Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Law Sample Question

Caricato da

knmodiDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Law Sample Question

Caricato da

knmodiCopyright:

Formati disponibili

CPT Sec.

B Mercantile Law

Indian Partnership Act, 1932

Practical Questions

1. A, B, C and D established a partnership for refining sugar. A was considered expert in the job

of buying sugar. Thus A was entrusted with the duty of purchasing sugar for the firm. A

himself was a wholesale dealer in sugar. He, unknown to his co-partners, supplied to the firm,

at the market price, with sugar previously bought by himself from his own resources when the

price was lower, and he so made considerable profit. B, C and D sued for the profits thus

made by him. Is A accountable?

2. A, B and C agreed to form a partnership. The partnership deed provided that all the three shall

share the profits equally. Afterwards they carried on the partnership business for many years,

A receiving one-half of the net profits and the other half being equally divided between B and

C, to which B and C never objected. The partnership developed some differences and as such

B and C file a suit for their share of profits for the past years on the basis of the partnership

deed. Decide.

3. A and B are partners in a business. A, without the knowledge of B, acting within the general

scope of his authority as a partner bribed C’s clerk, and induced him in breach of his duty to

his employer, to disclose some secrets relating to C’s business. C, as a result suffers a loss. Is

B liable for the acts of A?

4. A,B, and C are partners. An order is placed with D for supplying a certain quantity of goods to

the firm on credit. Before D could supply the goods C died. D supplies the goods after C’s

death, being totally ignorant about the fact of C’s death. A and B subsequently become

insolvent. Can D make C’s estate liable for his debt?

5. A and B, two chartered accountants, agree to carry on practice in common at the office of A

under the name “A and B” for a period of seven years. The terms of agreement entered into

between them provide that B should manage the office and supervise the clerical work and

that he should draw a fixed allowance of Rs2000 pm in lieu of profits. It is further agreed that

losses, if any, shall be borne by A alone, and that after seven years A would be entitled to the

office and all the other equipments, and B would not have any right, or claim, in respect of

them. Are A and B partners?

MODI’S, where success follows you. -1

-

CPT Sec. B Mercantile Law

6. A is the sole proprietor of a firm. He admits B as a partner on the following terms: 1. B is not

to bring any capital, 2. B is not to be responsible for any loss, 3. B is to receive Rs 10,000 pa

in lieu of profits, 4. B is not to enter any contracts on behalf of the firm. Discuss the legal

position of B.

7. M, A clerk in K’s business, entered into a verbal agreement with K for a share of profit and

loss in the proportion of one-sixth to M and five-sixth to K. It was further agreed that the

building in which the business was carried on should remain the property of K. M alleges that

he is a partner and claims dissolution of the firm and an account of assets. K denies the

partnership, and alleges that M is only a clerk. Decide.

8. A, B, and C started a cloth business in Chandni Chowk on 1 Jan 2003, for a period of five

years. The business resulted in a loss of Rs10000 in the first year, Rs 15000 in the second year

and Rs 18000 in the third year. B and C wish to dissolve the firm while A wants to continue

the business. Advise B and C.

9. A and B form a trading partnership for five years. After two years A is convicted of traveling

on the railway without a ticket. A file a suit for the dissolution of the firm on the ground of his

own misconduct. Will he succeed? Will your answer be different if B files the suit on the

ground of A’s misconduct?

MODI’S, where success follows you. -2

-

Potrebbero piacerti anche

- Florida Real Estate Exam Prep: Everything You Need to Know to PassDa EverandFlorida Real Estate Exam Prep: Everything You Need to Know to PassNessuna valutazione finora

- Partnership ExerciseDocumento11 paginePartnership ExerciseCris Tarrazona Casiple0% (1)

- RFBT 4-Partnership Post-TestDocumento5 pagineRFBT 4-Partnership Post-TestCharles D. FloresNessuna valutazione finora

- Business Law and Regulations Quiz: Partnerships 2Documento15 pagineBusiness Law and Regulations Quiz: Partnerships 2Gabriela Marie F. PalatulanNessuna valutazione finora

- Take Home QuizDocumento2 pagineTake Home Quizlancelotroyal21Nessuna valutazione finora

- Quiz - Partnership Law Nov 7 2020Documento4 pagineQuiz - Partnership Law Nov 7 2020eunicemaraNessuna valutazione finora

- Answer Key On Sample Questions of Partnership LawDocumento8 pagineAnswer Key On Sample Questions of Partnership LawHannah Jane Umbay100% (2)

- Leb Cases New 2009Documento18 pagineLeb Cases New 2009Richa AnandNessuna valutazione finora

