Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

08 Park ISM ch08 PDF

Caricato da

Benn DoucetTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

08 Park ISM ch08 PDF

Caricato da

Benn DoucetCopyright:

Formati disponibili

8-1

Chapter 8 Depreciation

Book Depreciation Methods

8.1 $45,000 2 (45,000 5,000)/4 = $25,000

8.2 d = (1/4) 2 = 0.5, D2 = 45,000(1 0.5) 0.5 = $11,250

8.3 SOYD = 1 + 2 + 3 + 4 = 10; D1 = (4/10) (45,000 5,000) = $16,000; D2 =

(3/10) (40,000) = $12,000; B2 = 45,000 16,000 12,000 = $17,000

CCA or UCC Calculation

8.4 d = 0.2; Un = 30,000 (1 0.2/2) (1 0.2)n 1 = 11,059; (n 1) ln(0.8) =

ln(0.4096); n = 5 years

Economic Depreciation

8.5 economic depreciation = $5,000 $2,300 = $2,700

Cost Basis

8.6 Cost basis for flexible manufacturing cells:

Flexible manufacturing cells ($500,000 3) $1,500,000

Freight charges 25,000

Handling fee 12,000

Site preparation costs 35,000

Start-up and testing costs 18,000

Special wiring and material costs 1,500

Cost basis $1,591,500

(Note: Start-up and testing costs = $15 40 6 5 = $18,000)

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-2

CCA or UCC Calculation

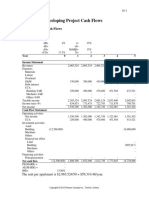

8.7 CCA Class 1 (d = 4%)

Year CCA UCC

0 $375,000

1 $7,500 367,500

2 14,700 352,800

3 14,112 338,688

4 13,548 325,140

5 13,005 312,135

Cost Basis

8.8 Trade-in allowance:

Old drill press (book value) $25,000

Less: Trade-in allowance 20,000

Unrecognized loss ($5,000)

Cost of new drill 95,000

Plus: Unrecognized loss on trade-in 5,000

Cost basis of new drill $100,000

Comments: If the old drill was sold on the market (instead of trade-in), there

would be no unrecognized loss. In that situation, the cost basis for the new drill

will be just $95,000.

8.9 Trade-in allowance:

Old lift-truck (book value) $6,000

Less: Trade-in allowance 10,000

Unrecognized gains ($4,000)

Cost of new lift-truck 35,000

Less: Unrecognized gains on trade-in 4,000

Cost basis of new truck $31,000

Comments: If the old truck was sold on the market (instead of trade-in), there

would be no unrecognized gains. In that situation, the cost basis for the new

truck will be just $35,000.

Book Depreciation Methods

8.10 d = (1/8) 2.0 = 0.25; D3 = 0.25 150,000 (1 0.25)2 = $21,094

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-3

*

8.11

Given: = $60,000, S = $5,000, = 8 years

DDB SL from Yr Depn With BV With

Annual Switching to Switching to

n Depn Book Value n to 8 SL SL

1 $15,000 $45,000 $6,875 $15,000 $45,000

2 $11,250 $33,750 $5,714 $11,250 $33,750

3 $8,438 $25,313 $4,792 $8,438 $25,313

4 $6,328 $18,984 $4,063 $6,328 $18,984

5 $4,746 $14,238 $3,496 $4,746 $14,238

6 $3,560 $10,679 $3,079 $3,560 $10,679

7 $2,670 $8,009 $2,839 $2,839 $7,839

8 $2,002 $6,007 $3,009 $2,839 $5,000

5(5 1)

8.12 (a) SOYD 15

2

(b) D1 = ($12,000 $2,000) (5/15) = $3,333

(c) The depreciation amounts in the first four years are (5/15), (4/15), (3/15),

and (2/15) respectively, for a total of (14/15). Therefore the total depreciation

for these four years is $10,000*(14/15) = $9,333. Therefore, B4 = $12,000-

$9,333 = $2,667.

