Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

06 Park ISM ch06 PDF

Caricato da

Benn DoucetTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

06 Park ISM ch06 PDF

Caricato da

Benn DoucetCopyright:

Formati disponibili

6-1

Chapter 6 Comparing Mutually Exclusive Alternatives

Mutually Exclusive Alternatives: PW Method

6.1

PW (12%) A $800 $1,500( P / F ,12%,1)

L $660( P / F ,12%,10)

$988.91

PW (12%) B $2, 635 $565( P / F ,12%,1)

L $840( P / F ,12%,10)

$1, 696.01

Select Project B.

6.2

(a)

PW (15%) A $1,500 $1,350( P / F ,15%,1) L

$100( P / F ,15%, 4)

$467.52

PW (15%) B $1,500 $1, 000( P / F ,15%,1) L

$150( P / F ,15%, 4)

$586.26

Select Project B.

(b)

NFW (15%) D $1,500( F / P,15%,4) $450( F / A,15%, 4)

$376.49

NFW (15%) E $1,800( F / P,15%, 4) $600( F / A,15%, 4)

$152.18

Select Project D.

(c)

PW (15%)C $3, 000 $1, 000( P / F ,15%,1)

X ( P / F ,15%, 2)

$1,500( P / F ,15%,3) X ( P / F ,15%, 4)

1.3279 X $1,144.16

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-2

To be acceptable, it must satisfy the following condition:

PW (15%)C 0

1.3279 X $1,144.16 0

X $861.63

(d)

PW (18%) D $1,500 $450( P / A,18%, 4)

$289.47 0

Yes, Project D is acceptable.

(e) If MARR < 10.40%, Project E is better. Otherwise, Project D is better.

6.3

(a)

PW (12%) A $14,500 $12,610( P / F ,12%,1) $12,930( P / F ,12%,2)

$12,300( P / F ,15%,3) $15,821.54

PW (12%) B $12,900 $11,210( P / F ,12%,1) $11,720( P / F ,12%,2)

$11,500( P / F ,12%,3) $14,637.51

Select Project A.

(b)

FW (12%) A $15,821.54( F / P,12%,3) $22,228.13

FW (12%) B $14,637.51( F / P,12%,3) $20,564.65

Select Project A.

6.4

(a)

PW (15%) A $6,000 $800( P / F ,15%,1) $14,000( P / F ,15%,2)

$5,281.66

PW (15%) B $8,000 $11,500( P / F ,15%,1) $400( P / F ,15%,2)

$2,302.46

Select Project A.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-3

(b) PW(i) function for each alterative on the same chart between 0% and 50%:

Project A is preferred at all interest rates between 0% and 50%.

6.5

Method A:

$25, 000( A / F ,12%,5)

CE (12%) A $60, 000 $92, 791.67

0.12

Method B:

$180, 000( A / F ,12%,50)

CE (12%) B $150, 000 $150, 625.5

0.12

Since CE(12%) values above represent cost, Method A is preferred.

6.6

Standard Lease Option:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-4

PW (0.5%)SL $5,500 $1,150( P / A, 0.5%, 24)

$1, 000( P / F , 0.5%, 24)

$30,560.10

Single Up-Front Option:

PW (0.5%)SU $31,500 $1, 000( P / F , 0.5%, 24)

$30, 612.82

Select the standard lease option as you will save $52.72 in present worth.

6.7

Machine A:

PW (13%) $75, 200 ($6,800 $2, 400)( P / A,13%, 6)

$21, 000( P / F ,13%, 6)

$101,891

Machine B:

PW (13%) $44, 000 $11,500( P / A,13%, 6)

$89,971

Machine B is a better choice.

*

6.8

(a)

Required HP to produce 10 HP:

Motor A: X 1 10 / 0.85 11.765 HP

Motor B: X 2 10 / 0.90 11.111 HP

Annual Energy Cost:

Motor A: 11.765(0.7457)(1,500)(0.07) $921.18

Motor B: 11.111(0.7457)(1,500)(0.07) $869.97

Present Worth:

*

An asterisk next to a problem number indicates that the solution is available to students

on the Companion Website.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-5

PW (8%) A $800 $921.18( P / A,8%,15)

$50( P / F ,8%,15)

$8, 669

PW (8%) B $1, 200 $869.97( P / A,8%,15)

$100( P / F ,8%,15)

$8, 614

Motor B is preferred.

(b) With 2,000 operating hours:

PW (8%) A $800 $1,535.26( P / A,8%,15)

$50( P / F ,8%,15)

$13,925

PW (8%) B $1, 200 $1, 449.97( P / A,8%,15)

$100( P / F ,8%,15)

$13,579

Motor B is still preferred.

6.9 Given: Required service period = infinite, analysis period = least common

multiple service periods (six years)

Project A:

PW (12%)cycle $20, 000 $17,500( P / F ,12%,1) $17, 000( P / F ,12%, 2)

$15, 000( P / F ,12%,3)

$19,854.00

PW (12%) total $19,854[1 ( P / F ,12%,3)]

$33,985.69

Project B:

PW (12%)cycle $25, 000 $25,500( P / F ,12%,1) $18, 000( P / F ,12%, 2)

$12,117.35

PW (12%) total $12,117.35[1 ( P / F ,12%, 2) ( P / F ,12%, 4)]

$29, 478.02

Project A is preferred.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-6

6.10

(a) Without knowing the future replacement opportunities, we may assume that

both alternatives will be available in the future with the identical investments

and expenses. We further assume that the required service period will be

indefinite.

(b) With the common service period of 24 years,

Project A1:

PW (10%)cycle $900 $400( P / A,10%,3)

$200( P / F ,10%,3)

$1, 744.48

PW (10%) total $1, 744.48[1 ( P / A,33.10%, 7)]

$6,302.63

Note that the effective interest rate for a three-year cycle is

(1.10)3 1 33.10%

Project A2:

PW (10%)cycle $1,800 $300( P / A,10%,8)

$500( P / F ,10%,8)

$3,167.22

PW (10%) total $3,167.22[1 ( P / F ,10%,8)

( P / F ,10%,16)]

$5,334.03

Project A2 is preferred.

(c)

PW (10%) A1 $1,744.48

PW (10%) A 2 $1,800 $300( P / A,10%,3) S ( P / F ,10%,3)

$2,546.06 0.7513S

Let PW (10%) A1 PW (10%) A 2 and solve for S.

S $1, 067

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-7

6.11

(a) Assuming a common service period of 15 years

Project B1:

PW (12%)cycle $18, 000 $2, 000( P / A,12%,5) $2, 000( P / F ,12%,5)

$24, 075

PW (12%) total $24, 075[1 ( P / A, 76.23%, 2)]

$45, 487

Note: (1.12) 5 1 76.23%

Project B2:

PW (12%) cycle $15,000 $2,100( P / A,12%,3) $1,000( P / F ,12%,3)

$19,332

PW (12%) total $19,332[1 ( P / A,40.49%,4)]

$54,826

Note: (1.12) 3 1 40.49%

Select Project B1.

(b)

Project B1 with two replacement cycles:

PW (12%) $24, 075 $24, 075( P / F ,12%,5)

$37, 736

Project B2 with four replacement cycles where the fourth replacement ends

at the end of the first operating year:

PW (12%) $19,332[1 ( P / F ,12%,3) ( P / F ,12%, 6)]

[$15, 000 ($2,100 $6, 000)( P / F ,12%,1)]( P / F ,12%,9)

$47, 040

Project B1 is still a better choice

6.12 Since only Model A is repeated in the future, we may have the following

sequence of replacement cycles:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-8

Option 1: Purchase Model A now and repeat Model A forever.

Option 2: Purchase Model B now and replace it at the end of year 2 by

Model A. Then repeat Model A forever.

PW (15%) Model A $6, 000 $3,500( P / A,15%,3)

$1,991.29

A $1,991.29( A / P,15%,3)

$872.14

PW (15%)Model B $15, 000 $10, 000( P / A,15%, 2)

$1, 257.09

A $1, 257.09( A / P,15%, 2)

$773.26

(a)

Option 1:

$872.14

PW (15%) AAAL

0.15

$5,814.27

Option 2:

$872.14

PW (15%) BAAL $1, 257.09 ( P / F ,15%, 2)

0.15

$5, 653.51

Option 1 is a better choice.

(b) Let S be the salvage value of Model A at the end of year 2.

