Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Launching Standard Chartered Fixed Maturity Plan-Yearly Series 3 (SCFMP-YS3) A Gateway To Earn Tax Efficient Returns

Caricato da

its_different17Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Launching Standard Chartered Fixed Maturity Plan-Yearly Series 3 (SCFMP-YS3) A Gateway To Earn Tax Efficient Returns

Caricato da

its_different17Copyright:

Formati disponibili

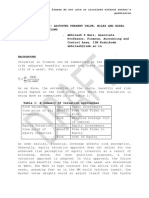

Launching Standard Chartered Fixed Maturity Plan-Yearly Series 3(SCFMP-YS3)

A gateway to earn tax efficient returns

Indexation Benefit available!

NFO March 12, 2007

NFO Closes

March 15, 2007

Type of Scheme Close ended income scheme

New Fund Offer Price Rs. 10 per unit

Maturity Date April 03, 2008 *Quarterly redemptions possible subject to exit load.

Tenor of the scheme 12 months and 3 days

For Redemption / Repurchase request received -

From date of allotment to September 30,2007 - 2.00% (Applicable Nav date for quarterly redemptions

30-6-2007 for Q1,30-9-2007 for Q2)

Exit Load in SCFMP-YS3

October1, 2007 to March 31, 2008 - 1.50% (Applicable Nav date for quarterly redemptions 31-12-2007

for Q3, 31-03-2008 for Q4)

April 1, 2008 to date of Maturity - Nil

Minimum application amount Rs. 500 & in multiples of Re 1 thereafter.

The investment objective of the Scheme is to seek to generate income by investing in

a portfolio of debt and money market instruments normally in line with the duration of

Investment Objective

the scheme. There can be no assurance that the investment objective of the Scheme

will be realised.

Options available Growth and Dividend

Transparency NAV Declaration - Every Wednesday, Half Yearly disclosure of portfolio.

Example for computation of Double Indexation Benefit

Dividend Growth

Double

Individual & Indexation

Corporate Growth

HUF

A Purchase Price 100 100 100 100

B Post Expenses Yield 10.40-10.50% 10.40-10.50% 10.40-10.50% 10.40-10.50%

111.00 -111.11 111.00 -111.11 111.00 -111.11 111.00 -111.11

C Repurchase Price A = P*(1+R)^T

D GAIN = C-A 11.00 -11.11 11.00 -11.11 11.00 -11.11 11.00 -11.11

NA NA NA 110.00

E INDEXED COST @ 5%

F INDEXED GAIN = C-E NA NA NA 1.00 - 1.11

14.16% 22.66% 11.33% 22.66%

G Tax Rate

H Tax 1.36 - 1.38 2.03 - 2.05 1.25 - 1.26 0.23 - 0.25

9.64 - 9.73 8.97 - 9.05 9.75 - 9.85 10.77 - 10.86

I Post Tax Gains

109.64 - 109.73 108.97 - 109.05 109.75 - 109.85 110.77 - 110.86

J Value of Investment

9.11 - 9.20% 8.48 - 8.56% 9.22 - 9.31% 10.19 - 10.26%

K Post Tax CAGR

IR - Indexation rate. In the above example indexation is assumed at 5.0% pa. Please note that this is

an assumed rate, as the actual indexation rate is announced by the Government in August every year

and can be higher or lower based on that year's inflation rate.

The Trustee reserves the right to extend the closing date, subject to the condition that the subscription

shall not be kept open for more than 30 days. The Trustee reserves the rights to close the subscription

earlier but not earlier than 1 Business Day after it opens. Any such extension or closure of the

subscription list shall be notified by a suitable display at the official point of acceptance of

transactions.

The above computation is an illustration only. Past performance is not indicative of future returns.

The above calculations are based on prevailing tax laws (Tax rates used for computation, are updated

as per Finance bill 2007), which can change in the future. In view of the individual nature of tax

consequences, each Unit holder is advised to consult his/ her own professional tax advisor.

