Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FIN Solutions

Caricato da

Path_of_windCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FIN Solutions

Caricato da

Path_of_windCopyright:

Formati disponibili

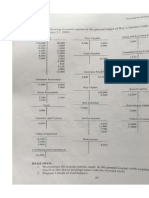

GENERAL JOURNAL

Date Particulars Debit Credit

December 1 Cash 100,000

MakaPassarlageko, Capital 100,000

Prepaid Rent/ Rent Expense 13,500

Cash 13,500

December 2 Office Equipment 20,000

Cash 10,000

Accounts Payable 10,000

3 Office Supplies 2,000

Cash 2,000

9 Purchases 95,000

Transportation In 4,000

Accounts Payable 99,000

17 Advertising Expense 200

Cash 200

11 Accounts Receivable 42,500

Sales 41,200

Cash 1,300

15 Accounts Receivable 32,600

Transportation Out 1,100

Sales 33,700

16 Sales Returns and Allowances 540

Accounts Receivable 540

17 Cash 74,560

Accounts Receivable 74,560

18 Accounts Payable 5,000

Cash 5,000

19 Accounts Payable 99,000

Purchase Discount 1,900

Cash 97,100

21 MakaPassarlageko, Withdrawals 10,000

Cash 10,000

27 Accounts Receivable 85,900

Transportation Out 2,400

Sales 85,900

Cash 2,400

31 Salaries Expense 6,000

Utilities Expense 2,000

Cash 8,000

Adjusting Journal Entries

Depreciation Expense 250

Accumulated Depreciation 250

Supplies Expense 1,250

Office Supplies 1,250

Bad Debts Expense 1,000

Allowance for Doubtful Accounts 1,000

Rent Expense/ Prepaid Rent 1,500 12,000

Prepaid Rent/ Rent Expense 1,500 12,000

Salaries Expense 3,000

Salaries Payable 3,000

Closing Entries

Income Summary 118,240

Sales Returns and Allowance 540

Transportation Out 3,500

Purchases 95,000

Transportation In 4,000

Advertising Expense 200

Office Supplies Expense 1,250

Salaries Expense 9,000

Depreciation Expense 250

Utilities Expense 2,000

Bad Debts 1,000

Rent Expense 1,500

Merchandise, Inventory 50,000

Sales 160,800

Purchase Discount 1,900

Income Summary 212,700

Income Summary 94,460

MakaPassarlageko, Capital 94,460

MakaPassarlageko, Capital 10,000

MakaPassarlageko, Withdrawal 10,000

Reversing Entries

***** Rent Expense 12,000

Prepaid Rent 12,000

Salaries Payable 3,000

Salaries Expense 3,000

GENERAL LEDGER

Account No.: Account Name: Cash

Date Particulars Debit Credit Balances

Decembe 1 Initial Investment 100,000 100,000

Payment for rent 13,500 86,500

Decembe 2 Purchase of office computer 10,000 76,500

3 Purchase of office supplies 2,000 74,500

10 Payment for advertisement 200 74,300

11 Sale to Mr. TopOne, Freight Prepaid 1,300 73,000

17 Receipt of Payment 74,560 147,560

18 Payment for office equipment 5,000 142,560

19 Payment for merchandise 97,100 45,460

21 Withdrawal of Ms. MakaPassarlageko 10,000 55,460

27 Sale to Mr. DebitCredit and Ms. AccountingCycle Freight O 2,400 53,060

31 Salary and utility expense 8,000 45,060

Account No.: Account Name: Accounts Receivable

Date Particulars Debit Credit Balances

December 11 Sale to Mr. TopOne 42,500 42,500

15 Sale to Ms. FinAccPaMore 32,600 75,100

16 Sales Return by Ms. FinAccPaMore 540 74,560

17 Receipt of Payment 74,560 -

27 Sale to Mr. DebitCredit and Ms. AccountingCycle 85,900 85,900

Account No.: Account Name: Allowance for Doubtful Accounys

Date Particulars Debit Credit Balances

ADJUSTMENT 1,000 1,000

Account No.: Account Name: Merchandise Inventory, End

Date Particulars Debit Credit Balances

