Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

All-India Anna Dravida Munnetra Kazhagam

Caricato da

Praveen VijayCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

All-India Anna Dravida Munnetra Kazhagam

Caricato da

Praveen VijayCopyright:

Formati disponibili

s .N c,.

tt tR') ( /

G :ANNAT:MUKA Te:.Office :28132266,28130787

Res :24992121,24991414

: : 1 1:

A LEn AA

LE A RDAVIni nttHL LIETDA ri A Al

ALL A VnAVIVA lttIU EEnA RAL AunI 1

HEAD OFFICE

226,AVVAISHANMUGAM SALAI,ROYAPETTAH,CHENNAI-600014.

Res.: VEDA NILAYAM",81,POES GARDEN,CHENNAI-600086.

J JAYALALITHAA Date:28.9 2013

General Secretary, A.l.A.D.M.K.,

Chief Minister of Tamil Nadu

\.r'T- 9

{q\,> ro:

'la

(^ [

nC fA) Thiru Varinder Ku+nar,

' "

z *bcretaryr-

Election Commission of India,

3 0 SEP

U:J

Nirvachan Sadan,

Ashoka Road,

New Delhi-l10 001.

Sir,

Sub: Guidelines on transparency and accountabitity in party

funds - Suggestions of AIADMK - furnished'

Ref: Your Letter No. 76/PPEMS/2013 dated 30.8.2013.

******x

With reference to the above, I am furnishing the views of the

All India Anna Dravida Munnetra Kazhagam on the following issues

in order to enable the Commission to formulate the guidelines on

transparency and accountability in party funds.

Issue No.1 The responsibility of maintaining the books of

accounts of the Party at all levels should be vested

with the Treasurer of the Party or in such person as

may be authorized by the Party, as provided in the

memorandum / rules and by-laws / constitution of the

PartY

Suggestion: MaY be accePted.

,

2

Issue No.2 The Treasurer of the political party or such person

authorized by the Party should maintain consolidated

accounts at the Central Party Headquarters (including

all State and local units) in such books of accounts

and in such accounting methods as required for audit

purpose, conforming to the accounting standards

issued by the Institute of Chartered Accountants of

India (ICAI)

Suggestion: It would be appropriate if the Treasurer of the Political

Party or such other person authorized by the Political

Party shall maintain the accounts at the Central Party

Head Quarters level alone. The proposed instructions /

conditions for maintaining of accounts of the local

units in consolidation at the Central Party Head

Quarters will be in consonance with their respective

party procedures as per the by-laws, rules, etc.

Issue No. 3 The authorized office bearer of each registered party

should issue appropriate acknowledgement / receipt

to persons or companies or others for every amount

of contribution or donation or sum received from them

and to maintain such details, as required for audit

purpose, conforming to the accounting standards.

Suggestion: A reading of Section 29(C) of the Representation of

the People Act, 1951 is necessary and the same

contemplates as follows:

"Secfion 29(C) Declaration of donation

received by the political parties-

(1) The treasurer of a political party or any

other person authorized by the political

party in this behalf shall, in each financial

yearl prepare a report in respect of the

following, namely - (a) the contribution in

excess of twenty thousand rupees received

by such political party from any person in

that financial year; (b) the contribution in

excess of twenty thousand rupees received

by such political party from companies

other than Government Companies in that

financial year.

6\

3

(2) The report under sub-section (1) shall

be in such form as may be prescribed.

(3) The report for a financial year under

sub-section (1) shall be submitted by the

treasurer of a political party or any other

person authorized by the political party in

this behalf before the due date for

furnishing a return of its income of that

financial year under Section 139 of the

Income Tax Act, 1961 to the Election

Commission.

(4) Where the treasurer of any political

party of any other person authorized by

the political party in this behalf fails to

submit a report under sub-section (3),

then, notwithstanding anything contained

in the Income Tax Act, 7961, such political

party shall not be entitled to any tax relief

under that Act. "

As the above provision of the Representation of

the People Act, 1951 covers the issue of maintaining

such details as required for audit purpose in respect of

amount received in excess of Rs.20,000/-, there is no

necessity for any specific instructions.

As all the parties are required to maintain their

account details in consonance with the accounting

standards and therefore any receipt of amount as

donation or corpus fund may be acknowledged by the

respective political parties.

