Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Quarterly Financial Results of Retail Company

Caricato da

dhruvg14Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Quarterly Financial Results of Retail Company

Caricato da

dhruvg14Copyright:

Formati disponibili

SALES LTL

` 77,554 Lacs Sales growth

Up by 14.8% at 12.7%

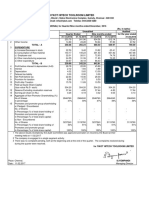

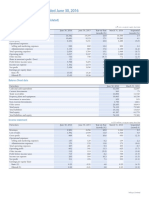

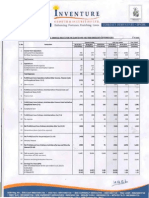

STATEMENT OF UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED JUNE 30, 2015

PART I PART II

Particulars Standalone SELECT INFORMATION FOR THE UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED JUNE 30,2015

Quarter Ended Financial Year Ended Particulars Standalone

30-Jun-15 31-Mar-15 30-Jun-14 31-Mar-15 Quarter Ended Financial Year Ended

(Refer Notes Below) (Unaudited) (Unaudited) (Unaudited) (Audited) 30-Jun-15 31-Mar-15 30-Jun-14 31-Mar-15

(Unaudited) (Unaudited) (Unaudited) (Audited)

1) Turnover

A) PARTICULARS OF SHAREHOLDING

Retail Turnover

1) Public Shareholding

Own merchandise (including concession sales) 71,270.47 82,523.71 61,537.83 306,930.78 - Number of Shares 27,356,848 27,338,131 27,240,183 27,338,131

Consignment merchandise 6,283.10 8,193.49 6,011.03 30,088.43 - Percentage of shareholding 32.81 32.79 32.71 32.79

77,553.57 90,717.20 67,548.86 337,019.21 2) Promoters and promoter group Shareholding

Less :- Value Added Tax / Sales Tax 3,640.04 4,365.68 3,310.55 16,095.48 a) Pledged / Encumbered

- Number of shares 7,077,204 7,077,204 7,077,204 7,077,204

Cost of consignment merchandise 4,130.45 5,532.77 4,030.50 20,162.71

- Percentage of shares (as a % of the total

Income from Operations 69,783.08 80,818.75 60,207.81 300,761.02 shareholding of promoter and promoter group) 12.63 12.63 12.63 12.63

2) Other operating income 1,332.14 861.33 1,001.99 4,236.64 - Percentage of shares (as a % of the total share

3) Total Income from operations (net) (1+2) 71,115.22 81,680.08 61,209.80 304,997.66 capital of the company) 8.49 8.49 8.50 8.49

b) Non-encumbered

4) Expenses

- Number of Shares 48,952,470 48,952,470 48,952,470 48,952,470

a) Purchases of stock-in-trade 46,052.86 49,636.81 37,448.37 191,051.05

- Percentage of shares (as a % of the total

b) Changes in inventories of stock-in trade -(Increase)/Decrease (2,783.85) 924.59 (1,409.25) (3,407.76) shareholding of promoter and promoter group) 87.37 87.37 87.37 87.37

c) Employees benefits expense 5,746.59 5,879.96 5,279.50 22,703.29 - Percentage of shares (as a % of the total share

capital of the company) 58.70 58.72 58.79 58.72

d) Depreciation and amortisation expense 1,988.44 2,661.21 1,985.68 8,580.71

e) Lease Rent and Hire Charges 7,341.59 7,449.95 6,633.98 28,514.11 Particulars Quarter Ended 30-Jun-15

f) Electricity Charges 2,321.89 2,017.09 2,101.29 8,654.43

B) INVESTOR COMPLAINTS

g) Other expenses 9,163.05 10,863.87 8,076.78 38,588.84 Pending at the beginning of the quarter (as on 01-Apr-2015) NIL

Total expenses 69,830.57 79,433.48 60,116.35 294,684.67 Received during the quarter ended 30-June-2015 Three

5) Profit from operations before Other Income, finance costs Disposed of during the quarter ended 30-June-2015 Three

and exceptional items (3-4) 1,284.65 2,246.60 1,093.45 10,312.99 Remaining unresolved at the end of the quarter (as on 30-June-2015) NIL

6) Other Income 511.92 613.32 338.27 1,765.49

Notes to results :

7) Profit from ordinary activities before finance costs and 1 The Company is primarily engaged in the business of retail trade through retail and departmental store facilities, which constitute a single

exceptional items (5+6) 1,796.57 2,859.92 1,431.72 12,078.48 reportable segment.

