Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

09.) BPI v. Franco - Property

Caricato da

123abc456defDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

09.) BPI v. Franco - Property

Caricato da

123abc456defCopyright:

Formati disponibili

BPI FAMILY BANK v.

AMADO FRANCO AND COURT OF APPEALS By: Jelica

GR No. 123498 Topic: Movable or personal property and

Date: November 23, 2007 their classification

Facts

Franco opened 3 accounts (current, savings, and time deposit) with BPI-FB. The total amount used to open this

account is traceable to a check issued by TEVESTECO. In turn, the funding for the check was part of the P 80M

debited by BPI-FB from FMICs time deposit account and credited to TEVESTECOs current account. This is

pursuant to an Authority to Debit signed by FMICs officers. However, the signatures of FMICs officers appeared to

be forged.

TEVESTECO had already effected several withdrawals amounting to P 37.46M, including the P 2M paid to Franco.

In light of FMICs forgery claim, BPI-FB ordered to debit Francos savings and current accounts for the amounts

remaining therein.

BPI-FB filed an Order of Attachment before the Makati RTC to garnish Francos current account and recover the P

37.46M. Franco filed a Motion to Discharge Attachment which the Makati RTC granted.

Franco demanded from BPI-FB to release his funds in his savings and current accounts. However, BPI-FB could not

comply because Francos current account had already been debited because of FMICs forgery claim.

In light of BPI-FBs refusal to unfreeze Francos accounts and release his deposits, Franco filed a complaint before the

Manila RTC and prayed for the payment of the following:

o interest on the remaining balance of his current account

o balance on his savings account plus interest

o P 63, 189 deducted from his time deposit account upon pretermination

o actual, moral, and exemplary damages and attorneys fees.

BPI-FB insisted that it was correct in freezing Francos accounts and that it has the right to the amounts, which

includes the money allegedly withdrawn fraudulently and ended up in Francos accounts.

RTC ruled in favor of Franco. Both parties filed their respective appeals before the CA. CA affirmed with modification

the RTCs decision.

BPI-FB filed for a petition for certiorari. It argued that its position is like that of an owner of personal property who

regains possession after it is stolen.

Issue/s

Does the BPI have better right to the deposit in Francos accounts?

Ruling - NO.

In this case, the deposit in Francos accounts consists of money which albeit characterized as a movable, is generic and

fungible. The quality of being fungible depends upon the possibility of the property, because of its nature or the will of the

parties, being substituted by others of the same kind, not having a distinct individuality.

While Art. 559 permits an owner who has lost or has been unlawfully deprived of a movable to recover the exact same thing

from the current possessor, BPI-FB simply claims ownership of the equivalent amount of money, that is, the value thereof,

which it had mistakenly debited from FMCIs account and credited to TEVESTECOs and subsequently traced to Francos

account.

Doctrine Notes

The movable property mentioned in Art. 559 of the Civil Code pertains to a BPI-FB BPI Family Bank

specific or determinate thing. A determinate or specific thing is one that is TEVESTECO Tevesteco

individualized and can be identified or distinguished from others of the same kind. Arrastre-Stevedoring Co., Inc.

FMIC First Metro Investment

Corporation

BPI-FB illustra

Potrebbero piacerti anche

- Ilisan v. People of The Philippines (2010) - Nachura, JDocumento3 pagineIlisan v. People of The Philippines (2010) - Nachura, Jkfv05Nessuna valutazione finora

- Philex Mining vs. CIRDocumento1 paginaPhilex Mining vs. CIRDyords TiglaoNessuna valutazione finora

- Northwest v. CatapangDocumento1 paginaNorthwest v. CatapangKris HannahNessuna valutazione finora

- Tuatis V EscolDocumento3 pagineTuatis V EscolRamonI.RochaIVNessuna valutazione finora

- 10 Oropeza V Allied BankDocumento4 pagine10 Oropeza V Allied BankmeriiNessuna valutazione finora

- Taxation Law Q&A 1994-2006 PDFDocumento73 pagineTaxation Law Q&A 1994-2006 PDFClark LimNessuna valutazione finora

- Republic of The Philippines Cagayan State University College of Law Andrews Campus, Tuguegarao City, Cagayan Evidence Final Examination (Part I)Documento6 pagineRepublic of The Philippines Cagayan State University College of Law Andrews Campus, Tuguegarao City, Cagayan Evidence Final Examination (Part I)Mikes FloresNessuna valutazione finora