The donation / contribution received are reflected

in the Financial Statements filed by the political party

before the Income Tax Department as well as before

the Election Commission of India.

Issue No. 4 All such donations / contributions I sum received

should be deposited in the bank account(s) of political

party within a reasonable time.

Suggestion: May be accepted.

4 `

fssue No. 5 The Treasurer or the authorized office bearer of the

party should ensure that all funds raised for the party

are used only for activities, ds enshrined in its

memorandum / Rules and by-laws / constitution.

Suggestion: This suggestion may be accepted.

Issue No. 6 Where the party provides any lump sum amount to its

candidates for meeting their election campaign

expenses, it should be ensured that such amount is

given only by crossed account payee cheque or draft

or by RTGS or NEFT or internet transfer; that the

amount does not exceed the ceiling prescribed for

such candidates; and that before filing its election

expenditure statement with the Commission, the

party obtains utilization certificate from such

candidates for funds disbursed to them that it has

been spent for defraying their election expenses.

Suggestion: In respect of this issue, Section 77 of the

Representation of the People Act, 1951 states as

follows:

"Secfion 77 Account of election

expenses and maximum thereof -

(1) Every candidate at an election shall,

either by himself or by his election

agent, keep a separate and correct

account of all expenditure in connection

with the election incurred or authorized

by him or by his election against

between (the date on which he has been

nominated) and the date of declaration

of the result thereof, both dates inclusive

Explanation-1 For the removal of doubts,

it is hereby declared that (a) the

expenditure incurred by leaders of a

political party on account of travel by air

or by any other means of transport for

propagating."

CC

V 5

As both the candidate as well as the respective

political party have to show their respective expenses

and expenditure in their account before the Election

commission of India and the Income Tax Department

as per the statutory provisions, there is no necessity

for obtaining any utilization certificate from the

candidate as mentioned in issue no.6 and the issue

requiring to ensure that amounts do not exceed the

prescribed ceiling for each candidate, has been taken

care of by the statutory provision under Section 77(3)

of the Representation of the people Act, 1951.

Issue No. 7 The Treasurer

or authorized office bearer of the party

should ensure that any payment or aggregate of

payments made from the party account to any person

or company or agency exceeding Rs. 20,000/- in a

day is done only by crossed account payee cheque or

draft or by RTGS or NEFT or through internet transfer.

Suggestion: It is suggested that the payment up to Rs. 20,000/-

can be paid by cash for each transaction.

fssue No. 8 The party should ensure that any donation or

contribution from a person or company or entity

exceeding Rs. 20,000/- in a financial year is received

by crossed account payee cheque or draft or by RTGS

or NEFT or through internet transfer.

Suggestion: considering the enormous number of members in the

party, it will be practically impossible for tracking the

cash receipts exceeding Rs. 20,OOO/- from a single

person in a financial year. whenever donations are

received, there are no separate ledger accounts for

tracking the receipts of each of the donors. In the

above circumstances, the proposar is impracticable for

political parties to follow the same.

fssue No. 9 During the election process, the political parties may

ensure that any party candidate, party functionary or

party worker does not carry party funds in cash,

exceeding a specific amount.

, V 6 '

Suggestion: It is suggested that if the political party allocates

election fund to any party candidate, the cash limit

may be restricted to 10olo of the election expenditure

ceiling limit. In the event of the party not funding the

candidates, the reply to the above question does not

arise.

Issue The political party should get their accounts audited

NoE 0 for every financial year and submit copy of the

audited accounts to the Election Commission of India

before 30th September or before the due date for

furnishing return of income of that financial year along

with their contribution reports referred to in Section

29C of the R.P. Act, 1951.

Suggestion As the political parties comply with the statutory

requirement under the Income Tax Act, 1961 and of

the Representation of the People Act, 1951, there may

not be any necessity to file accounts as proposed in

this issue.