8) Finance Costs 1,392.22 1,205.63 1,305.29 5,122.23 2 During the quarter, 18,717 equity shares were issued and allotted under the Company's Employee Stock Option Scheme.

3 Pursuant to levy of service tax on renting of immovable properties given for commercial use, retrospectively with effect from 1 June 2007

9) Profit from ordinary activities after finance costs but

by the Finance Act, 2010, the Company has, based on a legal advice, challenged the said levy and, inter-alia, its retrospective application.

before exceptional Items (7-8) 404.35 1,654.29 126.43 6,956.25

Consistent with the treatment in earlier periods, pending the final disposal of the matter, the Company continues not to provide for the

10) Exceptional Item : retrospective levy aggregating ` 1,659.56 Lacs (paid under protest) for the period 1st June, 2007 to 31st March, 2010.

Provision for diminution in value of investment in a Joint Venture 2,381.00 - - - 4 The Company has a financial involvement aggregating ` 43,270.37 Lacs in Hypercity Retail (India) Limited (Hypercity), a subsidiary

company. Consistent with the earlier periods, in view of Hypercitys business plans with strategic growth projections, the Company

11) (Loss) / Profit from ordinary activities before tax (9-10) (1,976.65) 1,654.29 126.43 6,956.25

considers that there is no loss for which a provision is

12) Tax expense 167.02 624.33 51.33 2,882.72 currently necessary. By order of the Board of Directors

13) Net (Loss) / Profit after tax (11-12) (2,143.67) 1,029.96 75.10 4,073.53 5 Figures of the previous period / year have been regrouped / For Shoppers Stop Limited

reclassified wherever necessary.

14) Paid-up equity share capital (Face value of ` 5/- Per Share) 4,169.33 4,168.39 4,163.49 4,168.39 Govind S. Shrikhande

6 The Standalone financial results have been reviewed by the

15) Reserves (Excluding Revaluation Reserve) 72,360.41 Audit Committee on 30th July, 2015 and approved by the Customer Care Associate & Managing Director

16) Earnings per share (In `) (not to be annualised - Refer Note 2) Board of Directors at their meeting held on 31st July, 2015.

- Basic (2.57) 1.24 0.09 4.89 The statutory auditors of the Company has carried out a limited

review of the Company's financial results for the quarter ended

- Diluted (2.57) 1.23 0.09 4.88 30th June, 2015.

Place: Mumbai

Date : 31st July, 2015

Regd. Off.: Eureka Towers, 9th Floor, B Wing, Mindspace, Link Road, Malad (West), Mumbai 400 064. Tel: (+91 22) 42497000 ; Fax : (+91 22) 28808877, Website : www.shoppersstop.com. E-mail : investor@shoppersstop.com

Corporate Identification No : L51900MH1997PLC108798

WE THANK ALL OUR CUSTOMERS, ASSOCIATES & PARTNERS FOR THEIR CONSTANT SUPPORT

Adfactors 253

Potrebbero piacerti anche

- Quarter1 2008Documento2 pagineQuarter1 2008Raghavendra DevadigaNessuna valutazione finora

- q1 Results FinalDocumento1 paginaq1 Results Finalmixedbag100% (1)

- Quarter1 2010Documento2 pagineQuarter1 2010DhruvRathoreNessuna valutazione finora

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Documento3 pagineColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaNessuna valutazione finora

- Baraka Power q1 Sep 2015Documento21 pagineBaraka Power q1 Sep 2015Sibiya ZamanNessuna valutazione finora

- 634085163601250000financial Highlights0310-Correcte-1Documento2 pagine634085163601250000financial Highlights0310-Correcte-1arunnair1985Nessuna valutazione finora

- Q2 20 & 6 Months DhunseriDocumento7 pagineQ2 20 & 6 Months Dhunserica.anup.kNessuna valutazione finora

- Eurasia Drilling Interim Financials H1 2018Documento19 pagineEurasia Drilling Interim Financials H1 2018KaiserNessuna valutazione finora

- Financial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Documento10 pagineFinancial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderNessuna valutazione finora

