Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CD

Caricato da

Anonymous HrsuLZUYCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CD

Caricato da

Anonymous HrsuLZUYCopyright:

Formati disponibili

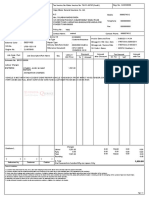

This form is a statement of final loan terms and closing costs.

Compare this

Closing Disclosure document with your Loan Estimate.

Closing Information Transaction Information Loan Information

Date Issued 6/7/2017 Borrower Scott Robert Dagel and Karla Jo Dagel Loan Term 30 years

Closing Date 6/16/2017 1213 Skyline Dr Purpose Purchase

Disbursement Date

6/16/2017 Watertown, SD 57201-1161 Product 1 Year Interest Only, 1

Settlement Agent Green Roby Oviatt LLP Seller Tom Dagel aka Thomas J. Dagel mo./1 mo. Adjustable Rate

File # Loan Type x Conventional FHA

Property SE 1/4 NE 1/4 except Lot VA

Watertown, SD 57201 Lender Farm Credit Services of America Loan ID # 912979

MIC #

Sale Price $150,000

Loan Terms Can this amount increase after closing?

Loan Amount $738,400 NO

Interest Rate 4.250 % YES Adjusts

Can go

every 1 months starting in month 2

as high as 22.250% in year 1

See AIR Table on page 4 for details

Monthly Principal & Interest $2,615.17 YES Adjusts every 1 months starting in month 2

Can go as high as $13,714 in year 2

See Projected Payments below for your Includes only interest and no principal until year 2

Estimated

Total Monthly Payment See AP Table on page 4 for details

Does the loan have these features?

Prepayment Penalty NO

Balloon Payment NO

Projected Payments

Year 1

Years 2-30

Payment Calculation

Principal & Interest $615 min $2,445 min

$13,691 max $13,714 max

only interest

Mortgage Insurance + 0 + 0

Estimated Escrow + 0 + 0

Amount can increase over time

Estimated Total

Monthly Payment $615$13,691 $2,445$13,714

This estimate includes In escrow?

Estimated

Taxes, Insurance x Property Taxes NO

&

Assessments $711.05 x Homeowners Insurance NO

Amount can increase over time a month Other:

See page 4 for details See Escrow Account on page 4 for details. You must pay for other property

costs separately.

Costs at Closing

Closing Costs

$7,945.75 Includes $4,673.25 in Loan Costs + $3,272.50 in Other Costs - $0

in Lender Credits. See page 2 for details.

Cash to Close

-$585,985.59 Includes Closing Costs. See Calculating Cash to Close on page 3 for details.

CLOSING DISCLOSURE GTRIDCDWS_S 1215 Page 1 of 5 LOAN ID # 912979

06/07/2017

02:08 PM PST GTRIDCDWSS (POD)

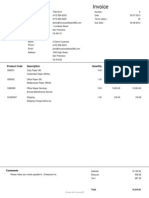

Closing Cost Details

Borrower-Paid Seller-Paid Paid by

Loan Costs At Closing Before Closing At Closing Before Closing Others

A. Origination Charges $3,500.00

01 % of Loan Amount (Points)

