Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Budget Amendments 2017-17 LMK

Caricato da

Tristan Hallman0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

44 visualizzazioni1 paginaDallas City Council member Lee Kleinman's proposed budget cuts.

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoDallas City Council member Lee Kleinman's proposed budget cuts.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

44 visualizzazioni1 paginaBudget Amendments 2017-17 LMK

Caricato da

Tristan HallmanDallas City Council member Lee Kleinman's proposed budget cuts.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

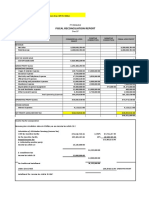

City

of Dallas 2017-18 Budget Amendments

Submitted by Lee M. Kleinman, Council Member D-11

Provides for Effective Tax Rate (or better) Budget

Property Tax (Less Non-Collections)

Certified 2017 Tax Roll: $118,314,677,595

Current Tax Rate: 78.25 $903,963,181

Effective Tax Rate: 74.96 $865,956,294

Budgeted Tax Rate after Amendemnts: 71.57 $826,848,319

Proposed Tax Increase: $38,006,886 (Note $65 million increase M&C and Pension)

Savings Identified -$78,978,760

Tax Decrease after Amendments: -$40,971,874

Police Department Service Original New Savings Tax Rate Effect

Budget: Recruiting and Personel (Civilianize and Outsource, move Sworn to Patrol) $9,149,829 $5,149,829 $4,000,000 0.34

$465,672,805 Police Academy and In Service (Civilianize and Require Peace Officer License) $18,199,274 $10,199,274 $8,000,000 0.68

Savings Total: Police Investigations (Consolidate 3 departments, efficiencies) $84,557,959 $80,557,959 $4,000,000 0.34

$25,000,000 Police Intelligence (Civilianize) $8,542,441 $5,542,441 $3,000,000 0.25

Percent of Budget: Police Operational Support (Civilainize) $34,359,717 $31,359,717 $3,000,000 0.25

5.37% Police Special Operations (effecincies, cross train and draw when needed) $35,623,915 $32,623,915 $3,000,000 0.25

Fire Department Service Original New Savings Tax Rate Effect

Budget: EMS Admin (Civilianize, effeceincies, no direct services here) $20,050,499 $17,050,499 $3,000,000 0.25

$267,026,909 Fire Training & Recruitment (civilianize and outsource) $27,997,309 $21,997,309 $6,000,000 0.51

Savings Total: Fire Rescue Equpiment and Facilites Maint (reset to 2016 budget) $11,505,306 $9,505,306 $2,000,000 0.17

$11,000,000

Percent of Budget:

4.12%

Code Compliance Service Original New Savings Tax Rate Effect

Budget: Consumer Health (Full Cost Recovery - Adds to Revenue) $500,000 $500,000 0.04

$30,438,826 Neighborhood Code Compliance (50% Cost Recovery - Adds to Revenue) $10,000,000 $10,000,000 0.85

Savings Total: Neighborhood Nuisance Abatement (50% Cost Recovery - Adds to Revenue) $5,000,000 $5,000,000 0.42

$15,500,000

Percent of Budget:

50.92%

Other Departments Service Original New Savings Tax Rate Effect

Parks and Receration Fair Park Privatization (1/2 Year - What happened to last year's $?) $6,500,000 $3,500,000 $3,000,000 0.25

Transportation SafeLight Program (Eliminate Redlight cameras. Net after collections) $3,620,000 $0 $3,620,000 0.31

Mayor and City Council Field Offices (Eliminate) $500,000 $0 $500,000 0.04

City Controller 5 FTEs (2016 Budget plus AP Transfers) $6,242,969 $5,842,969 $400,000 0.03

Civil Service Non-Mandatory Charter Tasks Eliminated $3,080,815 $2,680,815 $400,000 0.03

Court and Detention Bring to Full Cost Recovery $4,000,000 $4,000,000 0.34

Equipment and Building Bring to 2016 Budget and Privatize Vehicle Repair $28,590,583 $23,590,583 $5,000,000 0.42

Housing Grant funds only, no General Fund $21,047,815 $17,379,532 $3,668,283 0.31

Office of Community Care Grant funds only, no General Fund (WIC) $22,214,427 $18,775,849 $3,438,578 0.29

