Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Impact of Profitability on Pakistan Textile Industry Cash Flow

Caricato da

Sajid Mohy Ul DinDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Impact of Profitability on Pakistan Textile Industry Cash Flow

Caricato da

Sajid Mohy Ul DinCopyright:

Formati disponibili

Impact of Firms Profitability measures on free cash flows: A case of

Pakistan Textile Industry

Maria Khushi

MS Student

Lahore Leads University

mariakhushi@ymail.com

00923114442800

Sajid Mohy Ul Din

PhD Student

Universiti Utara Malaysia

sajidmohyuldingsk@yahoo.com

Abstract

This study is carried out to investigate the impact of firms profitability measures on the free-

cash-flow. To assess this, the population of Textile sector of Pakistan is used and by the

method of capitalization, a sample of 31 companies was taken from the three subsectors

(composite, spinning and weaving) of Pakistani Textile Sector. The Data is collected from

audited annual reports and from State Bank of Pakistans balance sheet analysis. Panel data

analysis techniques are used to study the relationship between dependent and independent

variables. The results reported a significant (p = 0.0007) and positive relationship between

overall profitability and free-cash-flow (FCF) of the firm. While as far as measures of

profitability are concerned, ROA and ROE are found to be positively and significantly related

with FCF whereas sales growth, size, and stock return although found to be significant but

negatively related with FCF.

Potrebbero piacerti anche

- Effects of Equity and Debt Financing On SME PerformanceDocumento9 pagineEffects of Equity and Debt Financing On SME PerformanceAlianza EspirituNessuna valutazione finora

- Supply Chain Management and Business Performance ofDocumento9 pagineSupply Chain Management and Business Performance ofFidlizan MuhammadNessuna valutazione finora

- Sustainability 12 02407Documento19 pagineSustainability 12 02407Ehsan SaleemNessuna valutazione finora

- Sustainability 12 02407Documento19 pagineSustainability 12 02407Waqas AhmadNessuna valutazione finora

- Group 4 PDFDocumento13 pagineGroup 4 PDFWajahat RehmanNessuna valutazione finora

- CCFDocumento24 pagineCCFMårkö ÅlexövåNessuna valutazione finora

- 2194 6053 1 SMDocumento16 pagine2194 6053 1 SMfayad setiawanNessuna valutazione finora

- Cogs PDFDocumento14 pagineCogs PDFRa KumalaNessuna valutazione finora

- Current Asset Management As The Driver of Financial EfficiencyDocumento18 pagineCurrent Asset Management As The Driver of Financial Efficiencyfenny maryandiNessuna valutazione finora

- The_Effect_of_Inventory_Management_on_OrDocumento15 pagineThe_Effect_of_Inventory_Management_on_Orkiokojuma4Nessuna valutazione finora

- Samo 2019Documento15 pagineSamo 2019vera maulithaNessuna valutazione finora

- EMJM 4403 Gyimah Et Al. (4) - REVISES 2Documento17 pagineEMJM 4403 Gyimah Et Al. (4) - REVISES 2Prince GyimahNessuna valutazione finora

- A Study On The Impact of Cash Management On The FiDocumento12 pagineA Study On The Impact of Cash Management On The Firahul nishadNessuna valutazione finora

- CIM ReportDocumento34 pagineCIM ReportMansi MehtaNessuna valutazione finora

- Relationship Between Working Capital Management and ProfitabilityDocumento5 pagineRelationship Between Working Capital Management and ProfitabilityEditor IJIRMFNessuna valutazione finora

- Supply Chain Management Practices and ManufacturinDocumento13 pagineSupply Chain Management Practices and Manufacturinsoriizenebe611Nessuna valutazione finora

- SSCM practices, SC capabilities, and firm performanceDocumento25 pagineSSCM practices, SC capabilities, and firm performanceMohd HammadNessuna valutazione finora

- Bankruptcy Prediction For Non-Financial Firms of Pakistan: July 2015Documento13 pagineBankruptcy Prediction For Non-Financial Firms of Pakistan: July 2015samashrafNessuna valutazione finora