- Quiz On PartnershipDocumento28 pagineQuiz On PartnershipJhernel SuaverdezNessuna valutazione finora

- PARTNERSHIP LAW MULTIPLE CHOICE QUESTIONSDocumento3 paginePARTNERSHIP LAW MULTIPLE CHOICE QUESTIONSwivada75% (4)

- Drill 1 Partnership PDFDocumento2 pagineDrill 1 Partnership PDFMaeNessuna valutazione finora

- BLT Final Pre-Boards NCPARDocumento12 pagineBLT Final Pre-Boards NCPARlorenceabad07Nessuna valutazione finora

- PartnershipDocumento18 paginePartnershipVanessa DozonNessuna valutazione finora

- Partnership QuestionDocumento2 paginePartnership QuestionPrasad SawantNessuna valutazione finora

- Multiple Choice QuestionsDocumento14 pagineMultiple Choice QuestionsTa Thi Ngoc BichNessuna valutazione finora

- Atp QuestionsDocumento2 pagineAtp QuestionsELYN APIADONessuna valutazione finora

- Partnership 1Documento4 paginePartnership 1Angel SagubanNessuna valutazione finora

- Law On Business OrganizationDocumento36 pagineLaw On Business OrganizationChristine PalaganasNessuna valutazione finora

- Quiz no 2, Partnership MCQsDocumento6 pagineQuiz no 2, Partnership MCQsAngela Nichole Carandang100% (1)

- Law 1st PB Oct 2012Documento7 pagineLaw 1st PB Oct 2012Ssan DunqueNessuna valutazione finora

- Partnership QDocumento4 paginePartnership QRizza Mae EudNessuna valutazione finora

- BLT 2011 Final Pre-Board April 25Documento16 pagineBLT 2011 Final Pre-Board April 25Lester AguinaldoNessuna valutazione finora

- BLR CompreDocumento8 pagineBLR CompreSILVER LININGNessuna valutazione finora

- LAWDocumento6 pagineLAWCaren Jay Comendador0% (1)

- UntitledDocumento6 pagineUntitledAndrea FuentesNessuna valutazione finora

- UDM Midterm Examinations Business Organization I 2020Documento3 pagineUDM Midterm Examinations Business Organization I 2020Kyle JamiliNessuna valutazione finora

- Page - 1Documento18 paginePage - 1Julian Adam Pagal75% (4)

- PartnershipDocumento10 paginePartnershiprhaika agapito0% (1)

- Bus Law 1 WeekDocumento26 pagineBus Law 1 Weekimsana minatozakiNessuna valutazione finora

- University of Nueva Caceres College of Business and Accountancy Business Laws and Regulations Preliminary ExamDocumento12 pagineUniversity of Nueva Caceres College of Business and Accountancy Business Laws and Regulations Preliminary ExamRence MarcoNessuna valutazione finora

- Saint Vincent College of CabuyaoDocumento4 pagineSaint Vincent College of CabuyaoRovic OrdonioNessuna valutazione finora

- TEST BANK FinalDocumento9 pagineTEST BANK FinalAira Kaye MartosNessuna valutazione finora

- Pamantasan ng Cabuyao Partnership Law ExamDocumento4 paginePamantasan ng Cabuyao Partnership Law ExamDan RyanNessuna valutazione finora

- Take-Home Assignment in Lieu of Ii Periodical Test 2020Documento3 pagineTake-Home Assignment in Lieu of Ii Periodical Test 2020vishu DNessuna valutazione finora

- Take-Home Assignment in Lieu of Ii Periodical Test 2020Documento3 pagineTake-Home Assignment in Lieu of Ii Periodical Test 2020vishu DNessuna valutazione finora

- RFBT Drill 2 (Partnership, Corpo, and Nego)Documento13 pagineRFBT Drill 2 (Partnership, Corpo, and Nego)ROMAR A. PIGANessuna valutazione finora

- BAM241 BusinesslawandregulationDocumento3 pagineBAM241 BusinesslawandregulationKathleen J. GonzalesNessuna valutazione finora

- Midterm Examination in RFBTDocumento16 pagineMidterm Examination in RFBTSherie Love LedamaNessuna valutazione finora

- Saint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Business Laws and Regulations Prelim ExamDocumento22 pagineSaint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Business Laws and Regulations Prelim ExamJessaNessuna valutazione finora

- Contract Act MCQsDocumento11 pagineContract Act MCQsMuhammadIjazAslam0% (1)

- PAT diagnostic ExerciseDocumento125 paginePAT diagnostic ExerciseEd sorianoNessuna valutazione finora

