Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ratio Analysis of PT Telekomunikasi

Caricato da

Jae Bok LeeDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ratio Analysis of PT Telekomunikasi

Caricato da

Jae Bok LeeCopyright:

Formati disponibili

Business Valuation

Ratio Analysis of PT Telekomunikasi

MEB2476 LEE JEABOK

361136 ADIF MUHAMMAD

Ratio Analysis

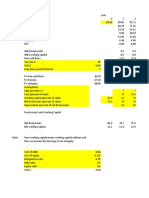

Liquidity

Current ratio = Current assets / Current liabilities

Acid-test ratio = (Cash and cash equivalents + Marketable securities + Accounts receivable) / Current liabilities

Collection period = (Average accounts receivable) / (Sales/360)

Days to sell inventory = Average inventory / (Cost of sales/360)

Capital Structure and Solvency

Total debt to equity = Total liabilities / Shareholders equity

Times interest earned = Income before income taxes and interest expense / Interest expense

Return on Investment

Return on assets = (Net income + interest expense * (1 Tax rate) / Average total assets

Return on common equity = Net Income / Average shareholders equity

Operation Performance

Gross profit margin = (Sale Cost of sales) / Sales

Operating profit margin (pretax) = Income from operations / Sales

Net profit margin = Net income / Sales

Asset Utilization

Cash turnover = Sales / Average cash and equivalents

Accounts receivable turnover = Sales / Average accounts receivable

Inventory turnover = Cost of sales / Average accounts receivable

Working capital turnover = Sales / Average working capital

PPE turnover = Sales / Average PPE

Total asset turnover = Sales / Average total assets

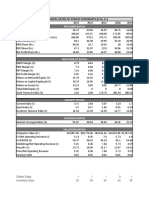

Ratio Analysis

2014

Ratios 2015 2013 2012 2011

(As restated)

Liquidity Ratios

Current ratio 1.35 1.06 1.16 1.16 0.96

Acid-test ratio 1.10 0.86 0.98 0.95 0.69

22.7

Collection period (in day) 25.95 28.06 30.18 32.67

2

7.2

Days to sell inventory (in day) 9.20 10.61 12.20 12.52

9

Capital Structure and Solvency

Ratio

Total debt to equity 0.78 0.65 0.65 0.66 0.69

Long-term debt to equity 0.32 0.18 0.19 0.20 0.21

13.6

Times interest earned 16.77 19.05 12.79 13.74

3

Return on Investment

Return on assets 19.65% 17.85% 16.44% 15.16% 12.72%

Return on common equity 31.12% 28.64% 26.51% 23.89% 20.12%

Operating Performance

Gross profit margin 72.56% 75.15% 76.70% 78.22% 77.02%

Operating profit margin (pretax) 31.64% 32.56% 33.56% 33.31% 30.82%

Net profit margin 23.37% 24.57% 24.59% 23.84% 21.73%

Asset Utilization

6.1

Cash turnover 5.39 4.98 4.63 4.28

6

15.8

Accounts receivable turnover 13.87 12.83 11.93 11.02

5

49.3

Inventory turnover 39.13 33.94 29.50 28.74

6

23.2

Working capital turnover 20.34 18.82 17.49 16.16

4

537.6

PPE turnover 470.60 435.29 404.74 373.84

2

Total asset turnover 0.79 0.69 0.64 0.59 0.55

Potrebbero piacerti anche

- Nerolac - On Ratio - SolvedDocumento6 pagineNerolac - On Ratio - Solvedricha krishnaNessuna valutazione finora

- Key Financial Ratios of Shree CementsDocumento2 pagineKey Financial Ratios of Shree CementsTrollNessuna valutazione finora

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Documento17 pagineEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004Nessuna valutazione finora

- Icici 1Documento2 pagineIcici 1AishwaryaSushantNessuna valutazione finora

- Ratio AnalysisDocumento2 pagineRatio AnalysisSEHWAG MATHAVANNessuna valutazione finora

- NFL Annual Report 2019 Compressed PDFDocumento130 pagineNFL Annual Report 2019 Compressed PDFZUBAIRNessuna valutazione finora

- Financial RatiosDocumento2 pagineFinancial Ratiosranjansolanki13Nessuna valutazione finora

- Ratio Analysis: Liquidity RatiosDocumento2 pagineRatio Analysis: Liquidity RatiosSuryakantNessuna valutazione finora

- Project of Tata MotorsDocumento7 pagineProject of Tata MotorsRaj KiranNessuna valutazione finora

- AFM Section C Group 1 Assignment CalculationsDocumento12 pagineAFM Section C Group 1 Assignment CalculationsAkshitNessuna valutazione finora

- Key Financial Ratios of NTPC: - in Rs. Cr.Documento3 pagineKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNessuna valutazione finora

- Financial RatiosDocumento2 pagineFinancial RatiosTejaswiniNessuna valutazione finora

- Sambal Owner of ZeeDocumento2 pagineSambal Owner of Zeesagar naikNessuna valutazione finora

- FY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Documento1 paginaFY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Divyank JyotiNessuna valutazione finora