Yours sin

Potrebbero piacerti anche

- Introduction to Negotiable Instruments: As per Indian LawsDa EverandIntroduction to Negotiable Instruments: As per Indian LawsValutazione: 5 su 5 stelle5/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Da EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Nessuna valutazione finora

- CommissionsOrderdatedMay252022Documento8 pagineCommissionsOrderdatedMay252022ujjwalNessuna valutazione finora

- Viprat : As Desired Vide Your Lettei No 76/Tianspaiency/2017/Ppems/Vol Ii Dated 3" NovDocumento25 pagineViprat : As Desired Vide Your Lettei No 76/Tianspaiency/2017/Ppems/Vol Ii Dated 3" Novprateekbunty81Nessuna valutazione finora

- Income Tax On Political PartiesDocumento2 pagineIncome Tax On Political PartiesBipin DurgapalNessuna valutazione finora

- The Societies Registration (Maharashtra) Rules, 1971Documento21 pagineThe Societies Registration (Maharashtra) Rules, 1971Vidya AdsuleNessuna valutazione finora

- Z - General Provisions FY 2023 GAADocumento24 pagineZ - General Provisions FY 2023 GAAJVB 1029Nessuna valutazione finora

- GFR QuizDocumento140 pagineGFR QuizNeelamSharmaNessuna valutazione finora

- Political Party Regn 2014Documento50 paginePolitical Party Regn 2014shubhamsbibankpoNessuna valutazione finora

- Pad201 Final ReportDocumento11 paginePad201 Final ReportTashfiq Ahmed 1811828630Nessuna valutazione finora

- 319655-2021-An Act Appropriating Funds For The Operation20220209-12-1luqtbkDocumento43 pagine319655-2021-An Act Appropriating Funds For The Operation20220209-12-1luqtbkAicing Namingit-VelascoNessuna valutazione finora

- RA 11639 An - Act - Appropriating - Funds 2021Documento43 pagineRA 11639 An - Act - Appropriating - Funds 2021SkskskskNessuna valutazione finora

- Les, 1951Documento59 pagineLes, 1951Vidya AdsuleNessuna valutazione finora

- PDF 1 20190207153559208uhjc1Documento4 paginePDF 1 20190207153559208uhjc1dgpmNessuna valutazione finora

- AA SynopsiDocumento5 pagineAA Synopsisabahat khusroNessuna valutazione finora

- NGO Registration MethodsDocumento8 pagineNGO Registration MethodsGajapathi Raman Panneer SelvamNessuna valutazione finora

- NGO Registration MethodsDocumento14 pagineNGO Registration MethodsAvijitneetika MehtaNessuna valutazione finora

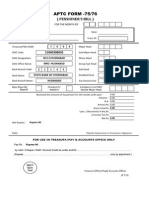

- APTC FORM - 75/76: (Pensioner'S Bill)Documento2 pagineAPTC FORM - 75/76: (Pensioner'S Bill)Venkataprasad Rebba67% (3)

- RMC No 31-2019 Candidates PDFDocumento3 pagineRMC No 31-2019 Candidates PDFFrancis Nico PeñaNessuna valutazione finora

- NGO, Trust PDFDocumento15 pagineNGO, Trust PDFmonaNessuna valutazione finora

- NGO Registration Methods in India - Trust, Society and Non Profit CompanyDocumento5 pagineNGO Registration Methods in India - Trust, Society and Non Profit CompanySudeeshNessuna valutazione finora

- NGO RegistrationDocumento6 pagineNGO RegistrationManoj DavangereNessuna valutazione finora

- Public Trusts LawsDocumento3 paginePublic Trusts LawsMin Hotep Tzaddik BeyNessuna valutazione finora

- Bill No.: Actions Votes Memo: A09885 SummaryDocumento13 pagineBill No.: Actions Votes Memo: A09885 SummaryRick KarlinNessuna valutazione finora

- Foreign Contribution Regulation Rules 2011Documento6 pagineForeign Contribution Regulation Rules 2011Latest Laws TeamNessuna valutazione finora

- Circular 155 - 2015Documento31 pagineCircular 155 - 2015Kim NguyenNessuna valutazione finora

- Ebcl Dec 2021 25102021Documento96 pagineEbcl Dec 2021 25102021khushi jaiswalNessuna valutazione finora

- POLITICAL PARTIES INTEGRITY ACT 2014pdfDocumento46 paginePOLITICAL PARTIES INTEGRITY ACT 2014pdfKagyannis SpyrosNessuna valutazione finora

- PTI Fundraising PolicyDocumento3 paginePTI Fundraising PolicyInsaf.PK60% (5)

