Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Account Test

Caricato da

ajay chaudharyDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Account Test

Caricato da

ajay chaudharyCopyright:

Formati disponibili

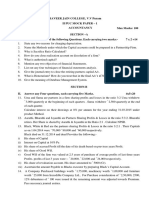

Ajay Chaudhary Classes

-Being Brilliant

Q1. Anita, Babita and Chanderkala are partners in a firm. Anita retires and the Balance Sheet of

this firm on that data is as under:

Liabilities () Assets ()

Creditors 4,000 Cash at Bank 6,000

Reserve 4,500 Debtors 16,000

Workmens Compensation Fund 5,000 Furniture 15,000

Profit and Loss Account 2,500 Plant 20,000

Capitals: Patents 4,000

Anita 20,000

Babita 15,000

Chanderkala 10,000 45,000

61,000 61,000

On retirement it was found that patents were valueless, furniture is to be brought down

12,000 and plant is reduced by 5,000 and there was a liability on account of workmens

compensation fund 3,000. Record necessary entries at the time of retirement.

1 1

Q2. Amit, Balan and Chander were partners in a firm sharing profits in the proportion of , and

2 3

1

respectively. Chander retired on 1st April, 2014. The Balance Sheet of the firm on the date of

6

Chanders retirement was as follows:

Balance Sheet of Amit, Balan and Chander

as at 1st April, 2014

Liabilities Amount Assets Amount

() ()

Sundry Creditors 12,600 Bank 4,100

Provident Fund 3,000 Debtors 30,000

General Reserve 9,000 Less: Provision 1,000 29,000

Capitals: Stock 25,000

Amit 40,000 Investments 10,000

Balan 36,000 Patents 5,000

Chander 20,000 96,500 Machinery 48,000

1,21,000 1,21,000

It was agreed that:

(a) Goodwill will be valued at 27,000.

(b) Depreciation of 10% was to be provided on machinery.

(c) patents were to be reduced by 20%.

(d) Liability on account of provident Fund was estimated at 2,400.

(e) Chander took over investment for 15,800.

(f) Amit and Balan decided to adjust their capitals in proportion of their profit-sharing ratio by

opening current accounts.

Potrebbero piacerti anche

- Screenshot 2022-10-06 at 9.42.46 AMDocumento20 pagineScreenshot 2022-10-06 at 9.42.46 AMUzer BagwanNessuna valutazione finora

- REVISION TEST Admission of A PartnerDocumento2 pagineREVISION TEST Admission of A PartnerOshvi ShrivastavaNessuna valutazione finora

- Partner Ship - IIDocumento6 paginePartner Ship - IIM JEEVARATHNAM NAIDUNessuna valutazione finora

- Accounts DPP Retirement of A PartnerDocumento15 pagineAccounts DPP Retirement of A PartnerPreeti SharmaNessuna valutazione finora

- Retirement Collage SPCC Term 2..Documento5 pagineRetirement Collage SPCC Term 2..Taaran ReddyNessuna valutazione finora

- Accountancy Test 5Documento2 pagineAccountancy Test 5dixa mathpalNessuna valutazione finora

- AccountsDocumento5 pagineAccountssunil kumar100% (2)

- Additional Questions 8Documento8 pagineAdditional Questions 8Neel DudhatNessuna valutazione finora

- Exercise - PartnershipDocumento6 pagineExercise - PartnershipTEIK LOONG KHORNessuna valutazione finora

- 3 AdmissionDocumento14 pagine3 AdmissionAman KakkarNessuna valutazione finora

- Financial Statement Class 11Documento3 pagineFinancial Statement Class 11KUNAL SHARMANessuna valutazione finora

- XII Test (Death, Ret - Diss)Documento4 pagineXII Test (Death, Ret - Diss)MLastTryNessuna valutazione finora

- Retirment of PartnerDocumento30 pagineRetirment of PartnerRoozbeh ElaviaNessuna valutazione finora

