-financial Statement 2016-2020XienaNessuna valutazione finora

- B205B Financial ExamplesDocumento6 pagineB205B Financial ExamplesAhmad RahjeNessuna valutazione finora

- Project 4 - Chap 5Documento3 pagineProject 4 - Chap 5Waqar ZulfiqarNessuna valutazione finora

- Key Answer Financial Statement - TP1Documento7 pagineKey Answer Financial Statement - TP1Riza AdiNessuna valutazione finora

- Financial Statement Analysis QuestionsDocumento4 pagineFinancial Statement Analysis QuestionsAsad RehmanNessuna valutazione finora

- Adjust Chapter 5 HW for All StudentsDocumento4 pagineAdjust Chapter 5 HW for All StudentsJalaj GuptaNessuna valutazione finora

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Documento36 pagineFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (27)

- CH 07 PPTsDocumento30 pagineCH 07 PPTsAfifan Ahmad FaisalNessuna valutazione finora

- CH 13Documento4 pagineCH 13Sri HimajaNessuna valutazione finora

- RATIO ANALYSIS Q 1 To 4Documento5 pagineRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- CH23 - Transactional Approach and CFExercises and SolutionsDocumento6 pagineCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNessuna valutazione finora

- Unit - II Module IIIDocumento7 pagineUnit - II Module IIIpltNessuna valutazione finora

- Problem 1: Cash Flow Statement (Class Practice)Documento2 pagineProblem 1: Cash Flow Statement (Class Practice)ronamiNessuna valutazione finora

- Addtional Cash Flow Problems and SolutionsDocumento7 pagineAddtional Cash Flow Problems and SolutionsHossein ParvardehNessuna valutazione finora

- Using The Following Financial Information Fill in The Table That FollowsDocumento3 pagineUsing The Following Financial Information Fill in The Table That FollowsDevang ShetyeNessuna valutazione finora

- This Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LDocumento4 pagineThis Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LRian RorresNessuna valutazione finora

- SLLC - 2021 - Acc - C - Review Question 2 - Ratio AnalysisDocumento3 pagineSLLC - 2021 - Acc - C - Review Question 2 - Ratio AnalysisChamela MahiepalaNessuna valutazione finora

- Wac 1 (Final)Documento12 pagineWac 1 (Final)lynloy24Nessuna valutazione finora

- Accounting Mock ExamDocumento6 pagineAccounting Mock ExamKiran alex ChallagiriNessuna valutazione finora

- SME Financial Statement AnalysisDocumento3 pagineSME Financial Statement AnalysisJere Mae MarananNessuna valutazione finora

- Introduction To Accounting and Business: Discussion QuestionsDocumento46 pagineIntroduction To Accounting and Business: Discussion QuestionsCyyyNessuna valutazione finora

- Mas DocumentsDocumento12 pagineMas DocumentsLorie Grace LagunaNessuna valutazione finora

- Chapter 2 Team ProjectDocumento2 pagineChapter 2 Team ProjectRaisa TasnimNessuna valutazione finora

- Question No 1: Journal EntriesDocumento3 pagineQuestion No 1: Journal EntriesMUKHTALIFNessuna valutazione finora

- Nguyen Thu HuyenDocumento8 pagineNguyen Thu Huyenhuyền nguyễnNessuna valutazione finora

- B02 Final Exam Review QuestionsDocumento8 pagineB02 Final Exam Review QuestionsnigaroNessuna valutazione finora

- Task 4 - Consolidation: Patricia HarringtonDocumento9 pagineTask 4 - Consolidation: Patricia HarringtonDewi Agus SukowatiNessuna valutazione finora

- Tesla, Inc. Statement of Financial Position (In USD Millions) For The Year EndedDocumento19 pagineTesla, Inc. Statement of Financial Position (In USD Millions) For The Year EndedXienaNessuna valutazione finora

- Chapter 13 Homework Assignment #2 QuestionsDocumento8 pagineChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Auditing AssignmentDocumento8 pagineAuditing AssignmentApril ManjaresNessuna valutazione finora

- Financial Accounting Part 3 PDFDocumento6 pagineFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNessuna valutazione finora

- Q.1) The Following Trial Balance Has Been Extracted From The Books of Rajesh On 31st December, 2016Documento11 pagineQ.1) The Following Trial Balance Has Been Extracted From The Books of Rajesh On 31st December, 2016Aarya Khedekar100% (2)

- AC3202 WK2 Exercises SolutionsDocumento11 pagineAC3202 WK2 Exercises SolutionsLong LongNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Latur District JUdge-1 - 37-2015Documento32 pagineLatur District JUdge-1 - 37-2015mahendra KambleNessuna valutazione finora

