Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Comparison Between Business Entities

Caricato da

suhanaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Comparison Between Business Entities

Caricato da

suhanaCopyright:

Formati disponibili

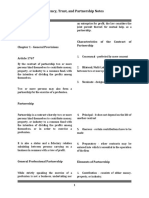

COMPARISON AND DISTINCTION BETWEEN

SOLE PROPRIETORSHIP, PARTNERSHIP AND COMPANY

SOLE

FEATURES PARTNERSHIP COMPANY

PROPRIETORSHIP

Must be formed in

No need to be formed Can be formed orally writing, through a

1. Formation

in writing or in writing Memorandum and

Articles of Association.

Partners are agents of

The owner manages the firm for carrying on

Members of a

the business himself or its business in the

company as such are

2. Management can hire employees to ordinary course of the

neither its manager

manage the firm for business and are

(directors) nor agent

him generally entitled to

manage the firm

Needs to register his Needs to register their

Need to be registered

business with the CCM business with CCM

with the CCM and as a

3. Registration under the Registration under the Registration

company under the

of Businesses Act of Businesses Act

Companies Act 2016

1956 1956

There is no maximum

The maximum is 20,

number of members

There is only 1 person there is no limit on the

4. Number of members excepts for a private

in a sole proprietorship number of members

company which case

for professional firm

the maximum is 50

A company must be

No agreement is A partnership must constituted in writing,

necessary since there have an agreement, i.e. by Articles of

5. Constitution

is only 1 person by either orally or in Association and

himself writing Memorandum of

Association

Liability for the firm

Liability for the Members are not liable

debts is unlimited

6. Liability businesss debts is for the companys

(unless it is a limited

unlimited debts

liability partnership)

A company is

A sole proprietorship

A partnership may be dissolved by winding

may be dissolved

7. Dissolution dissolved informally by up and liquidation,

informally by the owner

agreement of partners which are formal

himself

procedures

Potrebbero piacerti anche

- The Three Type of Business Are: Sole ProprietorshipDocumento3 pagineThe Three Type of Business Are: Sole ProprietorshipKave MathiNessuna valutazione finora

- Companies Act, 2013: Legal Aspects of Business Prof. Mehek KapoorDocumento15 pagineCompanies Act, 2013: Legal Aspects of Business Prof. Mehek KapoorAman jaiNessuna valutazione finora

- Introduction to Partnership & Company Law ManualDocumento7 pagineIntroduction to Partnership & Company Law ManualRAUDAHNessuna valutazione finora

- Corporation Law CompleteDocumento130 pagineCorporation Law CompleteQueenVictoriaAshleyPrieto92% (12)

- Law346 Chapter 1 & 2Documento25 pagineLaw346 Chapter 1 & 2rumaisyaNessuna valutazione finora

- Week1 - Assignment A - AccountingDocumento3 pagineWeek1 - Assignment A - AccountingJulan Calo CredoNessuna valutazione finora

- BOM Notes Ch-2Documento39 pagineBOM Notes Ch-2Nivedita GoswamiNessuna valutazione finora

- Information of CompaniesDocumento11 pagineInformation of CompaniesAli AliNessuna valutazione finora

- Partnership Act Notes Fast Track FinalDocumento14 paginePartnership Act Notes Fast Track Finalsamsfib420Nessuna valutazione finora

- Requirement 1: Aspect Sole Proprietorship Partnership Corporation 1. DefinitionDocumento4 pagineRequirement 1: Aspect Sole Proprietorship Partnership Corporation 1. DefinitionRosette SANTOSNessuna valutazione finora

- Law Unit 2Documento13 pagineLaw Unit 2Taha SanawadwalaNessuna valutazione finora

- Chapter 1 Business OrganizationDocumento13 pagineChapter 1 Business OrganizationAmmar JeffriNessuna valutazione finora

- Corpo Midterms Notes 501 PDFDocumento83 pagineCorpo Midterms Notes 501 PDFPhil JaramilloNessuna valutazione finora

- Insurance LawDocumento8 pagineInsurance LawRohit KumarNessuna valutazione finora

- Weeks 10 Chapter 5. General Provisions (Republic Act No. 11232)Documento6 pagineWeeks 10 Chapter 5. General Provisions (Republic Act No. 11232)Jean Paula SequiñoNessuna valutazione finora

