Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Risk and Opportunity

Caricato da

Geroldo 'Rollie' L. Querijero0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

149 visualizzazioni2 pagineRisk and Opportunity

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoRisk and Opportunity

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

149 visualizzazioni2 pagineRisk and Opportunity

Caricato da

Geroldo 'Rollie' L. QuerijeroRisk and Opportunity

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

Risk and Opportunity

One of the most misunderstood concepts in

risk management is the relationship between

risk and opportunity. Many people view risk

and opportunity as opposites - risk is

something bad and opportunity is something

good. In our view this is an erroneous

interpretation. Tony Harb and Mitchell

Morley, risk management and governance

specialists from InConsult, look at how

councils can better understand the

relationship between risk and opportunity.

Lets go back to basics. The international

standard on risk management, ISO 31000,

defines risk as the effect of uncertainty on

objectives. It is based on the fact that we These are purely downside risks at least

live in an uncertain environment in which in the short term.

we cannot always predict the outcome of

future events with complete accuracy. Some risks however, may have an up or

down side. For example, if we have invested

Notice risk is not defined as the negative money in the aim of achieving a return on

effect of uncertainty on objectives. Future our investment, changes in interest rates

uncertain events may have a positive or could have a positive or negative impact.

negative impact. A positive outcome However, if we have forecast that we will

presents an opportunity which can be receive a positive return and we receive the

defined as a favourable or advantageous exact level of return we forecast is this

circumstance or combination of really an upside? Its like saying that

circumstances. A negative outcome might achieving our objective is an upside. In our

be defined as a hazard or the exposure or view an upside would only occur if we

vulnerability to injury, loss, evil, etc. exceeded our target and this was seen as a

good thing. If we still received a return but

Pulling all of this together, risk and

it was less than anticipated then this would

opportunity are not opposites. Risk can be a

be a downside.

source of opportunity as well as a source of

loss. Risk management is as much about Very few risks will be upside only. If we

maximising opportunities as it is about could predict these we would all be off to

minimising negative consequences. the casino!

A better way to think about all of this is to But what does all this mean for councils.

use the terms upside risk and downside

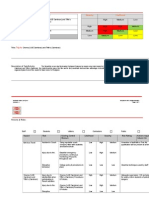

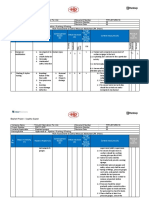

risk. In pursuing our objectives there are The Opportunity Matrix

some risks that if they eventuate will have

The misunderstanding about the

little or no upside. For example, there is

relationship between opportunity and risk

unlikely to be any immediate upside impact

manifests itself in some unusual ways. We

on objectives if a fire burns your building to

have seen organisations develop risk

the ground or an employee is seriously hurt.

InConsult Pty Ltd.

All rights reserved. No part of this document can be reproduced without permission. Page 1

opportunity matrices as well as risk Objective Setting

consequence matrices. Some organisations

identify loss of life, quite rightly, as a Focussing purely on downside risk can also

catastrophic impact on their consequence constrain thinking about organisational

matrix. But in their opportunity matrix they objectives. If we are constantly looking at

identify nobody dying as a significant what could go wrong there will be a natural

opportunity! Others have a separate section tendency to set fairly conservative, low risk

on their risk register for opportunities as objectives. Whilst this may be entirely

opposed to risks. appropriate for organisations with a

conservative attitude to risk (i.e. low risk

Describing All Risks in the Negative appetite) it can inhibit thinking about those

risks or situations that we may be able to

Another manifestation is for people to exploit to exceed our objectives or achieve

always describe risks as the chance of not more challenging targets.

achieving an objective e.g. lower than

anticipated return on investments due to Think About the Positives

change in interest rates. This ignores

consideration of the possible upside. A The key is when thinking about risk and

better way to describe this risk might be undertaking risk management activities (for

variation to anticipated return on example when designing consequence

investments (positive or negative) due to ratings tables, setting objectives) think

fluctuations in interest rates. Describing about whether there could be an upside as

risks in this way will help to get people to well as a down side from a future event. If

think about maximising opportunities there is, consider controls or strategies that

rather than just avoiding disasters. might enable the organisation to capitalise

on such situations should they arise as well

Response Strategies as strategies or controls to minimise

negative outcomes.