- Ratios FinancialDocumento16 pagineRatios Financialgaurav sahuNessuna valutazione finora

- Ratios FinDocumento30 pagineRatios Fingaurav sahuNessuna valutazione finora

- Ratios FinancialDocumento16 pagineRatios Financialgaurav sahuNessuna valutazione finora

- Ratios FinDocumento16 pagineRatios Fingaurav sahuNessuna valutazione finora

- Particulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018Documento6 pagineParticulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018MOHIT MARHATTANessuna valutazione finora

- Dividend Payout Ration On EPS CalculationDocumento2 pagineDividend Payout Ration On EPS CalculationvanishaNessuna valutazione finora

- Financial HighlightsDocumento4 pagineFinancial HighlightsmomNessuna valutazione finora

- Financial Ratios of Hero Honda MotorsDocumento6 pagineFinancial Ratios of Hero Honda MotorsParag MaheshwariNessuna valutazione finora

- Company Info - Print FinancialsDocumento2 pagineCompany Info - Print FinancialsKavitha prabhakaranNessuna valutazione finora

- ANJ AR 2013 - English - Ykds3c20170321164338Documento216 pagineANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNessuna valutazione finora

- Financial Analysis Coles GroupDocumento5 pagineFinancial Analysis Coles GroupAmmar HassanNessuna valutazione finora

- Reliance GuriDocumento2 pagineReliance GurigurasisNessuna valutazione finora

- Latihan Bab 3Documento19 pagineLatihan Bab 3Noura AdriantyNessuna valutazione finora

- Financial HighlightsDocumento3 pagineFinancial HighlightsSalman SaeedNessuna valutazione finora

- Key Financial Ratios of Tata Motors: - in Rs. Cr.Documento3 pagineKey Financial Ratios of Tata Motors: - in Rs. Cr.ajinkyamahajanNessuna valutazione finora

- Airan RatioDocumento2 pagineAiran RatiomilanNessuna valutazione finora

- Textile Industry Financial Analysis Report (321 Project)Documento34 pagineTextile Industry Financial Analysis Report (321 Project)hamnah lateefNessuna valutazione finora

- Axis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKDocumento2 pagineAxis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNessuna valutazione finora

- Marico RatiosDocumento2 pagineMarico RatiosAbhay Kumar SinghNessuna valutazione finora

- Arun 1Documento2 pagineArun 1Nishanth RioNessuna valutazione finora

- Star Company Comparative Income Statement December 31, 2016,2017 and 2018Documento2 pagineStar Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNessuna valutazione finora

- Black Gold - AnalysisDocumento12 pagineBlack Gold - AnalysisAbdulrahman DhabaanNessuna valutazione finora

- Financial Ratios of NHPCDocumento2 pagineFinancial Ratios of NHPCsathish kumarNessuna valutazione finora

- Year Month Dividend (%) : VisionDocumento4 pagineYear Month Dividend (%) : VisionReema KumariNessuna valutazione finora

- Financial Performance of Interloop Limited (Ilp)Documento2 pagineFinancial Performance of Interloop Limited (Ilp)Muhammad NadeemNessuna valutazione finora

- Financial Metrics Calculator - 3Documento9 pagineFinancial Metrics Calculator - 3Mihir JainNessuna valutazione finora

- RatiosDocumento2 pagineRatiosAbhay Kumar SinghNessuna valutazione finora

- Problem1 Section 19.2Documento2 pagineProblem1 Section 19.2SANSKAR JAINNessuna valutazione finora

- Ratios v2Documento15 pagineRatios v2Janarthanan VtNessuna valutazione finora

- ANJ AR 2014 English - dT8RRA20170321164537Documento232 pagineANJ AR 2014 English - dT8RRA20170321164537baktikaryaditoNessuna valutazione finora

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Documento4 pagineInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1Nessuna valutazione finora

- CCS G4Documento14 pagineCCS G4Harshit AroraNessuna valutazione finora

- Ratio Case Study - Standfornd Yard Mon Sec Summer 2021Documento8 pagineRatio Case Study - Standfornd Yard Mon Sec Summer 2021Muhammad Ali SamarNessuna valutazione finora

- Albermarle Financial ModelDocumento38 pagineAlbermarle Financial ModelParas AroraNessuna valutazione finora

- Ratios, VLOOKUP, Goal SeekDocumento15 pagineRatios, VLOOKUP, Goal SeekVIIKHAS VIIKHASNessuna valutazione finora

- Financial Section - Annual2019-08Documento11 pagineFinancial Section - Annual2019-08AbhinavHarshalNessuna valutazione finora

- Annual Report 2002Documento59 pagineAnnual Report 2002Enamul HaqueNessuna valutazione finora

- Solution To Mini Case (SAPM)Documento8 pagineSolution To Mini Case (SAPM)Snigdha IndurtiNessuna valutazione finora

- Final Excel FileDocumento14 pagineFinal Excel FileArif RahmanNessuna valutazione finora

- Housing Ratio PDFDocumento2 pagineHousing Ratio PDFAbdul Khaliq ChoudharyNessuna valutazione finora