$6, 000 $3,500( P / A,15%, 2) S ( P / F ,15%, 2) $1, 257.09

Solving for S yields

S $2, 072.50

6.13

Since either tower will have zero salvage value after 20 years, we may select

the analysis period of 35 years:

PW (11%) Bid A $137, 000 $2, 000( P / A,11%,35)

$154, 710

PW (11%)Bid B $128, 000 $3,300( P / A,11%,35)

$157, 222

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-9

Bid A is a better choice.

If you assume an infinite analysis period, the present worth of each bid will

be:

[$137, 000 $2, 000( P / A,11%, 40)]( A / P,11%, 40)

PW (11%) Bid A

0.11

$157, 296

[$128, 000 $3,300( P / A,11%,35)]( A / P,11%,35)

PW (11%) Bid B

0.11

$161,367

Bid A is still preferred.

6.14

(a)

PW (15%) A1 $15, 000 $9,500( P / F ,15%,1)

$12,500( P / F ,15%, 2) $7,500( P / F ,15%,3)

$7, 644.04

(b)

PW (15%) A 2 $25, 000 X ( P / F ,15%, 2)( P / F ,15%,1)

$9,300

X $24, 263

(c) Note that the net future worth of the project is equivalent to its terminal

project balance.

PB (15%)3 $7, 644.04( F / P,15%,3)

$11, 625.63

(d) Select Project A2.

6.15

(a) Project balances as a function of time are as follows:

Project Balances

n A D

0 $2,500 $5,000

1 2,100 6,000

2 1,660 7,100

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-10

3 1,176 3,810

4 694 1,191

5 163 1,690

6 421 3,859

7 763 7,245

8 1,139

All figures above are rounded to nearest dollars.

(b) Knowing the relationship FW (i ) PB (i ) N ,

FW (10%) A $1,139

FW (10%) D $7, 245

(c) Assuming a required service period of eight years

PW (10%) B $7, 000 $1,500( P / A,10%,8)

$1, 000( P / F ,10%,1) $500( P / F ,10%, 2)

$1,500( P / F ,10%, 7) $1,500( P / F ,10%,8)

$17, 794

PW (10%)C $5, 000 $2, 000( P / A,10%, 7)

$3, 000( P / F ,10%,8)

$16,136

Select Project C.

6.16

Option 1: Non-deferred plan

PW (12%)1 $200, 000 $21, 000( P / A,12%,8)

$304,320

Option 2: Deferred plan

PW (12%)2 $100, 000( P / F ,12%, 2) $6, 000( P / A,12%,3)( P / F ,12%, 2)

$160, 000( P / F ,12%,5) $15, 000( P / A,12%,3)( P / F ,12%,5)

$140, 000( P / F ,12%,8)

$258,982

Option 2 is a better choice.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-11

*

6.17

Alternative A: Once-For-All Expansion

PW (15%) A $30M $0.40M ( P / A,15%, 25)

$0.85M ( P / F ,15%, 25)

$32,559,839

Alternative B: Incremental Expansion

PW (15%) B $10M $18M ( P / F ,15%,10)

$12 M ( P / F ,15%,15) $1.5M ( P / F ,15%, 25)

$0.25M ( P / A,15%, 25)

$0.10M ( P / A,15%,15)( P / F ,15%,10)

$0.10 M ( P / A,15%,10)( P / F ,15%,15)

$17, 700, 745

Select Alternative B.

6.18

Option 1: Tank/tower installation

PW (12%)1 $164, 000

Option 2: Tank/hill installation with the pumping equipment replaced at the

end of 20 years at the same cost

PW (12%)2 ($120, 000 $12, 000)

($12, 000 $1, 000)( P / F ,12%, 20)

$1, 000( P / F ,12%, 40) $1, 000( P / A,12%, 40)

$141,373

Option 2 is a better choice.

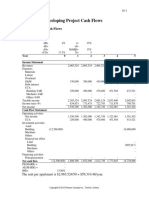

Unit-Cost Profit Calculation

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-12

*

6.19

Let T denote the total operating hours in full load.

Motor I (Expensive)

Annual power cost:

150

(0.746) (0.05) T $6.741T

0.83

Equivalent annual cost of operating the motor:

AEC (6%) I $4,500( A / P, 6%,10) $675 6.741T

$1, 286.41 $6.741T

Motor II (Less expensive):

Annual power cost:

150

(0.746) (0.05) T $6.9938T

0.80

Equivalent annual cost of operating the motor:

AEC (6%) II $3, 600( A / P, 6%,10) $540 6.9938T

$1, 026.11 6.9938T

Let AEC (6%) I AEC (6%) II and solve for T .

$1, 286.41 6.741T $1, 029.11 6.9938T

T 1, 017.8 hours per year

6.20

Option 1: Purchase units from John Holland

Unit cost $25 ($35, 000) / 20, 000 $23.25

Option 2: Make units in house

PW (15%)dm $63, 000( P / A1 ,5%,15%,5) $230, 241

PW (15%)dl $190,800( P / A1 , 6%,15%,5) $709, 491

PW (15%) vo $139, 050( P / A1 ,3%,15%,5) $490,888

AEC (15%) ($230, 241 $709, 491 $490,888)( A / P,15%,5) $70, 000

$496, 776

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-13

Unit cost $496, 776 / 20, 000 $24.84

Option 1 is a better choice.

6.21

(a) Determine the unit profit of air sample test by the TEM (in-house).

Subcontract Option:

Unit profit $400 $300 $0.50 $1,500 /1, 000 $98

TEM Purchase Option:

AEC (15%) ($415, 000 $9,500)( A / P,15%,8) ($50, 000

$6, 000 $18, 000 $20, 000)

$188, 600

Unit cost $188, 600 /1, 000 $188.60

Unit profit $300 $188.60 $111.40

(b) Let X denote the break-even number of air samples per year.

$1,500 $188, 600

$400 ($300 $0.50 ) $300

X X

Solving for X yields

X 933.17 934 air samples per year

Note: If SECs goal is simply to minimize per unit cost of sampling, then the

break-even point would be calculated without including the revenue:

($300+$0.50+ ($1,500/X) = $188,600/X

Solving for X yields: X= 622.62 623 air samples per year

Mutually Exclusive Alternatives: AE Method

6.22

(a)

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-14

AE (15%) A $12, 000( A / P,15%, 4) [$9,120 $2, 280( A / G,15%, 4)]

$1,892.95

AE (15%) B $12, 000( A / P,15%, 4) $6,350

$2,146.82

(b) Process A: $1,892.95 / 2, 000 $0.9465 / hour

Process B: $2,146.82 / 2, 000 $1.0734 / hour

(c) Process B is a better choice.

*

6.23

Capital recovery cost for both motors:

CR (13%)CV $13, 000( A / P,13%, 20) $1,851

CR(13%)PE $15, 600( A / P,13%, 20) $2, 221

Annual operating cost for both motors:

18.650 kW $0.07 3,120 hrs

CV : $4,551

0.895 kWh year

18.650 kW $0.07 3,120 hrs

PE : $4,380

0.93 kWh year

(a) Savings per kWh:

AEC (13%)CV $1,851 $4,551 $6, 402

AEC (13%) PE $2, 221 $4,380 $6, 601

Comments: At 3,120 annual operating hours, it will cost the company an

additional $370, but energy savings are only $171, which results in a $199

loss from each motor. The total output power is 58,188 kWh per year (25

HP 0.746 kW/HP 3120 hrs/year). Therefore, the savings (losses) per

operating hour from switching from conventional motor to the PE is

($199 / yr)

($0.034) / kWh

58,188 kWh/yr

(b)

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-15

$1,851 1.4587T $2, 221 1.4038T

0.0549T 370

T 6, 737 hours

6.24

New Lighting System Cost:

AEC (12%) $50, 000( A / P,12%, 20) ($8, 000 $3, 000)

$17, 694

Old Lighting System Cost:

AEC (12%) $20, 000

Annual savings from installing the new lighting system $2,306

6.25 Given: i 6% interest compounded monthly, the effective annual

interest (1.005)12 1 6.17% per year, effective semiannual

interest (1.005)6 1 3.04% per semiannual

Option 1: Buying a bond

AE (3.04%)1 $2, 000( A / P,3.04%, 6) $100 $2, 000( A / F ,3.04%, 6)

$39.20 per semiannual

AE (6.17%) $39.20( F / A,3.04%, 2)

$79.59 per year

Option 2: Buying and holding a growth stock for three years

AE (6.17%) 2 $2, 000( A / P, 6.17%,3) $2, 735.26( A / F , 6.17%,3)

$107.17

Option 3: Receiving $150 interest per year for three years

AE (6.17%)3 $2, 000( A / P, 6.17%,3) $150 $2, 000( A / F , 6.17%,3)

$126.60

Making the personal loan is the best option.

