Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

V-Adjustments, Closing, Worksheet, Separate and Combined Statements

Caricato da

Roxy SatuneroDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

V-Adjustments, Closing, Worksheet, Separate and Combined Statements

Caricato da

Roxy SatuneroCopyright:

Formati disponibili

V- Adjustments, Closing, Worksheet, Separate and Combined

Statements

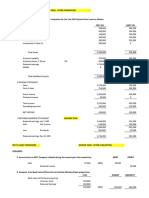

On December 31, 20x4, the end of a monthly period, the following trial balances were prepared for the

Spencer Co. and its branch. Merchandise was billed to the branch by the home office at 120% of cost.

Home Office Branch

Cash P 10, 350 P 2, 650

Accounts Receivable 26, 200 12, 850

Merchandise Inventory, Dec. 1 31, 500 14, 400

Furniture and Fixtures 8, 500 3, 000

Accumulated Depreciation Furniture

and Fixtures 2, 500 540

Unrealized Intercompany Inventory Profit 3, 700

Store Supplies 940 580

Branch 33, 760

Account Payable 35, 400 4, 200

Home Office 32, 040

Capital Stock 65, 000

Retained Earnings 6, 850

Sales 44, 850 20, 000

Shipment to Branch 8, 500

Purchases 27, 600 4, 100

Shipment from Home Office 10, 200

Advertising Expense 2, 850 2, 800

Salaries and Commission Expense 4, 250 2, 350

Miscellaneous Selling Expense 1, 850 1, 050

Rent Expense 2, 700 1, 500

Miscellaneous General Expense

(includes taxes and Insurance) 2, 600 700

P 159, 950 P 159, 950 P56, 780 P 56, 780

The following data were available on December 31:

Merchandise inventories: home office, cost P24, 200; branch, P14, 600, composed of

merchandise received from the home office (at billed price), P11, 700 and merchandise

purchased from outsiders (at cost), P2, 900.

Store supplies on hand: home office, P380; branch, P300.

Prepaid expenses (credit Miscellaneous General Expense): home office, P350; branch,

P120.

Accrued expenses (debit Miscellaneous General Expense): home office, P260; branch,

P105.

Depreciation of furniture and fixtures is recorded at 1% a month.

A cash remittance of P1, 500 had been recorded on the branch books, but the cash had

not yet been received by the home office and no entry has been made.

The home office had charge by the branch with the following expenses that have not yet

been recorded by the branch: taxes and insurance. P220.

Required:

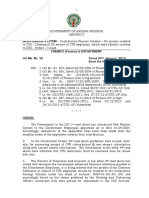

1. Prepare individual statements for the branch and the home office for December 20x4.

2. Prepare a worksheet for combined statements.

3. Prepare combined statements for the branch and the home office.

4. Prepare the entries to adjust and close the books of (a) the branch and (b) the home

office.

Potrebbero piacerti anche

- Mock 3 FARDocumento10 pagineMock 3 FARRodelLaborNessuna valutazione finora

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDocumento6 pagine2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNessuna valutazione finora

- Quiz 9 A6Documento20 pagineQuiz 9 A6Lara FloresNessuna valutazione finora

- Mock Cost Quiz 1Documento8 pagineMock Cost Quiz 1May Zablan PangilinanNessuna valutazione finora

- Discuss The Components and Characteristics of Maximization and Minimization ModelDocumento5 pagineDiscuss The Components and Characteristics of Maximization and Minimization ModelNicole AutrizNessuna valutazione finora

- Taxation: Multiple ChoiceDocumento16 pagineTaxation: Multiple ChoiceJomar VillenaNessuna valutazione finora

- Projected Income Statement of Ayala Land IncorporationDocumento2 pagineProjected Income Statement of Ayala Land IncorporationErika May RamirezNessuna valutazione finora

- Jpia CBLDocumento14 pagineJpia CBLAngelica CatallaNessuna valutazione finora

- Chapter 11 Prob 11-27Documento8 pagineChapter 11 Prob 11-27CelineAbbeyMangalindanNessuna valutazione finora

- AC 510 Kimwell Chapter 5 Solutions 1Documento134 pagineAC 510 Kimwell Chapter 5 Solutions 1Jeston TamayoNessuna valutazione finora

- Tax 2Documento3 pagineTax 2Emmanuel DiyNessuna valutazione finora

- What Is Community Tax?: Speaker: Valerie A. OngDocumento25 pagineWhat Is Community Tax?: Speaker: Valerie A. Ongmarz busaNessuna valutazione finora

- Enrichment Class Tax On CorporationDocumento4 pagineEnrichment Class Tax On CorporationEmersonNessuna valutazione finora

- Kasus 1Documento2 pagineKasus 1VieNessuna valutazione finora

- A Government Employee May Claim The Tax InformerDocumento3 pagineA Government Employee May Claim The Tax InformerYuno NanaseNessuna valutazione finora

- Assignment Transfer Tax ComputationDocumento3 pagineAssignment Transfer Tax ComputationAngelyn SamandeNessuna valutazione finora

