Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Future of Chemicals III

Caricato da

JohnCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Future of Chemicals III

Caricato da

JohnCopyright:

Formati disponibili

Perspective Marcus Morawietz

Matthias Bumler

Pedro Caruso

Jayant Gotpagar

Future of Chemicals III

The Commoditization

of Specialty Chemicals

Managing the Inevitable

Contact Information

Amsterdam Dubai London

Roger van den Heuvel Andrew Horncastle Richard Verity

Principal Principal Partner

+31-20-504-1900 +971-4-390-0260 +44-20-7393-3436

roger.vandenheuvel@booz.com andrew.horncastle@booz.com richard.verity@booz.com

Beirut Dsseldorf So Paulo

Ibrahim El-Husseini Dr. Joachim Rotering Arthur Ramos

Partner Partner Partner

+961-1-336433 +49-211-3890-250 +55-11-5501-6229

ibrahim.el-husseini@booz.com joachim.rotering@booz.com arthur.ramos@booz.com

Berlin Dr. Sven Uwe Vallerien Tokyo

Matthias Baeumler Partner Paul Duerloo

Principal +49-211-3890-260 Partner

+49-30-88705-852 sven.vallerien@booz.com +81-3-3436-8615

matthias.baeumler@booz.com paul.duerloo@booz.com

Frankfurt

Dallas Marcus Morawietz

Andrew Clyde Partner

Partner +49-69-97167-467

+1-214-746-6566 marcus.morawietz@booz.com

andrew.clyde@booz.com

Houston

Dennis Cassidy Pedro Caruso

Principal Principal

+1-214-746-6552 +1-713-650-4105

dennis.cassidy@booz.com pedro.caruso@booz.com

Scott Sharabura Jayant Gotpagar

Principal Principal

+1-214-746-6568 +1-713-650-4107

scott.sharabura@booz.com jayant.gotpagar@booz.com

Booz & Company

EXECUTIVE As the specialty chemical sector fights to stave off the

deleterious influence of commoditizationa losing struggle

SUMMARY

for many businessesit is becoming increasingly clear that

a large number of companies in the industry have failed

to manage and nurture their business models well enough.

Specialty chemical businesses are dependent on innovation

and a continuous pipeline of real innovative products

and applications. But research and development funds have

dried up, and new molecular discoveries are increasingly

rare. Few specialty chemical companies have demonstrated

the ability or nimbleness to adjust to the new, much more

difficult realities in the industry, and it is little surprise that the

specialty chemical sector is rapidly shrinking and searching

for a clear direction. How well these companies adopt one

of three business models will determine success or failure for

individual outfits and the industry as a whole.

Booz & Company 1

KEY HIGHLIGHTS

Commoditization is an inevitable

part of the life cycle of most

products; specialty chemicals are

not an exception.

The specialty chemical sector

today is particularly vulnerable to

commoditization, as innovation

has dried up and competition has

increased.

Too many specialty chemical

companies have tried to fight

commoditization with misdirected

innovation and service levels that

cannot be sustained profitably.

Looking ahead, to reach THE PROBLEM gross margins have declined to a

historical low of about 30 percent.

sustainable and profitable growth,

specialty chemical companies must

WITH SPECIALTY

rethink their portfolios, challenge CHEMICALS Except for a few niche segments,

commoditization was and still is an

the conventional specialty mind-set,

and redefine their business models inevitable result of the life cycle of

to adapt to new realities. specialty chemicals. At first, new and

differentiating chemicals, polymers, or

There used to be something special formulations are developed, driven by

about specialty chemicals, but application know-how or technology

in many ways this industry has advances and usually protected by

lost its luster. Like so many once- patents. Initially, because of their

hot sectors with once-enviable unique and differentiating properties,

profitstelecommunications and PCs which enable customers to achieve

are good examplesthe specialty higher levels of product performance

chemical industry has been beset by or to enter new applications, these

commoditization. Just a decade ago, molecules are perceived as having

gross margins for specialty products significant value for target segments

including additives, pigments, personal of the customer base. As a result,

care products made with process chemical companies can charge a

chemicals, and selected polymers premium for these products. Indeed,

were extremely attractive; thus, they are so unique and fresh that

many companieseven many large while customers are aware of the

oneswere motivated to participate potential of these new products,

in the specialty segment. For example, they require support in the use and

gross margins for polycarbonates fine-tuning of them. To address

were a remarkable 80 to 90 percent; this, the most enterprising specialty

now they are as low as 60 percent and chemical companies dedicate sales

falling; indeed, most customers today forces with expertise in applications

view polycarbonates as a commodity. and technical specifications to these

And thats illustrative of the specialty new products, and they also typically

chemical sector as a whole, where bundle servicesfor example, training

2 Booz & Company

that is tailored to a customers specific begin to penetrate the market, often expenditures may not be warranted.

