Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

DHFL Short Term Maturity Fund

Caricato da

Yogi173Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

DHFL Short Term Maturity Fund

Caricato da

Yogi173Copyright:

Formati disponibili

Report as of 13 Oct 2017

DHFL Pramerica Short Maturity Fund Growth

Morningstar Category Morningstar Benchmark Fund Benchmark Morningstar Rating

Short-Term Bond Not Categorized CRISIL Short Term Bond Fund PR INR QQQQQ

Used throughout report

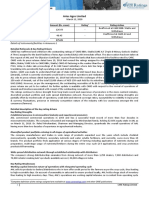

Investment Objective Performance

To generate steady returns with low to medium market

17,000

risk for investors by investing in a portfolio of short -

15,250

medium term debt and money market securities.

13,500

11,750

10,000

2012 2013 2014 2015 2016 2017-09

9.81 8.10 10.62 8.34 9.97 6.02 Fund

8.99 6.64 9.39 6.91 8.33 4.34 Category

Risk Measures Trailing Returns % Fund Cat Quarterly Returns % Q1 Q2 Q3 Q4

3Y Alpha - 3Y Sharpe Ratio 4.29 3 Months 1.66 1.27 2017 1.79 2.31 1.80 -

3Y Beta - 3Y Std Dev 1.13 6 Months 4.07 3.17 2016 2.20 2.20 3.11 2.12

3Y R-Squared - 3Y Risk bel avg 1 Year 7.88 5.73 2015 2.49 1.42 2.64 1.55

3Y Info Ratio - 5Y Risk Avg 3 Years Annualised 9.09 7.02 2014 2.11 2.98 2.19 2.95

3Y Tracking Error - 10Y Risk Avg 5 Years Annualised 9.02 6.96 2013 2.24 2.66 0.65 2.33

Portfolio 30/09/2017

Asset Allocation % Net Fixed Income Fund Credit Quality % Fund Credit Quality % Fund

Stocks 0.00 Style Box ModifiedDuration -

AAA 66.83 BBB 0.00

Bonds 89.55 Yield-to-Maturity (%) -

High Med Low

Credit Quality

AA 33.17 BB 0.00

Cash 10.45 Average Credit Quality AA

A 0.00 B 0.00

Other 0.00

Below B 0.00

Not Rated 0.00

Ltd Mod Ext

Interest Rate Sensitivity

Top Holdings Fixed Income Sector Weightings % Fund Maturity Distribution % Fund

Holding Name Sector %

Government 8.21 1 to 3 Years 85.08

Housing Development Finance... - 6.74 Corporate 81.34 3 to 5 Years 0.00

Reliance Jio Infocomm Limited - 5.71 u Securitized 0.00 5 to 7 Years 7.04

8.39% RJ SDL Spl 2020 - 5.48 Municipal 0.00 7 to 10 Years 3.26

Power Finance Corporation Ltd. - 5.45 y Cash & Equivalents 10.45 10 to 15 Years 0.00

Business Broadcast News... - 4.50 Derivative 0.00 15 to 20 Years 0.00

20 to 30 Years 0.00

Union Bank Of India - 4.47 Coupon Range % Fund Over 30 Years 0.00

Hansdeep Industries &... - 4.10

ICICI Bank Limited - 4.06 0 PIK 6.53

Dewan Housing Finance... - 4.06 0 to 4 1.19

Indiabulls Housing Finance... - 4.05 4 to 6 1.50

6 to 8 7.42

Assets in Top 10 Holdings % 48.61 8 to 10 74.30

Total Number of Equity Holdings 0 10 to 12 9.06

Total Number of Bond Holdings 26 Over 12 0.00

Operations

Fund Company DHFL Pramerica Asset Share Class Size (mil) - Minimum Initial Purchase 5,000 INR

Managers Private Limited Domicile India Minimum Additional Purchase 1,000 INR

Phone +91 22 Currency INR Exit Load 0.00% - >0 months

61593000/61593022 UCITS - Expense Ratio 1.29%

Website www.pramericamf.com Inc/Acc Acc

Inception Date 21/01/2003 ISIN INF223J01DT4

Manager Name Nitish Gupta

Manager Start Date 01/06/2008

NAV (12/10/2017) INR 31.08

Total Net Assets (mil) 18,834.95 INR

(30/09/2017)

2017 Morningstar. All Rights Reserved. The information, data, analyses and opinions (Information) contained herein: (1) include the proprietary information of Morningstar and Morningstars third party licensors; (2) may

not be copied or redistributed except as specifically authorised;(3) do not constitute investment advice;(4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may

be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it

and dont make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well

as up.