- MCOW S22 011 Nouman AliDocumento5 pagineMCOW S22 011 Nouman AliRumman IrfanNessuna valutazione finora

- Assignment-01 BUS101Documento4 pagineAssignment-01 BUS101Amit HasanNessuna valutazione finora

- Difference Between Limited Liability Partnership & Limited Liability CompanyDocumento1 paginaDifference Between Limited Liability Partnership & Limited Liability CompanyAishwarya Sharma100% (1)

- Unit 3 BLDocumento5 pagineUnit 3 BLlokeshmate825Nessuna valutazione finora

- Business GuideDocumento22 pagineBusiness GuideAnkitaNessuna valutazione finora

- Comparison of The Features of Different Types of Business OrganizationsDocumento2 pagineComparison of The Features of Different Types of Business Organizationsgavin adrianNessuna valutazione finora

- Types of Business EntitiesDocumento4 pagineTypes of Business EntitiesAini SyafiqahNessuna valutazione finora

- Atty. Gaviola's Corporation Law Notes from University of San CarlosDocumento50 pagineAtty. Gaviola's Corporation Law Notes from University of San CarlosLourleth Caraballa LluzNessuna valutazione finora

- Forms of BusniessesDocumento36 pagineForms of BusniessesahmadNessuna valutazione finora

- 404 Corpo Midterms Transcript 2019Documento71 pagine404 Corpo Midterms Transcript 2019Apple Ke-eNessuna valutazione finora

- LAW CompanyDocumento46 pagineLAW CompanyMaheshwari MahajanNessuna valutazione finora

- Sole Proprietorship: Types of Business OrganizationsDocumento25 pagineSole Proprietorship: Types of Business OrganizationsApple Ke-eNessuna valutazione finora

- COMPANY LAW 1 Final EdDocumento48 pagineCOMPANY LAW 1 Final EdNuwamanya DerrickNessuna valutazione finora

- Key Differences Between Sole Proprietorship and Joint Hindu Family Firm - A Comparison ChartDocumento6 pagineKey Differences Between Sole Proprietorship and Joint Hindu Family Firm - A Comparison ChartVarun KocharNessuna valutazione finora

- Module 2Documento12 pagineModule 2Shayek tysonNessuna valutazione finora

- Partnership Act 1932 DefinitionDocumento4 paginePartnership Act 1932 DefinitionSuptoNessuna valutazione finora

- Accounting for Managers Company AccountsDocumento32 pagineAccounting for Managers Company AccountsA Kaur MarwahNessuna valutazione finora

- Leb NCP1 MergedDocumento257 pagineLeb NCP1 MergedStudy CircleNessuna valutazione finora

- Partnership vs CorporationDocumento3 paginePartnership vs CorporationJoyce JadulcoNessuna valutazione finora

- Gbermic 2Documento6 pagineGbermic 2Lavander HongNessuna valutazione finora

- Partnership (Hand Out)Documento43 paginePartnership (Hand Out)Roy Kenneth LingatNessuna valutazione finora

- The Indian Partnership Act, 1932 ExplainedDocumento30 pagineThe Indian Partnership Act, 1932 ExplainedKumar Debabrata Patra100% (2)

- 1.5 Partneship LawDocumento9 pagine1.5 Partneship LawGastor Hilary MtweveNessuna valutazione finora

- Law Implications in BusinessDocumento5 pagineLaw Implications in Businessrocken samiunNessuna valutazione finora

- Unit 1 - 2Documento30 pagineUnit 1 - 2AkshayNessuna valutazione finora

- Company and PartnershipDocumento1 paginaCompany and PartnershiprahulNessuna valutazione finora

- Forms of Business Organizations - Comparative ChartsDocumento6 pagineForms of Business Organizations - Comparative ChartsVineetha Chowdary GudeNessuna valutazione finora

- Business Ethics Module 2 ABM StrandDocumento3 pagineBusiness Ethics Module 2 ABM StrandKatrina LuzungNessuna valutazione finora

- Topic 1 (Law303)Documento28 pagineTopic 1 (Law303)carazamanNessuna valutazione finora

- Partnership Act 1932Documento5 paginePartnership Act 1932Erfan KhanNessuna valutazione finora

- Corporations: Organization and Capital Stock Transaction: Corporation Second GradeDocumento113 pagineCorporations: Organization and Capital Stock Transaction: Corporation Second GradePeter WagdyNessuna valutazione finora

