Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Requirements in Securing Tax Clearance For Bidding Purposes

Caricato da

Denzel Edward CariagaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Requirements in Securing Tax Clearance For Bidding Purposes

Caricato da

Denzel Edward CariagaCopyright:

Formati disponibili

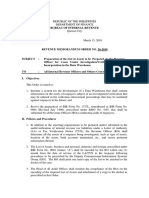

REQUIREMENTS IN SECURING TAX CLEARANCE FOR BIDDING PURPOSES:

1. Duly accomplished Sworn Application;

2. Delinquency Verification Certificate (DVC) issued by Concerned Regional Office;

NOTE : All taxpayers under the jurisdiction of the following RDOs are mandated to

secure the DVC from the concerned Regional Collection Divisions

a. Revenue Region No. 4 RDO Nos. 17A, 17B, 18, 19, 20, 21A, 21B, 22, 23A and 23B

b. Revenue Region No. 5 RDO Nos. 24, 25A, 25B, 26, and 27

c. Revenue Region No. 6 RDO Nos. 29, 30, 31, 32, 33, and 34

d. Revenue Region No. 7 RDO Nos. 28, 38, 39, 40, 41, 42, 43A, 43B, 45, and 46

e. Revenue Region No. 8 RDO Nos. 44, 27, 48, 49, 50, 51, 52, 53A and 53B

f. Revenue Region No. 9 RDO Nos. 54A, 54B, 55, 56, 57, 58, 59, and 60

3. Two (2) pieces loose documentary stamp tax worth P15.00 each; and

4. Confirmation Receipt of the electronic payment of certification fee.

CRITERIA TO BE SATISFIED TO QUALIFY:

1. ANNUAL REGISTRATION FEE FOR THE CURRENT YEAR PAID;

2. NO OPEN STOP FILER CASES (NOTE: STOP-FILER PERTAINS TO REQUISITE TAX RETURNS

NOT FILED BY THE APPLICANT);

3. NO RECORD OF TAX LIABILITIES/DELINQUENT ACCOUNTS;

4. NOT TAGGED AS CANNOT BE LOCATED TAXPAYER; AND

5. REGULAR USER OF THE ELECTRONIC FILING AND PAYMENT SYSTEM (EFPS) IN THE FILING

OF THE REQUISITE TAX RETURNS AND THE PAYMENT OF THE TAX DUE THEREON

(NOTE: NEW APPLICANT MUST BE A USER FOR AT LEAST TWO (2) CONSECUTIVE MONTHS,

WHILE RENEWAL OF TAX CLEARANCE MUST BE A CONSISTENT EFPS USER, FROM

ENROLLMENT TO DATE OF FILING OF THE APPLICATION)

PROCESSING PERIOD: WITHIN TWO (2) WORKING DAYS FROM RECEIPT OF

COMPLETE DOCUMENTS

NOTICE: LIST OF RELEASED TAX CLEARANCE IS POSTED IN THE BIR WEBSITE UNDER

ANNOUNCEMENT, THEN CLICK ON TAX CLEARANCE

Potrebbero piacerti anche

- A Business Plan For Laundry ShopDocumento31 pagineA Business Plan For Laundry ShopDenzel Edward Cariaga67% (12)

- CAE 2 Financial Accounting and Reporting: L-NU AA-23-02-01-18Documento8 pagineCAE 2 Financial Accounting and Reporting: L-NU AA-23-02-01-18Amie Jane Miranda100% (1)

- Vat Relief Esub Validtn Report 3rd Qtr2018Documento3 pagineVat Relief Esub Validtn Report 3rd Qtr2018KarlayaanNessuna valutazione finora

- Request For Cancellation of Stored CprsDocumento1 paginaRequest For Cancellation of Stored Cprsmichael viudezNessuna valutazione finora

- RR 2-98 Section 2.57 (B) - CWTDocumento3 pagineRR 2-98 Section 2.57 (B) - CWTZenaida LatorreNessuna valutazione finora