- Dissolution Collage SPCC Term 2 PDFDocumento7 pagineDissolution Collage SPCC Term 2 PDFTaaran ReddyNessuna valutazione finora

- Piecemeal Distribution of CashDocumento5 paginePiecemeal Distribution of CashAmar ChavanNessuna valutazione finora

- Cbse Question Bank Admission of PartnersDocumento6 pagineCbse Question Bank Admission of Partnersvsy9926Nessuna valutazione finora

- Model Question Paper - 2011 Class - XII Subject - AccountancyDocumento6 pagineModel Question Paper - 2011 Class - XII Subject - AccountancyKunal AggarwalNessuna valutazione finora

- Admission of PartnerDocumento3 pagineAdmission of PartnerPraWin KharateNessuna valutazione finora

- DISSLUTIONDocumento3 pagineDISSLUTIONomgarg2714Nessuna valutazione finora

- Test DissolutionDocumento1 paginaTest DissolutionGauri SinglaNessuna valutazione finora

- 11 - Final Accounts Assessment 2 PDFDocumento6 pagine11 - Final Accounts Assessment 2 PDFShreyas ParekhNessuna valutazione finora

- 11.piecemeal Distn. DT 27-8-2010Documento2 pagine11.piecemeal Distn. DT 27-8-2010Sooraj RamakrishnanNessuna valutazione finora

- Karnataka II PUC Accountancy Model Question Paper 17Documento6 pagineKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNessuna valutazione finora

- Syjc - B. K. - Prelim Exam No. 7Documento4 pagineSyjc - B. K. - Prelim Exam No. 7karkeraadiyaNessuna valutazione finora

- CASH FLOW Revision-1 PDFDocumento12 pagineCASH FLOW Revision-1 PDFBHUMIKA JAINNessuna valutazione finora

- Amalgamation, Absorption Etc PDFDocumento21 pagineAmalgamation, Absorption Etc PDFYashodhan MithareNessuna valutazione finora

- Accounts Parntership TestDocumento6 pagineAccounts Parntership TestdhruvNessuna valutazione finora

- 12th Accounts Partnership Test 15 Sept.Documento6 pagine12th Accounts Partnership Test 15 Sept.SGEVirtualNessuna valutazione finora

- Retirement of Partners Cbse Question BankDocumento6 pagineRetirement of Partners Cbse Question Bankabhayku1689Nessuna valutazione finora

- Admission of A Partner AssignmentDocumento3 pagineAdmission of A Partner AssignmentAishwarya NaikNessuna valutazione finora

- Partnership - Admission of Partner - DPP 05 (Of Lecture 07) - (Kautilya)Documento8 paginePartnership - Admission of Partner - DPP 05 (Of Lecture 07) - (Kautilya)DevanshuNessuna valutazione finora

- Adobe Scan 29 Aug 2022Documento9 pagineAdobe Scan 29 Aug 2022kumardeepak5242Nessuna valutazione finora

- ACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZXDocumento2 pagineACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZXAditya srivastavaNessuna valutazione finora

- Accountancy Assignment Grade 12Documento4 pagineAccountancy Assignment Grade 12sharu SKNessuna valutazione finora

- Ca QP ModelDocumento3 pagineCa QP Modelmahabalu123456789Nessuna valutazione finora

- Retire Death Dissolution SheetDocumento6 pagineRetire Death Dissolution SheetTanvi SisodiaNessuna valutazione finora

- Retirement of Partners - Updated WorksheetDocumento8 pagineRetirement of Partners - Updated WorksheetMisri SoniNessuna valutazione finora

- 12 Accounts Summer Vacation Assignment 2022-23Documento15 pagine12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaNessuna valutazione finora

- Cbse Questions Adm RetirementDocumento19 pagineCbse Questions Adm RetirementDeepanshu kaushikNessuna valutazione finora