- MODULE 6 ExerciseDocumento2 pagineMODULE 6 ExerciseomsfadhlNessuna valutazione finora

- Income & Business Taxation QB3Documento8 pagineIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- May 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasDocumento18 pagineMay 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasgoerginamarquezNessuna valutazione finora

- Recourse Obligation.: RequiredDocumento55 pagineRecourse Obligation.: RequiredJude SantosNessuna valutazione finora

- Prepare A Statement of Partnership Liquidation,...Documento3 paginePrepare A Statement of Partnership Liquidation,...Alene AmsaluNessuna valutazione finora

- Master Budget-WPS OfficeDocumento12 pagineMaster Budget-WPS OfficeRean Jane EscabarteNessuna valutazione finora

- Management Services Agamata 2014Documento12 pagineManagement Services Agamata 2014NICOLE FAYE SAN MIGUELNessuna valutazione finora

- DocxDocumento16 pagineDocxLeah Mae NolascoNessuna valutazione finora

- TX12 - Estate TaxDocumento14 pagineTX12 - Estate TaxPatrick Kyle AgraviadorNessuna valutazione finora

- Chapter 13 - Multiple Choices Problem and Theries KeyDocumento15 pagineChapter 13 - Multiple Choices Problem and Theries KeyKryscel ManansalaNessuna valutazione finora

- 2 - Special IssuesDocumento18 pagine2 - Special IssuesMoe AdelNessuna valutazione finora

- Prelim Topics BM 2Documento32 paginePrelim Topics BM 2ME ValleserNessuna valutazione finora

- Quiz 2 - Accounting ProcessDocumento3 pagineQuiz 2 - Accounting ProcessPrincess NozalNessuna valutazione finora

- CCE ReceivablesDocumento5 pagineCCE ReceivablesJane TuazonNessuna valutazione finora

- Quiz 2 - Cost AccountingDocumento4 pagineQuiz 2 - Cost AccountingDong WestNessuna valutazione finora

- Cash and Cash EquivalentDocumento50 pagineCash and Cash EquivalentAurcus JumskieNessuna valutazione finora

- ADVACCDocumento3 pagineADVACCCianne AlcantaraNessuna valutazione finora

- Accounting For Budgetary AccountsDocumento7 pagineAccounting For Budgetary AccountsSharn Linzi Buan MontañoNessuna valutazione finora

- Auditing Chapter 1Documento7 pagineAuditing Chapter 1Sigei LeonardNessuna valutazione finora

- Final Income TaxationDocumento15 pagineFinal Income TaxationElizalen MacarilayNessuna valutazione finora

- Quiz 101Documento1 paginaQuiz 101Mohammad Lomondot AmpasoNessuna valutazione finora

- CAT Exam 1 1Documento5 pagineCAT Exam 1 1YeppeuddaNessuna valutazione finora

- Group 1 ThesisDocumento9 pagineGroup 1 ThesisFallcia B. AranconNessuna valutazione finora

- St. Vincent'S College Incorporated College of Accounting EducationDocumento8 pagineSt. Vincent'S College Incorporated College of Accounting Educationrey mark hamacNessuna valutazione finora

- 1.3 Responsibility Accounting Problems AnswersDocumento5 pagine1.3 Responsibility Accounting Problems AnswersAsnarizah PakinsonNessuna valutazione finora

- CVP VAnswer Practice QuestionsDocumento5 pagineCVP VAnswer Practice QuestionsAbhijit AshNessuna valutazione finora

- 08 - Activity Based Costing and Balance ScorecardDocumento4 pagine08 - Activity Based Costing and Balance ScorecardMarielle CastañedaNessuna valutazione finora

- AC 300 Activity - 04.11.2023 Groupings: Group 1 Group 2 Group 3 Group 4 Group 5 Group 6Documento2 pagineAC 300 Activity - 04.11.2023 Groupings: Group 1 Group 2 Group 3 Group 4 Group 5 Group 6Frencis A. EsquierdoNessuna valutazione finora

- Unit 1 Erica Abegonia Sec Code 416 Exercise 1Documento2 pagineUnit 1 Erica Abegonia Sec Code 416 Exercise 1Ivan AnaboNessuna valutazione finora

- MSC-Audited FS With Notes - 2014 - CaseDocumento12 pagineMSC-Audited FS With Notes - 2014 - CaseMikaela SalvadorNessuna valutazione finora

- CMO No.03 s2007Documento225 pagineCMO No.03 s2007Pao AuxteroNessuna valutazione finora

- A4 PalacioDocumento3 pagineA4 PalacioPinky DaisiesNessuna valutazione finora

- 55026RR 14-2010 Accreditation PDFDocumento5 pagine55026RR 14-2010 Accreditation PDFlmin34Nessuna valutazione finora

- Cover SheetDocumento4 pagineCover SheetJhoanna TriaNessuna valutazione finora

- Chapter 8 Consolidation IDocumento18 pagineChapter 8 Consolidation IAkkama100% (1)

- Tarlac State University: Collegeof Business and Accountancy Department: AccountancyDocumento11 pagineTarlac State University: Collegeof Business and Accountancy Department: AccountancyJamaica DavidNessuna valutazione finora