- Revenue Memorandum Order 26-2010Documento2 pagineRevenue Memorandum Order 26-2010Jayvee OlayresNessuna valutazione finora

- Annex C.1: Sworn Application For Tax ClearanceDocumento1 paginaAnnex C.1: Sworn Application For Tax ClearanceKrizza MadridNessuna valutazione finora

- Revenue District Offices - Bureau of Internal RevenueDocumento79 pagineRevenue District Offices - Bureau of Internal RevenueKharylle ConolNessuna valutazione finora

- Buyer's Request Form (BRF)Documento2 pagineBuyer's Request Form (BRF)LeytonDelaCruzNessuna valutazione finora

- Bpi Endorsement LetterDocumento1 paginaBpi Endorsement LetterLawrence MangaoangNessuna valutazione finora

- New Application Form Importer Non-Individual RMO 56-2016.for PRINTINGDocumento1 paginaNew Application Form Importer Non-Individual RMO 56-2016.for PRINTINGchachi50% (2)

- Salary Slip (31109291 April, 2018)Documento1 paginaSalary Slip (31109291 April, 2018)Hassan RanaNessuna valutazione finora

- TRAIN LAW Estate-And-Donors-TaxDocumento22 pagineTRAIN LAW Estate-And-Donors-TaxNicky ChrisNessuna valutazione finora

- Authorization To TransactDocumento1 paginaAuthorization To Transactjoy buedoNessuna valutazione finora

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Documento7 pagineAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegNessuna valutazione finora

- Application For Accreditation and Registration: Bureau of CustomsDocumento3 pagineApplication For Accreditation and Registration: Bureau of CustomsNoan SimanNessuna valutazione finora

- GV Directors Certificate-Amendent To Articles of Incorporation DEFAULTDocumento2 pagineGV Directors Certificate-Amendent To Articles of Incorporation DEFAULTmlnathalie4012Nessuna valutazione finora

- Sworn Application For Tax Clearance: Annex CDocumento1 paginaSworn Application For Tax Clearance: Annex CJose Edmundo DayotNessuna valutazione finora

- BIR Ruling No. 242-18 (Gift Certs.)Documento7 pagineBIR Ruling No. 242-18 (Gift Certs.)LizNessuna valutazione finora

- 43735rmc No 5-2009 Annex CDocumento1 pagina43735rmc No 5-2009 Annex CJM GapisaNessuna valutazione finora

- Transmittal BIRDocumento1 paginaTransmittal BIRSylvia EnovisoNessuna valutazione finora

- Efps Letter 009Documento1 paginaEfps Letter 009ElsieJhadeWandasAmandoNessuna valutazione finora

- PhilGEPS Sworn StatementDocumento2 paginePhilGEPS Sworn Statementsevera martinNessuna valutazione finora

- Letter To EFPSDocumento1 paginaLetter To EFPSMarycris Balanay-CaoileNessuna valutazione finora

- EDD.1.F.014 - Permit To LocateDocumento7 pagineEDD.1.F.014 - Permit To Locaterey romNessuna valutazione finora

- BIR Request Letter Tax Clearance SampleDocumento1 paginaBIR Request Letter Tax Clearance SampleRachel ChanNessuna valutazione finora

- Bir Letter - 20211008Documento1 paginaBir Letter - 20211008LERAC Accounting100% (1)

- NOLCO ReportDocumento9 pagineNOLCO ReportfebwinNessuna valutazione finora

- RA 7160 Situs of The Tax - IRRDocumento71 pagineRA 7160 Situs of The Tax - IRRErnie F. CanjaNessuna valutazione finora

- Affidavit of Lot Owner's ConsentDocumento1 paginaAffidavit of Lot Owner's ConsentRaniel Calata0% (1)

- Sworn Statement For Application of Permit To Use Loose Leaf Books of AccountsDocumento1 paginaSworn Statement For Application of Permit To Use Loose Leaf Books of AccountsTesston Bullion100% (1)