Units-of-Production Method

8.13 Allowed depreciation amount

D = ($0.32)(55,000) = $17,600

$60, 000 $8, 000

8.14 D5,000hours (5, 000) $5, 200

50, 000

CCA or UCC Calculation

8.15

(a) Capital cost: $180,000 + $35,000 = $215,000

*

An asterisk next to a problem number indicates that the solution is available to students

on the Companion Website.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-4

Year CCA UCC

0 $215,000

1 $32,250 182,750

2 54,825 127,925

3 38,378 89,548

4 26,864 62,683

5 18,805 43,878

6 13,163 30,715

7 9,214 21,500

8 6,450 15,050

9 4,515 10,535

10 3,161 7,375

11 2,212 5,162

12 1,549 3,614

MACRS Depreciation

*

8.16

Given: I = $20,000, tax depreciation method = six-year MACRS property class

with half-year convention

200% DB SL MACRS

n Bn1 Dn life Dn Dn

1 $20,000 $3,333 $3,333

2 $16,667 $5,556 5.5 $3,030 $5,556

3 $11,111 $3,704 4.5 $2,469 $3,704

4 $7,407 $2,649 3.5 $2,116 $2,649

5 $4,938 $1,646 2.5 $1,975 $1,975

6 $3,292 $549 1.5 $1,975 $1,975

7 0.5 $988

: Optimal time to switch

CCA or UCC Calculation

*

8.17

For Class 43, d = 30%

Year CCA UCC

0 $68,000

1 $10,200 57,800

2 17,340 40,460

3 12,138 28,322

4 8,497 19,825

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-5

5 5,948 13,878

8.18 This non-systems software belongs in Class 12 (see Table 8.1) with d = 100%.

It is subject to the 50% rule since it is NOT exempt (see Section 8.4.4).

Year CCA UCC

0 $10,000

1 $5,000 5,000

2 5,000 0

3 0 0

4 0 0

Cost Basis

8.19

Total property value with the warehouse:

Land Building

Original cost $65,000 $35,000

Adjustments to basis 35,000

Add: New warehouse 50,000

Demolition expense 5,000

Subtract: Building loss (35,000)

Adjusted cost basis $100,000 $55,000

Total value = $100,000 + $5,000 + $50,000 = $155,000

Note that the old house that was demolished has no value. This loss may be

deductible for tax purposes, but this should not be added to the cost basis of the

new asset for book depreciation. In general, the propertys entire basis is

allocated to the land only, if the company intends to demolish the building

when they acquire the property for business use. Then the cost basis is

increased by the net cost of demolition. (The demolition can be treated as a site

preparation expense.)

Cost basis for book depreciation:

Cost basis = $5,000 + $50,000 = $55,000

Book Depreciation Methods

8.20 Depreciation allowances and book values: (a) depreciation rate = 1/N = 1/5 for

SL, (b) depreciation rate = 1/5 =20% for DB, (c) SOYD =15

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-6

SL DB SOYD

n Dn Bn Dn Bn Dn Bn

1 $18,000 $82,000 $20,000 $80,000 $30,000 $70,000

2 18,000 64,000 16,000 64,000 24,000 46,000

3 18,000 46,000 12,800 51,200 18,000 28,000

4 18,000 28,000 10,240 40,960 12,000 16,000

5 18,000 10,000 8,192 32,768 6,000 10,000

*

8.21

d = 1/7; SL calculated from period n to N, switch to straight-line when D(SL) >

D(DB).

n D(DB) D(SL)

0 $30,000

1 4,286* $3,143 25,714

2 3,673* 2,952 22,041

3 3,149* 2,808 18,892

4 2,699 2,723* 16,169

5 2,310 2,723* 13,446

6 1,921 2,723* 10,723

7 1,532 2,723* 8,000

*amount claimed in year n

8.22 Given: = $80,000, S = $22,000, = 6 years

(a) D1 = $26,667, D2 = $17,778, D3 = $11,852

(b) DDB switching to SL

n Dn Bn

1 $26,667 $53,333

2 17,778 35,556

3 11,852 23,704

4 1, 704 22,000

5 0 22,000

6 0 22,000

Comments: If the regular DDB deduction is taken during the fourth year, B4

would be less than the salvage value. Therefore, it is necessary to adjust D4.