Merchandise Inventory, end 50,000 50,000

Account No.: Account Name: Prepaid Rent

Date Particulars Debit Credit Balances

Decembe 1 Payment for rent 13,500 13,500

ADJUSTMENT 1,500 12,000

Account No.: Account Name: Prepaid Rent

Date Particulars Debit Credit Balances

ADJUSTMENT 12,000 12,000

Account No.: Account Name: Office Supplies

Date Particulars Debit Credit Balances

decembe 3 Office Supplies 2,000 2,000

ADJUSTMENT 1,250 750

Account No.: Account Name: Office Equipment

Date Particulars Debit Credit Balances

Decembe 2 Purchase of Office Computer 20,000 20,000

Account No.: Account Name: Accumulated Depreciation

Date Particulars Debit Credit Balances

ADJUSTMENT 250 250

Account No.: Account Name: Accounts Payable

Date Particulars Debit Credit Balances

Decembe 2 Purchase of Office Computer 10,000 10,000

9 Purchase of Merchandise 99,000 109,000

18 50% payment for Office Computer 5,000 104,000

19 Payment for merchandise 99,000 5,000

Account No.: Account Name: Salaries Payable

Date Particulars Debit Credit Balances

ADJUSTMENT 3,000 3,000

Account No.: Account Name: MakaPassarlageko, Capital

Date Particulars Debit Credit Balances

Decembe 1 Initial Investment 100,000 100,000

CLOSING ENTRY 10,000 90,000

PROFIT 94,460 184,460

Account No.: Account Name: MakaPassarlageko, Withdrawal

Date Particulars Debit Credit Balances

Decembe 21 Withdrawals for personal use 10,000 10,000

Account No.: Account Name: Sales

Date Particulars Debit Credit Balances

Decembe 11 Sales to Mr. TopOne 41,200 41,200

15 Sales to Ms. FinaccPaMore 33,700 74,900

27 Sale to Mr. DebitCredit and Ms. AccountingCycle 85,900 160,800

Account No.: Account Name: Sales Return and Allowances

Date Particulars Debit Credit Balances

Decembe 16 Sales Return by Ms. FinAccPaMore 540 540

Account No.: Account Name: Transportation Out

Date Particulars Debit Credit Balances

Decembe 15 Sale to Ms. FinAccPaMore 1,100 1,100

27 Sale to Mr. DebitCredit and Ms. AccountingCycle Freight O 2,400 3,500

Account No.: Account Name: Purchases

Date Particulars Debit Credit Balances

Decembe 9 Purchase of Merchandise 95,000 95,000

Account No.: Account Name: Purchases Discount

Date Particulars Debit Credit Balances

Decembe 19 Purchase of merchandise 1,900 1,900

Account No.: Account Name: Transportation In

Date Particulars Debit Credit Balances

Decembe 9 Purchase of Merchandise 4,000 4,000

Account No.: Account Name: Advertising Expense

Date Particulars Debit Credit Balances

Decembe 10 Payment for Advertisement 200 200

Account No.: Account Name: Office Supplies Expense

Date Particulars Debit Credit Balances

ADJUSTMENT 1,250 1,250

Account No.: Account Name: Salaries Expense

Date Particulars Debit Credit Balances

Decembe 31 Salaries for 2 employees 6,000 6,000

ADJUSTMENT 3,000 9,000

Account No.: Account Name: Depreciation Expense

Date Particulars Debit Credit Balances

Janaury 31 ADJUSTMENT 250 250

Account No.: Account Name: Utilities Expense

Date Particulars Debit Credit Balances

Decembe 31 for December 2,000 2,000

Account No.: Account Name: Bad Debts Expense

Date Particulars Debit Credit Balances

ADJUSTMENT 1,000 1,000

Account No.: Account Name: Rent Expense

Date Particulars Debit Credit Balances

ADJUSTMENT 1,500 1,500

Account No.: Account Name: Rent Expense

Date Particulars Debit Credit Balances

Decembe 1 Rent paid in advance 13,500 13,500

