Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Girl Rising - Women & Money Fact Sheet

Caricato da

Fred Mednick0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

79 visualizzazioni4 pagineGirl Rising - Women & Money Fact Sheet

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoGirl Rising - Women & Money Fact Sheet

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

79 visualizzazioni4 pagineGirl Rising - Women & Money Fact Sheet

Caricato da

Fred MednickGirl Rising - Women & Money Fact Sheet

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

Issue Fact Sheet: Women & Money

I raise up my voice not so that I can Missed Educational Opportunities

In the developing world, girls are often expected

shout, but so that those without a voice

can be heardWe cannot all succeed to work, maintain the home, and to care for

younger children instead of getting an education,

when half of us are held back.

and these expectations have harmful effects on

MALALA YOUSAFZAI girls.

Despite progress achieved over the past two

Overview

decades to improve gender equality in education,

All over the world, women must overcome

girls are still more likely than boys to never set

systemic challenges to gain the same

foot in a classroom. Girls who go to school see

opportunities as their male counterparts. Women

immediate benefits beyond what they are learning.

often face barriers to education, to economic

Earning one extra year of education equates to

advancement, and/or lack basic human rights.

nearly a 12% increase in income for women, on

Women also face greater financial challenges, as

average (World Bank, 2014). The rate of return

they earn lower average wages, have a longer

is even higher for postsecondary education,

life expectancy, and experience more career

with each additional year providing nearly a 17%

interruptions due to child rearing.

increase in income (World Bank, 2014).

Financial Literacy Among Women

Economic Vulnerability

Women have lower levels of financial literacy

Lower educational attainment can limit career

than men in the majority of countries in the world

opportunities and lifetime earnings. Lower

(Klapper, Lusardi, & van Oudheusden, 2015). This

earnings lead to economic vulnerability, and

gender gap in financial knowledge is present

economic vulnerability may mean physical

in both advanced economies and emerging

vulnerability.

economies (Hasler & Lusardi, 2017).

When women are not financially independent,

Low levels of financial knowledge have far-

they may find themselves stuck in undesirable

reaching consequences, because financial literacy

or abusive situations because they do not have

can be linked to important financial decisions.

the resources to leave. In the U.S., for example,

Thus, improving womens financial literacy is key

upwards of 99% of domestic abuse has involved

to promoting their financial security.

economic abuse (Adams et al., 2008). Economic

abuse involves behaviors used to control a

Inequities in Education

womans ability to acquire, use, and maintain

Even though we are educating more people than

economic resources (Adams et al., 2008). on

ever, the world is still under-serving girls. Two-

your own is a powerful tool in ensuring financial

thirds of children denied education are female

freedom.

(UNESCO, 2015).

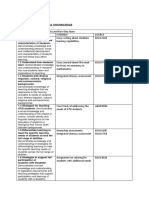

Career Opportunities hours more a day to housework than men and 2

The global job market consistently under-employs to 10 times the amount of time a day to care (for

females, meaning that they do not receive the children, elderly, and the sick) (World Bank, 2012).

jobs they are qualified for at the same rate as

men. For example, just 24% of global senior Barriers In America

management positions are held by women Although women in the United States benefit from

(Grant Thornton, 2016). Instead of corporate jobs, living in a more advanced economy, they still face

women disproportionately work in service or significant barriers to equality. Over their lifetimes,

informal roles, jobs that are often underpaid or women in the U.S. generally earn less money

unregulated. and have a higher cost of living than their male

counterparts.

Unpaid Labor

In addition to earning lower average salaries, In 2016, the median yearly earnings for a female

women also contribute more time to activities full-time worker in the U.S. were $8,632 lower than

associated with unpaid labor than men do (World the median earnings for a male full-time worker

Bank, 2012). Unpaid labor often includes domestic (Bureau of Labor Statistics, 2016). This number is

work inside the home. While there usually is no even lower for women of color (Hegewisch, Phil, &

financial reward for doing this work, it is necessary Williams-Baron, 2017).

for the day-to-day functioning of households.

