Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Barack Obama Foundation Irs Determination Letter July 21 2014

Caricato da

Jerome CorsiCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

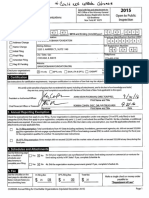

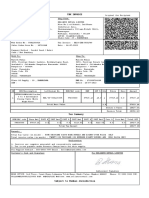

Barack Obama Foundation Irs Determination Letter July 21 2014

Caricato da

Jerome CorsiCopyright:

Formati disponibili

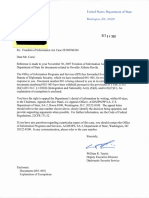

L7ILI_3L1_30

INTERNAL REVENUE SERVICE DEPARTMENT OF THE TREASURY

P. 0. BOX 2508

CINCINNATI, OH 45201

Employer Identification Number:

Date:

JUL21cj4 46-4950751

DLN:

17 053 1823 690 04

THE BARACK OBNA FOUNDATION Contact Person:

C/O PERKINS COLE LLP JOAN C KISER ID# 31217

700 13TH ST NW STE 600 Contact Telephone Number:

WASHINGTON, DC 20005 (877) 829-5500

Accounting Period Ending:

December 31

Public Charity Status:

170(b) (1) (A) (vi)

Form 990 Required:

Yes

Effective Date of Exemption:

January 31, 2014

Contribution Deductibility:

Yes

Addendum Applies:

No

Dear Applicant:

We are pleased to inform you that upon review of your application for tax

exempt status we have determined that you are exempt from Federal income tax

under section 501(c) (3) of the Internal Revenue Code. Contributions to you are

deductible under section 170 of the Code. You are also qualified to receive

tax deductible bequests, devises, transfers or gifts under section 2055, 2106

or 2522 of the Code. Because this letter could help resolve any questions

regarding your exempt status, you should keep it in your permanent records.

Organizations exempt under section 501(c) (3) of the Code are further classified

as either public charities or private foundations. We determined that you are

a public charity under the Code section(s) listed in the heading of this

letter.

For important information about your responsibilities as a tax-exempt

organization, go to www.irs.gov/charities . Enter 11 4221-PC" in the search bar

to view Publication 4221-PC, Compliance Guide for 501(c) (3) Public Charities,

which describes your recordiceeping, reporting, and disclosure requirements.

Sincerely,

Director, Exempt Organizations

Letter 947

Potrebbero piacerti anche

- 501 (C) (3) Non-Profit IRS Determination LetterDocumento2 pagine501 (C) (3) Non-Profit IRS Determination LetterKealamākia FoundationNessuna valutazione finora

- 501 (C) 3 LetterDocumento2 pagine501 (C) 3 LetterspearmintnycNessuna valutazione finora

- FCRA Renewal CertificateDocumento2 pagineFCRA Renewal CertificateBrukshya o Jeevar Bandhu ParisadNessuna valutazione finora

- Renewal-Certificate Fcra GcdwsDocumento2 pagineRenewal-Certificate Fcra Gcdwsapi-326261486Nessuna valutazione finora

- 2016 Fcra Renewal Certificate JanakalyanDocumento2 pagine2016 Fcra Renewal Certificate Janakalyanapi-326261486Nessuna valutazione finora

- The Servant Song: Words and Music by Richard GillardDocumento2 pagineThe Servant Song: Words and Music by Richard GillardtmptpaulNessuna valutazione finora

- Judicial Crisis Network 990 - 2018-2019Documento36 pagineJudicial Crisis Network 990 - 2018-2019davidsirota0% (1)

- Tax Exempt PDFDocumento2 pagineTax Exempt PDFLj Perrier100% (1)

- 10000016619Documento160 pagine10000016619Chapter 11 Dockets100% (1)

- Self Certifications PDFDocumento2 pagineSelf Certifications PDFAhmed Issah100% (1)

- Special Assumpsit, US Corp Gov Dept Agencies (Replevin)Documento12 pagineSpecial Assumpsit, US Corp Gov Dept Agencies (Replevin)Cindy Kay CurrierNessuna valutazione finora