- II Puc Accountancy Mock Paper IIDocumento5 pagineII Puc Accountancy Mock Paper IISAI KISHORENessuna valutazione finora

- Sale of PartnershipDocumento11 pagineSale of PartnershipJoel VargheseNessuna valutazione finora

- 12 Com....Documento5 pagine12 Com....Advanced AcademyNessuna valutazione finora

- Dissolution of A PartnerDocumento11 pagineDissolution of A PartnerjdsiNessuna valutazione finora

- Balance Sheet As On 31-12-2013: Liabilities Rs. Assets RsDocumento1 paginaBalance Sheet As On 31-12-2013: Liabilities Rs. Assets RsM JEEVARATHNAM NAIDUNessuna valutazione finora

- 12 Podar International School QPDocumento2 pagine12 Podar International School QPAkshat KhetanNessuna valutazione finora

- 1st Semi Prelium Chp. 1, 3, 4, 5, 6 (40 Marks) Dt. 07.12.2020 (All Branch)Documento3 pagine1st Semi Prelium Chp. 1, 3, 4, 5, 6 (40 Marks) Dt. 07.12.2020 (All Branch)Arthur ShelbyNessuna valutazione finora

- Ts Grewal Class 12 Accountancy Chapter 7 PDFDocumento11 pagineTs Grewal Class 12 Accountancy Chapter 7 PDFmonikaNessuna valutazione finora

- Commerce Syllabus Degree Part 2Documento12 pagineCommerce Syllabus Degree Part 2Dhruva AryanNessuna valutazione finora

- Corporate Accounting - I Semester ExaminationDocumento7 pagineCorporate Accounting - I Semester ExaminationVijay KumarNessuna valutazione finora

- Admission of A Partner PDFDocumento8 pagineAdmission of A Partner PDFSpandan DasNessuna valutazione finora

- Dissolution of FirmDocumento4 pagineDissolution of FirmAMIN BUHARI ABDUL KHADERNessuna valutazione finora

- Adobe Scan 09 Nov 2023Documento6 pagineAdobe Scan 09 Nov 2023iamadrish17Nessuna valutazione finora

- Set - B - SolutionDocumento2 pagineSet - B - Solutionyh9bzwtzwmNessuna valutazione finora

- 1Documento5 pagine1firoozdasmanNessuna valutazione finora

- Assignment - Dissolution and Death ChapterDocumento2 pagineAssignment - Dissolution and Death ChapterDevan KocharNessuna valutazione finora

- SEM III - Advanced Accounting (EM)Documento4 pagineSEM III - Advanced Accounting (EM)Abdul MalikNessuna valutazione finora

- ABPM Weekly Test 06.02.2020Documento3 pagineABPM Weekly Test 06.02.2020Veera SwamyNessuna valutazione finora

- Class 12 Accountancy Sample Paper Term 2Documento3 pagineClass 12 Accountancy Sample Paper Term 2Ayaan KhanNessuna valutazione finora

- Tales of Peasants, Traders, and Officials: Contracting in Rural Andhra Pradesh, 1980-82Da EverandTales of Peasants, Traders, and Officials: Contracting in Rural Andhra Pradesh, 1980-82Nessuna valutazione finora

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItDa EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItValutazione: 5 su 5 stelle5/5 (1)

- M4 Answer Key 1 Nad 3Documento11 pagineM4 Answer Key 1 Nad 3JOSCEL SYJONGTIANNessuna valutazione finora

- Kurt Sullivan Income Statement To Republic Bank 2020-2022Documento7 pagineKurt Sullivan Income Statement To Republic Bank 2020-2022Stephen FrancisNessuna valutazione finora

- 32531rtp May14 Ipcc-P3Documento37 pagine32531rtp May14 Ipcc-P3pathan1990Nessuna valutazione finora

- 1Documento48 pagine1Hamza Ali100% (2)

- Test Bank - Chapter 7 Variable CostingDocumento47 pagineTest Bank - Chapter 7 Variable CostingAiko E. Lara86% (7)