- PALMA V CADocumento3 paginePALMA V CAHazel BarbaronaNessuna valutazione finora

- Cebu vs. WT ConstructionDocumento3 pagineCebu vs. WT Constructionbb yattyNessuna valutazione finora

- Santos V BernabeDocumento4 pagineSantos V BernabeMizu LilyNessuna valutazione finora

- 2002 Evidence Copy-1Documento21 pagine2002 Evidence Copy-1Earl Andre PerezNessuna valutazione finora

- 21PNB vs. Pabalan DigestDocumento1 pagina21PNB vs. Pabalan DigestSharon G. BalingitNessuna valutazione finora

- Answer 3Documento4 pagineAnswer 3ShynnMiñozaNessuna valutazione finora

- Landcenter v. Ponce (Rule 17)Documento1 paginaLandcenter v. Ponce (Rule 17)Lynne SanchezNessuna valutazione finora

- Book Iii Title V. - Prescription: Eneral Rovisions Hat Is PrescriptionDocumento166 pagineBook Iii Title V. - Prescription: Eneral Rovisions Hat Is PrescriptionJerick BartolataNessuna valutazione finora

- Okol v. Slimmers World InternationalDocumento2 pagineOkol v. Slimmers World InternationalCamille GrandeNessuna valutazione finora

- Prop PAST FullDocumento14 pagineProp PAST Full유니스Nessuna valutazione finora

- Philippine National Bank v. Gancayco GR No. 18343, 30 September 1965Documento8 paginePhilippine National Bank v. Gancayco GR No. 18343, 30 September 1965demosreaNessuna valutazione finora

- Elenita Dewara V Spouses LamelaDocumento2 pagineElenita Dewara V Spouses LamelaIkangApostolNessuna valutazione finora

- Heirs of T. de Leon Vda de Roxas v. CADocumento3 pagineHeirs of T. de Leon Vda de Roxas v. CALeo TumaganNessuna valutazione finora

- Watercraft Venture vs. WolfeDocumento2 pagineWatercraft Venture vs. WolfeTinersNessuna valutazione finora

- Some Jurisprudence On Alternative Dispute ResolutionDocumento13 pagineSome Jurisprudence On Alternative Dispute ResolutionmastaacaNessuna valutazione finora

- Privatization and Management Office v. Court of Tax AppealsDocumento7 paginePrivatization and Management Office v. Court of Tax AppealsBeltran KathNessuna valutazione finora

- ONG CHUA Vs EDWARD CARR Evidence CaseDocumento2 pagineONG CHUA Vs EDWARD CARR Evidence CaseKarl Anthony Tence DionisioNessuna valutazione finora

- CivPro - Finals - DoctrinesDocumento13 pagineCivPro - Finals - Doctrinesraechelle bulosNessuna valutazione finora

- Wave 7 Goquiolay Vs Sycip Case DigestDocumento6 pagineWave 7 Goquiolay Vs Sycip Case DigestAnna L. Ilagan-MalipolNessuna valutazione finora

- Central Bank v. CA, 139 SCRA 46 (1985)Documento4 pagineCentral Bank v. CA, 139 SCRA 46 (1985)Fides DamascoNessuna valutazione finora

- Compiled Cases GuarantyDocumento20 pagineCompiled Cases GuarantyJec Luceriaga BiraquitNessuna valutazione finora

- Managerial Notes For All ChaptersDocumento479 pagineManagerial Notes For All Chaptershenryuab100% (1)

- Dewara v. Sps. LamelaDocumento4 pagineDewara v. Sps. LamelaAnonymous wINMQaNNessuna valutazione finora

- Macasaet v. MacasaetDocumento2 pagineMacasaet v. MacasaetKreezelNessuna valutazione finora

- 35 Metrobank vs. BA Finance Corp. (OREIRO)Documento2 pagine35 Metrobank vs. BA Finance Corp. (OREIRO)Raymund CallejaNessuna valutazione finora

- OBLI Digest Nov 28Documento20 pagineOBLI Digest Nov 28Zarah JeanineNessuna valutazione finora

- 220 Cuartero v. CADocumento3 pagine220 Cuartero v. CA01123813100% (1)

- Dizon v. Rodriguez (1965)Documento3 pagineDizon v. Rodriguez (1965)Zan BillonesNessuna valutazione finora

