Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 2: Accounting For Transactions: I. Financial Statements A. Income Statement

Caricato da

chand1234567893Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 2: Accounting For Transactions: I. Financial Statements A. Income Statement

Caricato da

chand1234567893Copyright:

Formati disponibili

CHAPTER 2: ACCOUNTING FOR TRANSACTIONS

I. FINANCIAL STATEMENTS

A. Income Statement

Describes a companys

revenues and expenses

along with the

resulting net income or

loss over a period of

time due to earnings

activities.

Examples of accounts

on form: Consulting

revenue, rental

revenue, advertising

expense, rent expense, salaries expense

B. Statement of Retained Earnings

Explains changes in retained earnings from net income (or loss) and from any

dividends over a

period of time.

Examples of

accounts on form:

retained earnings

for April 1, 2009,

Net Income or (net

loss), Dividends,

retained earnings

for April 30, 2009

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 1

C. Balance Sheet

Describes a companys

financial position (types

and amounts of assets,

liabilities, and equity) at a

point in time.

Examples of accounts on

form: assets like cash,

accounts receivable,

supplies, equipment;

liabilities like accounts

payable; equity like

common stock and

retained earnings

D. Statement of Cash Flows

Identifies cash inflows

(receipts) and cash outflows

(payments) over a period of

time.

Has three sections: 1st section

on cash flows from Operating

Activities, 2nd section reports

Investing Activities, and the

3rd section shows cash flows

from Financing Activities.

Examples of accounts on

form: cash from operating

activities, purchase of

equipment, investments by

stockholder, dividends to

stockholder

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 2

II. TRANSACTION ANALYSIS AND THE ACCOUNTING EQUATION

A. Accounting Equation

1. Assets

Resources owned or controlled by a company.

Examples: cash, accounts receivable, supplies,

equipment, and land

These resources are expected to yield future benefits

Examples: musical instruments for a rock band, land

for a vegetable grower

Receivableis an asset that promises a future inflow

of resources.

A company that provides a se rvice or product on credit is said to

have an account receivable from that customer.

2. Liabilities

What a company owes to its creditors in future

payments, products, or services.

Payablemeans a liability that promises a

future outflow of resources.

Examples: wages payable to workers, accounts payable to suppliers, notes payable to

banks, taxes payable to the government

3. Equity

Is the owners claim on assets.

It is the owners actual interest in the business.

Also called net assets or residual equity.

Can be found by subtracting total assets from total liabilities.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 3

Corporations equity is called stockholders equity or shareholders equity.

Revenuesincrease in company resources from the sale of goods or services.

Examples: consulting se rvices provided, sales of products, facilities rented to

others, commissions from services

Expensecosts encountered in the normal course of business.

Examples: costs of employee time, use of supplies, advertising from others, utilities

from others

Net Incomean overall measure of performance for the period which equals revenues

less expenses.

4. Equation

a. Basic Accounting Equation

Assets = Liabilities + Equity

Assets must be equal to the claims

against those assets.

If you have an asset, we can have two

broad categories of claims against that asset.

First, we may have claims by creditors, liabilities.

Secondly, after all creditor claims are satisfied, owners and stockholders have a

claim on those assets.

b.

Assets = Liabilities + Equity

+ - - + - +

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 4

Expanded Accounting Equation

Common stock

when an owner

invests in a company

in exchange for

common stock.

Dividendsa corporations distribution of assets to its owners; it reduces the

equity account.

B. Transaction Analysis

Business activities can be described in terms

of transactions and events.

Eventsare happenings that affect an

entitys accounting equation AND can be

reliably measured.

Examples: changes in the market value of certain assets and liabilities,

natural events such as floods and fires that destroy assets and create

losses

During the process of recording business transactions, it

is IMPORTANT to always keep the accounting equation in

balance. We cant let our books get out of balance.

III. ANALYZING AND RECORDING PROCESS

The accounting process identifies business transactions

and events, analyzes and records their effects, and

summarizes and presents information in reports and

financial statements.

External transactionswhere external parties like

creditors, customers, financial institutions and owners

have exchanges of value between the two entities.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 5

Internal transactionstransactions that may involve exchanges between divisions within a

company or payments to employees.

The analyzing and recording process consists of:

1. Analyze each transaction and event from source

documents

2. Record relevant transactions and events in a journal

3. Post journal information to ledger accounts

4. Prepare and analyze the trial balance

A. Source Documents

Identify and describe transactions and events

entering the accounting process.

Provide objective and reliable evidence about

transactions and events and their amounts.

Can be in hard copy form or in electronic

form.

Examples: sales tickets, checks, purchase

orders, bills from suppliers, employee earnings records, and bank statements

B. The Account and Its Analysis

Accounta record of increases and decreases in a specific asset, liability, equity,

revenue, or expense item.

Account information is analyzed, summarized, and presented in reports and financial

statements.

General Ledger (or ledger)is a record containing all accounts used by a company.

Accounts are arranged in three general categories based on the accounting equation: 1.

Assets, 2. Liabilities, 3. Equity

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 6

1. Asset Accounts

Assetsare resources owned or controlled by a company and that have expected

future benefits.

Examples: cash, accounts receivable, note receivable (or promissory note), prepaid

accounts, supplies, equipment, buildings, land

a. Cash

Reflects a companys cash balance.

All increases and decreases in cash are recorded in this account.

Examples: money and any medium of exchange that a bank accepts

for deposit (coins, checks, money orders, and checking account

balances)

b. Accounts Receivable

Also called credit sales or sales on account (or on credit).

Are promises of payment from customers to sellers.

Customers charge the item with the seller, get to take the item home and pay

for it later.

Account receivables are increased by credit sales.

Account receivables are decreased when customers make payments.

c. Note Receivable (or Promissory Note)

Is a written promise of another person to pay a definite sum of money on a

specified future date to the holder of the

note.