The number in the box represents the adjusted value.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-7

*

8.23

Given: = $20,000, = 5 years, S = $3,000

n SL DDB SOYD

1 $3,400 $8,000 $5,667

2 3,400 4,800 4,533

3 3,400 2,880 3,400

4 3,400 1,320 2,267

5 3,400 0 1,133

8.24 Given: = $58,000, S = $8,000, N = 12 years

($58, 000 $8, 000)

(a) D $4,167

12

(b) D3 = $6,713

(c) D2 = $7,051

Units-of-Production Method

8.25

Truck A:

25, 000

D ($50, 000 $5, 000) $5, 625

200, 000

Truck :

12, 000

D ($25, 000 $2,500) $2, 250

120, 000

Truck C:

15, 000

D ($18,500 $1,500) $2,550

100, 000

Truck D:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-8

20, 000

D ($35, 600 $3,500) $3, 210

200, 000

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-9

CCA or UCC Calculation

*

8.26

Given: = $32,000, S = $5,000, = 8 years

n D(book) CCA

1 $3,375 $4,800

2 3,375 8,160

3 3,375 5,712

4 3,375 3,998

5 3,375 2,799

6 3,375 1,959

7 3,375 1,371

8 3,375 960

8.27 CCA Class 1 for buildings (d = 4%); 50% rule applies

(a) CCA1 = (0.04/2) 120,000 = $2,400 (Note: The land is not depreciable.)

(b) UCC4 = 120,000 (1 0.04/2)(1 0.04)4 1 = $104,045

8.28 The spindle machine became available for use on the second taxation year

after the date the property was acquired, which is 2008. Since the spindle

machine became available for use more than 358 days after acquisition, it is

exempt from the 50% rule. Class 43: d = 30%

n CCAn UCCn

2006 $34,000

2008 $10,200 23,800

2009 7,140 16,660

2010 4,998 11,662

2011 3,499 8,163

2012 2,449 5,714

8.29 For Book depreciation: d = 1/6; D6 = 7,500(1 1/6)6 = $2,512

For Tax depreciation: d = 20%, 50% rule applies

CCA6 = 7,500 0.20 (1 0.2/2)(1 0.2)4 = $553

UCC6 = 7,500 (1 0.2/2)(1 0.2)5 = $2,219

8.30

Book depreciation:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-10

Asset Type

Year Lathe Truck Building Photocopier

1 $7,500 $2,530 $14,000 $13,333

2 6,250 2,875 14,000 10,666

(a) Tax depreciation: All four assets are subject to 50% rule

Asset Type

Year Lathe Truck Building Photocopier

1 $6,750 $3,750 $16,000 $4,000

2 11,475 6,375 31,360 7,200

(b) Book depreciation for lathe:

n Dn n Dn

1 $7,500 7 $2,512

2 6,250 8 2,093

3 5,208 9 1,866

4 4,340 10 1,866

5 3,617 11 1,866

6 3,014 12 1,866

*

8.31

Type of Asset I II III IV

Dep. methods SL DDB SOYD UP

End of year 7 4 3 3

Initial cost ($) 10,000 18,000 90, 000 30,000

Salvage value ($) 2,000 2,000 7,000 0

Book value ($) 3,000 2,320 23, 600 15, 000

Depreciable life 8 years 5 years 5 years 90,000 km

Dep. amount ($) 1, 000 1,555 16,600 5, 000

Accum. Dep. (S) 7, 000 15,680 66,400 15, 000

8.32

Given: = $147,000, = 10 years, S = $27,000, units produced = 250,000,

working hours = 30,000 hrs

(a) Straight-Line

$147, 000 $27, 000

D2009 $12, 000

10

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-11

(b) Units-of-Production Method

23, 450

D2009 ($147, 000 $27, 000) $11, 256

250, 000

(c) Working Hours

2, 450

D2009 ($120, 000) $9,800

30, 000

(d) Sum-Of-the-Years-Digits

10

D2009 ($147, 000 $27, 000) $21,818

55

(e) Declining Balance

1

D2009 ($147, 000) $14, 700

10

(f) Double Declining Balance

2

D2009 ($147, 000) $29, 400

10

8.33 All of these assets are subject to the 50% rule. CCA may be claimed starting in

the year when each asset becomes available for use.