- HUL Directors Report Ar 2013 14Documento24 pagineHUL Directors Report Ar 2013 14Lakshmi MNessuna valutazione finora

- Announcement of Interim Results For The Six Months Ended 30 June 2020Documento45 pagineAnnouncement of Interim Results For The Six Months Ended 30 June 2020in resNessuna valutazione finora

- Balaji Published Results 28-102010Documento2 pagineBalaji Published Results 28-102010Saurabh YadavNessuna valutazione finora

- Jamna Auto Industries Limited Unaudited ResultsDocumento4 pagineJamna Auto Industries Limited Unaudited ResultspoloNessuna valutazione finora

- Bajaj Hindusthan standalone/consolidated quarterly resultsDocumento5 pagineBajaj Hindusthan standalone/consolidated quarterly resultsRavi AgarwalNessuna valutazione finora

- Res Oct08Documento1 paginaRes Oct08narayanan_rNessuna valutazione finora

- STX Q3 2010 Financial StatementsDocumento16 pagineSTX Q3 2010 Financial StatementsLiying KwongNessuna valutazione finora

- China Milk Product 2009 Oct ReportDocumento16 pagineChina Milk Product 2009 Oct ReportPhilip Chua CHNessuna valutazione finora

- q209 - Airtel Published FinancialsDocumento7 pagineq209 - Airtel Published Financialsmixedbag100% (2)

- ZLL Financials Dec10Documento1 paginaZLL Financials Dec10vinay_bhandari_2Nessuna valutazione finora

- Standalone Financial Results For December 31, 2016 (Result)Documento2 pagineStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Profile: Unaudited Financial Results For The Quarter Ended 30Th June, 2010Documento16 pagineFinancial Profile: Unaudited Financial Results For The Quarter Ended 30Th June, 2010Arun SharmaNessuna valutazione finora

- Highlights of Consolidated Results For Fiscal Year Ended March 31, 2015Documento6 pagineHighlights of Consolidated Results For Fiscal Year Ended March 31, 2015Louis ChenNessuna valutazione finora

- Intellipharmaceutics International Inc. q2 2021Documento31 pagineIntellipharmaceutics International Inc. q2 2021Sandesh PatilNessuna valutazione finora

- Kawasaki Reports Higher Profits in Q1 2015Documento17 pagineKawasaki Reports Higher Profits in Q1 2015Tyasmara NugrahaNessuna valutazione finora

- United Company RUSAL PLC Consolidated Interim Condensed Financial Information For The Three-And Six-Month Periods Ended 30 June 2018Documento40 pagineUnited Company RUSAL PLC Consolidated Interim Condensed Financial Information For The Three-And Six-Month Periods Ended 30 June 2018Евно АзефNessuna valutazione finora

- Factsheet q4 2016 FinalDocumento9 pagineFactsheet q4 2016 FinaltambreadNessuna valutazione finora

- MMC BerhadDocumento27 pagineMMC Berhadpuravi91Nessuna valutazione finora

- Guorui Properties Limited 國瑞置業有限公司: Interim Results Announcement For The Six Months Ended June 30, 2020Documento38 pagineGuorui Properties Limited 國瑞置業有限公司: Interim Results Announcement For The Six Months Ended June 30, 2020in resNessuna valutazione finora

- Q3 2009 UTV Software Communications Financials Uploaded by MediaNamaDocumento1 paginaQ3 2009 UTV Software Communications Financials Uploaded by MediaNamamixedbagNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- EWI Q2-2018 ResultsDocumento20 pagineEWI Q2-2018 ResultskimNessuna valutazione finora

- HCL Q3 FY 14 - ResultsDocumento3 pagineHCL Q3 FY 14 - ResultsPrice Action Trading SurajNessuna valutazione finora

- Report For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)Documento7 pagineReport For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)ashokdb2kNessuna valutazione finora

- Mgm China Holdings Limited 美 高 梅 中 國 控 股 有 限 公 司Documento7 pagineMgm China Holdings Limited 美 高 梅 中 國 控 股 有 限 公 司Suix Leon LeeNessuna valutazione finora

- Announcement of The Results For The Three Months Ended March 31, 2023Documento27 pagineAnnouncement of The Results For The Three Months Ended March 31, 2023charles shawNessuna valutazione finora

