Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Trade in Commodity Via Market Experts

Caricato da

Rahul SolankiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Trade in Commodity Via Market Experts

Caricato da

Rahul SolankiCopyright:

Formati disponibili

Daily Market Reflection

2ndAugust 2017

27842 -

Market Outlook COMDEX

Gold prices held near their highest level in around seven weeks

on Tuesday, as market players looked ahead to a key batch of

U.S. economic data to gauge the strength of the world's largest

economy and how it will impact the Federal Reserve's view on

monetary policy. Oil traded near two-month high, supported by

signs that a persistent inventory glut is starting to ease and strong

global demand, although stronger OPEC production kept a lid on

gains. Copper prices are managing to generally hold on to most of

its recent gains and the metal looks strong, while the other metals Market Updates

appear not to be convinced that they should be following coppers MCX Date Date % Chg

lead. 31-07-17 1-08-17

GOLD 28557 28771 +0.05%

Fundamental News SILVER 38645 38515 -0.34%

Gold prices in India last week recorded the biggest discount in COPPER 410.65 407.90 -0.67%

seven months as a rebound in prices hurt retail demand while CRUDE 3183 3135 -1.51%

imports of the precious metal are expected to come under ALUMINIUM 122.70 121.85 -0.69%

pressure amid a seasonal slowdown. LEAD 149 149.20 +0.13%

Brent crude oil prices were expected to remain broadly unchanged NICKEL 657.30 657.90 +0.09%

in 2018 and average at around $45-$50 a barrel as U.S. shale ZINC 179.40 178 -0.78%

production is able to expand at these levels, effectively capping NATURALGAS 180 181.20 181.20

prices. +0.67%COME Date Date % Chg

X 31-07-17 1-08-17

Important Data GOLD 1266.60 1272.39 +0.46%

SILVER 16.786 16.758 -0.17%

Time Currenc Event Forecast Previous CRUDE 50.17 48.95 -2.43%

y COPPER 2.892 2.881 -0.36%

$ INDEX 92.67 92.82 +0.16%

Employment USDINR 64.4075 64.2850 -0.19%

4:15am NZD 0.7% 1.2%

Change q/q

4:15am NZD Unemployment Rate 4.8% 4.9%

OUR PREVIOUS CALLS UPDATE

Spanish Intraday super star

12:30pm EUR Unemployment -66.5K -98.3K Date Commodity Entry Exit P/L

Change

1/08 ALUMINIUM - - -

2:00pm GBP Construction PMI 54.2 54.8 Multibagger

Date Commodity Entry Exit P/L

ADP Non-Farm 1/08 SILVER - - -

Trifid special

5:45pm USD Employment 187K 158K

Date Commodity Entry Exit P/L

Change

1/08 GOLD - - -

Crude Oil For our next calls click here..

8:00pm USD

www.trifidresearch.com -4.4M -7.2M

Inventories| Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Gold and Silver

GOLD COMEX GOLD

Gold showed sideways to bullish movement and found

the important resistance level of 28814. Now if it will

PIVOT S1 S2 R1 R2

S close above the important resistance level of 28860 then

MCX 28500 28300 28860 29000 29000 will act as next resistance level. On the other

COME 1260 1255 1275 1280 hand 28500 will act as a major support level.

SILVER COMEX SILVER

Silver showed bearish movement and found the

PIVOTS S1 S2 R1 R2 important support level of 38230. Now if it will close

below the important support level of 38000 then 37500

MCX 38000 37500 39000 39500

will act as next support level. On the other hand 39000

COMEX 16.60 16.50 16.90 17.00

will act as a major resistance level.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Crude and Copper

CRUDE COMEX CRUDE

Crude showed bearish movement and found the

PIVOTS S1 S2 R1 R2 important support level of 3107. Now if it will close

below the important support level of 3100 then 3050 will

MCX 3100 3050 3235 3300

act as next support level. On the other hand 3235 will

COMEX 48.00 46.00 50.00 52.00

act as a major resistance level.