Car Arc Welder Freezer

Capital cost $15,000 $12,000 $8,000

Available-for-use 2005 2005 2006

CCA Class 10 43 8

DB rate d = 30% d = 30% d = 20%

2005 $2,250 $1,800

2006 3,825 3,060 $800

2007 2,678 2,142 1,440

2008 1,874 1,499 1,152

2009 1,312 1,050 922

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-12

8.34 Class 16: CCA rate = 40%; 50% rule applies

CCA - Schedule 8 Column Labels

2 3 5 6 7 8 12 13

UUC UCC 50% Reduced UCC

Yr Start Acquisitions Dispositions (unreduced) rule UCC CCA End

1 $0 $296,000 $0 $296,000 $148,000 $148,000 $59,200 $236,800

2 $236,800 $54,000 $0 $290,800 $27,000 $263,800 $105,520 $185,280

3 $185,280 $142,000 $58,000 $269,280 $42,000 $227,280 $90,912 $178,368

4 $178,368 $0 $32,000 $146,368 $0 $146,368 $58,547 $87,821

8.35

Depreciation Method

A SOYD

DDB

C CCA

D DDB with conversion to SL

MACRS Depreciation

8.36 Let P denote the cost basis for the equipment.

B3 P ( D1 D2 D3 ) P

P (0.1428 0.2449 0.1749) P

P 0.5626 P

0.4374($145, 000)

$63, 423

Revisions to Depreciable Property

8.37 Referring to Example 8.11, we must calculate the prorated portion, which is the

lesser of:

(a) one fifth of the capital cost: $22,000/5 = $4,400

or (b) the number, N, of 12-month periods from the start of the year when the

improvement was made to the end of the original lease = 7 (Note: Lease

renewal is not applicable.)

(Capital cost)/N $22,000/7 = $3,142

The lesser of these is $3,143, with only half claimable in the first year. The

allowable CCA for the first three years after the leasehold improvement:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-13

CCA1 = $1,571 CCA2 = $3,142 CCA3 = $3,142

8.38

(a) D = ($1,200,000 $400,000)/ 25 = $32,000/year

(b) B = $400,000 + $125,000 = $525,000

(c) Original estimate of depreciable life: ($1,200,000 $0)/N = $32,000

= 37.5 years

Remaining years after repairs = (37.5 25) + 10 = 22.5 years

Depreciation over the coming year: D = $525,000/22.5 = $23,333

8.39

(a) Book depreciation amount for 2011:

B2009 $140,000 3($14,000)