- Processed: Form6 Full and Public Disclosure of 2012 Financial InterestsDocumento2 pagineProcessed: Form6 Full and Public Disclosure of 2012 Financial InterestsMy-Acts Of-SeditionNessuna valutazione finora

- Securing Ohio's Future Inc.Documento19 pagineSecuring Ohio's Future Inc.Jessie BalmertNessuna valutazione finora

- SCC Irs Form 990 2013Documento27 pagineSCC Irs Form 990 2013L. A. PatersonNessuna valutazione finora

- Petition 62Documento23 paginePetition 62LCCR AdminNessuna valutazione finora

- 3 Ae 6 B 4 F 68Documento7 pagine3 Ae 6 B 4 F 68MohammadAhmadNessuna valutazione finora

- Direct Deposit Sign-Up Form (Philippines)Documento3 pagineDirect Deposit Sign-Up Form (Philippines)Noeh PiedadNessuna valutazione finora

- DonorsTrust522166327 2013 0afa3a0esearchableDocumento119 pagineDonorsTrust522166327 2013 0afa3a0esearchablecmf8926Nessuna valutazione finora

- Verification of Deosit Request FormDocumento1 paginaVerification of Deosit Request FormLincoln Reserve Group Inc.Nessuna valutazione finora

- Apostille/Certificate of Authentication Request: Country Where Documents Will Be Used (Required)Documento2 pagineApostille/Certificate of Authentication Request: Country Where Documents Will Be Used (Required)Joshua Gonsher100% (1)

- Deed in LieuDocumento33 pagineDeed in LieuSteven WhitfordNessuna valutazione finora

- CITIBANK Export Document Collections Application PDFDocumento5 pagineCITIBANK Export Document Collections Application PDFSyed Fahad Bin NazeerNessuna valutazione finora

- Complaint: Federal Trade Commission (FTC) : Complaints Against Sean Hannity, Freedom Concerts and Freedom Alliance: 3/29/10 - FTC Complaint CitationsDocumento254 pagineComplaint: Federal Trade Commission (FTC) : Complaints Against Sean Hannity, Freedom Concerts and Freedom Alliance: 3/29/10 - FTC Complaint CitationsCREWNessuna valutazione finora

- Banking Correspondence ToolsDocumento35 pagineBanking Correspondence Toolsmanjusha148825% (4)

- The Autobiography of Wolfe ToneDocumento354 pagineThe Autobiography of Wolfe ToneBrian John SpencerNessuna valutazione finora

- Contract Submitted To Lakota BoardDocumento6 pagineContract Submitted To Lakota BoardCincinnatiEnquirerNessuna valutazione finora

- Transaction Codes Pocket GuideDocumento17 pagineTransaction Codes Pocket GuideTheplaymaker508Nessuna valutazione finora

- CAIR-F 2007 Articles of Incorp (Ex. 10 To Ex. A - OCR)Documento5 pagineCAIR-F 2007 Articles of Incorp (Ex. 10 To Ex. A - OCR)Tim CavanaughNessuna valutazione finora

- 10000015787Documento30 pagine10000015787Chapter 11 DocketsNessuna valutazione finora

- Common Transaction SlipDocumento3 pagineCommon Transaction SlipGyan Swaroop TripathiNessuna valutazione finora

- PhiladelphiaBusinessJournal April 13, 2018Documento44 paginePhiladelphiaBusinessJournal April 13, 2018Craig EyNessuna valutazione finora

- oate:$EP: Contac0'Documento2 pagineoate:$EP: Contac0'api-284872995Nessuna valutazione finora

- Fy 2018 FinancialsDocumento68 pagineFy 2018 FinancialsAnonymous UH3nIimNessuna valutazione finora

- Not Indicate That The Organizations Have LostDocumento1 paginaNot Indicate That The Organizations Have LostIRSNessuna valutazione finora

- ST Ending:: CincinnatiDocumento3 pagineST Ending:: CincinnatiMassiNessuna valutazione finora

- FinalLetter 88-4282224 PLANTSFORHUMANITYFOUNDATION 01142023 00Documento1 paginaFinalLetter 88-4282224 PLANTSFORHUMANITYFOUNDATION 01142023 00CloudKitNessuna valutazione finora