Q1, Q2... Are the calendar quarters after the date of allotment

Copy of Offer Document(s) and key information(s) memorandum along with application form may be obtained from the office of

Standard Chartered Mutual Fund, 90, M G Road, Mumbai 400 001. Contact Call Free: 1-800-226622 Risk Factors: Mutual

Funds and securities investments are subject to market risks, reinvestment risk, changes in political, economic environment and

government policy and there is no assurance or guarantee that the objectives of the Scheme will be achieved. The NAV of the

Scheme can go up or down depending on factors and forces affecting the Securities Market including fluctuation in interest rates,

trading volumes and reinvestment risk. Past performance of the Sponsor/AMC/Mutual Fund is not necessarily indicative of the

future performance of the Scheme. Standard Chartered Fixed Maturity Plan Yearly Series 3 (SCFMP-YS3) is the name of

the Scheme and does not in any manner indicates either the quality of the Scheme, its future prospects or returns. The Sponsor or

any of its associates is not responsible or liable for any loss resulting from the operation of the Scheme beyond the corpus of the

Trust of Rs. 20,000/- Investors in the scheme are not being offered any guaranteed or assured rate of return. The scheme seeks to

have a minimum of 20 investors with no single investor accounting for more than 25% of the corpus of the scheme. In case of

non-fulfillment with either of the above two conditions, the investors money would be refunded, in full, immediately after the

close of the NFO. Scheme specific risk: The scheme may have market risk, credit risk & illquidity risk. Different types of

securities carry different levels and types of risk. Accordingly the schemes risk may increase or decrease depending upon

investment made by the scheme, e.g. corporate bonds carry a higher risk than Government securities as reflected by their

individual ratings.

Please read the Offer Document(s) carefully before investing.

Statutory Details: Standard Chartered Mutual Fund has been set up as a trust by Standard Chartered Bank (liability restricted to

corpus of Trust of Rs. 20,000) with Standard Chartered Trustee Company Private Limited (Company with limited liability) as the

trustee and Standard Chartered Asset Management Company Private Limited (Company with limited liability) as the investment

manager. Terms of Issue & Load Structure: SCFMP YS3 is a close-ended Income Scheme. The AMC will calculate and

publish the NAV on a weekly basis. The units issued under SCFMP YS3 will be redeemed on April 3, 2008. To give liquidity

to investors, repurchase facility is made available on quarterly basis on specified repurchase dates. The applicable exit load for

units repurchased on the stipulated Repurchase date(s) at the applicable NAV in the scheme for SCFMP YS3 is 2.00 % for

repurchases made on or upto September 30, 2007, 1.50% for repurchases made on or upto March 31, 2008 and Nil on maturity.

In case of an investor exiting the scheme before amortisation is completed, the AMC shall redeem the units only after recovering

the balance proportionate unamortised issue expenses, in accordance with SEBI Regulations. Please refer to the Offer document

for further details. Investment Objective: The investment objective of the Scheme is to seek to generate income by investing in

a portfolio of debt and money market instruments normally in line with the duration of the scheme. Asset Allocation of SCFMP

YS3: Debt and Money Market Instruments - 100% of the net assets of the scheme. Investments in Securitised Debt - Upto

50% of the Net Assets of the scheme. On January 26, 2007, Standard Chartered Bank (SCB) entered into an agreement with

Swiss Finance Corporation (Mauritius) Limited (UBS Mauritius) and UBS (India) Private Limited (UBS India) (jointly referred

to as UBS) to sell the equity and preference shares held by SCB in Standard Chartered Asset Management Company Private

Limited (SCAMC) and equity shares held by SCB in Standard Chartered Trustee Company Private Limited (SCTC), subject to

applicable regulatory approvals. The terms of the transaction are governed by the Sale Purchase Agreement signed between the

parties. Transfer of shareholding, when effected (on receipt of necessary approvals), will result in a change in controlling interest

of the AMC and would thus result in UBS being recognised as the sponsor of the Mutual Fund. Change in sponsor of the fund

will be carried out in accordance with the SEBI (Mutual Funds) Regulations 1996. Standard Chartered Bank will continue to be

the Sponsor of Standard Chartered Mutual Fund until the completion of the sale of shares held by SCB in SCAMC to UBS.

For other scheme specific risk factors and other details please read the Offer Document carefully before investing.