$98,000

revised depreciation basis $98, 000 $25, 000

$123, 000

revised useful life 12 years

D2011 $123, 000 /12 $10, 250

(b) Class 43: CCA rate = 30%

Moulding Machine Overhaul

Year CCA UCC CCA UCC Total CCA

$140,000

2006 $21,000 119,000 $21,000

2007 35,700 83,300 35,700

2008 24,990 58,310 $25,000 24,990

2009 17,493 40,817 $3,750 21,250 21,243

2010 12,245 28,572 6,375 14,875 18,620

2011 8,572 20,000 4,463 10,413 13,034

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-14

Short Case Studies

ST 8.1

CCA Schedule 8 Column Labels

2 3 5 6 7 8 9 12 13

YEAR 1 UUC UCC 50% Reduced CCA UCC

Class Start Acquisitions Dispositions (unreduced) rule UCC Rate CCA End

8 $0 $7,000 $0 $7,000 $3,500 $3,500 20% $700 $6,300

10 $0 $13,000 $0 $13,000 $6,500 $6,500 30% $1,950 $11,050

12 $0 $3,200 $0 $3,200 $1,600 $1,600 100% $1,600 $1,600

50 $0 $3,500 $0 $3,500 $1,750 $1,750 55% $963 $2,538

TOTAL = $5,213

YEAR 2

8 $6,300 $0 $0 $6,300 $0 $6,300 20% $1,260 $5,040

10 $11,050 $0 $0 $11,050 $0 $11,050 30% $3,315 $7,735

12 $1,600 $1,000 $0 $2,600 $500 $2,100 100% $2,100 $500

50 $2,538 $4,000 $0 $6,538 $2,000 $4,538 55% $2,496 $4,042

TOTAL = $9,171

YEAR 3

8 $5,040 $2,500 $1,000 $6,540 $750 $5,790 20% $1,158 $5,382

10 $7,735 $20,000 $6,000 $21,735 $7,000 $14,735 30% $4,421 $17,315

12 $500 $0 $0 $500 $0 $500 100% $500 $0

50 $4,042 $0 $0 $4,042 $0 $4,042 55% $2,223 $1,819

TOTAL = $8,302

YEAR 4

8 $5,382 $0 $0 $5,382 $0 $5,382 20% $1,076 $4,306

10 $17,315 $0 $0 $17,315 $0 $17,315 30% $5,194 $12,120

12 $0 $0 $0 $0 $0 $0 100% $0 $0

50 $1,819 $2,000 $500 $3,319 $750 $2,569 55% $1,413 $1,906

TOTAL = $7,684

ST 8.2

(a) Book depreciation schedule: SL depreciation rate = ($79,500 $4,500)/12

= $6,250 each year (including 2008)

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-15

(b) Cost basis = $79,500; Class 43 CCA rate = 30%

n CCAn UCCn

2005 $11,925 $67,575

2006 20,273 47,303

2007 14,191 33,112

2008 9,934 23,178

Comments: The accessories costing $2,000 that were incurred in 2007 do

not change the depreciation schedule. This type of regular maintenance gets

treated as current expenses.

ST 8.3 Given: P = $63,000 + $2,000 = $65,000, N = 10 years, and S = $4,000

Book depreciation expense for 2004:

$65, 000 $4, 000

D2004 $6,100

10

Year Dn Bn

2004 $6,100 $58,900

2005 $6,100 $52,800

new depreciation basis $52,800 $6, 000 $58,800

remaining useful life 11years

salvage value $4, 000

Book depreciation expense for 2006:

$58,800 $4, 000

D2006 $4,982

11

B2006 $58,800 $4,982 $53,818

new depreciation basis $53,818 $3, 000 $56,818

remaining useful life 10 years

salvage value $6, 000

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-16

Book depreciation expense for 2007:

$56,818 $6, 000

D2007 $5, 082

10

B2007 $56,818 $5, 082 $51, 736

Comments: Whenever any repairs or improvements increase the value of

the asset (increased salvage value) or extend the life of the asset, these costs

should be a part of the depreciation basis.

ST 8.4

(a) Book depreciation methods:

Straight-line method:

Cumulative

n Dn Bn Dn

1 $12,000 $53,000 $12,000

2 12,000 41,000 24,000

3 12,000 29,000 36,000

4 12,000 17,000 48,000

5 12,000 5,000 60,000

DDB method:

Cumulative

n Dn Bn Dn

1 $26,000 $39,000 $26,000

2 15,600 23,400 41,600

3 9,360 14,040 50,960

4 5,616 8,424 56,576

5 3,424 5,000 60,000

SOYD method:

Cumulative

n Dn Bn Dn

1 $20,000 $45,000 $20,000

2 16,000 29,000 36,000

3 12,000 17,000 48,000

4 8,000 9,000 56,000

5 4,000 5,000 60,000

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

8-17

(b) Class 43 CCA rate = 30%

n CCAn UCCn

0 $65,000

1 $9,750 55,250

2 16,575 38,675

3 11,603 27,073

4 8,122 18,951

5 5,685 13,266

(c) Since we don't have the market value after three years, we may assume

that the salvage value equals the trade-in value.

CCA4 = (UCC3 sales + purchases/2)*d

= (27,073 10,000 + 82,000/2)*0.3

= 17,422

UCC4 = UCC3 CCA4 = 27,073 17,422 = $9,651

ST 8.5 No solution provided; see Canada Revenue Agency website

www.cra-arc.gc.ca for Canada Customs and Revenue Agency

Interpretation Bulletins.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

Potrebbero piacerti anche

- 05 Park ISM ch05 PDFDocumento39 pagine05 Park ISM ch05 PDFBenn DoucetNessuna valutazione finora

- 10 Park ISM ch10 PDFDocumento61 pagine10 Park ISM ch10 PDFBenn DoucetNessuna valutazione finora

