Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Annex E RR14 - 2003

Caricato da

Jomar Teneza100%(1)Il 100% ha trovato utile questo documento (1 voto)

158 visualizzazioni1 paginaAnnex E RR14_2003

Titolo originale

Annex E RR14_2003

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoAnnex E RR14_2003

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

158 visualizzazioni1 paginaAnnex E RR14 - 2003

Caricato da

Jomar TenezaAnnex E RR14_2003

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

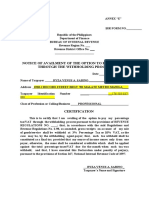

ANNEX E

BIR FORM NO.__________

Republic of the Philippines

Department of Finance

BUREAU OF INTERNAL REVENUE

Revenue Region No. ___

Revenue District Office No. ___

__________________________

NOTICE OF AVAILMENT OF THE OPTION TO PAY THE TAX

THROUGH THE WITHHOLDING PROCESS

Date __________________

Name of Taxpayer ______________________________________________________

Address _______________________________________________________________

Taxpayer Identification Number __________________________________________

Class of Profession or Calling _____________________________________________

CERTIFICATION

This is to certify that I am availing of the option to pay my percentage

tax/VAT through the withholding process pursuant to the provisions of

REVENUE REGULATIONS NO. ____; that, in accordance with the said

Regulations and Revenue Regulations No. 2-98, as amended, gross receipts on

account of my sale of goods/service shall be withheld at 3% Percentage Tax or

10% VAT, as the case may be, by the withholding agent-payor; that, such tax

withheld shall be constituted as a final tax provided that my source of income

comes only from one payor, otherwise, the same shall be considered creditable

which shall be applied against the total percentage taxes/VAT due for the month

when such tax was withheld; and that, I have executed this Declaration under

penalty of perjury, pursuant to the provisions of Section 267, National Internal

Revenue Code of 1997.

____________________________

Taxpayers Name and Signature

Potrebbero piacerti anche

- ANNEX eDocumento2 pagineANNEX eChristian Sadia0% (1)

- PentikostesDocumento4 paginePentikostesmagilNessuna valutazione finora

- Cancellation of DependnetsDocumento1 paginaCancellation of Dependnetsavelyn saraspeNessuna valutazione finora

- Undertaking To File A Separate Final/Adjustment ReturnDocumento1 paginaUndertaking To File A Separate Final/Adjustment ReturnAndrei Anne Palomar100% (1)

- Deed of Absolute SaleDocumento2 pagineDeed of Absolute SaleRyan Penalosa100% (1)

- Republic of The Philippines Sangguniang Panlungsod City of Makati PresentDocumento3 pagineRepublic of The Philippines Sangguniang Panlungsod City of Makati PresentSpcmb DocketNessuna valutazione finora

- Request For ORDocumento2 pagineRequest For ORKimberlyPlaza0% (1)

- Demand Letter - Damage To PropertyDocumento1 paginaDemand Letter - Damage To PropertyErikha AranetaNessuna valutazione finora

- ACKNOWLEDGMENT RECEIPT - EdwinDocumento1 paginaACKNOWLEDGMENT RECEIPT - EdwinGlo Villa100% (1)

- Appendix 42 - Schedule of Unreleased ChecksDocumento1 paginaAppendix 42 - Schedule of Unreleased ChecksIvy Michelle HabagatNessuna valutazione finora

- Visita Iglesia PrayersDocumento18 pagineVisita Iglesia PrayersShania Loveres100% (16)

- Sanitary OrderDocumento1 paginaSanitary Orderrocascesar0% (1)

- Application For Exclusive Sand and Gravel Permit/ Government/Private Gratuitous PermitDocumento2 pagineApplication For Exclusive Sand and Gravel Permit/ Government/Private Gratuitous PermitJerwin MacasinagNessuna valutazione finora

- RMC No. 4-2021 Revised - v2Documento6 pagineRMC No. 4-2021 Revised - v2nathalie velasquezNessuna valutazione finora

- 2016 Fao 196Documento24 pagine2016 Fao 196Christopher IgnacioNessuna valutazione finora

- Certificate of Sea ServiceDocumento1 paginaCertificate of Sea ServicebjhonrioNessuna valutazione finora

- CELEBRATION OF THE HOLY MASS PrintDocumento8 pagineCELEBRATION OF THE HOLY MASS PrintNoemi SalinasNessuna valutazione finora