02 Appraisal Fee $500.00

03 Construction Fee $2,500.00

04 Origination Fee $500.00

05

06

07

08

B. Services Borrower Did Not Shop For $17.50

01 Flood Certification to ServiceLink National Flood $17.50

02

03

04

05

06

07

08

09

10

C. Services Borrower Did Shop For $1,155.75

01 Title - Lender's Title Insurance to First Dakota Title - Watertown $996.00

02 Title - Title Exam to First Dakota Title - Watertown $159.75 $159.75

03

04

05

06

07

08

D. TOTAL LOAN COSTS (Borrower-Paid) $4,673.25

Loan Costs Subtotals (A + B + C) $4,673.25

Other Costs

E. Taxes and Other Government Fees $60.00

01 Recording Fees Deed: $30.00 Mortgage: $30.00 $60.00

02 State Tax/Stamps to Deed $150.00;Mortgage $0.00 $150.00

F. Prepaids $3,000.00

01 Homeowner's Insurance Premium (12 mo.) to Fischer Rounds & Assoc $3,000.00

02 Mortgage Insurance Premium ( mo.)

03 Prepaid Interest ( per day from to ) $0

04 Property Taxes ( mo.)

05

G. Initial Escrow Payment at Closing

01 Homeowner's Insurance per month for mo.

02 Mortgage Insurance per month for mo.

03 Property Taxes per month for mo.

04

05

06

07

08 Aggregate Adjustment $0.00

H. Other $212.50

01 2nd Half 2016 due 2017 RE Taxes to Codington County Treasurer $2,766.29

02 Title - Owner's Title Insurance (optional) to First Dakota Title - Watertown $212.50 $212.50

03

04

05

06

07

08

I. TOTAL OTHER COSTS (Borrower-Paid) $3,272.50

Other Costs Subtotals (E + F + G + H) $272.50 $3,000.00

J. TOTAL CLOSING COSTS (Borrower-Paid) $7,945.75

Closing Costs Subtotals (D + I) $4,945.75 $3,000.00 $3,288.54

Lender Credits

CLOSING DISCLOSURE GTRIDCDWS_S 1215 Page 2 of 5 LOAN ID # 912979

06/07/2017

02:08 PM PST GTRIDCDWSS (POD)

Loan Terms

Calculating Cash to Close Use this table to see what has changed from your Loan Estimate.

Loan Estimate Final Did this change?

Total Closing Costs (J) $12,694.00 $7,945.75 YES See Total Loan Costs (D) and Total Other Costs (I)

(I).

Closing Costs Paid Before Closing $0 -$3,000.00 YES You paid these Closing Costs before closing.

Closing Costs Financed $0

$0 NO

(Paid from your Loan Amount)

Down Payment/Funds from Borrower -$700,000.00 -$588,400.00 YES You increased this payment. See details in Section L.

Deposit $0 $0 NO

Funds for Borrower $0 $0 NO

Seller Credits $0 $0 NO

Adjustments and Other Credits $0 -$2,531.34 YES See details in Section L.

Cash to Close -$687,306.00 -$585,985.59

Summaries of Transactions Use this table to see a summary of your transaction.

BORROWERS TRANSACTION SELLERS TRANSACTION

K. Due from Borrower at Closing $154,945.75 M. Due to Seller at Closing $150,106.25

01 Sale Price of Property $150,000.00 01 Sale Price of Property $150,000.00

02 Sale Price of Any Personal Property Included in Sale 02 Sale Price of Any Personal Property Included in Sale

03 Closing Costs Paid at Closing (J) $4,945.75 03 Reissue Credit Due to Seller $106.25

04 04

Adjustments 05

05 06

06 07

07 08

Adjustments for Items Paid by Seller in Advance Adjustments for Items Paid by Seller in Advance

08 City/Town Taxes to 09 City/Town Taxes to

09 County Taxes to 10 County Taxes to

10 Assessments to 11 Assessments to

11 12

12 13

13 14

14 15

15 16

L. Paid Already by or on Behalf of Borrower at Closing $740,931.34 N. Due from Seller at Closing $5,819.88

01 Deposit 01 Excess Deposit

02 Loan Amount $738,400.00 02 Closing Costs Paid at Closing (J) $3,288.54

03 Existing Loan(s) Assumed or Taken Subject to 03 Existing Loan(s) Assumed or Taken Subject to

04 04 Payoff of First Mortgage Loan

05 Seller Credit 05 Payoff of Second Mortgage Loan

Other Credits 06

06 07

07 08 Seller Credit

Adjustments 09

08 10

09 11

10 12

11 13

Adjustments for Items Unpaid by Seller Adjustments for Items Unpaid by Seller

12 City/Town Taxes to 14 City/Town Taxes to

13 County Taxes 01/01/17 to 06/17/17 $2,531.34 15 County Taxes 01/01/17 to 06/17/17 $2,531.34

14 Assessments to 16 Assessments to

15 17

16 18

17 19

CALCULATION CALCULATION

Total Due from Borrower at Closing (K) $154,945.75 Total Due to Seller at Closing (M) $150,106.25

Total Paid Already by or on Behalf of Borrower at Closing (L) -$740,931.34 Total Due from Seller at Closing (N) -$5,819.88

Cash to Close From x To Borrower $585,985.59 Cash From x To Seller $144,286.37

CLOSING DISCLOSURE GTRIDCDWS_S 1215 Page 3 of 5 LOAN ID # 912979

06/07/2017

02:08 PM PST GTRIDCDWSS (POD)

Additional Information About This Loan

Loan Disclosures

Assumption Escrow Account

If you sell or transfer this property to another person, your lender For now, your loan

will allow, under certain conditions, this person to assume this will have an escrow account (also called an impound or trust

loan on the original terms. account) to pay the property costs listed below. Without an escrow

x will not allow assumption of this loan on the original terms. account, you would pay them directly, possibly in one or two large

payments a year. Your lender may be liable for penalties and interest

Demand Feature for failing to make a payment.