6.26

Equivalent Annual Cost:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-16

AEC (13%) A ($1, 200, 000 $60, 000)( A / P,13%, 20)

(0.13)($60, 000) $50, 000 $40, 000

$260, 083

AEC (13%) B ($750, 000 $30, 000)( A / P,13%,10)

(0.13)($30, 000) $80, 000 $30, 000

$216,395

Processing cost per tonne:

C A $260, 083 /(20)(365) $35.63 per tonne

CB $216,395 /(20)(365) $29.64 per tonne

Incinerator B is a better choice.

6.27

(a)

AE (15%) A [$2,500 $1, 000( P / F ,15%,1)

$400( P / F ,15%, 4)]( A / P,15%, 4)

$216.06

AE (15%) B [$4, 000 $100( P / F ,15%,1)]( A / P,15%, 4) $1,500

$129.40

Project A is a better choice.

(b)

AE (15%) B $129.40

AE (15%)C [$5, 000 $200( P / A,15%, 2)]( A / P,15%, 4) $2, 000

$134.79

Project C is a better choice.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-17

Life-Cycle Cost Analysis

6.28 Assumption: Jet Fuel Cost = $1.50/L

System A : Equivalent annual fuel cost: A1 = ($1.5/L)(160kL/1,000

hours)(2,000 hours) $480, 000 (assuming an end of-year convention)

AEC (10%)fuel [$480, 000( P / A1 , 6%,10%,3)]( A / P,10%,3)

$507, 494

AEC (10%) A ($100, 000 $10, 000)( A / P,10%,3)

(0.10)($10, 000) $507, 494

$544, 684

System B : Equivalent annual fuel cost: A1 = ($1.50/L)(128kL/1,000

hours)(2,000 hours = $384,400

AEC (10%)fuel [$384, 000( P / A1 , 6%,10%,3)]( A / P,10%,3)

$405,995

AEC (10%) B ($200, 000 $20, 000)( A / P,10%,3)

(0.10)($20, 000) $405,995

$480,376

Cost of owning and operating:

System A $544, 684 / 2, 000 $272.34 per hour

System B $480,376 / 2, 000 $240.19 per hour

System B is a better choice.

6.29 Since the required service period is 12 years and the future replacement cost

for each truck remains unchanged, we can easily determine the equivalent

annual cost over a 12-year period by simply finding the annual equivalent cost

of the first replacement cycle for each truck.

Truck A: Four replacements are required.

AEC (12%) A ($15, 000 $5, 000)( A / P,12%,3)

(0.12)($5, 000) $3, 000

$7, 763.50

Truck B: Three replacements are required.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-18

AEC (12%) B ($20, 000 $8, 000)( A / P,12%, 4)

(0.12)($8, 000) $2, 000

$6,910.80

Truck B is a more economical choice.

6.30

(a) Number of decision alternatives (required service period = five years):

Alternative Description

Buy Machine A and use it for four years.

A1

Then lease the machine for one year.

A2 Buy Machine B and use it for five years.

A3 Lease a machine for five years.

Buy Machine A and use it for four years.

A4 Then buy another Machine A and use it

for just one year.

Buy Machine A and use it for four years.

A5

Then buy Machine B and use it for one year.

Both A4 and A5 are feasible but may not be practical alternatives. To

consider these alternatives, we need to know the salvage values of the

machines after one-year use.

(b) With lease, the O&M costs will be paid by the leasing company:

For A1:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-19

PW (10%)1 $6,500 ($600 $100)( P / F ,10%, 4)

$800( P / A,10%, 4) $200( P / F ,10%,3)

$100( P / F ,10%, 2) ($3, 000 $100)( P / F ,10%,5)

$10,976

AEC (10%)1 $10,976( A / P,10%,5)

$2,895.44

For A2:

PW (10%) 2 $8,500 $1, 000( P / F ,10%,5)

$520( P / A,10%,5) $280( P / F ,10%, 4)

$10, 042

AEC (10%) 2 $10, 042( A / P,10%,5)

$2, 649

For A3:

AEC (10%)3 [$3, 000 $3, 000( P / A,10%, 4)]( A / P,10%,5)

$3,300

A2 is a better choice.

*

6.31

Option 1:

AEC (18%)1 $125,000(300)( A / P,18%, 20)

$(0.08)(125,000)(300)( A / F ,18%, 20)

(0.01 0.473)(80,000,000)

$52,824,600

cost/kg $52,824,600 / 80,000,000

$66.0 cents/kg

Option 2:

AEC (18%) 2 ($0.10 0.473)(80,000,000)

$45,840,000

cost/kg $45.84 / 80

57.34 cents/kg

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-20

Option 2 is a better choice.

6.32 Given: Required service period indefinite, analysis period indefinite

Plan A: Incremental Investment Strategy:

Capital Investment :

AEC (10%)1 [$400, 000 $400, 000( P / F ,10%,15)]( A / P,10%, )

$49,576

Supporting Equipment:

AEC (10%) 2 [($75, 000 $75, 000 / 3.1772)( P / F ,10%,30)]

( A / P,10%, )

$565

Note that the effective interest rate for 15-year period is

(1 0.1)15 1 3.1772

Operating Cost:

AEC (10%)3 [$31, 000( P / A,10%,15)

$62, 000( P / A,10%,5)( P / F ,10%,15)]

$63, 000

[ $1, 000( P / G,10%, )]

0.10

( P / F ,10%, 20)]( A / P,10%, )

$40, 056

Note that ( P / G, i, ) 1/ i 2 or ( P / G,10%, ) 100

Total Equivalent Annual Worth:

AEC (10%) A $49,576 $565 $40, 056 $90,197

Plan B: One-Time Investment Strategy:

Capital Investment:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-21

AEC (10%)1 $550, 000( A / P,10%, )

$55, 000

Supporting Equipment:

$150, 000

AEC (10%) 2 ( A / P,10%, )

16.4494

$912

Note that the effective interest rate for 30-year period is

(1 0.1)30 1 16.4494

Operating Cost:

AEC (10%)3 [$35, 000( P / A,10%,15)

$55, 000( P / A,10%, )( P / F ,10%,15)]

( A / P,10%, )

$39, 788

Total Equivalent Annual Worth:

AEC (10%) B $55, 000 $912 $39, 788 $95,700

Plan A is a better choice.

Design Economics

*

6.33

(a)

Energy Loss:

0.0042059 $3, 038.13

(24 365)($0.0825)

A A

Material Weight:

(60)(8894) A 533640 A

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-22

Total Material Costs:

(533 640 A)(13) $693 7320 A

Capital Recovery Cost:

CR (11%) [$6937 320 A $2 533640 A]( A / P,11%, 25) $2 533640 A 0.11

5870040 A A / P,11%, 25 117400.8 A

814175 A

Total Equivalent Annual Cost:

3.03813

AEC (11%) $814175 A

A

Optimal Cross-Sectional Area:

dAEC (11%) 3.03813

$814175 0

dA A2

A 0.00193172m 2 19.3172 cm 2

(b) Minimum Annual Equivalent Total Cost:

AEC (11%)

2 3.03813 $3,145.52

0.00193172

(c) Graphs of the capital cost, energy-loss cost, and the total cost as a function of

the cross-sectional area A:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-23

Mixed Investments

6.34

(a) IRR for the incremental investment:

n Net Cash Flow

Project A Project B B-A

0 $300 $800 $500

1 0 $1,150 $1,150

2 $690 $40 $650

i* B A 0% or 30%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-24

Since this is a mixed incremental investment, we need to find the RIC using an

external interest rate of 15%.

RICB-A IRRB-A 16.95% 15%

Project B is preferred.

(b) PW(i) function between 0% and 50%:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-25

Mutually Exclusive Alternatives: IRR Method

6.35

(a) Project A: IRR 11.71%

Project B: IRR 19.15%

(b) Only Project B is acceptable.

(c) Since Project A is not acceptable, select Project B.

6.36 Option 1:Buy a GIC.

Option 2: Purchase a bond, and assume that MARR 9%

Net Cash Flow

n Option 1 Option 2 Option 1 Option 2

0 -$10,000 -$10,000 0

1 0 1,000 -1,000

2 0 1,000 -1,000

3 0 1,000 -1,000

4 0 1,000 -1,000

5 16,105 11,000 5,105

The rate of return on incremental investment is

i*1 2 10% 9%

Option 1 is a better choice.