- 1 - PCAB - Application LetterDocumento1 pagina1 - PCAB - Application LetterMardeOpamenNessuna valutazione finora

- CDC Sanitation Request LetterDocumento2 pagineCDC Sanitation Request LetterwallyNessuna valutazione finora

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDocumento2 pagineRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake Mitsuki100% (1)

- Secretary's Certificate - Redentor CambaDocumento1 paginaSecretary's Certificate - Redentor CambaRobert marollanoNessuna valutazione finora

- FIESTADocumento2 pagineFIESTAgerrymandering100% (1)

- Securities and Exchange Commission: Republic of The PhilippinesDocumento1 paginaSecurities and Exchange Commission: Republic of The PhilippinesRobert Paul A Moreno100% (1)

- RMC 69-2020 POS Cancellation New RequirementDocumento2 pagineRMC 69-2020 POS Cancellation New RequirementGreyNessuna valutazione finora

- Checklist PcabDocumento5 pagineChecklist PcabLyka Amascual ClaridadNessuna valutazione finora

- CPRS Affidavit-Revised.11-22-16Documento2 pagineCPRS Affidavit-Revised.11-22-16Rosalie Padilla100% (2)

- BOC Application Form ImporterDocumento3 pagineBOC Application Form Importerlyn121988gmailcom100% (3)

- Secretary'S Certificate: (Authorized Filer For Securities and Exchange Commission)Documento1 paginaSecretary'S Certificate: (Authorized Filer For Securities and Exchange Commission)Mark John JovenNessuna valutazione finora

- Secretary CertificateDocumento3 pagineSecretary CertificateAnnina IlasNessuna valutazione finora

- Aff of Loss Sales Invoice BookletDocumento1 paginaAff of Loss Sales Invoice BookletGio TriesteNessuna valutazione finora

- PFF053 MembersContributionRemittanceForm V02-FillableDocumento2 paginePFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielNessuna valutazione finora

- Process For Application To Use LooseleafDocumento1 paginaProcess For Application To Use LooseleafFrancis MartinNessuna valutazione finora

- Business Permits and Licensing Office: City of CaloocanDocumento2 pagineBusiness Permits and Licensing Office: City of CaloocanCarl Walfred Adajar Dael100% (1)

- Pasig BPLO Charter. Udate 12-6-2018Documento7 paginePasig BPLO Charter. Udate 12-6-2018Roy LataquinNessuna valutazione finora

- REVISED PASAY CITY REVENUE CODE (As of July 17, 2023)Documento148 pagineREVISED PASAY CITY REVENUE CODE (As of July 17, 2023)Alyssa Marie MartinezNessuna valutazione finora

- Return-to-Work Establishment Report FormDocumento4 pagineReturn-to-Work Establishment Report FormBhianca Ruth MauricioNessuna valutazione finora

- RMC 57-2015 PDFDocumento1 paginaRMC 57-2015 PDFJomar CarabotNessuna valutazione finora

- AHLENS Letter To BIRDocumento2 pagineAHLENS Letter To BIRTe Amo Guid100% (1)

- Annex - A - Ptu LooseleafDocumento1 paginaAnnex - A - Ptu LooseleafPaola VirataNessuna valutazione finora

- Special Power of AttorneyDocumento1 paginaSpecial Power of AttorneyMaureenNessuna valutazione finora

- BIR Ruling DA-648-04Documento2 pagineBIR Ruling DA-648-04Phoebe SpaurekNessuna valutazione finora

- 1604-C Jan 2018 Final Annex A PDFDocumento1 pagina1604-C Jan 2018 Final Annex A PDFAs Li NahNessuna valutazione finora

- Certification of Company Car AssignmentDocumento1 paginaCertification of Company Car AssignmentCasandra KayeNessuna valutazione finora

- Biodata Revised As of 11.5.18Documento1 paginaBiodata Revised As of 11.5.18Oceanspeed LogisticsNessuna valutazione finora

- Revenue Memorandum Order No. 4-2007: I. BackgroundDocumento7 pagineRevenue Memorandum Order No. 4-2007: I. BackgroundtoniNessuna valutazione finora