Potrebbero piacerti anche

- Applied Corporate Finance. What is a Company worth?Da EverandApplied Corporate Finance. What is a Company worth?Valutazione: 3 su 5 stelle3/5 (2)

- HDFC Top 200 Fund LeafletDocumento4 pagineHDFC Top 200 Fund LeafletNandakumar GanesamoorthyNessuna valutazione finora

- L&T Tax Saver Fund Application FormDocumento32 pagineL&T Tax Saver Fund Application FormPrajna CapitalNessuna valutazione finora

- Interest On FD 1Documento8 pagineInterest On FD 1Padma mohanNessuna valutazione finora

- Basic Financial Concepts - FinalDocumento34 pagineBasic Financial Concepts - FinalDu Baladad Andrew MichaelNessuna valutazione finora

- Pictet ProspectusDocumento569 paginePictet ProspectusboxpignonNessuna valutazione finora

- Contoh Kasus Instrumen KeuanganDocumento31 pagineContoh Kasus Instrumen KeuanganDedy SiburianNessuna valutazione finora

- Analysis of Financial Statement UlDocumento29 pagineAnalysis of Financial Statement UlUmer FarooqNessuna valutazione finora

- Analysis of Financial Statement UlDocumento29 pagineAnalysis of Financial Statement UlUmer FarooqNessuna valutazione finora

- Combined Factsheet Nov11Documento17 pagineCombined Factsheet Nov11friendrocks20079017Nessuna valutazione finora

- Model PaperDocumento19 pagineModel PaperInovacia CraftsNessuna valutazione finora

- (ABN-AMRO) A Breathrough in Synthetic Credit InvestmentsDocumento39 pagine(ABN-AMRO) A Breathrough in Synthetic Credit Investmentsbc500Nessuna valutazione finora

- GIPS Compliant Performance Report: September 30, 2013Documento23 pagineGIPS Compliant Performance Report: September 30, 2013HIRA -Nessuna valutazione finora

- FM 101 SG 7Documento17 pagineFM 101 SG 7Mariel TagulaoNessuna valutazione finora

- Solved Scanner CS Professional Model II, Paper-3 Financial, Treasury and Forex Management (I) AnsDocumento13 pagineSolved Scanner CS Professional Model II, Paper-3 Financial, Treasury and Forex Management (I) AnskalbhorkNessuna valutazione finora

- Capital Budgeting Q&a PDFDocumento28 pagineCapital Budgeting Q&a PDFCLAUDINE MUGABEKAZINessuna valutazione finora

- Marketfield Fund: PerformanceDocumento2 pagineMarketfield Fund: PerformanceAshish KulkarniNessuna valutazione finora

- Nippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Documento29 pagineNippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Saif MansooriNessuna valutazione finora

- NAFA GIPS Dec 2015 ReportDocumento26 pagineNAFA GIPS Dec 2015 ReportHIRA -Nessuna valutazione finora

- Financial ManagementDocumento28 pagineFinancial ManagementSny Kumar DeepakNessuna valutazione finora

- BPI Equity Value Fund - November 2023 v2Documento3 pagineBPI Equity Value Fund - November 2023 v2Lexter Renzo RamosNessuna valutazione finora

- My Apv NotesDocumento22 pagineMy Apv NotesAbhishekKumarNessuna valutazione finora

- Great Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByDocumento6 pagineGreat Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByAbhishek ChaurasiaNessuna valutazione finora

- Master of Business Administration-MBA Semester 2 MB0045 - Financial Management - 4 Credits (Book ID: B1134) Assignment Set - 2 (60 Marks)Documento13 pagineMaster of Business Administration-MBA Semester 2 MB0045 - Financial Management - 4 Credits (Book ID: B1134) Assignment Set - 2 (60 Marks)Maulik Parekh100% (1)

- Birla Sun Life Dynamic Bond FundDocumento3 pagineBirla Sun Life Dynamic Bond FundrajdashrvceNessuna valutazione finora

- NAFA GIPS Mar 2015 Report PDFDocumento26 pagineNAFA GIPS Mar 2015 Report PDFHIRA -Nessuna valutazione finora

- Answer To 1aDocumento28 pagineAnswer To 1asharib zaidiNessuna valutazione finora

- Cohen & Steets - Dynamic Income 2020-1Documento3 pagineCohen & Steets - Dynamic Income 2020-1ag rNessuna valutazione finora

- Chapter 1 - Updated-1 PDFDocumento29 pagineChapter 1 - Updated-1 PDFj000diNessuna valutazione finora