6.37 Determine the cash flow on incremental investment:

Net Cash Flow

n Project A Project B B-A

0 -$2,000 -$3,000 -$1,000

1 1,400 2,400 1,000

2 1,640 2,000 360

i* B A 28.11% 15%

Select Project B.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-26

6.38

(a) IRR on the incremental investment:

Net Cash Flow

n Project A1 Project A2 A2 A1

0 10,000 12,000 $2,000

1 5,000 6,100 1,100

2 5,000 6,100 1,100

3 5,000 6,100 1,100

i* A 2 A1 29.92%

(b) Since it is a simple incremental investment, IRR A2-A1 29.92% 10% .

Therefore, select Project A2.

6.39

(a) IRR on the incremental investment:

Net Cash Flow

n

A1 A2 A2 A1

0 -$15,000 -$20,000 -$5,000

1 7,500 8,000 500

2 7,500 15,000 7,500

3 7,500 5,000 -2,500

Since the incremental cash flow series portrays a nonsimple investment, we

need to find the RIC at 10%, which is RIC A 2 A1 7.36% 10% . So, select A1.

(b) We can verify the same result by applying the NPW criterion.

PW (10%) A1 15, 000 $7,500( P / A,10%,3)

$3, 651

PW (10%) A 2 20, 000 $8, 000( P / F ,10%,1) $15, 000( P / F ,10%2)

$5, 000( P / F ,10%,3)

$3, 426

Select Project A1.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-27

6.40 Incremental cash flows ( Model A Model B):

n AB

0 $2,376

1 0

2 0

3 0

4 2,500

IRR A B 1.28%

If MARR 1.28%, Model A is a preferred.

*

6.41

IRR for Model A: 6.01%, IRR for Model B: 7.25%

The best decision is do-nothing.

6.42

(a) The least common multiple project lives = six years analysis period six

years

Net Cash Flow

n

Project A Project B BA

0 $100 $200 100

1 60 120 60

2 50 150-200 100

3 50100 120 170

4 60 150-200 110

5 50 120 70

6 50 150 100

Since the incremental cash flow series indicates a nonsimple investment, but it

is a pure incremental investment.

IRRB A 15.98% 15%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-28

So, select Project B.

(b) Incremental analysis between C and D:

Net Cash Flow

n

Project C Project D CD

0 $4,000 $2,000 $2,000

1 2,410 1,400 1,010

2 2,930 1,720 1,210

IRR C D 7.03% , Project D is preferred.

(c) Incremental analysis between E and F:

Net Cash Flow

n

Project E Project F F E

0 $2,000 $3,000 $1,000

1 3,700 2,500 1,200

2 1,640 1,500 140

No IRR, Project E dominates Project F. Select E.

6.43 Let A0 = current practice, A1 just-in-time system, A2 stocks less supply

system.

Comparison Between A0 and A1:

n A0 A1 A1 A0

0 0 -$2,500,000 -$2,500,000

1-8 -5,000,000 -2,900,000 2,100,000

i* A1 A0 IRR A1 A0 83.34% 10%

A1 is a better choice.

Comparison Between A1 and A2:

n A2 A1 A2 A1

0 -$5,000,000 -$2,500,000 -$2,500,000

1-8 -1,400,000 -2,900,000 1,500,000

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-29

i* A 2 A1 IRR A 2 A1 58.49% 10%

A2 is a better choice. That means that the stockless supply system is the final

choice.

6.44

(a)

Project A vs. Project B

Net Cash Flow

n

Project A Project B BA

0 $1,000 $1,000 0

1 900 600 -$300

2 500 500 0

3 100 500 400

4 50 100 50

i* B A IRR B A 21.27% 12% , select B.

Project B vs. Project C

Net Cash Flow

n

Project B Project C CB

0 $1,000 $2,000 $1,000

1 600 900 300

2 500 900 400

3 500 900 400

4 100 900 800

i*C B IRR C B 26.32% 12% , select C.

(b)

$1, 000 $300( P / A, i, 4)

i 7.71%

(c) Since borrowing rate of return (BRR) is less than MARR, Project D is

acceptable.

(d)

Net Cash Flow

n

Project C Project E CE

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-30

0 $2,000 $1,200 $800

1 900 400 500

2 900 400 500

3 900 400 500

4 900 400 500

i*C E IRR C E 50.23% 12% , select C.

6.45

(a)

i1* 85.08%, i2* 48.11%, and i3* 44.31%

(b)

Project 1 vs. Project 2:

n Project 1 Project 2 21

0 $1,000 $5,000 $4,000

1 500 7,500 7,000

2 2,500 600 1,900

This is a nonsimple incremental investment. So we need to compute RIC at

15%.

RIC21 33.69% 15%

Select Project 2.

Project 2 vs. Project 3:

n Project 2 Project 3 23

0 -$5,000 -$2,000 -$3,000

1 7,500 1,500 6,000

2 600 2,000 -1,400

This is another nonsimple incremental investment, so we need to calculate

RIC on the incremental investment.

RIC23 59.42% 15%

Again, select Project 2.

6.46

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-31

(a) IRRB 25.99%

(b) PW (15%) A $10, 000 $5,500( P / A,15%,3) $2,558

(c) Incremental Analysis:

Net Cash Flow

n Project A Project B BA

0 $10,000 $20,000 $10,000

1 5,500 0 5,500

2 5,500 0 5,500

3 5,500 40,000 34,500

Since IRR B A 24.24% 15%, select Project B.

6.47 Select Model C. Note that all three projects would be acceptable individually,

as each projects IRR exceeds the MARR. The incremental IRR of Model (C

B) is 40%, indicating that Model C is preferred over Model B at MARR = 12%.

Similarly, the incremental IRR of Model (C A) is 15%, which exceeds the

MARR. Therefore, Model C is again preferred.

6.48 All projects would be acceptable because individual ROR exceed the MARR.

Based on the incremental analysis, we observe the following relationships:

IRR A 2 A1 10% 15% (Select A1)

IRR A3 A1 18% 15% (Select A3)

IRR A3 A 2 23% 15% (Select A3)

Therefore, A3 is the best alternative.

6.49 From the incremental rate of return table, we can deduce the following

relationships:

IRR A 2 A1 9% 15% (Select A1)

IRR A3 A 2 42.8% 15% (Select A3)

IRR A 4 A3 0% 15% (Select A3)

IRR A5 A 4 20.2% 15% (Select A5)

IRR A6 A5 36.3% 15% (Select A6)

It is necessary to determine the preference relationship among A1, A3, and A6.

IRR A3 A1 16.66% 15% (Select A3)

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-32

IRR A6 A3 20.18% 15% (Select A6)

IRR A6 A1 18.24% 15% (Select A6)

A6 is the best alternative.

6.50 For each power saw model, we need to determine the incremental cash flows

over the by-hand operation that will result over a 20-year service life.

Power Saw

Category Model A Model B Model C

Investment cost $4,000 $6,000 $7,000

Salvage value $400 $600 $700

Annual labour savings $1,296 $1,725 $1,944

Annual power cost $400 $420 $480

Net annual savings $896 $1,305 $1,464

Net Cash Flow

n Model A Model B Model C

0 -$4,000 -$6,000 -$7,000

1 896 1,305 1,464

2 896 1,305 1,464

20 400+896 600+1,305 700+1,464

IRR 22.03% 21.35% 20.46%

PW(10%) $3,688 $5,199 $5,568

Model A vs. Model B:

PW (i ) B A $2, 000 $409( P / A, i, 20) $200( P / F , i, 20)

0

IRR B A 19.97% 10%

Select Model B.

Model B vs. Model C:

PW (i )C B $1, 000 $159( P / A, i, 20) $100( P / F , i, 20)

0

IRR C B 15.03% 10%

Select Model C.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-33

Unequal Service Lives

6.51 With the least common multiple of six project years,

Net Cash Flow

n Project A Project B BA

0 -$100 -$200 -$100

1 60 120 60

2 50 150-200 -100

3 50-100 120 170

4 60 150-200 -110

5 50 120 70

6 50 150 100

Since the incremental cash flow series is a nonsimple investment, we may

abandon the IRR analysis and use the PW decision rule.

PW (15%) B A $100 $60( P / F ,15%,1)

$100( P / F ,15%, 6)

$3.48

Since PW (15%) B A 0, or PW (15%) B PW (15%) A , select Project B.