- GAA 2020 VOL 1 B - General ProvisionsDocumento25 pagineGAA 2020 VOL 1 B - General ProvisionsRonald VillaNessuna valutazione finora

- S4897Documento32 pagineS4897Darren WheelerNessuna valutazione finora

- Form No. 10Bc: Income-Tax Rules, 1962Documento3 pagineForm No. 10Bc: Income-Tax Rules, 1962busuuuNessuna valutazione finora

- Annex A Form 101 Checklist of DocumentsDocumento3 pagineAnnex A Form 101 Checklist of DocumentsAdrian joseph AdrianoNessuna valutazione finora

- Section: The Political Parties Act, 2011 Arrangement of SectionsDocumento54 pagineSection: The Political Parties Act, 2011 Arrangement of SectionsSyed Imran AdvNessuna valutazione finora

- Consti VishnuDocumento23 pagineConsti VishnuvishnuameyaNessuna valutazione finora

- Commissioner of Income Tax Vs Indian National CongressDocumento71 pagineCommissioner of Income Tax Vs Indian National CongressPGurusNessuna valutazione finora

- Senate Bill No.: Third Regular SessionDocumento17 pagineSenate Bill No.: Third Regular Sessionjeppiner4Nessuna valutazione finora

- Padma Awards 2012 Recommendations List. Suggestion For Fair Selection Rejected.Documento49 paginePadma Awards 2012 Recommendations List. Suggestion For Fair Selection Rejected.satyabhashnamNessuna valutazione finora

- Role of DDO in GovtDocumento27 pagineRole of DDO in GovtPratik ViholNessuna valutazione finora

- HB 6Documento3 pagineHB 6WSETNessuna valutazione finora

- Duties & Responsibilities of DDOsDocumento54 pagineDuties & Responsibilities of DDOsArshadMohdNessuna valutazione finora

- RMC No. 22-2022Documento5 pagineRMC No. 22-2022Shien TumalaNessuna valutazione finora

- Be It Enacted in The Senate and House of Representatives of The Philippines in Congress AssembledDocumento12 pagineBe It Enacted in The Senate and House of Representatives of The Philippines in Congress AssembledNational Citizens' Movement for Free Elections (NAMFREL)Nessuna valutazione finora

- General Provisions Fiscal Year 2022: Official Gazette J 3, 2022Documento23 pagineGeneral Provisions Fiscal Year 2022: Official Gazette J 3, 2022Ju DebNessuna valutazione finora

- InformationBookletonAIR 11072008Documento13 pagineInformationBookletonAIR 11072008Santhosh Kumar BaswaNessuna valutazione finora

- India Sudar TaxFile 2006-07Documento9 pagineIndia Sudar TaxFile 2006-07India Sudar Educational and Charitable TrustNessuna valutazione finora

- FcraDocumento41 pagineFcraPrem TiwariNessuna valutazione finora

- Analysis of Advocate Welfare Fund Act and Role of Advocate Welfare Association IntroductionDocumento6 pagineAnalysis of Advocate Welfare Fund Act and Role of Advocate Welfare Association IntroductionHarsh GuptaNessuna valutazione finora

- Corporate Governance and Auditing: Raj Nandani 567Documento10 pagineCorporate Governance and Auditing: Raj Nandani 567Raj NandaniNessuna valutazione finora

- Financial Intelligence UnitDocumento7 pagineFinancial Intelligence UnitpraprirNessuna valutazione finora

- A Guide To Political Parties RegistrationDocumento25 pagineA Guide To Political Parties RegistrationAuto VeteranNessuna valutazione finora

- English Analysis of Sources of Funding of National and Regional Parties FY 2020-21Documento11 pagineEnglish Analysis of Sources of Funding of National and Regional Parties FY 2020-21The WireNessuna valutazione finora

- Parisha Virat IPLRJDocumento35 pagineParisha Virat IPLRJjiviteshNessuna valutazione finora

- Political Parties Act Chapter 258 R.E. 2019 PDFDocumento33 paginePolitical Parties Act Chapter 258 R.E. 2019 PDFEsther MaugoNessuna valutazione finora

- Final PDF Draft PACDocumento8 pagineFinal PDF Draft PACMuhammad Nadeem MughalNessuna valutazione finora