- Bankruptcy Prediction Models for Non-Financial Firms in PakistanDocumento13 pagineBankruptcy Prediction Models for Non-Financial Firms in PakistansamashrafNessuna valutazione finora

- Impact of Capital Structure On Financial Performance of Textile Sector in Pakistan Attaullah Muhammad Kashif SaifullahDocumento20 pagineImpact of Capital Structure On Financial Performance of Textile Sector in Pakistan Attaullah Muhammad Kashif Saifullahmaria saleemNessuna valutazione finora

- I JP MB 060304 Venkat EshDocumento24 pagineI JP MB 060304 Venkat Eshshantnu singhNessuna valutazione finora

- Ijfs 07 00062 v2Documento37 pagineIjfs 07 00062 v2NadeemNessuna valutazione finora

- WCM and Profitability in Textiles IndustryDocumento18 pagineWCM and Profitability in Textiles IndustryMahesh BendigeriNessuna valutazione finora

- Factors Impacting Cash Conversion Cycle of Manufacturing FirmsDocumento5 pagineFactors Impacting Cash Conversion Cycle of Manufacturing Firmsmahfuz1209Nessuna valutazione finora

- Competition in Malaysia's Dual Banking IndustryDocumento21 pagineCompetition in Malaysia's Dual Banking Industryirwan hermawanNessuna valutazione finora

- SlideDocumento11 pagineSlideabdirahmamsaladNessuna valutazione finora

- Working Capital Management: A Comparative Study of Cement, Food and Textile IndustryDocumento14 pagineWorking Capital Management: A Comparative Study of Cement, Food and Textile IndustryAshish ValanjuNessuna valutazione finora

- The Impact of Covid-19 Movement Control Order On Smes' Businesses and Survival StrategiesDocumento13 pagineThe Impact of Covid-19 Movement Control Order On Smes' Businesses and Survival StrategiesJiana NasirNessuna valutazione finora

- Application of Maqasid Al-Shariah Into Supply Chain Management Practices For Sustainable DevelopmentDocumento15 pagineApplication of Maqasid Al-Shariah Into Supply Chain Management Practices For Sustainable DevelopmentMd. Mahmudul AlamNessuna valutazione finora

- IJAFR CG Vol6Documento35 pagineIJAFR CG Vol6assignmentservices947Nessuna valutazione finora

- UntitledDocumento11 pagineUntitledSonia KousarNessuna valutazione finora

- Corporate Governance Systems and Their Impact On Performance of CompaniesDocumento10 pagineCorporate Governance Systems and Their Impact On Performance of CompaniesZainab NasirNessuna valutazione finora

- Open Innovation: The Missing Nexus Between Entrepreneurial Orientation, Total Quality Management, and Performance of SmesDocumento13 pagineOpen Innovation: The Missing Nexus Between Entrepreneurial Orientation, Total Quality Management, and Performance of SmesKule898Nessuna valutazione finora

- Pengaruh Ios, NWC, CCC, Dan Go Terhadap Cash Holding Perusahaan Industri Konsumsi Emilia Hanifatur Rosyidah Bambang Hadi SantosoDocumento19 paginePengaruh Ios, NWC, CCC, Dan Go Terhadap Cash Holding Perusahaan Industri Konsumsi Emilia Hanifatur Rosyidah Bambang Hadi Santosonikia cantikNessuna valutazione finora

- Accounting Finance - 2023 - Bhattacharyya - Improving Small and Medium Size Enterprise Performance Does Working CapitalDocumento27 pagineAccounting Finance - 2023 - Bhattacharyya - Improving Small and Medium Size Enterprise Performance Does Working CapitalKatherine HoàngNessuna valutazione finora

- Mergers and Acquisitions of The Financial Institutions - Factors Affecting The Employee Turnover IntentionDocumento21 pagineMergers and Acquisitions of The Financial Institutions - Factors Affecting The Employee Turnover Intentionarthasiri.udaNessuna valutazione finora

