Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PNB Pratibha-Education Loan Scheme & Checklist

Caricato da

alif0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

308 visualizzazioni1 paginaloan

Titolo originale

Pnb Pratibha-education Loan Scheme & Checklist

Copyright

© © All Rights Reserved

Formati disponibili

DOC, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoloan

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

308 visualizzazioni1 paginaPNB Pratibha-Education Loan Scheme & Checklist

Caricato da

alifloan

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

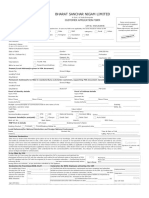

RETAIL ASSETS BRANCH, JMD Pacific Square, Sector 15, Part-II, Gurgaon

Ph. 4201096-97, Email: bo5278@pnb.co.in

PNB EDUCATION LOAN SCHEME & CHECKLIST PNB PRATIBHA

(EDUCATION LOAN FOR PREMIER / REPUTED INSTITUTES)

Loan Amount Varying from Rs. 7.50 Lacs to 20 Lacs (According to the Institute)

Interest Rate & Repayment ROI up to 7.5 lacs -10.00 % %[MCLR + 0.60%]

period (MCLR-1 yr - above 7.5 lacs -9.50% [MCLR + 0.10%]

basis=9.40% wef: 01.04.2016)

(Simple interest charged during repayment holiday)

Interest Concession 0.50% rebate for female students

In case interest is repaid regularly during study period, Interest rebate of 1.00 %

Margin NIL

Repayment Period For Loans upto 7.50 Lacs : Upto 10 Years | For Loans above 7.50 Lacs : Upto 15 Years

Repayment Holiday Course period +1 year or 6 months after getting job, whichever is earlier

Processing Fee & Processing Fees : NIL

Documentation Charges Documentation Charges : Upto 4 Lacs : Rs. 270 + ST+ED Cess | Above 4 Lacs : Rs. 450 +

ST+ED Cess

Inspection charges for security verification: Rs.250/- + ST

Eligible person Should be an Indian national

Admission secured to Professional/Technical courses in India through Entrance

Test/Merit Basis Selection Process. (Management Quota will not be considered) in

Premier Institutes, eg : IIMs IITs, MDI etc.

(Eligible institutes as per the List Issued vide PNB Pratibha Education Loan Circulars)

Expenditure Covered Fee payable to college/ School/ Hostel/ Examination / Library/ Laboratory fee

Purchase of books/ uniforms/ equipment/ computer/ other essentials.

Insurance premium for student borrower

Any other expense required complete the course-like Study Tours/Projects etc..

Purpose No deserving student should be denied an opportunity to pursue higher education for

want of financial support in line with the Policy of Govt. of India.

Pre-Payment Charges No Part/Full Prepayment or foreclosure charges.

Non-payment charges Penal interest@2% besides Cheque bouncing and other out of pocket charges.

Assets Insurance Low Cost Life cum Assets cover Insurance from PNB Metlife Insurance Co. Ltd.

Documents required 1. Loan Application with Passport size photograph of Borrower/s & Guarantor

2. PAN no. of Borrower/s and Guarantors

3. Residence Proof of all the Borrower/s and Guarantors;

1. Income proof of (Salaried) Borrower/s and Guarantor ITRs for last 3 years & latest

Salary Slip/ Salary Certificate/Form-16 duly verified by employer/ Employees I-Card

2. For Non-Salaried persons- ITRs with Computation of Income, P/L & Balance Sheet

with Tax Challan/Form 26-AS for the last 3 years duly certified by C.A.

4. Proof having Passed the Last Qualifying examination.

5. Letter of Admission in Professional/Technical/Vocational course.

6. Prospectus of the Course wherein charges like Admission Fee, Exam. Fee, Hostel

Charges etc. are mentioned

7. Documentary Evidence of the Assets and Liabilities of the Borrower/s and

Guarantors

8. Any other Document/Information, depending upon the Case and Purpose of the

Loan.

At the time of disbursement:

1) Borrower/s should have Deposit account with PNB

2) Affidavit on Banks format

PNBs Commitment Turn-Around time of 5 working days from completion of formalities.

Interest on Daily Reducing Balance

No Pre-Payment or Foreclosure charges

No Hidden Costs

No Collateral Security/Third Party Guarantee required

*Conditions Apply

.