Your loan

has a demand feature, which permits your lender to require early Escrow

repayment of the loan. You should review your note for details. Escrowed Estimated total amount over year 1 for

x does not have a demand feature. Property Costs your escrowed property costs:

over Year 1

Late Payment

If your payment is more than 15 days late, your lender will charge a Non-Escrowed Estimated total amount over year 1

late fee of 5% of the principal and interest overdue. Property Costs for your non-escrowed property costs:

over Year 1

You may have other property costs.

Negative Amortization (Increase in Loan Amount)

Under your loan terms, you Initial Escrow A cushion for the escrow account you

Payment pay at closing. See Section G on page 2.

are scheduled to make monthly payments that do not pay all of

the interest due that month. As a result, your loan amount will

increase (negatively amortize), and your loan amount will likely Monthly Escrow The amount included in your total

become larger than your original loan amount. Increases in your Payment monthly payment.

loan amount lower the equity you have in this property.

x may have monthly payments that do not pay all of the interest x will not have an escrow account because you declined it x your

due that month. If you do, your loan amount will increase lender does not offer one. You must directly pay your property

(negatively amortize), and, as a result, your loan amount may costs, such as taxes and homeowners insurance. Contact your

become larger than your original loan amount. Increases in your lender to ask if your loan can have an escrow account.

loan amount lower the equity you have in this property.

do not have a negative amortization feature. No Escrow

Estimated Estimated total amount over year 1. You

$7,821.55

Partial Payments Property Costs must pay these costs directly, possibly

Your lender over Year 1 in one or two large payments a year.

x may accept payments that are less than the full amount due Escrow Waiver Fee

(partial payments) and apply them to your loan.

may hold them in a separate account until you pay the rest of the In the future,

payment, and then apply the full payment to your loan. Your property costs may change and, as a result, your escrow pay

ment may change. You may be able to cancel your escrow account,

does not accept any partial payments.

but if you do, you must pay your property costs directly. If you fail

If this loan is sold, your new lender may have a different policy. to pay your property taxes, your state or local government may (1)

impose fines and penalties or (2) place a tax lien on this property. If

Security Interest you fail to pay any of your property costs, your lender may (1) add

You are granting a security interest in the amounts to your loan balance, (2) add an escrow account to your

SE 1/4 NE 1/4 except Lot H-1 and highway r-o-w in 33-118-51, loan, or (3) require you to pay for property insurance that the lender

Watertown, SD 57201 buys on your behalf, which likely would cost more and provide fewer

benefits than what you could buy on your own.

You may lose this property if you do not make your payments or

satisfy other obligations for this loan.

Adjustable Payment (AP) Table Adjustable Interest Rate (AIR) Table

Interest Only Payments? YES For your first 12 payments

Index + Margin + 1%

Initial Interest Rate 4.250%

Optional Payments? NO

Minimum/Maximum Interest Rate 1%/22.250%

Step Payments? NO

Change Frequency

Seasonal Payments? NO

First Change Beginning of 2nd month

Monthly Principal and Interest Payments

Subsequent Changes Every 1st month after first change

First Change/Amount $2,445 - $13,714 at 13th payment

Limits on Interest Rate Changes

Subsequent Changes Every 1st payment

First Change 18%

Maximum Payment $13,714 starting at 13th payment

Subsequent Changes 18%

CLOSING DISCLOSURE GTRIDCDWS_S 1215 Page 4 of 5 LOAN ID # 912979

06/07/2017

02:08 PM PST GTRIDCDWSS (POD)

Loan Calculations Other Disclosures

Total of Payments. Total you will have paid after Appraisal

you make all payments of principal, interest, $1,321,997.22 If the property was appraised for your loan, your lender is required to

mortgage insurance, and loan costs, as scheduled. give you a copy at no additional cost at least 3 days before closing. If

you have not yet received it, please contact your lender at the

information listed below.

