Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Process of Capital Formation

Caricato da

manishaamba7547100%(2)Il 100% ha trovato utile questo documento (2 voti)

107 visualizzazioni2 paginestudy note

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentostudy note

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

100%(2)Il 100% ha trovato utile questo documento (2 voti)

107 visualizzazioni2 pagineProcess of Capital Formation

Caricato da

manishaamba7547study note

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

PROCESS OF CAPITAL FORMATION:

The process of capital formation involves following three steps.

1. Increase in the volume of real saving

2. Mobilization of savings

3. Investments of savings in creating real assets.

These three steps are being discussed in some detail.

1. Increase in the volume of real savings: Increase in the volume of real savings

depends upon the following factors.

i. Ability or capacity or power to save and will to save:

The level of savings in a country mainly depends upon the ability or

power or capacity to save. This ability itself depends upon the size of the average

level of income, the size of the family and the standard of living of the people.

The higher the level of average income, the greater will be the rate of savings. If

the average size of the family is small or the people are accustomed to such a

standard of living which is not much consumption-oriented, the power or ability

to save will be higher, otherwise vice versa.

Savings also depend upon the will to save of the people. They may do so

to meet emergencies, for family requirement or for maintaining social status. But

their willingness will depend upon some certain facilities and incentives made

available by the government. People will save if the government is stable and

there is peace and security. Willingness to save of the people will be very poor if

there is lawlessness and disorder and no security of life and property and business

in the country. Further, if the banking and financial institutions are well-

established, paying attractive rates of interests or profits on different term

deposits, providing best services to their clients, people will be willing to save

more. Furthermore, the taxation policy of the government may also affect the

saving attitude of the people. Highly progressive income and property taxes may

discourage the incentive to save. Low rates of taxation, offering different

attractive concessions for savings may encourage will of savings.

ii. Incentives of increasing rates of Profits:

Incentive of increasing rates of profits to the national income may

also help in increasing the level of savings. This can be done through

expanding the economy. For this purpose, a number of incentives should be

provided to enterprises including protects them from foreign competition. The

increased profits will be used in production investment.

iii. Governments role as a saver:

Government can also save by adopting a number of fiscal and monetary

measures. These measures may be in the form of reduction in governments

non-developmental expenditure, expension of export sector and raising money

by public loans etc. If people are not saving voluntarily, inflation can help in

reducing unnecessary consumption. Besides, government can also increase

savings by running public enterprises.

2. Mobilization of Savings: The next step of capital formation is the mobilization of

savings which can be mobilized through banks, financial institutions, investment

trusts, insurance companies and capital markets. As the savers and the investors

are different people so to bring together the both there must be existed well-

developed and well-organized capital and money markets in the country.

3. Investment of savings in creating real assets:

The third step of capital formation is the investment of savings in creating

real assets. For this purpose, the profit making classes can be induced to play an

important role in agriculture and industrial sectors of the country. Besides, a

regular supply of capable, honest and dependable entrepreneurs must be

maintained. This can be done through providing necessary technical know-how to

produce new products. Further, the facilities of well-developed infrastructure,

means of transport, communication, power, and water, educated and trained

personnel along with financial assistance must be made available.

Domestic sources for capital formation are also required to be

supplemented by external sources.

Potrebbero piacerti anche

- Capital Formation: Definitions, Process & FactorsDocumento5 pagineCapital Formation: Definitions, Process & FactorsSharad ParteNessuna valutazione finora

- Factors Affecting DevelopmentDocumento6 pagineFactors Affecting DevelopmentSarose ThapaNessuna valutazione finora

- Management of Financial Institutions - Unit IDocumento7 pagineManagement of Financial Institutions - Unit ISudha MuralinathNessuna valutazione finora

- Fiscal Policy 1d78e36d 8f83 4cc4 B1be 45b89069fe1eDocumento7 pagineFiscal Policy 1d78e36d 8f83 4cc4 B1be 45b89069fe1eyash agNessuna valutazione finora

- Low Capital Formation in India: Causes and SolutionsDocumento15 pagineLow Capital Formation in India: Causes and SolutionsRevti sainNessuna valutazione finora

- ACCA BT Topic 4 NotesDocumento5 pagineACCA BT Topic 4 Notesعمر اعظمNessuna valutazione finora

- UNIT 2 Tutorial Questions and AnswersDocumento6 pagineUNIT 2 Tutorial Questions and AnswersAlicia AbsolamNessuna valutazione finora