- CRA Letter of Intention To Revoke Charitable Status of The Canadian Islamic Trust FoundationDocumento112 pagineCRA Letter of Intention To Revoke Charitable Status of The Canadian Islamic Trust FoundationsdbcraigNessuna valutazione finora

- Project Veritas Tax Exemption ApplicationDocumento22 pagineProject Veritas Tax Exemption ApplicationLachlan MarkayNessuna valutazione finora

- 501 C 3 LetterDocumento2 pagine501 C 3 Letterapi-245103834Nessuna valutazione finora

- Check My Ads - 12.31.21 990-N FiledDocumento1 paginaCheck My Ads - 12.31.21 990-N FiledGabe KaminskyNessuna valutazione finora

- Fowlis, Jesse - T183Documento2 pagineFowlis, Jesse - T183End UserNessuna valutazione finora

- Welrp 2010 990Documento38 pagineWelrp 2010 990WELRPNessuna valutazione finora

- 358 T1 2021 Corey - Duizendstraal T183Documento2 pagine358 T1 2021 Corey - Duizendstraal T183jeffcartier.66Nessuna valutazione finora

- ChargeBack Order ABH-122009-CO101 PDFDocumento2 pagineChargeBack Order ABH-122009-CO101 PDFAllen-nelson of the Boisjoli familyNessuna valutazione finora

- Ein 575Documento2 pagineEin 575minhdang03062017Nessuna valutazione finora

- Anatolia Cultural FoundationDocumento110 pagineAnatolia Cultural FoundationStewart Bell100% (3)

- Marked Up CF 2011 990 Tax ReturnDocumento116 pagineMarked Up CF 2011 990 Tax ReturnJim Hoft100% (1)

- Miami Dade County Real Estate 24 (TODOS)Documento12 pagineMiami Dade County Real Estate 24 (TODOS)OmarVargasNessuna valutazione finora

- IRS Notice Regarding Pending Tax Payment Balance of $3,900 Due by September 9thDocumento1 paginaIRS Notice Regarding Pending Tax Payment Balance of $3,900 Due by September 9thKeller Brown JnrNessuna valutazione finora

- Adverse Action LetterDocumento2 pagineAdverse Action LetterAnthony PNessuna valutazione finora

- P Neupane CPA 407R Mystic Avenue Suite 26 Medford, MA 02155 (617) 717-8108Documento37 pagineP Neupane CPA 407R Mystic Avenue Suite 26 Medford, MA 02155 (617) 717-8108GOODS AND SERVICES TAXNessuna valutazione finora

- TGDocumento2 pagineTGpr995Nessuna valutazione finora

- CDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Documento27 pagineCDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Peter M. HeimlichNessuna valutazione finora

- Complete IRS Production 18Documento906 pagineComplete IRS Production 18Laney SommerNessuna valutazione finora

- Taxation 2nd PreboardDocumento17 pagineTaxation 2nd PreboardJaneNessuna valutazione finora

- Responsive Document - CREW: IRS: Regarding 501c Correspondence and Work Plan - 3/11/14Documento41 pagineResponsive Document - CREW: IRS: Regarding 501c Correspondence and Work Plan - 3/11/14CREWNessuna valutazione finora

- BGB#1 Private AgreementDocumento1 paginaBGB#1 Private AgreementKanyya MartinNessuna valutazione finora

- Document SOS1Documento5 pagineDocument SOS1Mickie FieldsNessuna valutazione finora

- View FileDocumento8 pagineView Filecamilacorredor1998Nessuna valutazione finora

- Jomar V. Villena, Cpa, Mba: Accounting and Auditing Assurance ServicesDocumento2 pagineJomar V. Villena, Cpa, Mba: Accounting and Auditing Assurance ServicesJM Valonda Villena, CPA, MBANessuna valutazione finora

- QAnon Decode Multiple Posts Sat Jan 27 and Sun Jan 28 2018 Vers 26.0 CFR Members Jan 28 2018Documento39 pagineQAnon Decode Multiple Posts Sat Jan 27 and Sun Jan 28 2018 Vers 26.0 CFR Members Jan 28 2018Jerome Corsi99% (97)