- Impact of Working Capital Management On Profitability of Textile Sector of PakistanDocumento15 pagineImpact of Working Capital Management On Profitability of Textile Sector of PakistanshahrukhziaNessuna valutazione finora

- Investment Opportunity Set, Ownership Control and Voluntary Disclosures in MalaysiaDocumento15 pagineInvestment Opportunity Set, Ownership Control and Voluntary Disclosures in MalaysiaIcHa Jangan MenyerahNessuna valutazione finora

- AkuntansiDocumento23 pagineAkuntansiShelly ExmildaNessuna valutazione finora

- Effects of Financial Innovations On FinaDocumento12 pagineEffects of Financial Innovations On FinaKevin OdhiamboNessuna valutazione finora

- Effect of Quality Management On Supply Chain and Organisational Performance in The Egyptian Textile IndustryDocumento26 pagineEffect of Quality Management On Supply Chain and Organisational Performance in The Egyptian Textile IndustryEngr. Enamul Hasan TamimNessuna valutazione finora

- Barriers To The Adoption of Sustainable Supply Chain Management Practices Moderating Role of Firm SizeDocumento21 pagineBarriers To The Adoption of Sustainable Supply Chain Management Practices Moderating Role of Firm SizeAysha BatoolNessuna valutazione finora

- 369-Article Text-922-1-10-20220729Documento5 pagine369-Article Text-922-1-10-20220729Vanesa Amalia DuatiNessuna valutazione finora

- Analisis Faktor-Faktor Yang Mempengaruhi Struktur Modal (Studi Empiris Terhadap Perusahaan Manufaktur Yang Terdaftar Di Bej)Documento1 paginaAnalisis Faktor-Faktor Yang Mempengaruhi Struktur Modal (Studi Empiris Terhadap Perusahaan Manufaktur Yang Terdaftar Di Bej)Harris AfdhalNessuna valutazione finora

- 052 F - Osman JusohDocumento21 pagine052 F - Osman Jusohilyan_sazaliNessuna valutazione finora

- Corporate Restructuring Through Mergers and Acquisitions: A Case StudyDocumento12 pagineCorporate Restructuring Through Mergers and Acquisitions: A Case Studyvenkatesh sahuNessuna valutazione finora

- Relationship Between TQM Dimensions and Organizational PerformanceDocumento19 pagineRelationship Between TQM Dimensions and Organizational PerformanceMakiNessuna valutazione finora

- 10-05-2021-1620641754-7-Ijfm-3. Ijfm - Factors Influencing Effective Inventory Management in The Textile Industries of BangladeshDocumento16 pagine10-05-2021-1620641754-7-Ijfm-3. Ijfm - Factors Influencing Effective Inventory Management in The Textile Industries of Bangladeshiaset123Nessuna valutazione finora

- 2019 8Documento13 pagine2019 8FarrukhShanNessuna valutazione finora

- Supply Chain Strategies Enhance Customer SatisfactionDocumento17 pagineSupply Chain Strategies Enhance Customer Satisfactionamani benboualiNessuna valutazione finora

- 30 Covid 19impactone CommerceusageDocumento12 pagine30 Covid 19impactone Commerceusagehafiz hassanNessuna valutazione finora

- Effect of Transport Management on Organizational Performance in Textile FirmsDocumento17 pagineEffect of Transport Management on Organizational Performance in Textile FirmsMasoud KadengeNessuna valutazione finora

- Sabari Final ProjectDocumento54 pagineSabari Final ProjectRam KumarNessuna valutazione finora

- Digital Financial Inclusion and Sustainable Growth of Small and Micro Enterprises-Evidence Based On China's New Third Board Market Listed CompaniesDocumento21 pagineDigital Financial Inclusion and Sustainable Growth of Small and Micro Enterprises-Evidence Based On China's New Third Board Market Listed CompaniesjulietNessuna valutazione finora

- Awais 2021 E1 RDocumento15 pagineAwais 2021 E1 RAmira YahiaNessuna valutazione finora

- IMPACT OF FINANCIAL INCLUSIONDocumento11 pagineIMPACT OF FINANCIAL INCLUSIONMili ShahzadiNessuna valutazione finora