- Defensor Santiago v. ComelecDocumento15 pagineDefensor Santiago v. ComelecRubierosse DongalloNessuna valutazione finora

- Bwff1013 Foundations of Finance Quiz #3Documento8 pagineBwff1013 Foundations of Finance Quiz #3tivaashiniNessuna valutazione finora

- Rahul IAS Notes on Code of Criminal ProcedureDocumento310 pagineRahul IAS Notes on Code of Criminal Proceduresam king100% (1)

- Bank StatementDocumento2 pagineBank StatementZakaria EL MAMOUNNessuna valutazione finora

- Xavier Institute of Management: PGPBFS 2010-2011Documento21 pagineXavier Institute of Management: PGPBFS 2010-2011Tanmay MohantyNessuna valutazione finora

- Khilafat Movement 1919 1924Documento4 pagineKhilafat Movement 1919 1924obaidNessuna valutazione finora

- COMPLETING YOUR IRC FORM C TAX RETURNDocumento31 pagineCOMPLETING YOUR IRC FORM C TAX RETURNDanielNessuna valutazione finora

- Global Politics Paper 2 HLDocumento3 pagineGlobal Politics Paper 2 HLterabaapNessuna valutazione finora

- COMMERCIAL LAW REVIEW - SamplexDocumento10 pagineCOMMERCIAL LAW REVIEW - SamplexML BanzonNessuna valutazione finora

- LABFORS-4 IntasDocumento6 pagineLABFORS-4 IntasAlisha TurnerNessuna valutazione finora

- Impact of Pop Culture On PoliticsDocumento3 pagineImpact of Pop Culture On PoliticsPradip luitelNessuna valutazione finora

- Godisnjak PFSA 2018 Za WebDocumento390 pagineGodisnjak PFSA 2018 Za WebAida HamidovicNessuna valutazione finora

- Script FiestaDocumento5 pagineScript FiestaLourdes Bacay-DatinguinooNessuna valutazione finora

- s3 UserguideDocumento1.167 pagines3 UserguideBetmanNessuna valutazione finora

- Education in The Face of Caste: The Indian CaseDocumento13 pagineEducation in The Face of Caste: The Indian CaseParnasha Sankalpita BhowmickNessuna valutazione finora

- MELENDEZ Luis Sentencing MemoDocumento9 pagineMELENDEZ Luis Sentencing MemoHelen BennettNessuna valutazione finora

- Texas Driver's Handbook On Bicycle SafetyDocumento2 pagineTexas Driver's Handbook On Bicycle SafetydugbegleyNessuna valutazione finora

- Clem Amended ComplaintDocumento26 pagineClem Amended ComplaintstprepsNessuna valutazione finora

- Romans Catholic DefendersDocumento176 pagineRomans Catholic DefendersКирие ЭлейсонNessuna valutazione finora

- Release Vehicle Motion Philippines Theft CaseDocumento3 pagineRelease Vehicle Motion Philippines Theft Caseczabina fatima delicaNessuna valutazione finora

- The 3 Key Financial Decisions Facing ManagersDocumento6 pagineThe 3 Key Financial Decisions Facing ManagersSaAl-ismailNessuna valutazione finora

- Prophet Muhammad's Military LeadershipDocumento8 pagineProphet Muhammad's Military Leadershipshakira270Nessuna valutazione finora

- Pop Art: Summer Flip FlopsDocumento12 paginePop Art: Summer Flip FlopssgsoniasgNessuna valutazione finora

- FIT EdoraDocumento8 pagineFIT EdoraKaung MyatToeNessuna valutazione finora

- Safety Integrity Level Selection: Systematic Methods Including Layer of Protection AnalysisDocumento2 pagineSafety Integrity Level Selection: Systematic Methods Including Layer of Protection AnalysiswalidNessuna valutazione finora

- McCurdy FR 6-15-18Documento12 pagineMcCurdy FR 6-15-18David FritzNessuna valutazione finora

- LifeCycleSequencingCardsFREEButterflyandFrog 1Documento11 pagineLifeCycleSequencingCardsFREEButterflyandFrog 1Kayleigh Cowley100% (1)

- Gridplus Efl Ver No 4 Basic 12 - CNP - English - 05.08.2019Documento1 paginaGridplus Efl Ver No 4 Basic 12 - CNP - English - 05.08.2019Mayur PatelNessuna valutazione finora

- Abraham 01Documento29 pagineAbraham 01cornchadwickNessuna valutazione finora