Dallas Film Commission Eliminate to pay for increase in Small Business Initiatives $451,899 $0 $451,899 0.04

Public Works Various reductions $73,137,927 $70,137,927 $3,000,000 0.25

Potrebbero piacerti anche

- Practice Problems Ch12 PDFDocumento57 paginePractice Problems Ch12 PDFzoeyNessuna valutazione finora

- Instructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseDocumento14 pagineInstructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseShefali GoyalNessuna valutazione finora

- Dallas Lawsuit Against 11760 Ferguson ApartmentsDocumento39 pagineDallas Lawsuit Against 11760 Ferguson ApartmentsTristan HallmanNessuna valutazione finora

- POM+ Project - IT Project MGTDocumento4 paginePOM+ Project - IT Project MGTRogerio100% (2)

- General Principles of Public Fiscal Administration: Prepared By: Jonathan A. RiveraDocumento19 pagineGeneral Principles of Public Fiscal Administration: Prepared By: Jonathan A. RiveraeugenioNessuna valutazione finora

- Template For Feasibility Study Project ProposalDocumento13 pagineTemplate For Feasibility Study Project ProposalArnold Steven100% (2)

- Tutorial 6 - Salaries TaxDocumento5 pagineTutorial 6 - Salaries Tax周小荷Nessuna valutazione finora

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocumento16 pagineCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (27)

- R2. TAX ML Solution CMA January 2022 ExaminationDocumento6 pagineR2. TAX ML Solution CMA January 2022 ExaminationPavel DhakaNessuna valutazione finora

- Appropriation Ordinance 2022Documento5 pagineAppropriation Ordinance 2022Romulo Sierra Jr.Nessuna valutazione finora

- DOA Board October 4, 2017 Agenda PacketDocumento14 pagineDOA Board October 4, 2017 Agenda PacketOaklandCBDsNessuna valutazione finora

- 2015 Annual Accomplishment ReportDocumento8 pagine2015 Annual Accomplishment ReportAngelica Aquino GasmenNessuna valutazione finora

- Bald Head Island FY 2024 Budget PresentationDocumento35 pagineBald Head Island FY 2024 Budget PresentationJamie BouletNessuna valutazione finora

- EMPH2800 TAXSHEET March 2021Documento1 paginaEMPH2800 TAXSHEET March 2021the anonymousNessuna valutazione finora

- Proposed Budget ReductionsDocumento5 pagineProposed Budget ReductionsbainbridgereviewNessuna valutazione finora

- City of Hoboken CY 2017 Introduced BudgetDocumento13 pagineCity of Hoboken CY 2017 Introduced BudgetGrafixAvengerNessuna valutazione finora

- Appropriation For Annual Budget Year 2021Documento5 pagineAppropriation For Annual Budget Year 2021Rafael FerolinoNessuna valutazione finora

- Itemized Deduction Vs Optional Standard Deductions 40OSDDocumento4 pagineItemized Deduction Vs Optional Standard Deductions 40OSDjason genitaNessuna valutazione finora

- Barangay Budget Authorization Form CY2019Documento6 pagineBarangay Budget Authorization Form CY2019Auza Jp100% (1)

- Appropriation For Annual Budget Year 2020Documento5 pagineAppropriation For Annual Budget Year 2020Rafael FerolinoNessuna valutazione finora

- Finance Homework OCFDocumento4 pagineFinance Homework OCFShoaib ShahzadNessuna valutazione finora

- Chapter 1 SolutionsDocumento3 pagineChapter 1 Solutionshassan.muradNessuna valutazione finora

- Brealey 5CE Ch09 SolutionsDocumento27 pagineBrealey 5CE Ch09 SolutionsToby Tobes TobezNessuna valutazione finora

- Payroll Template Single Employee - Segun Akiode - 2022Documento1 paginaPayroll Template Single Employee - Segun Akiode - 2022Eben-Haezer100% (1)

- Appropriation For Annual Budget Year 2022Documento5 pagineAppropriation For Annual Budget Year 2022Rafael FerolinoNessuna valutazione finora

- Prelim SolutionDocumento5 paginePrelim SolutionMst TeriousNessuna valutazione finora

