Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FUND FOLIO - Indian Mutual Fund Tracker - August 2017

Caricato da

nrcagroTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FUND FOLIO - Indian Mutual Fund Tracker - August 2017

Caricato da

nrcagroCopyright:

Formati disponibili

For CY17 YTD, equity AUM is up 34% against

Niftys rise of 23%

Equity Incl. ELSS AUM (INR b)

AUM CAGR 29% Nifty Index

Nifty CAGR 12%

10,077

8,283 7,946 8,186

Equity AUM (+6.4% MoM) at a new INR6.3t 6,295

high; quickest INR1t jump 6,304 4,697

5,905 4,057

3,195

1,918 1,827

INR127b Net inflows in July highest

since January 2008

CY12 CY13 CY14 CY15 CY16 CY17YTD

Deven Mistry Research analyst (Deven@MotilalOswal.com); +91 22 3982 5440

Investors are advised to refer to important disclosures made at the last page of the Research Report August 2017

SUMMARY: Equity AUM witnesses quickest INR1t jump

Key observations

Equity AUM of the MF industry grew 6.4% MoM to INR6.3t in July to a new high, also marking the quickest INR1t jump.

The increase in equity AUM was led by a rise in market indices (Nifty up 5.8% MoM). While gross inflows remained steady (INR280b, up 6% MoM),

redemptions fell 16% MoM to INR153b. Consequently, net inflows increased by 56% from INR82b in June to INR127b in July.

Notably, net inflows of INR127b in July were the highest since January 2008.

Total AUM of the MF industry rose 5.3% MoM in July to touch a new high of INR19.97t. The rise during the month of July was primarily led by a rise

in AUM of income funds (INR672b), equity funds (INR381b) and balanced funds (INR117b).

Some interesting facts

The month saw a notable change in sector and stock allocation of funds. On an MoM basis, the weights of Financials, Metals and Oil & Gas increased,

while those of Consumer, Healthcare, Autos, Telecom and Media showed signs of moderation.

NBFCs sector weight reached a new high of 7.9% (+70bp MoM and +170bp YoY). As a result, the sector has risen to the fourth position in sector

allocation of mutual funds it was at the seventh position 12 months ago.

Defensives weight decreased from 24.2% in June to 23.4% in July, as the weights of Healthcare, Consumer, Telecom and Technology decreased,

while Utilities saw an increase on MoM basis. (refer to page 3 for detailed chart).

Metals maintained positive momentum, with a sustained MoM increase in weight since May 2016 to reach a new high of 3.5% (+20bp MoM).

Of the top 10 stocks in terms of value increase MoM, seven were from Equity AUM touched new high of INR6.3t; quickest INR1t jump

Financials.

Equity AUM Incl. ELSS (INR t)

HDFC Bank, one of the preferred stocks among MFs in July, saw net buying by 6.29

17 funds. Value increased by INR41.2b; the stock was up by 8% for the month. 5.20

5.91

Other Financials witnessing an increase in value on an MoM basis were SBI

5.84

5.69

4.03

5.44

4.97

(INR36.1b), HDFC (INR30.8b), ICICI Bank (INR20.6b), Yes Bank (INR14.5b), Kotak

4.85

4.70

4.69

4.68

4.67

4.51

4.28

4.15

3.97

4.06

4.00

Mahindra Bank (INR11.6b) and Indusind Bank (INR11b).

3.94

3.87

3.86

3.84

3.83

3.72

3.65

3.55

3.46

3.45

3.45

3.41

ITC saw a decline of INR15.7b in value; 12 funds sold the stock; the stock was

down by 12% for the month. Value shocks were seen in Healthcare stocks. Dr

Reddys (-INR3.6b) and Sun Pharma (-INR3.2b) saw a maximum decline in value.

May-15

May-16

May-17

Mar-15

Mar-16

Mar-17

Jan-15

Nov-15

Jan-16

Nov-16

Jan-17

Jul-15

Sep-15

Jul-16

Sep-16

Jul-17

Idea Cellular, one of the least preferred stocks among MFs in July, saw net selling

by 5 funds. Value decreased by INR2b, despite the stock gain ~9% in the month.

Fund Folio: Indian Mutual Fund Tracker | August 2017 2

SUMMARY: Equity AUM witnesses the quickest INR1t jump

Key interesting charts

Domestic MFs received highest equity inflows since January 2008 NBFCs saw highest increase in weight MoM

Equity Incl. ELSS Net Inflows (INR b) NBFC

150 137 127 7.9

123

108

100 7.2

7.0 7.0

6.8

6.5 6.5 6.7

50 6.2 6.3 6.2 6.1 6.4

-50

-100 -73

May-17

Apr-17

July-17

June-17

Dec-16

July-16

Aug-16

Mar-17

Oct-16

Nov-16

Jan-17

Sep-16

Feb-17

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-17

Apr-08

Apr-09

Apr-10

Apr-11

Apr-12

Apr-13

Apr-14

Apr-15

Apr-16

Apr-17

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Jan-15

Jan-16

Jan-17

Oct-08

Oct-09

Oct-10

Oct-11

Oct-12

Oct-13

July-14

Oct-14

July-15

Oct-15

July-16

Oct-16

Defensives weight fell 80bp in July... led by Consumer, Healthcare and Telecom Metals sustained MoM increase in weight

Defensives Chg pp (MoM) Metals

0.0

3.3

3.5

27.4 3.1

27.1 26.9

26.526.3 26.3 0.0 2.6 2.7

25.9 25.7 -0.1 2.3

25.6 2.1 2.1 2.4

1.8

1.5 1.6 1.6

24.2 -0.3

23.823.7

23.4 -0.5

Consumer

Telecom

Technology

Healthcare

Utilities

May-17

Apr-17

July-17

June-17

May-17

Apr-17

July-17

June-17

Dec-16

July-16

Aug-16

Mar-17

Oct-16

Nov-16

Jan-17

Sep-16

Feb-17

Dec-16

July-16

Aug-16

Mar-17

Oct-16

Nov-16

Jan-17

Sep-16

Feb-17

Fund Folio: Indian Mutual Fund Tracker | August 2017 3

Contents

AUM: Equity AUM reached new high; up 6.4% MoM to INR6.3t in July

Flows: Net inflows in July at INR127b highest since January 2008 About the product

Top-20 funds: Equity value up 7% MoM and 53% YoY Fund Folio is a handbook on the

Sector-wise weight: MoM increase seen in Financials, Metals and Oil & Gas holdings of the top 20 domestic mutual

funds in India. This monthly report will

Sectoral allocation of funds: Oil & Gas, Consumer, Technology under-owned cover:

Nifty-50 snapshot: MFs net buyers in two-thirds of the stocks

Trend in AUMs and flows

Top schemes and NAV change: 76% of top-25 schemes underperformed market Sector allocation by funds

Value surprise: Maximum MoM change in HDFC Bank, SBI, HDFC and Infosys Stock-wise holding change

Funds snapshot: Overview Top schemes and NAV chg.

Axis Kotak Mahindra Fund-wise snapshot on top holdings

Birla Sun Life L&T

BNP Paribas Mirae Asset Notes:

This report covers only the top 20 mutual

Canara Robeco Motilal Oswal funds by exposure to equity

DSP BlackRock Principal All aggregates pertain only to the funds

Franklin Templeton Reliance listed in this report

Sectors are as defined by MOSL Research

HDFC SBI

Source: AMFI, NAVIndia

ICICI Prudential Sundaram

IDFC Tata

Invesco UTI

Fund Folio: Indian Mutual Fund Tracker | August 2017 4

AUM: Equity AUM reached new high; up 6.4% MoM to INR6.3t in July

Equity AUM of the MF industry grew 6.4% MoM to INR6.3t in July to a new high, also marking the quickest INR1t jump. The increase in equity AUM

was led by a rise in market indices (Nifty up 5.8% MoM). While gross inflows remained steady (INR280b, up 6% MoM), redemptions fell 16% MoM

to INR153b. Consequently, net inflows increased from INR82b in June to INR127b in July.

Total AUM of the MF industry rose 5.3% MoM in July to touch a new high of INR19.97t. The rise during the month of July was primarily led by a rise

in AUM of income funds (INR672b), equity funds (INR381b) and balanced funds (INR117b).

Equity AUM, as a percentage of total AUM, rose 30bp MoM to 31.5% in July. Equity AUM accounts for 4.7% of Indias market capitalization.

Trend in total AUM and equity AUM (as % of total) Trend in equity AUM and % of market capitalization

Total AUM (INR t) Equity as % to total AUM - RHS Equity AUM Incl. ELSS (INR t) % to Mktcap - RHS

22 37

19.3

19.97 7.0

6.3 5.3

18 17.4 32 5.5

5.2 4.6

16.3

15.2 4.0

14 13.2 14.2 27 4.0 3.1 3.9

11.8 12.0

10.1

10 9.0 22 2.5 3.2

6 17 1.0 2.5

Jan-13

Jan-14

Jan-15

Jan-16

Jan-17

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jan-13

Jan-14

Jan-15

Jan-16

Jan-17

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

What drove total AUM in July (INR b) What drove equity AUM in July (INR b)

117 45 7 0 0 254

381 280

672 -1 -216 6,295

19,969 -153

18,963

5,914

June-17 Income Equity Balanced Other GILT Infra FOF Gold Liquid July-17 June-17 Sales Redemption Capital July-17

Incl ELSS ETFs Debt Fund ETF Appreciation

Fund Folio: Indian Mutual Fund Tracker | August 2017 5

Flows: Net inflows in July at INR127b highest since January 2008

Mutual funds gross inflows rose to INR280b or 6% MoM in July. However, there was a meaningful fall in redemptions (INR153b, -16% YoY), leading

to a 56% increase in net inflows to INR127b in July from INR82b in June.

