Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Pay When WorkWeek Changes

Caricato da

claokerCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Pay When WorkWeek Changes

Caricato da

claokerCopyright:

Formati disponibili

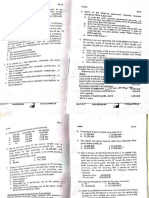

How Is Pay Figured When The Workweek Changes?

how to calculate a non-exempt employee's pay under the federal Fair Labor Standards Act for the

timeframe during which the employer adopts a different workweek.

When the FLSA workweek is changed, the period in which the conversion occurs typically

involves hours worked falling within, or overlapping, both the new and the old workweeks. As

an enforcement policy, the U.S. Department of Labor will deem FLSA wages to have been paid

properly if the employer uses a particular computation method. The agency's approach calls for

an employer to:

Assume that the overlapping hours were worked in only the "old" workweek, compute FLSA

straight-time and overtime pay due for each of the workweeks, and then total the sums;

Perform the same calculation assuming instead that the overlapping hours were worked in the

"new" workweek; and

Pay the employee the greater of the two totals.

See 29 C.F.R. 778.301, 778.302.

How Does This Actually Work?

For example, assume that an employer is changing its workweek from one beginning on Monday

and running through Sunday to one spanning from Friday through Thursday. Assume also that an

employee paid on an hourly basis at the rate of $10.00 works the following hours during the

period of the workweek change:

----------------- Old WW -----------------

M T W Th F Sat Sun M T W Th

8 8 10 9 7 8 9 1 8 8 8

----------------- New WW -----------------

This employee's wages would be computed as follows:

Pay for 60.25 "old" workweek's hours:

[(40 hrs. $10.00) + (20.25 OT hrs. 1.5 $10.00)] = $703.75

Pay for 25.25 "new" workweek's hours:

($10.00) (25.25 hrs.) = $252.50

TOTAL DUE FOR ELEVEN-DAY PERIOD: ($703.75 + $252.50) = $956.25

Pay for 50.25 "new" week's hours:

[(40 hrs. $10.00) + (10.25 OT hrs. 1.5 $10.00)] = $553.75

Pay for 35.25 "old" week's hours:

($10.00) (35.25 hrs.) = $352.50

TOTAL DUE FOR ELEVEN-DAY PERIOD: ($553.75 + $352.50) = $906.25

Because the first computation produces the greater figure, that is, $956.25, USDOL's

enforcement position calls for the employer to pay this amount.

Remember To Check Other Laws

Once again, this is something employers should also check into under any applicable laws of a

state or other jurisdiction.

For instance, under its own laws, a state might (i) require a different approach, or (ii) prescribe a

minimum period of advance notice before the new workweek may take effect.

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Reprinting Form W-2 Employee Copies With Address ChangesDocumento1 paginaReprinting Form W-2 Employee Copies With Address ChangesclaokerNessuna valutazione finora

- SF 1808 Release Overview BizXDocumento74 pagineSF 1808 Release Overview BizXclaokerNessuna valutazione finora

- Employment Standard Levy - ERP Human Capital Management - Community WikiDocumento2 pagineEmployment Standard Levy - ERP Human Capital Management - Community WikiclaokerNessuna valutazione finora

- Sales Area Transportation Planning Point Sales OrganizationDocumento3 pagineSales Area Transportation Planning Point Sales OrganizationclaokerNessuna valutazione finora

- Capital Budgeting, Problems and SolutionDocumento3 pagineCapital Budgeting, Problems and SolutionclaokerNessuna valutazione finora

- Enterprise Learning Content Caching OptionsDocumento12 pagineEnterprise Learning Content Caching OptionsclaokerNessuna valutazione finora

- Hiring Employee in USA Without SSNDocumento7 pagineHiring Employee in USA Without SSNclaokerNessuna valutazione finora

- Management ResearchDocumento5 pagineManagement ResearchclaokerNessuna valutazione finora