A company that is holding a promissory

note signed by another person (entity) has

an asset that is recorded in a Note (or

Notes) Receivable account.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 7

d. Prepaid Accounts (also called Prepaid Expenses)

Are assets that represent prepayments of FUTURE expenses (NOT current

expenses).

When the expense finally happens through the passage of time or are used up,

the amounts in prepaid accounts are transferred to expense accounts.

Examples: prepaid insurance, prepaid rent, prepaid services (such as club

memberships)

Prepaid accounts are adjusted when the financial statements are prepared so

that: (1) all expired and used prepaid accounts are recorded as regular

expenses and (2) all unexpired and unused prepaid accounts are recorded as

assets.

Example: a premium is an insurance fee that is paid in advance for a certain

length of time (i.e. one year). It is listed as Prepaid Insurance and is an asset

for the insurance coverage that we have paid for in advance but havent used

yet. Once we use up a months worth of insurance, it is deducted from the

worth of Prepaid Insurance (an asset) and is recorded as an expense.

e. Supplies

Are considered assets until they are used.

When used up, their costs are reported as expenses.

Are grouped by purpose Office Supplies, Store Supplies

Office Supplies includes stationery, paper, toner, pens.

Store Supplies includes packaging materials, plastic and paper

bags, gift boxes and cartons, cleaning materials.

f. Equipment

Is an asset.

Are grouped by purpose Office Equipment, Store Equipment

Office Equipment includes computers, printers, desks, chairs, and

shelves.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 8

Store Equipment includes counters,

showcases, ladders, hoists, and cash registers

g. Buildings

Are assets because they provide expected future benefits to those who control

or own them.

Examples: stores, offices, warehouses,

and factories

Separate accounts are sometimes kept when a business owns several buildings.

h. Land

The cost of land owned by a business is recorded in a Land

account.

Buildings on that land are recorded in a Building account.

2. Liability Accounts

Are claims by creditors against assets; obligations to transfer assets or

provide products or services to other entities/companies.

Creditorsindividuals and organizations that own the right to receive

payments from a company.

Its when your business charges items with another company and still owes the

money.

If your business fails to pay the company (creditor) money when it is due, the creditor

has a legal right to take your assets, sell them and pay for your debt.

Examples: Accounts Payable, Note Payable, Accrued Liabilities

a. Accounts Payable

Oral or implied promises to pay later, which usually happens from purchases of

merchandise on account.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 9

It can also happen from purchases of supplies, equipment, and services.

b. Notes Payable

A formal promise, usually indicated by the signing of a promissory note, to pay a

future amount.

Depending on when it is to be paid, it can be recorded either to a short-term Note

Payable account or a long-term Note Payable account.

c. Unearned Revenue

Revenuealso called sales

Is when the cash has been received but the product or service has not been

delivered.

Example: you subscribe to a magazine, you pay a one -year subscription in

advance. The publishing company has received cash but

nothing has been done to earn that revenue. As the magazine

is delivered to you, the publishing company recognizes a

portion of the money received as revenue. At the end of the

year, all the revenue will be earned and the liability no longer

exists.

d. Accrued Liabilities

Amounts owed that are not yet paid.

Examples: Wages Payable, Taxes Payable, Interest Payable

3. Equity Accounts

Also called stockholders equity, or shareholders equity

Is the owners claim on a corporations assets.

Equity is the owners remaining interest in the assets of a business after deducting

liabilities.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 10

Equity is affected by four accounts: common stock, dividends, re venues, and

expenses.

a. Common Stock

When an owner invest in a company in exchange for a

share/stock in the company.

Increases equity.

b. Dividends

Opposite of owner investment and

decreases equity.

Its the distribution of assets to the

stockholders.

Is an account used in recording asset

distribution to stockholders/owners.

c. Revenues

When products and services are sold or provided to customers.

Increases equity.

Examples: Sales, Commissions Earned, Professional Fees Earned, Rent

Earned, Interest Revenue

d. Expenses

Result from assets and services used in a companys operation.

Decreases equity.

Examples: Advertising Expense, Store Supplies Expense, Office Salaries

Expense, Office Supplies Expense, Rent Expense, Utilities Expense, Insurance

Expense

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 11

IV. ANALYZING AND PROCESSING TRANSACTIONS

A. Ledger and Chart of Accounts

Ledger (or General Ledger)a record containing all the accounts and their

amounts for a business.

A small company may have 20 to 30 accounts.

A large company may have several thousand accounts.

Chart of Accountsis a list of all

accounts a company uses and

includes an identification number

assigned to each account.

The identification number is a 3-digit

code.

The first digit refers to the type of

account it isasset, liability, etc.

The second and third digits relate to the accounts subcategories.

B. Debits and Credits

T-accountrepresents a ledger account; it is

used as a tool to understand the effects of one or

more transactions.

t-account is in the shape of a capital T.

Debit (Dr.)is the left side of an account.

Credit (Cr.)is the right side of an account.

When you enter an amount on the left side of an account, you debit the account.

When you enter an amount on the right side of an account, you credit the account.

Account balanceis the difference between total debits and total credits for an

account including any beginning balance.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 12

Debit balancewhen the sum of the

debits exceeds the sum of the credits.

Credit balancewhen the sum of the

credits exceeds the sum of the debits.

Zero balancewhen the sum of debits

equals the sum of credits.

C. Double-Entry Accounting

Double-entry accountingrequires that each transaction affects at least two

accounts and is recorded in two accounts.

it also means that the total debits of a transaction must equal the total credits.

With transactions, if you increase one side of the accounting equation, you must

increase the other side.

If you decrease one side of the accounting equation, you must decrease the other

side.

If the transaction affects only one side of the accounting equation, then one

account is increased and one account is decreased.

Dividends, Expenses, Assets (DEA) have Normal Balances on the Debit side OR

on the side that you increase.

Liabilities, Equity, Common Stock, Revenues (LECR) have Normal Balances on

the Credit side OR on the side that you increase.

Equity has 4 sub-categories: Common Stock, Dividends, Revenue, Expenses.

