Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

09 Park ISM Ch09

Caricato da

Benn DoucetCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

09 Park ISM Ch09

Caricato da

Benn DoucetCopyright:

Formati disponibili

9-1

Chapter 9 Corporate Income Taxes

Note: Unless otherwise specified, tax rates from Tables 9.1 and 9.2 are used in the

solutions.

Corporate Income Taxes

9.1 (b)

Gains, Losses, Disposal Tax Effect

9.2 UCC with 50% rule = 0.85(0.7)4$50,000 = $10,204

Corporate Income Taxes

9.3 Taxable income = $200,000 $84,000 $4,000 = $112,000; net income =

(1 0.30)$112,000 = $78,400

9.4 Net cash generated = $78,400 + $4,000 = $82,400

9.5 Since all of these expenses are tax deductible, both companies have the same

taxable income of $240,000.

9.6

(a) Taxable income:

$2,500,000 $1,280,000 $128,000 = $1,092,000

(b) Income tax calculation using data from Tables 9.1 and 9.2 (Saskatchewan):

Combined small business tax rate on $400,000 taxable income = 11.0% +

4.5% = 15.5%

Combined manufacturing tax rate on remaining $692,000 = 19.5% + 10% =

29.5%

Income taxes = 0.155($400,000) + 0.295($692,000) = $266,140

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-2

Gains, Losses, Disposal Tax Effect

*

9.7

(a) Disposed of in year 3:

UCC 2 0.85(0.70) 2 $60, 000

$24,990

loss $20, 000 $24,990

($4,990)

(b) Disposed of in year 5:

UCC 4 0.85(0.70) 4 $60, 000

$12, 245

loss $10, 000 $12, 245

($2, 245)

(c) Disposed of in year 6:

UCC5 0.85(0.70)5 $60, 000

$8,571

loss $5, 000 $8,571

($3,571)

*

9.8

UCC 4 0.85(0.70) 4 $300, 000

$61, 225

(a) If sold at $10,000:

loss $10, 000 $61, 225

($51, 225)

disposal tax effect $51, 225(0.34)

$17, 416

*

An asterisk next to a problem number indicates that the solution is available to students

on the Companion Website.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-3

(b) If sold at $125,460:

gain $125, 460 $61, 225

$64, 235

disposal tax effect $64, 235(0.34)

$21,839

(c) If sold at $200,000:

gain $200, 000 $61, 225

$138, 775

disposal tax effect $138, 775

$47,183

9.9

(a) Taxable operating income:

Gross revenue $ 1,250,000

Expenses:

Labour 350,000

Material 185,000

CCA 32,500

Rental 57,200

Taxable income 625,300

(b) Taxable gains:

$23,000 $20,000 = $3,000

(c) Total taxes:

Alberta-based small business combined tax rate = 11.0% + 3.0% = 14.0%

Alberta-based nonmanufacturing combined tax rate = 19.5% + 10% = 29.5%

income taxes 0.14 $400, 000 0.295 225,300 tax on gains

$122, 464 0.295 $3, 000 $123,349

(d) Disposal tax effect:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-4

(0.295)($3,000) = $885

9.10 Given: = $50,000, = 10 years, S = $1,000

(a) SL depreciation:

$50,000 $1,000

D $4,900

10

B2011 $35,300 3($4,900) $35, 400

(b) DDB method:

D2011 = $6,400

(c) Optimal time to switch: in year 7

(d) SOYD

45

D2014 ($50, 000 $1, 000) $40, 091

55

(e) Taxable gain:

UCC3 $0.85(0.70)3 ($50, 000)

$14,578

disposal tax effect $0.35(14,578 $30, 000)

$5,398

Incremental & Marginal Tax Rates

9.11

(a) Marginal tax rates:

Existing taxable income already exceeds small business maximum of

$400,000 (small business tax rate = 11.0% + 5.5% = 16.5%). Therefore,

marginal tax rates before and after venture = 19.5% + 14.0 % = 33.5%

(b) Average tax rates:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-5

Without the project = ($400,000/$450,000) 16.5% + ($50,000/$450,000)

33.5% = 18.39%

With the project = ($400,000/$600,000) 16.5% + ($150,000/$600,000)

33.5% = 19.38%

9.12 Marginal tax rate = Average tax rate = 33.5%

9.13

(a) Economic depreciation for the milling machine:

$200,000 $30,000 = $170,000

(b) Marginal tax rates with the project (assume O&M costs are unchanged):