- PSW2 Tax1 SetbDocumento1 paginaPSW2 Tax1 Setb'Bhandamme ParagasNessuna valutazione finora

- Chapter One TDocumento39 pagineChapter One TtemedebereNessuna valutazione finora

- ABEJUELA - BSMA 3-5 (Assignment 1)Documento3 pagineABEJUELA - BSMA 3-5 (Assignment 1)Marlou AbejuelaNessuna valutazione finora

- Quiz 2 - Corp Liqui and Installment SalesDocumento8 pagineQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- Chapter 13 Advacc2Documento27 pagineChapter 13 Advacc2Anthony Ariel Ramos Depante0% (1)

- Hausler v. Felton, 10th Cir. (2012)Documento18 pagineHausler v. Felton, 10th Cir. (2012)Scribd Government DocsNessuna valutazione finora

- January 2015 1421559051 12Documento3 pagineJanuary 2015 1421559051 12Kavishek KalindiNessuna valutazione finora

- Certificate of Transfer of ChargeDocumento2 pagineCertificate of Transfer of ChargeHemam PrasantaNessuna valutazione finora

- Bs 50119003519779Documento2 pagineBs 50119003519779janice corderoNessuna valutazione finora

- Procedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarDocumento57 pagineProcedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarAarti Kulkarni0% (2)

- 9 - 30 Trading Setup - A Simple Moving Average StrategyDocumento3 pagine9 - 30 Trading Setup - A Simple Moving Average StrategybhushanNessuna valutazione finora

- Multination Finance Butler 5th EditionDocumento3 pagineMultination Finance Butler 5th EditionUnostudent2014Nessuna valutazione finora

- MCQDocumento25 pagineMCQAnith PillaiNessuna valutazione finora

- Usol SyllabusDocumento93 pagineUsol SyllabusAkansha KalraNessuna valutazione finora

- AP - Property, Plant and EquipmentDocumento6 pagineAP - Property, Plant and EquipmentRhuejane Gay MaquilingNessuna valutazione finora

- Term-Lending Financial Institbttl (Qns India Level: Unit 11 ALLDocumento15 pagineTerm-Lending Financial Institbttl (Qns India Level: Unit 11 ALLSiva Venkata RamanaNessuna valutazione finora

- 08) RCBC V Royal CargoDocumento2 pagine08) RCBC V Royal CargokathreenmonjeNessuna valutazione finora

- Cost Management Problems CA FinalDocumento266 pagineCost Management Problems CA Finalksaqib89100% (1)

- ACCY 231: The Conceptual FrameworkDocumento30 pagineACCY 231: The Conceptual FrameworkVinny AujlaNessuna valutazione finora

- (Application Format For Empanelment of Valuers With Banks) (To Be Obtained in The Letterhead of The Valuer)Documento5 pagine(Application Format For Empanelment of Valuers With Banks) (To Be Obtained in The Letterhead of The Valuer)Subramaniam GanesanNessuna valutazione finora

- Financial DerivativeDocumento2 pagineFinancial DerivativearmailgmNessuna valutazione finora

- Unit 20 and 21 - Derivatives and CommoditiesDocumento6 pagineUnit 20 and 21 - Derivatives and CommoditiesHemant bhanawatNessuna valutazione finora

- Photon Trading Market StructureDocumento13 paginePhoton Trading Market Structurekoko90% (10)

- Go.22 Da Arrears of CPS Account in CashDocumento4 pagineGo.22 Da Arrears of CPS Account in CashVenkatadurgaprasad GopamNessuna valutazione finora

- Taxation Principles and Remedies Finals ReviewerDocumento39 pagineTaxation Principles and Remedies Finals ReviewerRamilNessuna valutazione finora

- TransactionHistory 3236776565Documento2 pagineTransactionHistory 3236776565Badrulsyafiq -Nessuna valutazione finora

- Accounting Principle Kieso 8e - Ch09Documento47 pagineAccounting Principle Kieso 8e - Ch09Sania M. JayantiNessuna valutazione finora

- IT Detections From Gross Total Income Pt-1Documento25 pagineIT Detections From Gross Total Income Pt-1syedfareed596100% (1)

- Agencies Tasked With PFADocumento13 pagineAgencies Tasked With PFAKrissie LimNessuna valutazione finora

- NDPLDocumento84 pagineNDPLsiddhoo2000100% (1)

- Market Outlook 13th January 2012Documento6 pagineMarket Outlook 13th January 2012Angel BrokingNessuna valutazione finora

- TakeoversDocumento22 pagineTakeoversRohit SharmaNessuna valutazione finora

- Cost of CapitalDocumento32 pagineCost of CapitalJames MutarauswaNessuna valutazione finora

- Capital Structure: Basic ConceptsDocumento25 pagineCapital Structure: Basic ConceptsThuyDuongNessuna valutazione finora

- Norton vs. All Asia BankDocumento8 pagineNorton vs. All Asia BankYong NazNessuna valutazione finora