- FM Chapter 3.new-1Documento11 pagineFM Chapter 3.new-1Terefe DubeNessuna valutazione finora

- Chap 2 Management Accounting AgamataDocumento13 pagineChap 2 Management Accounting AgamataLee DlwlrmaNessuna valutazione finora

- Pakistan Synthetic... AssignmentDocumento6 paginePakistan Synthetic... AssignmentArooj IqbalNessuna valutazione finora

- Nestle and Britannia RatiosDocumento21 pagineNestle and Britannia RatiosKartik RawatNessuna valutazione finora

- Section 3 Group 14 IocDocumento5 pagineSection 3 Group 14 IocRachit Jaiswal MBA21Nessuna valutazione finora

- Diagnostic Examination For PPE (11over20)Documento11 pagineDiagnostic Examination For PPE (11over20)Sunny MoreNessuna valutazione finora

- Solution in Partnership Liquidation InstallmentDocumento20 pagineSolution in Partnership Liquidation InstallmentNikki GarciaNessuna valutazione finora

- 8 PDFDocumento77 pagine8 PDFHemanthThotaNessuna valutazione finora

- Local CHAPTER 14 COST ACCOUNTING (Answer)Documento4 pagineLocal CHAPTER 14 COST ACCOUNTING (Answer)MA ValdezNessuna valutazione finora

- Assignment Accounting Merchendising #2Documento1 paginaAssignment Accounting Merchendising #2NELVA QABLINANessuna valutazione finora

- BADNEWS!Documento4 pagineBADNEWS!Janella CastroNessuna valutazione finora

- SCM Discussion1Documento18 pagineSCM Discussion1David GuevarraNessuna valutazione finora

- Methods of Cost Classification: Done By: Nived, Kartik, Peter, Nirmal, VedashreeDocumento16 pagineMethods of Cost Classification: Done By: Nived, Kartik, Peter, Nirmal, VedashreeShangh PeterNessuna valutazione finora

- Introduction To Corporate Finance - Unit 1Documento21 pagineIntroduction To Corporate Finance - Unit 1VEDANT SAININessuna valutazione finora

- BE AnalysisDocumento44 pagineBE Analysissahu.tukun003Nessuna valutazione finora

- CFAB Accounting Chap02 Accounting EquationDocumento38 pagineCFAB Accounting Chap02 Accounting EquationHoa NguyễnNessuna valutazione finora

- Class-12-Accountancy-Part-2-Chapter-6 SolutionsDocumento41 pagineClass-12-Accountancy-Part-2-Chapter-6 Solutionssugapratha lingamNessuna valutazione finora

- Class No 14 & 15Documento31 pagineClass No 14 & 15WILD๛SHOTッ tanvirNessuna valutazione finora

- Igcse Accounting 2-2Documento43 pagineIgcse Accounting 2-2Yenny Tiga88% (8)

- Advanced Accounting - Dayag 2015 - Chapter 15 - Multiple Choice Solution (26-28)Documento1 paginaAdvanced Accounting - Dayag 2015 - Chapter 15 - Multiple Choice Solution (26-28)John Carlos DoringoNessuna valutazione finora

- AAPL DCF ValuationDocumento12 pagineAAPL DCF ValuationthesaneinvestorNessuna valutazione finora

- Test (Far)Documento9 pagineTest (Far)Aira Kaye MartosNessuna valutazione finora

- Cost Management Accounting Assignment Bill French Case StudyDocumento5 pagineCost Management Accounting Assignment Bill French Case Studydeepak boraNessuna valutazione finora

- Chapter 13 (4) Additional QuestionDocumento2 pagineChapter 13 (4) Additional QuestionJason BickertNessuna valutazione finora

- Prepare Financial Statements From Trial Balance in ExcelDocumento5 paginePrepare Financial Statements From Trial Balance in ExcelShania FordeNessuna valutazione finora