- Payslip SampleDocumento1 paginaPayslip SampleWayo PhodangNessuna valutazione finora

- 2020 Statewide Veto ListDocumento8 pagine2020 Statewide Veto ListWXYZ-TV Channel 7 DetroitNessuna valutazione finora

- Tugas 2 MK IIDocumento6 pagineTugas 2 MK IIKirana Maharani - SagasitasNessuna valutazione finora

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Documento36 pagineFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (23)

- Business Plan: Product DescriptionDocumento7 pagineBusiness Plan: Product DescriptionNikhil BirajNessuna valutazione finora

- 2023 BudgetDocumento1 pagina2023 Budgetmisyel deveraNessuna valutazione finora

- Financial Accounting 3A Assignment 2tendai MakosaDocumento5 pagineFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNessuna valutazione finora

- PadilhaWeek2 Case3Documento14 paginePadilhaWeek2 Case3Elisabete PadilhaNessuna valutazione finora

- City of Hoboken SFY 2010Documento12 pagineCity of Hoboken SFY 2010Mile Square ViewNessuna valutazione finora

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions ManualDocumento26 pagineFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (16)

- Finals Exam SolutionsDocumento6 pagineFinals Exam SolutionsZhengzhou CalNessuna valutazione finora

- Computation For Exercise 1Documento10 pagineComputation For Exercise 1Xyzra AlfonsoNessuna valutazione finora

- Provisional Taxsheet Mar 2020Documento1 paginaProvisional Taxsheet Mar 2020vivianNessuna valutazione finora

- FS - LandscapeDocumento9 pagineFS - LandscapeMekay OcasionesNessuna valutazione finora

- Section 3Documento1 paginaSection 3Floieh QuindaraNessuna valutazione finora

- CH 2.TaxSalary IncomeDocumento13 pagineCH 2.TaxSalary IncomeSajid AhmedNessuna valutazione finora

- Dilg Budget ReportsDocumento12 pagineDilg Budget ReportsApril Joy Sumagit HidalgoNessuna valutazione finora

- Answer For Payroll ProblemsDocumento21 pagineAnswer For Payroll ProblemsAnonymous Lz2qH7Nessuna valutazione finora

- Simulasi Corporate TaxDocumento9 pagineSimulasi Corporate TaxANDIYANA ANSARNessuna valutazione finora

- Model Solution: Page 1 of 6Documento6 pagineModel Solution: Page 1 of 6ShuvonathNessuna valutazione finora

- Model - Student Version: MODULE 13 CORAL BAY HOSPITAL: Traditional Project AnalysisDocumento23 pagineModel - Student Version: MODULE 13 CORAL BAY HOSPITAL: Traditional Project AnalysisHassanNessuna valutazione finora

- m2 Answer KeyDocumento2 paginem2 Answer KeyLara Camille CelestialNessuna valutazione finora

- Model Solution: Solution To The Question No. 1Documento9 pagineModel Solution: Solution To The Question No. 1HossainNessuna valutazione finora

- University of Makati J.P. Rizal Ext. West Rembo, City of Makati College of Business and Financial ScienceDocumento16 pagineUniversity of Makati J.P. Rizal Ext. West Rembo, City of Makati College of Business and Financial ScienceKarla OñasNessuna valutazione finora

- Computation Part2Documento4 pagineComputation Part2Jeane Mae BooNessuna valutazione finora

- Finance HW1 - Atharva ManjrekarDocumento15 pagineFinance HW1 - Atharva ManjrekarAtharva ManjrekarNessuna valutazione finora

- Government Rank and File Employee Summary of Compensation and Benefits in 2020Documento4 pagineGovernment Rank and File Employee Summary of Compensation and Benefits in 2020kate bautistaNessuna valutazione finora

- Financial ManagementDocumento12 pagineFinancial ManagementValeria MartinezNessuna valutazione finora

- ST Lukes Predominance TestDocumento12 pagineST Lukes Predominance TestCARLO JOSE BACTOLNessuna valutazione finora

- Cash Flow Brigham SolutionDocumento14 pagineCash Flow Brigham SolutionShahid Mehmood100% (4)

- AFA IIP.L III SolutionJune 2016Documento4 pagineAFA IIP.L III SolutionJune 2016HossainNessuna valutazione finora