Finance Charge. The dollar amount the loan will $581,781.72

cost you. Contract Details

See your note and security instrument for information about

Amount Financed. The loan amount available after $735,382.50 what happens if you fail to make your payments,

paying your upfront finance charge. what is a default on the loan,

situations in which your lender can require early repayment of

Annual Percentage Rate (APR). Your costs over loan, and

the loan term expressed as a rate. This is not your 4.284 % the rules for making payments before they are due.

interest rate. Liability after Foreclosure

If your lender forecloses on this property and the foreclosure does not

Total Interest Percentage (TIP). The total amount cover the amount of unpaid balance on this loan,

of interest that you will pay over the loan term as a 78.381 % x state law may protect you from liability for the unpaid balance. If

percentage of your loan amount. you refinance or take on any additional debt on this property, you

may lose this protection and have to pay any debt remaining even

after foreclosure. You may want to consult a lawyer for more

information.

state law does not protect you from liability for the unpaid balance.

?

Refinance

Questions? If you have questions about the Refinancing this loan will depend on your future financial situation,

loan terms or costs on this form, use the contact the property value, and market conditions. You may not be able to

information below. To get more information refinance this loan.

or make a complaint, contact the Consumer

Financial Protection Bureau at Tax Deductions

www.consumerfinance.gov/mortgage-closing If you borrow more than this property is worth, the interest on the

loan amount above this propertys fair market value is not deductible

from your federal income taxes. You should consult a tax advisor for

more information.

Contact Information

Lender Mortgage Broker Real Estate Broker Real Estate Broker Settlement Agent

(B) (S)

Name Farm Credit Services Green Roby Oviatt

of America LLP

Address PO Box 1117 816 South Broadway

Watertown, SD 57201 Watertown, SD 57201

NMLS ID 579135

SD License ID

Contact Nick Hartness Bev Beutler

Contact NMLS ID 1288413

Contact SD License ID

Email Nick.Hartness@ bev@grolawfirm.com

fcsamerica.com

Phone 605-882-4030 605-886-5812

Confirm Receipt

By signing, you are only confirming that you have received this form. You do not have to accept this loan because you have signed or received

this form.

Applicant Signature Date Co-Applicant Signature Date

CLOSING DISCLOSURE GTRIDCDWS_S 1215 Page 5 of 5 LOAN ID # 912979

06/07/2017

02:08 PM PST GTRIDCDWSS (POD)

Addendum to Closing Disclosure This form is a continued statement of final loan terms and closing costs.

Property SE 1/4 NE 1/4 except Lot H-1 and highway r-o-w in 33-118-51

Watertown, SD 57201

Seller Carol Dagel aka Carol K. Dagel

CLOSING DISCLOSURE GTRIDCDWS_S 1215 LOAN ID # 912979

06/07/2017

02:08 PM PST GTRIDCDWSS (POD)

Potrebbero piacerti anche

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionDa EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNessuna valutazione finora

- DocumentDocumento15 pagineDocumentElijah Aziz'ElNessuna valutazione finora

- Agreement 2Documento11 pagineAgreement 2Ramona SowersNessuna valutazione finora

- ATTBill 0236 Aug2022Documento2 pagineATTBill 0236 Aug2022Hakuna MatataNessuna valutazione finora

- Loan Agreement PDFDocumento9 pagineLoan Agreement PDFHengki YonoNessuna valutazione finora

- Loan Number: Borrower Co-BorrowerDocumento5 pagineLoan Number: Borrower Co-BorrowerJeff BettsNessuna valutazione finora

- Motor World Private Limited.: NANDI TOYOTA, 69/5, Bommanahalli, BangaloreDocumento1 paginaMotor World Private Limited.: NANDI TOYOTA, 69/5, Bommanahalli, BangaloreSheik SalmanNessuna valutazione finora

- Auto Repair InvoiceDocumento4 pagineAuto Repair Invoicedagz10131979Nessuna valutazione finora

- Title Loan Contract 12-2003Documento1 paginaTitle Loan Contract 12-2003Lily GillNessuna valutazione finora

- Bolivia Miami Jetski & Watercraft Service Invoice 2491882Documento1 paginaBolivia Miami Jetski & Watercraft Service Invoice 2491882felix avilaNessuna valutazione finora