needswith the chemicals. All of this leveraging its attractive cost base (In several cases, a specialty chemical

helps justify charging more for the and lucrative profit margins. With company has suddenly found itself

specialized items. Call this the sweet some trepidation about losing its in a race to the bottom.) A long and

spot for specialty chemical companies. first-mover advantage, the specialty costly price waror, in this context,

chemical provider feels compelled to commoditizationensues.

Over time, though, the memories redirect its support toward lower-

of that sweet spot are about all margin applications in hopes of An apt illustration of this product

that remain. Slowly, but inevitably, expanding and creating new markets proliferation phenomenon can be seen

other manufacturers, which have for its productoften overlooking by comparing the 1980s to today (see

gradually improved their know- the fact that these less profitable Exhibit 1). Decades ago, engineering

how of the specialty chemical arena, applications and additional R&D plastics like polycarbonates and nylon

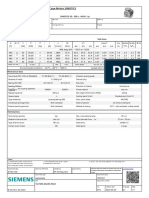

Exhibit 1

Plastics Proliferate and Move from High Margins to Low over Two Decades

e 1980s 2000s

trativ

Illus

Bio-Based

PE/PP PC/PUR PE/PP PC/PUR

Consumer Goods

Epoxy PE/PP/ABS

PVC PUR

Infrastructure Epoxy

PE/PP/ABS PVC

PUR

Healthcare PC Nylon

PET PP PP PC/PUR Polyester

Electronics PBT PBT PP PC

PP PC

PVC/Acrylic/ABS

Auto PVC/Acrylic/ABS PC/Nylon PEI/PPS

PC/Nylon/PP

Low Medium High Low Medium High

Value-Add Value-Add

(increasing margin) (increasing margin)

Note: Abbreviations are for acrylonitrile butadiene styrene (ABS), polybutylene terephthalate (PBT), polycarbonate (PC), polyethylene (PE), polyetherimide (PEI), polyethylene

terephthalate (PET), polypropylene (PP), polyphenylene sulfide (PPS), polyurethane (PUR), and polyvinyl chloride (PVC).

Source: Industry interviews; Booz & Company analysis

Booz & Company 3

were primarily serving high-value- entrants had to accept substantially can replace commoditized products

add applications with relatively small lower margins to compete. And the with new ones, their innovation-based

market sizesfor example, auto features that initially differentiated business model can remain intact.

companies used them for components some of these engineering plastics Unfortunately, that is getting harder

that had to withstand high from other types of chemicals are now and harder to do: The innovation

temperatures. But a slew of companies commonplace. rate in the chemical sector in general

have developed new applications is declining, and advances are

for these polymers, widening their For specialty chemical companies, increasingly focused on products

market significantly. However, as these this unavoidable scenario doesnt with limited business potential or

markets were often already served seem like the end of the world, at merely incremental innovation value

by lower-priced incumbents, the new least at first. Indeed, as long as they (see Exhibit 2).

Exhibit 2

The Innovation Pipeline Dries Up

DECLINE IN NUMBER OF NEW MOLECULES AND BLOCKBUSTERS

Since the 1960's we have seen few

Number of New Molecules new molecules and fewer blockbusters

6

PMMA PEEK PEI

PS

PPSU

5 PA

PP

LDPE HDPE LCP

PUR

4

PI PSU

PTFE

3 PET

PC ABS

PBT LLDPE

2

PPE PES

1 PVC

0

1920-1930 1930-1940 1940-1950 1950-1960 1960-1970 1970-1980 1980-1990 1990-2000

- Size of bubble indicates relative volume, with PET showing a baseline of 60 KTon

- Chemicals with a volume of > 0.1 KTon are indicated by a small dot ( )