Marginal tax rate Combined manufacturing tax rate

19.5% 13.0% 32.5%

(c) Average tax rate:

Small business rate on first $400,000 = 11.0% + 5.0% = 16.0%

Combined

Project Taxable Taxable

n Revenue CCAn Income Income

1 $80,000 $30,000 $50,000 $520,000

2 80,000 51,000 29,000 499,000

3 80,000 35,700 44,300 514,300

4 80,000 24,990 55,010 525,010

5 80,000 17,493 62,507 532,507

6 80,000 12,245 67,755 537,755

Combined Combined Average

Taxable Income Tax

n Income Taxes Rate

1 $520,000 $103,000 19.81%

2 499,000 96,175 19.27%

3 514,300 101,148 19.67%

4 525,010 104,628 19.93%

5 532,507 107,065 20.11%

6 537,755 108,770 20.23%

9.14 Incremental tax rate calculation:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-6

Combined small business tax rate for Alberta = 11.0% + 3.0% = 14.0%

Combined nonmanufacturing tax rate for Alberta =19.5% + 10.0% =

29.5%

Year 1 Year 2

Revenue $200,000 $200,000

Operating costs 100,000 100,000

CCA 7,500 12,750

Taxable income $92,500 $87,250

Year 1 Year 2

Taxable income without project $350,000 $350,000

Income taxes @ 14.0% 49,000 49,000

Taxable income with project 442,500 437,250

Income taxes @ 14.0% on first

$400,000 and 29.5% thereafter 68,538 66,989

Incremental taxable income 92,500 87,250

Incremental income taxes 19,538 17,989

Incremental tax rate 21.1% 20.6%

9.15 (a) and (b) B.C. combined manufacturing tax rate = 19.5% + 11.5% = 31.0%

Economic Condition

Taxable Income Good Fair Poor

before expansion $2,000,000 $2,000,000 $2,000,000

due to expansion 2,000,000 500,000 (100,000)

after expansion 4,000,000 2,500,000 1,900,000

Income taxes $1,544,800 $965,500 $733,780

Marginal tax rate 31.0% 31.0% 31.0%

Incremental tax rate 31.0% 31.0% 31.0%

Average tax rate 31.0% 31.0% 31.0%

Comments: Note that all tax rates over the project life remain unchanged

because there is no small business deduction with a public company.

9.16 Taxable income from project during year 1:

Combined small business tax rate in Quebec = 11.0% + 8.0% = 19.0%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-7

CCA1 0.15($100, 000)

$15, 000

taxable income $50, 000 $15, 000

$35, 000

(a) Increment in income tax due to the project during year 1:

Without With Project

Project Project Alone

Taxable income $95,000 $130,000 $35,000

Income taxes 18,050 24,700 ?

increment in income taxes = $24,700 $18,050 = $6, 650

(b) Incremental tax rate:

$6,650/$35,000 = 19.0%

The marginal tax rate is 19.0% also.

9.17 Incremental tax calculations:

(a) Additional taxable income due to project:

Year

1 2 3

Annual revenue $80,000 $80,000 $80,000

Operating cost 20,000 20,000 20,000

CCA 7,500 12,750 8,925

Taxable income $52,500 $47,250 $51,075

(b) Additional income tax calculation:

Combined small business tax rate for Ontario = 16.5%

Combined manufacturing tax rate for Ontario = 31.5%

Year 1 Without With Project

Project Project Alone

Taxable income $ 500,000 $ 552,500 $ 52,500

income taxes 97,500 114,038 16,538

Year 2 Without With Project

Project Project Alone

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-8

Taxable income 500,000 547,250 47,250

income taxes 97,500 112,384 14,884

Year 3 Without With Project

Project Project Alone

Taxable income 500,000 551,075 51,075

income taxes 97,500 113,589 16,089

(c) Capital gain taxes:

UCC 0.85(0.70) 2 $50, 000

$20,825

disposal tax effect 0.315($20,825 $10, 000)

$3, 410

9.18 (a) and (b):

Property

n Un1 Taxes

1 $3,500,000 $42,000

2 2,975,000 35,700

3 2,082,500 24,990

4 1,457,750 17,493

5 1,020,425 12,245

6 714,297 8,572

7 500,008 6,000

8 350,005 4,200

Total $151,200

Investment Tax Credits

9.19

Year 1: Building: eligible for 10% ITC (Atlantic Provinces)