- Financial Statement For PcabDocumento5 pagineFinancial Statement For Pcabma ana hiponiaNessuna valutazione finora

- Accomplishment Report: Documents of Some Are AttachedDocumento1 paginaAccomplishment Report: Documents of Some Are AttachedLorenz De Lemios Nalica100% (1)

- Certificate of COC Earned: Annex ADocumento3 pagineCertificate of COC Earned: Annex AJerlyn CabanlitNessuna valutazione finora

- Provident Apllication FormDocumento2 pagineProvident Apllication FormIan Khay Castro50% (2)

- PHILGASEA Membership Form 1Documento1 paginaPHILGASEA Membership Form 1Jean Kenneth AlontoNessuna valutazione finora

- Lenten Recollection 2024 .Catechists'Documento25 pagineLenten Recollection 2024 .Catechists'villamilcecil909Nessuna valutazione finora

- Application Form For ACR I-CARD NEW PDFDocumento2 pagineApplication Form For ACR I-CARD NEW PDFButch AmbataliNessuna valutazione finora

- Daily Time RecordDocumento1 paginaDaily Time RecordAlee AbdulcalimNessuna valutazione finora

- Clearance Forms SBDocumento1 paginaClearance Forms SBRodney Atibula100% (1)

- Annex EDocumento2 pagineAnnex EBeboy EvardoNessuna valutazione finora

- RR 2-98 Section 2.57 (B) - CWTDocumento3 pagineRR 2-98 Section 2.57 (B) - CWTZenaida LatorreNessuna valutazione finora

- Transmittal To ROD-FPADocumento1 paginaTransmittal To ROD-FPALorna U. Fernandez-EspinozaNessuna valutazione finora

- Deed of Absolute SaleDocumento2 pagineDeed of Absolute SaleEric EchonNessuna valutazione finora

- Apply For PCSO Medical Financial AssistanceDocumento9 pagineApply For PCSO Medical Financial AssistancePCSO LOTTONessuna valutazione finora

- WeAccess PAG-IBIG Bills Payment - 18JUNE2014Documento31 pagineWeAccess PAG-IBIG Bills Payment - 18JUNE2014Jonathan Beverly Jane100% (1)

- Sworn DeclarationDocumento1 paginaSworn DeclarationGilden Joy CequenaNessuna valutazione finora

- ConsentDocumento1 paginaConsentGn GulanesNessuna valutazione finora

- Liquidation Report FormDocumento4 pagineLiquidation Report FormJeremy LiboonNessuna valutazione finora

- Liquidation FormDocumento6 pagineLiquidation FormLara Grace M. CunananNessuna valutazione finora

- Agency Authorized Officer (AAO) Commitment Form: Government Service Insurance SystemDocumento3 pagineAgency Authorized Officer (AAO) Commitment Form: Government Service Insurance SystemAnonymous pHooz5aH6VNessuna valutazione finora

- Annex B-2 RR 11-2018Documento1 paginaAnnex B-2 RR 11-2018Princess RegalaNessuna valutazione finora

- Reply Slip - 2020 Deployment PDFDocumento1 paginaReply Slip - 2020 Deployment PDFJackferr LacandulaNessuna valutazione finora

- Conditional Deed of SaleDocumento3 pagineConditional Deed of SaleHuey CalabinesNessuna valutazione finora

- Property-Account Card: Department of Education Schools Division Office of BataanDocumento1 paginaProperty-Account Card: Department of Education Schools Division Office of BataanChristine Joy E. Sanchez-CasteloNessuna valutazione finora

- Deed of Sale of Motor Vehicle ClosedDocumento1 paginaDeed of Sale of Motor Vehicle ClosedMasian DickNessuna valutazione finora

- Ebcs Enrollment FormDocumento1 paginaEbcs Enrollment FormZandie Garcia75% (4)

- Affidavit of Descrepancy (Name)Documento1 paginaAffidavit of Descrepancy (Name)Jacob AlabadoNessuna valutazione finora

- Board of CanvassersDocumento7 pagineBoard of CanvassersamberspanktowerNessuna valutazione finora

- Curriculum Vitae: Application FormDocumento2 pagineCurriculum Vitae: Application FormKeisha Pearl Jaime SillaNessuna valutazione finora