Note: For PS, PTFE, and PVC, the date of commercialization is used (molecules discovered in 1800s). Abbreviations are for acrylonitrile butadiene styrene (ABS), high-density

polyethylene (HDPE), liquid crystalline polymer (LCP), low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), polyamide (PA), polybutylene terephthalate (PBT),

polycarbonate (PC), polyether ether ketone (PEEK), polyetherimide (PEI), polyether sulfide (PES), polyethylene terephthalate (PET), polyimide (PI), poly(methyl methacrylate) (PMMA),

polypropylene (PP), polyphenylene ether (PPE), polyphenylene sulfone (PPSU), polystyrene (PS), polysulfone (PSU), polytetrafluoroethane (PTFE), polyurethane (PUR), and polyvinyl

chloride (PVC).

Source: Chemsystems, 2007 data; Booz & Company analysis

4 Booz & Company

Even companies with market-focused, has worsened the decline in developing course, production and supply chain

customer-centric philosophies new chemicals. R&D expenditures in optimization.

increasingly struggle because the specialty segment have dropped by

most of the low-hanging fruit in as much as 20 percent since 2002. Often, market dislocations or shocks

applications has already been picked, will catalyze such a dramatic change.

and customers knowledge about All of which has left many specialty In those cases, companies have no

the impact and relevance of new chemical companies with no choice choice but to come up with new

chemicals to their products has but to adjust their marketing strategies and innovative business

grown significantly, enough that strategies away from innovation models; if they dont, they doom

they are pickier about purchasing and new applications toward a less themselves to suboptimal performance.

untried chemicals and applications. profitable portfolio of commodities But the relentless economic growth of

In addition, with a greater focus and specialty products that are the 1990s and mid-2000s to a large

than ever on cutting costs, customers rapidly diminishing in value. The degree cushioned the fall for many

assess the potential value delivered result is too much money and effort specialty chemical companies, whose

by their chemical suppliers much targeted at selling commodities, profits didnt reflect the true weakness

more rigorously than in the past. which hurts profit margins, while new of their portfolios. So they didnt begin

In short, several players are faced product development lags, leaving to feel the pain of commoditization

with an increasing fragmentation of the portfolio woefully shy of critical until more recently, when the

their product portfolios and eroding high-margin specialty items. More global economy slowed and global

margins just when the bargaining than anything else, this reflects the competition increased. Only now is

power of their customers and the difficulty of changing business models it becoming readily apparent that

number of competitors are increasing. even as business conditions shift, many specialty chemical companies

because altering them to face new are weighed down by their business

Out of this, a vicious circle has environments involves significant models and need to adjust, a rather

emerged. Many companies have and often uncomfortable dislocations painful exercise that few organizations

responded by reducing the amount in organizational structure, will undertake successfully.

they spend on innovationan effort to processes, R&D focus, application

cut costs when margins are falling that technology development, and, of

R&D expenditures in the specialty

segment have dropped by as much

as 20 percent since 2002.

Booz & Company 5

WHICH NEW Commoditization is inevitable

and needs to be managed actively.

during commoditization. This is not

inherently a competitive advantage; it

BUSINESS MODEL? Once a company is aware of the merely buys time while new chemicals

commoditization threat in its and products can be developed. From

portfolio, applying appropriate a business model perspective, this

business models can help sustain approach adds a lot of complexity

the profitability of respective to the supply chain, so it should

business segments. Turning the be undertaken only when all the

flawed models around requires life-cycle costs are weighed against

looking at the specialty chemical the potential returns. Examples of

business with an entirely new products customized in this fashion

lens, in the process analyzing a include paints and coatings made

companys operations objectively to the specifications of individual

and making tough decisions that automakers or polycarbonates

ultimately transform laggard enhanced with thermoplastics like

organizations into those more suited ABS for specific aerospace and defense

for todays operational conditions companies. We believe that a majority

in the industry. Clearly, the specialty of commoditizing specialties can be

chemical sector will fundamentally transformed into customized products.

change in the next decade. But just

applying a commodities business 2. Solutions and materials: This model

model to specialty businesses is not is expected to be the new growth

a satisfactory answer in all cases, lever for todays specialty players. In

because it places significant value this approach, companies use their

potential at risk. In our view, there are deep knowledge of their customers,

three ideal possible approaches that applications, and technology to find

specialty chemical companies should new materials and solutions for large

consider: groups of end-users. Companies that

implement this strategy successfully

1. Customized products: This is a can enjoy the types of sustainable

good strategy when the specialty and stable revenue returns that

chemical has already become a the so-called razor-blade model

pseudo-commodity and by itself offers; that is, after the initial sale,

cannot command a premium customers are likely to keep coming

anymore. By custom tailoring the back for refills over a long period of

formulation for individual customers time. This approach is particularly

in particular industries, companies valuable for established chemical

take advantage of their inside companies because their long-standing

knowledge of end-users to maintain relationships with customersand

somewhat higher premiums even their intimate understanding of

Turning flawed business models

around requires looking at the

specialty chemical business with

an entirely new lens.