Not considering the potential up and down

side of risks can result in response Avoiding risks is not the objective of risk

strategies or contingency plans that are one management. In fact, risk management is

dimensional. Think about a risk event that an opportunity enabler. However, dont

could result in positive or negative publicity take risks that are not well understood.

depending on the outcome of the event. A Dont take risks when the upside risk does

typical control for such an event might be a not justify the downside risk.

public relations or communication strategy. Understanding your objectives and both the

But if we focus exclusively on the negative potential upside and downside of risks will

consequences of the risk event (i.e. the help organisations to be better prepared

downside) it is likely that the PR or and hopefully make better decisions.

communication strategy will be all about Thinking about the upside can open

crisis management or damage control. peoples minds to the full range of potential

Thinking about the possible upside might outcomes from future events.

result in a PR strategy that enables the

organisation to capitalise or leverage off the Tony Harb & Mitchell Morley can

upside of the risk if it eventuates. be contacted on 02 9241 1344

or tonyh@inconsult.com.au

InConsult Pty Ltd.

All rights reserved. No part of this document can be reproduced without permission. Page 2

Potrebbero piacerti anche

- Simple Safety Risk RegisterDocumento4 pagineSimple Safety Risk RegisterChanthouen PichNessuna valutazione finora

- Risk Management: Construction ProjectsDocumento33 pagineRisk Management: Construction ProjectsvenkaatramNessuna valutazione finora

- PPO TMP RR ProjectRiskRegisterDocumento12 paginePPO TMP RR ProjectRiskRegisterSwadhin PalaiNessuna valutazione finora

- Inherent V Residual RiskDocumento2 pagineInherent V Residual RiskAlephNessuna valutazione finora

- EOHS Management System Procedure Procedure For Context of The OrganizationDocumento4 pagineEOHS Management System Procedure Procedure For Context of The OrganizationSuresh MuruganNessuna valutazione finora

- Risk Assessment TemplateDocumento5 pagineRisk Assessment Templateapi-285406906Nessuna valutazione finora

- You Exec - Risk Management FreeDocumento9 pagineYou Exec - Risk Management FreeJuan GómezNessuna valutazione finora

- Business Risk and Risk ManagementDocumento5 pagineBusiness Risk and Risk ManagementDickens LubangaNessuna valutazione finora

- The Use of Bowties To Aid Risk Management in Mining IndustriesDocumento21 pagineThe Use of Bowties To Aid Risk Management in Mining IndustriesTimNessuna valutazione finora

- Risk Assessment Procedure: Daqing Petroleum Iraq BranchDocumento10 pagineRisk Assessment Procedure: Daqing Petroleum Iraq Branchkhurram100% (1)

- 36 Types of Technology Risk: Simpl IcableDocumento25 pagine36 Types of Technology Risk: Simpl IcableMichael LimboNessuna valutazione finora

- RA Flushing &Hydro-TestingDocumento8 pagineRA Flushing &Hydro-Testingalla malikNessuna valutazione finora

- Hydro Static Test: Risk AssessmentDocumento10 pagineHydro Static Test: Risk Assessmentmohammed a hseNessuna valutazione finora

- Risk Assessment Checklist: Insert Company Logo HereDocumento17 pagineRisk Assessment Checklist: Insert Company Logo HereRaffique HazimNessuna valutazione finora

- Risk Assessment For Concrete Repair WorkDocumento11 pagineRisk Assessment For Concrete Repair WorkSaeed AhmadNessuna valutazione finora

- Ibrahim Saad C.V Storekeeper, "Manufacture - Supply Chain"Documento5 pagineIbrahim Saad C.V Storekeeper, "Manufacture - Supply Chain"Ibrahim Mohamed Saad Ibrahim67% (3)