- Qanon Decode Post Thursday Jan 18 2018 Hussein Cabinet Staff Vers 9.0 Jan 19 2018Documento10 pagineQanon Decode Post Thursday Jan 18 2018 Hussein Cabinet Staff Vers 9.0 Jan 19 2018Jerome Corsi97% (58)

- Qanon Decode Multiple Posts Mon Tues Jan 29 & 30 Vers 15.0 Narrative Shifts Completed Jan. 31, 2018 JEROME CORSIDocumento14 pagineQanon Decode Multiple Posts Mon Tues Jan 29 & 30 Vers 15.0 Narrative Shifts Completed Jan. 31, 2018 JEROME CORSIJerome Corsi99% (158)

- QAnon DECODE Two Posts Monday, Jan 22, 2018, "What Would Happen If FBI Missing Texts Discuss Assassination" Vers 10.0 Jan 23 2018 JEROME CORSIDocumento9 pagineQAnon DECODE Two Posts Monday, Jan 22, 2018, "What Would Happen If FBI Missing Texts Discuss Assassination" Vers 10.0 Jan 23 2018 JEROME CORSIJerome Corsi99% (68)

- QAnon Decode Post Friday Jan 19 2018 Why Are We Here Vers 8.0 Jan 19 2018Documento9 pagineQAnon Decode Post Friday Jan 19 2018 Why Are We Here Vers 8.0 Jan 19 2018Jerome Corsi95% (56)

- JEROME CORSI Decode of Multiple Messages by QAnon Filed On 8chan "The Storm," Saturday Jan 6 2018 Vers 16.0Documento22 pagineJEROME CORSI Decode of Multiple Messages by QAnon Filed On 8chan "The Storm," Saturday Jan 6 2018 Vers 16.0Jerome Corsi99% (168)

- Qanon Decode Four Posts Sunday Jan 21 2018 Will Sessions Drop The Hammer Vers 16.0 Jan 21 2018Documento20 pagineQanon Decode Four Posts Sunday Jan 21 2018 Will Sessions Drop The Hammer Vers 16.0 Jan 21 2018Jerome Corsi94% (32)

- The Haiti Scam CHAPTER 7 Jan 7 2015 PARTNERS IN CRIME Final EditDocumento50 pagineThe Haiti Scam CHAPTER 7 Jan 7 2015 PARTNERS IN CRIME Final EditJerome Corsi50% (2)

- Qanon Decode Four Posts Sunday Jan 21 2018 Will Sessions Drop The Hammer Vers 17.0 Jan 21 2018Documento21 pagineQanon Decode Four Posts Sunday Jan 21 2018 Will Sessions Drop The Hammer Vers 17.0 Jan 21 2018Jerome Corsi99% (324)

- QAnon Post #151134 Dec 27 2017 DECIPHER Vers 21.0 Dec 27 2017Documento9 pagineQAnon Post #151134 Dec 27 2017 DECIPHER Vers 21.0 Dec 27 2017Jerome Corsi99% (111)

- Qanon Decode Post Thursday Jan 18 2018 Photographs Qanon Posted Vers 3.0 Jan 19 2018Documento9 pagineQanon Decode Post Thursday Jan 18 2018 Photographs Qanon Posted Vers 3.0 Jan 19 2018Jerome Corsi98% (50)

- Chapter 5 The Haiti Scam Vers 61.0 Jan 7 2015Documento50 pagineChapter 5 The Haiti Scam Vers 61.0 Jan 7 2015Jerome Corsi0% (1)

- USA V Arpaio # 239 AMICUS BRIEF - Certain Members of Congress Opposing VacaturDocumento15 pagineUSA V Arpaio # 239 AMICUS BRIEF - Certain Members of Congress Opposing VacaturJack RyanNessuna valutazione finora

- Qanon Post #173382 Dec 25 2017 DECIPHER Vers 3.0 Jan 1 2018Documento2 pagineQanon Post #173382 Dec 25 2017 DECIPHER Vers 3.0 Jan 1 2018Jerome Corsi95% (40)