- Financial Planning& Wealth ManagementDocumento10 pagineFinancial Planning& Wealth Managementpallavigupta003Nessuna valutazione finora

- One Sheeter Cpof5y4sDocumento2 pagineOne Sheeter Cpof5y4sRoshaan MahbubaniNessuna valutazione finora

- Capital BudgetingDocumento12 pagineCapital BudgetingFrankline RickyNessuna valutazione finora

- CF FinalDocumento9 pagineCF FinalRaniNessuna valutazione finora

- VQT Overview - Hedged ETFDocumento19 pagineVQT Overview - Hedged ETFPhil MironenkoNessuna valutazione finora

- Research Lit ReviewDocumento6 pagineResearch Lit ReviewAbhi Krishna ShresthaNessuna valutazione finora

- Fixed Income CompositeDocumento4 pagineFixed Income CompositeWaseem SajjadNessuna valutazione finora

- Docrep O00000908 00000039 0001 2022 02 18 Ki en 0000Documento2 pagineDocrep O00000908 00000039 0001 2022 02 18 Ki en 0000Geeta RawatNessuna valutazione finora

- Bdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 BillionDocumento7 pagineBdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 Billionk100% (1)

- SM CHDocumento53 pagineSM CHInderjeet JeedNessuna valutazione finora

- Fs PDFDocumento1 paginaFs PDFJuhaizan Mohd YusofNessuna valutazione finora

- Scheme Features: Quantum Tax Saving FundDocumento3 pagineScheme Features: Quantum Tax Saving FundSacred MindNessuna valutazione finora

- P 09 P Smallcap PKF - EngDocumento5 pagineP 09 P Smallcap PKF - EngherbertNessuna valutazione finora

- FM FormulasDocumento13 pagineFM Formulassudhir.kochhar3530Nessuna valutazione finora

- 2019 Level III CFA Mock Exam Answers AfternoonDocumento39 pagine2019 Level III CFA Mock Exam Answers AfternoonHelloWorldNow50% (2)

- Fund Fact Sheet As at 31 July 2021: Investment ObjectiveDocumento1 paginaFund Fact Sheet As at 31 July 2021: Investment ObjectiveMohd Hafizi Abdul RahmanNessuna valutazione finora

- Which WACC WhenDocumento6 pagineWhich WACC Whenkalyan_mallaNessuna valutazione finora

- Module 1 - Time Value of Money Handout For LMS 2020Documento8 pagineModule 1 - Time Value of Money Handout For LMS 2020sandeshNessuna valutazione finora

- Financial Management V2 PDFDocumento28 pagineFinancial Management V2 PDFNeeraj SinghNessuna valutazione finora

- Capital Investment and Appraisal MethodsDocumento34 pagineCapital Investment and Appraisal MethodsAnesu ChimhowaNessuna valutazione finora

- Capital Investment DecisionsDocumento12 pagineCapital Investment Decisionsmoza salimNessuna valutazione finora

- Chapter 5Documento10 pagineChapter 5Ali KazmiNessuna valutazione finora

- BAC3684 Tutorial 6QDocumento6 pagineBAC3684 Tutorial 6Q1191103342Nessuna valutazione finora

- Financial ManagementDocumento48 pagineFinancial Managementalokthakur100% (1)

- Financial Management Mb0045Documento5 pagineFinancial Management Mb0045Anonymous UFaC3TyiNessuna valutazione finora

- Question 1666013841Documento6 pagineQuestion 1666013841SheikhFaizanUl-HaqueNessuna valutazione finora

- HSBC Global Investment Funds - US Dollar BondDocumento2 pagineHSBC Global Investment Funds - US Dollar BondMay LeungNessuna valutazione finora

- JWM - The Value of Tax EffInvestmentsDocumento8 pagineJWM - The Value of Tax EffInvestmentsbrettpevenNessuna valutazione finora

- High-Q Financial Basics. Skills & Knowlwdge for Today's manDa EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manNessuna valutazione finora

- Sample QsDocumento25 pagineSample Qsits_different17Nessuna valutazione finora

- Investor Psychology and Its Influence On Investment DecisionsDocumento11 pagineInvestor Psychology and Its Influence On Investment Decisionsits_different17Nessuna valutazione finora