Potrebbero piacerti anche

- TutorialDocumento9 pagineTutorialNaailah نائلة MaudarunNessuna valutazione finora

- Post-Foreclosure Complaint Plaintiff)Documento48 paginePost-Foreclosure Complaint Plaintiff)tmccand100% (1)

- Sanctionletter 10045975 29-8-2023 113638Documento3 pagineSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNessuna valutazione finora

- Bills Purchase Line AgreementDocumento4 pagineBills Purchase Line AgreementJonathan P. OngNessuna valutazione finora

- Whole Loan Book Entry White Paper: A Blueprint For The Future, 1993 Whitepaper - Phyllis K SlesingerDocumento3 pagineWhole Loan Book Entry White Paper: A Blueprint For The Future, 1993 Whitepaper - Phyllis K SlesingerTim BryantNessuna valutazione finora

- Boarding House Tenancy AgreementDocumento4 pagineBoarding House Tenancy AgreementavalonrunNessuna valutazione finora

- Rusu Irina - Test - B2 - 0 PDFDocumento8 pagineRusu Irina - Test - B2 - 0 PDFAgrigoroaiei IonelNessuna valutazione finora

- HOME LOAN Idlc NEWDocumento9 pagineHOME LOAN Idlc NEWMohammad Tamzid SiddiqueNessuna valutazione finora

- BDO Auto LoanDocumento2 pagineBDO Auto LoanRalph Christian Lusanta FuentesNessuna valutazione finora

- Short Term Loan Remittance FormDocumento2 pagineShort Term Loan Remittance FormJosel Tud100% (1)

- Loan Approval Prediction Using Machine LearningDocumento11 pagineLoan Approval Prediction Using Machine LearningSingi TejaswiniNessuna valutazione finora

- New York Residential Purchase Agreement: Buyer's Initials - Seller's InitialsDocumento9 pagineNew York Residential Purchase Agreement: Buyer's Initials - Seller's Initialsmorgan tiernanNessuna valutazione finora

- Project Report For Bank Loan - FormatDocumento1 paginaProject Report For Bank Loan - FormatvidyutNessuna valutazione finora

- List of Institutions Aa A B C 29 01 2020 PDFDocumento17 pagineList of Institutions Aa A B C 29 01 2020 PDFtayicNessuna valutazione finora

- Loan-Agreement Citi MortgagesDocumento80 pagineLoan-Agreement Citi Mortgagesmrinal lalNessuna valutazione finora

- Home Loan - Master BCC BR 106 380Documento158 pagineHome Loan - Master BCC BR 106 380binalamitNessuna valutazione finora

- Loan Visit FormatDocumento1 paginaLoan Visit Formatchandan bhatiNessuna valutazione finora

- Loan AgreementDocumento13 pagineLoan AgreementKiran GolwadNessuna valutazione finora

- 6 - Availing Interest Free Loan-FormatDocumento3 pagine6 - Availing Interest Free Loan-FormatSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (1)

- PMS AgreementDocumento41 paginePMS AgreementSandeep BorseNessuna valutazione finora

- Project Report For Bank LoanDocumento11 pagineProject Report For Bank LoanSubbaravamma JaruguNessuna valutazione finora

- Tender No. SH/01/2017-2019Documento15 pagineTender No. SH/01/2017-2019State House Kenya100% (7)

- Tender No: SH/01/2019-2020 For Pre-Qualification/registration of Suppliers For Supply/provision of Goods and Services - Financial Years 2019/2021Documento16 pagineTender No: SH/01/2019-2020 For Pre-Qualification/registration of Suppliers For Supply/provision of Goods and Services - Financial Years 2019/2021State House Kenya100% (4)

- Standing Instruction Format: Mortgages/DVRA/Ver5.0/July2013Documento5 pagineStanding Instruction Format: Mortgages/DVRA/Ver5.0/July2013Yudhi OctoraNessuna valutazione finora

- Personal Loan PDFDocumento5 paginePersonal Loan PDFaman SinghNessuna valutazione finora

- Home Loan AgreementDocumento3 pagineHome Loan AgreementJnanamNessuna valutazione finora

- Personal Business Loan Agreement PDFDocumento16 paginePersonal Business Loan Agreement PDFVijay V RaoNessuna valutazione finora

- Loan Policy: Uttar Bihar Gramin BankDocumento27 pagineLoan Policy: Uttar Bihar Gramin BankNaim Siddiqui100% (1)

- IRJET Prediction For Loan Approval Using12Documento4 pagineIRJET Prediction For Loan Approval Using12Altaf SMTNessuna valutazione finora

- Refunds: What Type of Refund Are You Applying For?Documento2 pagineRefunds: What Type of Refund Are You Applying For?Leigh OlssonNessuna valutazione finora