Comments: Even though the incremental flow is a nonsimple, it has a unique rate

of return. As shown in Problem 7.39, this incremental cash flow series will pass the

net investment test, indicating that the incremental cash flow is a pure investment.

IRR B A 15.98% 15%

6.52

(a) Since there is not much information given regarding the future replacement

options and the required service period, we may assume that the required

service period is indefinite and both projects can be repeated at the same cost

in the future.

(b) The analysis period may be chosen as the least common multiple of project

lives, which is three years.

n A2 A1

0 -$5,000

1 0

2 0

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-34

3 15,000

IRR A 2 A1 44.195%

The MARR must be less than 44.195% for Project A1 to be preferred.

Short Case Studies

ST6.1

Option 1: Process device A lasts only four years. You have a required

service period of six years. If you take this option, you must consider how you

will satisfy the rest of the required service period at the end of the project life.

One option would subcontract the remaining work for the duration of the

remaining required service period. If you select this subcontracting option

along with Device A, the equivalent net present worth would be

PW (12%)1 $100, 000 $60, 000( P / A,12%, 4)

$10, 000( P / F ,12%, 4)

$100, 000( P / A,12%, 2)( P / F ,12%, 4)

$383, 292

Option 2: This option creates no problem because its service life coincides

with the required service period.

PW (12%) 2 $150, 000 $50, 000( P / A,12%, 6)

$30, 000( P / F ,12%, 6)

$340,371

Option 3: With the assumption that the subcontracting option would be

available over the next six years at the same cost, the equivalent present worth

would be

PW (12%)3 $100, 000( P / A,12%, 6)

$411,141

With the restricted assumptions above, Option 2 appears to be the best

alternative.

Notes to Instructors: This problem is deceptively simple. However, it can make

the problem interesting with the following embellishments.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-35

If the required service period is changed from six years to five years, what would

be the best course of action?

If there are price differentials in the subcontracting option (say, $55,000 a year for

a six-year contract, $60,000 for a five-year contract, $70,000 a year for a four-

year contract, and $75,000 a year for any contract lasting less than four years),

what would be the best option?

If both Processes A and B would be available in the subsequent years, but the

required investment and salvage value would be increasing at the annual rate of

10%, what would be the best course of action?

If both Device A and B will be available in the subsequent years, but the required

investment and salvage value (as well as the O & M costs) would be decreasing at

the annual rate of 10%, what would be the best course of action?

ST6.2

Note to Instructors: This case problem requires several pieces of information. (1)

No minimum attractive rate return figure is given for Northern Electric. (2) What

would be a typical number of accidents in line construction work? (3) How does a

typical electric utility handle the nesting problems? If there is some cleaning cost,

how much and how often?

First, we may calculate the equivalent present value (cost) for each option

without considering the accident costs and nesting problems.

Design Options

Factors Option 1 Option 2 Option 3 Option 4

Cross Arm Triangular Horizontal Stand Off

Line

Investment:

Construction cost $495,243 $396,813 $402,016 $398,000

Accident cost

Annual cost:

Flashover repair $6,000 $3,000 $3,000 $3,000

Cleaning nest

Annual savings:

Inventory 0 $4,521 $4,521 $4,521

Assume that Northern Electrics required rate of return would be 12%. The

equivalent present value cost for each option is as follows:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-36

PW (12%)1 $495, 243 $6, 000( P / A,12%, 20)

$540, 060

PW (12%)2 $396,813 $3, 000( P / A,12%, 20)

$4,521( P / A,12%, 20)

$385, 452

PW (12%)3 $402, 016 $3, 000( P / A,12%, 20)

$4,521( P / A,12%, 20)

$398, 654

PW (12%)4 $398, 000 $3, 000( P / A,12%, 20)

$4,521( P / A,12%, 20)

$386, 639

It appears that the triangular design configuration be the most

economical.

If we consider the potential accident costs ($65,000 per accident) during line

construction work, it is likely to change the outcome. If we expect only a

couple of accidents, Option 2 still appears to be the best. However, if you

expect more than three accidents, the conventional cross-arm design appears

to be more economical. If the nest cleaning cost were factored into the

analysis, the accident cost would be reduced to the extent of the annual

cleaning cost, indicating the preference of the triangular design.

ST6.3

This case problem appears to be a trivial decision problem as one alternative

(laser blanking method) dominates the other (conventional method). The

problem of this nature (from an engineers point of view) involves more

strategic planning issues than comparing the accounting data. We will first

calculate the unit cost under each production method. Since all operating costs

are already given in dollars per part, we need to convert the capital expenditure

into the required capital recovery cost per unit.

Conventional method:

CR (16%) $106, 480( A / P,16%,10)

$22, 031 per year

$22, 031

Unit capital recovery cost

3, 000

$7.34 per year

Laser blanking method:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-37

CR(16%) $83, 000( A / P,16%,10)

$17,173 per year

$17,173

Unit capital recovery cost

3, 000

$5.72 per part

Blanking Method

Description Conventional Laser

Steel cost/part $14.98 $8.19

Transportation cost/part $0.67 $0.42

Blanking cost/part $0.50 $0.40

Capital cost/part $7.34 $5.72

Total unit cost $23.49 $14.73

It appears that the window frame production by the laser blanking

technique would save about $8.76 for each part produced. If Ford decides

to make the window frame in house, the part cost would range between

$14.73 and $23.49, depending upon the blanking method adopted. If Ford

relies on an outside supplier, the subcontracting work should be in this

cost range. If Ford were producing the window frames by the conventional

method, the die investment had already been made. In this case, one of the

important issues is to address if it is worth switching to the laser blanking

this time or later. If Ford decides to go with the laser blanking, it will take

six months to reach the required production volume. What option should

Ford exercise to meet the production need during this start-up period?

ST6.4

Given: annual energy requirement 66 Gg of steam, net proceeds from

demolishing the old boiler unit $1, 000

Annual Energy Requirement 66 2.32 153.12 TJ

(a) Annual fuel costs for each alternative:

Alternative 1:

153,12 TJ

Weight of dry coal

(0.75)(33.24 MJ/kg)

6,142 tonnes

Annual fuel cost 6,142 125

= $7,67,750

Alternative 2:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-38

153.12 TJ(0.94)

Natural Gas cost 40 / m3 3

(0.78)(39 MJ/m )

= $1,892,608

153.12 TJ(0.06)

Heating Oil cost $864 / L

(0.81)(38.6 MJ/L)

= $252,702

Annual fuel cost = $1,892,608 + $252,702

= $2,145,310

(b) Unit cost per steam kg:

Alternative 1: Assuming a zero salvage value of the investment

AEC (10%) ($1, 770,300 $100, 000

$1, 000)( A / P,10%, 20)

$767, 750

$10, 71,970

$10, 71,970

Unit cost $1.62 /kg

66106 kg

Alternative 2:

AEC (10%) ($889, 200 $1, 000)( A / P,10%, 20)

$2,145,310

$2, 249, 638

$2, 249, 638

Unit cost 3.41 /kg

66106 kg

(c) Select Alternative 1.

ST6.5

(a) Assumptions Required:

There is no information regarding the analysis period; we will assume that the

firm will be in business for an indefinite period.

There is no information regarding the future plastics technology options; we

will assume that the best one available will be the technology introduced n

months from now.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-39

We will assume that the annual revenue/costs are spread evenly throughout

the year.

(b) Investment Decision:

Present Worth Analysis: First we will determine the equivalent present worth for

each option, and its value at MARR = 15%

Option 1:

PW(i)1 = -10 + [15/12 6/12](P/A,i,96) + 1(P/F,i,96)

PW(i)1 = -10 + 0.75(P/A,i,96) + 1(P/F,i,96)

PW(1%)1 = -10 + 46.15 + 0.38 = $36.53 M

Option 2:

PW(i)2 = {(0.1n 10) + [(15/12 0.15n) (6/12 + 0.05n)](P/A,i,96-n) +

[1+0.05n](P/F,i,96-n)}(P/F,i,n) + [15/12 6/12](P/A,i,n)

PW(i)2 = {(0.1n 10) + [0.75 0.2n](P/A,i,96-n) + [1+0.05n](P/F,i,96-

n)}(P/F,i,n)) + 0.75(P/A,i,n)

Although Option 1 (switching now) bestows a great present worth ($36.53 M), it

can be seen that the best time to retrofit would be to wait the full 96 months,

which would yield a PW of $48.22 M. The worst time to retrofit would be after

41 months ($186.43 M).