- Liability & Agreement Waiver (TIP-CC-029)Documento4 pagineLiability & Agreement Waiver (TIP-CC-029)Ivan Radzll Mendoza MontealegreNessuna valutazione finora

- General Waiver of ActionDocumento1 paginaGeneral Waiver of ActionHazel Lontoc Helmuth-VegaNessuna valutazione finora

- Appendix 35 - Instructions - RCIDocumento2 pagineAppendix 35 - Instructions - RCITesa GD100% (1)

- Audit Report - TuburanDocumento87 pagineAudit Report - TuburanMaria100% (1)

- Certificate of Appearance 2023Documento3 pagineCertificate of Appearance 2023Armando Mendoza Jr.Nessuna valutazione finora

- Donation Letter of IntentDocumento2 pagineDonation Letter of IntentVALIANT NAJIB ERESUELANessuna valutazione finora

- HOLY-MASS-GUIDE-original (Edited (Documento7 pagineHOLY-MASS-GUIDE-original (Edited (cy baromanNessuna valutazione finora

- Notice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnDocumento1 paginaNotice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnWarlie Zambales DiazNessuna valutazione finora

- Notice of Availment of Substituted Filing of Percentage Tax ReturnsDocumento1 paginaNotice of Availment of Substituted Filing of Percentage Tax ReturnsJomar TenezaNessuna valutazione finora

- Notice of Availment of The Option To Pay The Tax Through The Withholding ProcessDocumento2 pagineNotice of Availment of The Option To Pay The Tax Through The Withholding ProcessArgielJedTabalBorrasNessuna valutazione finora

- Bir Form For Tax ExceptionDocumento1 paginaBir Form For Tax ExceptionPublic Safety OfficeNessuna valutazione finora

- Annex FDocumento1 paginaAnnex FJoyNessuna valutazione finora

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocumento1 paginaNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- Froilan R. Montalban, Sr. For Petitioner Sixto B. Dela Victoria. Escalon Law Office For Private RespondentDocumento3 pagineFroilan R. Montalban, Sr. For Petitioner Sixto B. Dela Victoria. Escalon Law Office For Private RespondentJomar TenezaNessuna valutazione finora

- People Vs VeraDocumento24 paginePeople Vs VeraJomar TenezaNessuna valutazione finora

- Katigbak v. Solicitor General, 180 SCRA 540Documento2 pagineKatigbak v. Solicitor General, 180 SCRA 540Jomar Teneza100% (1)

- Bataan Shipyard & Engineering Co., Inc. v. PCGG, 234 Phil. 180Documento17 pagineBataan Shipyard & Engineering Co., Inc. v. PCGG, 234 Phil. 180Jomar TenezaNessuna valutazione finora

- (G.r. No. L-9141. September 25, 1956.) Testate Estate of Olimpio Fernandez, Deceased. Republic of THDocumento4 pagine(G.r. No. L-9141. September 25, 1956.) Testate Estate of Olimpio Fernandez, Deceased. Republic of THJia Chu ChuaNessuna valutazione finora

- Ceniza Vs ComelecDocumento6 pagineCeniza Vs ComelecJomar TenezaNessuna valutazione finora

- Robertson Vs BaldwinDocumento5 pagineRobertson Vs BaldwinJomar TenezaNessuna valutazione finora

- People Vs PinedaDocumento5 paginePeople Vs PinedaJomar TenezaNessuna valutazione finora

- Manantan vs. CADocumento9 pagineManantan vs. CAfullpizzaNessuna valutazione finora

- People Vs EchegarayDocumento16 paginePeople Vs EchegarayJomar Teneza100% (1)

- Abadia Vs CADocumento4 pagineAbadia Vs CAJomar TenezaNessuna valutazione finora

- In Re Edillon, 84 SCRA (1979)Documento3 pagineIn Re Edillon, 84 SCRA (1979)kingNessuna valutazione finora

- US Vs LanzaDocumento4 pagineUS Vs LanzaJomar TenezaNessuna valutazione finora

- G.R. No. L-32613-14 People Vs FerrerDocumento10 pagineG.R. No. L-32613-14 People Vs FerrerEdz Votefornoymar Del RosarioNessuna valutazione finora

- People Vs MolinaDocumento4 paginePeople Vs MolinaJomar TenezaNessuna valutazione finora