- FC Manual (1 (1) (1) .1) - FC200VDocumento45 pagineFC Manual (1 (1) (1) .1) - FC200Vits_different17Nessuna valutazione finora

- IMS Proschool - Financial Planning Weekly - Volume 4: IPO Book-Building May GoDocumento2 pagineIMS Proschool - Financial Planning Weekly - Volume 4: IPO Book-Building May Goits_different17Nessuna valutazione finora

- Iapm SolutionsDocumento81 pagineIapm Solutionsjayaram_polarisNessuna valutazione finora

- Investment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)Documento17 pagineInvestment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)its_different17Nessuna valutazione finora

- 21st Annual Wealth Creation Study (2011-2016)Documento44 pagine21st Annual Wealth Creation Study (2011-2016)KirmaniNessuna valutazione finora

- Tax Planning TestDocumento22 pagineTax Planning Testits_different17Nessuna valutazione finora

- Solved Problems in Porfolio MangementDocumento170 pagineSolved Problems in Porfolio Mangementdilip504100% (1)

- Biz QuotesDocumento6 pagineBiz Quotesits_different17Nessuna valutazione finora

- Bitcoin - A BriefDocumento11 pagineBitcoin - A BriefAKSHAYNessuna valutazione finora

- Brief Write-Up On Pass Through Certificates (PTCS) : BackgroundDocumento4 pagineBrief Write-Up On Pass Through Certificates (PTCS) : Backgroundits_different17Nessuna valutazione finora

- Chapt 9Documento6 pagineChapt 9its_different17Nessuna valutazione finora

- 19 Annual Wealth Creation Study 2009-2014: 12 December 2014Documento24 pagine19 Annual Wealth Creation Study 2009-2014: 12 December 2014its_different17Nessuna valutazione finora

- Something On Credit Rating0001Documento4 pagineSomething On Credit Rating0001its_different17Nessuna valutazione finora

- Macro Analysis of IndiaDocumento6 pagineMacro Analysis of Indiaits_different17Nessuna valutazione finora

- Are You Investing The Right WayDocumento2 pagineAre You Investing The Right Wayits_different17Nessuna valutazione finora

- Contents of Basic Financial Plan: Sardesai FinanceDocumento1 paginaContents of Basic Financial Plan: Sardesai Financeits_different17Nessuna valutazione finora

- Plan Contents ComprehensiveDocumento2 paginePlan Contents Comprehensiveits_different17Nessuna valutazione finora

- Are You Still Investing in Bank FDS?: Print This PageDocumento1 paginaAre You Still Investing in Bank FDS?: Print This Pageits_different17Nessuna valutazione finora

- G-Secs Corp BondsDocumento2 pagineG-Secs Corp Bondsits_different17Nessuna valutazione finora

- Bond Market Interest Rates: Bonds CurriculumDocumento4 pagineBond Market Interest Rates: Bonds Curriculumits_different17Nessuna valutazione finora

- Pass Thru' Certificates: PTC RatingDocumento1 paginaPass Thru' Certificates: PTC Ratingits_different17Nessuna valutazione finora

- Oscar Wilde QuotationsDocumento12 pagineOscar Wilde Quotationsashok kulkarni100% (3)

- New TaxDocumento1 paginaNew Taxits_different17Nessuna valutazione finora

- Free Letter SamplesDocumento27 pagineFree Letter Samplesbel_catarroja50% (2)

- Seven MudrasDocumento8 pagineSeven Mudrasits_different17Nessuna valutazione finora

- 26 of Kabir's SayingDocumento5 pagine26 of Kabir's Sayingits_different17Nessuna valutazione finora

- 26 of Kabir's SayingDocumento5 pagine26 of Kabir's Sayingits_different17Nessuna valutazione finora

- Chapter 1 - Nature and Regulation of Companies: Review QuestionsDocumento19 pagineChapter 1 - Nature and Regulation of Companies: Review QuestionsShek Kwun HeiNessuna valutazione finora

- The Effect of Changes in Foreign Exchange RatesDocumento11 pagineThe Effect of Changes in Foreign Exchange RateshantumarangNessuna valutazione finora

- SMC Global Institutional Equities-Max Ventures & Industries LTDDocumento9 pagineSMC Global Institutional Equities-Max Ventures & Industries LTDJatin SoniNessuna valutazione finora