6 Booz & Company

customer products, processes, and and materials model will require a design processas opposed to merely

operationsallow them to address significant upgrade of a companys hoping that success will be achieved

end-user needs more precisely than go-to-market capabilities as well are absolutely essential.

newer outfits in the chemical industry. as its complexity and innovation

Pricing and promotions management is management skills. For example, Companies that choose to focus on

critical, however, to make this strategy transformed specialty chemical customized products or solutions and

work. Products must be offered at companies will have to successfully materials must also clearly identify the

prices that customers perceive to be adopt new innovation-focused markets in which they can gain and

on par with the value of these new strategies encompassing five sustain leadership positions. Currently,

solutions and materials, and chemical key dimensions of innovation specialty chemical companies

companies have to decide whether to management: prolific idea generation; positioned in the top three of their

seek high margins but low volume cross-functional and -regional segments sustain the most attractive

(and possibly low cash flow) or high cooperation; multiple product margins. Going forward, transformed

volume with lower margins. growth platforms with realistic specialty players must have sufficient

targets; a disciplined process that management vision to accurately

Lonzas recent bioscience blitz and holds project managers responsible anticipate which future segment will

Monsantos transformation from for execution; and ruthless portfolio provide the most value for customers,

a fertilizer and pesticide giant into management. While most companies and they must have the discipline to

the worlds largest proponent of are good at the first dimensions, very develop and deliver these offerings

genetically modified organism seeds few actually attempt real portfolio at the lowest cost and in the least

are apt illustrations of a solutions and managementto their detriment. In wasteful ways. In addition, companies

materials approach. order to achieve a balanced innovation must have the foresight to recognize

portfolio, killing bad projects early when a specialty chemical, application,

Overall, a move into either a and making hard decisions about or product is headed toward

customized products or a solutions outcomes at clear hurdle points in the commoditization (see Exhibit 3). If

Exhibit 3

Signs of Commoditization

Internal Signs (Symptoms) External Signs

Accelerating proliferation of SKUs Increasing excess capacity in upstream segment

(e.g. resin manufacturing)

Declining margin Demand slowdown in the target downstream markets

Widening gap in the profit split between upstream core Emerging technology breakthroughs creating cheap

molecule" production and downstream application" product substitutes in the downstream

Compressing timeline in the margin erosion Emergence of low-cost players

Decreasing sales force effectiveness with same Emergence of new channels

structure and incentives

Source: Booz & Company

Booz & Company 7

it is, the company must make quick and vertical layers of customers

and careful decisions about separating organizations. This allows them

the item from the specialty side of the to develop a lasting knowledge of

business. customer behaviors, needs, and

preferences, which is a far more

3. Basic chemicals: For most powerful barrier to entry than, say,

companies, both customized products patent protection, which has a limited

and solutions and materials are lifetime. In addition, these companies

viewed as strategies that carry too judiciously seek new growth

much risk and, hence, are avoided. opportunities that dovetail well with

Indeed, moving from a specialties their culture and mind-set and never

business model to merely offering compromise the coherence of their

basic, commoditized chemicals is the strategy, built on their capabilities,1 in

typical approach and will continue pursuit of bigger markets where they

to be a valid option for products that dont belong.

do not offer additional potential as

customized products or solutions In any case, companies will need

and materials. An upcoming to be prepared to establish several CONCLUSION

Booz & Company report in the business models based on the different

Future of Chemicals series will offer a commoditization speeds of their

step-by-step guide to implementing a portfolios and reflecting the variety

commodities-based chemical strategy. of their natural businesses, which

will be determined by differences in

Although commoditization appears customers, regions, assets, operations, Specialty chemical companies

to be an inevitable stage in the and projected revenues and expenses. are facing a critical crossroads

specialty chemical landscape today, These natural businesses must be of their own making. Individual

some specialty niche markets still maintained separately, segregated business segments will have to

exist; examples are defense and from one another so that each cope with managing the inevitable

aerospace. In our work with several focuses solely on the part of the commoditization process. We have

niche players, we have observed that market that it is targeting. And as outlined in some detail the expected

the most successful ones cultivate the the external environment evolves, the transformation of specialties.