- Accounting of MGR McqsDocumento8 pagineAccounting of MGR McqsclaokerNessuna valutazione finora

- Implementing Validation Rules in The New Payroll Control CenterDocumento2 pagineImplementing Validation Rules in The New Payroll Control CenterclaokerNessuna valutazione finora

- Management Models and Theories Associated With MotivationDocumento16 pagineManagement Models and Theories Associated With MotivationReuben EscarlanNessuna valutazione finora

- Even Event Reason Replicate in EcpDocumento15 pagineEven Event Reason Replicate in EcpclaokerNessuna valutazione finora

- H&R Block Income Tax School: CatalogDocumento17 pagineH&R Block Income Tax School: CatalogclaokerNessuna valutazione finora

- MSN TodayDocumento6 pagineMSN TodayclaokerNessuna valutazione finora

- Making RadioDocumento4 pagineMaking RadioclaokerNessuna valutazione finora

- Cashflows 1Documento34 pagineCashflows 1claokerNessuna valutazione finora

- Battery Stops Charging at 70 % - HP Support Community - 6584675Documento7 pagineBattery Stops Charging at 70 % - HP Support Community - 6584675claokerNessuna valutazione finora

- Statistics QDocumento24 pagineStatistics Qclaoker100% (1)

- Tee Performanceuserguide v75 1649374Documento91 pagineTee Performanceuserguide v75 1649374claokerNessuna valutazione finora

- Economic Analysis For Business Decisions Multiple Choice Questions Unit-1: Basic Concepts of EconomicsDocumento15 pagineEconomic Analysis For Business Decisions Multiple Choice Questions Unit-1: Basic Concepts of EconomicsMuzaffar Mahmood KasanaNessuna valutazione finora

- Rockcollector2 - Quantitative Methods Final ExamDocumento4 pagineRockcollector2 - Quantitative Methods Final ExamclaokerNessuna valutazione finora

- Factors Affecting Organizational DesignDocumento8 pagineFactors Affecting Organizational DesignclaokerNessuna valutazione finora

- User Guide For Amity Proactored Online Exam 2016 PDFDocumento10 pagineUser Guide For Amity Proactored Online Exam 2016 PDFAmit KumarNessuna valutazione finora

- Adoption AssistanceDocumento4 pagineAdoption AssistanceclaokerNessuna valutazione finora

- How To Find Personal Data and Assess Privacy RisksDocumento4 pagineHow To Find Personal Data and Assess Privacy RisksclaokerNessuna valutazione finora

- SAP HCM Proposed Schedule PDFDocumento7 pagineSAP HCM Proposed Schedule PDFclaokerNessuna valutazione finora

- How To Find Personal Data and Assess Privacy RisksDocumento4 pagineHow To Find Personal Data and Assess Privacy RisksclaokerNessuna valutazione finora

- How To Store Address Details For Personnel SubareasDocumento3 pagineHow To Store Address Details For Personnel SubareasclaokerNessuna valutazione finora

- Working WiththeEmployeeCentral Data ModelVers. 1.0Documento9 pagineWorking WiththeEmployeeCentral Data ModelVers. 1.0claokerNessuna valutazione finora

- Powers of 10 - Scientific NotationDocumento4 paginePowers of 10 - Scientific NotationclaokerNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Cat Enclosure IngDocumento40 pagineCat Enclosure IngJuan Pablo GonzálezNessuna valutazione finora

- 10.MIL 9. Current and Future Trends in Media and InformationDocumento26 pagine10.MIL 9. Current and Future Trends in Media and InformationJonar Marie100% (1)

- Michelle E. Parsons-Powell CVDocumento3 pagineMichelle E. Parsons-Powell CVMichelle ParsonsNessuna valutazione finora

- Portales Etapas 2022 - MonicaDocumento141 paginePortales Etapas 2022 - Monicadenis_c341Nessuna valutazione finora

- Restaurant Business PlanDocumento20 pagineRestaurant Business PlandavidNessuna valutazione finora