- Groupe Ariel Project AnalysisDocumento1 paginaGroupe Ariel Project AnalysisGiorgi Kharshiladze100% (4)

- Dhanuka Agritech LTDDocumento57 pagineDhanuka Agritech LTDSubscriptionNessuna valutazione finora

- The Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyDocumento5 pagineThe Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyJel SanNessuna valutazione finora

- WorldCom Fraud PPT (Accounting Learning)Documento12 pagineWorldCom Fraud PPT (Accounting Learning)蒲睿灵Nessuna valutazione finora

- Accounts Debit Credit: TotalDocumento8 pagineAccounts Debit Credit: TotaljangjangNessuna valutazione finora

- Balance Sheet: Forever YoungDocumento2 pagineBalance Sheet: Forever YoungJulie Ann BonNessuna valutazione finora

- Capital Budgeting Decisions: A Primer: BM63002: Corporate FinanceDocumento38 pagineCapital Budgeting Decisions: A Primer: BM63002: Corporate FinanceSagaeNessuna valutazione finora

- Hup Seng Report 2012Documento102 pagineHup Seng Report 2012Abdullah Mujahid HasanuddinNessuna valutazione finora

- Corporate Law Assignment 2Documento8 pagineCorporate Law Assignment 2tawandaNessuna valutazione finora

- Iac 11 Probs PDFDocumento12 pagineIac 11 Probs PDFGuinevereNessuna valutazione finora

- MFRS 120 Government GrantsDocumento21 pagineMFRS 120 Government Grantsyym cindyyNessuna valutazione finora

- Uniparts India LTD.: Jatin MahajanDocumento2 pagineUniparts India LTD.: Jatin Mahajanpradeep kumar pradeep kumarNessuna valutazione finora

- Account Classification and PresentationDocumento8 pagineAccount Classification and Presentationariane100% (1)

- Practicepdf 1Documento88 paginePracticepdf 1mhoddi100% (1)

- IAS 41 AgriculturalDocumento20 pagineIAS 41 AgriculturalWedaje AlemayehuNessuna valutazione finora

- Grade11 Fabm1 Q2 Week1Documento22 pagineGrade11 Fabm1 Q2 Week1Mickaela MonterolaNessuna valutazione finora

- Voluntary Winding Up and Removal of NamesDocumento21 pagineVoluntary Winding Up and Removal of Namessreedevi sureshNessuna valutazione finora

- Spto LK TW Iii 2019 PDFDocumento90 pagineSpto LK TW Iii 2019 PDFfaulaNessuna valutazione finora

- Chapter NineDocumento10 pagineChapter NineAsif HossainNessuna valutazione finora

- Standard Bank BEE Financing StructuresDocumento15 pagineStandard Bank BEE Financing StructuresKhanyile NcubeNessuna valutazione finora

- summary#NFBNFfri 20122019Documento554 paginesummary#NFBNFfri 20122019BHAVESH MEHTANessuna valutazione finora

- Worksheet Problem #5Documento104 pagineWorksheet Problem #5Gutierrez Ronalyn Y.Nessuna valutazione finora

- Oswaal ISC Class 11 Accounts Revision Notes For 2023 ExamDocumento38 pagineOswaal ISC Class 11 Accounts Revision Notes For 2023 Examharshaverma726Nessuna valutazione finora

- Practice Set 3Documento7 paginePractice Set 3argie pelanteNessuna valutazione finora

- Dr. Marasigan Journal EntriesDocumento1 paginaDr. Marasigan Journal EntriesNeilan Jay FloresNessuna valutazione finora

- Credit Rating 3-Year Default Rate (%) Notional % of Reference PortfolioDocumento9 pagineCredit Rating 3-Year Default Rate (%) Notional % of Reference PortfolioOUSSAMA NASRNessuna valutazione finora

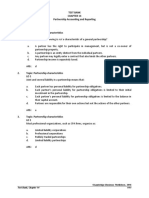

- Test Bank Partnership Accounting and Reporting Multiple Choice 1. Topic: Partnership Characteristics LO1Documento44 pagineTest Bank Partnership Accounting and Reporting Multiple Choice 1. Topic: Partnership Characteristics LO1Wendelyn Tutor100% (1)