ability to seamlessly link innovative natural businesses may change shape Companies that first succeed in

problem-solving, marketing, and accordingly, requiring an updated analyzing and identifying the key

operating activities and to form business model. components of their product lines and

tight relationships with horizontal the natural businesses they possess

will have the opportunity to shape the

market. In many ways, the product

portfolios of these companies can

and should dictate their future and

the type of business models they must

implement. Without that alignment,

the chances decline rapidly that

specialty chemical companies will not

fall prey to commoditization.

8 Booz & Company

Endnote

1

Leinwand, Paul and Cesare Mainardi, Essential Advantage:

How to Win with a Capabilities-Driven Strategy (Harvard Business

Review Press, December 2010).

About the Authors

Dr. Marcus Morawietz is a

partner with Booz & Company

in Frankfurt. He focuses on

growth strategies, supply chain

optimization, and transaction

support for the chemical

industry.

Matthias Bumler is a principal

with Booz & Company in Berlin.

He specializes in strategy and

growth development, as well as

operations restructuring efforts,

for companies across the entire

chemical value chain.

Pedro Caruso is a principal

with Booz & Company in

Houston. He specializes

in strategy design and

implementation for energy

and chemical companies. He

balances hard-core analytics

with soft considerations

required to achieve impact.

Jayant Gotpagar is a principal

with Booz & Company in

Houston. He focuses on

business unit growth strategies,

operating model design,

innovation management, and

operational improvement

programs in the firms

chemicals and downstream oil

and gas sector.

Booz & Company 9

The most recent Worldwide Offices

list of our offices

and affiliates, with Asia Bangkok Helsinki Middle East Florham Park

addresses and Beijing Brisbane Istanbul Abu Dhabi Houston

telephone numbers, Delhi Canberra London Beirut Los Angeles

can be found on Hong Kong Jakarta Madrid Cairo Mexico City

our website, Mumbai Kuala Lumpur Milan Doha New York City

www.booz.com. Seoul Melbourne Moscow Dubai Parsippany

Shanghai Sydney Munich Riyadh San Francisco

Taipei Oslo

Tokyo Europe Paris North America South America

Amsterdam Rome Atlanta Buenos Aires

Australia, Berlin Stockholm Chicago Rio de Janeiro

New Zealand & Copenhagen Stuttgart Cleveland Santiago

Southeast Asia Dublin Vienna Dallas So Paulo

Adelaide Dsseldorf Warsaw DC

Auckland Frankfurt Zurich Detroit

Booz & Company is a leading global management

consulting firm, helpingthe worlds top businesses,

governments, and organizations.

Our founder, Edwin Booz, defined the profession

when he established the first management consulting

firm in 1914.

Today, with more than 3,300 people in 61 offices

around the world, we bring foresight and knowledge,

deep functional expertise, and a practical approach

to building capabilities and delivering real impact.

We work closely with our clients tocreate and

deliver essential advantage.

For our management magazine strategy+business,

visit www.strategy-business.com.

Visit www.booz.com to learn more about

Booz & Company.

2010 Booz & Company Inc.

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Banas Dairy ETP Training ReportDocumento38 pagineBanas Dairy ETP Training ReportEagle eye0% (2)

- Metamorphic Rocks ImagesDocumento7 pagineMetamorphic Rocks Imagesapi-289985616100% (1)

- UW Computational-Finance & Risk Management Brochure Final 080613Documento2 pagineUW Computational-Finance & Risk Management Brochure Final 080613Rajel MokNessuna valutazione finora

- Deposit Control Polymers For Stressed Phosphate-Based Cooling Water SystemsDocumento15 pagineDeposit Control Polymers For Stressed Phosphate-Based Cooling Water SystemsJohnNessuna valutazione finora

- Chemical Injection OcrDocumento4 pagineChemical Injection OcrJohnNessuna valutazione finora