- Profitabilitas Dalam Sektor Manufaktur Barang Konsumsi Indonesia: Investigasi EmpirisDocumento16 pagineProfitabilitas Dalam Sektor Manufaktur Barang Konsumsi Indonesia: Investigasi EmpirisOkto BriaNessuna valutazione finora

- Strategic Sourcing An Antecedent of Supply Chain Resilience in Manufacturing Firms in KenyaDocumento18 pagineStrategic Sourcing An Antecedent of Supply Chain Resilience in Manufacturing Firms in KenyaSeye KareemNessuna valutazione finora

- A Logistics It Strategy Firm Performance & Generation Y Corporate Social ResponsibilityDa EverandA Logistics It Strategy Firm Performance & Generation Y Corporate Social ResponsibilityNessuna valutazione finora

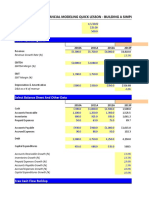

- Wall Street Prep - Financial Modeling Quick Lesson - Building A Simple Discounted Cash Flow ModelDocumento6 pagineWall Street Prep - Financial Modeling Quick Lesson - Building A Simple Discounted Cash Flow ModelSajid Mohy Ul DinNessuna valutazione finora

- Intrinsic and Extrinsic Motivation For University Staff Satisfaction: Confirmatory Composite Analysis and Confirmatory Factor AnalysisDocumento27 pagineIntrinsic and Extrinsic Motivation For University Staff Satisfaction: Confirmatory Composite Analysis and Confirmatory Factor AnalysisSajid Mohy Ul DinNessuna valutazione finora

- Recent Advances in Liquid Organic Hydrogen Carriers: An Alcohol-Based Hydrogen EconomyDocumento15 pagineRecent Advances in Liquid Organic Hydrogen Carriers: An Alcohol-Based Hydrogen EconomySajid Mohy Ul Din100% (1)

- Submission Date: 10-Mar-2021 07:58AM (UTC-0800) Submission ID: 1529370323 File Name: Essay - Docx (29.22K) Word Count: 1371 Character Count: 8583Documento7 pagineSubmission Date: 10-Mar-2021 07:58AM (UTC-0800) Submission ID: 1529370323 File Name: Essay - Docx (29.22K) Word Count: 1371 Character Count: 8583Sajid Mohy Ul DinNessuna valutazione finora

- Insurance Activity and Economic Performance: Fresh Evidence From Asymmetric Panel Causality TestsDocumento20 pagineInsurance Activity and Economic Performance: Fresh Evidence From Asymmetric Panel Causality TestsSajid Mohy Ul DinNessuna valutazione finora

- ChartDocumento1 paginaChartSajid Mohy Ul DinNessuna valutazione finora

- Wall Street Prep - Financial Modeling Quick Lesson - Building A Simple Discounted Cash Flow ModelDocumento6 pagineWall Street Prep - Financial Modeling Quick Lesson - Building A Simple Discounted Cash Flow ModelSajid Mohy Ul DinNessuna valutazione finora

- Surroca PDFDocumento28 pagineSurroca PDFGuillem CasolivaNessuna valutazione finora

- In The University of Chakwal: Form of Application For The Use of Candidates For AppointmentDocumento6 pagineIn The University of Chakwal: Form of Application For The Use of Candidates For AppointmentSajid Mohy Ul DinNessuna valutazione finora

- Institutional Quality and Initial Public Offering Underpricing: Evidence From Hong KongDocumento12 pagineInstitutional Quality and Initial Public Offering Underpricing: Evidence From Hong KongSajid Mohy Ul DinNessuna valutazione finora

- The Impact of Corporate Social Responsibility On Firms' Financial Performance in South AfricaDocumento23 pagineThe Impact of Corporate Social Responsibility On Firms' Financial Performance in South AfricaSajid Mohy Ul DinNessuna valutazione finora

- A Theoretical Basis For Innovation, Institutions and Insurance Penetration NexusDocumento13 pagineA Theoretical Basis For Innovation, Institutions and Insurance Penetration NexusSajid Mohy Ul DinNessuna valutazione finora