- LifeFoundation AuditorReport2006Documento10 pagineLifeFoundation AuditorReport2006cachandhiranNessuna valutazione finora

- Progressive Electoral Trust PDFDocumento13 pagineProgressive Electoral Trust PDFbandgar123Nessuna valutazione finora

- Gpf-Bill-Form 40a Nam Ta 49Documento2 pagineGpf-Bill-Form 40a Nam Ta 49robert100% (1)

- SSE Checklist - For - Registration - 02.05.2023Documento3 pagineSSE Checklist - For - Registration - 02.05.2023Anuj Kumar SinghNessuna valutazione finora

- 2017 Davis-Stirling Common Interest DevelopmentDa Everand2017 Davis-Stirling Common Interest DevelopmentNessuna valutazione finora

- New Doc 2018-09-01 09.53.25 - 5Documento1 paginaNew Doc 2018-09-01 09.53.25 - 5Praveen VijayNessuna valutazione finora

- DR.V K Ahuja, LDocumento2 pagineDR.V K Ahuja, LPraveen Vijay0% (3)

- Law Regarding Sale. of Minors PropertyDocumento1 paginaLaw Regarding Sale. of Minors PropertyPraveen VijayNessuna valutazione finora

- Socio Economic OffencesDocumento19 pagineSocio Economic OffencesPraveen VijayNessuna valutazione finora

- Socio - 1Documento115 pagineSocio - 1Praveen VijayNessuna valutazione finora

- Research Project On: Compulsory LicenceDocumento12 pagineResearch Project On: Compulsory LicencePraveen VijayNessuna valutazione finora

- ACFrOgDt2vplQz8XM1H5qY qnmW0SnyPn09RZlxu-8 B55pRrm7Gk6uB2VfCPjL-QiKJXYCMlxusvqQmK67ov3tGvihIk0Bj3tYhUfBi77xScKpGtcntksH9nUT8K YDocumento5 pagineACFrOgDt2vplQz8XM1H5qY qnmW0SnyPn09RZlxu-8 B55pRrm7Gk6uB2VfCPjL-QiKJXYCMlxusvqQmK67ov3tGvihIk0Bj3tYhUfBi77xScKpGtcntksH9nUT8K YPraveen VijayNessuna valutazione finora

- Sutherland TheoryDocumento27 pagineSutherland TheoryPraveen VijayNessuna valutazione finora

- Rio Stockholm To Johannesburg and Beyond Executive SummaryDocumento11 pagineRio Stockholm To Johannesburg and Beyond Executive SummaryPraveen VijayNessuna valutazione finora

- Environmental Law: Dr. S.K. Balashanmugam Assistant Professor TnnlsDocumento35 pagineEnvironmental Law: Dr. S.K. Balashanmugam Assistant Professor TnnlsPraveen VijayNessuna valutazione finora

- Schools of CriminologyDocumento70 pagineSchools of CriminologyPraveen Vijay100% (1)

- Rio Stockholm To Johannesburg and Beyond Executive SummaryDocumento11 pagineRio Stockholm To Johannesburg and Beyond Executive SummaryPraveen VijayNessuna valutazione finora

- Tax Survey - TNNLS - PilotDocumento1 paginaTax Survey - TNNLS - PilotPraveen VijayNessuna valutazione finora

- Minimum Contact Theory: IndiaDocumento8 pagineMinimum Contact Theory: IndiaPraveen VijayNessuna valutazione finora

- University Institute of Legal Studies Panjab University: Submitted To: Submitted byDocumento16 pagineUniversity Institute of Legal Studies Panjab University: Submitted To: Submitted byPraveen VijayNessuna valutazione finora

- When The Plaintiff Files A Suit, The Defendant Has To Be: Unit 4.1: SUMMONSDocumento14 pagineWhen The Plaintiff Files A Suit, The Defendant Has To Be: Unit 4.1: SUMMONSPraveen VijayNessuna valutazione finora

- SSIP SampleDocumento6 pagineSSIP SampleAngelo Delgado100% (6)

- Limbona v. Comelec GR 186006, Oct 16, 2009Documento5 pagineLimbona v. Comelec GR 186006, Oct 16, 2009Elisa JordanNessuna valutazione finora