Common Stock and Revenues INCREASE Equity on the Credit side.

Dividends and Expenses DECREASE Equity on the Debit side.

D. Journalizing and Posting Transactions

Journalgives a complete record of each transaction

in one place.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 13

Journalizingis the process of recording transactions in a journal.

Postingthe process of transferring journal entry information to the ledger.

Steps in Processing Transactions:

1) Analyze transactions and source

documents.

2) Apply double-entry accounting

by putting it into T-accounts.

3) Record each transaction in a

journal as a journal entry.

4) Post journal entry to the ledger.

1. Journalizing Transactions

General Journalan all-purpose journal

for recording the debits and credits of

transactions and events.

Posting Reference (PR) columnis left blank in a manual system when

entering a transaction in the General Journal. Later this column will be filled

in with a number when you post to the Ledgers.

The General Journal can be used to record any transaction and includes the

following information:

1) date of transaction

2) titles of affected accounts

3) dollar amount of each debit and credit

4) explanation of the transaction

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 14

To record entries (transactions) into a General Journal, follow these steps:

1) Date the transaction. Enter

the year at the top of the

first column and the month

and day on the first line of

each journal entry.

2) On the same line as the

month and day, enter titles

of accounts debited aligned

with the left margin of the

column. Then enter

amounts in the Debit

column on the same line.

3) On the line below, indent and enter titles of accounts credited. Then enter

amounts in the Credit column on the same line.

4) Indent half as far as the credited account title on the next line below. It is

italicized. Then enter a brief explanation of the transaction. It references a

source document. Then leave a blank line in between transactions for

clarity purposes.

2. Balance Column Account

Is similar to a T-account in that it has

columns for debits and credits.

It also has columns for the Date,

Explanation, PR (post reference), and Balance.

The heading of the Balance column does not show whether it is a debit or a

credit balance.

3. Posting Journal Entries

To make sure that the ledger is up-to-date, entries are posted as soon as

possible.

It could be daily, weekly, or when time permits.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 15

Posting creates a link and a cross-reference between the ledger and the General

Journal entry.

All entries must be posted to the ledgers before financial statements can be

prepared.

If it is a debit in the General Journal, then it is a debit in the Ledger.

Steps to post a journal entry:

1) Identify the ledger account that is debited in the entry; then, in the ledger,

enter the entry date, the journal and page in its PR column, the debit

amount, and the new balance of the ledger.

2) Enter the ledger account number in the PR column of the General Journal.

3) and 4) Repeat the first two steps for credit entries and amounts.

E. Analyzing TransactionsAn Illustration

ANALYSIS Identify 1. Determine what accounts are affected.

Classify 2. Determine what kind of account it is (i.e. asset, liability, etc.)

+/- 3. Determine if each account increases or decreases

Balance 4. Determine if the accounting equation is in balance.

Debit/Credit Rule Which account is debited?_________________________________

Which account is credited? _________________________________

T-Accounts

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 16

1. Investment by Owner

TRANSACTION #1: Shareholders invested $30,000 in FastForward on Dec. 1.

ANALYSIS Identify 1. Cash; Common Stock

Classify 2. CashAsset; Common StockEquity

+/- 3. Cash + ; Common Stock +

Balance 4. The equation is balanced

Debit/Credit Rule Which account is debited? Cash

Which account is credited? Common Stock

T-Accounts

Cash Common Stock

+ - - +

30,000 30,000

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 0 0 0 0 0 = 0 0 0 0 0

1 +30,000 +30,000

Bal. 30,000 + 0 + 0 + 0 + 0 = 0 + 30,000 - 0 + 0 - 0

Double Entry:

(1) Cash 30,000

Common Stock 30,000

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 17

2. Purchase Supplies for Cash

TRANSACTION #2: FastForward purchases supplies by paying $2,500 cash.

ANALYSIS Identify 1 Cash; Supplies

Classify 2. CashAsset; SuppliesAsset

+/- 3. Cash - ; Supplies +

Balance 4. The equation is balanced

Debit/Credit Rule Which account is debited? Supplies

Which account is credited? Cash

T-Accounts

Supplies Cash

+ - + -

2,500 2,500

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 30,000 0 0 0 0 = 0 30,000 0 0 0

2 -2,500 +2,500

Bal. 27,500 + 0 + 2,500 + 0 + 0 = 0 + 30,000 - 0 + 0 - 0

Double Entry:

(2) Supplies 2,500

Cash 2,500

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 18

3. Purchase Equipment for Cash

TRANSACTION #3: FastForward purchases equipment by paying $26,000 cash.

ANALYSIS Identify 1. Equipment; Cash

Classify 2. EquipmentAsset; CashAsset

+/- 3. Equipment + ; Cash -

Balance 4. The equation is balanced

Debit/Credit Rule Which account is debited? Equipment

Which account is credited? Cash

T-Accounts

Equipment Cash

+ - + -

26,000 26,000

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 27,500 0 2,500 0 0 = 0 30,000 0 0 0

3 -26,000 +26,000

Bal. 1,500 + 0 + 2,500 + 0 + 26,000 = 0 + 30,000 - 0 + 0 - 0

Double Entry:

(3) Equipment 26,000

Cash 26,000

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 19

4. Purchase Supplies on Credit

TRANSACTION #4: FastForward purchases $7,100 of supplies on credit.

ANALYSIS Identify 1. Supplies; Accounts Payable

Classify 2. SuppliesAsset; Accounts PayableLiability

+/- 3. Supplies + ; Accounts Payable +

Balance 4. The equation is balanced

Debit/Credit Rule Which account is debited? Supplies

Which account is credited? Accounts Payable

T-Accounts

Supplies Accounts Payable

+ - - +

7,100 7,100

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 1,500 0 2,500 0 26,000 = 0 30,000 0 0 0

4 +7,100 +7,100

Bal. 1,500 + 0 + 9,600 + 0 + 26,000 = 7,100 + 30,000 - 0 + 0 - 0

Double Entry:

(4) Supplies 7,100

Accounts Payable 7,100

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 20

5. Provide Services for Cash

TRANSACTION #5: FastForward provides consulting services and immediately collects $4,200

cash.