While women earn lower average salaries than

men, products for women also cost 7% more, on

STOP AND THINK

average, than similar products for men (Menin,

What are some ways you have seen 2015).

women engage in unpaid labor in the

home? Why is it important for other family

TRY IT OUT

members to contribute to household

Go to your local drugstore and try to find

duties as well?

products that are the same except for their

marketing. Are products for women the

Examples of unpaid labor might include anything same price as products for men? Is it the

from spending hours a day finding food and

same in the supermarket? In the toy store?

water, to being responsible for the care of young

children, to ensuring that laundry and other

household chores are completed each week. Summary

Unpaid labor may look different, depending on Altogether, in 2015 American women are 11

where a woman lives in the world. One thing that percentage points more likely to be financially

is common, however, is the increased amount fragile than American men (Bumcrot et al., 2016).

of time that women spend on these household Fewer opportunities for educational attainment

tasks when compared to their male counterparts. in the developing world, coupled with lower

Worldwide, women devote an average of 1 to 3 average wages, a higher cost of living and more

Issue Fact Sheet: Women & Money

contributions to unpaid labor, contribute to Department of State (2016). United States global

inequities in the world today. The good news is strategy to empower adolescent girls.

that future generations can take steps to improve

these outcomes for women and girls. Girl Rising (2015). Teachers guide.

Make an Impact Grant Thornton (2016). Women in business:

Everyone can help support women and girls. You Turning theory into practice.

can make a difference with your voice. Fight for

women to be treated fairly. Speak up for yourself Hasler, A. & Lusardi, A. (2017). The gender gap

if you think youre being treated unfairly. Speak in financial literacy. The Global Financial Literacy

up for others if you see them being treated badly. Excellence Center.

Remember, your words matter. Your actions matter.

You matter. Hegewisch, A., Phil. M., and E. Williams-Baron

(2017). The gender wage gap by occupation 2016;

Additional Resources And by race and ethnicity (Fact Sheet #C456).

Pew Research Center Institute for Womens Policy Research.

NYC Department of Consumer Affairs

IWPR Klapper, L., Lusardi, A., & van Oudheusden, P.

Purple Purse (2015). Financial literacy around the world: Insights

Catalyst from the Standard & Poors Rating Services Global

AAUW Financial Literacy Survey.

UN Women

Payscale Menin, J. (2015). From cradle to cane: The cost of

USAID being a female consumer. New York City Dept. of

Consumer Affairs.

References

Adams, A., Bybee, D., Greeson, M., and C. Sullivan. UNESCO (2015). Education for all global

(2008). Development of the scale of economic monitoring report: Gender summary.

abuse. Violence Against Women, 14(5), 563-588.

World Bank (2012). World development report ch.

Bumcrot, C., Kieffer, C., Lin, J., Lusardi, A., Mottola, 2: The persistence of gender inequality. World

G., Ulicny, T., and G. Walsh (2016). Financial Bank.

capability in the United States 2016. FINRA

Investor Education Foundation. World Bank (2014). Open data.

Bureau of Labor Statistics (2016). Labor force

statistics from the current population survey.

Issue Fact Sheet: Women & Money

Suggested Use

For younger students, instructors may choose

statistics to highlight on the board, or assign

groups to read sections and identify the main idea

to share with the class.

For middle school or high school audiences,

instructors may have students complete a writing

activity about facts that surprised them the most,

synthesizing the research presented.

Issue Fact Sheet: Women & Money

This lesson is a component of an educational module designed to

enhance financial literacy and independence among young people.

Created for Girl Rising by the Global Financial Literacy Excellence Center

at the George Washington University.

In partnership with Citi.

2017 Citigroup Inc. All rights reserved.

Citi and Arc Design is a registered service mark of Citigroup Inc.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Transcript-Ex23-As1-2018-Bc-Bw 1564166663001 1Documento4 pagineTranscript-Ex23-As1-2018-Bc-Bw 1564166663001 1api-4901105670% (1)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Hitlers Daughter Integrated Unit S4Documento25 pagineHitlers Daughter Integrated Unit S4S TANCRED0% (1)

- Briefing Book - Curriculum Design and AssessmentDocumento44 pagineBriefing Book - Curriculum Design and AssessmentFred MednickNessuna valutazione finora

- Case Studies Research Paper - Sp2019 - FinalDocumento9 pagineCase Studies Research Paper - Sp2019 - FinalFred MednickNessuna valutazione finora