- Accounting of Income Tax Collection PerspectiveDocumento12 pagineAccounting of Income Tax Collection PerspectiveadilshahkazmiNessuna valutazione finora

- Bureau of Internal Revenue Quezon CityDocumento6 pagineBureau of Internal Revenue Quezon CityPeggy SalazarNessuna valutazione finora

- Fully Electronic Refund ProcessDocumento4 pagineFully Electronic Refund ProcessCA Sumit GargNessuna valutazione finora

- 5: EJI Of: Establishment Lmplementation For Critical Services Under Online SurveyDocumento5 pagine5: EJI Of: Establishment Lmplementation For Critical Services Under Online SurveyLOUISE ELIJAH GACUANNessuna valutazione finora

- Advisory - Filing of ITR 2021Documento2 pagineAdvisory - Filing of ITR 2021pelgonehNessuna valutazione finora

- Torres Vs SatsatinDocumento10 pagineTorres Vs SatsatinDenzel Edward CariagaNessuna valutazione finora

- Northern Islands Vs GarciaDocumento7 pagineNorthern Islands Vs GarciaDenzel Edward CariagaNessuna valutazione finora

- CREATE Features 26nov20Documento14 pagineCREATE Features 26nov20Denzel Edward CariagaNessuna valutazione finora

- Phil Airconditioning Center vs. RCJ LinesDocumento25 paginePhil Airconditioning Center vs. RCJ LinesDenzel Edward CariagaNessuna valutazione finora

- Mangila Vs Court of AppealsDocumento13 pagineMangila Vs Court of AppealsDenzel Edward CariagaNessuna valutazione finora

- Lim JR Vs LazaroDocumento6 pagineLim JR Vs LazaroDenzel Edward CariagaNessuna valutazione finora

- Luzon Development Vs KrishnanDocumento6 pagineLuzon Development Vs KrishnanDenzel Edward CariagaNessuna valutazione finora

- Chuidian Vs SandiganbayanDocumento16 pagineChuidian Vs SandiganbayanDenzel Edward CariagaNessuna valutazione finora

- Excellent Quality Apparel vs. Visayan SuretyDocumento17 pagineExcellent Quality Apparel vs. Visayan SuretyDenzel Edward CariagaNessuna valutazione finora

- Notes On Registration of Book of AccountsDocumento3 pagineNotes On Registration of Book of AccountsDenzel Edward CariagaNessuna valutazione finora

- Spa Tleung 112016Documento1 paginaSpa Tleung 112016Denzel Edward CariagaNessuna valutazione finora

- Notes On Application For Authority To Print ReceiptsDocumento3 pagineNotes On Application For Authority To Print ReceiptsDenzel Edward CariagaNessuna valutazione finora

- Transportation Law - Compiled Reports Chapters 12-20Documento44 pagineTransportation Law - Compiled Reports Chapters 12-20Denzel Edward CariagaNessuna valutazione finora

- Writ of Continuing Mandamus v4 Super FinalDocumento30 pagineWrit of Continuing Mandamus v4 Super FinalDenzel Edward CariagaNessuna valutazione finora

- Statement of Premium Account (Spa) - Formal Sector: Philhealth Eprs Premium Payment SlipDocumento1 paginaStatement of Premium Account (Spa) - Formal Sector: Philhealth Eprs Premium Payment SlipDenzel Edward CariagaNessuna valutazione finora

- Cma Final DT MarathonDocumento205 pagineCma Final DT Marathonkomalc2026Nessuna valutazione finora

- Adjusting Entry Page 180Documento9 pagineAdjusting Entry Page 180rainellagmendozaNessuna valutazione finora

- It Statement For The Month of February'14: Date On Which Amount Paid/creditedDocumento8 pagineIt Statement For The Month of February'14: Date On Which Amount Paid/creditedpasamvNessuna valutazione finora