- GREGORIO DE VERA V CA CASE DIGESTDocumento4 pagineGREGORIO DE VERA V CA CASE DIGESTKristanne Louise YuNessuna valutazione finora

- 5.victoria vs. Pidlaoan Et Al. GR No. 196470 April 20 2016Documento7 pagine5.victoria vs. Pidlaoan Et Al. GR No. 196470 April 20 2016The ApprenticeNessuna valutazione finora

- GSIS Vs Court of AppealsDocumento1 paginaGSIS Vs Court of AppealsJanice M. PolinarNessuna valutazione finora

- Serrano vs. CBDocumento1 paginaSerrano vs. CBChicoRodrigoBantayogNessuna valutazione finora

- Sps. Sobrejuanite vs. ASB Development Corporation (Credit Transactions)Documento2 pagineSps. Sobrejuanite vs. ASB Development Corporation (Credit Transactions)mei_2208Nessuna valutazione finora

- 32 Gonzales Vs CADocumento2 pagine32 Gonzales Vs CApaul carmelo esparagozaNessuna valutazione finora

- BSB vs. Sally GoDocumento4 pagineBSB vs. Sally GoJustinJalandoniNessuna valutazione finora

- Homework 3 REMDocumento26 pagineHomework 3 REMCzarina Joy PenaNessuna valutazione finora

- Quilala V AlcantaraDocumento2 pagineQuilala V AlcantaraRosana Villordon SoliteNessuna valutazione finora

- Lao v. Heirs of AlburoDocumento4 pagineLao v. Heirs of AlburoJude Raphael S. FanilaNessuna valutazione finora

- Guaranty, Loan, DepositDocumento15 pagineGuaranty, Loan, DepositKyla Valencia Ngo100% (1)

- Ibañez v. People: GR No. 190798. January 27, 2016Documento2 pagineIbañez v. People: GR No. 190798. January 27, 2016Tootsie GuzmaNessuna valutazione finora

- 123160-1999-Rubberworld Phils. Inc. v. National LaborDocumento10 pagine123160-1999-Rubberworld Phils. Inc. v. National LaborInigo MiguelNessuna valutazione finora

- Ojeda v. OrbetaDocumento2 pagineOjeda v. OrbetaElle MichNessuna valutazione finora

- Case Digest Testamentary SuccessionDocumento100 pagineCase Digest Testamentary SuccessionTIGAO ACTIVE YOUTH ORGANIZATIONNessuna valutazione finora

- Law On Secrecy of Bank DepositsDocumento2 pagineLaw On Secrecy of Bank DepositsMan HernandoNessuna valutazione finora

- Universal Motors Corp Vs CaDocumento2 pagineUniversal Motors Corp Vs Cayannie11Nessuna valutazione finora

- Widows & Orphans Association, Inc. vs. Court of AppealsDocumento32 pagineWidows & Orphans Association, Inc. vs. Court of AppealsPMV100% (1)

- PNB Vs AtendidoDocumento1 paginaPNB Vs AtendidoJr MateoNessuna valutazione finora

- San Miguel Properties, Inc. v. PerezDocumento2 pagineSan Miguel Properties, Inc. v. PerezGigi LucilleNessuna valutazione finora

- Case Digest Sulo Sa Nayon Inc.Documento3 pagineCase Digest Sulo Sa Nayon Inc.Cherry ChaoNessuna valutazione finora

- Upreme (Ourt: L/Epubut of Tuelbilippine, FflanilaDocumento10 pagineUpreme (Ourt: L/Epubut of Tuelbilippine, FflanilaChugsNessuna valutazione finora

- 10 BPI Family Bank V Franco, SollegueDocumento5 pagine10 BPI Family Bank V Franco, SollegueShanicaNessuna valutazione finora

- G.R. No. 123498 November 23, 2007 Bpi Family Bank, Petitioner, Vs - Amado Franco and COURT OF APPEALS, Respondents. Nachura, J.Documento2 pagineG.R. No. 123498 November 23, 2007 Bpi Family Bank, Petitioner, Vs - Amado Franco and COURT OF APPEALS, Respondents. Nachura, J.Karen De VillaNessuna valutazione finora

- BPI Family Bank VsDocumento3 pagineBPI Family Bank VsKatrina PerezNessuna valutazione finora