- Organize To InnovateDocumento3 pagineOrganize To InnovateJohnNessuna valutazione finora

- Betrayal of TrusttDocumento3 pagineBetrayal of TrusttJohnNessuna valutazione finora

- Efficient Estimation Parameters NBDDocumento23 pagineEfficient Estimation Parameters NBDJohnNessuna valutazione finora

- Failure To Staff EffectivelymentDocumento3 pagineFailure To Staff EffectivelymentJohnNessuna valutazione finora

- Beta and Gamma FunctionsDocumento32 pagineBeta and Gamma FunctionsSa'ad Abd Ar RafieNessuna valutazione finora

- Lack of ComposuresDocumento3 pagineLack of ComposuresJohnNessuna valutazione finora

- Insensitive To OthersprovementDocumento3 pagineInsensitive To OthersprovementJohnNessuna valutazione finora

- Failure To Build A TeamementDocumento3 pagineFailure To Build A TeamementJohnNessuna valutazione finora

- Unable To Adapt TotDocumento3 pagineUnable To Adapt TotJohnNessuna valutazione finora

- Es9b03891 Si 001Documento13 pagineEs9b03891 Si 001JohnNessuna valutazione finora

- Lack of Ethics and ValuesntDocumento3 pagineLack of Ethics and ValuesntJohnNessuna valutazione finora

- Negative Binomial RegressionDocumento36 pagineNegative Binomial RegressionJohnNessuna valutazione finora

- SIAM Report On Mathematics in Industry (MII 2012)Documento48 pagineSIAM Report On Mathematics in Industry (MII 2012)Madd MathsNessuna valutazione finora

- Cryptography TheoryDocumento76 pagineCryptography TheoryVickyNessuna valutazione finora

- EAU Guidelines On Urolithiasis - 2017 - 10 05V2 PDFDocumento84 pagineEAU Guidelines On Urolithiasis - 2017 - 10 05V2 PDFMelanie SalimNessuna valutazione finora

- Beta and Gamma FunctionsDocumento32 pagineBeta and Gamma FunctionsSa'ad Abd Ar RafieNessuna valutazione finora

- Table of Contents: PurgingDocumento11 pagineTable of Contents: PurgingJohnNessuna valutazione finora

- Exmax - Revolution: Compact - Easy Installation - Universal - Cost Effective - SafeDocumento4 pagineExmax - Revolution: Compact - Easy Installation - Universal - Cost Effective - SafeJohnNessuna valutazione finora

- LIT2007 Temp - Compensation - W - PH PDFDocumento1 paginaLIT2007 Temp - Compensation - W - PH PDFJohnNessuna valutazione finora

- 475 Using Asme Performance Test Codes in TheDocumento18 pagine475 Using Asme Performance Test Codes in Theaaa206Nessuna valutazione finora

- Silica Analyzer - HACHDocumento136 pagineSilica Analyzer - HACHSheikh ZakirNessuna valutazione finora

- SIAM Report On Mathematics in Industry (MII 2012)Documento48 pagineSIAM Report On Mathematics in Industry (MII 2012)Madd MathsNessuna valutazione finora

- Cooling Water Analysis: by Ashutosh Mehndiratta Kribhco Shyam Fertilizers Limited Shahjahanpur Uttar Pradesh IndiaDocumento39 pagineCooling Water Analysis: by Ashutosh Mehndiratta Kribhco Shyam Fertilizers Limited Shahjahanpur Uttar Pradesh IndiaJohnNessuna valutazione finora

- Paper 8Documento8 paginePaper 8Veky PamintuNessuna valutazione finora

- Nephrolithiasis: in The ClinicDocumento16 pagineNephrolithiasis: in The ClinicJohnNessuna valutazione finora

- TrigggonommeterDocumento467 pagineTrigggonommeterJohnNessuna valutazione finora

- Table of Contents: PurgingDocumento11 pagineTable of Contents: PurgingJohnNessuna valutazione finora

- EAU Guidelines On Urolithiasis - 2017 - 10 05V2 PDFDocumento84 pagineEAU Guidelines On Urolithiasis - 2017 - 10 05V2 PDFMelanie SalimNessuna valutazione finora

- Qatar Airways E-ticket Receipt for Travel from Baghdad to AthensDocumento1 paginaQatar Airways E-ticket Receipt for Travel from Baghdad to Athensمحمد الشريفي mohammed alshareefiNessuna valutazione finora