- Introduction To Public Finance Meaning of Public FinanceDocumento4 pagineIntroduction To Public Finance Meaning of Public FinanceSakshi HaldankarNessuna valutazione finora

- Bangladesh Economic PoliciesDocumento2 pagineBangladesh Economic PoliciesPeter DundeeNessuna valutazione finora

- 7,520 KM of Coastline, 29,000 KM of Rivers and 1.7 Million Hectares of ReservoirsDocumento8 pagine7,520 KM of Coastline, 29,000 KM of Rivers and 1.7 Million Hectares of ReservoirsRakshana SrikanthNessuna valutazione finora

- Understanding The Circular Flow of Income 1049Documento3 pagineUnderstanding The Circular Flow of Income 1049Moises LeonNessuna valutazione finora

- A Study On Effectiveness of Financial Education Programs in IndiaDocumento10 pagineA Study On Effectiveness of Financial Education Programs in IndiaGULLU DADANessuna valutazione finora

- Defense and Development:: Economic PolicyDocumento9 pagineDefense and Development:: Economic Policyshaikh qutbuddinNessuna valutazione finora

- National income statistics help economic analysis, planning and policyDocumento8 pagineNational income statistics help economic analysis, planning and policyshaikh qutbuddinNessuna valutazione finora

- Public Finance Assignment - WPSDocumento6 paginePublic Finance Assignment - WPSzambogo7Nessuna valutazione finora

- Understanding Fiscal PolicyDocumento10 pagineUnderstanding Fiscal PolicygyytgvyNessuna valutazione finora

- Dfi 341 - Lecture II RDocumento28 pagineDfi 341 - Lecture II RElizabeth MulukiNessuna valutazione finora

- Savings and Investments ChapterDocumento17 pagineSavings and Investments Chapterakash GoswamiNessuna valutazione finora

- Understanding Public Expenditure: Meaning, Classification, Objectives & EffectsDocumento25 pagineUnderstanding Public Expenditure: Meaning, Classification, Objectives & EffectsAbas Mohamed SidowNessuna valutazione finora

- A Technical Note On Savings and Savers As Stakeholders K. KanagasabapathyDocumento6 pagineA Technical Note On Savings and Savers As Stakeholders K. KanagasabapathyMuthu ShreeNessuna valutazione finora

- PF Notes Chapter 7Documento8 paginePF Notes Chapter 7uah346Nessuna valutazione finora

- Role of Government in Economic Development of A CountryDocumento4 pagineRole of Government in Economic Development of A CountryVinz Patrick E. PerochoNessuna valutazione finora

- Research ProposalDocumento11 pagineResearch ProposalHabtemichael ShimalesNessuna valutazione finora

- Role of financial institutions in socioeconomic developmentDocumento19 pagineRole of financial institutions in socioeconomic developmentDarwin SolanoyNessuna valutazione finora

- Chapter 2Documento11 pagineChapter 2rakibulislammbstu01Nessuna valutazione finora

- Demand-Pull InflationDocumento6 pagineDemand-Pull InflationMalik Muhammad JamalNessuna valutazione finora

- When Should The Government Intervene in The Economy?: 1. Market FailureDocumento4 pagineWhen Should The Government Intervene in The Economy?: 1. Market FailurenishmaNessuna valutazione finora

- Concept of Outreach in Microfinance Institutions:: Indicator of Success of MfisDocumento6 pagineConcept of Outreach in Microfinance Institutions:: Indicator of Success of MfisRiyadNessuna valutazione finora

- 36 Investment AlternativeDocumento54 pagine36 Investment AlternativesauravNessuna valutazione finora

- A) Economic Growth, Economic Development and SustainabilityDocumento13 pagineA) Economic Growth, Economic Development and SustainabilityNana budu HayfordNessuna valutazione finora

- 10 Strong Economical Countries Around The WorldDocumento3 pagine10 Strong Economical Countries Around The WorldMd Sabbir HossainNessuna valutazione finora

- 8 Main Canons of Public ExpenditureDocumento12 pagine8 Main Canons of Public ExpenditureLala100% (2)

- Government Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmallDocumento6 pagineGovernment Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmalljoooNessuna valutazione finora

- ECONOMICS HOLIDAY ASSIGNMENT ON INDIGENIZATION, NATIONALIZATION AND PRIVATIZATIONDocumento12 pagineECONOMICS HOLIDAY ASSIGNMENT ON INDIGENIZATION, NATIONALIZATION AND PRIVATIZATIONTemitope AjibodeNessuna valutazione finora