- PDF ShoppersDocumento43 paginePDF ShoppersVikrant KarhadkarNessuna valutazione finora

- Asl Marine Holdings LTDDocumento28 pagineAsl Marine Holdings LTDAnonymous Feglbx5Nessuna valutazione finora

- Profit and Loss Account For The Year Ended 31 March, 2009: ST STDocumento2 pagineProfit and Loss Account For The Year Ended 31 March, 2009: ST STRanjan DasguptaNessuna valutazione finora

- Pidilite Industries Income StatementDocumento4 paginePidilite Industries Income StatementRehan TyagiNessuna valutazione finora

- Careplus Jul 2011 Q2Documento21 pagineCareplus Jul 2011 Q2thamNessuna valutazione finora

- Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)Documento1 paginaResubmission of Standalone Financial Results For December 31, 2014 (Company Update)Shyam SunderNessuna valutazione finora

- Asl Marine Holdings Ltd.Documento30 pagineAsl Marine Holdings Ltd.citybizlist11Nessuna valutazione finora

- Case StudyDocumento3 pagineCase StudyJamshidbek OdiljonovNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Documento11 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNessuna valutazione finora

- Consolidated 11-Year Summary: Financial / Data SectionDocumento60 pagineConsolidated 11-Year Summary: Financial / Data SectionMUHAMMAD ISMAILNessuna valutazione finora

- PDF SampleDocumento43 paginePDF Sampled5508626Nessuna valutazione finora

- Bc Technology Group Limited B C 科 技 集 團 有 限 公 司: Interim Results Announcement For The Six Months Ended 30 June 2020Documento30 pagineBc Technology Group Limited B C 科 技 集 團 有 限 公 司: Interim Results Announcement For The Six Months Ended 30 June 2020aalalalNessuna valutazione finora

- 中期报告2011614Documento54 pagine中期报告2011614yf zNessuna valutazione finora

- Statement of Changes StandaloneDocumento2 pagineStatement of Changes StandaloneMadhu MohanNessuna valutazione finora

- Jamna Auto Industries LimitedDocumento1 paginaJamna Auto Industries LimitedpoloNessuna valutazione finora

- Thermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014Documento1 paginaThermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014kartiknamburiNessuna valutazione finora

- Accounts SEBL1STMF 31MAR-18 PDFDocumento10 pagineAccounts SEBL1STMF 31MAR-18 PDFAhm FerdousNessuna valutazione finora

- TXP MDA December 31 2019 FINALDocumento47 pagineTXP MDA December 31 2019 FINALasraghuNessuna valutazione finora

- ZHI Announcement - 1H 2020Documento25 pagineZHI Announcement - 1H 2020Kang Xian WongNessuna valutazione finora

- Announcement of Interim Results For The Six Months Ended 30 June 2020Documento19 pagineAnnouncement of Interim Results For The Six Months Ended 30 June 2020in resNessuna valutazione finora

- Tata Steel Thailand Annual Report HighlightsDocumento144 pagineTata Steel Thailand Annual Report Highlightshinbox7Nessuna valutazione finora

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDa EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNessuna valutazione finora

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosDa EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNessuna valutazione finora

- Using Economic Indicators to Improve Investment AnalysisDa EverandUsing Economic Indicators to Improve Investment AnalysisValutazione: 3.5 su 5 stelle3.5/5 (1)

- XAT Past Years Question Papers and Answer Keys 2010 2012Documento111 pagineXAT Past Years Question Papers and Answer Keys 2010 2012dhruvg14Nessuna valutazione finora

- Punjab Manifesto AAP 2017Documento31 paginePunjab Manifesto AAP 2017muditfoolNessuna valutazione finora

- Of Solar Module Manufacturers:: Solar Industry in India ListDocumento3 pagineOf Solar Module Manufacturers:: Solar Industry in India ListManoj YadavNessuna valutazione finora

- DL 2018 q1 Allinone PDFDocumento191 pagineDL 2018 q1 Allinone PDFdhruvg14Nessuna valutazione finora

- Civil Services Examination 2017 - Service Allocation ListDocumento22 pagineCivil Services Examination 2017 - Service Allocation Listkaladhar reddyNessuna valutazione finora