ANALYSIS Identify 1. Cash; Consulting Revenue

Classify 2. CashAsset; Consulting RevenueEquity

+/- 3. Cash + ; Consulting Revenue +

Balance 4. The equation is in balance.

Debit/Credit Rule Which account is debited? Cash

Which account is credited? Consulting Revenue

T-Accounts

Cash Consulting Revenue

+ - - +

4,200 4,200

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 1,500 0 9,600 0 26,000 = 7,100 30,000 0 0 0

5 +4,200 Cons.

+4,200

Bal. 5,700 + 0 + 9,600 + 0 + 26,000 = 7,100 + 30,000 - 0 + 4,200 - 0

Double Entry:

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 21

(5) Cash 4,200

Consulting Revenue 4,200

6. Payment of Expense in Cash

TRANSACTION #6: FastForward pays $1,000 for December rent to the landlord of the

building where its facilities are located.

ANALYSIS Identify 1. Cash; Rent Expense

Classify 2. CashAsset; Rent ExpenseEquity

+/- 3. Cash - ; Rent Expense +

Balance 4. The equation is in balance.

Debit/Credit Rule Which account is debited? Rent Expense

Which account is credited? Cash

T-Accounts

Rent Expense Cash

+ - + -

1,000 1,000

A

Assets = Liab + Equity

Accts Equip- Accts Common Divi-

Supp Prepd =

Recv dends

Cash + + + + ment Pay + Stock + Revenu Exp

Insur

e

Bal 5,700 0 9,600 0 26,000 = 7,100 30,000 0 4,200 0

.

6 -1,000 Rent

-1,000

Bal 4,700 + 0 + 9,600 + 0 + 26,000 = 7,100 + 30,000 - 0 + 4,200 - 1,000

.

Double Entry:

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 22

(6) Rent Expense 1,000

Cash 1,000

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 23

7. Payment of Expense in Cash

TRANSACTION #7: FastForward pays the bi-weekly $700 salary of the companys only

employee.

ANALYSIS Identify 1. Cash; Salaries Expense

Classify 2. CashAsset; Salaries ExpenseEquity

+/- 3. Cash - ; Salaries Expense +

Balance 4. The equation is in balance.

Debit/Credit Rule Which account is debited? Salaries Expense

Which account is credited? Cash

T-Accounts

Cash Salaries Expense

+ - + -

700 700

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 4,700 0 9,600 0 26,000 = 7,100 30,000 0 4,200 - 1,000

7 -700 Salar

-700

Bal. 4,000 + 0 + 9,600 + 0 + 26,000 = 7,100 + 30,000 - 0 + 4,200 - 1,700

Double Entry:

(7) Salaries Expense 700

Cash 700

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 24

8. Provide Consulting and Rental Services on Credit

TRANSACTION #8: FastForward provides consulting services of $1,600 and rents its test

facilities for $300 to an amateur sports club. The customer is billed $1,900 for these

services.

ANALYSIS Identify 1. Consulting Revenue; Rental Revenue; Accounts Receivable

Classify 2. Consul RevRevenue; Rent RevRev; Accounts ReceivableAsset

+/- 3. Consulting Revenue + ; Rental Revenue + ; Accounts Receivable +

Balance 4. The equation is in balance.

Accounts

Debit/Credit Rule Which account is debited? Accounts Receivable

Receivable

Which account is credited? Consulting Revenue; Rental Revenue

+ - T-Accounts

1,900 Consulting Revenue Rental Revenue

- + - +

1,600 300

A

Assets = Liab + Equity

Accts Equip- Accts Com m on Divi-

Supp Prepd =

Recv dends

Cash + + + + m ent Pay + Stock + Revenue Exp

Insur

Bal. 4,000 0 9,600 0 26,000 = 7,100 30,000 0 4,200 - 1,700

8 +1,900 Cons

+1,600

Renta

+300

Bal. 4,000 + 1,900 + 9,600 + 0 + 26,000 = 7,100 + 30,000 - 0 + 6,100 - 1,700

Double Entry:

(8) Accounts Receivable 1,900

Consulting Revenue 1,600

Rental Revenue 300

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 25

9. Receipt of Cash on Account

TRANSACTION #9: The client in Transaction #8 pays $1,900 to FastForward 10 days after it

is billed for consulting services.

ANALYSIS Identify 1. Cash; Accounts Receivable

Classify 2. CashAsset; Accounts ReceivableAsset

+/- 3. Cash - ; Accounts Receivable -

Balance 4. The equation is balanced.

Debit/Credit Rule Which account is debited? Cash

Which account is credited? Accounts Receivable

T-Accounts

Cash Accounts Receivable

+ - + -

1,900 1,900

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

B 4,000 1,900 9,600 0 26,000 = 7,100 30,000 0 6,100 - 1,700

al.

9 +1,900 -1,900

Bal. 5,900 + 0 + 9,600 + 0 + 26,000 = 7,100 + 30,000 - 0 + 6,100 - 1,700

Double Entry:

(9) Cash 1,900

Accounts Receivable 1,900

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 26

10. Partial Payment of Accounts Payable

TRANSACTION #10: FastForward pays CalTech Supply $900 cash as partial payment for its

earlier $7,100 purchase of supplies (Transaction #4), leaving $6,200 unpaid.

ANALYSIS Identify 1. Cash; Accounts Payable

Classify 2. CashAsset; Accounts PayableLiability

+/- 3. Cash - ; Accounts Payable -

Balance 4. The equation is balanced.