COPPER COMEX COPPER

Copper showed bearish movement and found the

important support level of 406.10. Now if it will close

PIVOTS S1 S2 R1 R2

below the important support level of 405 then 400 will

MCX 405 400 415 420 act as next support level. On the other hand 415 will act

COMEX 2.8200 2.7800 2.8900 2.9500 as a major resistance level.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Other Commodities

PIVOT

COMMODITIE S1 S2 R1 R2 VOLUME OI TREND

S

ALUMINIUM 120 119 123.50 125 4063 2780 Bearish

LEAD 147 145 150 152 14522 2303 Bullish

NICKEL 640 625 665 680 35938 18186 Bullish

ZINC 177 175 180 182 18954 5248 Bearish

NATURAL GAS 177 175 183 187 49483 11637 Bullish

LME INVENTORY

dasdasdinkjjlfcnl

Due to Summer

COMMODITIES Bank Holiday NO LME

26/07/2017 DATA TODAY

27/07/2017 28/07/2017 31/07/2017 01/08/2017

ALUMINIUM -3425 -4375 -5975 -7775 -5000

COPPER -1600 -1125 -1550 -3600 -1450

LEAD -900 +300 -375 -275 -1025

NICKEL +900 +42 -1602 -1446 -96

ZINC -950 -225 -325 -100 -1275

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Agri Commodity Updates

GUARSEED

Guarseed showed bullish movement and found the

important resistance level of 3650. If prices sustains

below 3550 level in next trading session then this

momentum can take prices to 3500 level. If it breaks

the resistance level of 3650 then 3700 will act as

next resistance level.

PIVOTS S1 S2 R1 R2

3550 3500 3650 3700

JEERA

Jeera showed bearish movement today and found

the support level of 19000. If prices sustain below

19000 levels in next trading session then this

momentum can take prices to 18700 levels. If it

breaks the resistance level of 19400 then 19600 will

act as next resistance level.

PIVOTS S1 S2 R1 R2

19000 18900 19400 19600

SOYABEAN

Soyabean showed sideways movement and found

the important support level of 3000. If prices sustain

below 3000 level in next trading session then this

bearish momentum can take prices to 2950 level. If

it breaks the resistance level of 3070 then 3100 will

act as next resistance level.

PIVOTS S1 S2 R1 R2

3000 2950 3070 3100

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Intraday Super Star

(Premium Section)

CALL: SELL ALUMINIUM BELOW 122 TARGETS 121/120 SL 123.50

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Multibagger Call

(Premium Section)

CALL: BUY SILVER ABOVE 38820 TARGETS 39120/39420 SL 38400.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Trifid Special

(Premium Section)

CALL: BUY GOLD ABOVE 28860 TARGETS 28960/29060 SL 28700.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Trifid Research respects and values the Right to Policy of each and every individual. We are

esteemed by the relationship and by becoming our clients; you have a promise from our side

that we shall remain loyal to all our clients and non-clients whose information resides with us.

This Privacy Policy of Trifid Research applies to the current clients as well as former clients.

Below are the word by word credentials of our Privacy Policy:

1. Your information, whether public or private, will not be sold, rented, exchanged,

transferred or given to any company or individual for any reason without your consent.

2. The only use we will be bringing to your information will be for providing the services to

you for which you have subscribed to us.

3. Your information given to us represents your identity with us. If any changes are brought

in any of the fields of which you have provided us the information, you shall bring it to

our notice by either calling us or dropping a mail to us.

4. In addition to the service provided to you, your information (mobile number, E-mail ID

etc.) can be brought in use for sending you newsletters, surveys, contest information, or

information about any new services of the company which will be for your benefit and

while subscribing for our services, you agree that Trifid Research has the right to do so.

5. By subscribing to our services, you consent to our Privacy Policy and Terms of Use.

6. Trifid research does not guarantee or is responsible in any which way, for the trade

execution of our recommendations, this is the sole responsibility of the client.

7. Due to the markets volatile nature, the trader may/ may not get appropriate opportunity

to execute the trades at the mentioned prices and Trifid Research holds no liability for

any profit/ loss incurred whatsoever in this case.

8. It is the responsibility of the client to view the report timely from our Premium member

section on our website: www.trifidresearch.com and the same will also be mailed to this

registered email id.

9. Trifid research does not hold any liability or responsibility of delay in mail delivery of

reports, as this depends on our mail service providers network infrastructure.

10. The clients can call us for any query related to buying/selling the securities, based on

our recommendations.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Altered Ego Todd HermanDocumento11 pagineAltered Ego Todd HermanCatherine Guimard-Payen75% (4)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Fundamentals of Accounting I Accounting For Manufacturing BusinessDocumento14 pagineFundamentals of Accounting I Accounting For Manufacturing BusinessBenedict rivera100% (2)

- 6 Habits of True Strategic ThinkersDocumento64 pagine6 Habits of True Strategic ThinkersPraveen Kumar JhaNessuna valutazione finora

- Hymns by John Henry NewmanDocumento286 pagineHymns by John Henry Newmanthepillquill100% (1)

- Asawne Kubora Final PDFDocumento8 pagineAsawne Kubora Final PDFAlun Rees100% (1)