- RAMOS and COMPEAN State Department FOIA REQUEST 2007 Received 2017Documento16 pagineRAMOS and COMPEAN State Department FOIA REQUEST 2007 Received 2017Jerome Corsi67% (3)

- USA V Arpaio # 236 USA Supplemental Response To Arpaio Motion To Vacate, EtcDocumento5 pagineUSA V Arpaio # 236 USA Supplemental Response To Arpaio Motion To Vacate, EtcJack RyanNessuna valutazione finora

- QANON DECODE Message Jan 4 2018 #238914 Who Is Matlock Vers 11.0Documento6 pagineQANON DECODE Message Jan 4 2018 #238914 Who Is Matlock Vers 11.0Jerome Corsi97% (68)

- Bill Walters Doj Letter Gov Submits Attachments Not Redacted Disclosing FBI Agent Name Following Dec 21 2016 Hearing ImportantDocumento22 pagineBill Walters Doj Letter Gov Submits Attachments Not Redacted Disclosing FBI Agent Name Following Dec 21 2016 Hearing ImportantJerome Corsi80% (5)

- VERNON JARRETT 1979 Article St. Petersburg Independent DETAIL VIEWDocumento1 paginaVERNON JARRETT 1979 Article St. Petersburg Independent DETAIL VIEWJerome Corsi0% (1)

- VERNON JARRETT 1979 Article ST Petersburg Independent COMPLETE ARTICLEDocumento1 paginaVERNON JARRETT 1979 Article ST Petersburg Independent COMPLETE ARTICLEJerome Corsi0% (2)

- BARACK OBAMA FOUNDATION IRS Form 1023 June 21 2014 PDFDocumento51 pagineBARACK OBAMA FOUNDATION IRS Form 1023 June 21 2014 PDFJerome Corsi100% (1)

- BARACK OBAMA FOUNDATION IRS Form 1023 June 21 2014 PDFDocumento51 pagineBARACK OBAMA FOUNDATION IRS Form 1023 June 21 2014 PDFJerome Corsi100% (1)

- Barack Obama Foundation Irs Form 990 2014Documento34 pagineBarack Obama Foundation Irs Form 990 2014Jerome Corsi100% (1)

- Barack Obama Foundation Irs Form 990 2015Documento35 pagineBarack Obama Foundation Irs Form 990 2015Jerome CorsiNessuna valutazione finora

- Barack Obama Foundation Irs Determination Letter July 21 2014Documento1 paginaBarack Obama Foundation Irs Determination Letter July 21 2014Jerome CorsiNessuna valutazione finora

- Barack Obama Foundation Annual Filing Statement New York 2015Documento52 pagineBarack Obama Foundation Annual Filing Statement New York 2015Jerome CorsiNessuna valutazione finora

- Barack Obama Foundation Tax-Exempt Application June 21 2014Documento51 pagineBarack Obama Foundation Tax-Exempt Application June 21 2014Jerome CorsiNessuna valutazione finora

- Barack Obama Foundation Annual Filing Statement New York 2014Documento54 pagineBarack Obama Foundation Annual Filing Statement New York 2014Jerome CorsiNessuna valutazione finora

- Barack Obama Foundation Form 1023 June 21 2014Documento51 pagineBarack Obama Foundation Form 1023 June 21 2014Jerome CorsiNessuna valutazione finora

- Cummins 380KVA QuotationDocumento1 paginaCummins 380KVA QuotationabhibawaNessuna valutazione finora

- "Foreign Currency Deposit Unit" or "FCDU" Shall Refer To That Unit of A Local BankDocumento3 pagine"Foreign Currency Deposit Unit" or "FCDU" Shall Refer To That Unit of A Local Bankalimoya13Nessuna valutazione finora

- Recinto, Rommel T1 SummaryDocumento1 paginaRecinto, Rommel T1 SummarymichelleNessuna valutazione finora

- Performa Invoice For Packed Lunch GE 3rd, 4th & 5th January 2024Documento1 paginaPerforma Invoice For Packed Lunch GE 3rd, 4th & 5th January 2024avv kaaNessuna valutazione finora

- Life insurance premium receiptDocumento1 paginaLife insurance premium receiptani dNessuna valutazione finora