ADJUSTMENT 12,000 1,500

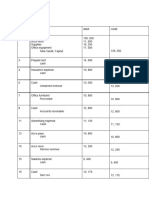

Accounting 101

Worksheet

December 31, 2017

UNADJUSTED TRIAL STATEMENT OF REVENUE

Account Titles BALANCE ADJUSTMENTS ADJUSTED TRIAL BALANCE AND EXPENSES BALANCE SHEET ADJUSTED TRIAL BALANCE

Cash 25,060 25,060 25,060 25,060

Accounts Receivable 85,900 85,900 85,900 85,900

Allowance for Doubtful Accounts 1,000 1,000 1,000 1,000

Merchandise Inventory 50,000 50,000 50,000

Prepaid Rent 13,500 1,500 12,000 12,000 12,000

Office Supplies 2,000 1,250 750 750 750

Office Equipment 20,000 20,000 20,000 20,000

Accumulated Depreciation 250 250 250 250

Accounts Payable 5,000 5,000 5,000 5,000

Salaries Payable 3,000 3,000 3,000 3,000

MakaPassarlageko, Capital 100,000 100,000 100,000 184,460

MakaPassarlageko, Withdrawal 10,000 10,000 10,000

Sales 160,800 160,800 160,800

Sales Return and Allowances 540 540 540

Purchases 95,000 95,000 95,000

Purchase Discount 1,900 1,900 1,900

Transportation In 4,000 4,000 4,000

Transportation Out 3,500 3,500 3,500

Advertising Expense 200 200 200

Office Supplies Expense 1,250 1,250 1,250

Salaries Expense 6,000 3,000 9,000 9,000

Depreciation Expense 250 250 250

Utilities Expense 2,000 2,000 2,000

Bad Debts 1,000 1,000 1,000

Rent Expense 1,500 1,500 1,500

TOTAL 267,700 267,700 7,000 7,000 271,950 271,950 118,240 212,700 203,710 109,250 193,710 193,710

Profit 94,460 94,460

TOTAL 212,700 212,700 203,710 203,710

Potrebbero piacerti anche

- Norse Gods and GoddessesDocumento22 pagineNorse Gods and GoddessesPath_of_wind100% (3)

- Sample Marketing PlanDocumento21 pagineSample Marketing PlanPath_of_windNessuna valutazione finora

- Accounting 101 Sample ExercisesDocumento12 pagineAccounting 101 Sample ExercisesFloidette JimenezNessuna valutazione finora

- Exercises - Trial Balance and Final Accounts - PracticeDocumento23 pagineExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- Assignment in AccountingDocumento19 pagineAssignment in AccountingPAU VLOGSNessuna valutazione finora

- Account Titles With DefinitionDocumento5 pagineAccount Titles With DefinitionAngelo Miranda86% (7)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionDa EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionValutazione: 2.5 su 5 stelle2.5/5 (2)

- STUDENT Copy Chapter 1 Review of The Accounting CycleDocumento28 pagineSTUDENT Copy Chapter 1 Review of The Accounting CycleKurt Latrell AlcantaraNessuna valutazione finora

- AssignmentDocumento3 pagineAssignmentER ABHISHEK MISHRANessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Start-Up Real Estate Business PlanDocumento32 pagineStart-Up Real Estate Business PlanKush Bairoliya100% (1)

- Jackielyn Magpantay Chart of AccountsDocumento9 pagineJackielyn Magpantay Chart of AccountsIgnite NightNessuna valutazione finora

- Problem 1: University of San Jose-Recoletos Auditing ProblemsDocumento9 pagineProblem 1: University of San Jose-Recoletos Auditing ProblemsPaul Doroin100% (1)

- Fabm Sample Exercises With Answer KeyDocumento7 pagineFabm Sample Exercises With Answer KeySg Dimz100% (1)

- Module 3 Quiz With AnswersssDocumento3 pagineModule 3 Quiz With AnswersssShahd Okasha100% (1)

- Test Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Documento17 pagineTest Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Kimberly Etulle Celona100% (1)