Monthly trend of sales, redemptions and net amount raised by mutual funds (toward equity)

Inflows in Equity Incl. ELSS (INR b) Redemptions in Equity Incl. ELSS (INR b) 280

300 Net Inflow/Outflow in Equity Incl. ELSS (INR b) 264

200

127 Redemptions

100

fell 16% to

0 INR153b in

-100

July

-200 -153

-183

-300

May-13

May-14

May-15

May-16

May-17

Mar-13

Mar-14

July-14

Mar-15

July-15

Mar-16

July-16

Mar-17

Nov-12

Jan-13

Nov-13

Jan-14

Nov-14

Jan-15

Nov-15

Jan-16

Nov-16

Jan-17

Jul-12

Sep-12

Jul-13

Sep-13

Sep-14

Sep-15

Sep-16

Jul-17

Yearly trend of net inflows by mutual funds (toward equity) Yearly trend of sales and redemptions by mutual funds (toward equity)

Net Inflow/Outflow in Equity Incl. ELSS (INR b) Sale in Equity Incl. ELSS (INR b)

906 Redemptions in Equity Incl. ELSS (INR b) 1,728 1,866 1,669

606 1,082 1,206

495 549 720 690 574

311 494 414 447

266

77

14

-409 -481 -498 -571 -551

-158 -156 -104 -816 -848 -712 -822

-1,317 -1,063

CY07 CY08 CY09 CY10 CY11 CY12 CY13 CY14 CY15 CY16 CY17 CY07 CY08 CY09 CY10 CY11 CY12 CY13 CY14 CY15 CY16 CY17

YTD YTD

Fund Folio: Indian Mutual Fund Tracker | August 2017 6

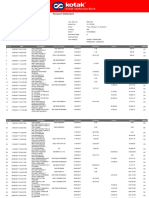

Top-20 funds: Equity value up 7% MoM and 53% YoY

Total equity value of the top-20 AMCs rose 7.3% MoM (+52.6% YoY) in July as against the Niftys rise of 5.8% MoM (+16.7% YoY).

Among the top-10 funds, the highest MoM increase was recorded in Kotak Mahindra Mutual Fund (+14.4%), HDFC Mutual Fund (+8.4%), SBI Mutual

Fund (+7.8%), Axis Mutual Fund (+7.5%) and DSP BlackRock Mutual Fund (+6.8%).

Trend of top-20 mutual funds by equity value

Value (INR b) MoM Change (%) 12M Chg Cash

Holding

July-17 July-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 July-17 (INRb) (%)

(%)

HDFC Mutual Fund 1,081 5.2 4.6 -0.3 4.3 -2.7 -0.3 8.1 4.2 5.9 5.6 3.7 2.2 8.4 373 52.6 4.0

ICICI Prudential Mutual Fund 931 4.2 4.0 2.0 5.6 -1.0 -0.8 6.1 7.0 4.0 4.2 3.6 2.1 6.2 319 52.3 10.3

SBI Mutual Fund 837 7.5 5.0 4.3 4.8 -2.3 5.2 9.1 8.1 8.9 5.1 4.9 3.4 7.8 387 86.1 6.8

Reliance Mutual Fund 743 4.1 2.8 -1.5 3.3 -3.0 -3.0 15.7 2.1 4.7 3.4 1.1 1.0 6.5 200 36.8 5.4

Birla Sun Life Mutual Fund 608 6.8 2.7 2.1 5.0 -4.3 0.5 10.0 8.1 8.0 5.3 4.1 4.1 6.4 240 65.2 5.9

UTI Mutual Fund 482 4.9 2.0 -1.1 1.5 -3.9 0.6 6.3 4.0 4.8 2.8 1.2 -0.5 4.3 93 23.9 4.6

Franklin Templeton Mutual Fund 478 3.8 3.5 -0.1 3.8 -2.4 -0.5 6.6 3.6 4.7 3.5 2.4 0.7 5.6 126 35.9 6.0

DSP BlackRock Mutual Fund 321 7.2 3.9 1.9 6.1 -4.3 2.3 7.5 6.8 10.0 8.0 4.5 2.0 6.8 133 70.7 3.6

Kotak Mahindra Mutual Fund 304 7.4 8.6 1.4 4.7 2.7 2.6 11.2 1.7 14.2 7.8 4.5 -1.8 14.4 151 98.4 8.5

AXIS Mutual Fund 223 7.4 2.4 0.4 3.6 -5.6 -3.7 7.6 5.8 5.7 8.0 2.7 3.5 7.5 68 43.8 5.7

L&T Mutual Fund 200 6.1 2.7 1.5 4.1 -1.1 -3.8 10.7 4.1 7.0 9.1 4.1 6.1 10.7 82 69.8 4.1

Sundaram Mutual Fund 145 7.0 4.6 0.1 7.5 -8.3 -1.5 8.5 5.1 6.8 8.5 2.3 1.7 6.6 48 49.0 6.2

IDFC Mutual Fund 134 7.8 2.0 -0.9 4.6 -8.2 -1.7 3.5 6.9 0.9 5.2 -0.3 0.4 9.3 25 22.6 4.0

Tata Mutual Fund 122 5.6 1.1 0.6 0.1 -5.2 -0.5 7.1 0.9 2.8 4.5 0.1 0.0 4.7 18 16.9 3.6

Motilal Oswal Mutual Fund 112 7.9 1.0 5.7 4.4 -2.4 -0.9 8.8 8.5 9.2 9.1 2.3 5.9 11.4 51 83.2 1.4

Mirae Asset Mutual Fund 95 9.2 7.1 7.9 12.1 0.0 -0.2 10.0 8.0 8.2 8.4 6.1 4.7 7.6 51 115.2 1.5

Canara Robeco Mutual Fund 55 5.9 3.0 2.3 0.2 -3.2 -2.8 6.9 4.5 6.7 7.9 0.4 2.6 6.6 16 40.1 2.5

BNP Paribas Mutual Fund 34 5.5 0.0 -3.9 -0.8 -5.9 -3.2 6.8 3.2 2.8 9.9 0.3 0.7 5.7 4 15.3 4.7

PRINCIPAL Mutual Fund 30 4.6 4.5 -0.2 2.8 -3.7 -2.8 6.6 4.0 5.9 6.7 4.0 2.7 5.0 9 40.9 4.0

Invesco Mutual Fund 27 3.5 1.2 0.5 2.5 -5.8 -0.8 4.0 3.3 5.9 7.2 1.7 -4.6 8.1 5 24.7 5.9

Total of above 6,961 5.6 3.6 0.9 4.3 -2.9 -0.1 8.7 5.2 6.3 5.2 3.1 2.0 7.3 2,398 52.6 4.9

Nifty 10,077 4.2 1.7 -2.0 0.2 -4.7 -0.5 4.6 3.7 3.3 1.4 3.4 -1.0 5.8 16.7

Note: Equity Value represent equity exposure for all schemes of Mutual Fund, having exposure in balanced or any other category.

Cash is derived by deducting equity AUM from total AUM; Only equity growth schemes have been considered for cash.

Fund Folio: Indian Mutual Fund Tracker | August 2017 7

Sector-wise weight: MoM increase seen in Financials, Metals and Oil & Gas

In July, MFs showed interest in NBFCs, Private Banks, PSU Banks, Metals and Oil & Gasthese sectors saw an MoM increase in weight. Consumer,

Healthcare, Autos, Telecom, Media, Infrastructure, Chemicals and Textiles saw an MoM decrease in weight.

Private Banks (17.7%) was the top sector holding in July, followed by Auto (10.1%), Capital Goods (8.3%) and NBFC (7.9%).

Consumer and Textiles were the only sectors witnessing a decline in value on an MoM basis.

Sector allocation (%): Sector value change MoM (%): MFs v/s BSE-200 weight (%):

Financials and Metals see highest increase Consumer and Textiles see highest fall in value Consumer u/w and Capital Goods o/w

July Weight (%) MoM Chg (pp) BSE 200 Weight (%) MF Weight (%)

NBFC 17.5

Banks Private 18.5

Banks Private 17.7 0.4 Metals 15.1 17.7

Consumer 11.2

Auto 10.1 Real Estate 14.1 6.3

NBFC 11.2

Capital Goods 8.3 - 7.9

Banks Public 14.0 10.4

NBFC 7.9 0.7

Auto 10.1

Banks Private 9.8 9.4

Technology 6.6 - Technology 6.6

Oil & Gas 8.8 9.3

Healthcare 6.4 Oil & Gas 6.1

Utilities 8.8 5.5

Consumer 6.3 Healthcare 6.4

Capital Goods 7.1 4.6

Oil & Gas 6.1 0.1 Capital Goods 8.3

Retail 6.9 Metals 3.4

Banks Public 5.2 0.3 3.5

Technology 6.8 Utilities 3.3

Chemicals 3.7 3.0

Metals Cement 6.7 Banks Public 3.1

3.5 0.2 5.2

Cement 3.2 Auto 5.6 Cement 2.2

- 3.2

Utilities 3.0 Healthcare 2.3 Telecom 1.9

- 1.1

Infrastructure 1.3 Media 2.3 Chemicals 1.3

3.7

Telecom 1.1 Chemicals 2.2 Infrastructure 1.0

1.3

Media 1.1 Infrastructure 1.3 Media 0.8

1.1

Textiles 1.1 Telecom Retail 0.7

0.5 1.0

Retail 1.0 Consumer -0.4 Textiles 0.4

- 1.1

Real Estate 0.5 Real Estate 0.2

- Textiles -7.8 0.5

Fund Folio: Indian Mutual Fund Tracker | August 2017 8

Sectoral allocation of funds: Oil & Gas, Consumer, Technology under-owned

Top sectors where ownership of mutual funds vis--vis BSE-200 is at least 1% lower: Oil & Gas (18 funds under-owned), Consumer (17 funds

under-owned), Technology (17 funds under-owned), NBFCs (16 funds under-owned) and Telecom (14 funds under-owned).

Top sectors where ownership of mutual funds vis--vis BSE-200 is at least 1% higher: Capital Goods (18 funds over-owned), Cement (14 funds

over-owned), PSU Banks (9 funds over-owned), Healthcare (7 funds over-owned) and Metals (7 funds over-owned).