- Commercial Law 11 DR Caroline Mwaura NotesDocumento16 pagineCommercial Law 11 DR Caroline Mwaura NotesNaomi CampbellNessuna valutazione finora

- B16. Project Employment - Bajaro vs. Metro Stonerich Corp.Documento5 pagineB16. Project Employment - Bajaro vs. Metro Stonerich Corp.Lojo PiloNessuna valutazione finora

- Today Commodity Gold Trading Tips and News UpdatesDocumento9 pagineToday Commodity Gold Trading Tips and News UpdatesRahul SolankiNessuna valutazione finora

- Free Online Commodity Gold Market NewsDocumento9 pagineFree Online Commodity Gold Market NewsRahul SolankiNessuna valutazione finora

- Today Gold Market Trend and NewsDocumento9 pagineToday Gold Market Trend and NewsRahul SolankiNessuna valutazione finora

- Free Commodity Tips and News AlertsDocumento9 pagineFree Commodity Tips and News AlertsRahul SolankiNessuna valutazione finora

- Free Indian Commodity MArket Report 1st Sept 2017Documento9 pagineFree Indian Commodity MArket Report 1st Sept 2017Rahul SolankiNessuna valutazione finora

- Real Time Market News and DataDocumento9 pagineReal Time Market News and DataRahul SolankiNessuna valutazione finora

- Free Indian Commodity Market Data and Charts For Trading PDFDocumento9 pagineFree Indian Commodity Market Data and Charts For Trading PDFRahul SolankiNessuna valutazione finora

- Live MCX Gold Market News 29 Aug 2017Documento9 pagineLive MCX Gold Market News 29 Aug 2017Rahul SolankiNessuna valutazione finora

- Free Online Commodity Trading Tips Via Market ExpertsDocumento9 pagineFree Online Commodity Trading Tips Via Market ExpertsRahul SolankiNessuna valutazione finora

- Live Commodity Trading Tips and Experts ViewDocumento9 pagineLive Commodity Trading Tips and Experts ViewRahul SolankiNessuna valutazione finora

- Daily Indian Commodity Market Report 24 Aug 2017Documento9 pagineDaily Indian Commodity Market Report 24 Aug 2017Rahul SolankiNessuna valutazione finora

- Free Indian Commodity Market Report Via ResearcherDocumento9 pagineFree Indian Commodity Market Report Via ResearcherRahul SolankiNessuna valutazione finora

- Commodity Trading Tips Via Share Market ExpertsDocumento9 pagineCommodity Trading Tips Via Share Market ExpertsRahul SolankiNessuna valutazione finora

- Free Commodity Trading Tips Via Experts AdviserDocumento9 pagineFree Commodity Trading Tips Via Experts AdviserRahul SolankiNessuna valutazione finora

- Daily News Report For Commodity MarketDocumento9 pagineDaily News Report For Commodity MarketRahul SolankiNessuna valutazione finora

- Free Indian Commodity Market Reprot and Tips PDFDocumento9 pagineFree Indian Commodity Market Reprot and Tips PDFRahul SolankiNessuna valutazione finora

- Commodity Market Premium UpdatesDocumento9 pagineCommodity Market Premium UpdatesRahul SolankiNessuna valutazione finora

- Free Online Commodity Trading Tips and NewsDocumento9 pagineFree Online Commodity Trading Tips and NewsRahul SolankiNessuna valutazione finora

- Commodity Market Live Charts For TradingDocumento9 pagineCommodity Market Live Charts For TradingRahul SolankiNessuna valutazione finora

- Free Indian Commodity Market Reprot and Tips PDFDocumento9 pagineFree Indian Commodity Market Reprot and Tips PDFRahul SolankiNessuna valutazione finora

- Commodity Trading Tips and Live ChartsDocumento9 pagineCommodity Trading Tips and Live ChartsRahul SolankiNessuna valutazione finora

- New Commodity Trading Data For TradingDocumento9 pagineNew Commodity Trading Data For TradingRahul SolankiNessuna valutazione finora

- Weekly Trend of Commodity Market 8th Aug 2017Documento8 pagineWeekly Trend of Commodity Market 8th Aug 2017Rahul SolankiNessuna valutazione finora

- Premium Commodity Trading Tips and News UpdatesDocumento9 paginePremium Commodity Trading Tips and News UpdatesRahul SolankiNessuna valutazione finora

- Commodity-Premium Report 31ST July 147426655844145Documento9 pagineCommodity-Premium Report 31ST July 147426655844145Rahul SolankiNessuna valutazione finora

- Premium Commodity Tips For New InvestorsDocumento9 paginePremium Commodity Tips For New InvestorsRahul SolankiNessuna valutazione finora