Debit/Credit Rule Which account is debited? Accounts Payable

Which account is credited? Cash

T-Accounts

Cash Accounts Payable

+ - - +

900 900

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 5,900 0 9,600 0 26,000 = 7,100 30,000 0 6,100 - 1,700

10 -900 -900

Bal. 5,000 + 0 + 9,600 + 0 + 26,000 = 6,200 + 30,000 - 0 + 6,100 - 1,700

Double Entry:

(10) Accounts Payable 900

Cash 900

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 27

11. Payment of Cash Dividend

TRANSACTION #11: FastForward pays $200 cash for dividends.

ANALYSIS Identify 1. Cash; Dividends

Classify 2. CashAsset; DividendsEquity

+/- 3. Cash - ; Dividends -

Balance 4. The equation is balanced.

Debit/Credit Rule Which account is debited? Dividends

Which account is credited? Cash

T-Accounts

Cash Dividends

+ - + -

200 200

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 5,000 0 9,600 0 26,000 = 6,200 30,000 0 6,100 - 1,700

11 -200 -200

Bal. 4,800 + 0 + 9,600 + 0 + 26,000 = 6,200 + 30,000 - 200 + 6,100 - 1,700

Double Entry:

(11) Dividends 200

Cash 200

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 28

12. Receipt of Cash for Future Services

TRANSACTION #12: FastForward receives $3,000 cash in advance of providing consulting

services to a customer.

ANALYSIS Identify 1. Cash; Unearned Consulting Revenue

Classify 2. CashAsset; Unearned Consulting RevenueLiability

+/- 3. Cash + ; Unearned Consulting Revenue +

Balance 4. The equation is balanced.

Debit/Credit Rule Which account is debited? Cash

Which account is credited? Unearned Consulting Revenue

T-Accounts

Cash Unearned Consulting Revenue

+ - - +

3,000 3,000

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 4,800 0 9,600 0 26,000 = 6,200 30,000 - 200 6,100 - 1,700

12 +3,000 +3,000

Bal. 7,800 + 0 + 9,600 + 0 + 26,000 = 9,200 + 30,000 - 200 + 6,100 - 1,700

Double Entry:

(12) Cash 3,000

Accounts Payable 3,000

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 29

13. Pay Cash for Future Insurance Coverage

TRANSACTION #13: FastForward pays $2,400 cash {insurance premium} for a 24-month

insurance policy. Coverage begins on December 1.

ANALYSIS Identify 1. Cash; Prepaid Insurance

Classify 2. CashAsset; Prepaid InsuranceAsset

+/- 3. Cash - ; Prepaid Insurance +

Balance 4. The equation is balanced.

Debit/Credit Rule Which account is debited? Prepaid Insurance

Which account is credited? Cash

T-Accounts

Cash Prepaid Insurance

+ - + -

2,400 2,400

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 7,800 0 9,600 0 26,000 = 9,200 30,000 - 200 6,100 - 1,700

13 -2,400 +2,400

Bal. 5,400 + 0 + 9,600 + 2,400 + 26,000 = 9,200 + 30,000 - 200 + 6,100 - 1,700

Double Entry:

(13) Prepaid Insurance 2,400

Cash 2,400

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 30

14. Purchase Supplies for Cash

TRANSACTION #14: FastForward pays $120 cash for supplies.

ANALYSIS Identify 1. Cash; Supplies

Classify 2. CashAsset; SuppliesAsset

+/- 3. Cash - ; Supplies +

Balance 4. The equation is balanced.

Debit/Credit Rule Which account is debited? Supplies

Which account is credited? Cash

T-Accounts

Supplies Cash

+ - + -

120 120

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 5,400 0 9,600 2,400 26,000 = 9,200 30,000 - 200 6,100 - 1,700

14 -120 +120

Bal. 5,280 + 0 + 9,720 + 2,400 + 26,000 = 9,200 + 30,000 - 200 + 6,100 - 1,700

Double Entry:

(14) Supplies 120

Cash 120

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 31

15. Payment of Expense in Cash

TRANSACTION #15: FastForward pays $230 cash for December utilities expense.

ANALYSIS Identify 1. Cash; Utilities Expense

Classify 2. CashAsset; Utilities ExpenseEquity

+/- 3. Cash - ; Utilities Expense +

Balance 4. The equation is balanced.

Debit/Credit Rule Which account is debited? Utilities Expense

Which account is credited? Cash

T-Accounts

Cash Utilities Expense

+ - + -

230 230

Assets = Liab + Equity

Accts Equip- Accts Commo Divi-

Supp Prepd =

Recv n dends

Cash + + + + ment Pay + + Reven Exp

Insur Stock ue

Bal. 5,280 0 9,720 2,400 26,000 = 9,200 30,000 - 200 6,100 - 1,700

15 -230 Utilit

-230

Bal. 5,050 + 0 + 9,720 + 2,400 + 26,000 = 9,200 + 30,000 - 200 + 6,100 - 1,930

Double Entry:

(15) Utilities Expense 230

Cash 230

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 32

4. Accounting Equation Analysis

See page 62 in your textbook.

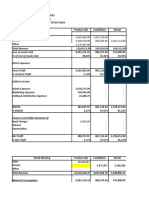

IIII. TRIAL BALANCE

Trial balanceis a list of accounts and their balances at a point in time.

Account balances are reported in the appropriate debit or credit column of a trial balance.

A. Preparing a Trial Balance

Involves 3 steps:

1) List each account title

and its amount (from

ledger) in the trial

balance. A zero balance

is listed with a zero in its

normal balance column.

2) Compute the total of

debit balances and the

total of credit balances.

3) Verify {prove} total debit

balances equal total

credit balances.

1. Searching for and Correcting Errors

If the trial balance doesnt balance, the error(s) must be found and corrected.

Three Ways to Check for Errors:

a) REVERSE ORDER.

i. Verify that the trial balance columns are correctly added.

ii. Verify that account balances are accurately entered from the ledger.

iii. See whether a debit (or credit) balance is mistakenly listed in the trial

balance as a credit (or debit). CLUE: when the difference between total

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 33

debits and total credits equals twice the amount of the incorrect account

balance.

iv. Recompute each account balance in the ledger.

v. Verify that each journal entry is properly posted.

vi. Verify that the original journal entry has equal debits and credits

b) IF THE ERROR IS DISCOVERED BEFORE YOU POST:

Manual System: it can be corrected by drawing a line through the incorrect

information. Then write the correct information above it to create a record

of change for the auditor.