- Case Name: Suplicio Lines Vs Domingo Curso GR No. 157009 Date: March 17, 2010 By: Jethro Laurente Topic: Damages in Case of DeathDocumento1 paginaCase Name: Suplicio Lines Vs Domingo Curso GR No. 157009 Date: March 17, 2010 By: Jethro Laurente Topic: Damages in Case of DeathPio Guieb AguilarNessuna valutazione finora

- CHINA AIRLINES vs. CADocumento1 paginaCHINA AIRLINES vs. CA123abc456defNessuna valutazione finora

- Hidalgo Enterprises vs. Balandan (Digest)Documento1 paginaHidalgo Enterprises vs. Balandan (Digest)PatNessuna valutazione finora

- Professional Services Inc. Vs Sps. AganaDocumento1 paginaProfessional Services Inc. Vs Sps. AganaPio Guieb AguilarNessuna valutazione finora

- Milagros Ibardovs, Pelagia Nava V CADocumento1 paginaMilagros Ibardovs, Pelagia Nava V CA123abc456defNessuna valutazione finora

- Arlegui v. CADocumento1 paginaArlegui v. CA123abc456defNessuna valutazione finora

- Nikko Hotel Manila Garden vs. ReyesDocumento2 pagineNikko Hotel Manila Garden vs. Reyes123abc456defNessuna valutazione finora

- Case Name: Vestil v. IAC and Uy G.R. No. 74431 Date: November 6, 1989 By: Chua, Dane Larieze Topic: Strict LiabilityDocumento2 pagineCase Name: Vestil v. IAC and Uy G.R. No. 74431 Date: November 6, 1989 By: Chua, Dane Larieze Topic: Strict Liability123abc456defNessuna valutazione finora

- 22 DELSAN TRANSPORT LINES, INC. vs. C - A CONSTRUCTION, INC. (2003)Documento2 pagine22 DELSAN TRANSPORT LINES, INC. vs. C - A CONSTRUCTION, INC. (2003)123abc456defNessuna valutazione finora

- Pantranco North Express, Inc. BaesaDocumento2 paginePantranco North Express, Inc. BaesaPio Guieb Aguilar100% (1)

- Case GR By: Topic: FactsDocumento2 pagineCase GR By: Topic: Facts123abc456defNessuna valutazione finora

- Eastern SHipping Lines vs. CADocumento1 paginaEastern SHipping Lines vs. CAPio Guieb AguilarNessuna valutazione finora

- Africa v. Caltex (Phil), IncDocumento1 paginaAfrica v. Caltex (Phil), Inc123abc456defNessuna valutazione finora

- Carillo vs. PeopleDocumento1 paginaCarillo vs. People123abc456defNessuna valutazione finora

- Ilao-Oreta v. Sps. RonquilloDocumento1 paginaIlao-Oreta v. Sps. Ronquillo123abc456defNessuna valutazione finora

- Preciolita Corliss v. Manila RailroadDocumento2 paginePreciolita Corliss v. Manila RailroadPio Guieb AguilarNessuna valutazione finora

- CDI-1, Chapter 2-Unit 1 ARRESTDocumento34 pagineCDI-1, Chapter 2-Unit 1 ARRESTFREDERICK REYESNessuna valutazione finora

- Emergency Motion To Vacate JudgmentDocumento6 pagineEmergency Motion To Vacate Judgmentwinstons2311100% (5)

- Law Student Resume SampleDocumento2 pagineLaw Student Resume Samplefancybae2Nessuna valutazione finora

- TC 20 RespondentDocumento24 pagineTC 20 Respondentgauri sharmaNessuna valutazione finora

- Keating Construction Contract First SupplementDocumento2 pagineKeating Construction Contract First SupplementsoumenNessuna valutazione finora

- ICC Rules For ArbitrationDocumento4 pagineICC Rules For Arbitrationtanmaya_purohitNessuna valutazione finora

- De Leon vs. Court of AppealsDocumento19 pagineDe Leon vs. Court of Appealsanon_614984256Nessuna valutazione finora

- Proclamation No. 635 S. 1995 - Official Gazette of The Republic of The PhilippinesDocumento6 pagineProclamation No. 635 S. 1995 - Official Gazette of The Republic of The PhilippinesEric NagumNessuna valutazione finora

- Nxivm Doc 475: Lauren Salzman Pleads GuiltyDocumento2 pagineNxivm Doc 475: Lauren Salzman Pleads GuiltyTony OrtegaNessuna valutazione finora