- Renewable Energys TransformationDocumento24 pagineRenewable Energys TransformationpassinetNessuna valutazione finora

- HDFC Diners Club - Covers - DinersDocumento3 pagineHDFC Diners Club - Covers - DinersPrashant RajputNessuna valutazione finora

- Swiggy Order 1170227065Documento2 pagineSwiggy Order 1170227065dhruvg14Nessuna valutazione finora

- S. No. City Lounge Name Airport Terminal Airport Name AddressDocumento3 pagineS. No. City Lounge Name Airport Terminal Airport Name Addressdhruvg14Nessuna valutazione finora

- Diners 10X TNC Jan 2021Documento5 pagineDiners 10X TNC Jan 2021dhruvg14Nessuna valutazione finora

- IBReg FormDocumento1 paginaIBReg FormAbhishek KoliNessuna valutazione finora

- DL 160225 q4 Allinone PDFDocumento472 pagineDL 160225 q4 Allinone PDFdhruvg14Nessuna valutazione finora

- End-Term Exam Schedule - Term III 2014-16Documento1 paginaEnd-Term Exam Schedule - Term III 2014-16dhruvg14Nessuna valutazione finora

- Tax Point Date Description Tax Amount Net Amount: Sgst/UtgstDocumento1 paginaTax Point Date Description Tax Amount Net Amount: Sgst/Utgstdhruvg14Nessuna valutazione finora

- IIMA Casebook 2011 PDFDocumento93 pagineIIMA Casebook 2011 PDFdhruvg14Nessuna valutazione finora

- The Evolving Brand Logic: A Service-Dominant Logic PerspectiveDocumento18 pagineThe Evolving Brand Logic: A Service-Dominant Logic Perspectivedhruvg14Nessuna valutazione finora

- TV White Space Regulatory Framework: 2015/SOM2/TEL51/DSG/WKSP1/002Documento15 pagineTV White Space Regulatory Framework: 2015/SOM2/TEL51/DSG/WKSP1/002dhruvg14Nessuna valutazione finora

- Cost, Risk-Taking, and Value in The Airline IndustryDocumento23 pagineCost, Risk-Taking, and Value in The Airline Industrydhruvg14Nessuna valutazione finora

- HW 06 CorrectionDocumento3 pagineHW 06 Correctiondhruvg14Nessuna valutazione finora

- Basic Treasury PDFDocumento206 pagineBasic Treasury PDFdhruvg14Nessuna valutazione finora

- Fundamental Geometry ConceptsDocumento0 pagineFundamental Geometry ConceptsRohit Sharma70% (10)

- Careers in Financial Markets 2010-2011 PDFDocumento100 pagineCareers in Financial Markets 2010-2011 PDFtrop41Nessuna valutazione finora

- Unit CostingDocumento4 pagineUnit Costingdhruvg14Nessuna valutazione finora

- HW 03 CorrectionDocumento3 pagineHW 03 Correctiondhruvg14Nessuna valutazione finora

- Derivative Question Sample PaperDocumento8 pagineDerivative Question Sample Paperdhruvg14Nessuna valutazione finora

- FixedIncome Class02Documento49 pagineFixedIncome Class02dhruvg14Nessuna valutazione finora

- Multiple CamScanner ScansDocumento19 pagineMultiple CamScanner Scansdhruvg14Nessuna valutazione finora

- Fixed Income: Securities & MarketsDocumento57 pagineFixed Income: Securities & Marketsdhruvg14Nessuna valutazione finora

- Civil Unrest in Eswatini. Commission On Human Rights 2021Documento15 pagineCivil Unrest in Eswatini. Commission On Human Rights 2021Richard RooneyNessuna valutazione finora

- Social Media Audience Research (To Use The Template, Click The "File" Tab and Select "Make A Copy" From The Drop-Down Menu)Documento7 pagineSocial Media Audience Research (To Use The Template, Click The "File" Tab and Select "Make A Copy" From The Drop-Down Menu)Jakob OkeyNessuna valutazione finora

- Ledford EPC Geothermal PresentationDocumento27 pagineLedford EPC Geothermal PresentationgadisaNessuna valutazione finora

- Baker Jennifer. - Vault Guide To Education CareersDocumento156 pagineBaker Jennifer. - Vault Guide To Education Careersdaddy baraNessuna valutazione finora