- Eco Dev MidtermDocumento6 pagineEco Dev MidtermGlenn VeluzNessuna valutazione finora

- The Washington Consensus: Winter 2010/2011Documento20 pagineThe Washington Consensus: Winter 2010/2011Lê Phan Anh ThưNessuna valutazione finora

- Two Aspects of Deficit FinancingDocumento5 pagineTwo Aspects of Deficit FinancingQamar AliNessuna valutazione finora

- 04 - Chapter 1Documento28 pagine04 - Chapter 1shan23586Nessuna valutazione finora

- Homework Chap 25Documento2 pagineHomework Chap 25An leeNessuna valutazione finora

- 26 Economic Development & 4.2 Measuring DevelopmentDocumento95 pagine26 Economic Development & 4.2 Measuring DevelopmentDarryn FlettNessuna valutazione finora

- Five Debates by Jatin Ravi N MaheshDocumento33 pagineFive Debates by Jatin Ravi N Maheshyajuvendra7091Nessuna valutazione finora

- Fiscal PolicyDocumento10 pagineFiscal Policyshaliniagarwal2777Nessuna valutazione finora

- Public ExpenditureDocumento15 paginePublic ExpenditureVikas Singh100% (1)

- Fiscalpolics : Tax, On National ProductionDocumento5 pagineFiscalpolics : Tax, On National ProductionAnkitNessuna valutazione finora

- Public FinanceDocumento5 paginePublic FinanceMhai Penolio100% (1)

- Economy 105Documento11 pagineEconomy 105manasisahu.auraNessuna valutazione finora

- 2020 - ED - BED - 001-WPS OfficeDocumento3 pagine2020 - ED - BED - 001-WPS OfficeAmbroseNessuna valutazione finora

- Topic: Economic Policies: I. Learning ObjectivesDocumento11 pagineTopic: Economic Policies: I. Learning ObjectivesAlexis KingNessuna valutazione finora

- Tutorial 4Documento5 pagineTutorial 4seee CelinaNessuna valutazione finora

- RecitationDocumento1 paginaRecitationMark John BetitoNessuna valutazione finora

- Presented By-: Ankit Bansal Jasleen Kaur Ashish Joshi Bhupendra Khatri Smita Saxena Ram Gopal YadavDocumento23 paginePresented By-: Ankit Bansal Jasleen Kaur Ashish Joshi Bhupendra Khatri Smita Saxena Ram Gopal YadavbmitisuNessuna valutazione finora

- BE Final SemDocumento16 pagineBE Final Semkevinnp149Nessuna valutazione finora

- Keynes fiscal policy literature reviewDocumento7 pagineKeynes fiscal policy literature reviewJohn NjorogeNessuna valutazione finora

- Government Spending Theories and ClassificationsDocumento6 pagineGovernment Spending Theories and ClassificationsTrixie CabotageNessuna valutazione finora

- Fiscal and Monetary Policy: What Is Fiscal Policy?Documento7 pagineFiscal and Monetary Policy: What Is Fiscal Policy?sana shahidNessuna valutazione finora

- S5 - Ch35 - Different Stages of DevelopmentDocumento21 pagineS5 - Ch35 - Different Stages of DevelopmentEnkhjin OtgonbatNessuna valutazione finora

- Eco539 Intermediate MicroeconomicsDocumento10 pagineEco539 Intermediate MicroeconomicsMOHD REDZUAN BIN A KARIM (MOH-NEGERISEMBILAN)Nessuna valutazione finora

- Common Sense Economics: Key Concepts and Personal Finance StrategiesDocumento5 pagineCommon Sense Economics: Key Concepts and Personal Finance StrategiesAbdulrahman Nogsane0% (1)

- Capital FormationDocumento16 pagineCapital Formationemmanuel Johny100% (3)

- Economic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsDa EverandEconomic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsNessuna valutazione finora

- Career Planning & Development GuideDocumento23 pagineCareer Planning & Development GuidedhaliwalNessuna valutazione finora

- Research Methodology Assignememnt QuestionsDocumento1 paginaResearch Methodology Assignememnt Questionsmanishaamba7547Nessuna valutazione finora

- Resource Bundle: Using Bloom's Taxonomy To Plan QuestionsDocumento12 pagineResource Bundle: Using Bloom's Taxonomy To Plan Questionsmanishaamba7547Nessuna valutazione finora