- Company 1Documento48 pagineCompany 1mcyhndhieNessuna valutazione finora

- Company Law Notes For MCCDocumento38 pagineCompany Law Notes For MCCAllan StanleyNessuna valutazione finora

- Agency, Trust, and Partnership Comparison ChartDocumento97 pagineAgency, Trust, and Partnership Comparison ChartRoberto AguilaNessuna valutazione finora

- Item Sole Partnership Corporation Cooperative: ProprietorshipDocumento4 pagineItem Sole Partnership Corporation Cooperative: ProprietorshipLeilalyn Nicolas50% (2)

- Unit II - Company Act 2013Documento12 pagineUnit II - Company Act 2013Aniket SutarNessuna valutazione finora

- Introduction To Business Administration: BS MathematicsDocumento12 pagineIntroduction To Business Administration: BS Mathematicskanwal hafeezNessuna valutazione finora

- Steps and Procedure For Incorporation of The CompanyDocumento34 pagineSteps and Procedure For Incorporation of The CompanyKiran KumarNessuna valutazione finora

- CH 6 LLPDocumento24 pagineCH 6 LLPKrishna SurekaNessuna valutazione finora

- Basic Considerations and Formation 1Documento6 pagineBasic Considerations and Formation 1EllaineNessuna valutazione finora

- Business Law & Practice FINAL NOTESDocumento129 pagineBusiness Law & Practice FINAL NOTESZohair SadiNessuna valutazione finora

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCDa EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNessuna valutazione finora

- Selling ProcessDocumento2 pagineSelling ProcesssuhanaNessuna valutazione finora

- DPB2012 - T5Documento27 pagineDPB2012 - T5suhanaNessuna valutazione finora

- Format P&LDocumento1 paginaFormat P&LsuhanaNessuna valutazione finora

- DPB2012 - T1Documento71 pagineDPB2012 - T1suhanaNessuna valutazione finora

- Business Law Chapter 4 AgencyDocumento68 pagineBusiness Law Chapter 4 Agencysuhana33% (3)

- Registration of Business OwnershipDocumento13 pagineRegistration of Business OwnershipsuhanaNessuna valutazione finora

- DPB2012 - T3Documento21 pagineDPB2012 - T3suhanaNessuna valutazione finora

- Introduction To Malaysia Legal SystemDocumento40 pagineIntroduction To Malaysia Legal SystemsuhanaNessuna valutazione finora

- Pop QuizDocumento1 paginaPop QuizsuhanaNessuna valutazione finora

- Dpb3063: Business Law: Chapter 5: Sale of GoodsDocumento51 pagineDpb3063: Business Law: Chapter 5: Sale of GoodssuhanaNessuna valutazione finora

- Comparison Between Business EntitiesDocumento1 paginaComparison Between Business EntitiessuhanaNessuna valutazione finora

- Bolton Partners v. Lambert Retrospective Ratification Validates Unauthorized ContractDocumento1 paginaBolton Partners v. Lambert Retrospective Ratification Validates Unauthorized ContractsuhanaNessuna valutazione finora

- DPB3023 T1 Dis2016Documento35 pagineDPB3023 T1 Dis2016suhanaNessuna valutazione finora

- Introduction To Business AccountingDocumento30 pagineIntroduction To Business AccountingsuhanaNessuna valutazione finora

- Dpa5053 Company Law: Pn. Suhana Binti Mohd JamilDocumento44 pagineDpa5053 Company Law: Pn. Suhana Binti Mohd Jamilsuhana0% (1)

- T3 Dpb3023 Comm LawDocumento33 pagineT3 Dpb3023 Comm LawsuhanaNessuna valutazione finora

- DPB3023 T2 Dis2016Documento87 pagineDPB3023 T2 Dis2016suhana100% (1)

- Entrepreneurial Sources of Capital and Support SystemsDocumento28 pagineEntrepreneurial Sources of Capital and Support SystemssuhanaNessuna valutazione finora

- SuffixDocumento5 pagineSuffixErin StephensNessuna valutazione finora

- Corporations Law - Research Assessment PDFDocumento12 pagineCorporations Law - Research Assessment PDFHarjit Singh MahindrooNessuna valutazione finora

- ERRORLESS DT Concept Book May 21 & June 21 Used in Full Course VideoDocumento313 pagineERRORLESS DT Concept Book May 21 & June 21 Used in Full Course VideoDilip KumarNessuna valutazione finora