- File 7365772675460733734Documento16 pagineFile 7365772675460733734Raisa Gelera100% (1)

- Regulatory Framework For Business Transactions: Page 1 of 5Documento5 pagineRegulatory Framework For Business Transactions: Page 1 of 5Paul GeorgeNessuna valutazione finora

- Business Scenario: 1. Offer and Acceptance Intention To Create A LeDocumento3 pagineBusiness Scenario: 1. Offer and Acceptance Intention To Create A Leilyas muhammadNessuna valutazione finora

- REGULATORY FRAMEWORK FOR BUSINESS TRANSACTIONS EXAMDocumento5 pagineREGULATORY FRAMEWORK FOR BUSINESS TRANSACTIONS EXAMlovely cNessuna valutazione finora

- #Test Bank - Law 2-DiazDocumento35 pagine#Test Bank - Law 2-DiazKryscel Manansala81% (59)

- Accounting Hawk - LawDocumento24 pagineAccounting Hawk - LawClaire BarbaNessuna valutazione finora

- BSBA Pre Final Exam BA 2Documento4 pagineBSBA Pre Final Exam BA 2marco poloNessuna valutazione finora

- OSE Business Law and TaxationDocumento16 pagineOSE Business Law and TaxationBlessy Mae SumabatNessuna valutazione finora

- Preliminary Exam Questionnaire BL 212Documento8 paginePreliminary Exam Questionnaire BL 212Jhulo CastroNessuna valutazione finora

- Partnership Cases (Company Law)Documento11 paginePartnership Cases (Company Law)sasshmithaNessuna valutazione finora

- Quiz No. 1 - PrelimDocumento6 pagineQuiz No. 1 - Prelimstar lightNessuna valutazione finora

- Test Bank Law 2 DiazDocumento35 pagineTest Bank Law 2 DiazJessica ParingitNessuna valutazione finora

- ALDERSGATE COLLEGE Partnership Law ReviewDocumento9 pagineALDERSGATE COLLEGE Partnership Law ReviewJessiCa AnTonio0% (1)

- Prefinals With Answer Quiz 1Documento7 paginePrefinals With Answer Quiz 1Loi Gacho100% (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Da EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Nessuna valutazione finora

- Law of Partnerships (Indian Partnership Act 1932)Da EverandLaw of Partnerships (Indian Partnership Act 1932)Nessuna valutazione finora

- MOS Excel 2013 Training OutlineDocumento6 pagineMOS Excel 2013 Training OutlineknmodiNessuna valutazione finora

- Business HousesDocumento89 pagineBusiness HousesknmodiNessuna valutazione finora

- BM JOBS BrochureDocumento8 pagineBM JOBS BrochureknmodiNessuna valutazione finora

- Annual Remuneration Return 1172014100110 AmDocumento1 paginaAnnual Remuneration Return 1172014100110 AmknmodiNessuna valutazione finora

- Synopsis of Budget For Fy 2068-69 Prepared by G. K. Agrawal & Co.Documento33 pagineSynopsis of Budget For Fy 2068-69 Prepared by G. K. Agrawal & Co.knmodiNessuna valutazione finora

- General Systems and CLERICAL Procedures in BusinessDocumento18 pagineGeneral Systems and CLERICAL Procedures in BusinessknmodiNessuna valutazione finora

- Nepal Company Act 2063Documento112 pagineNepal Company Act 2063knmodiNessuna valutazione finora

- Calculate your income tax with this formDocumento1 paginaCalculate your income tax with this formknmodiNessuna valutazione finora

- Pratikraman For JainDocumento4 paginePratikraman For JainknmodiNessuna valutazione finora

- Sure Success in C.A.Documento30 pagineSure Success in C.A.knmodiNessuna valutazione finora

- Investment in NepalDocumento1 paginaInvestment in NepalknmodiNessuna valutazione finora

- 2.2 Cases at GlanceDocumento39 pagine2.2 Cases at Glanceapi-3813392100% (1)

- MANAGEMENT ACCOUNTING INFO SYSTEMSDocumento12 pagineMANAGEMENT ACCOUNTING INFO SYSTEMSknmodiNessuna valutazione finora

- Baby NamesDocumento5 pagineBaby NamesknmodiNessuna valutazione finora

- Accounting Definitions: Join Khalid Aziz 0322-3385752 0312-2302870Documento39 pagineAccounting Definitions: Join Khalid Aziz 0322-3385752 0312-2302870knmodiNessuna valutazione finora

- 2.2 Cases at GlanceDocumento39 pagine2.2 Cases at Glanceapi-3813392100% (1)