ITC1 (bldg) = 0.10 $3,500,000 = $350,000

CCA1(bldg@4%) = (0.04) $3,500,000 = $70,000

UCC1(bldg) = $3,430,000

Equipment: SR&ED investment eligible for ITCs as a CPCC

Calculate the Expenditure Limit (EL) based on the previous years

taxable income to determine the ITC rate:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-9

EL = $3,000,000 10($525,000$400,000) = $1,750,000

ITC1 (equip) = 0.35 $1,750,000 + 0.20 $1,250,000 =

$862,500

CCA1(equip@20%) = (0.20) $1,750,000 = $175,000

UCC1(equip) = $1,575,000

Net Effect in the First Year:

The taxable income is lowered by the sum of the two CCA

amounts: $245,000

The sum of the two ITC amounts can be deducted from taxes

owing: $1,212,500

Year 2: Building: The beginning UCC must be lowered by the year 1 ITC:

CCA2(bldg@4%) = (0.04) ($3,430,000$350,000)= $123,200

UCC2(bldg) = $3,430,000$350,000$123,200 = $2,956,800

Equipment: The beginning UCC must be lowered by the year 1

ITC:

CCA2(equip@20%) = (0.20) ($1,575,000$862,500)=

$142,500

UCC2(equip) = $1,575,000$862,500$142,500 = $570,000

Net Effect in the Second Year:

The taxable income is lowered by the sum of the two CCA

amounts: $265,700

9.20 Total planned expenditures = $975,000

Maximum amount eligible for ITC = 20 spaces $40,000/space = $800,000

The company applies the maximum credit to the asset with the higher CCA

rate (the furnishings) to get the maximum benefit:

ITC(furnishings) = 0.25 $75,000 = $18,750

ITC(building) = 0.25 $725,000 = $181,250

Year 1: Building:

CCA1(bldg@4%) = (0.04) $900,000 = $18,000

UCC1(bldg) = $882,000

Furnishings:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-10

CCA1(furn@20%) = (0.20) $75,000 = $7,500

UCC1(furn) = $67,500

Net Effect in the First Year:

The taxable income is lowered by the sum of the two CCA

amounts: $25,500

The sum of the two ITC amounts can be deducted from taxes

owing: $200,000

Year 2: Building: The beginning UCC must be lowered by the Year 1 ITC:

CCA2(bldg@4%) = (0.04) ($882,000$181,250)= $28,030

UCC2(bldg) = $882,000$181,250$28,030 = $672,720

Furnishings: The beginning UCC must be lowered by the Year 1

ITC:

CCA2(furn@20%) = (0.20) ($67,500$18,750)= $9,750

UCC2(furn) = $67,500$18,750$9,750 = $39,000

Net Effect in the Second Year:

The taxable income is lowered by the sum of the two CCA

amounts: $37,780

Corporate Income Taxes

9.21

(a) Taxable income:

Revenues: $1,450,000

Expenses:

Labour 550,000

Materials 185,000

CCA 32,500

Rental 45,000

Total taxable income $1,162,500

(b) Taxable gain:

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-11

gain proceeds from old equipment UCC

$23, 000 $20, 000

$3, 000

(c) Marginal and average tax rates:

Combined small business tax rate on $400,000 taxable income =

11.0% + 5.0% = 16.0%

Combined nonmanufacturing tax rate on $762,500 = 19.5% + 16.0% =

35.5%

Income taxes = 0.16($400,000) + 0.355($762,500) = $334,688

Effective tax rate = $334,688/$1,162,500 = 28.79%

Marginal tax rate = 35.5%

(d) Net cash flow:

Taxable income $1,162,500

Income taxes 334,688

Net income $827,812

Adjustment:

Add CCA 32,500

Add proceed from

equipment sale 23,000

Subtract gains tax

@ 35.5% (1,065)

Net cash flow $882,247

Gains, Losses, Disposal Tax Effect

9.22

(a) CCA:

Building (Class 1 asset, d = 4%, placed in service in February):

CCA building $400, 000(0.04 / 2)

$8, 000

Equipment (Class 43 asset, d = 30%)

CCA equipment $200, 000(0.30 / 2)

$30, 000

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-12

Total CCA allowed:

CCA total $8, 000 $30, 000

$38, 000

(b) Tax liability:

Sales revenue $1,500,000

Expenses:

Cost of goods sold 600,000

Bond interest 50,000

CCA 38.000

Taxable income $812,000

Income taxes 324.800

Net income $487,200

Short Case Studies

ST 9.1

(a) Economic depreciation:

economic depreciation = $4,000 $2,500 = $1,500

(b) Cost basis:

depreciation base = $14,000 + $800 + $200 = $15,000

(c) Taxable gains and gains taxes:

U 3 $0.85(0.70) 2 $4, 000

$1, 666

disposal tax effect $0.40(1, 666 $2,500)

$334

(d) Capital gains:

U 3 $1, 666

disposal tax effect 0.40($1, 666 $4, 000) 0.40(1/ 2)($4, 000 $5, 000)

$1,134

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-13

(e) Book value at the end of year 3 under 175% DB:

B3 = $1,420

(f) Optimal time to switch: during the fourth year

ST 9.2 (a) and (b) Additional annual taxable income due to expansion:

Since the taxable income before and after the expansion is less than

$400,000, the marginal and average tax rates are the small business value.

Combined small business tax rate for Nova Scotia = 11.0% + 5.0% =

16.0%

(c) PW of income taxes:

CCA schedules: base = $20,000, d = 20%

n CCA

1 $2,000

2 3,600

3 2,880

Incremental income taxes over a three-year period:

Operating Year

Year l Year 2 Year 3

Revenue $30,000 $30,000 $30,000

Expense 10,000 10,000 10,000

CCA 2,000 3,600 2,880

Taxable income $18,000 $16,400 $17,120

Income taxes 2,880 2,624 2,739

Equivalent cost of income taxes:

PW (10%) $2,880( P / F , 10%, 1) 2,624( P / F ,10%, 2) 2,739( P / F ,10%,3)

$6,845

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-14

ST 9.3

(a) Incremental operating income:

Operating Year

Year l Year 2 Year 3 Year 4 Year 5

Revenue $15,000,000 $15,000,000 $15,000,000 $15,000,000 $15,000,000

Expenses:

Mfg. cost 6,000,000 6,000,000 6,000,000 6,000,000 6,000,000

O&M costs 1,200,000 1,200,000 1,200,000 1,200,000 1,200,000

CCA 750,000 1,275,000 892,500 624,750 437,325

Taxable 7,050,000 6,525,000 6,907,500 7,175,250 7,362,675

income

Income 2,467,500 2,283,750 2,417,625 2,511,337 2,576,936

taxes(35%)

Net income 4,582,500 4,241,250 4,489,875 4,663,912 4,785,739

(b) Gains or losses:

U 5 0.85(0.70) 4 $5,000,000

$1,020,425

disposal tax effect 0.35($ 1,020,425 $1,600,000)

$202,851

ST 9.4 (a)

Combined tax rates for Alberta, small business = 14.0% on first $400K,

manufacturing rate = 29.5%

(b) Gains or losses:

Plant:

U 8 0.9(0.80)7 $10,000,000

$1,887,436

disposal tax effect 0.3662($1,887,436 $6,000,000)

$1,506,021

Equipment:

U 8 0.85(0.70)7 $40,000,000

$280,046

disposal tax effect 0.3662($280,046 $4,000,000)

$1,362,247

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

9-15

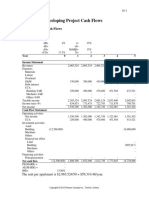

(c)

Income Statement (in thousands of dollars)

1 2 3 4 5 6 7 8

Revenue 30,000.0 30,000.0 30,000.0 30,000.0 30,000.0 30,000.0 30,000.0 30,000.0

Expenses

Mfg cost 9,000.0 9,000.0 9,000.0 9,000.0 9,000.0 9,000.0 9,000.0 9,000.0

Operating

cost 12,000.0 12,000.0 12,000.0 12,000.0 12,000.0 12,000.0 12,000.0 12,000.0

CCA

Plant 1,000.0 1,800.0 1,440.0 1,152.0 921.6 737.3 589.8 471.9

Equipment 6,000.0 10,200.0 7,140.0 4,998.0 3,498.6 2,449.0 1,714.3 1,200.0

Taxable

income 2,000.0 -3,000.0 420.0 2,850.0 4,579.8 5,813.7 6,695.9 7,328.1

Income taxes 528.0 -823.0(1) 61.9 778.8 1,289.0 1,653.0 1,913.3 2,099.8

Net income 1,472.0 -2,177.0 358.1 2,071.3 3,290.8 4,160.7 4,782.6 5,228.3

(1) As a start-up company, Diamonid may not be able to use this years loss against other taxable

income in the company. So there is no simple answer about what marginal tax rate applies to this

loss, as it may be carried forward to future years. For simplicity, the same marginal tax rates are

used as for the other years.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- 14 Park ISM ch14 PDFDocumento36 pagine14 Park ISM ch14 PDFBenn DoucetNessuna valutazione finora