- Motivation TheoriesDocumento22 pagineMotivation TheoriesslixsterNessuna valutazione finora

- TNA: Determine Training NeedsDocumento6 pagineTNA: Determine Training NeedsShahzad SalimNessuna valutazione finora

- Research Methodology Assignememnt QuestionsDocumento1 paginaResearch Methodology Assignememnt Questionsmanishaamba7547Nessuna valutazione finora

- Education 4.0: A Paradigm ShiftDocumento46 pagineEducation 4.0: A Paradigm Shiftmanishaamba7547Nessuna valutazione finora

- On-the-Job vs Off-the-Job Training MethodsDocumento5 pagineOn-the-Job vs Off-the-Job Training Methodsnivedita vermaNessuna valutazione finora

- Assignment PHDDocumento1 paginaAssignment PHDmanishaamba7547Nessuna valutazione finora

- Assignment HR 405Documento1 paginaAssignment HR 405manishaamba7547Nessuna valutazione finora

- B. Organizational Structure C. Organizational Behaviour D. Organisational Value Answer: B) Organizational BehaviourDocumento1 paginaB. Organizational Structure C. Organizational Behaviour D. Organisational Value Answer: B) Organizational Behaviourmanishaamba7547Nessuna valutazione finora

- Performance Appraisal ObjectivesDocumento24 paginePerformance Appraisal Objectivesmanishaamba7547Nessuna valutazione finora

- MB 204 Unit 1 HRMDocumento47 pagineMB 204 Unit 1 HRMmanishaamba7547Nessuna valutazione finora

- Shares and Share CapitalDocumento40 pagineShares and Share Capitalmanishaamba7547Nessuna valutazione finora

- Employee Counselling: Meaning, Concept, Types, Benefits and ChallengesDocumento13 pagineEmployee Counselling: Meaning, Concept, Types, Benefits and Challengesmanishaamba7547Nessuna valutazione finora

- 10 1 1 501 8873Documento8 pagine10 1 1 501 8873manishaamba7547Nessuna valutazione finora

- Borrowing Power of Company PDFDocumento12 pagineBorrowing Power of Company PDFmanishaamba7547Nessuna valutazione finora

- Job Satisfaction and MoraleDocumento21 pagineJob Satisfaction and Moralemanishaamba7547Nessuna valutazione finora

- Duignan 1997Documento17 pagineDuignan 1997manishaamba7547Nessuna valutazione finora

- Consumer ProtectionDocumento23 pagineConsumer Protectionmanishaamba7547Nessuna valutazione finora

- 8 N D Mathur - Globalisation and The Flat World EconomyDocumento53 pagine8 N D Mathur - Globalisation and The Flat World Economymanishaamba7547Nessuna valutazione finora

- Motivation 100714090658 Phpapp01Documento22 pagineMotivation 100714090658 Phpapp01manishaamba7547Nessuna valutazione finora

- Virtual Marketing: Importance in Today's MarketDocumento13 pagineVirtual Marketing: Importance in Today's Marketmanishaamba7547Nessuna valutazione finora

- Ascd 412 1 PDFDocumento5 pagineAscd 412 1 PDFmanishaamba7547Nessuna valutazione finora

- MBA 2 Year AssigmentDocumento2 pagineMBA 2 Year Assigmentmanishaamba7547Nessuna valutazione finora

- LP Bba 401 Human Resource ManagementDocumento2 pagineLP Bba 401 Human Resource Managementmanishaamba7547Nessuna valutazione finora

- Rural School PrincipalsDocumento21 pagineRural School Principalsmanishaamba7547Nessuna valutazione finora

- The Changing Shape of LeadershipDocumento5 pagineThe Changing Shape of Leadershipmanishaamba7547Nessuna valutazione finora

- GooglepreviewDocumento41 pagineGooglepreviewmanishaamba7547Nessuna valutazione finora

- 2015 Fernet Et Al WorkStressDocumento23 pagine2015 Fernet Et Al WorkStressmanishaamba7547Nessuna valutazione finora

- FAit - (MUHAMMAD FAISAL - ABDUL MAJEED) - MBDFACCM2108039Documento1 paginaFAit - (MUHAMMAD FAISAL - ABDUL MAJEED) - MBDFACCM2108039wavikod507Nessuna valutazione finora

- Covenant Bank Shareholder LetterDocumento2 pagineCovenant Bank Shareholder LetterwednesdayjournalNessuna valutazione finora