- Elements ARR PaybackDocumento3 pagineElements ARR PaybackAngela Miles DizonNessuna valutazione finora

- AIP (Annual Investment Program)Documento27 pagineAIP (Annual Investment Program)Raquel AlarasNessuna valutazione finora

- Hasil Abnormal ReturnDocumento1 paginaHasil Abnormal ReturnSurya KeceNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNessuna valutazione finora

- Dallas Special NC 10-18-2018Documento1 paginaDallas Special NC 10-18-2018Tristan HallmanNessuna valutazione finora

- CHDO Letter - NBCDCDocumento1 paginaCHDO Letter - NBCDCTristan HallmanNessuna valutazione finora

- Mutts and Mayhem's Response To Ellis County LawsuitDocumento9 pagineMutts and Mayhem's Response To Ellis County LawsuitTristan HallmanNessuna valutazione finora

- Election Fraud LawsuitDocumento5 pagineElection Fraud LawsuitTristan HallmanNessuna valutazione finora

- Sanchez Response To LawsuitDocumento6 pagineSanchez Response To LawsuitTristan HallmanNessuna valutazione finora

- StreetsToSheets LawsuitDocumento5 pagineStreetsToSheets LawsuitTristan HallmanNessuna valutazione finora

- HUD LetterDocumento14 pagineHUD LetterSchutzeNessuna valutazione finora

- Notification On Marlon Rollins (Park Board Member)Documento1 paginaNotification On Marlon Rollins (Park Board Member)Tristan HallmanNessuna valutazione finora

- Audit of Homeless Response System Effectiveness 12-08-2017Documento69 pagineAudit of Homeless Response System Effectiveness 12-08-2017Tristan HallmanNessuna valutazione finora

- Judge Godfrey's Pension OrderDocumento26 pagineJudge Godfrey's Pension OrderTristan HallmanNessuna valutazione finora

- Lake Cliff Historic DistrictDocumento1 paginaLake Cliff Historic DistrictTristan HallmanNessuna valutazione finora

- Julia Poff Federal Court DocsDocumento5 pagineJulia Poff Federal Court DocsTristan HallmanNessuna valutazione finora

- State Legislative Director AppointmentDocumento1 paginaState Legislative Director AppointmentTristan HallmanNessuna valutazione finora

- D Link RouteDocumento1 paginaD Link RouteTristan HallmanNessuna valutazione finora

- ARC and The CovenantsDocumento5 pagineARC and The CovenantsTristan HallmanNessuna valutazione finora

- Dallas GO SummaryDocumento9 pagineDallas GO SummaryTristan HallmanNessuna valutazione finora

- Moody's Nov 17 2017Documento9 pagineMoody's Nov 17 2017Tristan HallmanNessuna valutazione finora

- EMF and Peaks Addition LawsuitDocumento154 pagineEMF and Peaks Addition LawsuitTristan HallmanNessuna valutazione finora

- Audit of Construction Related ProcurementsDocumento36 pagineAudit of Construction Related ProcurementsTristan HallmanNessuna valutazione finora

- Resolution - NC Spending BanDocumento1 paginaResolution - NC Spending BanTristan HallmanNessuna valutazione finora

- Dallas Animal Services Shelter StatisticsDocumento1 paginaDallas Animal Services Shelter StatisticsTristan HallmanNessuna valutazione finora

- Sabine River Authority Settlement BriefingDocumento3 pagineSabine River Authority Settlement BriefingTristan HallmanNessuna valutazione finora

- SCV ComplaintDocumento15 pagineSCV ComplaintTristan HallmanNessuna valutazione finora

- 8-28-17 - Resolution For Sept. 6 Agenda (Rawlings)Documento5 pagine8-28-17 - Resolution For Sept. 6 Agenda (Rawlings)Tristan HallmanNessuna valutazione finora

- City's Response To SCV LawsuitDocumento50 pagineCity's Response To SCV LawsuitTristan HallmanNessuna valutazione finora

- Townsend LawsuitDocumento118 pagineTownsend LawsuitTristan HallmanNessuna valutazione finora

- Ed Jamison ResumeDocumento6 pagineEd Jamison ResumeTristan HallmanNessuna valutazione finora