- 16 Park ISM ch16 PDFDocumento18 pagine16 Park ISM ch16 PDFBenn DoucetNessuna valutazione finora

- 05 Park ISM ch05 PDFDocumento39 pagine05 Park ISM ch05 PDFBenn DoucetNessuna valutazione finora

- 04 Park ISM ch04 PDFDocumento28 pagine04 Park ISM ch04 PDFBenn DoucetNessuna valutazione finora

- 03 Park ISM ch03 PDFDocumento15 pagine03 Park ISM ch03 PDFBenn DoucetNessuna valutazione finora

- 10 Park ISM ch10 PDFDocumento61 pagine10 Park ISM ch10 PDFBenn DoucetNessuna valutazione finora

- 07 Park ISM ch07 PDFDocumento7 pagine07 Park ISM ch07 PDFBenn DoucetNessuna valutazione finora

- 02 Park ISM ch02 PDFDocumento3 pagine02 Park ISM ch02 PDFBenn DoucetNessuna valutazione finora

- 11 Park ISM ch11 PDFDocumento95 pagine11 Park ISM ch11 PDFBenn DoucetNessuna valutazione finora

- 12 Park ISM ch12 PDFDocumento21 pagine12 Park ISM ch12 PDFBenn DoucetNessuna valutazione finora

- 08 Park ISM ch08 PDFDocumento17 pagine08 Park ISM ch08 PDFBenn DoucetNessuna valutazione finora

- Wind Riders of The Jagged Cliffs PDFDocumento138 pagineWind Riders of The Jagged Cliffs PDFBenn Doucet100% (1)

- 15 Park ISM ch15 PDFDocumento36 pagine15 Park ISM ch15 PDFBenn DoucetNessuna valutazione finora

- 13 Park ISM ch13 PDFDocumento12 pagine13 Park ISM ch13 PDFBenn DoucetNessuna valutazione finora

- Dark Sun - 2419 - CGR2 - The Complete Gladiator's Handbook PDFDocumento132 pagineDark Sun - 2419 - CGR2 - The Complete Gladiator's Handbook PDFPedro Lamas100% (2)

- The Ivory Triangle PDFDocumento213 pagineThe Ivory Triangle PDFBenn Doucet100% (2)

- 06 Park ISM ch06 PDFDocumento44 pagine06 Park ISM ch06 PDFBenn DoucetNessuna valutazione finora

- Veiled Alliance PDFDocumento98 pagineVeiled Alliance PDFBenn Doucet100% (4)

- Valley of Dust and Fire PDFDocumento106 pagineValley of Dust and Fire PDFBenn Doucet100% (2)

- AD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFDocumento130 pagineAD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFWannes Ikkuhyu100% (8)

- Black Spine PDFDocumento314 pagineBlack Spine PDFBenn Doucet100% (6)

- Asticlian GambitDocumento121 pagineAsticlian GambitDylan Flippance100% (1)

- Slave Tribes PDFDocumento98 pagineSlave Tribes PDFBenn Doucet100% (5)

- Wind Riders of The Jagged Cliffs PDFDocumento138 pagineWind Riders of The Jagged Cliffs PDFBenn Doucet100% (1)

- Black FlamesDocumento122 pagineBlack FlamesDylan Flippance100% (2)

- Arcane ShadowsDocumento120 pagineArcane ShadowsKasper Holm100% (1)

- The Ivory TriangleDocumento213 pagineThe Ivory TriangleDylan Flippance100% (1)

- Veiled Alliance PDFDocumento98 pagineVeiled Alliance PDFBenn Doucet100% (4)

- Beyond The Prism PentadDocumento34 pagineBeyond The Prism PentadDiego Fernando Lastorta67% (6)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- May 18, 2018 - Investor Day Slide PresentationDocumento34 pagineMay 18, 2018 - Investor Day Slide Presentationbillroberts981Nessuna valutazione finora