Computer System: allows the person to replace the incorrect information

directly.

c) ERROR IS DISCOVERED AFTER YOU POST:

DONT draw a line through it. It looks suspicious.

You have to create a CORRECTING ENTRY that removes the amount from

the wrong account and records it to the correct account.

B. Using a Trial Balance to Prepare Financial Statements

These statements are also called unadjusted

statements because we need to make some

further accounting adjustments.

1. Income Statement

Reports the Revenues earned less the

Expenses incurred by a business over a

period of time.

Information is taken from the Trial Balance.

Owner investments and dividends are NOT part of income.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 34

2. Statement of Retained Earnings

Reports information about how

Retained Earnings changes over the

reporting period.

It shows the beginning-of-period

balance, Net Income, Dividends, and

the end-of-period balance.

3. Balance Sheet

Reports the financial position of a

company at a point in time.

Usually at the end of a month,

quarter, or year.

ACCOUNT FORM: the left side lists

its Assets, the upper right side

lists its Liabilities, and the bottom

right side lists its Equity.

Think of the accounting equation: assets on the left, liabilities and equity on the

right.

REPORT FORM: Assets on the top, followed below by Liabilities and then Equity

4. Presentation Issues

Dollar signs are NOT used in journals and ledgers.

They appear in financial statements and other reports, like the trial balance.

When you have a column of numbers, only put a dollar sign beside the first and

last numbers.

Commas are optional to indicate thousands, millions, etc., when amounts are

entered in a journal, ledger, or trial balance.

Companies also commonly round amounts in reports to the nearest dollar, or even

to a higher level.

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 35

Potrebbero piacerti anche

- Jay Tesla: ExplanationDocumento9 pagineJay Tesla: ExplanationJonathan Cheung100% (1)

- Company Outsiders: Resources TodayDocumento20 pagineCompany Outsiders: Resources TodaySarbani Mishra0% (1)

- Chapter 2 Supa My NotesDocumento40 pagineChapter 2 Supa My NotesYousaf Jamal100% (1)

- Financial Acc 2Documento35 pagineFinancial Acc 2MohamoudNessuna valutazione finora

- Entrep ReviewerDocumento2 pagineEntrep ReviewerIvymarian CantoyNessuna valutazione finora

- Analyzing and Recording Financial TransactionsDocumento2 pagineAnalyzing and Recording Financial TransactionsFranze Beatriz FLORESNessuna valutazione finora

- Chapter - 2 @2003Documento14 pagineChapter - 2 @2003Tariku KolchaNessuna valutazione finora

- Lesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From OwnersDocumento5 pagineLesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From OwnersRomae DomagasNessuna valutazione finora

- Types of Accounts and The Account Titles: AssetsDocumento90 pagineTypes of Accounts and The Account Titles: AssetsNichole Balao-asNessuna valutazione finora

- Chapter Two The Accounting CycleDocumento30 pagineChapter Two The Accounting CycleFantayNessuna valutazione finora

- Chapter 6 Financial Statement Analysis Balance SheetDocumento30 pagineChapter 6 Financial Statement Analysis Balance SheetKhadija YaqoobNessuna valutazione finora

- UNIT II The Accounting Process Service and TradingDocumento22 pagineUNIT II The Accounting Process Service and TradingAlezandra SantelicesNessuna valutazione finora

- Basic Accounting: I. Fields of AccountingDocumento11 pagineBasic Accounting: I. Fields of Accountingalliah brionesNessuna valutazione finora

- 1st Quarter DiscussionDocumento10 pagine1st Quarter DiscussionCHARVIE KYLE RAMIREZNessuna valutazione finora

- Statement of Financial PositionDocumento8 pagineStatement of Financial PositionKaye LiwagNessuna valutazione finora

- DMGT403 AccountingDocumento20 pagineDMGT403 Accountinghemant kumar100% (1)

- Basic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)Documento22 pagineBasic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)LiaNessuna valutazione finora

- Fa Module 2: Accounting Equation: LECTURE 1:the Accounting Equation Assets Liabilities + Owner's EquityDocumento6 pagineFa Module 2: Accounting Equation: LECTURE 1:the Accounting Equation Assets Liabilities + Owner's EquitycheskaNessuna valutazione finora

- ACCOUNTING1Documento12 pagineACCOUNTING1Trixie GabatinoNessuna valutazione finora

- Basic NoteDocumento8 pagineBasic Noteworld2learnNessuna valutazione finora

- 1st Quarter DiscussionDocumento10 pagine1st Quarter DiscussionThea Gwyneth RodriguezNessuna valutazione finora

- Objectives: Chapter 3: Accounting Equation and The Double Entry SystemDocumento4 pagineObjectives: Chapter 3: Accounting Equation and The Double Entry SystemMark Kevin JavierNessuna valutazione finora

- Basic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)Documento16 pagineBasic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)LiaNessuna valutazione finora

- Basic Financial Statements NotesDocumento6 pagineBasic Financial Statements NotesNNessuna valutazione finora

- Chapter 9: Financial Statements PartsDocumento10 pagineChapter 9: Financial Statements PartsNeil CorpuzNessuna valutazione finora

- THE Accounting Equation (Module 5, Camerino, D.)Documento10 pagineTHE Accounting Equation (Module 5, Camerino, D.)Che AllejeNessuna valutazione finora

- Chapter 2Documento23 pagineChapter 2Abrha636100% (1)

- TA CN Tai Chinh Ngan Hang 21.7 (2) - 40 - Unit 4 - Financial StatementsDocumento17 pagineTA CN Tai Chinh Ngan Hang 21.7 (2) - 40 - Unit 4 - Financial StatementsPhương NhiNessuna valutazione finora