- 16 Park ISM ch16 PDFDocumento18 pagine16 Park ISM ch16 PDFBenn DoucetNessuna valutazione finora

- 15 Park ISM ch15 PDFDocumento36 pagine15 Park ISM ch15 PDFBenn DoucetNessuna valutazione finora

- 14 Park ISM ch14 PDFDocumento36 pagine14 Park ISM ch14 PDFBenn DoucetNessuna valutazione finora

- 04 Park ISM ch04 PDFDocumento28 pagine04 Park ISM ch04 PDFBenn DoucetNessuna valutazione finora

- 03 Park ISM ch03 PDFDocumento15 pagine03 Park ISM ch03 PDFBenn DoucetNessuna valutazione finora

- 11 Park ISM ch11 PDFDocumento95 pagine11 Park ISM ch11 PDFBenn DoucetNessuna valutazione finora

- 09 Park ISM Ch09Documento15 pagine09 Park ISM Ch09Benn DoucetNessuna valutazione finora

- 07 Park ISM ch07 PDFDocumento7 pagine07 Park ISM ch07 PDFBenn DoucetNessuna valutazione finora

- 12 Park ISM ch12 PDFDocumento21 pagine12 Park ISM ch12 PDFBenn DoucetNessuna valutazione finora

- 06 Park ISM ch06 PDFDocumento44 pagine06 Park ISM ch06 PDFBenn DoucetNessuna valutazione finora

- The Ivory Triangle PDFDocumento213 pagineThe Ivory Triangle PDFBenn Doucet100% (2)

- 02 Park ISM ch02 PDFDocumento3 pagine02 Park ISM ch02 PDFBenn DoucetNessuna valutazione finora

- 13 Park ISM ch13 PDFDocumento12 pagine13 Park ISM ch13 PDFBenn DoucetNessuna valutazione finora

- Wind Riders of The Jagged Cliffs PDFDocumento138 pagineWind Riders of The Jagged Cliffs PDFBenn Doucet100% (1)

- Wind Riders of The Jagged Cliffs PDFDocumento138 pagineWind Riders of The Jagged Cliffs PDFBenn Doucet100% (1)

- Arcane ShadowsDocumento120 pagineArcane ShadowsKasper Holm100% (1)

- Valley of Dust and Fire PDFDocumento106 pagineValley of Dust and Fire PDFBenn Doucet100% (2)

- Veiled Alliance PDFDocumento98 pagineVeiled Alliance PDFBenn Doucet100% (4)

- Veiled Alliance PDFDocumento98 pagineVeiled Alliance PDFBenn Doucet100% (4)

- Dark Sun - 2419 - CGR2 - The Complete Gladiator's Handbook PDFDocumento132 pagineDark Sun - 2419 - CGR2 - The Complete Gladiator's Handbook PDFPedro Lamas100% (2)

- Black Spine PDFDocumento314 pagineBlack Spine PDFBenn Doucet100% (6)

- AD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFDocumento130 pagineAD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFWannes Ikkuhyu100% (8)

- Slave Tribes PDFDocumento98 pagineSlave Tribes PDFBenn Doucet100% (5)

- Asticlian GambitDocumento121 pagineAsticlian GambitDylan Flippance100% (1)

- Beyond The Prism PentadDocumento34 pagineBeyond The Prism PentadDiego Fernando Lastorta67% (6)

- The Ivory TriangleDocumento213 pagineThe Ivory TriangleDylan Flippance100% (1)

- Black FlamesDocumento122 pagineBlack FlamesDylan Flippance100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Property LawDocumento10 pagineProperty LawVaalu MuthuNessuna valutazione finora

- Volunteer Background Check FormDocumento1 paginaVolunteer Background Check FormStanley ChuNessuna valutazione finora

- Final Merit List of KU For LaptopDocumento31 pagineFinal Merit List of KU For LaptopAli Raza ShahNessuna valutazione finora

- Kenya Methodist University Tax Exam QuestionsDocumento6 pagineKenya Methodist University Tax Exam QuestionsJoe 254Nessuna valutazione finora

- Pro Proctor Guide v2Documento16 paginePro Proctor Guide v2Agnes BofillNessuna valutazione finora