- An Inter Disciplinary Review of The Literature On Mental Illness Disclosure in The Workplace Implications For Human Resource ManagementDocumento38 pagineAn Inter Disciplinary Review of The Literature On Mental Illness Disclosure in The Workplace Implications For Human Resource ManagementSajid Mohy Ul DinNessuna valutazione finora

- SHWMDocumento24 pagineSHWMVineet RathoreNessuna valutazione finora

- Linking Anthropology: History ClothingDocumento5 pagineLinking Anthropology: History ClothingSajid Mohy Ul DinNessuna valutazione finora

- U.S. Ssecurity Ppolicy Iin Ssouth Aasia Since 9/11 - Cchallenges Aand Implications Ffor Tthe FfutureDocumento16 pagineU.S. Ssecurity Ppolicy Iin Ssouth Aasia Since 9/11 - Cchallenges Aand Implications Ffor Tthe FfutureSajid Mohy Ul DinNessuna valutazione finora

- Colloids and Surfaces A: Physicochemical and Engineering AspectsDocumento10 pagineColloids and Surfaces A: Physicochemical and Engineering AspectsSajid Mohy Ul DinNessuna valutazione finora

- File000001 999062024Documento1 paginaFile000001 999062024Sajid Mohy Ul DinNessuna valutazione finora

- Mobile Banking A Potential CADocumento32 pagineMobile Banking A Potential CASajid Mohy Ul DinNessuna valutazione finora

- Student Teacher Challenges Using The Cognitive Load Theory As An Explanatory Lens PDFDocumento16 pagineStudent Teacher Challenges Using The Cognitive Load Theory As An Explanatory Lens PDFSajid Mohy Ul DinNessuna valutazione finora

- Insurance Growth Nexus A Comparative Analysis With Multiple Insurance Proxies PDFDocumento20 pagineInsurance Growth Nexus A Comparative Analysis With Multiple Insurance Proxies PDFSajid Mohy Ul DinNessuna valutazione finora

- Study On Technologies For Financial Inclusion in BRICSDocumento17 pagineStudy On Technologies For Financial Inclusion in BRICSSajid Mohy Ul DinNessuna valutazione finora

- Frequency Changes in AC Systems Connected To DC Grids: Impact of AC vs. DC Side EventsDocumento5 pagineFrequency Changes in AC Systems Connected To DC Grids: Impact of AC vs. DC Side EventsSajid Mohy Ul DinNessuna valutazione finora

- Marceau 2009Documento36 pagineMarceau 2009Sajid Mohy Ul DinNessuna valutazione finora

- Can 2017Documento29 pagineCan 2017Sajid Mohy Ul DinNessuna valutazione finora

- Jacob 2008Documento37 pagineJacob 2008Sajid Mohy Ul DinNessuna valutazione finora

- And 1992Documento14 pagineAnd 1992Sajid Mohy Ul DinNessuna valutazione finora

- A New Era For Women? Some Reflections On Blind Spots of ICT-based Development Projects For Women's Entrepreneurship and EmpowermentDocumento16 pagineA New Era For Women? Some Reflections On Blind Spots of ICT-based Development Projects For Women's Entrepreneurship and EmpowermentSajid Mohy Ul DinNessuna valutazione finora

- (Doi 10.1007/978-981!10!8147-7 - 4) Tan, Lee-Ming Lau Poh Hock, Evan Tang, Chor Foon - Finance & Economics Readings - Management of Mobile Financial Services-Review and Way ForwardDocumento19 pagine(Doi 10.1007/978-981!10!8147-7 - 4) Tan, Lee-Ming Lau Poh Hock, Evan Tang, Chor Foon - Finance & Economics Readings - Management of Mobile Financial Services-Review and Way ForwardSajid Mohy Ul DinNessuna valutazione finora

- Financial Inclusion HarnessinDocumento9 pagineFinancial Inclusion HarnessinSajid Mohy Ul DinNessuna valutazione finora