- The Tax Treatment of Sum of Money Received As Gift Under Section 56Documento4 pagineThe Tax Treatment of Sum of Money Received As Gift Under Section 56Anshu kumarNessuna valutazione finora

- Salary Slip - June 2022 - UnlockedDocumento2 pagineSalary Slip - June 2022 - UnlockedRmillionsque FinserveNessuna valutazione finora

- TaxDocumento6 pagineTaxBirs BirsNessuna valutazione finora

- Income Tax AustraliaDocumento9 pagineIncome Tax AustraliaAbdul HadiNessuna valutazione finora

- ACCOUNTING 101 - No.2 - ProblemsDocumento3 pagineACCOUNTING 101 - No.2 - ProblemslemerleNessuna valutazione finora

- Class 27 - Depreciation and Income Taxes Contd..Documento33 pagineClass 27 - Depreciation and Income Taxes Contd..SwastikNessuna valutazione finora

- JFC - PH Jollibee Foods Corp. Annual Income Statement - WSJDocumento1 paginaJFC - PH Jollibee Foods Corp. Annual Income Statement - WSJフ卂尺乇ᗪNessuna valutazione finora

- Building Plan Approval Procedure (Walton) PDFDocumento2 pagineBuilding Plan Approval Procedure (Walton) PDFalirazaNessuna valutazione finora

- TAX NIRC and Remedies Atty Lumbera PREBAR Trans From UPDocumento87 pagineTAX NIRC and Remedies Atty Lumbera PREBAR Trans From UPKyle MerillNessuna valutazione finora

- Tax AmnestyDocumento38 pagineTax AmnestyElsha dela penaNessuna valutazione finora

- 0400012155946apr 2024Documento2 pagine0400012155946apr 2024maazraza123Nessuna valutazione finora

- Addition To DPS P 102Documento2 pagineAddition To DPS P 102roooyyNessuna valutazione finora

- TX - Mock Test - Đáp ÁnDocumento12 pagineTX - Mock Test - Đáp ÁnPhán Tiêu Tiền100% (1)

- GCRO Module 120 - 07 Computation of TaxDocumento34 pagineGCRO Module 120 - 07 Computation of TaxKezia100% (1)

- Income Tax Authority and Its Powers Under Income TaxDocumento5 pagineIncome Tax Authority and Its Powers Under Income TaxIndu Shekhar PoddarNessuna valutazione finora

- Wade Corp Has 150 000 Shares of Common Stock Outstanding in PDFDocumento1 paginaWade Corp Has 150 000 Shares of Common Stock Outstanding in PDFAnbu jaromiaNessuna valutazione finora

- Assingment 1 Payroll TheoryDocumento15 pagineAssingment 1 Payroll TheoryJenmark John JacolbeNessuna valutazione finora

- Final-Accounts-Q - A P&L ACCDocumento31 pagineFinal-Accounts-Q - A P&L ACCNikhil PrasannaNessuna valutazione finora

- Krishn Vilas (Plot) Price List 08.01.2021 X CatagoryDocumento1 paginaKrishn Vilas (Plot) Price List 08.01.2021 X CatagoryZama KazmiNessuna valutazione finora

- G.R. No. L-25043 J EN BANC J April 26 J 1968 J BENGZON J J.P J JDocumento2 pagineG.R. No. L-25043 J EN BANC J April 26 J 1968 J BENGZON J J.P J JarzaianNessuna valutazione finora

- Governement Grants PDFDocumento3 pagineGovernement Grants PDFVillaruz Shereen MaeNessuna valutazione finora

- Conneqt Business Solutions Limited: 286124 Siddhant Murari SharmaDocumento1 paginaConneqt Business Solutions Limited: 286124 Siddhant Murari SharmaRadha SharmaNessuna valutazione finora

- Tax Act ProblemDocumento1 paginaTax Act ProblemMervidelleNessuna valutazione finora

- Capital Budgeting Quiz 1: Multiple ChoiceDocumento7 pagineCapital Budgeting Quiz 1: Multiple ChoiceMark Jesus Aristo100% (1)