- Service & Rate GUIDE 2019: DHL ExpressDocumento17 pagineService & Rate GUIDE 2019: DHL Expressnomanjavid88Nessuna valutazione finora

- Sample InvoicesDocumento22 pagineSample InvoicesImtooNessuna valutazione finora

- 1799 - Vehicle Application (R0118)Documento2 pagine1799 - Vehicle Application (R0118)sarapreppyhandbookNessuna valutazione finora

- Confirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTDocumento1 paginaConfirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTKarthik SheshadriNessuna valutazione finora

- CertificateDocumento1 paginaCertificateFauNessuna valutazione finora

- Offer Letter 23177Documento2 pagineOffer Letter 23177Kayle RichardsonNessuna valutazione finora

- Service Invoice For October 2020Documento1 paginaService Invoice For October 2020YasirTajNessuna valutazione finora

- Dropshipper Wholeseller ListDocumento10 pagineDropshipper Wholeseller ListMainak Dutta GuptaNessuna valutazione finora

- Sample InsuranceDocumento4 pagineSample InsuranceShashanth Kumar (CS - OMTP)Nessuna valutazione finora

- Summary of Account Activity Payment Information: Protecting What Matters MostDocumento4 pagineSummary of Account Activity Payment Information: Protecting What Matters MostJames BergmanNessuna valutazione finora

- Your 2024 Social Security Cost of Living IncreaseDocumento4 pagineYour 2024 Social Security Cost of Living IncreasenazoyaqNessuna valutazione finora

- Enterprise Inc. Invoice: CustomerDocumento1 paginaEnterprise Inc. Invoice: CustomerjunkyardNessuna valutazione finora

- PROSPECTIVE TENANT QUESTIONNAIRE (Updated 31.05.19 BHJ and MJBS) - 1Documento10 paginePROSPECTIVE TENANT QUESTIONNAIRE (Updated 31.05.19 BHJ and MJBS) - 1Duke Jno100% (1)

- Get The Facts: Auto Financing: A Historical PerspectiveDocumento1 paginaGet The Facts: Auto Financing: A Historical PerspectiveAbhilash ShenoyNessuna valutazione finora

- BigBank Tee & Big Me Jan Navy Federal Bank StatementDocumento3 pagineBigBank Tee & Big Me Jan Navy Federal Bank StatementLillian AwtNessuna valutazione finora

- Al'Kedra E Williams Bank Statement JanDocumento1 paginaAl'Kedra E Williams Bank Statement JanLillian AwtNessuna valutazione finora

- Employment VerificationDocumento2 pagineEmployment VerificationthehomemachineNessuna valutazione finora

- Application Form: Sign Here Sign Here Sign HereDocumento5 pagineApplication Form: Sign Here Sign Here Sign Heresumitsingh26janNessuna valutazione finora

- SafecoDocumento9 pagineSafecoDreamworxx DevelopmentsNessuna valutazione finora

- Auto Fokus Invoice R26807Documento25 pagineAuto Fokus Invoice R26807Brian SnowNessuna valutazione finora

- Voucher Package - 0000177054 PDFDocumento5 pagineVoucher Package - 0000177054 PDFNickMillerNessuna valutazione finora

- Service InvoiceDocumento1 paginaService Invoicerishi070881Nessuna valutazione finora

- PayStatement 1000139864Documento1 paginaPayStatement 1000139864ash.payan123Nessuna valutazione finora

- Checkstub3 26 19Documento1 paginaCheckstub3 26 19Anonymous hFbpJzuBZM0% (1)

- Auto Repair Invoice 28Documento2 pagineAuto Repair Invoice 28Liza GeorgeNessuna valutazione finora

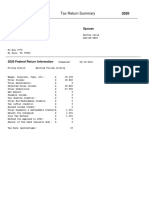

- Tax Return SummaryDocumento14 pagineTax Return Summaryevalle13Nessuna valutazione finora

- Documents PDFDocumento6 pagineDocuments PDFAngela NortonNessuna valutazione finora

- Document For Your Electronic Signature From W PDFDocumento4 pagineDocument For Your Electronic Signature From W PDFORLANDONessuna valutazione finora

- eTranscriptFreeDocumento3 pagineeTranscriptFreeSylvia TunNessuna valutazione finora

- Wells Fargo Wireless Auction October 14Documento22 pagineWells Fargo Wireless Auction October 14ray745Nessuna valutazione finora