Sector-wise allocation of funds v/s BSE-200 (%)

Birla Sun BNP Canara DSP Franklin ICICI Kotak Motilal

Sector BSE200 Axis HDFC IDFC Invesco L&T Mirae Principal Reliance SBI Sundaram TATA UTI

Life Paribas Robeco BlackRock Templeton Pru Mahindra Oswal

Auto 10.4 18.8 11.2 5.9 10.9 8.6 12.9 7.1 9.6 10.3 13.9 10.4 6.9 9.9 15.3 9.5 7.6 9.2 11.4 11.3 14.7

Banks Private 18.5 18.3 17.9 24.4 14.0 17.6 24.9 15.6 15.8 12.0 19.7 23.7 14.3 20.4 18.8 15.2 16.0 19.2 9.3 18.7 19.4

Banks Public 3.1 0.1 2.0 1.8 1.8 5.4 4.5 11.7 4.8 1.8 1.5 6.6 5.1 3.0 0.0 4.4 6.5 4.2 3.1 2.7 1.7

Capital Goods 4.6 9.3 6.9 7.0 8.4 9.4 4.9 12.3 6.3 10.5 7.4 6.9 10.6 7.3 1.3 6.1 12.2 6.1 10.9 7.4 5.8

Cement 2.2 2.0 3.8 4.6 4.5 3.8 3.9 1.5 1.5 3.9 2.2 5.8 7.2 4.3 0.7 7.4 4.5 2.4 6.0 5.9 3.9

Chemicals 1.3 6.0 3.8 4.8 8.1 7.0 1.8 3.9 2.8 4.0 3.7 3.2 4.1 3.0 1.2 5.2 4.3 3.3 9.2 2.1 2.9

Consumer 11.2 7.1 10.6 6.2 11.6 5.6 5.8 2.3 6.3 6.0 4.7 5.8 5.5 7.0 6.7 10.5 4.0 9.1 9.7 5.9 8.2

Healthcare 5.5 3.5 6.3 1.9 4.4 3.8 7.0 4.8 9.1 7.0 3.8 5.1 3.6 9.2 10.5 6.0 6.2 7.9 3.4 5.6 6.6

Infrastructure 1.0 0.2 1.1 3.1 1.1 2.0 1.3 2.1 1.3 0.9 1.7 0.5 1.1 0.0 1.6 1.3 0.8 1.8 3.7 1.0

Media 0.8 0.3 1.7 4.9 1.4 1.4 0.9 1.2 0.6 1.4 1.6 1.3 1.1 0.5 0.0 1.5 1.4 0.7 1.5 2.4 0.7

Metals 3.4 0.1 5.4 4.5 0.1 6.3 1.0 4.4 4.9 4.7 3.1 1.8 4.9 4.9 0.0 2.7 4.1 2.1 1.1 2.3 2.5

NBFC 11.2 19.3 11.6 8.0 10.1 6.7 3.2 4.3 6.4 8.5 10.1 8.1 8.2 5.6 21.6 7.6 6.2 11.2 9.6 7.4 6.7

Oil & Gas 9.3 1.3 5.4 4.9 6.6 6.8 5.1 5.3 6.4 5.0 7.6 9.2 4.5 6.7 13.2 6.4 6.4 7.4 3.2 5.5 6.3

Real Estate 0.2 0.0 0.3 0.1 0.5 0.6 0.7 0.3 0.3 0.9 0.5 0.6 2.9 0.0 0.6 0.7 0.0 0.4 0.6 0.2

Retail 0.7 2.7 0.6 2.5 0.6 0.5 2.0 1.1 0.4 2.3 0.9 0.4 3.0 0.0 0.3 1.1 0.5 1.3 2.6 0.6

Technology 9.4 3.3 4.9 2.6 3.7 2.1 6.4 8.7 9.7 3.6 6.7 3.4 3.7 5.4 1.2 5.2 6.4 7.1 3.7 5.5 10.1

Telecom 1.9 0.5 0.6 1.6 0.1 0.0 4.0 0.6 2.2 0.5 1.2 0.3 1.4 0.4 0.0 0.4 0.6 1.7 0.5 0.0 0.4

Textiles 0.4 1.7 0.5 1.4 2.0 4.1 1.2 0.6 0.1 2.4 0.0 1.4 2.2 2.9 0.0 2.2 0.9 0.9 3.7 0.8 1.0

Utilities 3.3 1.4 2.1 3.4 3.0 0.6 2.9 4.9 6.4 2.0 2.8 1.0 0.7 1.9 0.0 0.8 2.2 1.9 1.5 4.2 1.9

Note: Green box indicates over-ownership by +1% and orange box indicates under-ownership by -1% of a sector vis-a-vis BSE200 weight.

Fund Folio: Indian Mutual Fund Tracker | August 2017 9

Nifty-50 snapshot: MFs net buyers in two-thirds of the stocks

Highest net buying in July on an MoM basis was witnessed in HDFC (+17%), Hero MotoCorp (+16%) and Ambuja Cements (+14%).

Number of Funds Number of Funds

Value July- Value Chg Shares July- Shares Chg Value July- Value Chg Shares July- Shares Chg

Company Having Exposure Company Having Exposure

17 (INR B) MoM (%) 17 (M) MoM (%) 17 (INR B) MoM (%) 17 (M) MoM (%)

>2% <2% >2% <2%

HDFC 132.8 30.1 74.2 17.5 6 14 Asian Paints 20.8 4.9 17.9 -0.4 20

Hero MotoCorp 38.8 14.1 10.6 15.5 1 18 IndusInd Bank 114.5 10.6 69.6 -0.6 10 10

Ambuja Cements 16.8 21.6 63.9 13.9 18 HCL Tech. 66.5 4.2 74.5 -0.7 1 19

Lupin 27.6 10.5 26.8 13.5 19 HUL 37.0 5.5 32.0 -1.4 20

ACC 11.4 25.4 6.6 13.4 18

Maruti Suzuki 136.9 5.7 17.7 -1.6 11 9

Tata Power 12.3 12.6 149.8 10.6 16

Zee Entertainmen 25.1 8.0 46.2 -2.1 20

IOC 55.6 5.6 151.2 10.6 20

Wipro 28.4 9.2 98.5 -2.2 1 16

NTPC 55.1 13.1 335.3 9.5 1 17

ONGC 40.6 15.3 239.4 7.1 18 UltraTech Cement 25.5 -0.1 6.3 -2.5 19

Eicher Motors 32.8 18.8 1.1 6.8 1 18 Yes Bank 85.3 20.4 47.2 -2.6 4 15

Hindalco 49.1 22.7 223.7 6.7 17 Dr Reddys Labs. 21.1 -14.6 8.9 -3.7 17

Bank of Baroda 41.8 9.2 251.6 6.3 17 Reliance Inds. 116.2 11.7 71.9 -4.5 6 14

GAIL 51.4 10.8 136.4 6.3 19 Bharti Airtel 53.8 5.2 128.5 -4.6 1 19

Axis Bank 95.1 6.6 183.0 6.1 3 15 Bosch 18.2 -2.7 0.8 -6.1 1 15

Vedanta 55.7 19.1 199.1 6.0 1 18 Bajaj Auto 15.3 -11.5 5.4 -12.0 19

Tata Steel 77.8 7.7 137.1 3.6 2 17 Bharti Infratel 3.9 -5.8 9.6 -12.1 17

Kotak Mah. Bank 123.2 10.4 120.6 3.3 7 13 BPCL 37.6 -3.3 79.8 -12.6 1 17

HDFC Bank 397.6 11.6 222.8 3.3 19 1 Indiabulls Hsg Fin 9.9 -7.0 8.4 -14.8 18

Tata Motors 67.2 6.1 151.1 3.2 20

ICICI Bank 302.4 7.3 999.5 2.9 16 4 MFs weight in Nifty (%)

Infosys 207.1 11.2 204.8 2.8 12 8 OW/UW to Nifty(pp)

TCS 42.2 7.8 16.9 2.2 1 17 5.6 0.1 4.5 1.5 1.3 1.6 0.7

ITC 142.5 -9.9 499.6 2.2 9 11

L&T 193.2 8.1 161.8 1.8 9 11 MFs Weight in Nifty (%)

29.7

SBI 257.5 16.3 824.0 1.8 10 10

Coal India 24.3 3.7 97.6 1.6 17 10.9 9.9

8.0 7.9 5.7 5.3 5.1 4.8

M&M 68.1 5.6 48.6 1.5 1 18 4.3 3.8 1.5 1.4 0.8 0.7

Cipla 39.2 2.0 69.9 1.2 1 14

Consumer

Banks PSU

Metals

Cement

Media

Banks Pvt

Auto

Telecom

Technology

Healthcare

Cap. Goods

Utilities

Infra

Oil & Gas

NBFC

Tech Mahindra 30.4 1.5 78.8 0.5 18

Aurobindo Pharma 56.1 5.4 78.1 0.4 1 19

Sun Pharma 71.4 -4.2 134.2 0.1 2 18

Adani Ports & SEZ 29.0 8.9 73.2 -0.2 18

Power Grid 69.0 5.7 309.1 -0.4 4 16

Fund Folio: Indian Mutual Fund Tracker | August 2017 10

Top schemes and NAV change: 76% of top-25 schemes underperformed market

Among the top-25 schemes by AUM, the top schemes registering the highest rise are: Motilal Oswal Most Focused Multicap 35 Fund (+6.6%

MoM change in NAV), HDFC Top 200 Fund (+6.6% MoM change in NAV), HDFC Equity Fund (+6.5% MoM change in NAV), Reliance Growth Fund

(+6.1% MoM change in NAV), Franklin India Prima Plus (+5.9% MoM change in NAV) and ICICI Pru Focused Bluechip Equity Fund (+5.9% MoM

change in NAV).

Top schemes by AUM

Scheme Name Total AUM (INR B) Equity AUM (INR B) MoM NAV Chg (%) 12M NAV Chg (%)

HDFC Equity Fund - (G) 204 200 6.5 25.4

Birla Sun Life Frontline Equity Fund (G) 188 178 5.3 18.7

HDFC Mid-Cap Opportunities Fund (G) 178 170 4.6 26.5

ICICI Pru Value Discovery Fund (G) 176 159 3.5 11.0

HDFC Top 200 Fund (G) 154 152 6.6 23.8

SBI BlueChip Fund (G) 152 137 4.9 15.2

AXIS Long Term Equity Fund (G) 144 138 5.5 15.9

ICICI Pru Focused Bluechip Equity Fund (G) 143 139 5.9 19.4

Kotak Select Focus Fund (G) 128 114 5.4 23.9

Franklin India Prima Plus - (G) 116 110 5.9 17.5

Reliance Equity Opportunities Fund (G) 101 98 4.7 17.9

Reliance Tax Saver (ELSS) Fund - (G) 90 87 5.7 27.1

Franklin India Bluechip Fund - (G) 90 84 5.8 15.4

Motilal Oswal Most Focused Multicap 35 Fund (G) 79 78 6.6 28.5

ICICI Pru Dynamic Plan (G) 71 48 3.5 21.6

Franklin India High Growth Companies Fund (G) 69 65 4.7 21.1

Reliance Growth Fund - (G) 67 64 6.1 25.2

HDFC Tax Saver Fund (G) 67 63 5.4 27.1

Birla Sun Life Equity Fund (G) 65 58 4.9 26.5

Franklin India Smaller Companies Fund (G) 61 56 2.7 20.6

Franklin India Prima Fund - (G) 60 56 3.7 20.1

DSP BR Micro-Cap Fund (G) 60 58 0.6 23.6

IDFC Premier Equity Fund (G) 60 57 2.4 12.8

SBI Magnum Tax Gain Scheme (G) 59 57 4.7 17.4

Sundaram Select Midcap - (G) 56 54 3.7 23.8

Note: Equity growth schemes considered for this comparison

Fund Folio: Indian Mutual Fund Tracker | August 2017 11

Value surprise: Maximum MoM change in HDFC Bank, SBI, HDFC and Infosys

In July, seven of the top-10 stocks that saw maximum change in value were from Financials. HDFC Bank, SBI, HDFC, Infosys and ICICI Bank saw

maximum value change on an MoM basis.