- PISA2015 Released FT Cognitive ItemsDocumento89 paginePISA2015 Released FT Cognitive ItemsAznani Hasnor AhmadNessuna valutazione finora

- Asset Mapping ToolkitDocumento43 pagineAsset Mapping ToolkitCaroline A Langcay100% (2)

- Template For Modern Education Systems PaperDocumento5 pagineTemplate For Modern Education Systems PaperTeachers Without BordersNessuna valutazione finora

- Designing For ResultsDocumento151 pagineDesigning For ResultsFred MednickNessuna valutazione finora

- New Theory of Change DocumentDocumento120 pagineNew Theory of Change DocumentFred MednickNessuna valutazione finora

- Template: Case Studies in Curriculum DesignDocumento5 pagineTemplate: Case Studies in Curriculum DesignFred MednickNessuna valutazione finora

- VIII OAS Edu Ministerial MednickDocumento19 pagineVIII OAS Edu Ministerial MednickFred MednickNessuna valutazione finora

- Panel Cards - 8 LensesDocumento4 paginePanel Cards - 8 LensesFred MednickNessuna valutazione finora

- Syllabus: Modern Education SystemsDocumento42 pagineSyllabus: Modern Education SystemsFred MednickNessuna valutazione finora

- The Pull of PISA-Uncertainty, Influence, and IgnoranceDocumento18 pagineThe Pull of PISA-Uncertainty, Influence, and IgnoranceFred MednickNessuna valutazione finora

- Perception of Teachers Multicultural EnvironmentDocumento39 paginePerception of Teachers Multicultural EnvironmentFred Mednick100% (2)

- Community Assessment RubricDocumento10 pagineCommunity Assessment RubricFred MednickNessuna valutazione finora

- Template For Paper - Management of Education ChangeDocumento5 pagineTemplate For Paper - Management of Education ChangeTeachers Without BordersNessuna valutazione finora

- Case Studies Syllabus Spring2018 VUBDocumento17 pagineCase Studies Syllabus Spring2018 VUBFred MednickNessuna valutazione finora

- Management of Education Change: SyllabusDocumento11 pagineManagement of Education Change: SyllabusFred MednickNessuna valutazione finora

- Case Studies Syllabus Spring2018 VUBDocumento17 pagineCase Studies Syllabus Spring2018 VUBFred MednickNessuna valutazione finora

- Syllabus - Management of Education Change 2017-2018Documento10 pagineSyllabus - Management of Education Change 2017-2018Fred MednickNessuna valutazione finora

- Title of Paper/Project: Management of Education ChangeDocumento5 pagineTitle of Paper/Project: Management of Education ChangeFred MednickNessuna valutazione finora

- Girl Rising - Youth & Money Fact SheetDocumento4 pagineGirl Rising - Youth & Money Fact SheetFred MednickNessuna valutazione finora

- 2014 - 990form - Teachers Without BordersDocumento28 pagine2014 - 990form - Teachers Without BordersFred MednickNessuna valutazione finora

- Goal Setting Worksheet PDFDocumento1 paginaGoal Setting Worksheet PDFFred MednickNessuna valutazione finora

- 2015 - 990EZ - Teachers Without BordersDocumento18 pagine2015 - 990EZ - Teachers Without BordersFred MednickNessuna valutazione finora

- Worksheet 1Documento1 paginaWorksheet 1Fred MednickNessuna valutazione finora

- 2013 - Form 990Documento30 pagine2013 - Form 990Fred MednickNessuna valutazione finora

- Girl Rising - Financial Literacy CurriculumDocumento13 pagineGirl Rising - Financial Literacy CurriculumFred MednickNessuna valutazione finora

- Wants Vs Needs Worksheet PDFDocumento2 pagineWants Vs Needs Worksheet PDFFred MednickNessuna valutazione finora

- 2012 - Form 990Documento25 pagine2012 - Form 990Fred MednickNessuna valutazione finora

- Kindergarten DLP Week 17Documento134 pagineKindergarten DLP Week 17Vinz Vinnie Ting MoranoNessuna valutazione finora

- Frank LaubachDocumento2 pagineFrank Laubachapi-331306128Nessuna valutazione finora