- Chapter 2Documento31 pagineChapter 2abenezer nardiyasNessuna valutazione finora

- Types of Accounts and The Account TitlesDocumento25 pagineTypes of Accounts and The Account TitlesSeung BatumbakalNessuna valutazione finora

- 1accounting Equation RevisedDocumento4 pagine1accounting Equation RevisedReniel MillarNessuna valutazione finora

- BASIC FINANCIAL ACCOUNTING and REPORTINGDocumento18 pagineBASIC FINANCIAL ACCOUNTING and REPORTINGEian chin mana-ayNessuna valutazione finora

- Chapter 2 HandoutsDocumento15 pagineChapter 2 HandoutsBlackpink BtsNessuna valutazione finora

- Chapter 22Documento19 pagineChapter 22Betelehem GebremedhinNessuna valutazione finora

- Elements of The Statement of Financial PositionDocumento4 pagineElements of The Statement of Financial PositionHeaven SyNessuna valutazione finora

- The Accounting EquationDocumento5 pagineThe Accounting EquationHuskyNessuna valutazione finora

- Journal: Double Entry System of AccountingDocumento17 pagineJournal: Double Entry System of AccountingBole ShubhamNessuna valutazione finora

- Chapter - 2 Basic Accounting TermsDocumento6 pagineChapter - 2 Basic Accounting TermsChaudhary GaylesabbNessuna valutazione finora

- Co Chapter 2 Accounting Cycle RevisedDocumento19 pagineCo Chapter 2 Accounting Cycle RevisedmikeNessuna valutazione finora

- (C3) The Accounting Equation & Types of AccountsDocumento3 pagine(C3) The Accounting Equation & Types of AccountsVenus LacambraNessuna valutazione finora

- Essential Elements of The Definition of AccountingDocumento9 pagineEssential Elements of The Definition of AccountingPamela Diane Varilla AndalNessuna valutazione finora

- Understanding Financial Statements and Cash FlowsDocumento7 pagineUnderstanding Financial Statements and Cash FlowsBlanche Iris Estrel SiapnoNessuna valutazione finora

- Chapter 2 Accounting CycleDocumento17 pagineChapter 2 Accounting CycleEzy playboyNessuna valutazione finora

- Measuring Business Income: The Adjusting Process: Chapter OutlineDocumento4 pagineMeasuring Business Income: The Adjusting Process: Chapter OutlineARSLAN HUSSAINNessuna valutazione finora

- Unit 3-Recording of TransactionDocumento20 pagineUnit 3-Recording of Transactionanamikarajendran441998Nessuna valutazione finora

- Accounting..... All Questions & Answer.Documento13 pagineAccounting..... All Questions & Answer.MehediNessuna valutazione finora

- Module 2 Basic Expanded Acctg. Equation Student VersionDocumento29 pagineModule 2 Basic Expanded Acctg. Equation Student VersionRowena ReoloNessuna valutazione finora

- FABM 2 - Lesson1 5Documento78 pagineFABM 2 - Lesson1 5Sis HopNessuna valutazione finora

- Topic 2 (Acc)Documento48 pagineTopic 2 (Acc)Nur Adnin KhairaniNessuna valutazione finora

- 1.introduction To AccountingDocumento14 pagine1.introduction To AccountingBhuvaneswari karuturiNessuna valutazione finora

- Chapter-2 Double Entry Book Keeping Book SystemDocumento5 pagineChapter-2 Double Entry Book Keeping Book SystemgaurabNessuna valutazione finora

- Chapter 4 Statement of Financial PositionDocumento4 pagineChapter 4 Statement of Financial PositionDaniel Tan KtNessuna valutazione finora

- Fabm 2 Module 1 NotesDocumento8 pagineFabm 2 Module 1 NotesReynalene ParagasNessuna valutazione finora

- CH 2 3Documento18 pagineCH 2 3Eyuel SintayehuNessuna valutazione finora

- ABMFABM1 q3 Mod4 Types-of-Major-AccountsDocumento14 pagineABMFABM1 q3 Mod4 Types-of-Major-AccountsEduardo john DolosoNessuna valutazione finora

- The Accounting EquationDocumento11 pagineThe Accounting EquationMIA DEITANessuna valutazione finora

- Fundamental ConceptsDocumento3 pagineFundamental ConceptsPrecious ViterboNessuna valutazione finora

- Updated Lecture Partnership and CorporationDocumento10 pagineUpdated Lecture Partnership and CorporationAppleNessuna valutazione finora

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersDa EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNessuna valutazione finora

- 1.introduction To Financial AccountingDocumento40 pagine1.introduction To Financial Accountingchand1234567893Nessuna valutazione finora

- CROSS - CULTURAL - COMMUNICATION - BARRIERS - IN WorkplaceDocumento4 pagineCROSS - CULTURAL - COMMUNICATION - BARRIERS - IN Workplacechand1234567893Nessuna valutazione finora

- Basic CcountingDocumento29 pagineBasic Ccountingchand1234567893Nessuna valutazione finora

- The Feature of P &L AccountDocumento14 pagineThe Feature of P &L Accountchand1234567893Nessuna valutazione finora

- Classification of Assets and LiabilitiesDocumento5 pagineClassification of Assets and Liabilitieschand1234567893Nessuna valutazione finora

- Sections of The Balance Sheet: Assets SectionDocumento4 pagineSections of The Balance Sheet: Assets Sectionchand1234567893Nessuna valutazione finora

- Chapter 5 M&ADocumento30 pagineChapter 5 M&Achand1234567893Nessuna valutazione finora

- 10 Green CSR Projects by Indian CompaniesDocumento13 pagine10 Green CSR Projects by Indian Companieschand1234567893Nessuna valutazione finora

- Mergers, Acquisitions and Corporate RestructuringDocumento49 pagineMergers, Acquisitions and Corporate Restructuringchand1234567893Nessuna valutazione finora