- BibliographyDocumento16 pagineBibliographymaryjoensNessuna valutazione finora

- Petition For Review: Allan L. SibalDocumento6 paginePetition For Review: Allan L. SibalJZ LabNessuna valutazione finora

- NP Vs Vera - GISTDocumento1 paginaNP Vs Vera - GISTRommel Mancenido LagumenNessuna valutazione finora

- Senate Vs Ermita - G.R. 169777, April 20, 2006Documento2 pagineSenate Vs Ermita - G.R. 169777, April 20, 2006DyanNessuna valutazione finora

- I Want The Epa Sued For All Obstructions of Patent and The Obstructions of The Disabled and VulnerableDocumento7 pagineI Want The Epa Sued For All Obstructions of Patent and The Obstructions of The Disabled and Vulnerablepaul budnekNessuna valutazione finora

- Rent Agreement For GSTDocumento2 pagineRent Agreement For GSTMRIDUL SRIVASTAVANessuna valutazione finora

- Argumentative EssayDocumento3 pagineArgumentative EssayCarolina CastilloNessuna valutazione finora

- 2 Filipino Society of Composers V Tan GR No L36402Documento3 pagine2 Filipino Society of Composers V Tan GR No L36402LexNessuna valutazione finora

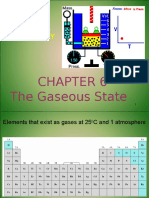

- Gaseous StateDocumento51 pagineGaseous StateSal Sabeela RahmanNessuna valutazione finora

- Sandoval NotesDocumento5 pagineSandoval NotesCharshiiNessuna valutazione finora

- M & A - HarvardDocumento38 pagineM & A - HarvardMohammed Zubair BhatiNessuna valutazione finora

- Law Enforcement in JapanDocumento10 pagineLaw Enforcement in JapanJudilyn RavilasNessuna valutazione finora

- Tawid Fun Run 2023 Minor WaiverDocumento2 pagineTawid Fun Run 2023 Minor WaiverdagumangledoNessuna valutazione finora

- Nba-Nbpa Cba (2011)Documento510 pagineNba-Nbpa Cba (2011)thenbpa100% (9)

- Kepco Ilijan Corp v. CIRDocumento4 pagineKepco Ilijan Corp v. CIRPatrick ManaloNessuna valutazione finora

- Spouses Roque vs. AguadoDocumento14 pagineSpouses Roque vs. AguadoMary May AbellonNessuna valutazione finora

- People Vs ButlerDocumento32 paginePeople Vs ButlerKeithMounirNessuna valutazione finora

- New FIDIC White Book - The Key ChangesDocumento4 pagineNew FIDIC White Book - The Key ChangesKarthiktrichyNessuna valutazione finora

- Civil Law - Animo Notes PDFDocumento86 pagineCivil Law - Animo Notes PDFNakalimutan Na Fifteenbillionsaphilhealth LeonardoNessuna valutazione finora

- Original PDF Guiding Young Children 9th Edition by Patricia F Hearron PDFDocumento34 pagineOriginal PDF Guiding Young Children 9th Edition by Patricia F Hearron PDFjoseph.mikesell366100% (31)

- Electrical Lighting FixturesDocumento5 pagineElectrical Lighting FixturesglenNessuna valutazione finora

- Deregistration/ Change of Address FormDocumento2 pagineDeregistration/ Change of Address Formpoetdb1594Nessuna valutazione finora

- Capital PunishmentDocumento6 pagineCapital PunishmentAdv Nikita SahaNessuna valutazione finora

- Resume: Adv. Amjadkhan Asifkhan PathanDocumento4 pagineResume: Adv. Amjadkhan Asifkhan PathanlordvorldomortNessuna valutazione finora

- Definition of Terms: Intellectual PropertyDocumento1 paginaDefinition of Terms: Intellectual PropertyAmanda HernandezNessuna valutazione finora

- People Vs Henry T GoDocumento8 paginePeople Vs Henry T GoNath Antonio100% (1)

- Kawayan Hills vs. Court of AppealsDocumento4 pagineKawayan Hills vs. Court of AppealsShaneena KumarNessuna valutazione finora

- Facts: Lauritzen v. Larsen - Law of The SeaDocumento5 pagineFacts: Lauritzen v. Larsen - Law of The SeaEmmanuel MaalaNessuna valutazione finora