ITC, Dr Reddys Lab, Sun Pharma, CG Consumer Electrical and Idea Cellular saw maximum decline in value.

Top-10 stocks by change in value

Value July-17 Value Chg MoM Value Chg Shares July-17 Shares Chg Shares Chg Price Chg %

Company

(INR B) (INR B) MoM (%) (M) MoM (M) MoM (%) MoM (%) AUM

HDFC Bank 397.6 41.2 11.6 222.8 7.1 3.3 7.9 5.7

SBI 257.5 36.1 16.3 824.0 14.9 1.8 14.2 3.7

HDFC 132.8 30.8 30.1 74.2 11.0 17.5 10.5 1.9

Infosys 207.1 20.8 11.2 204.8 5.7 2.8 8.1 3.0

ICICI Bank 302.4 20.6 7.3 999.5 28.2 2.9 4.1 4.3

Yes Bank 85.3 14.5 20.4 47.2 -1.3 -2.6 23.8 1.2

L&T 193.2 14.4 8.1 161.8 2.9 1.8 5.9 2.8

Reliance Inds 116.2 12.2 11.7 71.9 -3.4 -4.5 16.9 1.7

Kotak Mah Bank 123.2 11.6 10.4 120.6 3.9 3.3 6.7 1.8

IndusInd Bank 114.5 11.0 10.6 69.6 -0.4 -0.6 10.9 1.6

Bottom-10 stocks by change in value

Value July-17 Value Chg Value Chg Shares July-17 Shares Chg Shares Chg Price Chg %

Company

(INR B) MoM (INR B) MoM (%) (M) MoM (M) MoM (%) MoM (%) AUM

ITC 142.5 -15.7 -9.9 499.6 10.7 2.2 -11.9 2.0

Dr Reddys Labs 21.1 -3.6 -14.6 8.9 -0.3 -3.7 -11.1 0.3

Sun Pharma 71.4 -3.2 -4.2 134.2 0.1 0.1 -4.1 1.0

CG Cons Elect 11.9 -2.2 -15.7 54.3 -7.9 -12.7 -2.9 0.2

Idea Cellular 8.2 -2.0 -19.7 88.8 -31.2 -26.0 8.8 0.1

Bajaj Auto 15.3 -2.0 -11.5 5.4 -0.7 -12.0 0.6 0.2

P I Industries 15.2 -1.6 -9.8 19.9 -0.3 -1.3 -8.3 0.2

Mindtree 3.6 -1.5 -29.8 7.6 -2.2 -22.2 -9.8 0.1

Sundram Fasteners 8.2 -1.4 -14.5 19.9 -2.5 -11.3 -3.6 0.1

PVR 6.1 -1.3 -18.0 4.5 -0.7 -13.8 -4.6 0.1

Fund Folio: Indian Mutual Fund Tracker | August 2017 12

HDFC IN ORDER OF EQUITY AUM, CLICK ON THE FUND NAME FOR DETAILS

ICICI Prudential

SBI

Reliance

Birla Sun Life

UTI

Franklin Templeton

DSP BlackRock

Kotak Mahindra

Axis

FUNDS

L&T

Sundaram

SNAPSHOT

IDFC

Tata

Motilal Oswal

Mirae Asset

Canara Robeco

BNP Paribas

Principal

Invesco

Fund Folio: Indian Mutual Fund Tracker | August 2017 13

HDFC: Equity AUM INR1081b ICICI Prudential: Equity AUM INR931b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

SBI 6.5 0.5 15.6 0.3 ICICI Bank 4.7 -0.3 15.8 -0.5

Banks Pvt Banks Pvt

ICICI Bank 6.5 -0.1 12.3 -0.4 HDFC Bank 4.7 -0.2 9.7 -0.2

Cap Goods Technology

L&T 5.5 -0.1 11.7 0.6 SBI 4.4 0.1 9.6 -0.1

Banks PSU Auto

Infosys 4.8 0.5 8.7 0.4 L&T 3.9 0.2 9.1 -0.3

Technology Healthcare

HDFC Bank 4.5 0.3 7.7 -0.7 3.5 -0.1 6.4 0.7

Auto Infosys NBFC

Reliance Inds 2.7 0.0 5.3 -0.1 3.2 -0.3 6.4 1.1

Oil & Gas Sun Pharma Oil & Gas

Power Grid 2.3 0.1 4.9 0.2 2.6 0.2 Utilities 6.4 0.1

Utilities NTPC

2.3 0.0 4.8 -0.1 2.6 -0.1 6.3 0.3

Tata Steel Healthcare Axis Bank Cap Goods

2.2 0.0 4.4 0.2 2.3 -0.2 Consumer 6.3 0.0

Aurobindo Metals Cipla

1.9 -0.5 4.3 0.6 2.2 0.1 Metals 4.9 0.4

Maruti Suzuki NBFC Wipro

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

SBI 10.38 5,819 SBI 0.49 6.54 HDFC 9.50 4,993 HDFC 0.99 1.59

Infosys 8.67 5,140 Infosys 0.47 4.78 GAIL 4.68 11,807 GAIL 0.47 1.08

HDFC Bank 6.87 1,956 HDFC Bank 0.31 4.54 IOCL 4.59 13,850 ONGC 0.43 1.21

ICICI Bank 4.82 6,649 HDFC 0.30 1.60 ONGC 4.38 22,761 IOCL 0.42 1.67

HDFC 4.34 1,643 Vedanta 0.23 1.47 L&T 3.88 1,597 Lupin 0.28 1.16

L&T 3.98 475 Power Grid 0.13 2.33 Hindalco 3.42 5,803 Hindalco 0.27 1.90

Vedanta 3.48 6,946 PNB 0.13 1.16 SBI 3.40 -6,244 NTPC 0.21 2.63

Power Grid 3.28 8,760 M&M 0.13 0.28 NTPC 3.24 15,458 L&T 0.20 3.89

Reliance Inds 2.75 -1,110 Tata Motors 0.08 0.99 Lupin 3.05 3,151 Asian Paints 0.18 0.38

PNB 2.30 2,671 TCS 0.08 1.09 Petronet LNG 2.09 12,226 Petronet LNG 0.17 1.02

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

HDFC Long Term Advantage Fund (G) 15.3 14.7 7.0 ICICI Pru Focused Bluechip Equity Fund (G) 142.9 138.7 5.9

HDFC Top 200 Fund (G) 153.6 151.7 6.6 ICICI Pru Select Large Cap Fund (G) 7.3 6.6 4.5

HDFC Equity Fund - (G) 203.5 199.9 6.5 ICICI Pru Top 100 Fund - (G) 25.6 24.8 4.3

HDFC Infrastructure Fund (G) 13.8 13.7 6.2 ICICI Pru Infrastructure Fund - (G) 16.6 15.8 3.7

HDFC Focused Equity Fund - Plan B (G) 5.4 5.2 6.2 ICICI Pru Dynamic Plan (G) 71.2 47.5 3.5

Fund Folio: Indian Mutual Fund Tracker | August 2017 14

SBI: Equity AUM INR837b Reliance: Equity AUM INR743b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

HDFC Bank 8.0 0.3 19.2 0.5 5.70.3 16.0 0.5

Banks Pvt HDFC Bank Banks Pvt

ICICI Bank 4.4 0.1 11.2 1.6 5.1 0.4 12.2 0.0

NBFC SBI Cap Goods

SBI 4.0 0.4 9.3 -0.3 4.4 0.1 7.6 0.0

Auto ICICI Bank Auto

ITC 4.0 -0.9 9.1 -1.2 3.6 0.3 6.5 0.7

Consumer Infosys Banks PSU

Reliance Inds 3.9 0.3 7.9 -0.4 2.0 0.0 6.4 -0.7

Healthcare L&T Oil & Gas

3.8 0.5 7.4 0.1 6.4 0.4

HDFC Oil & Gas ONGC 2.0 -0.1 Technology

3.4 0.1 Technology 7.1 -0.6 -0.1 6.2 -0.3

Kotak M Bank HCL Tech 1.9 Healthcare

2.9 -0.3 Cap Goods 6.1 -0.1 -0.3 6.2 0.4

Infosys IOCL 1.9 NBFC

2.7 -0.1 4.2 0.4 -0.1 4.5 0.4

L&T Banks PSU 1.8 Cement

Tata Steel

1.6 0.1 Chemicals 3.2 -0.2 0.0 Chemicals 4.3 -0.2

Maruti Suzuki TVS Motor 1.7

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

HDFC Bank 6.97 1,228 AU Small Finance 0.69 0.69 SBI 5.23 2,016 Shriram Trans Fin 0.42 0.52

HDFC 6.05 1,855 HDFC 0.48 3.76 HDFC Bank 4.73 975 SBI 0.42 5.07

AU Small Finance 5.77 9,771 SBI 0.37 4.03 Infosys 3.94 2,076 Infosys 0.33 3.59

SBI 5.30 4,053 Ajanta Pharma 0.28 0.30 Shriram Trans Fin 3.19 3,127 HDFC Bank 0.31 5.66

Reliance Inds 4.50 -218 HDFC Bank 0.27 7.97 ICICI Bank 2.94 5,509 Aditya Birla Capital 0.25 0.25

ICICI Bank 3.47 6,794 Reliance Inds 0.27 3.94 Ambuja Cements 1.96 6,890 Ambuja Cements 0.24 0.57

Kotak M Bank 2.68 908 Bajaj Finserv 0.24 0.38 Aditya Birla Capital 1.84 9,990 Bharat Forge 0.17 1.13