- Advanced Taxation - Singapore (Atx - SGP) : Strategic Professional - OptionsDocumento13 pagineAdvanced Taxation - Singapore (Atx - SGP) : Strategic Professional - OptionsLee WendyNessuna valutazione finora

- 2018 Income Tax QDocumento4 pagine2018 Income Tax QlightNessuna valutazione finora

- UntitledDocumento28 pagineUntitledBusiness UpdateNessuna valutazione finora

- Mindanao Shopping V DuterteDocumento2 pagineMindanao Shopping V DutertefcnrrsNessuna valutazione finora

- RA No. 10963: Train LawDocumento3 pagineRA No. 10963: Train LawSephora SequiñoNessuna valutazione finora

- Lowering Personal Income Tax (PIT) : Tax Reform For Acceleration and InclusionDocumento4 pagineLowering Personal Income Tax (PIT) : Tax Reform For Acceleration and InclusionChristine Joy RamirezNessuna valutazione finora

- Clorox 2013 Executive SummaryDocumento22 pagineClorox 2013 Executive SummarykirkhereNessuna valutazione finora

- Chapter 17 - After-Tax Economic AnalysisDocumento28 pagineChapter 17 - After-Tax Economic AnalysisBich Lien Pham0% (1)

- Taxable Income: Credit", As FollowsDocumento13 pagineTaxable Income: Credit", As FollowsSuzette VillalinoNessuna valutazione finora

- Dwnload Full Corporate Finance Canadian 7th Edition Jaffe Solutions Manual PDFDocumento35 pagineDwnload Full Corporate Finance Canadian 7th Edition Jaffe Solutions Manual PDFgoblinerentageb0rls7100% (13)

- Costeo Op1Documento18 pagineCosteo Op1Cindy StefaniaNessuna valutazione finora

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocumento27 pagineRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane HandumonNessuna valutazione finora

- Mixed Income EarnersDocumento6 pagineMixed Income EarnersEzi AngelesNessuna valutazione finora

- CHP 4 EconDocumento10 pagineCHP 4 Econld123456Nessuna valutazione finora

- 2021 - Python For Absolute BeginnersDocumento158 pagine2021 - Python For Absolute Beginnersjohandelivers100% (1)

- Solution Manual For Mcgraw Hills Taxation of Individuals and Business Entities 2020 Edition 11th by SpilkerDocumento37 pagineSolution Manual For Mcgraw Hills Taxation of Individuals and Business Entities 2020 Edition 11th by Spilkeractinozoalionizem7k7100% (23)

- Cpa Review School of The Philippines ManilaDocumento2 pagineCpa Review School of The Philippines ManilaEsse ValdezNessuna valutazione finora

- Conceptual FrameworkDocumento65 pagineConceptual FrameworkKatKat OlarteNessuna valutazione finora

- 1701A Annual Income Tax ReturnDocumento3 pagine1701A Annual Income Tax ReturnWa37354Nessuna valutazione finora

- Income Tax (1) - FinalDocumento50 pagineIncome Tax (1) - FinalMay Encarnina P. Gaoiran100% (5)

- Fit Chap012Documento56 pagineFit Chap012djkfhadskjfhksd100% (2)

- Categories of Income and Tax RatesDocumento5 pagineCategories of Income and Tax RatesRonel CacheroNessuna valutazione finora

- BUSINESS LAW - Tax Law FSJES SOUISSI LPE-BADocumento45 pagineBUSINESS LAW - Tax Law FSJES SOUISSI LPE-BAAMINENessuna valutazione finora

- Income Tax Calculator - FY 2011-12 (FINAL)Documento16 pagineIncome Tax Calculator - FY 2011-12 (FINAL)hamzabashamNessuna valutazione finora

- 2023 16th Rich States Poor StatesDocumento59 pagine2023 16th Rich States Poor StatesVerónica SilveriNessuna valutazione finora

- Financial Ratio Analysis Infosys PresentationDocumento44 pagineFinancial Ratio Analysis Infosys PresentationSushanth VarmaNessuna valutazione finora

- Article Review-TaxationDocumento7 pagineArticle Review-Taxationembiale ayaluNessuna valutazione finora

- Spring 1999: Problem 1Documento30 pagineSpring 1999: Problem 1ShubhamNessuna valutazione finora

- R12 E-Business Tax - Part 1Documento26 pagineR12 E-Business Tax - Part 1srama1986Nessuna valutazione finora