- 2021 Hib 4850Documento3 pagine2021 Hib 4850WXYZ-TV Channel 7 DetroitNessuna valutazione finora

- La Suerte v. CaDocumento2 pagineLa Suerte v. CaLuna BaciNessuna valutazione finora

- Let's Meet Your StrawmanDocumento21 pagineLet's Meet Your Strawmanscottyup100% (3)

- Maruti Manesar Lockout: The Flip Side of People Management: Case AnalysisDocumento16 pagineMaruti Manesar Lockout: The Flip Side of People Management: Case AnalysisDikshaNessuna valutazione finora

- Visayan SuretyDocumento2 pagineVisayan SuretyTanya PimentelNessuna valutazione finora

- United States v. Lizza Industries, Inc., Herbert Hochreiter, 775 F.2d 492, 2d Cir. (1985)Documento10 pagineUnited States v. Lizza Industries, Inc., Herbert Hochreiter, 775 F.2d 492, 2d Cir. (1985)Scribd Government DocsNessuna valutazione finora

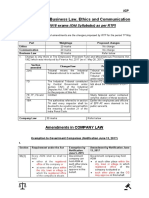

- Amendments in Business Law, Ethics and Communication: (For May 2018 Exams (Old Syllabubs) As Per RTP)Documento3 pagineAmendments in Business Law, Ethics and Communication: (For May 2018 Exams (Old Syllabubs) As Per RTP)Neha jainNessuna valutazione finora

- Letter To DOJ Inspector General: Investigate Possible Misconduct of Senior Justice Department OfficialsDocumento6 pagineLetter To DOJ Inspector General: Investigate Possible Misconduct of Senior Justice Department OfficialsThe Brennan Center for JusticeNessuna valutazione finora

- Weaknesses in The Registration of Land Dealings System in MalaysiaDocumento48 pagineWeaknesses in The Registration of Land Dealings System in MalaysiaTok Muda50% (8)

- de Braganza Vs Villa Abrille 105 Phil 456 DigestDocumento2 paginede Braganza Vs Villa Abrille 105 Phil 456 DigestJERROM ABAINZA100% (1)

- Please Tick As ApplicableDocumento4 paginePlease Tick As ApplicableAnand ThackerNessuna valutazione finora

- Leave RulesDocumento10 pagineLeave RulesManoharanR RajamanikamNessuna valutazione finora

- Increased Size: FIDIC Redbook 2017 Vs 99 - Top 11 ChangesDocumento3 pagineIncreased Size: FIDIC Redbook 2017 Vs 99 - Top 11 ChangesDangi DilleeRamNessuna valutazione finora

- REPLY TO OPPOSITION TO DEMURRER TO PLAINTIFF'S COMPLAINT San ScribeDocumento9 pagineREPLY TO OPPOSITION TO DEMURRER TO PLAINTIFF'S COMPLAINT San ScribeTodd GoetzNessuna valutazione finora

- Appointment Letter Format1 477Documento7 pagineAppointment Letter Format1 477Homeocare International LimitedNessuna valutazione finora

- The-NGO-Handbook Handbook-Series English 508 PDFDocumento80 pagineThe-NGO-Handbook Handbook-Series English 508 PDFDengAwutNessuna valutazione finora

- Twenty Years of Collapse and Counting The Cost of Failure in SomaliaDocumento60 pagineTwenty Years of Collapse and Counting The Cost of Failure in SomaliaSFLDNessuna valutazione finora

- International Compliance Operations Counsel in Florida Resume Jean Marie PaddenDocumento2 pagineInternational Compliance Operations Counsel in Florida Resume Jean Marie PaddenJean Marie Padden2Nessuna valutazione finora

- The Limits of Civil Society in Democratising The State: The Malaysian CaseDocumento19 pagineThe Limits of Civil Society in Democratising The State: The Malaysian CasephilirlNessuna valutazione finora

- The Taking of A House Part IV - Rape, Voter ID, and Unanswered Questions - PDQDocumento20 pagineThe Taking of A House Part IV - Rape, Voter ID, and Unanswered Questions - PDQchristoofar2190Nessuna valutazione finora

- United States v. Michael Jessup, 4th Cir. (2012)Documento3 pagineUnited States v. Michael Jessup, 4th Cir. (2012)Scribd Government DocsNessuna valutazione finora