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-40

n PW n PW n PW n PW n PW n PW

1 $24.64 17 -$116.43 33 -$179.01 49 -$180.47 65 -$134.77 81 -$53.08

2 $13.14 18 -$122.44 34 -$180.73 50 -$178.86 66 -$130.61 82 -$47.00

3 $2.02 19 -$128.16 35 -$182.22 51 -$177.08 67 -$126.32 83 -$40.81

4 -$8.72 20 -$133.57 36 -$183.48 52 -$175.12 68 -$121.90 84 -$34.52

5 -$19.09 21 -$138.69 37 -$184.51 53 -$172.98 69 -$117.34 85 -$28.13

6 -$29.09 22 -$143.53 38 -$185.31 54 -$170.68 70 -$112.65 86 -$21.64

7 -$38.73 23 -$148.08 39 -$185.90 55 -$168.20 71 -$107.83 87 -$15.06

8 -$48.01 24 -$152.36 40 -$186.27 56 -$165.56 72 -$102.89 88 -$8.38

9 -$56.95 25 -$156.36 41 -$186.43 57 -$162.75 73 -$97.82 89 -$1.61

10 -$65.54 26 -$160.09 42 -$186.39 58 -$159.79 74 -$92.63 90 $5.25

11 -$73.79 27 -$163.56 43 -$186.13 59 -$156.67 75 -$87.32 91 $12.20

12 -$81.70 28 -$166.76 44 -$185.67 60 -$153.39 76 -$81.90 92 $19.24

13 -$89.29 29 -$169.71 45 -$185.02 61 -$149.96 77 -$76.36 93 $26.36

14 -$96.55 30 -$172.41 46 -$184.17 62 -$146.38 78 -$70.70 94 $33.57

15 -$103.49 31 -$174.85 47 -$183.12 63 -$142.65 79 -$64.94 95 $40.85

16 -$110.12 32 -$177.05 48 -$181.89 64 -$138.78 80 -$59.06 96 $48.22

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-41

ST6.6

(a) Assumptions Required:

There is no information regarding the expected cash flows from the current

operation if Chiller Cooling decides to defer the introduction of the

absorption technology for three years. Therefore, we need to make an

explicit assumption of the expected cash flows for the first three years if

Chiller Cooling decides to defer the decision. Assume that the annual cash

flow during this period would be X.

Another assumption we have to make is about the analysis period.

Assuming that the firm will be in business for an indefinite period, we also

need to make an explicit assumption regarding the future cooling technology.

Since there is no information about the future cooling technology options,

we may assume that the best cooling technology will be the absorption

technology that will be introduced three years from now. Therefore, if

Chiller Cooling decides to select Option 1, we could assume that, at the end

of eight years, Option 2 (the best cooling technology at that time) will be

adopted for an indefinite period.

(b) Investment Decision:

Present Worth Analysis: First, we will determine the equivalent present

worth for each option:

PW (i )1 $6 $9( P / A, i,8) $1( P / F , i,8)

[$5 $4( P / A, i,8) $2( P / F , i,8)]( A / P, i,8)

i

( P / F , i,8)

PW (i ) 2 X ( P / A, i,3)

[$5 $4( P / A, i,8) $2( P / F , i,8)]( A / P, i,8)

i

( P / F , i,3)

Now we can determine the value X that makes the two options economically

equivalent at an interest rate of 15%. In other words, if we evaluate the two

present worth functions at i 15% , we have

PW (15%)1 $41.31

PW (15%)2 2.2832 X $13.28

Letting PW (15%)1 PW (15%) 2 and solving for X gives

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-42

X $12.28

As long as the current operation continues to generate annual net revenue of

$12.28 millions for three years, Option 2 is a better choice.

Rate of return analysis: The present worth analysis above indicates that, if

X $12.28 , the break-even rate of return on incremental investment is

i*1 2 15%

Therefore, the ultimate choice will depend on the level of annual revenues

generated during the first three years when the advanced cooling technology is

deferred. Clearly, if

X $12.28 , then i*1 2 15% , Option 1 is preferred.

ST6.7

n Current Pump(A) Larger Pump(B) B-A

0 $0 -$1,600,000 -$1,600,000

1 $10,000,000 $20,000,000 $10,000,000

2 $10,000,000 $0 -$10,000,000

IRR = 25%

400%

The incremental cash flows result in multiple rates of return (25% and 400%), so

we may abandon the rate of return analysis. Using the PW analysis,

PW (20%) $1.6 M $10 M ( P / F , 20%,1) $10 M ( P / F , 20%, 2)

$0.21 0

Reject the larger pump.

Return on Invested Capital:

PB (i, 20%)0 $1, 600, 000

PB(i, 20%)1 $1, 600, 000(1 i ) $10, 000, 000

8, 400, 000 1, 600, 000i

If i 525%, then PB(i, 20%)1 0 .

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-43

PB (i, 20%) 2 (8, 400, 000 1, 600, 000i)(1 0.20) $10, 000, 000

80, 000 1,920, 000i

0

i 4.17% 20%

If i 525%, then PB(i, 20%)1 0 , no RIC exists. So the RIC on the incremental

cash flows should be 4.17%, which indicates Select a smaller pump.

ST6.8

(a) Whenever you need to compare a set of mutually exclusive projects based

on the rate of return criterion, you should perform an incremental analysis.

In our example, the incremental cash flows would look like the following:

n B-A

0 -$10,000

1 +23,000

2 -13,200

This is a nonsimple investment with two rates of return.

i* B A 10% or 20%

We could abandon the IRR analysis and use the PW analysis to rank the

projects.

(b) If we plot the present worth as a function of interest rate, we will observe

the following:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

6-44

If MARR < 10% select Project A.

If 10% MARR 18.1%, select Project B.

If MARR > 18.1%, do nothing.

Return on Invested Capital: The true rate of return can be found as a function of

MARR.

Let i IRR and assume i 1.3

PB (i, MARR)0 $10, 000

PB(i, MARR)1 $10, 000(1 i ) $23, 000

$13, 000 10, 000i

PB(i, MARR) 2 ($13, 000 10, 000i)(1 MARR)

$13, 200

0

(Note that, if, i 1.3, there will be no feasible solution.) Rearranging the terms

in PB(i, MARR) 2 gives an expression of IRR as a function of MARR.

1.32

IRR 1.3

1 MARR

For example, at MARR 15%

IRR B A 15.3% 15%

Project B (the higher cost investment) would be justified.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

Potrebbero piacerti anche

- Solution Manual Engineering Economy 16th Edition William G. Sullivan, Elin M. Wicks, C. Patrick KoellingDocumento15 pagineSolution Manual Engineering Economy 16th Edition William G. Sullivan, Elin M. Wicks, C. Patrick KoellingTrí NhânNessuna valutazione finora

- EE HW3 SolutionDocumento5 pagineEE HW3 SolutionLê Trường ThịnhNessuna valutazione finora

- Fundamentals of Engineering Economics 4th Edition Park Solutions ManualDocumento24 pagineFundamentals of Engineering Economics 4th Edition Park Solutions Manualjadehacr7u100% (18)

- 05 Park ISM ch05 PDFDocumento39 pagine05 Park ISM ch05 PDFBenn DoucetNessuna valutazione finora

- EE - Assignment Chapter 6 SolutionDocumento9 pagineEE - Assignment Chapter 6 SolutionXuân ThànhNessuna valutazione finora

- 1 Mutually Exclusive and Independent ProjectsDocumento34 pagine1 Mutually Exclusive and Independent ProjectsAngel NaldoNessuna valutazione finora

- GGFGGDocumento12 pagineGGFGGkarimNessuna valutazione finora

- TUGAS EKOTEK (Adesita N)Documento21 pagineTUGAS EKOTEK (Adesita N)AdeSitaNursabaniahNessuna valutazione finora

- Park - Fundamentals of Engineering Economics - 2nd Edition - Solution Manual - ch2Documento15 paginePark - Fundamentals of Engineering Economics - 2nd Edition - Solution Manual - ch2Mobin Akhand50% (6)

- Tugas Estimasi Parameter FS Proyek Infrastruktur - Dadang Noor Fithri - 2125011015Documento7 pagineTugas Estimasi Parameter FS Proyek Infrastruktur - Dadang Noor Fithri - 2125011015NoviNandaNessuna valutazione finora

- Lecture 4-Comparing Alternatives - UQUDocumento15 pagineLecture 4-Comparing Alternatives - UQUmidoNessuna valutazione finora