- Invoice For Missed Toll: Second NoticeDocumento2 pagineInvoice For Missed Toll: Second NoticeTKnowlesNessuna valutazione finora

- DeclarationDocumento11 pagineDeclarationTammy Reeves WhiteNessuna valutazione finora

- Multi-Purpose Loan (MPL) Application Form: Ledesma Christy Policar 0922-477-1905Documento2 pagineMulti-Purpose Loan (MPL) Application Form: Ledesma Christy Policar 0922-477-1905Bev's AblaoNessuna valutazione finora

- Direct Deposit AuthorizationDocumento1 paginaDirect Deposit Authorizationapi-351412138Nessuna valutazione finora

- Chime Checking Statement January 2024Documento2 pagineChime Checking Statement January 2024fjpz6vfqktNessuna valutazione finora

- 2019 Master Piping Products Price List (Effective 8-15-2019) Rev-FinalDocumento108 pagine2019 Master Piping Products Price List (Effective 8-15-2019) Rev-FinalpogisimpatikoNessuna valutazione finora

- Renewal Document PDFDocumento2 pagineRenewal Document PDFAbdulakeem MohammedNessuna valutazione finora

- Invoice: Bill To X Works Solutions Corporation Attn: Accounts Payable DepartmentDocumento2 pagineInvoice: Bill To X Works Solutions Corporation Attn: Accounts Payable DepartmentRuodNessuna valutazione finora

- Pa 8 Cs SHBK 2 LVWZ1 JL847 Ur 9 JDocumento9 paginePa 8 Cs SHBK 2 LVWZ1 JL847 Ur 9 JMorenita ParelesNessuna valutazione finora

- Sandra Adams Funeral ProgramDocumento2 pagineSandra Adams Funeral ProgramHerb WalkerNessuna valutazione finora

- Tsys Mpa With Logo 1Documento6 pagineTsys Mpa With Logo 1api-503333470Nessuna valutazione finora

- Date Invoice #: Please Detach and Return Upper Portion With Your PaymentDocumento3 pagineDate Invoice #: Please Detach and Return Upper Portion With Your PaymentJaquelineNessuna valutazione finora

- Direct Deposit Election FormDocumento2 pagineDirect Deposit Election FormAsha Leigh100% (1)

- Explanation of Benefits This Is Not A BillDocumento1 paginaExplanation of Benefits This Is Not A BillShannonNessuna valutazione finora

- SSPCNADVDocumento1 paginaSSPCNADVearlcorrNessuna valutazione finora

- LCCI 48182 L1 Bookkeeping Collation September 2015 PDFDocumento46 pagineLCCI 48182 L1 Bookkeeping Collation September 2015 PDF苏进凯Nessuna valutazione finora

- Change of Landlord Agent FormDocumento2 pagineChange of Landlord Agent FormimiescribdNessuna valutazione finora

- Account Settings ComEd - An Exelon Company PDFDocumento1 paginaAccount Settings ComEd - An Exelon Company PDFLola100% (1)

- HUD PrelimDocumento3 pagineHUD PrelimAnonymous VUfB64qLNessuna valutazione finora

- Healthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersDocumento8 pagineHealthcare - Gov/sbc-Glossary: Important Questions Answers Why This Mattersapi-252555369Nessuna valutazione finora

- Valuation Report: M/S. Auto Therm EquipementsDocumento14 pagineValuation Report: M/S. Auto Therm EquipementsKalpana KappiNessuna valutazione finora

- Hacienda Luisita, Inc. (HLI) vs. Presidential Agrarian Reform Council (PARC), Et Al. - GR No. 171101Documento3 pagineHacienda Luisita, Inc. (HLI) vs. Presidential Agrarian Reform Council (PARC), Et Al. - GR No. 171101Angelica Mojica LaroyaNessuna valutazione finora

- Mendiola v. CA Et Al., 190 SCRA 421Documento11 pagineMendiola v. CA Et Al., 190 SCRA 421Alexis Anne P. ArejolaNessuna valutazione finora

- 20994bg Duediligence PDFDocumento188 pagine20994bg Duediligence PDFAmitesh AgarwalNessuna valutazione finora

- Tax Review Estate and DonorsDocumento12 pagineTax Review Estate and DonorsAnonymous JqiHOYWmsNessuna valutazione finora