- Public Participation and Environmental Jurisprudence in Kenya - Education For Sustainable Development ParadgmDocumento18 paginePublic Participation and Environmental Jurisprudence in Kenya - Education For Sustainable Development ParadgmDuncan Kiboyye Okoth-Yogo100% (2)

- Effect of Parental Involvement On The Reading Skills of Pupils in Lower Primary School in Ondo State, NigeriaDocumento8 pagineEffect of Parental Involvement On The Reading Skills of Pupils in Lower Primary School in Ondo State, NigeriaTeresa Mae Abuzo Vallejos-BucagNessuna valutazione finora

- EDUC4185 Assignment 2Documento9 pagineEDUC4185 Assignment 2DavidNessuna valutazione finora

- Labour in Medieval IslamDocumento27 pagineLabour in Medieval Islamshrutigarodia0% (1)

- Chapter 3 - Assistive Technology For CommunicationDocumento64 pagineChapter 3 - Assistive Technology For CommunicationOLASIMAN, SHAN ANGELNessuna valutazione finora

- Effective Writing by Judith HochmanDocumento7 pagineEffective Writing by Judith HochmanmegbhicksNessuna valutazione finora

- Issues in Remedial TeachingDocumento2 pagineIssues in Remedial TeachingVimala DeviNessuna valutazione finora

- PopulationDocumento47 paginePopulationRaghuNessuna valutazione finora

- Community Medicine: Cross-Sectional Studies (Prevalence Studies/ Surveys)Documento5 pagineCommunity Medicine: Cross-Sectional Studies (Prevalence Studies/ Surveys)api-3829364Nessuna valutazione finora

- Ecological LiteracyDocumento9 pagineEcological LiteracyKyle CornetaNessuna valutazione finora

- Jammu DLL FinalDocumento12 pagineJammu DLL FinalGeetika SinghNessuna valutazione finora

- The Knowledge Society Book OkDocumento17 pagineThe Knowledge Society Book OkMan Iam StrongNessuna valutazione finora

- Accomplishment Report OnresearchDocumento2 pagineAccomplishment Report Onresearchrene conaNessuna valutazione finora

- I Was Born in A Middle Class Family of IndiaDocumento2 pagineI Was Born in A Middle Class Family of IndiaHiya MukherjeeNessuna valutazione finora

- Potentialities of Applied Translation For Language Learning in The Era of Artificial IntelligenceHispaniaDocumento25 paginePotentialities of Applied Translation For Language Learning in The Era of Artificial IntelligenceHispaniaandi adamNessuna valutazione finora

- Community Diagnosis Brgy 142 Zone 12-ALDWINDocumento20 pagineCommunity Diagnosis Brgy 142 Zone 12-ALDWINmefav7778520Nessuna valutazione finora

- Dual-Language Immersion Programs Boost Student Success - Nea TodayDocumento5 pagineDual-Language Immersion Programs Boost Student Success - Nea Todayapi-341096973Nessuna valutazione finora

- Review Literature Oral Communication SkillsDocumento18 pagineReview Literature Oral Communication SkillsJulie Rose AbivaNessuna valutazione finora

- Discussion On SDG 4 - Quality Education: Review of SDG Implementation and Interrelations Among GoalsDocumento14 pagineDiscussion On SDG 4 - Quality Education: Review of SDG Implementation and Interrelations Among GoalsNur AqilahNessuna valutazione finora

- Civic Engagement 0Documento36 pagineCivic Engagement 0Rosel PatotoyNessuna valutazione finora

- Edu-Edpc (2023)Documento25 pagineEdu-Edpc (2023)Daniel Alexis Munar MartínNessuna valutazione finora

- Q1W3 - Key Concepts and Benefits of MILDocumento8 pagineQ1W3 - Key Concepts and Benefits of MILMelvy EspanolNessuna valutazione finora

- OELP: Promoting Early Literacy in IndiaDocumento1 paginaOELP: Promoting Early Literacy in IndiaURVI SAWANTNessuna valutazione finora

- Foundations - Gender Questions and ReadingsDocumento21 pagineFoundations - Gender Questions and ReadingsBrian Roberts0% (1)

- Module 7Documento9 pagineModule 7Lance AustriaNessuna valutazione finora

- Child LabourDocumento14 pagineChild LabourPriNessuna valutazione finora