- A. N - Bhagat - Risk Officer C.M.Chugh, AGM (Civil) - Resource Person Anand Trivedi, MGR (U&S) - Resource PersonDocumento67 pagineA. N - Bhagat - Risk Officer C.M.Chugh, AGM (Civil) - Resource Person Anand Trivedi, MGR (U&S) - Resource PersonAnil100% (1)

- Qualitative V Quantitative Risk AssessmentDocumento5 pagineQualitative V Quantitative Risk AssessmentGundeepNessuna valutazione finora

- OpRisk MonitoringDocumento16 pagineOpRisk MonitoringPol Bernardino0% (2)

- Risk Management ProcessDocumento17 pagineRisk Management Processtimesave240Nessuna valutazione finora

- Hira Format Lmi...Documento4 pagineHira Format Lmi...Prince RajNessuna valutazione finora

- Hazard Report Form: Workplace South Brisbane InstituteDocumento3 pagineHazard Report Form: Workplace South Brisbane InstituteAnderson OlivierNessuna valutazione finora

- Risk Management For Human ErrorDocumento81 pagineRisk Management For Human Errorbasit.000Nessuna valutazione finora

- Document of Risk Assessment & ManagementDocumento21 pagineDocument of Risk Assessment & ManagementravimutyamNessuna valutazione finora

- Step 1: Risk Identification Step 2: Risk Assessment Step 3: Risk Response Step 4: Monitor & ControlDocumento28 pagineStep 1: Risk Identification Step 2: Risk Assessment Step 3: Risk Response Step 4: Monitor & ControlAnbuNessuna valutazione finora

- Risk AssessmntDocumento5 pagineRisk Assessmntapi-456358200Nessuna valutazione finora

- Bec 3324: Project Management Year Iii - Semester Ii Session 7Documento35 pagineBec 3324: Project Management Year Iii - Semester Ii Session 7Tharindu PereraNessuna valutazione finora

- Risk Management Report: A. OverviewDocumento4 pagineRisk Management Report: A. OverviewAmit JainNessuna valutazione finora

- Session 1 - Project Risk ManagementDocumento21 pagineSession 1 - Project Risk ManagementShahzad Sultan AliNessuna valutazione finora

- Iosh Risk Assessment FormDocumento3 pagineIosh Risk Assessment FormNehal AhmadNessuna valutazione finora

- Risk Assesssment-Vinyl & Tile Floor InstallationDocumento2 pagineRisk Assesssment-Vinyl & Tile Floor InstallationMunaku TafadzwaNessuna valutazione finora

- HSE RA 032 Diesel Storage Rev 0Documento11 pagineHSE RA 032 Diesel Storage Rev 0عمروNessuna valutazione finora

- Ngos' Due Diligence and Risk Mitigation: A Holistic ApproachDocumento54 pagineNgos' Due Diligence and Risk Mitigation: A Holistic ApproachMichel KozahNessuna valutazione finora

- RISK ASSESSMENT Matrix To Assess Risk LevelDocumento1 paginaRISK ASSESSMENT Matrix To Assess Risk LevelRahul RajNessuna valutazione finora

- Infection Control Risk AssessmentDocumento3 pagineInfection Control Risk AssessmentAninditaNessuna valutazione finora

- IAA Risk Book Chapter 4 - Operational Risk Peter Boller Caroline Grégoire Toshihiro Kawano Executive SummaryDocumento17 pagineIAA Risk Book Chapter 4 - Operational Risk Peter Boller Caroline Grégoire Toshihiro Kawano Executive SummaryAlexanderHFFNessuna valutazione finora

- Risk Assessment For Ceramic & Porcelain Tile WorksDocumento6 pagineRisk Assessment For Ceramic & Porcelain Tile WorksFaizan TanveerNessuna valutazione finora

- Level 1 - Risk Register Project Name: Example Project Risk IdentificationDocumento5 pagineLevel 1 - Risk Register Project Name: Example Project Risk IdentificationHeltonNessuna valutazione finora