- Kingston Press Release and Resolution - MonumentsDocumento4 pagineKingston Press Release and Resolution - MonumentsTristan HallmanNessuna valutazione finora

- Investment Apraisal or Capital Budgeting - IrrDocumento4 pagineInvestment Apraisal or Capital Budgeting - IrrJayna CrichlowNessuna valutazione finora

- Pakistan Economy - IMF Loan Review Funding Requirement, Primary Deficit, Gas Pricing & Monetary PolicyDocumento10 paginePakistan Economy - IMF Loan Review Funding Requirement, Primary Deficit, Gas Pricing & Monetary PolicyMohammad RazaNessuna valutazione finora

- "Capital Budgeting": A Summer Training Report OnDocumento45 pagine"Capital Budgeting": A Summer Training Report OnRahul BhagatNessuna valutazione finora

- Finance 22393Documento23 pagineFinance 22393Rajesh Kumar100% (1)

- Unified Accounts Code StructureDocumento3 pagineUnified Accounts Code Structurenica leeNessuna valutazione finora

- Senate Hearing, 112TH Congress - The G-20 and Global Economic and Financial RisksDocumento48 pagineSenate Hearing, 112TH Congress - The G-20 and Global Economic and Financial RisksScribd Government DocsNessuna valutazione finora

- How To Create Budget in Excel Spreadsheet With TemplateDocumento7 pagineHow To Create Budget in Excel Spreadsheet With TemplateAldrin LiwanagNessuna valutazione finora

- Market Strategy: February 2021Documento19 pagineMarket Strategy: February 2021Harshvardhan SurekaNessuna valutazione finora

- Senior Financial Analyst in Washington DC Resume Jacques M Kouta-LopateyDocumento2 pagineSenior Financial Analyst in Washington DC Resume Jacques M Kouta-LopateyJacquesMKoutaLopateyNessuna valutazione finora

- FULL Publication 2017 - Web PDFDocumento57 pagineFULL Publication 2017 - Web PDFIsidor GrigorasNessuna valutazione finora

- Guidelines Jnnurm Bsup IhsdpDocumento26 pagineGuidelines Jnnurm Bsup Ihsdptaniachopra50% (2)

- Projects Solutions PfaDocumento89 pagineProjects Solutions PfaNaresh KumarNessuna valutazione finora

- Res AccountingDocumento33 pagineRes Accountingsunanda88Nessuna valutazione finora

- TRReport 23Documento30 pagineTRReport 23Nathan MartinNessuna valutazione finora

- Unit 6 PDFDocumento10 pagineUnit 6 PDFpayal sachdevNessuna valutazione finora

- Managerial Accounting Sem 1Documento556 pagineManagerial Accounting Sem 1Rakesh Singh100% (1)

- Lums Cases Bibliography FinalDocumento142 pagineLums Cases Bibliography Finalsoni0033100% (2)

- Philippines Good PracticesDocumento8 paginePhilippines Good PracticesKhayc YvonneNessuna valutazione finora

- TN Budget Manual Vol I Book PDFDocumento222 pagineTN Budget Manual Vol I Book PDFhafeena MNessuna valutazione finora

- Life Skills Math Personal Budget Project: Marital Status/DependentsDocumento11 pagineLife Skills Math Personal Budget Project: Marital Status/Dependentsapi-311634646Nessuna valutazione finora

- Multiple Choice QuestionsDocumento7 pagineMultiple Choice QuestionsSardar AftabNessuna valutazione finora

- Management of Government ExpendituresDocumento26 pagineManagement of Government ExpendituresAh MhiNessuna valutazione finora

- Differences Between Fiscal and Monetary PoliciesDocumento7 pagineDifferences Between Fiscal and Monetary PoliciesCheapestPapersNessuna valutazione finora

- Mas MidtermDocumento4 pagineMas MidtermJericho Lavaniego-CerezoNessuna valutazione finora

- COST ACCTG Semi Final Exam 2020Documento9 pagineCOST ACCTG Semi Final Exam 2020TyrsonNessuna valutazione finora

- t7 2009 Dec QDocumento8 paginet7 2009 Dec Q595580Nessuna valutazione finora