- Real Estate Investment Trusts ReitsDocumento2 pagineReal Estate Investment Trusts ReitssunsetstarzNessuna valutazione finora

- Whats Race Got To Do With It 1iiw6hz PDFDocumento14 pagineWhats Race Got To Do With It 1iiw6hz PDFKaroline SantosNessuna valutazione finora

- Pamela Owen. Civil Rights. Memorandum of Points and Authorities To Motion To Stay Proceedings. Document 25Documento6 paginePamela Owen. Civil Rights. Memorandum of Points and Authorities To Motion To Stay Proceedings. Document 25Emanuel McCrayNessuna valutazione finora

- Architect List RetailDocumento5 pagineArchitect List RetailnkbshoppedNessuna valutazione finora

- Last WillDocumento4 pagineLast WillTaz BratNessuna valutazione finora

- Literature Review Affordable HousingDocumento7 pagineLiterature Review Affordable Housinge9xy1xsv100% (1)

- Mercado and Mercado vs. Espiritu, 37 Phil. 215, No. 11872 December 1, 1917Documento19 pagineMercado and Mercado vs. Espiritu, 37 Phil. 215, No. 11872 December 1, 1917Lester AgoncilloNessuna valutazione finora

- Deed of Sale of Motor Vehicle - TemplateDocumento1 paginaDeed of Sale of Motor Vehicle - Template4geniecivilNessuna valutazione finora

- IAS 40 QuestionsDocumento3 pagineIAS 40 QuestionsEddie PienaarNessuna valutazione finora

- 156407Documento18 pagine156407ανατολή και πετύχετεNessuna valutazione finora

- 166688-2011-Torbela v. Spouses RosarioDocumento30 pagine166688-2011-Torbela v. Spouses RosarioYi FanNessuna valutazione finora

- Wade Timmerson, Suzanne Caplan, - Building Big Profit in REDocumento273 pagineWade Timmerson, Suzanne Caplan, - Building Big Profit in REkafes51427Nessuna valutazione finora

- LLB201A Law of Property and EasementDocumento3 pagineLLB201A Law of Property and EasementCrystal CaveNessuna valutazione finora

- Blank Deed of Sale of Motor Vehicle Template - Doc FormatDocumento1 paginaBlank Deed of Sale of Motor Vehicle Template - Doc Format4geniecivilNessuna valutazione finora

- Best Evidence Rule CasesDocumento10 pagineBest Evidence Rule CasesmissyaliNessuna valutazione finora

- DLF Projects RDocumento30 pagineDLF Projects R9986212378Nessuna valutazione finora

- Proposal For The Crestwood Plaza Redevelopment Area by UrbanStreet - Crestwood, MODocumento52 pagineProposal For The Crestwood Plaza Redevelopment Area by UrbanStreet - Crestwood, MOnextSTL.comNessuna valutazione finora

- Partition Under Land Laws As Applicable in State of Haryana: Dr. Pradeep KumarDocumento7 paginePartition Under Land Laws As Applicable in State of Haryana: Dr. Pradeep KumarPreeti KashyapNessuna valutazione finora

- Re Spa LetterDocumento3 pagineRe Spa LetterLogicJockNessuna valutazione finora

- 2013-04-25 - Moneysaver - Lewis-Clark EditionDocumento24 pagine2013-04-25 - Moneysaver - Lewis-Clark EditionDavid ArndtNessuna valutazione finora

- The History of Developments Toward Open Building in JapanDocumento8 pagineThe History of Developments Toward Open Building in JapanAfonso PortelaNessuna valutazione finora

- PMJFB Kfgrs Ivc Ipr Kfnfjmgi: Ièlong Dy Iswkf Qy Aujfvy Di QLVFR Muv LtkiDocumento32 paginePMJFB Kfgrs Ivc Ipr Kfnfjmgi: Ièlong Dy Iswkf Qy Aujfvy Di QLVFR Muv Ltkisingh1699Nessuna valutazione finora

- Additional Terms To LeaseDocumento2 pagineAdditional Terms To LeasemhtdsmNessuna valutazione finora

- Short Sale PacketDocumento22 pagineShort Sale PacketAndrew MorrisNessuna valutazione finora

- Certificate of Acceptance For COURT1Documento1 paginaCertificate of Acceptance For COURT1Tiggle Madalene100% (2)