- Compliance Risk Assessment TemplateDocumento13 pagineCompliance Risk Assessment TemplateMariano HernánNessuna valutazione finora

- Traffic Management Control ProcedureDocumento52 pagineTraffic Management Control Procedureshanoj tharayilNessuna valutazione finora

- RMH HiraDocumento12 pagineRMH HiraShirley SetshediNessuna valutazione finora

- RISK Assement AGE - Maintenance of SOD Sapin Uae-18-8-2023Documento7 pagineRISK Assement AGE - Maintenance of SOD Sapin Uae-18-8-2023arabiangulfdoorest2008Nessuna valutazione finora

- HIRARC MAKLUMAT ASASDocumento4 pagineHIRARC MAKLUMAT ASASNurDoriaNessuna valutazione finora

- 3 - Operational Risk Management - 1Documento39 pagine3 - Operational Risk Management - 1MikealayNessuna valutazione finora

- Risk Assessment For Coring WorksDocumento5 pagineRisk Assessment For Coring WorksFaizan Tanveer100% (1)

- Efficient Warehouse Design GuideDocumento16 pagineEfficient Warehouse Design GuideAbhinit SinhaNessuna valutazione finora

- ACTIVITY DESCRIPTION: TRANSITION DUCT LIFTINGDocumento3 pagineACTIVITY DESCRIPTION: TRANSITION DUCT LIFTINGAnıl AKÇANessuna valutazione finora

- Installation of GIS SWITCHGEAR risk register projectDocumento4 pagineInstallation of GIS SWITCHGEAR risk register projectYashaswiniNessuna valutazione finora

- Risk Assessment FormDocumento2 pagineRisk Assessment FormMeng Hwi KorNessuna valutazione finora

- Nebosh IGC Q&Amp A SampleDocumento39 pagineNebosh IGC Q&Amp A Sample이준규Nessuna valutazione finora

- Hazards Identification and Risk Assessment FormDocumento3 pagineHazards Identification and Risk Assessment FormIslam ShaheenNessuna valutazione finora

- Use Risk Impact/Probability Chart Manage ICT Congress RisksDocumento2 pagineUse Risk Impact/Probability Chart Manage ICT Congress RisksJonathanA.RamirezNessuna valutazione finora

- Risk Assessment Proc - 1Documento35 pagineRisk Assessment Proc - 1bilo1984Nessuna valutazione finora

- 4.risk Assessment For PPM-Water HeaterDocumento2 pagine4.risk Assessment For PPM-Water HeaterManzur AhmadNessuna valutazione finora

- RISK Assement AGE-DSV-HIGH SPEED DOOR-30.05.2023Documento6 pagineRISK Assement AGE-DSV-HIGH SPEED DOOR-30.05.2023arabiangulfdoorest2008Nessuna valutazione finora

- Baseline Risk Assessment: Phindile Kula (Project Coordinator)Documento9 pagineBaseline Risk Assessment: Phindile Kula (Project Coordinator)EmilNessuna valutazione finora

- Confined Space - RA-R9-01-002-01Documento1 paginaConfined Space - RA-R9-01-002-01cmrig74Nessuna valutazione finora

- Risk Management OverviewDocumento59 pagineRisk Management OverviewKrishia MendozaNessuna valutazione finora

- Fundamentals of Risk Management - Understanding, Evaluating and Implementing Effective Risk Management (PDFDrive)Documento9 pagineFundamentals of Risk Management - Understanding, Evaluating and Implementing Effective Risk Management (PDFDrive)FADAL ALLAH ABDELILAH100% (1)

- An Overview of Risk Management in Banking PDFDocumento77 pagineAn Overview of Risk Management in Banking PDFSweta Kanguri SonulkarNessuna valutazione finora

- NSH 7 Element 2 Meter Beam AntennaDocumento3 pagineNSH 7 Element 2 Meter Beam AntennaGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- 5-30 MINUTE TIMERDocumento2 pagine5-30 MINUTE TIMERGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- 24 Hour TimerDocumento2 pagine24 Hour TimerWaseem AhmadNessuna valutazione finora