- Macn000000315+111 (USAA) Universal Sovereign Original Indigenous Natural Divine Affidavit Ov Written Innitial Unniversal Commercial Code 1 Phinansinge Statement LienDocumento5 pagineMacn000000315+111 (USAA) Universal Sovereign Original Indigenous Natural Divine Affidavit Ov Written Innitial Unniversal Commercial Code 1 Phinansinge Statement Liencarolyn linda wiggins el all rights exercised and retained at all timesNessuna valutazione finora

- The First, First ResponderDocumento26 pagineThe First, First ResponderJose Enrique Patron GonzalezNessuna valutazione finora

- Division of WorkDocumento19 pagineDivision of WorkBharadwaj KwcNessuna valutazione finora

- Document 6Documento32 pagineDocument 6Pw LectureNessuna valutazione finora

- MSA BeijingSyllabus For Whitman DizDocumento6 pagineMSA BeijingSyllabus For Whitman DizcbuhksmkNessuna valutazione finora

- MS 1806 Inventory ModelDocumento5 pagineMS 1806 Inventory ModelMariane MananganNessuna valutazione finora

- Database of Success Indicators (Dilg Central Office) : Major Final Output/Ppas Success Indicators Standard Rating Due DateDocumento13 pagineDatabase of Success Indicators (Dilg Central Office) : Major Final Output/Ppas Success Indicators Standard Rating Due DateFender Boyang100% (1)

- Your Guide To Starting A Small EnterpriseDocumento248 pagineYour Guide To Starting A Small Enterprisekleomarlo94% (18)

- The Slave Woman and The Free - The Role of Hagar and Sarah in PaulDocumento44 pagineThe Slave Woman and The Free - The Role of Hagar and Sarah in PaulAntonio Marcos SantosNessuna valutazione finora

- Uttara ClubDocumento16 pagineUttara ClubAccounts Dhaka Office75% (4)

- UGC Project FormatDocumento19 pagineUGC Project FormatAmit GautamNessuna valutazione finora

- FINPLAN Case Study: Safa Dhouha HAMMOU Mohamed Bassam BEN TICHADocumento6 pagineFINPLAN Case Study: Safa Dhouha HAMMOU Mohamed Bassam BEN TICHAKhaled HAMMOUNessuna valutazione finora

- Definition of Internal Order: Business of The Company (Orders With Revenues)Documento6 pagineDefinition of Internal Order: Business of The Company (Orders With Revenues)MelanieNessuna valutazione finora

- Transformation of The Goddess Tara With PDFDocumento16 pagineTransformation of The Goddess Tara With PDFJim Weaver100% (1)

- 30 Chichester PL Apt 62Documento4 pagine30 Chichester PL Apt 62Hi TheNessuna valutazione finora

- Final Project Taxation Law IDocumento28 pagineFinal Project Taxation Law IKhushil ShahNessuna valutazione finora

- Buku Drawing - REV - 02Documento40 pagineBuku Drawing - REV - 02agung kurniawanNessuna valutazione finora

- CUBihar Dec12 ChallanDocumento1 paginaCUBihar Dec12 Challannareshjangra397Nessuna valutazione finora

- Key Ideas of The Modernism in LiteratureDocumento3 pagineKey Ideas of The Modernism in Literaturequlb abbasNessuna valutazione finora

- Forty Years of PopDocumento24 pagineForty Years of PopHelci RamosNessuna valutazione finora

- Liberal Arts Reading ListDocumento2 pagineLiberal Arts Reading ListAnonymous 7uD3SBhNessuna valutazione finora

- Jesu, Joy of Mans DesiringDocumento6 pagineJesu, Joy of Mans DesiringAleksandar TamindžićNessuna valutazione finora

- 55850bos45243cp2 PDFDocumento58 pagine55850bos45243cp2 PDFHarshal JainNessuna valutazione finora

- Attestation Process ChecklistDocumento2 pagineAttestation Process Checklistkim edwinNessuna valutazione finora

- General Banking LawsDocumento140 pagineGeneral Banking LawsedreaNessuna valutazione finora

- CHRAEFSB2016-32-MotoService Tool - Factory Boot ModeDocumento2 pagineCHRAEFSB2016-32-MotoService Tool - Factory Boot Modedanny1977100% (1)