- To Be Submitted Along With Documents As Per The Check ListDocumento4 pagineTo Be Submitted Along With Documents As Per The Check ListArun VijilanNessuna valutazione finora

- Lender Borrower AgreementDocumento7 pagineLender Borrower AgreementSudeepNessuna valutazione finora

- Housing Loan DetailsDocumento9 pagineHousing Loan DetailsPandurangbaligaNessuna valutazione finora

- Loan ProvisioningDocumento16 pagineLoan ProvisioningrajmirakshanNessuna valutazione finora

- Car LoanDocumento14 pagineCar LoanFaid AmmarNessuna valutazione finora

- Loan AgreementDocumento17 pagineLoan AgreementVishal BawaneNessuna valutazione finora

- CompendiumDocumento18 pagineCompendiumpranithroyNessuna valutazione finora

- Real Estate Purchase Sale Agreement DocumentDocumento16 pagineReal Estate Purchase Sale Agreement DocumentNew Life NetworkNessuna valutazione finora

- Collateral Loan Info PDFDocumento8 pagineCollateral Loan Info PDFcasmith43Nessuna valutazione finora

- 32642892-PL WelcomeLetterDocumento4 pagine32642892-PL WelcomeLetterMohan ChandraNessuna valutazione finora

- Loan AgreementDocumento6 pagineLoan AgreementV KiranNessuna valutazione finora

- Formalities For Transfer of PlotDocumento20 pagineFormalities For Transfer of PlotInderjeet Singh ToorNessuna valutazione finora

- Business FinanceDocumento13 pagineBusiness FinanceThone Gregor VisayaNessuna valutazione finora

- Housing Loan Review FormatDocumento5 pagineHousing Loan Review FormatggaganNessuna valutazione finora

- Indian Bank Student Loan Agreement FormDocumento4 pagineIndian Bank Student Loan Agreement FormSathish JuliusNessuna valutazione finora

- Cancellation FormDocumento2 pagineCancellation FormAkash TebaliyaNessuna valutazione finora

- Home LoanDocumento130 pagineHome LoanAnkit ButtoliaNessuna valutazione finora

- CV Loan AgreementDocumento17 pagineCV Loan AgreementankitNessuna valutazione finora

- HSBC Rtgs Form - 241109Documento2 pagineHSBC Rtgs Form - 241109Kevin HillNessuna valutazione finora

- Pre-Sanction Visit Report For Retail LendingDocumento5 paginePre-Sanction Visit Report For Retail Lendingneeraj guptaNessuna valutazione finora

- Loan Application Form: Part-I Cent VidyarthiDocumento8 pagineLoan Application Form: Part-I Cent VidyarthiSandeep ChowdhuryNessuna valutazione finora

- Car Sale AGreement BIlal ShahDocumento3 pagineCar Sale AGreement BIlal ShahYasir KhanNessuna valutazione finora

- Home Loan Application FormDocumento7 pagineHome Loan Application Formrahulgeo05Nessuna valutazione finora

- Car Loan: Application FormDocumento6 pagineCar Loan: Application FormVijay BhemalNessuna valutazione finora

- Guarantee Deed Corporate For Retail HL and Lap 065709200147385837011Documento13 pagineGuarantee Deed Corporate For Retail HL and Lap 065709200147385837011AMAN KUMARNessuna valutazione finora

- Positive Pay Key Features 12 13Documento3 paginePositive Pay Key Features 12 13NitinNessuna valutazione finora

- Apr2019Documento19 pagineApr2019జెల్ల ఉమేష్ అను నేనుNessuna valutazione finora

- BSNL CafDocumento3 pagineBSNL CafAnoop K JayanNessuna valutazione finora

- PNB Education Loan Scheme ChecklistDocumento1 paginaPNB Education Loan Scheme ChecklistVikas SinghNessuna valutazione finora

- PNB Education Loan Scheme Checklist SaraswatiDocumento1 paginaPNB Education Loan Scheme Checklist SaraswatiRidhtang DuggalNessuna valutazione finora

- MITC Student Loan March 2015 CArd DetailsDocumento2 pagineMITC Student Loan March 2015 CArd DetailsPranav ShaucheNessuna valutazione finora

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!Da EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!Nessuna valutazione finora

- Weir DesignDocumento8 pagineWeir Designbadulla100% (4)

- FDB PPT 4Documento25 pagineFDB PPT 4alifNessuna valutazione finora

- Ground Water Hydrology: 30% of Fresh Water Exist in The Form of Ground WaterDocumento41 pagineGround Water Hydrology: 30% of Fresh Water Exist in The Form of Ground WateralifNessuna valutazione finora