- ETB STD Application Form (Sch9) - DTT - EngDocumento3 pagineETB STD Application Form (Sch9) - DTT - Engunnamed90Nessuna valutazione finora

- CB 4 Letter To Gov. Cuomo Re Congestion PricingDocumento3 pagineCB 4 Letter To Gov. Cuomo Re Congestion PricingGersh KuntzmanNessuna valutazione finora

- Consolidated Financial StatementsDocumento62 pagineConsolidated Financial StatementsSuraj ManikNessuna valutazione finora

- TominiDocumento21 pagineTominiChiara D'AloiaNessuna valutazione finora

- Case Chapter 02Documento2 pagineCase Chapter 02Pandit PurnajuaraNessuna valutazione finora

- Ptu Question PapersDocumento2 paginePtu Question PapersChandan Kumar BanerjeeNessuna valutazione finora

- KSA Salary Guide 2023: Emerging Sectors & Mega-Projects to Drive 3% Pay RiseDocumento29 pagineKSA Salary Guide 2023: Emerging Sectors & Mega-Projects to Drive 3% Pay Riseدحوم ..100% (8)

- Sample Business Plans - UK Guildford Dry CleaningDocumento36 pagineSample Business Plans - UK Guildford Dry CleaningPalo Alto Software100% (14)

- Point: Cryptocurrencies in KenyaDocumento7 paginePoint: Cryptocurrencies in KenyaMETANOIANessuna valutazione finora

- QO-D-7.1-3 Ver-4.0 - Withdrawal of Specification of ItemsDocumento3 pagineQO-D-7.1-3 Ver-4.0 - Withdrawal of Specification of ItemsSaugata HalderNessuna valutazione finora

- Consti II NotesDocumento108 pagineConsti II NotesVicky LlasosNessuna valutazione finora

- DepEd Mandaluyong City outlines COVID-19 work arrangementsDocumento18 pagineDepEd Mandaluyong City outlines COVID-19 work arrangementsRenante SorianoNessuna valutazione finora

- STAMPF V TRIGG - OpinionDocumento32 pagineSTAMPF V TRIGG - Opinionml07751Nessuna valutazione finora

- Non-Negotiable Copy Mediterranean Shipping Company S.A.: 12-14, Chemin Rieu - CH - 1208 GENEVA, SwitzerlandDocumento1 paginaNon-Negotiable Copy Mediterranean Shipping Company S.A.: 12-14, Chemin Rieu - CH - 1208 GENEVA, SwitzerlandVictor Victor100% (2)

- Certification Manual: Servomex OxydetectDocumento32 pagineCertification Manual: Servomex OxydetectfamelotNessuna valutazione finora

- 3059 10-5 TenderBulletinDocumento56 pagine3059 10-5 TenderBulletinFadyNessuna valutazione finora

- WR CSM 20 NameList 24032021 EngliDocumento68 pagineWR CSM 20 NameList 24032021 EnglivijaygnluNessuna valutazione finora

- Criminal Law 1 NotesDocumento3 pagineCriminal Law 1 Notesmbdometita100% (1)

- What Is Leave Travel Allowance or LTADocumento3 pagineWhat Is Leave Travel Allowance or LTAMukesh UpadhyeNessuna valutazione finora

- Catalogueofsanfr00sanfrich PDFDocumento310 pagineCatalogueofsanfr00sanfrich PDFMonserrat Benítez CastilloNessuna valutazione finora

- United Coconut Planters Bank vs. Planters Products, Inc.Documento4 pagineUnited Coconut Planters Bank vs. Planters Products, Inc.Arah Salas PalacNessuna valutazione finora

- People Vs MagnoDocumento2 paginePeople Vs MagnoJan Christiane Maningo SaleNessuna valutazione finora

- Create PHP CRUD App DatabaseDocumento6 pagineCreate PHP CRUD App DatabasearyaNessuna valutazione finora

- Activity 1 Home and Branch Office AccountingDocumento2 pagineActivity 1 Home and Branch Office AccountingMitos Cielo NavajaNessuna valutazione finora

- Classification of CorruptionDocumento3 pagineClassification of CorruptionMohammad Shahjahan SiddiquiNessuna valutazione finora