- Alfredo Calupitan, and Gibbs, Mcdonough & Johnson For Petitioner. Assistant City of Fiscal Felix For RespondentDocumento3 pagineAlfredo Calupitan, and Gibbs, Mcdonough & Johnson For Petitioner. Assistant City of Fiscal Felix For RespondentJomar TenezaNessuna valutazione finora

- People Vs EchegarayDocumento16 paginePeople Vs EchegarayJomar TenezaNessuna valutazione finora

- The Solicitor General For Plaintiff-Appellee. Public Attorney's Office For Accused-AppellantDocumento4 pagineThe Solicitor General For Plaintiff-Appellee. Public Attorney's Office For Accused-AppellantJomar TenezaNessuna valutazione finora

- G.R. No. 81561 January 18, 1991 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee ANDRE MARTI, Accused-AppellantDocumento8 pagineG.R. No. 81561 January 18, 1991 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee ANDRE MARTI, Accused-AppellantnikkaremullaNessuna valutazione finora

- Soliven Vs MakasiarDocumento2 pagineSoliven Vs MakasiarJomar TenezaNessuna valutazione finora

- Harris Vs USDocumento1 paginaHarris Vs USJomar TenezaNessuna valutazione finora

- Malacat Vs CADocumento8 pagineMalacat Vs CAJuLievee LentejasNessuna valutazione finora

- People Vs GesmundoDocumento5 paginePeople Vs GesmundoJomar TenezaNessuna valutazione finora

- People Vs IntingDocumento4 paginePeople Vs IntingJomar TenezaNessuna valutazione finora

- Go Vs CADocumento6 pagineGo Vs CAJomar TenezaNessuna valutazione finora

- Volkschel Vs BLRDocumento3 pagineVolkschel Vs BLRJomar TenezaNessuna valutazione finora

- G.R. No. L-32613-14 People Vs FerrerDocumento10 pagineG.R. No. L-32613-14 People Vs FerrerEdz Votefornoymar Del RosarioNessuna valutazione finora

- Chavez Vs RomuloDocumento12 pagineChavez Vs RomuloJomar TenezaNessuna valutazione finora

- Occena vs. Comelec, 127 Scra 404Documento7 pagineOccena vs. Comelec, 127 Scra 404kingNessuna valutazione finora

- PAD Vs CADocumento9 paginePAD Vs CAJay RuizNessuna valutazione finora

- The Hidden Wealth of Nations: The Scourge of Tax HavensDa EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensValutazione: 4 su 5 stelle4/5 (11)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDa EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNessuna valutazione finora

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDa EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNessuna valutazione finora

- Public Finance: Legal Aspects: Collective monographDa EverandPublic Finance: Legal Aspects: Collective monographNessuna valutazione finora

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesDa EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesValutazione: 4 su 5 stelle4/5 (9)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNessuna valutazione finora

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionDa EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionValutazione: 5 su 5 stelle5/5 (27)

- Taxes Have Consequences: An Income Tax History of the United StatesDa EverandTaxes Have Consequences: An Income Tax History of the United StatesNessuna valutazione finora

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyDa EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyValutazione: 4 su 5 stelle4/5 (52)

- How to get US Bank Account for Non US ResidentDa EverandHow to get US Bank Account for Non US ResidentValutazione: 5 su 5 stelle5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProDa EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProValutazione: 4.5 su 5 stelle4.5/5 (43)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderValutazione: 5 su 5 stelle5/5 (4)

- The Great Multinational Tax Rort: how we’re all being robbedDa EverandThe Great Multinational Tax Rort: how we’re all being robbedNessuna valutazione finora

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessDa EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessValutazione: 5 su 5 stelle5/5 (5)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionDa EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNessuna valutazione finora

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Da EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Nessuna valutazione finora

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationDa EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNessuna valutazione finora

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsDa EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsValutazione: 3.5 su 5 stelle3.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingDa EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingValutazione: 5 su 5 stelle5/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationDa EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNessuna valutazione finora

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCDa EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCValutazione: 4 su 5 stelle4/5 (5)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreDa EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreValutazione: 4.5 su 5 stelle4.5/5 (13)

- Canadian International Taxation: Income Tax Rules for ResidentsDa EverandCanadian International Taxation: Income Tax Rules for ResidentsNessuna valutazione finora