Ajanta Pharma 2.36 1,700 Tata Steel 0.17 0.64 Bharat Forge 1.70 1,180 Bharti Airtel 0.17 0.24

Bajaj Finserv 2.08 369 Hindalco 0.17 0.79 Axis Bank 1.62 3,033 BOB 0.15 0.62

Hindalco 1.79 4,870 Hindustan Zinc 0.13 0.19 BOB 1.34 7,510 Jubilant Food 0.15 0.59

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

SBI Banking & Financial Services Fund (G) 4.6 4.2 9.0 Reliance Capital Builder Fund II - Sr.B (G) 12.8 10.1 9.3

SBI Contra Fund (G) 18.4 16.8 5.2 Reliance Diversified Power Sector (G) 18.7 18.2 8.8

SBI BlueChip Fund (G) 152.4 137.2 4.9 Reliance Banking Fund - (G) 30.3 28.2 7.2

SBI Magnum Multicap Fund (G) 27.4 26.5 4.9 Reliance Growth Fund - (G) 67.1 64.3 6.1

SBI Small & Midcap Fund (G) 7.3 6.8 4.9 Reliance Vision Fund - (G) 33.8 33.0 5.9

Fund Folio: Indian Mutual Fund Tracker | August 2017 15

Birla Sun Life: Equity AUM INR608b UTI: Equity AUM INR482b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

ICICI Bank 4.5 0.0 Banks Pvt 17.9 1.0 HDFC Bank 6.5 0.2 Banks Pvt 19.4 0.5

HDFC Bank 4.3 0.4 NBFC 11.6 0.3 Infosys 4.3 0.1 Auto 14.9 -0.3

3.0 0.1 11.2 0.7 ICICI Bank 4.1 0.0 10.1 -0.1

Maruti Suzuki Auto Technology

2.8 0.0 10.6 0.0 Maruti Suzuki 3.3 0.1 8.2 -0.6

ITC Consumer Consumer

2.7 0.4 6.9 0.0 3.0 0.1 6.7 0.6

Yes Bank Cap Goods IndusInd Bank NBFC

2.4 0.1 6.3 -1.0 2.8 -0.6 6.6 -0.2

Infosys Healthcare ITC Healthcare

2.4 0.1 5.4 -0.1 2.1 0.0 6.3 0.4

Kotak M Bank Oil & Gas TCS Oil & Gas

2.2 0.1 0.5 1.9 0.1 5.8 0.0

IndusInd Bank Metals 5.4 HDFC Cap Goods

0.1 -0.2 1.8 0.1 3.9 0.2

Vedanta 2.1 Technology 4.9 Kotak M Bank Cement

1.8 0.4 -0.6 1.8 -0.2 Chemicals 2.7 0.0

Hindalco Cement 3.8 Sun Pharma

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

HDFC Bank 3.87 1,174 HDFC Bank 0.40 4.28 HDFC Bank 2.07 -140 Grasim 0.38 0.66

Yes Bank 3.08 -43 Hindalco 0.38 1.84 Grasim 1.87 1,917 Reliance Inds 0.23 1.67

Hindalco 2.83 7,185 Yes Bank 0.37 2.70 Reliance Inds 1.39 157 Vedanta 0.21 0.93

Hero MotoCorp 2.44 680 Hero MotoCorp 0.36 1.00 Infosys 1.36 -200 HDFC Bank 0.17 6.45

Tata Motors 1.92 3,840 Tata Motors 0.23 1.59 IndusInd Bank 1.23 -152 Yes Bank 0.17 1.51

Maruti Suzuki 1.72 64 Aditya Birla Capital 0.23 0.23 Vedanta 1.18 2,739 Jubilant Food 0.16 0.40

ICICI Bank 1.56 1,538 Zee Ent. 0.16 1.25 Yes Bank 1.08 -211 Aditya Birla Capital 0.15 0.15

Infosys 1.47 390 HPCL 0.16 1.41 Maruti Suzuki 1.04 -8 IndusInd Bank 0.14 2.97

HPCL 1.44 1,364 L&T Fin. Holdings 0.16 1.27 HDFC 0.87 2 LIC Hsg Fin 0.13 0.19

Vedanta 1.41 24 Bajaj Finance 0.14 1.18 ICICI Bank 0.85 151 Infosys 0.11 4.30

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

Birla Sun Life Banking & Financial Services (G) 13.3 12.9 9.3 UTI-Banking Sector Fund (G) 6.5 6.4 7.2

Birla Sun Life Infrastructure Fund - (G) 5.9 5.5 7.3 UTI-Bluechip Flexicap Fund (G) 19.9 19.4 6.3

Birla Sun Life Advantage Fund (G) 40.8 40.1 7.0 UTI-Infrastructure Fund (G) 16.4 16.1 6.1

Birla Sun Life Top 100 Fund (G) 31.9 29.3 5.7 UTI-Nifty Index Fund (G) 5.7 5.6 6.0

Birla Sun Life Pure Value Fund (G) 14.6 13.9 5.6 UTI-Mastershare (G) 44.3 44.0 5.1

Fund Folio: Indian Mutual Fund Tracker | August 2017 16

Franklin: Equity AUM INR478b DSP BlackRock: Equity AUM INR321b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

HDFC Bank 8.4 0.3 HDFC Bank 5.0 0.3 17.6 1.3

Banks Pvt 24.9 0.5 Banks Pvt

4.1 -0.1 3.7 0.3

ICICI Bank Auto 12.9 -0.5 SBI Cap Goods 9.4 -0.2

3.9 0.3 3.2 0.8

SBI Healthcare 7.0 -0.3 Yes Bank Auto 8.6 0.4

3.7 -0.2 -0.2 3.1 0.2

Axis Bank Technology 6.4 ICICI Bank Chemicals 7.0 -0.5

3.7 0.6 -0.2 2.9 -0.6

Yes Bank Consumer 5.8 ITC Oil & Gas 6.8 -0.7

3.3 0.1 0.2 2.6 0.1 0.5

Bharti Airtel Oil & Gas 5.1 Maruti Suzuki NBFC 6.7

0.1 0.1 0.1 0.5

Infosys 2.4 Cap Goods 4.9 IndusInd Bank 2.5 Metals 6.3

2.1 0.0 4.5 0.3 0.0 5.6 -0.4

M&M Banks PSU L&T 2.4 Consumer

0.0 4.0 0.1 0.0 5.4 0.5

IndusInd Bank 2.0 Telecom Federal Bank 2.2 Banks PSU

-0.1 3.9 -0.3 4.1 -0.4

Tata Motors-DVR 2.0 Cement Bajaj Finance 2.0 0.4 Textiles

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

Yes Bank 3.47 51 Yes Bank 0.56 3.71 Yes Bank 3.20 856 Yes Bank 0.85 3.17

HDFC Bank 3.35 233 Aditya Birla Capital 0.32 0.32 HDFC Bank 2.03 504 Bajaj Finance 0.36 1.96

SBI 2.40 277 SBI 0.31 3.92 SBI 1.79 1,158 Hindalco 0.36 1.49

IOCL 1.58 4,788 IOCL 0.28 1.16 Bajaj Finance 1.49 198 HDFC 0.35 1.58

Aditya Birla Capital 1.54 8,390 HDFC Bank 0.27 8.37 HDFC 1.39 555 SBI 0.34 3.69

Equitas Holdings 1.42 5,811 Equitas Holdings 0.25 1.11 Hindalco 1.39 3,999 HDFC Bank 0.33 5.03

Bharti Airtel 1.19 -801 Ramkrishna Forging 0.13 0.13 ICICI Bank 1.18 2,649 M&M 0.25 0.25

Infosys 0.94 74 Ipca Lab 0.12 0.15 Maruti Suzuk 0.90 46 Infosys 0.21 1.08

Kotak M Bank 0.80 295 Jubilant Food 0.10 0.41 Infosys 0.86 638 Sterlite Tech 0.20 0.77

BPCL 0.63 -136 Finolex Inds 0.09 0.26 M&M 0.82 583 Dalmia Bharat 0.20 1.03

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

Templeton India Growth Fund - (G) 5.9 5.7 7.6 DSP BR Focus 25 Fund (G) 28.4 28.2 7.4

Franklin India Prima Plus - (G) 115.6 109.9 5.9 DSP BR Top 100 Equity Fund (G) 35.3 35.2 7.3

Franklin India Bluechip Fund - (G) 89.6 84.5 5.8 DSP BR Opportunities Fund (G) 31.5 29.9 6.4

Franklin India High Growth Companies Fund (G) 69.2 64.9 4.7 DSP BR Tax Saver Fund (G) 30.4 29.3 6.2

Franklin India Taxshield - (G) 32.0 29.5 4.2 DSP BR Equity Fund (G) 24.6 24.3 6.0

Fund Folio: Indian Mutual Fund Tracker | August 2017 17

Kotak Mahindra: Equity AUM INR304b Axis: Equity AUM INR223b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

HDFC Bank 8.3 0.1 Banks Pvt 23.7-0.3 7.9 0.5 19.3 0.8

HDFC Bank NBFC

4.8 0.4 10.4 -0.1 7.5 0.3

SBI Auto Kotak M Bank Auto 18.8 -0.6

4.7 0.0 9.2 0.1 5.6 0.1 18.3 0.9

ICICI Bank Oil & Gas hdfC Banks Pvt

3.5 0.2 8.1 -0.1 5.6 0.2 9.3 -0.2

IndusInd Bank NBFC Maruti Suzuki Cap Goods

3.0 0.3 6.9 0.7 5.2 0.8 7.1 -1.6

Reliance Inds Cap Goods Bajaj Finance Consumer

2.8 -0.3 6.6 0.7 3.9 -0.6 6.0 -0.8

ITC Banks PSU Motherson SumI Chemicals

-0.5 -0.4 3.5 0.7

Axis Bank 2.3 -0.1 Consumer 5.8 l&t 3.7 Healthcare

-0.1 -0.3 3.3 -0.1

Hero MotoCorp 2.1 -0.2 Cement 5.8 Pidilite IndS 3.4 Technology

0.1 0.2 0.5

2.1 0.0 5.1 GRUH Finance 3.0 Retail 2.7

Maruti Suzuki Healthcare

0.1 3.0 0.1 2.0 0.2

Infosys 2.0 0.0 Technology 3.4 Cummins India Cement

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

HDFC Bank 3.40 927 BEML 0.59 0.97 Bajaj Finance 2.43 136 Bajaj Finance 0.78 5.19

SBI 2.90 3,908 SBI 0.39 4.83 HDFC Bank 2.28 594 Avenue Supermarts 0.52 2.52

Reliance Inds 2.04 502 MRF 0.37 0.96 Kotak M Bank 1.75 695 HDFC Bank 0.51 7.89

BEML 1.94 1,048 Reliance Inds 0.33 3.04 Avenue Supermarts 1.47 1,018 Sun Pharma 0.41 0.49