- Capital FinancingDocumento31 pagineCapital FinancingJohnMarkEvangelioNessuna valutazione finora

- Management & Organizational PlanningDocumento16 pagineManagement & Organizational PlanningMary De JesusNessuna valutazione finora

- Muñasque vs. Court of AppealsDocumento9 pagineMuñasque vs. Court of AppealsAaron CariñoNessuna valutazione finora

- Characteristics of PartnershipDocumento2 pagineCharacteristics of Partnershipckarla800% (1)

- Business Organizations CasesDocumento38 pagineBusiness Organizations CasesMacKenzieNessuna valutazione finora

- RFBT-05 (Partnerships)Documento14 pagineRFBT-05 (Partnerships)Gup KnwNessuna valutazione finora

- Basic AccountingDocumento16 pagineBasic AccountingronnelNessuna valutazione finora

- Girma 2013 WaDocumento52 pagineGirma 2013 Waendris aliNessuna valutazione finora

- BA 118.1 17-18 Partnership Assignment 1Documento1 paginaBA 118.1 17-18 Partnership Assignment 1Acads LangNessuna valutazione finora

- Association of Chartered Certified Accountants: Introduction To Accounting and The Regulatory FrameworkDocumento59 pagineAssociation of Chartered Certified Accountants: Introduction To Accounting and The Regulatory FrameworkBetseline IgnatiusNessuna valutazione finora

- Nur Qamarina - Notes ObDocumento5 pagineNur Qamarina - Notes ObAMIRAH MARDHIAH ABDUL KARIMNessuna valutazione finora

- Dissolution-Changes in OwnershipDocumento72 pagineDissolution-Changes in OwnershipmonneNessuna valutazione finora

- bUSINESS STUDIESDocumento3 paginebUSINESS STUDIESuhhwotNessuna valutazione finora

- Partnership Operations and Dissolution AnalysisDocumento33 paginePartnership Operations and Dissolution Analysislavender hazeNessuna valutazione finora

- Converting a Partnership to a Limited CompanyDocumento33 pagineConverting a Partnership to a Limited CompanyJustineNessuna valutazione finora

- Persons Family Relations Crammers Aid Pangalangan EscarezDocumento117 paginePersons Family Relations Crammers Aid Pangalangan EscarezPaul Aaron Esguerra EscarezNessuna valutazione finora

- Partnership Formation Problems and Solutions PDFDocumento2 paginePartnership Formation Problems and Solutions PDFMaricar San AntonioNessuna valutazione finora

- This Chapter Is Taken From The Book Music Business by Shane Simpson More Information Can Be Found atDocumento11 pagineThis Chapter Is Taken From The Book Music Business by Shane Simpson More Information Can Be Found atDaniel TrocheiNessuna valutazione finora

- Business Management HL - Study Guide - Miloš Drezga - Second Edition - IB Academy 2019 (Ib - Academy)Documento103 pagineBusiness Management HL - Study Guide - Miloš Drezga - Second Edition - IB Academy 2019 (Ib - Academy)amira zahariNessuna valutazione finora

- Important Topics of Patnership ActDocumento11 pagineImportant Topics of Patnership ActMd. Mostafizur RahmanNessuna valutazione finora

- Questions and Guide For EntrepreneurshipDocumento45 pagineQuestions and Guide For EntrepreneurshipNsemi NsemiNessuna valutazione finora

- Practical Accounti ng2: Jonathan M. Tipay, CpaDocumento10 paginePractical Accounti ng2: Jonathan M. Tipay, CpaCristine Joy FerrerNessuna valutazione finora

- LLPDocumento15 pagineLLPAnkit JainNessuna valutazione finora

- PE - Law Firm & PartnershipDocumento9 paginePE - Law Firm & PartnershipNursara RosliNessuna valutazione finora

- Calculating cash investment of new partner RRDocumento243 pagineCalculating cash investment of new partner RRVirgo CruzNessuna valutazione finora

- East Gate Media Fund Investment ProceduresDocumento3 pagineEast Gate Media Fund Investment ProceduresYoung-Kwon LeeNessuna valutazione finora

- 1 Accounting For Partnership - Basic Cionsiderations and FormationDocumento83 pagine1 Accounting For Partnership - Basic Cionsiderations and FormationJean Rae RemiasNessuna valutazione finora