- Cipla Financial RatiosDocumento2 pagineCipla Financial RatiosNEHA LALNessuna valutazione finora

- Financial Ratio Latest 5 YrsDocumento2 pagineFinancial Ratio Latest 5 YrsAryan BagdekarNessuna valutazione finora

- Irctc InvestmentDocumento6 pagineIrctc InvestmentYashNessuna valutazione finora

- Annual Report 2004Documento81 pagineAnnual Report 2004Enamul HaqueNessuna valutazione finora

- Financial Analysis of NBFCDocumento14 pagineFinancial Analysis of NBFCPKNessuna valutazione finora

- Working Capital Management - PharmaDocumento26 pagineWorking Capital Management - PharmaKshitij MittalNessuna valutazione finora

- LSIP - Bilingual - 30 - Sep - 2022 RELEASE PDFDocumento121 pagineLSIP - Bilingual - 30 - Sep - 2022 RELEASE PDFandry4jcNessuna valutazione finora

- Chapter 3 Job Order CostingDocumento20 pagineChapter 3 Job Order Costingazam_rasheedNessuna valutazione finora

- Hero MotoCorp DCFDocumento34 pagineHero MotoCorp DCFvijayNessuna valutazione finora

- OCR AS A Level GCE Accounting Mark Scheme January 2007 PDFDocumento29 pagineOCR AS A Level GCE Accounting Mark Scheme January 2007 PDFAnonymous PpX8nZL0% (1)

- Accounting Notes PDFDocumento67 pagineAccounting Notes PDFEjazAhmadNessuna valutazione finora

- 770976ce9 - DLeon Part IDocumento5 pagine770976ce9 - DLeon Part IMuhammad sohailNessuna valutazione finora

- Hyacith Financial PlanDocumento18 pagineHyacith Financial PlanERICKA GRACE DA SILVANessuna valutazione finora

- Tesla FinModelDocumento58 pagineTesla FinModelPrabhdeep DadyalNessuna valutazione finora

- PrepzFy - LBO - VemptyDocumento3 paginePrepzFy - LBO - VemptykouakouNessuna valutazione finora

- SO On Manua Accounting Valix Peralta Valix VOL ME - 201 EditioDocumento231 pagineSO On Manua Accounting Valix Peralta Valix VOL ME - 201 EditioAnne EstrellaNessuna valutazione finora

- 15 Retained EarningsDocumento8 pagine15 Retained Earningsrandomlungs121223Nessuna valutazione finora

- Account Determination MM en USDocumento81 pagineAccount Determination MM en USkamal_dipNessuna valutazione finora

- Tcs Subsidiary Financials 2017 18Documento1.266 pagineTcs Subsidiary Financials 2017 18Shirin BalanNessuna valutazione finora

- Final Accounts With Adjustments - Principles of AccountingDocumento9 pagineFinal Accounts With Adjustments - Principles of AccountingAbdulla Maseeh100% (1)

- Taxation BookDocumento29 pagineTaxation BookbiggykhairNessuna valutazione finora

- Exercise 5-5Documento2 pagineExercise 5-5Ammar TuahNessuna valutazione finora

- f7hkg 2010 Jun QDocumento9 paginef7hkg 2010 Jun QOni SegunNessuna valutazione finora

- Auditing ProblemsDocumento53 pagineAuditing ProblemsZerjo Cantalejo0% (1)

- Bombay Dyeing Balance SheetDocumento2 pagineBombay Dyeing Balance SheetPRATHAMNessuna valutazione finora

- 6 Hyperinflation and Current Cost AccountingDocumento11 pagine6 Hyperinflation and Current Cost Accountingkris mNessuna valutazione finora

- Hoba AcctgDocumento5 pagineHoba Acctgfer maNessuna valutazione finora

- 2008 LCCI Level 1 (1017) Specimen Paper AnswersDocumento4 pagine2008 LCCI Level 1 (1017) Specimen Paper AnswersTszkin PakNessuna valutazione finora

- Accountancy ImpQ CH04 Admission of A Partner 01Documento18 pagineAccountancy ImpQ CH04 Admission of A Partner 01praveentyagiNessuna valutazione finora

- BMSR 2016 PDFDocumento205 pagineBMSR 2016 PDFFitria Rizal Eka PutriNessuna valutazione finora

- T.S. Grewal (2018) For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial StatementsDocumento97 pagineT.S. Grewal (2018) For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial Statementssumitha ganesan0% (1)

- Kelompok 4 AKL II Chapter 9Documento36 pagineKelompok 4 AKL II Chapter 9Aimer RainNessuna valutazione finora

- Kuis 1 Akuntansi Keuangan Lanjutan Semester Antara 2019/2020Documento3 pagineKuis 1 Akuntansi Keuangan Lanjutan Semester Antara 2019/2020danu prayuda0% (1)

- Managerial AccountingDocumento18 pagineManagerial Accountingirfan103158Nessuna valutazione finora

- Managerial Finance (503) EMBA Summer-2020 Jahangirnagar UniversityDocumento4 pagineManagerial Finance (503) EMBA Summer-2020 Jahangirnagar UniversityIsmail EmonNessuna valutazione finora