- Accounting For Government Organizations Mock CEDocumento15 pagineAccounting For Government Organizations Mock CEDena Heart OrenioNessuna valutazione finora

- The Unadjusted Trial Balance of Atma Company On December 31Documento1 paginaThe Unadjusted Trial Balance of Atma Company On December 31erikNessuna valutazione finora

- XYZ CompanyDocumento8 pagineXYZ CompanyLala Bub100% (1)

- Compre Audit Cieloflawless Q PDFDocumento3 pagineCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNessuna valutazione finora

- Data Flow Diagram For ScholarshipsDocumento6 pagineData Flow Diagram For ScholarshipsPath_of_wind100% (3)

- Mock Exam FinalDocumento23 pagineMock Exam FinalKamaruslan MustaphaNessuna valutazione finora

- Ched CmoDocumento222 pagineChed CmoJake Altiyen0% (1)

- FS MerchandisingDocumento14 pagineFS MerchandisingDesirre TransonaNessuna valutazione finora

- Trial BalanceDocumento4 pagineTrial BalanceRonnie Lloyd JavierNessuna valutazione finora

- ISSo FPDocumento6 pagineISSo FPabbeangedesireNessuna valutazione finora

- WorkDocumento8 pagineWorkshifaanjum7172Nessuna valutazione finora

- EntDocumento2 pagineEntNathalie GetinoNessuna valutazione finora

- Journal EntryDocumento13 pagineJournal EntryMecah Lou Odchigue LanzaderasNessuna valutazione finora

- Financial Statement Assignment 1Documento3 pagineFinancial Statement Assignment 1tahasafdari772Nessuna valutazione finora

- Zabala Auto SupplyDocumento7 pagineZabala Auto SupplyEryn GabrielleNessuna valutazione finora

- Q No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditDocumento4 pagineQ No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditNAFEES NASRUDDIN PATEL0% (1)

- Accouncting ProblemDocumento3 pagineAccouncting ProblemShaneNessuna valutazione finora

- Accounting 02182021Documento4 pagineAccounting 02182021badNessuna valutazione finora

- Financial Statement HandoutDocumento5 pagineFinancial Statement Handoutmuzamilarshad31Nessuna valutazione finora

- Date Adjusting Entries Dec.31Documento18 pagineDate Adjusting Entries Dec.31Cheska Anne Mikka RoxasNessuna valutazione finora

- Dot Printing Narioazelleah B.Documento12 pagineDot Printing Narioazelleah B.Aizha NarioNessuna valutazione finora

- Accounting Fundamentals - PWS - 7Documento11 pagineAccounting Fundamentals - PWS - 7Meet PatelNessuna valutazione finora

- Lecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceDocumento16 pagineLecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceGarp BarrocaNessuna valutazione finora

- Auditing Practice Problem 5Documento2 pagineAuditing Practice Problem 5Maria Fe FerrarizNessuna valutazione finora

- Sample ProblemDocumento4 pagineSample ProblemENIDNessuna valutazione finora

- Additional Questions AcctsDocumento3 pagineAdditional Questions AcctsDEV NANKANINessuna valutazione finora

- Book Answers BalanceDocumento9 pagineBook Answers BalanceIza Valdez100% (1)

- Income StatementDocumento13 pagineIncome StatementShakir IsmailNessuna valutazione finora

- Jayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsDocumento2 pagineJayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsJayalakshmi Institute of TechnologyNessuna valutazione finora

- M4 Prac Exer. 2Documento10 pagineM4 Prac Exer. 2Jasmine ActaNessuna valutazione finora

- FS Withoutadj QuesDocumento2 pagineFS Withoutadj QuesHimank SaklechaNessuna valutazione finora

- Comprehensive Problem For Merchandising OperationsDocumento8 pagineComprehensive Problem For Merchandising OperationsSam Rae LimNessuna valutazione finora

- Sole Proprietorship Final AccountDocumento4 pagineSole Proprietorship Final Accountsujan BhandariNessuna valutazione finora

- Final Accounts Example - MBA WPDocumento6 pagineFinal Accounts Example - MBA WPJIJONessuna valutazione finora