- IRR-Data Privacy Act (Aug 25, 2016)Documento49 pagineIRR-Data Privacy Act (Aug 25, 2016)BlogWatch100% (1)

- Pickup Wiring PDFDocumento7 paginePickup Wiring PDFGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Surge X Power GroundDocumento43 pagineSurge X Power GroundGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Transformerless Power Supply CircuitDocumento2 pagineTransformerless Power Supply CircuitGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Adc With No Adc PDFDocumento10 pagineAdc With No Adc PDFGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- GuitarNuts 00Documento13 pagineGuitarNuts 00Geroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Logic Level Mosfet v1 00Documento13 pagineLogic Level Mosfet v1 00Geroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Electric Cars Are Twice As Harmful Than Conventional Cars To The Environment During ManufacturingDocumento2 pagineElectric Cars Are Twice As Harmful Than Conventional Cars To The Environment During ManufacturingGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Strat Shielding TipsDocumento10 pagineStrat Shielding TipsAloysius JulindraNessuna valutazione finora

- GuitarElectronics 3Documento3 pagineGuitarElectronics 3Geroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Philippines Data Privacy Act SummaryDocumento7 paginePhilippines Data Privacy Act SummaryGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Pickup Wiring PDFDocumento7 paginePickup Wiring PDFGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- RFI HamDocumento66 pagineRFI HamGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Concrete PDFDocumento2 pagineConcrete PDFGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Ao2005 0029Documento10 pagineAo2005 0029Geroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Surge X Power GroundDocumento43 pagineSurge X Power GroundGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Power Line NoiseDocumento8 paginePower Line NoiseGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Siege of Baler-Fictional VersionDocumento4 pagineSiege of Baler-Fictional VersionGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- 292Documento12 pagine292billpaparounisNessuna valutazione finora

- Thomas PhilipDocumento74 pagineThomas PhilipGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- 8856Documento1 pagina8856Geroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Electromagnetic CompatibilityDocumento48 pagineElectromagnetic CompatibilityGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Fender Stratocaster - Shielding For Hum ReductionDocumento6 pagineFender Stratocaster - Shielding For Hum ReductionGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Berde For New Construction v1.0Documento139 pagineBerde For New Construction v1.0Geroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Greenhouse GasDocumento23 pagineGreenhouse GasGeroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- White Paper - The Beginners Guide To ISO50001 (December 2011)Documento4 pagineWhite Paper - The Beginners Guide To ISO50001 (December 2011)Geroldo 'Rollie' L. QuerijeroNessuna valutazione finora

- Budgeting: Estimating Costs, Risks, and Improving EstimatesDocumento16 pagineBudgeting: Estimating Costs, Risks, and Improving Estimatesbobby510Nessuna valutazione finora

- CHAPTER 1 Risk and Related Topics NewDocumento10 pagineCHAPTER 1 Risk and Related Topics NewbikilahussenNessuna valutazione finora

- Guide To Effective Risk Management 3.0Documento111 pagineGuide To Effective Risk Management 3.0Alex Sidorenko100% (4)

- Rubric - Argumentative EssayDocumento2 pagineRubric - Argumentative EssayBobNessuna valutazione finora

- Determining F Floor Flatness and F Floor Levelness Numbers: Standard Test Method ForDocumento8 pagineDetermining F Floor Flatness and F Floor Levelness Numbers: Standard Test Method Forrenzo_macherNessuna valutazione finora

- Complexity Self-Organization and Emergence at The Edge of Chaos in Life-Origin ModelsDocumento17 pagineComplexity Self-Organization and Emergence at The Edge of Chaos in Life-Origin ModelsFernando ScholarNessuna valutazione finora

- Current Status of Seismic Margin Assessment, Risk Evaluation, and Key IssuesDocumento34 pagineCurrent Status of Seismic Margin Assessment, Risk Evaluation, and Key IssuesggsacharyNessuna valutazione finora