- Manisha Tyagi Vs Deepak Kumar On 10 February, 2010Documento10 pagineManisha Tyagi Vs Deepak Kumar On 10 February, 2010anks12345Nessuna valutazione finora

- Palileo v. CosioDocumento4 paginePalileo v. CosioHency TanbengcoNessuna valutazione finora

- NMIMS PGDM Unfair Labour PracticesDocumento11 pagineNMIMS PGDM Unfair Labour PracticesSAURABH SINGHNessuna valutazione finora

- Rule 21 SubpoenaDocumento6 pagineRule 21 SubpoenacrisNessuna valutazione finora

- History Perspective and Regulation of Legal ProfessionDocumento3 pagineHistory Perspective and Regulation of Legal Professionchitiz sharmaNessuna valutazione finora

- BKAL 3023 Public Sector Accounting TutorialDocumento8 pagineBKAL 3023 Public Sector Accounting TutorialFatin NajihahNessuna valutazione finora

- Criminal Liability of Receiver of Stolen GoodsDocumento19 pagineCriminal Liability of Receiver of Stolen GoodsÃýuśh RâjNessuna valutazione finora

- CASE 253 - Li Tong Pek vs. Republic, 122 Phil. 828, (G.R. No. L-20912, Nov. 29, 1965)Documento2 pagineCASE 253 - Li Tong Pek vs. Republic, 122 Phil. 828, (G.R. No. L-20912, Nov. 29, 1965)bernadeth ranolaNessuna valutazione finora

- Title IDocumento155 pagineTitle IDanielle Nicole ValerosNessuna valutazione finora

- Younes Kabbaj v. Mark Simpson, 3rd Cir. (2013)Documento7 pagineYounes Kabbaj v. Mark Simpson, 3rd Cir. (2013)Scribd Government DocsNessuna valutazione finora

- Motion To Dismiss - SampleDocumento3 pagineMotion To Dismiss - SampleJunivenReyUmadhay100% (1)

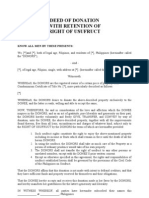

- Deed of Donation Right of UsufructDocumento2 pagineDeed of Donation Right of UsufructChester Ogsimer100% (11)

- DBM Dilg JMC No 2021 3 Dated September 13 2021Documento10 pagineDBM Dilg JMC No 2021 3 Dated September 13 2021carmanvernonNessuna valutazione finora

- Witness impeachment methodsDocumento9 pagineWitness impeachment methodsFrancis JuarezNessuna valutazione finora

- Jurisdiction 138Documento11 pagineJurisdiction 138sreevarshaNessuna valutazione finora

- Torts and Damages Cases 1Documento45 pagineTorts and Damages Cases 1Irene PacaoNessuna valutazione finora

- Fundamental Rights in India (A 19,20,21)Documento29 pagineFundamental Rights in India (A 19,20,21)warriorsNessuna valutazione finora

- Punjab Consumer Protection Act 2005 SummaryDocumento12 paginePunjab Consumer Protection Act 2005 SummaryIslam KanjuNessuna valutazione finora

- Booking Report 7-28-2021Documento3 pagineBooking Report 7-28-2021WCTV Digital TeamNessuna valutazione finora

- CPAR General Principles (Batch 93) - HandoutDocumento12 pagineCPAR General Principles (Batch 93) - HandoutJuan Miguel UngsodNessuna valutazione finora

- Society Bylaws PDFDocumento2 pagineSociety Bylaws PDFDeep DudhatNessuna valutazione finora

- Policies of SbiDocumento10 paginePolicies of Sbiyadavmihir63Nessuna valutazione finora

- Introduction To The Philosophy To The Human PersonDocumento28 pagineIntroduction To The Philosophy To The Human Persongemini googleNessuna valutazione finora

- Philippine Labor LawDocumento3 paginePhilippine Labor Lawtere_aquinoluna828Nessuna valutazione finora

- Titles of NobilityDocumento157 pagineTitles of NobilityLisa_SageNessuna valutazione finora

- Parish Priest V RigorDocumento2 pagineParish Priest V Rigorrgtan3Nessuna valutazione finora

- The Public Liability Insurance Act, 1991Documento8 pagineThe Public Liability Insurance Act, 1991Karsin ManochaNessuna valutazione finora

- Rental Agreement SummaryDocumento3 pagineRental Agreement SummaryGeorge Florin TauscherNessuna valutazione finora

- Pauper SuitDocumento11 paginePauper SuitKanchan ManchandaNessuna valutazione finora

- Cang V CADocumento17 pagineCang V CAPaulineNessuna valutazione finora