ICICI Bank 1.87 4,398 L&T 0.30 1.84 Maruti Suzuki 1.39 73 Page IndS 0.35 1.68

IndusInd Bank 1.79 491 Lupin 0.23 0.61 HDFC 1.08 -89 Tube Investments 0.30 0.61

L&T 1.50 1,045 Suzlon Energy 0.22 0.26 Page Inds 0.98 64 Kotak M Bank 0.28 7.53

MRF 1.35 19 Bharat Forge 0.21 0.42 GRUH Finance 0.96 731 Maruti Suzuki 0.25 5.61

BOB 0.85 4,666 Shriram Trans Fin 0.19 0.60 Sun Pharma 0.94 1,771 Sun Pharma Advance 0.25 0.25

Lupin 0.84 836 IndusInd Bank 0.18 3.46 Cummins India 0.77 339 GRUH Finance 0.23 3.03

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

Kotak Opportunities (G) 17.4 16.8 5.4 AXIS Equity Fund (G) 18.5 17.2 5.9

Kotak Select Focus Fund (G) 127.7 114.1 5.4 AXIS Focused 25 Fund (G) 16.7 15.8 5.9

Kotak Tax Saver (G) 6.8 6.7 5.1 AXIS Long Term Equity Fund (G) 143.8 137.7 5.5

Kotak 50 (G) 14.1 13.5 4.5 AXIS Emerging Opportunities Fund - Sr.2 (G) 11.9 11.7 5.3

Kotak Emerging Equity Fund (G) 21.8 20.3 2.5 AXIS Midcap Fund (G) 12.3 11.8 4.0

Fund Folio: Indian Mutual Fund Tracker | August 2017 18

L&T: Equity AUM INR200b Sundaram: Equity AUM INR145b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

4.2 0.2 HDFC Bank 1.9 0.0 11.4 -0.4

ICICI Bank Banks Pvt 14.3 0.9 Auto

3.8 0.0 10.6 -0.7 1.8 0.2 10.9 1.0

ITC Cap Goods Bajaj Finserv Cap Goods

HDFC 3.6 0.7 NBFC 8.2 0.8 UPL 1.8 0.0 NBFC 9.6 -0.2

SBI 2.9 0.5 Cement 7.2 0.9 Ramco Cement 1.6 -0.4 Consumer 9.5 -0.4

2.9 -0.1 7.0 0.1 1.4 0.0 9.3 -0.2

L&T Auto Schaeffler India Banks Pvt

2.9 0.2 5.5 0.1 1.4 0.0 9.2 0.3

HDFC Bank Consumer Sundaram Clayton Chemicals

1.8 0.0 5.1 0.3 1.4 -0.1 6.0 -0.3

Kotak M Bank Banks PSU Karur Vysya Bank Cement

-0.2 4.9 0.9 0.0 3.7 -0.2

Ramco Cement 1.7 Metals Timken India 1.3 Textiles

0.7 4.5 0.1 3.7 0.0

Axis Bank 1.7 Oil & Gas 1.3 -0.1 Technology

DCB Bank

-0.2 4.1 -0.2 Healthcare 3.4 0.0

IndusInd Bank 1.6 Chemicals Honeywell 1.3 0.0

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

Grasim 2.42 2,353 Grasim 1.17 1.57 ABB India 1.00 712 ABB India 0.67 0.97

HDFC 1.93 756 Axis Bank 0.75 1.66 Trent 0.55 1,733 Security & Intelligenc 0.38 0.38

Axis Bank 1.67 3,195 HDFC 0.68 3.62 Security & Intelligenc 0.55 675 Trent 0.35 0.84

SBI 1.51 2,846 SBI 0.52 2.94 Vedanta 0.49 1,728 Vedanta 0.34 0.40

ICICI Bank 1.18 2,893 Idea Cellular 0.51 0.73 Bajaj Finserv 0.40 -16 Tata Steel 0.25 0.25

Idea Cellular 1.07 11,199 Hero MotoCorp 0.44 0.57 Tata Steel 0.36 635 Akzo Nobel India 0.18 0.18

HDFC Bank 0.98 334 Hindustan Zinc 0.39 0.43 Mahindra & Mahindr 0.32 188 Rallis India 0.17 0.45

Hero MotoCorp 0.91 250 Lakshmi Machine 0.38 0.38 Rallis India 0.28 1,168 Bajaj Finserv 0.17 1.84

Hindustan Zinc 0.79 2,758 Aditya Birla Capital 0.38 0.38 Siemens 0.26 125 Mahindra & Mahindr 0.16 1.13

Lakshmi Machine 0.77 130 Reliance Inds 0.26 1.31 Akzo Nobel India 0.26 144 Aurobindo Pharma 0.16 0.16

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

L&T India Large Cap Fund (G) 3.9 3.9 5.9 Sundaram Select Focus - (G) 4.9 4.5 6.5

L&T Infrastructure Fund (G) 6.8 6.4 5.6 Sundaram Diversified Equity (G) 19.5 18.7 4.3

L&T Midcap Fund (G) 10.8 10.2 4.9 Sundaram Rural India Fund (G) 14.7 13.3 4.0

L&T Business Cycles Fund (G) 9.9 9.8 4.6 Sundaram Select Midcap - (G) 55.7 54.2 3.7

L&T India Value Fund (G) 49.0 46.8 4.5 Sundaram Infrastructure Advantage Fund (G) 6.5 6.2 3.7

Fund Folio: Indian Mutual Fund Tracker | August 2017 19

IDFC: Equity AUM INR134b Tata: Equity AUM INR122b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

HDFC Bank 3.0 0.2 12.0 2.5 HDFC Bank 5.4 0.2 18.70.9

Banks Pvt Banks Pvt

Sun Pharma 2.2 0.2 10.5 -0.1 ICICI Bank 4.6 0.0 11.3 0.5

Cap Goods Auto

Kotak M Bank 2.1 0.6 10.3 -0.4 Yes Bank 4.4 0.7 7.4 0.8

Auto NBFC

2.0 0.0 3.4 0.0 7.4 0.2

Maruti Suzuki NBFC 8.5 -0.3 Power Grid Cap Goods

1.9 0.7 2.8 -1.0 5.9 -0.7

Infosys Healthcare 7.0 0.0 ITC Consumer

-0.1 2.3 0.2 5.9 -0.4

Voltas 1.9 Consumer 6.0 -0.8 Maruti Suzuki Cement

-0.1 0.2 5.6 -0.3

APL Apollo 1.6 5.0 -0.4 Reliance Inds 2.2 Healthcare

Oil & Gas -0.1

-0.1 2.1 0.0 Oil & Gas 5.5

Ambuja Cements 1.6 Metals 4.7 -0.1 HCL Tech

-0.1 0.0 5.5 0.0

1.6 4.0 -0.5 L&T 2.1 Technology

JM Financial Chemicals

-0.2 -0.4 2.0 0.2 Utilities 4.2 -0.6

ICICI Pru Life 1.5 Cement 3.9 SBI

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

Infosys 1.07 939 Infosys 0.70 1.95 Yes Bank 1.07 19 Yes Bank 0.71 4.44

Kotak M Bank 0.97 830 ICICI Bank 0.63 1.20 HDFC Bank 0.52 24 Ashok Leyland 0.41 0.41

ICICI Bank 0.91 2,914 Kotak M Bank 0.60 2.08 Ashok Leyland 0.50 4,540 Tata Global Bev. 0.40 0.44

Axis Bank 0.76 1,453 Axis Bank 0.53 0.98 Tata Global Bev. 0.49 2,876 Vedanta 0.39 0.54

Tube Investments 0.71 905 Tube Investments 0.53 0.57 Vedanta 0.49 1,667 Indiabulls Hsg Fin. 0.27 0.50

Hero MotoCorp 0.69 191 Hero MotoCorp 0.48 0.86 Reliance Inds 0.38 -8 JSPL 0.25 0.25

HDFC Bank 0.63 203 TCS 0.43 0.46 Maruti Suzuki 0.37 27 Escorts 0.25 0.25

RBL Bank 0.59 1,013 RBL Bank 0.38 1.15 Indiabulls Hsg Fin. 0.35 275 HDFC 0.23 1.05

TCS 0.58 233 Future Lifestyle 0.38 0.55 HDFC 0.33 126 Reliance Inds 0.22 2.22

Future Lifestyle 0.52 1,686 KPIT Tech 0.36 0.36 JSPL 0.31 2,000 Hindalco 0.22 0.53

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

IDFC Focused Equity Fund (G) 2.5 2.4 6.8 Tata Banking & Financial Services Fund (G) 2.0 1.9 8.1

IDFC Sterling Equity Fund (G) 15.5 15.3 5.5 Tata India Tax Savings Fund (G) 7.7 7.4 6.0

IDFC Infrastructure Fund (G) 3.8 3.4 5.2 Tata Mid Cap Growth Fund - (G) 6.4 6.2 5.9

IDFC Equity Fund (G) 2.8 2.7 5.0 Tata Large Cap Fund - Regular (G) 8.2 8.1 5.8

IDFC Tax Advantage (ELSS) Fund (G) 6.6 6.4 4.8 Tata Equity P/E Fund - (G) 15.0 14.1 5.4

Fund Folio: Indian Mutual Fund Tracker | August 2017 20

Motilal Oswal: Equity AUM INR112b Mirae Asset: Equity AUM INR95b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