- MidtermDocumento11 pagineMidtermdumpanonymouslyNessuna valutazione finora

- NO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Documento6 pagineNO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Rizki Fajar RhamadanNessuna valutazione finora

- Journal Entries (Llandino)Documento12 pagineJournal Entries (Llandino)Joy Danielle LlandinoNessuna valutazione finora

- 02 - Sam Sung - Question AnswerDocumento4 pagine02 - Sam Sung - Question AnswerAliyah AliNessuna valutazione finora

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Documento21 pagineRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNessuna valutazione finora

- Seatwork #6Documento5 pagineSeatwork #6Jasmine Maningo100% (1)

- Lecture Discussion On Worksheet Preparation To Post Closing Trial Balance November 092020Documento18 pagineLecture Discussion On Worksheet Preparation To Post Closing Trial Balance November 092020Garp BarrocaNessuna valutazione finora

- Bsa Midterm Non Graded Exercises Worksheet and Financial Statements Preparation Answer KeyDocumento7 pagineBsa Midterm Non Graded Exercises Worksheet and Financial Statements Preparation Answer KeyGarp BarrocaNessuna valutazione finora

- Comprehensiveproblemset#8Documento15 pagineComprehensiveproblemset#8DEO100% (1)

- Assignment 1 ACCOUNTANCYDocumento3 pagineAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNessuna valutazione finora

- Buenaflor WorksheetDocumento10 pagineBuenaflor WorksheetRaff LesiaaNessuna valutazione finora

- FdnacctDocumento20 pagineFdnacctvitobautistaNessuna valutazione finora

- DagohoyDocumento6 pagineDagohoylinkin soyNessuna valutazione finora

- Financial Accounting Journalization and Trial BalanceDocumento5 pagineFinancial Accounting Journalization and Trial BalanceRemy Rose LetranNessuna valutazione finora

- WS MerchDocumento5 pagineWS Merchjeonlei02Nessuna valutazione finora

- 2010 DR CR December 1 Cash: Journal EntriesDocumento14 pagine2010 DR CR December 1 Cash: Journal EntriesRafe Alexis MiravillaNessuna valutazione finora

- JournalizingDocumento2 pagineJournalizingMajjieNessuna valutazione finora

- Final Accounts: Problem SheetDocumento2 pagineFinal Accounts: Problem SheetSaransh MaheshwariNessuna valutazione finora

- CHP 2 Exam Preparation ProblemsDocumento3 pagineCHP 2 Exam Preparation ProblemsShawn JohnstonNessuna valutazione finora

- Frq-Acc-Grade 11-Set 05Documento3 pagineFrq-Acc-Grade 11-Set 05itzmellowteaNessuna valutazione finora

- Jimbo P. Manalastas BSA 1-1Documento4 pagineJimbo P. Manalastas BSA 1-1Jimbo ManalastasNessuna valutazione finora

- Penyesuaian PD Tati EngDocumento8 paginePenyesuaian PD Tati EngnurullafajiraNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Wire Manufacturing CaseDocumento2 pagineWire Manufacturing CasePath_of_windNessuna valutazione finora

- Political Science - Philippine Constitution SummaryDocumento6 paginePolitical Science - Philippine Constitution SummaryPath_of_windNessuna valutazione finora

- FIN1 Review ExercisesDocumento1 paginaFIN1 Review ExercisesPath_of_windNessuna valutazione finora

- FIN - Review ExercisesDocumento1 paginaFIN - Review ExercisesPath_of_windNessuna valutazione finora

- FIN - Review ExercisesDocumento1 paginaFIN - Review ExercisesPath_of_windNessuna valutazione finora

- Wire Manufacturing CaseDocumento2 pagineWire Manufacturing CasePath_of_windNessuna valutazione finora

- Comparative Paper On The Database Logical ModelsDocumento6 pagineComparative Paper On The Database Logical ModelsPath_of_windNessuna valutazione finora

- Entity-Relationship DiagramDocumento2 pagineEntity-Relationship DiagramPath_of_wind100% (1)