- Geo MaticsDocumento38 pagineGeo MaticsalifNessuna valutazione finora

- SD End SemDocumento40 pagineSD End SemalifNessuna valutazione finora

- Jacketing Crack ControlDocumento55 pagineJacketing Crack Controlalif100% (1)

- State College Area School District SWAP FiascoDocumento5 pagineState College Area School District SWAP FiascoDon Gordon100% (1)

- History of Bank and Banking SystemDocumento7 pagineHistory of Bank and Banking SystemAtiqah DalikNessuna valutazione finora

- RSB Application Form - New 04242013 1st PageDocumento1 paginaRSB Application Form - New 04242013 1st PageBoyTibsNessuna valutazione finora

- Book Four - Title XIV of The Civil CodeDocumento4 pagineBook Four - Title XIV of The Civil CodeCharley Labicani BurigsayNessuna valutazione finora

- WALSH v. LONSDALE. (1882 W. 1127.) - (1882)Documento9 pagineWALSH v. LONSDALE. (1882 W. 1127.) - (1882)camy liewNessuna valutazione finora

- Funds Flow AnalysisDocumento20 pagineFunds Flow AnalysisRajeevAgrawalNessuna valutazione finora

- Mortgage Agreement QuicoyDocumento3 pagineMortgage Agreement Quicoypersantiago.lawofficeNessuna valutazione finora

- Authority To Mortgage and Does Not Bind The Grantor Personally To Other Obligations Contracted by The Grantee."Documento1 paginaAuthority To Mortgage and Does Not Bind The Grantor Personally To Other Obligations Contracted by The Grantee."k santosNessuna valutazione finora

- Bri59689 ch02 WebDocumento17 pagineBri59689 ch02 WebPhillip HoNessuna valutazione finora

- Hodges vs. Salas and Salas PDFDocumento14 pagineHodges vs. Salas and Salas PDFdanexrainierNessuna valutazione finora

- Guide To Understanding Financial Statements PDFDocumento96 pagineGuide To Understanding Financial Statements PDFyarokNessuna valutazione finora

- Micro InsuranceDocumento15 pagineMicro Insurancesujithsnair100% (2)

- Chapter 5 Time Value of Money Multiple Choice Questions PDFDocumento36 pagineChapter 5 Time Value of Money Multiple Choice Questions PDFImran Zulfiqar100% (3)

- Article 1811Documento6 pagineArticle 1811venus mae b caulinNessuna valutazione finora

- Model Trust DeedDocumento5 pagineModel Trust Deedasprithviraj100% (1)

- Rojas V MaglanaDocumento4 pagineRojas V MaglanaJennyNessuna valutazione finora

- Act 502 Co Operative Societies Act 1993Documento72 pagineAct 502 Co Operative Societies Act 1993Adam Haida & CoNessuna valutazione finora

- Final Accounts-Sole TradersDocumento35 pagineFinal Accounts-Sole TradersBhavik Shah100% (1)

- Chapter 3 Insurable InterestDocumento11 pagineChapter 3 Insurable InterestMelvin PernezNessuna valutazione finora

- Minimum Capital Requirement GhanaDocumento2 pagineMinimum Capital Requirement GhanaAndrew TandohNessuna valutazione finora

- State Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredDocumento3 pagineState Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredMojahed AhmarNessuna valutazione finora

- Neo-Liberalist Vs Realist: The GLobal Financial Crisis QuestionDocumento30 pagineNeo-Liberalist Vs Realist: The GLobal Financial Crisis QuestionCris Virgil Pescadero33% (3)

- Role of Imf & World Bank in Economic FinalDocumento18 pagineRole of Imf & World Bank in Economic FinalSuraj ThakurNessuna valutazione finora

- Remedies in RightsDocumento6 pagineRemedies in RightsRebel X100% (1)

- 36 - de Barreto V Villanueva - PeraltaDocumento3 pagine36 - de Barreto V Villanueva - PeraltaTrixie PeraltaNessuna valutazione finora

- Saurav Aryal - M.E - Monetary Policy ReviewDocumento3 pagineSaurav Aryal - M.E - Monetary Policy Reviewaswin adhikariNessuna valutazione finora

- A Project Report On Asset Liability Management in Andhra BankDocumento91 pagineA Project Report On Asset Liability Management in Andhra BankBabasab Patil (Karrisatte)50% (2)

- TEST5Documento5 pagineTEST5Praveen ChaturvediNessuna valutazione finora