- X-by-Wire: Fred SeidelDocumento9 pagineX-by-Wire: Fred SeidelHồng TháiNessuna valutazione finora

- Tax Compliance, Moral..Documento52 pagineTax Compliance, Moral..PutriNessuna valutazione finora

- Business Communication EnglishDocumento191 pagineBusiness Communication EnglishkamaleshvaranNessuna valutazione finora

- A Brief History: The Four Waves of FeminismDocumento2 pagineA Brief History: The Four Waves of FeminismMuHammAD ShArjeeLNessuna valutazione finora

- Listen The Song and Order The LyricsDocumento6 pagineListen The Song and Order The LyricsE-Eliseo Surum-iNessuna valutazione finora

- Bebras2021 BrochureDocumento5 pagineBebras2021 BrochureJeal Amyrrh CaratiquitNessuna valutazione finora

- Do 18-A and 18 SGV V de RaedtDocumento15 pagineDo 18-A and 18 SGV V de RaedtThomas EdisonNessuna valutazione finora

- Hp Ux系统启动的日志rcDocumento19 pagineHp Ux系统启动的日志rcMq SfsNessuna valutazione finora

- Cotton Fruit Extract As A Degreaser: Marvie OsorioDocumento17 pagineCotton Fruit Extract As A Degreaser: Marvie OsorioJamailla MelendrezNessuna valutazione finora

- MBA Negotiable Instruments Act 1881 F2Documento72 pagineMBA Negotiable Instruments Act 1881 F2khmahbub100% (1)

- The Periodontal Ligament: A Unique, Multifunctional Connective TissueDocumento21 pagineThe Periodontal Ligament: A Unique, Multifunctional Connective TissueSamuel Flores CalderonNessuna valutazione finora

- Silo - Tips - Datex Ohmeda S 5 Collect Users Reference ManualDocumento103 pagineSilo - Tips - Datex Ohmeda S 5 Collect Users Reference Manualxiu buNessuna valutazione finora

- Fogarty HardwickDocumento35 pagineFogarty HardwickBen KellerNessuna valutazione finora

- Infographic Group Output GROUP 2Documento2 pagineInfographic Group Output GROUP 2Arlene Culagbang GuitguitinNessuna valutazione finora

- Mall Road HistoryDocumento3 pagineMall Road HistoryKaleem Ahmed100% (1)

- RetrofitDocumento4 pagineRetrofitNiket ShahNessuna valutazione finora

- CerinaDocumento13 pagineCerinajoe 02Nessuna valutazione finora

- Test Bank For Biology 7th Edition Neil A CampbellDocumento36 pagineTest Bank For Biology 7th Edition Neil A Campbellpoupetonlerneanoiv0ob100% (31)

- Part 1: Hôm nay bạn mặc gì?Documento5 paginePart 1: Hôm nay bạn mặc gì?NamNessuna valutazione finora

- Project ProposalDocumento1 paginaProject ProposalLadee ClaveriaNessuna valutazione finora

- NASA: 45607main NNBE Interim Report1 12-20-02Documento91 pagineNASA: 45607main NNBE Interim Report1 12-20-02NASAdocumentsNessuna valutazione finora

- Multiple Effect EvaporatorDocumento4 pagineMultiple Effect EvaporatorKusmakarNessuna valutazione finora

- 05 CEE2219 TM2 MidExam - 2018-19 - SolnDocumento8 pagine05 CEE2219 TM2 MidExam - 2018-19 - SolnCyrus ChartehNessuna valutazione finora

- PRTC Tax Final Preboard May 2018Documento13 paginePRTC Tax Final Preboard May 2018BonDocEldRicNessuna valutazione finora

- CT, PT, IVT, Current Transformer, Potential Transformer, Distribution Boxes, LT Distribution BoxesDocumento2 pagineCT, PT, IVT, Current Transformer, Potential Transformer, Distribution Boxes, LT Distribution BoxesSharafatNessuna valutazione finora