- Solution Assignment 3 Chapter 6Documento14 pagineSolution Assignment 3 Chapter 6Huynh Ng Quynh NhuNessuna valutazione finora

- Chapter 5 Present-Worth Analysis: Identifying Cash Inflows and OutflowsDocumento23 pagineChapter 5 Present-Worth Analysis: Identifying Cash Inflows and Outflowsahjhnlol50% (2)

- Engineering Economy Homework OptimizationDocumento4 pagineEngineering Economy Homework OptimizationMinh TríNessuna valutazione finora

- ENERGY MANAGEMENT PRESENT WORTH ANALYSISDocumento20 pagineENERGY MANAGEMENT PRESENT WORTH ANALYSISاحمد محمد عريبيNessuna valutazione finora

- Real Real TPD501 AYANLADEDocumento54 pagineReal Real TPD501 AYANLADEdavidolalere7Nessuna valutazione finora

- Fundamentals of Engineering Economics 3rd Edition Park Solutions ManualDocumento21 pagineFundamentals of Engineering Economics 3rd Edition Park Solutions Manualjadehacr7u100% (25)

- Engine displacement savings calculationDocumento3 pagineEngine displacement savings calculationEzlan HarithNessuna valutazione finora

- Chapter6E2010 PDFDocumento12 pagineChapter6E2010 PDFutcm77Nessuna valutazione finora

- Chapter9E2010 PDFDocumento29 pagineChapter9E2010 PDFmariahx91Nessuna valutazione finora

- ENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023Documento7 pagineENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023jearsonsanderNessuna valutazione finora

- Assigment 3Documento9 pagineAssigment 3Felipe PinedaNessuna valutazione finora

- Selecting Process Tool Using NPV and IRR AnalysisDocumento5 pagineSelecting Process Tool Using NPV and IRR AnalysisabcNessuna valutazione finora

- ENGR 301 - Assignment 6: Deadline: Due 16:00, Thursday November 17, 2016Documento4 pagineENGR 301 - Assignment 6: Deadline: Due 16:00, Thursday November 17, 2016Miriam HebbassiNessuna valutazione finora

- Annual Worth Analysis: Principles of Engineering Economic Analysis, 5th EditionDocumento28 pagineAnnual Worth Analysis: Principles of Engineering Economic Analysis, 5th EditionnorahNessuna valutazione finora

- Universidad Mariano Gálvez del Guatemala - Análisis Financiero Gerencial IIDocumento10 pagineUniversidad Mariano Gálvez del Guatemala - Análisis Financiero Gerencial IIBRYAN ALEXIS ALFARO CONTRERASNessuna valutazione finora

- Chapter 10 Dealing With Uncertainty: General ProcedureDocumento15 pagineChapter 10 Dealing With Uncertainty: General ProcedureHannan Mahmood TonmoyNessuna valutazione finora

- HomeWork Slide 7Documento5 pagineHomeWork Slide 7Anisa Fitriani0% (1)

- Dinah Fe T. Olitan Activity 5-7 Capital Budgeting Problems and SolutionsDocumento7 pagineDinah Fe T. Olitan Activity 5-7 Capital Budgeting Problems and SolutionsDinah Fe Tabaranza-OlitanNessuna valutazione finora

- Engineering Economy 15th Edition Sullivan Test Bank Full Chapter PDFDocumento51 pagineEngineering Economy 15th Edition Sullivan Test Bank Full Chapter PDFRobertFordicwr100% (13)

- Engineering Economy 15th Edition Sullivan Test BankDocumento30 pagineEngineering Economy 15th Edition Sullivan Test Bankkieranthang03m100% (35)

- 05 Present Worth AnalysisDocumento25 pagine05 Present Worth Analysis王泓鈞Nessuna valutazione finora

- Mcgraw-Hill, Inc: Lecture Notes 5Documento6 pagineMcgraw-Hill, Inc: Lecture Notes 5Hassan ShehadiNessuna valutazione finora

- IFM11 Solution To Ch10 P18 Build A Model-2Documento3 pagineIFM11 Solution To Ch10 P18 Build A Model-2Diana SorianoNessuna valutazione finora

- W4. Annual Worth Analysis AnnotasiDocumento38 pagineW4. Annual Worth Analysis AnnotasiChrisThunder555Nessuna valutazione finora

- Four mutually exclusive jogging track projects compared using IRR and B/C ratio methodsDocumento5 pagineFour mutually exclusive jogging track projects compared using IRR and B/C ratio methodsnorrrrNessuna valutazione finora

- Farrel Gunawan LB41 2201752590 Assignment Engineering Economy (Break Even Analysis and Payback Period)Documento3 pagineFarrel Gunawan LB41 2201752590 Assignment Engineering Economy (Break Even Analysis and Payback Period)Farel GunawanNessuna valutazione finora

- Chap. 6Documento8 pagineChap. 6Khuram MaqsoodNessuna valutazione finora

- Assigment 2Documento14 pagineAssigment 2Felipe PinedaNessuna valutazione finora

- Final Exam SolutionDocumento6 pagineFinal Exam SolutionRoronoa ZoroNessuna valutazione finora

- Engineering Economy 16th Edition Sullivan Test BankDocumento31 pagineEngineering Economy 16th Edition Sullivan Test Bankrussellmatthewspctjegdyox100% (23)

- Chapter 11 SolutionsDocumento50 pagineChapter 11 SolutionsabcNessuna valutazione finora

- Solution: Life First. FirstDocumento3 pagineSolution: Life First. FirstEzz El-Deen MohamadNessuna valutazione finora

- Chapter # 18 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocumento26 pagineChapter # 18 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'bNessuna valutazione finora

- Homework 3 Egr OumaimaDocumento6 pagineHomework 3 Egr Oumaimaoumaidi123Nessuna valutazione finora

- Solutions To Chapter 12 Problems: 12-1 EUACDocumento29 pagineSolutions To Chapter 12 Problems: 12-1 EUACabcNessuna valutazione finora

- Ch#7 Practice Problem SolutionDocumento4 pagineCh#7 Practice Problem SolutionF0x123100% (1)

- Math Economy Bibat 1Documento14 pagineMath Economy Bibat 1Cams SenoNessuna valutazione finora

- Annual Cash Flow AnalysisDocumento35 pagineAnnual Cash Flow AnalysisNur Irfana Mardiyah DiyahlikebarcelonaNessuna valutazione finora

- Engineering Economics Annual Cash Flow AnalysisDocumento35 pagineEngineering Economics Annual Cash Flow AnalysisNur Irfana Mardiyah DiyahlikebarcelonaNessuna valutazione finora

- Engineering Economy Alday Ric Harold MDocumento6 pagineEngineering Economy Alday Ric Harold MHarold AldayNessuna valutazione finora

- Ch6 newAnnualWorthAnalysis 2020Documento11 pagineCh6 newAnnualWorthAnalysis 2020NUR IZZAH NABILA BINTI ISKANDAR SYAH A18KT0230Nessuna valutazione finora

- Topic 4 AW and BC Ratio ComparisonsDocumento7 pagineTopic 4 AW and BC Ratio Comparisonssalman hussainNessuna valutazione finora

- Student 11 Problem: 18: Cost of DebtDocumento6 pagineStudent 11 Problem: 18: Cost of DebtFakerPlaymakerNessuna valutazione finora

- WRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevDocumento11 pagineWRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevMeg TNessuna valutazione finora

- Economics of Climate Change Mitigation in Central and West AsiaDa EverandEconomics of Climate Change Mitigation in Central and West AsiaNessuna valutazione finora

- Cambodia: Energy Sector Assessment, Strategy, and Road MapDa EverandCambodia: Energy Sector Assessment, Strategy, and Road MapNessuna valutazione finora

- Carbon Capture, Utilization, and Storage Game Changers in Asia: 2020 Compendium of Technologies and EnablersDa EverandCarbon Capture, Utilization, and Storage Game Changers in Asia: 2020 Compendium of Technologies and EnablersValutazione: 4.5 su 5 stelle4.5/5 (2)

- Asia in the Global Transition to Net Zero: Asian Development Outlook 2023 Thematic ReportDa EverandAsia in the Global Transition to Net Zero: Asian Development Outlook 2023 Thematic ReportNessuna valutazione finora

- Deployment of Hybrid Renewable Energy Systems in MinigridsDa EverandDeployment of Hybrid Renewable Energy Systems in MinigridsNessuna valutazione finora