8.8 2.4 NBFC 21.6 3.7 ICICI Bank 5.2 -0.1 20.4 0.7

HDFC Banks Pvt

8.4 0.1 Banks Pvt 18.8 -0.8 HDFC Bank 4.5 0.2 9.9 0.2

HDFC Bank Auto

7.3 -0.3 Auto 15.3 -0.5 IndusInd Bank 3.8 0.3 9.2 -0.5

Maruti Suzuki Healthcare

5.5 0.0 Oil & Gas 13.2 0.9 Kotak M Bank 3.7 0.2 7.3 0.0

IndusInd Bank Cap Goods

5.2 0.7 10.5 -2.0 3.3 -0.3 7.0 0.6

Bajaj Finance Healthcare Grasim Consumer

0.1 -0.1 0.5

Eicher Motors 5.0 Consumer 6.7 Tata Steel 3.2 0.4 Oil & Gas 6.7

-0.7 -0.1 0.3

Max Financial 5.0 Cap Goods 1.3 CEAT 2.6 -0.1 NBFC 5.6

0.4 -0.1 -0.1 -0.3

BPCL 4.9 Chemicals 1.2 2.6 Technology 5.4

Federal Bank

4.7 -0.9 0.0 0.2 4.9 0.5

PNB Hsg Fin Technology 1.2 SBI 2.3 Metals

4.4 0.8 -0.1 4.3 -0.3

HPCL Cement 0.7 2.3 0.3 Cement

Havells India

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

HDFC 3.46 1,550 HDFC 2.44 8.81 Tata Global Bev. 0.76 3,768 Tata Global Bev. 0.72 1.78

AU Small Finance 1.91 3,016 AU Small Finance 1.68 1.88 Aditya Birla Capital 0.65 3,519 Aditya Birla Capital 0.68 0.68

HPCL 1.31 2,224 HPCL 0.80 4.35 Tata Steel 0.58 851 Finolex Cables 0.49 0.49

Bajaj Finance 1.26 92 Bajaj Finance 0.66 5.22 HDFC Bank 0.48 103 Tata Steel 0.41 3.22

HDFC Bank 1.04 207 BPCL 0.38 4.92 IndusInd Bank 0.48 80 HUL 0.36 0.47

BPCL 0.95 979 ERIS Lifesciences 0.32 1.38 Kotak M Bank 0.47 253 Yes Bank 0.32 0.32

IndusInd Bank 0.68 38 Britannia 0.19 2.34 Finolex Cables 0.46 989 Sun TV 0.31 0.31

Eicher Motors 0.62 2 Bajaj Finserv 0.16 0.16 HPCL 0.41 492 Tata Motors 0.31 1.06

Maruti Suzuki 0.58 3 Interglobe Aviation 0.11 3.11 Havells 0.39 724 HPCL 0.29 2.28

ERIS Lifesciences 0.48 792 IOCL 0.11 1.04 Exide Inds 0.38 1,862 Reliance Inds 0.28 1.61

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

Motilal Oswal Most Focused Multicap 35 Fund (G) 78.8 77.6 6.6 Mirae Asset India Opportunities Fund (G) 42.9 42.3 5.8

Motilal Oswal Most Focused Long Term Fund (G) 5.8 5.7 5.5 Mirae Asset Tax Saver Fund (G) 5.1 4.9 5.3

Motilal Oswal MoSt Focused 25 Fund (G) 7.0 7.0 4.3 Mirae Asset Great Consumer Fund (G) 0.9 0.7 5.0

Motilal Oswal Most Focused Midcap 30 Fund (G) 13.7 13.5 2.3 Mirae Asset Emerging Bluechip Fund (G) 42.4 42.1 4.3

Motilal Oswal Securities Limited is the Sponsor of Motilal Oswal Mutual Fund. The Sponsor is not responsible or liable for any loss or shortfall resulting from the operation of the Mutual Fund beyond the initial

contribution made by it of an amount of Rs. 1 Lac towards setting up of the Mutual Fund. Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Fund Folio: Indian Mutual Fund Tracker | August 2017 21

Canara Robeco: Equity AUM INR55b BNP Paribas: Equity AUM INR34b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

HDFC Bank 4.4 0.1 Banks Pvt 14.0 0.9 6.4 0.7

HDFC Bank Banks Pvt 24.4 0.5

HDFC 3.1 0.3 Auto 11.6 -0.7 ICICI Bank 5.4 -0.1 8.0 -2.0

NBFC

ICICI Bank 2.8 0.2 Consumer 11.6 0.9 4.5 0.1 7.0 -0.1

IndusInd Bank Cap Goods

2.7 0.8 10.1 1.1 3.8 -0.3 6.2 -1.4

Kotak M Bank NBFC Federal Bank Consumer

2.6 1.0 Cap Goods 8.4 -1.0 3.4 0.1 5.9 1.2

Bajaj Finserv Maruti Suzuki Auto

2.5 -0.1 7.5 -0.5 2.9 0.1 4.9 0.0

Concor Chemicals Bharat Elect. Oil & Gas

2.4 0.4 6.6 -0.6 2.5 0.0 4.9 0.4

Infosys Oil & Gas Power Grid Media

0.1 Cement 4.5 0.1 2.2 0.3 Chemicals 4.8 0.3

IndusInd Bank 2.4 Infosys

0.1 4.4 0.1 1.9 -0.3 4.6 0.7

2.0 Healthcare PVR Cement

Minda Inds

0.3 3.7 0.6 1.9 -0.6 Metals 4.5 -0.1

ITC 2.0 Technology Repco Home Fin

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

Bajaj Finserv 0.59 83 Bajaj Finserv 0.98 2.61 HDFC Bank 0.32 100 Hero MotoCorp 0.75 1.13

Kotak M Bank 0.51 436 Kotak M Bank 0.82 2.74 Hero MotoCorp 0.26 72 AU Small Finance 0.65 0.96

HUL 0.29 202 Grasim Inds 0.49 0.86 AU Small Finance 0.23 277 HDFC Bank 0.65 6.40

Grasim Inds 0.28 288 KPIT Tech 0.49 0.49 Reliance Inds 0.21 129 Reliance Inds 0.62 0.66

KPIT Tech 0.27 2,100 HUL 0.43 1.89 Kotak M Bank 0.20 171 Kotak M Bank 0.53 1.83

Infosys 0.27 178 Dabur India 0.38 0.93 MCX 0.16 134 Titan Company 0.43 0.53

HDFC 0.24 50 Infosys 0.36 2.43 Titan Company 0.15 269 MCX 0.42 1.38

Dabur India 0.23 675 HDFC 0.27 3.08 BHEL 0.15 948 HDFC 0.42 0.63

HDFC Bank 0.21 21 ITC 0.25 2.02 HDFC 0.15 77 BHEL 0.41 0.78

ITC 0.20 1,066 Reliance Inds 0.24 1.94 Infosys 0.13 85 Century Textiles 0.36 0.42

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

Canara Robeco F.O.R.C.E. Fund (G) 1.6 1.6 6.5 BNP Paribas Dividend Yield Fund (G) 3.8 3.6 6.2

Canara Robeco Large Cap+ Fund (G) 1.1 1.1 5.4 BNP Paribas Long Term Equity Fund (G) 5.9 5.6 4.7

Canara Robeco Equity Diversified (G) 8.1 7.9 5.1 BNP Paribas Mid Cap Fund (G) 8.3 7.9 3.7

Canara Robeco Emerging Equities (G) 21.8 21.2 4.2 BNP Paribas Equity Fund (G) 10.9 10.4 3.6

Canara Robeco Equity - Tax Saver (G) 8.7 8.6 4.1

Fund Folio: Indian Mutual Fund Tracker | August 2017 22

Principal: Equity AUM INR30b Invesco: Equity AUM INR27b

Back to

Snapshot

Top company holdings (%) Top sector allocation (%) Top company holdings (%) Top sector allocation (%)

July-17 Chg MoM (pp) Weight (%) Chg MoM (pp) July-17 Chg MoM (pp) Weight (%) Chg MoM (pp)

HDFC Bank 3.9 0.2 Banks Pvt 15.2 0.2 HDFC Bank 6.6 0.3 Banks Pvt 19.7 -0.3

ICICI Bank 3.7 0.0 10.5 0.5 Maruti Suzuki 4.8 -0.1 13.9 0.1

Consumer Auto

SBI 3.1 0.3 9.5 0.0 Reliance Inds 3.9 1.5 NBFC 10.1 -1.0

Auto

2.5 0.3 7.6 1.3 3.8 0.2 7.6 0.1

Reliance Inds NBFC IndusInd Bank Oil & Gas

2.4 0.1 7.4 0.7 3.4 0.0 7.4 -0.1

Infosys Cement ICICI Bank Cap Goods

0.0 0.0

Britannia 2.3 Oil & Gas 6.4 Infosys 3.0 0.1 Technology 6.7 0.4

-0.5 6.1 0.2 -0.5

ITC 2.3 Cap Goods L&T Fin Holdings 2.7 0.4 Consumer 4.7

1.9 -0.2 6.0 -0.5 2.6 -0.2 3.8 0.5

Aurobindo Healthcare Kotak Ma Bank Healthcare

0.0 5.2 0.4 2.5 0.0 3.7 0.0

DHFL 1.8 Technology Power Grid Chemicals

-0.1 5.2 0.1 3.1 0.7

Kotak M Bank 1.8 Chemicals Coromandel Intl. 2.5 0.1 Metals

Top change by market value Top change in weight (%) Top change by market value Top change in weight (%)

Mkt Value Shares Chg Chg MoM Current Mkt Value Shares Chg Chg MoM Current

Company Company Company Company

Chg (INR b) ('000) (pp) Weight Chg (INR b) ('000) (pp) Weight

United Spirits 0.28 108 United Spirits 0.91 1.31 Reliance Inds 0.46 220 Reliance Inds 1.53 3.89

Grasim 0.21 200 Grasim 0.72 0.72 Piramal Ent. 0.32 107 Piramal Ent. 1.18 1.18

Raymond 0.20 249 Raymond 0.66 0.66 Chola Invst & Fin 0.22 188 Chola Invst & Fin 0.84 0.84

Rico Auto 0.17 1,391 Rico Auto 0.54 1.02 HDFC Bank 0.20 45 Tata Steel 0.54 1.13

Birla Corp. 0.17 165 Birla Corp. 0.54 0.96 Tata Steel 0.16 266 SIB 0.50 0.50

L&T Technology 0.15 193 L&T Technology 0.49 0.49 L&T Fin Holdings 0.15 201 KNR Constructions 0.42 0.48

Shriram Trans Fin 0.15 143 Shriram Trans Fin 0.49 0.49 SIB 0.13 4,399 L&T Fin Holdings 0.41 2.66

SBI 0.13 40 MMFS 0.37 0.37 IndusInd Bank 0.12 10 HDIL 0.35 0.35

Reliance Inds 0.12 6 SBI 0.29 3.11 KNR Constructions 0.11 534 Exide Inds 0.32 1.69