Potrebbero piacerti anche

- Anchor Intimation-LetterDocumento6 pagineAnchor Intimation-LetterManthan PatelNessuna valutazione finora

- Nippon India Silver ETF Fund of Fund (FOF) Direct GrowthDocumento1 paginaNippon India Silver ETF Fund of Fund (FOF) Direct GrowthYogi173Nessuna valutazione finora

- Aditya Birla Sun Life Silver ETF Fund of Fund Direct GrowthDocumento1 paginaAditya Birla Sun Life Silver ETF Fund of Fund Direct GrowthYogi173Nessuna valutazione finora

- Morningstarreport 20220317030236Documento1 paginaMorningstarreport 20220317030236Yogi173Nessuna valutazione finora

- Red Herring ProspectusDocumento351 pagineRed Herring ProspectusYogi173Nessuna valutazione finora

- Morningstarreport 20220317034508Documento1 paginaMorningstarreport 20220317034508Yogi173Nessuna valutazione finora

- Morningstarreport 20220317034204Documento1 paginaMorningstarreport 20220317034204Yogi173Nessuna valutazione finora

- Morningstarreport 20220317031934Documento1 paginaMorningstarreport 20220317031934Yogi173Nessuna valutazione finora

- ICICI Prudential NASDAQ 100 Index Fund Direct Growth: H R T y UDocumento1 paginaICICI Prudential NASDAQ 100 Index Fund Direct Growth: H R T y UYogi173Nessuna valutazione finora

- Morningstarreport 20220317032219Documento1 paginaMorningstarreport 20220317032219Yogi173Nessuna valutazione finora

- Kotak Global Innovation Fund of Fund Direct Growth: H R T y UDocumento2 pagineKotak Global Innovation Fund of Fund Direct Growth: H R T y UYogi173Nessuna valutazione finora

- Shipham Special Alloy ValvesDocumento62 pagineShipham Special Alloy ValvesYogi173Nessuna valutazione finora

- ERIS LIFESCIENCES Q1 EARNINGS REVIEWDocumento6 pagineERIS LIFESCIENCES Q1 EARNINGS REVIEWYogi173Nessuna valutazione finora

- Aries Agro Ratings Reaffirmed and Withdrawn at RequestDocumento4 pagineAries Agro Ratings Reaffirmed and Withdrawn at RequestYogi173Nessuna valutazione finora

- Jyothy Labs Limited: Rating Reaffirmed: Summary of Rating ActionDocumento7 pagineJyothy Labs Limited: Rating Reaffirmed: Summary of Rating ActionYogi173Nessuna valutazione finora

- Corporate Banking TipsDocumento1 paginaCorporate Banking TipsYogi173Nessuna valutazione finora

- V-Guard Industries - R - 10052019Documento8 pagineV-Guard Industries - R - 10052019Yogi173Nessuna valutazione finora

- Climate Change and Extreme Weather Events - Implications For FoodDocumento16 pagineClimate Change and Extreme Weather Events - Implications For FoodYogi173Nessuna valutazione finora

- Piston ValvesDocumento20 paginePiston ValvesYogi173Nessuna valutazione finora

- Alkali Metals Limited: Instrument Amount in Rs. Crore Rating ActionDocumento3 pagineAlkali Metals Limited: Instrument Amount in Rs. Crore Rating ActionYogi173Nessuna valutazione finora

- ASM Technologies Limited-R-30082019Documento7 pagineASM Technologies Limited-R-30082019Yogi173Nessuna valutazione finora

- Alkali Metals Limited - R - 26112020Documento7 pagineAlkali Metals Limited - R - 26112020Yogi173Nessuna valutazione finora

- Press Release Dhampur Sugar Mills Limited: Details of Instruments/facilities in Annexure-1Documento5 paginePress Release Dhampur Sugar Mills Limited: Details of Instruments/facilities in Annexure-1Yogi173Nessuna valutazione finora

- Citizen Registration and Appointment For Vaccination User ManualDocumento14 pagineCitizen Registration and Appointment For Vaccination User ManualSahilNessuna valutazione finora

- Covid-19 Related Item - : - Inj. Itolizumab (100mg)Documento50 pagineCovid-19 Related Item - : - Inj. Itolizumab (100mg)Yogi173Nessuna valutazione finora

- Axis Special Situations Fund Direct GrowthDocumento1 paginaAxis Special Situations Fund Direct GrowthYogi173Nessuna valutazione finora

- PermenPUPR27 2016 Penyelenggraan SPAMDocumento3 paginePermenPUPR27 2016 Penyelenggraan SPAMferry ferdiansyah pradanaNessuna valutazione finora

- 1 PDFDocumento9 pagine1 PDFYogi173Nessuna valutazione finora

- Toothbrushes - Covid 19 April 2020Documento2 pagineToothbrushes - Covid 19 April 2020Yogi173Nessuna valutazione finora

- Yoga Class PrayerDocumento1 paginaYoga Class PrayerChandu KanthNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocumento1 paginaTax Invoice: Billing Address Installation Address Invoice DetailsKuladeep Naidu PatibandlaNessuna valutazione finora