- Philippine Tax Case on Compensating, Carrier and Documentary TaxesDocumento3 paginePhilippine Tax Case on Compensating, Carrier and Documentary TaxesIsay CaguioaNessuna valutazione finora

- April Pay SlipDocumento1 paginaApril Pay SlipBandari GoverdhanNessuna valutazione finora

- Year-End Adjustment NewDocumento27 pagineYear-End Adjustment NewKyrzen Novilla0% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocumento1 paginaIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNessuna valutazione finora

- Caf GST Booster m1 m20Documento94 pagineCaf GST Booster m1 m20thotasravani 1997Nessuna valutazione finora

- Form 440 Emo Ird Gov TTDocumento5 pagineForm 440 Emo Ird Gov TTTamira LalchandNessuna valutazione finora

- Salary Structure CreationDocumento4 pagineSalary Structure CreationPriyankaNessuna valutazione finora

- Rod Pana Quotation DetailsDocumento1 paginaRod Pana Quotation Detailsgourav vyasNessuna valutazione finora

- Form 49 B (TAN)Documento4 pagineForm 49 B (TAN)Mohan NaiduNessuna valutazione finora

- REVENUE REGULATIONS NO. 10-2002 Issued On July 18, 2002 Imposes A CeilingDocumento1 paginaREVENUE REGULATIONS NO. 10-2002 Issued On July 18, 2002 Imposes A CeilingCliff DaquioagNessuna valutazione finora

- Name of Assessee: Chandadevi Ghevarchand Jain PAN: ACLPJ0515ADocumento3 pagineName of Assessee: Chandadevi Ghevarchand Jain PAN: ACLPJ0515ADpr MachineriesNessuna valutazione finora

- Tax Invoice: Product Description Qty Gross A Mount Discount Taxable V Alue Igst TotalDocumento2 pagineTax Invoice: Product Description Qty Gross A Mount Discount Taxable V Alue Igst TotalRaju Kumar SoniNessuna valutazione finora

- Procedure in Computing Vanishing DeductionDocumento5 pagineProcedure in Computing Vanishing DeductionDon Tiansay100% (5)

- Valencia Chap 5 Estate TaxDocumento11 pagineValencia Chap 5 Estate TaxCha DumpyNessuna valutazione finora

- Payment Receipt: Applicant DetailsDocumento1 paginaPayment Receipt: Applicant Detailsakhil SrinadhuNessuna valutazione finora

- Reliance Retail tax invoice for dining table and chairsDocumento6 pagineReliance Retail tax invoice for dining table and chairsmanish kumarNessuna valutazione finora

- Indian Oil Corporation Limited: Supplier ConsigneeDocumento1 paginaIndian Oil Corporation Limited: Supplier ConsigneeDiwakar MinzNessuna valutazione finora

- Big Thanks Mock TaxationDocumento23 pagineBig Thanks Mock TaxationHussein SeetalNessuna valutazione finora

- Tax Credit Certificate 2023 9552312947779Documento2 pagineTax Credit Certificate 2023 9552312947779Toni rogers CardosoNessuna valutazione finora

- Electronic Filing Instructions For Your 2020 Federal Tax ReturnDocumento16 pagineElectronic Filing Instructions For Your 2020 Federal Tax Returnann laijas57% (7)

- Solved Whaleco Acquired All of The Common Stock of Minnowco EarlyDocumento1 paginaSolved Whaleco Acquired All of The Common Stock of Minnowco EarlyAnbu jaromiaNessuna valutazione finora

- Tax Invoice (Original For Recipient) : S.NO. Item Description Rate Total Disc Taxable Value Igst CessDocumento1 paginaTax Invoice (Original For Recipient) : S.NO. Item Description Rate Total Disc Taxable Value Igst Cesssyed haneefNessuna valutazione finora

- Tax InvoiceDocumento1 paginaTax InvoiceVitrrag ShahNessuna valutazione finora

- Vinod Singh Computation Revised-3Documento4 pagineVinod Singh Computation Revised-3vinodNessuna valutazione finora

- Other Percentage TaxDocumento2 pagineOther Percentage TaxGerald SantosNessuna valutazione finora