MMFS 0.11 272 Reliance Inds 0.28 2.49 Exide Inds 0.11 537 HDFC Bank 0.30 6.57

Top scheme by NAV change Top scheme by NAV change

Total AUM Equity AUM MoM NAV Total AUM Equity AUM MoM NAV

Scheme Name Scheme Name

(INR B) (INR B) Chg (%) (INR B) (INR B) Chg (%)

Principal Large Cap Fund (G) 3.2 3.2 6.3 Invesco India Growth Fund (G) 2.0 2.0 7.2

Principal Emerging Bluechip Fund (G) 11.4 11.0 5.8 Invesco India Dynamic Equity Fund (G) 2.9 2.2 7.0

Principal Growth Fund - (G) 4.9 4.7 5.5 Invesco India Tax Plan (G) 4.5 4.3 5.6

Principal Tax Saving Fund 3.5 3.2 5.4 Invesco India Contra Fund (G) 6.1 6.0 4.6

Principal Dividend Yield Fund (G) 1.2 1.2 5.2 Invesco India Mid N Small Cap Fund (G) 4.9 4.7 3.9

Fund Folio: Indian Mutual Fund Tracker | August 2017 23

Motilal Oswal Securities Limited

MEMBER OF BSE AND NSE

Motilal Oswal Tower, Sayani Road, Prabhadevi, Mumbai 400 025, INDIA

BOARD: +91 22 3982 5500 | WEBSITE: www.motilaloswal.com

Disclosures

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (herein after referred to as the Regulations).

Motilal Oswal Securities Ltd. (MOSL) is a SEBI Registered Research Analyst having registration no. INH000000412. MOSL, the Research Entity (RE) as defined in the Regulations, is engaged in the business

of providing Stock broking services, Investment Advisory Services, Depository participant services & distribution of various financial products. MOSL is a subsidiary company of Motilal Oswal Financial Service

Ltd. (MOFSL). MOFSL is a listed public company, the details in respect of which are available on www.motilaloswal.com. MOSL is registered with the Securities & Exchange Board of India (SEBI) and is a

registered Trading Member with National Stock Exchange of India Ltd. (NSE) and Bombay Stock Exchange Limited (BSE), Metropolitan Stock Exchange Of India Ltd. (MSE) for its stock broking activities & is

Depository participant with Central Depository Services Limited (CDSL) & National Securities Depository Limited (NSDL) and is member of Association of Mutual Funds of India (AMFI) for distribution of

financial products. Details of associate entities of Motilal Oswal Securities Limited are available on the website at http://onlinereports.motilaloswal.com/Dormant/documents/Associate%20Details.pdf

Pending Regulatory Enquiries against Motilal Oswal Securities Limited by SEBI:

SEBI pursuant to a complaint from client Shri C.R. Mohanraj alleging unauthorized trading, issued a letter dated 29th April 2014 to MOSL notifying appointment of an Adjudicating Officer as per SEBI

regulations to hold inquiry and adjudge violation of SEBI Regulations; MOSL requested SEBI to provide all documents, records, investigation report relied upon by SEBI which were referred in Show Cause

Notice and also sought personal hearing. The matter is currently pending.

MOSL, its associates, Research Analyst or their relative may have any financial interest in the subject company. MOSL and/or its associates and/or Research Analyst may have beneficial ownership of 1% or

more securities in the subject company at the end of the month immediately preceding the date of publication of the Research Report. MOSL and its associate company(ies), their directors and Research

Analyst and their relatives may; (a) from time to time, have a long or short position in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in

any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or

lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.; however the same shall have no

bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely independent of the views of the associates of MOSL even though

there might exist an inherent conflict of interest in some of the stocks mentioned in the research report. Research Analyst may have served as director/officer, etc. in the subject company in the last 12 month

period. MOSL and/or its associates may have received any compensation from the subject company in the past 12 months.

In the last 12 months period ending on the last day of the month immediately preceding the date of publication of this research report, MOSL or any of its associates may have:

a)managed or co-managed public offering of securities from subject company of this research report,

b)received compensation for investment banking or merchant banking or brokerage services from subject company of this research report,

c)received compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company of this research report.

d)Subject Company may have been a client of MOSL or its associates during twelve months preceding the date of distribution of the research report.

MOSL and its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report. To enhance transparency, MOSL has

incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. MOSL and / or its affiliates do and seek to do

business including investment banking with companies covered in its research reports. As a result, the recipients of this report should be aware that MOSL may have a potential conflict of interest that may

affect the objectivity of this report. Compensation of Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

Fund Folio: Indian Mutual Fund Tracker | August 2017 24

Terms & Conditions:

This report has been prepared by MOSL and is meant for sole use by the recipient and not for circulation. The report and information contained herein is strictly confidential and may not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of MOSL. The report is based on the facts, figures and

information that are considered true, correct, reliable and accurate. The intent of this report is not recommendatory in nature. The information is obtained from publicly available media or other sources believed to

be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information

and opinions are subject to change without notice. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation of offer to buy or sell or subscribe for securities

or other financial instruments for the clients. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. MOSL will not treat recipients as customers by

virtue of their receiving this report.

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will

be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report.

Disclosure of Interest Statement Companies where there is interest

Analyst ownership of the stock No

A graph of daily closing prices of securities is available at www.nseindia.com, www.bseindia.com. Research Analyst views on Subject Company may vary based on Fundamental research and Technical

Research. Proprietary trading desk of MOSL or its associates maintains arms length distance with Research Team as all the activities are segregated from MOSL research activity and therefore it can have an

independent view with regards to subject company for which Research Team have expressed their views.

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to

law, regulation or which would subject MOSL & its group companies to registration or licensing requirements within such jurisdictions.

For Hong Kong:

This report is distributed in Hong Kong by Motilal Oswal capital Markets (Hong Kong) Private Limited, a licensed corporation (CE AYY-301) licensed and regulated by the Hong Kong Securities and Futures

Commission (SFC) pursuant to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) SFO. As per SEBI (Research Analyst Regulations) 2014 Motilal Oswal Securities (SEBI Reg No.

INH000000412) has an agreement with Motilal Oswal capital Markets (Hong Kong) Private Limited for distribution of research report in Hong Kong. This report is intended for distribution only to Professional

Investors as defined in Part I of Schedule 1 to SFO. Any investment or investment activity to which this document relates is only available to professional investor and will be engaged only with professional

investors. Nothing here is an offer or solicitation of these securities, products and services in any jurisdiction where their offer or sale is not qualified or exempt from registration. The Indian Analyst(s) who

compile this report is/are not located in Hong Kong & are not conducting Research Analysis in Hong Kong.

For U.S.

Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In

addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws

in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not

available to or intended for U.S. persons. This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC

(henceforth referred to as "major institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this

document relates is only available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S.

Securities Exchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors

based in the U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to

this report will have to be executed within the provisions of this chaperoning agreement. The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such

research analyst may not be associated persons of the U.S. registered broker-dealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a

subject company, public appearances and trading securities held by a research analyst account.

Fund Folio: Indian Mutual Fund Tracker | August 2017 25

For Singapore

Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors

Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to

accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time. In respect of any matter arising from or in connection with

the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited:

Disclaimer:

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any

other person or to the media or reproduced in any form, without prior written consent. This report and information herein is solely for informational purpose and may not be used or considered as an offer

document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any

investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own

investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document

(including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all

investors. Certain transactions -including those involving futures, options, another derivative products as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. No

representation or warranty, express or implied, is made as to the accuracy, completeness or fairness of the information and opinions contained in this document. The Disclosures of Interest Statement

incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. This information is subject to change without any

prior notice. The Company reserves the right to make modifications and alternations to this statement as may be required from time to time without any prior approval. MOSL, its associates, their directors and

the employees may from time to time, effect or have effected an own account transaction in, or deal as principal or agent in or for the securities mentioned in this document. They may perform or seek to perform

investment banking or other services for, or solicit investment banking or other business from, any company referred to in this report. Each of these entities functions as a separate, distinct and independent of

each other. The recipient should take this into account before interpreting the document. This report has been prepared on the basis of information that is already available in publicly accessible media or

developed through analysis of MOSL. The views expressed are those of the analyst, and the Company may or may not subscribe to all the views expressed therein. This document is being supplied to you solely

for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or

intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would

be contrary to law, regulation or which would subject MOSL to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all

jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. Neither the Firm, not its directors,

employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with

the use of the information. The person accessing this information specifically agrees to exempt MOSL or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and

agrees not to hold MOSL or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSL or any of its affiliates or employees free and harmless from all losses, costs,

damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

Registered Office Address: Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai-400025; Tel No.: 022-3980 4263; www.motilaloswal.com. Correspondence Address:

Palm Spring Centre, 2nd Floor, Palm Court Complex, New Link Road, Malad (West), Mumbai- 400 064. Tel No: 022 3080 1000. Compliance Officer: Neeraj Agarwal, Email Id: na@motilaloswal.com, Contact

No.:022-30801085.

Registration details of group entities.: MOSL: NSE (Cash): INB231041238; NSE (F&O): INF231041238; NSE (CD): INE231041238; BSE (Cash): INB011041257; BSE(F&O): INF011041257; BSE(CD);

MSE(Cash): INB261041231; MSE(F&O): INF261041231; MSE(CD): INE261041231; CDSL: IN-DP-16-2015; NSDL: IN-DP-NSDL-152-2000; Research Analyst: INH000000412. AMFI: ARN 17397. Investment

Adviser: INA000007100. Motilal Oswal Asset Management Company Ltd. (MOAMC): PMS (Registration No.: INP000000670) offers PMS and Mutual Funds products. Motilal Oswal Wealth Management Ltd.

(MOWML): PMS (Registration No.: INP000004409) offers wealth management solutions. *Motilal Oswal Securities Ltd. is a distributor of Mutual Funds, PMS, Fixed Deposit, Bond, NCDs, Insurance and IPO

products. * Motilal Oswal Commodities Broker Pvt. Ltd. offers Commodities Products. * Motilal Oswal Real Estate Investment Advisors II Pvt. Ltd. offers Real Estate products. * Motilal Oswal Private Equity

Investment Advisors Pvt. Ltd. offers Private Equity products

Fund Folio: Indian Mutual Fund Tracker | August 2017 26

Quant Research & India Strategy Gallery

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)