- 17 Answers To All ProblemsDocumento25 pagine17 Answers To All ProblemsAarti J100% (1)

- History of ComputersDocumento4 pagineHistory of ComputersPath_of_windNessuna valutazione finora

- Terrestrial Biomes Basic InformationDocumento7 pagineTerrestrial Biomes Basic InformationPath_of_windNessuna valutazione finora

- Practice Worksheet - CA and Its DerivativesDocumento1 paginaPractice Worksheet - CA and Its DerivativesPath_of_windNessuna valutazione finora

- StatisticsDocumento1 paginaStatisticsPath_of_windNessuna valutazione finora

- Ways To Improve Productivity at The Workplace andDocumento5 pagineWays To Improve Productivity at The Workplace andPath_of_windNessuna valutazione finora

- Household Products With Organic CompoundsDocumento6 pagineHousehold Products With Organic CompoundsPath_of_wind100% (1)

- A History of Computer Programming LanguagesDocumento5 pagineA History of Computer Programming LanguagesPath_of_windNessuna valutazione finora

- Financial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Documento22 pagineFinancial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Pasupuleti Balasubramaniyam100% (1)

- 20201111report Financial Report December 2020 TheresidencesatbrentDocumento18 pagine20201111report Financial Report December 2020 TheresidencesatbrentChaNessuna valutazione finora

- Farm Record & Balance SheetDocumento29 pagineFarm Record & Balance SheetHaikal SapurataNessuna valutazione finora

- Jan David's Accounting Las 4Documento9 pagineJan David's Accounting Las 4Cj ArquisolaNessuna valutazione finora

- Oktay Urcan: Financial Accounting: Advanced TopicsDocumento39 pagineOktay Urcan: Financial Accounting: Advanced TopicsRishap JindalNessuna valutazione finora

- CH 6 Accounting For ReceivableDocumento17 pagineCH 6 Accounting For ReceivableSirazul Islam RanaNessuna valutazione finora

- Analyzing Transactions To Start A BusinessDocumento8 pagineAnalyzing Transactions To Start A BusinessJose Cruz100% (1)

- Chart of AccountDocumento1 paginaChart of AccountTusshar AhmedNessuna valutazione finora

- Escasinas Date Account Title & Explanation PR Debit Credit: 2021 AprilDocumento12 pagineEscasinas Date Account Title & Explanation PR Debit Credit: 2021 AprilAustine Crucillo TangNessuna valutazione finora

- Financial ReportingDocumento156 pagineFinancial ReportingAkanksha singhNessuna valutazione finora

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Documento7 pagine640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNessuna valutazione finora

- 6072 p3 Lembar JawabanDocumento54 pagine6072 p3 Lembar JawabanPeweNessuna valutazione finora

- Arias, Kyla Kim B. - Garcia's Health Care - 2Documento11 pagineArias, Kyla Kim B. - Garcia's Health Care - 2Kyla Kim AriasNessuna valutazione finora

- 25 Financial RatiosDocumento35 pagine25 Financial RatiosLia LeeNessuna valutazione finora

- Ratio Analysis ObjectiveDocumento5 pagineRatio Analysis ObjectiveAnjali AgarwalNessuna valutazione finora

- Sol. Man. - Chapter 10 - She (Part 1) - 2021Documento18 pagineSol. Man. - Chapter 10 - She (Part 1) - 2021Ventilacion, Jayson M.Nessuna valutazione finora

- Statement of Significant Accounting PoliciesDocumento6 pagineStatement of Significant Accounting PoliciesthomasNessuna valutazione finora

- Hardhat LTD Projected Income Statement 2000/2001Documento12 pagineHardhat LTD Projected Income Statement 2000/2001Rajeshkumar NayakNessuna valutazione finora

- Kaef LK TW Ii 2022Documento208 pagineKaef LK TW Ii 2022Nida Maulida HaviyaNessuna valutazione finora

- Coal IndiaDocumento24 pagineCoal IndiaAswini Kumar BhuyanNessuna valutazione finora

- ToTo ProjectDocumento29 pagineToTo ProjectPawan KumarNessuna valutazione finora