- Mini Ice Plant Design GuideDocumento4 pagineMini Ice Plant Design GuideDidy RobotIncorporatedNessuna valutazione finora

- Peter Wilkinson CV 1Documento3 paginePeter Wilkinson CV 1larry3108Nessuna valutazione finora

- 2006-07 (Supercupa) AC Milan-FC SevillaDocumento24 pagine2006-07 (Supercupa) AC Milan-FC SevillavasiliscNessuna valutazione finora

- 1LE1503-2AA43-4AA4 Datasheet enDocumento1 pagina1LE1503-2AA43-4AA4 Datasheet enAndrei LupuNessuna valutazione finora

- Tata Chemicals Yearly Reports 2019 20Documento340 pagineTata Chemicals Yearly Reports 2019 20AkchikaNessuna valutazione finora

- Software EngineeringDocumento3 pagineSoftware EngineeringImtiyaz BashaNessuna valutazione finora

- C 7000Documento109 pagineC 7000Alex Argel Roqueme75% (4)

- Haul Cables and Care For InfrastructureDocumento11 pagineHaul Cables and Care For InfrastructureSathiyaseelan VelayuthamNessuna valutazione finora

- BlueDocumento18 pagineBluekarishma nairNessuna valutazione finora

- Binaural Recording Technology: A Historical Review and Possible Future DevelopmentsDocumento22 pagineBinaural Recording Technology: A Historical Review and Possible Future DevelopmentsNery BorgesNessuna valutazione finora

- COVID-19's Impact on Business PresentationsDocumento2 pagineCOVID-19's Impact on Business PresentationsRetmo NandoNessuna valutazione finora

- Difference Between OS1 and OS2 Single Mode Fiber Cable - Fiber Optic Cabling SolutionsDocumento2 pagineDifference Between OS1 and OS2 Single Mode Fiber Cable - Fiber Optic Cabling SolutionsDharma Teja TanetiNessuna valutazione finora

- Craft's Folder StructureDocumento2 pagineCraft's Folder StructureWowNessuna valutazione finora

- Project The Ant Ranch Ponzi Scheme JDDocumento7 pagineProject The Ant Ranch Ponzi Scheme JDmorraz360Nessuna valutazione finora

- Tokyo Disneyland ItineraryDocumento8 pagineTokyo Disneyland ItineraryTayla Allyson ThomasNessuna valutazione finora

- Ebook The Managers Guide To Effective Feedback by ImpraiseDocumento30 pagineEbook The Managers Guide To Effective Feedback by ImpraiseDebarkaChakrabortyNessuna valutazione finora

- Chapter 7 - Cash BudgetDocumento23 pagineChapter 7 - Cash BudgetMostafa KaghaNessuna valutazione finora

- NAC Case Study AnalysisDocumento25 pagineNAC Case Study AnalysisSushma chhetriNessuna valutazione finora

- 3.4 Spending, Saving and Borrowing: Igcse /O Level EconomicsDocumento9 pagine3.4 Spending, Saving and Borrowing: Igcse /O Level EconomicsRingle JobNessuna valutazione finora

- 28 Government Service Insurance System (GSIS) vs. Velasco, 834 SCRA 409, G.R. No. 196564 August 7, 2017Documento26 pagine28 Government Service Insurance System (GSIS) vs. Velasco, 834 SCRA 409, G.R. No. 196564 August 7, 2017ekangNessuna valutazione finora

- Corruption in PakistanDocumento15 pagineCorruption in PakistanklutzymeNessuna valutazione finora

- Unit 5 - FitDocumento4 pagineUnit 5 - FitAustin RebbyNessuna valutazione finora

- Lister LRM & SRM 1-2-3 Manual and Parts List - Lister - Canal WorldDocumento4 pagineLister LRM & SRM 1-2-3 Manual and Parts List - Lister - Canal Worldcountry boyNessuna valutazione finora

- BAM PPT 2011-09 Investor Day PDFDocumento171 pagineBAM PPT 2011-09 Investor Day PDFRocco HuangNessuna valutazione finora

- "60 Tips On Object Oriented Programming" BrochureDocumento1 pagina"60 Tips On Object Oriented Programming" BrochuresgganeshNessuna valutazione finora

- StandardsDocumento3 pagineStandardshappystamps100% (1)