- Examples of 13 Most Successful Company Mergers and Acquisitions of All TimeDocumento18 pagineExamples of 13 Most Successful Company Mergers and Acquisitions of All Timechand1234567893Nessuna valutazione finora

- Fin 223: Sample MCQ, CH-1: Answers: 1. (B) 2. (C) 3. (A) 4. (D) 5. (D) 6 (D)Documento4 pagineFin 223: Sample MCQ, CH-1: Answers: 1. (B) 2. (C) 3. (A) 4. (D) 5. (D) 6 (D)chand1234567893Nessuna valutazione finora

- Section 1: Concepts, Strategies and TacticsDocumento12 pagineSection 1: Concepts, Strategies and Tacticschand1234567893Nessuna valutazione finora

- Accounting Club: MeetingsDocumento1 paginaAccounting Club: Meetingschand1234567893Nessuna valutazione finora

- Corporate Restructuring NOTESDocumento16 pagineCorporate Restructuring NOTESchand1234567893Nessuna valutazione finora

- Maruti Suzuki StockDocumento2 pagineMaruti Suzuki Stockchand1234567893Nessuna valutazione finora

- ACC 226 Week 4 To 5 SIMDocumento33 pagineACC 226 Week 4 To 5 SIMMireya YueNessuna valutazione finora

- TRIAL Electrical Contractor Financial Model Excel Template v.1.0.122020Documento98 pagineTRIAL Electrical Contractor Financial Model Excel Template v.1.0.122020Angel De Las HerasNessuna valutazione finora

- Guese, Christian Nicolas A FM 2-3 Financial Management Practice Problem MidtermDocumento1 paginaGuese, Christian Nicolas A FM 2-3 Financial Management Practice Problem MidtermGuese, Christian Nicolas ANessuna valutazione finora

- MCQ of Financial Statement AnalysisDocumento8 pagineMCQ of Financial Statement AnalysisRahul Ghosale100% (11)

- DepreciationDocumento54 pagineDepreciationJane Atendido100% (4)

- Case: Ravi Bose, An NSU Business Graduate With Few Years' Experience As An Equities Analyst, Was Recently Brought in As Assistant To TheDocumento13 pagineCase: Ravi Bose, An NSU Business Graduate With Few Years' Experience As An Equities Analyst, Was Recently Brought in As Assistant To TheAtik MahbubNessuna valutazione finora

- Financial AnalysisDocumento8 pagineFinancial Analysisfelix robertNessuna valutazione finora

- Godrej Agrovet PDFDocumento10 pagineGodrej Agrovet PDFanuj bhardwajNessuna valutazione finora

- E9-3 Determining Financial Statement Effects of An Asset Acquisition and Straight-Line DepreciationDocumento12 pagineE9-3 Determining Financial Statement Effects of An Asset Acquisition and Straight-Line DepreciationRamiro Gallo Diaz GonzalezNessuna valutazione finora

- Standard Balance Sheet - YUNITA WIDHY ASTUTIDocumento1 paginaStandard Balance Sheet - YUNITA WIDHY ASTUTIDian Novia PurwandariNessuna valutazione finora

- Unit 5. Verification and Valuation of Assets and LiabilitiesDocumento16 pagineUnit 5. Verification and Valuation of Assets and LiabilitiesAmit PatelNessuna valutazione finora

- Financial Statements Meaning and CharacteristicsDocumento64 pagineFinancial Statements Meaning and CharacteristicsAbhishek Sinha100% (1)

- 10.13, Dr. G. MalyadriDocumento25 pagine10.13, Dr. G. MalyadriPaulo HunterNessuna valutazione finora

- Ifsa Full LatestDocumento36 pagineIfsa Full LatestRyan JeeNessuna valutazione finora

- Advanced Financial AccountingDocumento78 pagineAdvanced Financial Accountingtsegaye andualemNessuna valutazione finora

- Analysis Using T-AccountsDocumento10 pagineAnalysis Using T-AccountsChris Aruh BorsalinaNessuna valutazione finora

- Paper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Documento16 paginePaper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Aleena Clare ThomasNessuna valutazione finora

- FABM2 Module 1Documento14 pagineFABM2 Module 1Rea Mariz Jordan100% (1)

- PTCL Accounts 2009 (Parent)Documento48 paginePTCL Accounts 2009 (Parent)Najam U SaharNessuna valutazione finora

- Powerol - Monthly MIS FormatDocumento34 paginePowerol - Monthly MIS Formatdharmender singhNessuna valutazione finora

- f7 Mock QuestionDocumento20 paginef7 Mock Questionnoor ul anumNessuna valutazione finora

- Chapter 4 Completed Journal Entries Exercise SolutionsDocumento25 pagineChapter 4 Completed Journal Entries Exercise SolutionsCheuk Ying NicoleNessuna valutazione finora

- Sol. Man. - Chapter 11 - She (Part 2) - 2021Documento26 pagineSol. Man. - Chapter 11 - She (Part 2) - 2021Crystal Rose TenerifeNessuna valutazione finora

- Basics of Accounting Till Balance SheetDocumento39 pagineBasics of Accounting Till Balance Sheetjayti desaiNessuna valutazione finora

- Special Handout 001Documento2 pagineSpecial Handout 001LorilieNessuna valutazione finora

- 2 Topsim WS2012 13 InitialsituationDocumento8 pagine2 Topsim WS2012 13 InitialsituationMaliha KhanNessuna valutazione finora

- Financials - Biomass Briquetting - 5 YearsDocumento14 pagineFinancials - Biomass Briquetting - 5 YearsSHARMA TRAVELS LATURNessuna valutazione finora

- Problem 2 12 AccountingDocumento4 pagineProblem 2 12 AccountingSofia Gwen VenturaNessuna valutazione finora

- National University of Science and TechnologyDocumento8 pagineNational University of Science and TechnologyPATIENCE MUSHONGANessuna valutazione finora