- Live Commodity Market Trading Tips and Market NewsDocumento9 pagineLive Commodity Market Trading Tips and Market NewsRahul SolankiNessuna valutazione finora

- Real Time Commodity Market Data, Calls and ChatrsDocumento9 pagineReal Time Commodity Market Data, Calls and ChatrsRahul SolankiNessuna valutazione finora

- Commodity Market Trend and News PortalDocumento9 pagineCommodity Market Trend and News PortalRahul SolankiNessuna valutazione finora

- Toms River Fair Share Housing AgreementDocumento120 pagineToms River Fair Share Housing AgreementRise Up Ocean CountyNessuna valutazione finora

- CT-e: Legal Change: Configuration GuideDocumento14 pagineCT-e: Legal Change: Configuration GuidecamillagouveaNessuna valutazione finora

- Bài Tập Tiếng Anh Cho Người Mất GốcDocumento8 pagineBài Tập Tiếng Anh Cho Người Mất GốcTrà MyNessuna valutazione finora

- Senior Residents & Senior Demonstrators - Annexure 1 & IIDocumento3 pagineSenior Residents & Senior Demonstrators - Annexure 1 & IIsarath6872Nessuna valutazione finora

- Revised WHD Quiz 2023 Flyer PDFDocumento5 pagineRevised WHD Quiz 2023 Flyer PDFDevkesh ByadwalNessuna valutazione finora

- Unconstituted Praxis PDFDocumento115 pagineUnconstituted Praxis PDFGerardo AlbatrosNessuna valutazione finora

- Pathwinder Software v. Core Cashless - Personal Jurisdiction PDFDocumento19 paginePathwinder Software v. Core Cashless - Personal Jurisdiction PDFMark JaffeNessuna valutazione finora

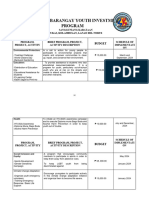

- Annual Barangay Youth Investment ProgramDocumento4 pagineAnnual Barangay Youth Investment ProgramBarangay MukasNessuna valutazione finora

- G.R. No. 113899. October 13, 1999. Great Pacific Life Assurance Corp., Petitioner, vs. Court of Appeals and Medarda V. Leuterio, RespondentsDocumento12 pagineG.R. No. 113899. October 13, 1999. Great Pacific Life Assurance Corp., Petitioner, vs. Court of Appeals and Medarda V. Leuterio, RespondentsdanexrainierNessuna valutazione finora

- HYPERLINKDocumento2 pagineHYPERLINKmico torreNessuna valutazione finora

- Empower Catalog Ca6721en MsDocumento138 pagineEmpower Catalog Ca6721en MsSurya SamoerNessuna valutazione finora

- Application To Visit Australia For Tourism: or Other Recreational ActivitiesDocumento13 pagineApplication To Visit Australia For Tourism: or Other Recreational ActivitiesZoran H. VukchichNessuna valutazione finora

- MA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCDocumento105 pagineMA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCPrisca RaniNessuna valutazione finora

- Veronica Guerin Interview With Anne FelloniDocumento2 pagineVeronica Guerin Interview With Anne FelloniDeclan Max BrohanNessuna valutazione finora

- Case Study No. 8-Managing Floods in Metro ManilaDocumento22 pagineCase Study No. 8-Managing Floods in Metro ManilapicefeatiNessuna valutazione finora

- Business Forecasting: by ITH PhannyDocumento2 pagineBusiness Forecasting: by ITH PhannysmsNessuna valutazione finora

- PRC AUD Prelim Wit Ans KeyDocumento10 paginePRC AUD Prelim Wit Ans KeyJeanette FormenteraNessuna valutazione finora

- Name: Joselle A. Gaco Btled-He3A: THE 303-School Foodservice ManagementDocumento3 pagineName: Joselle A. Gaco Btled-He3A: THE 303-School Foodservice ManagementJoselle GacoNessuna valutazione finora

- Lyotard, Apathy in TheoryDocumento10 pagineLyotard, Apathy in TheoryAshley WoodwardNessuna valutazione finora

- Zlodjela Bolesnog UmaDocumento106 pagineZlodjela Bolesnog UmaDZENAN SARACNessuna valutazione finora

- Qualitative KPIDocumento7 pagineQualitative KPIMas AgusNessuna valutazione finora

- Heliflex Cable: Situation AnalysisDocumento5 pagineHeliflex Cable: Situation AnalysisananyaNessuna valutazione finora

- ColaDocumento4 pagineColaAkhil ChauhanNessuna valutazione finora