- Compensation Survey 2021Documento14 pagineCompensation Survey 2021Oussama NasriNessuna valutazione finora

- One Up On A Wall StreetDocumento11 pagineOne Up On A Wall StreetShubham Kesarkar0% (1)

- BANKING INDUSTRY RESEARCH FROM BoscoDocumento41 pagineBANKING INDUSTRY RESEARCH FROM BoscoNizeyimana Eddy PalatinNessuna valutazione finora

- Del Monte Pacific LimitedDocumento7 pagineDel Monte Pacific LimitedPrincess Diane VicenteNessuna valutazione finora

- Reserve Bank of IndiaDocumento14 pagineReserve Bank of IndiaJAYANTHI BNessuna valutazione finora

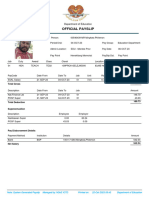

- Official Payslip: Department of EducationDocumento1 paginaOfficial Payslip: Department of Educationphillmingkwa2017Nessuna valutazione finora

- Finance areas interconnectionDocumento3 pagineFinance areas interconnectionCASTOR, Vincent PaulNessuna valutazione finora

- A Summer Training Project Report A Study of Capital Market Reforms With Focus On Mutual Fund AT Edelweiss Broking LimitedDocumento79 pagineA Summer Training Project Report A Study of Capital Market Reforms With Focus On Mutual Fund AT Edelweiss Broking LimitedShashank BaranwalNessuna valutazione finora

- INSEAD - Executive Master in Finance - CurriculumDocumento17 pagineINSEAD - Executive Master in Finance - CurriculumJM KoffiNessuna valutazione finora

- Literature ReviewDocumento5 pagineLiterature ReviewGourab MondalNessuna valutazione finora

- Equity Trading and Demat Account Opening FormDocumento19 pagineEquity Trading and Demat Account Opening FormJAYSURYA YASHVANT100% (1)

- Customer Perception Towards Investment in Mutual FundDocumento49 pagineCustomer Perception Towards Investment in Mutual FundPaankaj NetamNessuna valutazione finora

- The Evolution of Credit and Money SystemsDocumento4 pagineThe Evolution of Credit and Money SystemsChantelle IshiNessuna valutazione finora

- The Walt Disney CompanyDocumento19 pagineThe Walt Disney CompanyBMX2013100% (1)

- Mod 04 - Trade A - RDocumento2 pagineMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- C Statment - Ivan Maleakhi - Des 2020Documento4 pagineC Statment - Ivan Maleakhi - Des 2020Budi ArtantoNessuna valutazione finora

- Performance Evaluation of PNB and HDFC BankDocumento58 paginePerformance Evaluation of PNB and HDFC BankEkam Jot100% (1)

- A-Z Accounting Terms and MeaningsDocumento23 pagineA-Z Accounting Terms and MeaningsRomilie Mae BalagtasNessuna valutazione finora

- Financial Inclusion Through India Post: Dr. Joji Chandran PHDDocumento4 pagineFinancial Inclusion Through India Post: Dr. Joji Chandran PHDJoji ChandranNessuna valutazione finora

- Argentina Paso Results 1692061948Documento8 pagineArgentina Paso Results 1692061948fernando vaninaNessuna valutazione finora

- Accountancy For Lawyers - Practice QuestionsDocumento3 pagineAccountancy For Lawyers - Practice QuestionsNantege ProssielyNessuna valutazione finora

- BDB Annual Report 2021 - Part - 4Documento111 pagineBDB Annual Report 2021 - Part - 42023149467Nessuna valutazione finora

- Receipt 1 PDFDocumento3 pagineReceipt 1 PDFsomenathbasakNessuna valutazione finora

- Monthly Statistics - 2077 - 03 July 2020 PDFDocumento59 pagineMonthly Statistics - 2077 - 03 July 2020 PDFRupEshNessuna valutazione finora

- Final Draft Philippines Case StudyDocumento43 pagineFinal Draft Philippines Case StudyDarwin SolanoyNessuna valutazione finora

- ICICI Bank Platinum Chip Credit Card Membership GuideDocumento14 pagineICICI Bank Platinum Chip Credit Card Membership GuideVijay TambareNessuna valutazione finora

- Santander Consumer Finance Case StudyDocumento8 pagineSantander Consumer Finance Case StudyKennedy Gitonga ArithiNessuna valutazione finora

- Agricultural Business ManagementDocumento5 pagineAgricultural Business ManagementAreicra NutNessuna valutazione finora