- 16 Park ISM ch16 PDFDocumento18 pagine16 Park ISM ch16 PDFBenn DoucetNessuna valutazione finora

- 10 Park ISM ch10 PDFDocumento61 pagine10 Park ISM ch10 PDFBenn DoucetNessuna valutazione finora

- 02 Park ISM ch02 PDFDocumento3 pagine02 Park ISM ch02 PDFBenn DoucetNessuna valutazione finora

- 13 Park ISM ch13 PDFDocumento12 pagine13 Park ISM ch13 PDFBenn DoucetNessuna valutazione finora

- 03 Park ISM ch03 PDFDocumento15 pagine03 Park ISM ch03 PDFBenn DoucetNessuna valutazione finora

- 04 Park ISM ch04 PDFDocumento28 pagine04 Park ISM ch04 PDFBenn DoucetNessuna valutazione finora

- 15 Park ISM ch15 PDFDocumento36 pagine15 Park ISM ch15 PDFBenn DoucetNessuna valutazione finora

- 14 Park ISM ch14 PDFDocumento36 pagine14 Park ISM ch14 PDFBenn DoucetNessuna valutazione finora

- 11 Park ISM ch11 PDFDocumento95 pagine11 Park ISM ch11 PDFBenn DoucetNessuna valutazione finora

- 12 Park ISM ch12 PDFDocumento21 pagine12 Park ISM ch12 PDFBenn DoucetNessuna valutazione finora

- 08 Park ISM ch08 PDFDocumento17 pagine08 Park ISM ch08 PDFBenn DoucetNessuna valutazione finora

- Veiled Alliance PDFDocumento98 pagineVeiled Alliance PDFBenn Doucet100% (4)

- The Ivory Triangle PDFDocumento213 pagineThe Ivory Triangle PDFBenn Doucet100% (2)

- 07 Park ISM ch07 PDFDocumento7 pagine07 Park ISM ch07 PDFBenn DoucetNessuna valutazione finora

- Arcane ShadowsDocumento120 pagineArcane ShadowsKasper Holm100% (1)

- 09 Park ISM Ch09Documento15 pagine09 Park ISM Ch09Benn DoucetNessuna valutazione finora

- Wind Riders of The Jagged Cliffs PDFDocumento138 pagineWind Riders of The Jagged Cliffs PDFBenn Doucet100% (1)

- Wind Riders of The Jagged Cliffs PDFDocumento138 pagineWind Riders of The Jagged Cliffs PDFBenn Doucet100% (1)

- Valley of Dust and Fire PDFDocumento106 pagineValley of Dust and Fire PDFBenn Doucet100% (2)

- Slave Tribes PDFDocumento98 pagineSlave Tribes PDFBenn Doucet100% (4)

- AD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFDocumento130 pagineAD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFWannes Ikkuhyu100% (6)

- Dark Sun - 2419 - CGR2 - The Complete Gladiator's Handbook PDFDocumento132 pagineDark Sun - 2419 - CGR2 - The Complete Gladiator's Handbook PDFPedro Lamas100% (1)

- Black FlamesDocumento122 pagineBlack FlamesDylan Flippance100% (2)

- Black Spine PDFDocumento314 pagineBlack Spine PDFBenn Doucet100% (5)

- The Ivory TriangleDocumento213 pagineThe Ivory TriangleDylan Flippance100% (1)

- Asticlian GambitDocumento121 pagineAsticlian GambitDylan Flippance100% (1)

- Beyond The Prism PentadDocumento34 pagineBeyond The Prism PentadDiego Fernando Lastorta67% (6)

- Veiled Alliance PDFDocumento98 pagineVeiled Alliance PDFBenn Doucet100% (4)

- Olympian Generator Brochure 26-200 KvaDocumento7 pagineOlympian Generator Brochure 26-200 KvaJawad RazaNessuna valutazione finora

- 2008 Company Performance 2008 Company Performance & 2009 Business Outlook & 2009 Business OutlookDocumento30 pagine2008 Company Performance 2008 Company Performance & 2009 Business Outlook & 2009 Business OutlookKakasNessuna valutazione finora

- House Service Connection NEW BSR 2020-1Documento1 paginaHouse Service Connection NEW BSR 2020-1Deshraj BairwaNessuna valutazione finora

- Creative NonfictionDocumento11 pagineCreative NonfictionRubelyn CagapeNessuna valutazione finora

- Price List Grand I10 Nios DT 01.05.2022Documento1 paginaPrice List Grand I10 Nios DT 01.05.2022VijayNessuna valutazione finora

- Design of Goods & Services: Tanweer Ascem KharralDocumento10 pagineDesign of Goods & Services: Tanweer Ascem KharralHadeed GulNessuna valutazione finora

- Fakeaway - Healthy Home-Cooked Takeaway MealsDocumento194 pagineFakeaway - Healthy Home-Cooked Takeaway MealsBiên Nguyễn HữuNessuna valutazione finora

- Tajima Usb Linker User's GuideDocumento35 pagineTajima Usb Linker User's GuideFermin MuñozNessuna valutazione finora

- ABRACON's Tuning Fork Crystals and Oscillators for 32.768kHz RTC ApplicationsDocumento13 pagineABRACON's Tuning Fork Crystals and Oscillators for 32.768kHz RTC Applicationsdit277Nessuna valutazione finora

- Diversification in Flavoured Milk: A ReviewDocumento6 pagineDiversification in Flavoured Milk: A ReviewInternational Journal of Clinical and Biomedical Research (IJCBR)Nessuna valutazione finora

- RFIADocumento11 pagineRFIAMary Joy TorresNessuna valutazione finora

- GRT9165 Product GuideDocumento23 pagineGRT9165 Product GuideEslamAldenAbdoNessuna valutazione finora

- Answer Example Source Questio N Type Topic: Glish/Doanddoeshasandhave/Bjgd /post - HTMDocumento92 pagineAnswer Example Source Questio N Type Topic: Glish/Doanddoeshasandhave/Bjgd /post - HTMFarhan HakimiNessuna valutazione finora

- Lesson Plan 2aDocumento5 pagineLesson Plan 2aapi-332424736Nessuna valutazione finora

- June 2023 BillingDocumento10 pagineJune 2023 BillingEsther AkpanNessuna valutazione finora

- Energy Monitoring With Ultrasonic Flow MetersDocumento35 pagineEnergy Monitoring With Ultrasonic Flow MetersViswa NathanNessuna valutazione finora

- Sea Cucumber PDFDocumento171 pagineSea Cucumber PDFRebeccaSulivanNessuna valutazione finora

- Yara Crop Nutrition For HorticultureDocumento8 pagineYara Crop Nutrition For HorticultureadjieNessuna valutazione finora

- CrankDocumento9 pagineCrankKresna BayuNessuna valutazione finora

- NPC PrintPlay DeckDocumento19 pagineNPC PrintPlay DeckBenjamin Pappa Bach FossumNessuna valutazione finora

- DLP Science Week 6 Day 5Documento3 pagineDLP Science Week 6 Day 5John Carlo DinglasanNessuna valutazione finora

- Rom BlonDocumento8 pagineRom BlonCharlesJustin AyunonNessuna valutazione finora

- Yamaha TT600RE Service ManualDocumento382 pagineYamaha TT600RE Service ManualStefan30393% (14)

- Microsoft PowerPoint - ECHOCARDIOGRAPHY IN ADULT CONGENITAL HEART DISEASE PDFDocumento51 pagineMicrosoft PowerPoint - ECHOCARDIOGRAPHY IN ADULT CONGENITAL HEART DISEASE PDFHanafieHeluthNessuna valutazione finora

- Axminster CarpetDocumento19 pagineAxminster Carpetrohit sinhaNessuna valutazione finora

- Ashrae 62.1-2019Documento92 pagineAshrae 62.1-2019Alejandro Castillo100% (16)

- Incorrect Fuel Level Indication RepairDocumento3 pagineIncorrect Fuel Level Indication RepairBogdan StefanNessuna valutazione finora

- Techint Group Brochure 2013Documento100 pagineTechint Group Brochure 2013MD AFROZ RAZANessuna valutazione finora

- Mathematics: Full Marks Zero Marks: 0 in All Other CasesDocumento31 pagineMathematics: Full Marks Zero Marks: 0 in All Other CasesAbhishek KumarNessuna valutazione finora

- Science Technologyand International RelationsDocumento20 pagineScience Technologyand International RelationsMuhammad HussainNessuna valutazione finora