- The Plewes Method - A Word of CautionDocumento10 pagineThe Plewes Method - A Word of CautionLuis Fernando Vergaray AstupiñaNessuna valutazione finora

- UncertaintyDocumento20 pagineUncertaintySaji JimenoNessuna valutazione finora

- Measuring The Coefficient of Restitution of A Table Tennis BallDocumento8 pagineMeasuring The Coefficient of Restitution of A Table Tennis BallEd Moss100% (1)

- Factor PricingDocumento18 pagineFactor PricingOnindya MitraNessuna valutazione finora

- Introduction To Risk: Trieschmann, Hoyt & SommerDocumento16 pagineIntroduction To Risk: Trieschmann, Hoyt & SommerBeka Tru'Luv JakipovNessuna valutazione finora

- Physics I Lab ManualDocumento106 paginePhysics I Lab ManualAsma NazirNessuna valutazione finora

- Tolerance CalibrationDocumento29 pagineTolerance CalibrationSunil GurubaxaniNessuna valutazione finora

- Mosca 2015Documento5 pagineMosca 2015Leticia Bonancio CerqueiraNessuna valutazione finora

- Decoding Quantitative Risk Assessment: Ken Ho Deputy Head, Geotechnical Engineering OfficeDocumento133 pagineDecoding Quantitative Risk Assessment: Ken Ho Deputy Head, Geotechnical Engineering OfficeYUK LAM WONGNessuna valutazione finora

- Shell Scenarios Explorers - GuideDocumento98 pagineShell Scenarios Explorers - GuidedaddotNessuna valutazione finora

- 048-003 Plain Plug GaugeDocumento5 pagine048-003 Plain Plug GaugeRavichandran DNessuna valutazione finora

- 1112 HL Chem Lab Report Format - Design FocusDocumento3 pagine1112 HL Chem Lab Report Format - Design FocusChirag HablaniNessuna valutazione finora

- IB HL Chemistry Lab Report Format: Name: Date: TitleDocumento2 pagineIB HL Chemistry Lab Report Format: Name: Date: TitledzenitaNessuna valutazione finora

- Decision-Making Under Risk & UncertaintyDocumento8 pagineDecision-Making Under Risk & UncertaintyRizwan ZahoorNessuna valutazione finora

- On Black Swans and Perfect Storms - Risk Analysis 2012Documento12 pagineOn Black Swans and Perfect Storms - Risk Analysis 2012Guido 125 LavespaNessuna valutazione finora

- ASTM C 680 - 03 Estimate of The Heat Gain or Loss and The Surface Temperatures of Insulated Flat, Cylindrical, and Spherical SystemsDocumento15 pagineASTM C 680 - 03 Estimate of The Heat Gain or Loss and The Surface Temperatures of Insulated Flat, Cylindrical, and Spherical SystemsFu_JohnNessuna valutazione finora

- RIBA Building in Quality - Guide To Using Quality TrackerDocumento32 pagineRIBA Building in Quality - Guide To Using Quality Trackerchong pak limNessuna valutazione finora

- Conversions Workflow v2020 02 FlierDocumento2 pagineConversions Workflow v2020 02 FlierMilan LLanque CondeNessuna valutazione finora

- Calculating Uncertainties (Answer Key)Documento2 pagineCalculating Uncertainties (Answer Key)Navakrishna SajeevanNessuna valutazione finora

- Planning Function & Decision-MakingDocumento38 paginePlanning Function & Decision-MakingTilahun EshetuNessuna valutazione finora

- Basics of Uncertainty Analysis: ActivityDocumento4 pagineBasics of Uncertainty Analysis: ActivityChristos LeptokaridisNessuna valutazione finora

- Amca 230-12Documento23 pagineAmca 230-12Jeff Anderson Collins50% (2)

- Techno Economic AnalysisDocumento21 pagineTechno Economic AnalysisSHUBHAM SINGHNessuna valutazione finora