- Pakistan Stock Exchange Limited: Internet Trading Subscribers ListDocumento3 paginePakistan Stock Exchange Limited: Internet Trading Subscribers ListMuhammad AhmedNessuna valutazione finora

- This Study Resource Was Shared Via: TopicsDocumento4 pagineThis Study Resource Was Shared Via: TopicsNana GandaNessuna valutazione finora

- International Business Finance FINS3616: By: Mishal Manzoor M.manzoor@unsw - Edu.auDocumento48 pagineInternational Business Finance FINS3616: By: Mishal Manzoor M.manzoor@unsw - Edu.auKelvin ChenNessuna valutazione finora

- Saroj Intern ReportDocumento47 pagineSaroj Intern ReportAwshib BhandariNessuna valutazione finora

- Financing Disbursement Master Roll: B0685 Malapatan RegularDocumento18 pagineFinancing Disbursement Master Roll: B0685 Malapatan RegularAsa Ph MalapatanNessuna valutazione finora

- The Walt Disney CompanyDocumento19 pagineThe Walt Disney CompanyBMX2013100% (1)

- Argentina Paso Results 1692061948Documento8 pagineArgentina Paso Results 1692061948fernando vaninaNessuna valutazione finora

- C Statment - Ivan Maleakhi - Des 2020Documento4 pagineC Statment - Ivan Maleakhi - Des 2020Budi ArtantoNessuna valutazione finora

- Sub Entrepreneurship Development ED Semester 4thday Teacher Pampa Jana Topic Stimulation Support SustainabilityDocumento6 pagineSub Entrepreneurship Development ED Semester 4thday Teacher Pampa Jana Topic Stimulation Support SustainabilityJiminNessuna valutazione finora

- TVM and No-Arbitrage Principle: Practice Questions and ProblemsDocumento2 pagineTVM and No-Arbitrage Principle: Practice Questions and ProblemsMavisNessuna valutazione finora

- Financial Inclusion Through India Post: Dr. Joji Chandran PHDDocumento4 pagineFinancial Inclusion Through India Post: Dr. Joji Chandran PHDJoji ChandranNessuna valutazione finora

- Credit Ratings Provide Insight Into Financial StrengthDocumento6 pagineCredit Ratings Provide Insight Into Financial StrengthvishNessuna valutazione finora

- Ratio Analysis Of: Bata Shoe Company (BD) LTDDocumento19 pagineRatio Analysis Of: Bata Shoe Company (BD) LTDMonjur HasanNessuna valutazione finora

- TMA Divergence Indicator Script For Trading ViewDocumento5 pagineTMA Divergence Indicator Script For Trading ViewKrish Karaniya50% (2)

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocumento4 pagineTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceJaseem MonuNessuna valutazione finora

- PAS1 Answer KeyDocumento4 paginePAS1 Answer KeyGalilee Dawn JullezaNessuna valutazione finora

- 3rd Cases-Labor-Ft PDFDocumento42 pagine3rd Cases-Labor-Ft PDF001nooneNessuna valutazione finora

- Continental Carriers IncDocumento3 pagineContinental Carriers IncEnrique Garcia25% (4)

- Statement - 271185814 - Juan Camilo Cardenas AguirreDocumento12 pagineStatement - 271185814 - Juan Camilo Cardenas AguirrePedro Ant. Núñez UlloaNessuna valutazione finora

- FCFE TemplateDocumento9 pagineFCFE TemplateSelva Bavani SelwaduraiNessuna valutazione finora

- Company Report Detailed TGL 19042016Documento9 pagineCompany Report Detailed TGL 19042016Sobia FaizNessuna valutazione finora

- Liquidity Adjustment FacilityDocumento1 paginaLiquidity Adjustment FacilityPrernaSharma100% (1)

- Opportunities and Challenges of E - Payment System in IndiaDocumento9 pagineOpportunities and Challenges of E - Payment System in IndiaSUJITH THELAPURATHNessuna valutazione finora

- Compound Interest Problems With Detailed SolutionsDocumento11 pagineCompound Interest Problems With Detailed SolutionsJerle Mae ParondoNessuna valutazione finora

- Probable Solution For Questions Asked - Current Batch - March 2015Documento30 pagineProbable Solution For Questions Asked - Current Batch - March 2015aditiNessuna valutazione finora

- Partnership Formation Answer KeyDocumento8 paginePartnership Formation Answer KeyNichole Joy XielSera TanNessuna valutazione finora

- Receivable Financing: Pledge, Assignment and FactoringDocumento35 pagineReceivable Financing: Pledge, Assignment and FactoringMARY GRACE VARGASNessuna valutazione finora

- Equity YyyDocumento33 pagineEquity YyyJude SantosNessuna valutazione finora

- Investment PaperDocumento3 pagineInvestment Paperapi-583759965Nessuna valutazione finora