Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fiji National University Investment Course

Caricato da

Bimal KrishnaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fiji National University Investment Course

Caricato da

Bimal KrishnaCopyright:

Formati disponibili

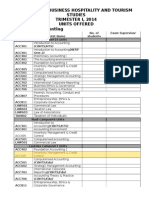

FIJI NATIONAL UNIVERSITY

COLLEGE OF BUSINESS, HOSPITALITY AND TOURISM STUDIES

SCHOOL OF ECONOMICS, BANKING AND FINANCE

DEPARTMENT OF BANKING & FINANCE

FIN 701 Investment and Portfolio Analysis

16 Credit Points

Unit Coordinator & Lecturer:

Email:

Phone:

Contributing Lecturers:

LECTURES

DAY EVENING

Tuesday 12 -2 pm [ERC 1] Thursday 6pm -8pm[ERC 9]

TUTORIALS

Wednesday 11 1pm [ERC 5] Thursday 8pm -9pm [ERC 9]

Thursday 11-1pm [ERC 5]

Consultation Time: Tuesday 10am 11am

Prerequisite: The student must have passed FIN 601 or receive a

consent from HOD.

E-Information: All pertinent information relating to the unit will be

posted on moodle (web learning platform).

Students are required to check this platform

regularly for communication from the lecturer.

FIN701: Investment and Portfolio Analysis Trimester 1 2017 Page 1

1.0 Welcome

I welcome you to this Unit and hope that you will find it enriching and

interesting. This unit will introduce you to the theory and applications of

investment finance. This unit is a core unit for B. Com major in Finance.

2.0 Unit Description

This unit will allow students to obtain a broad knowledge of the asset

allocation process, security markets, market structures, the risk-return

characteristics of investment products, and hedging applications with

financial innovations through the unit materials, lectures, discussions, and

assignments. The emphasis of this unit is on both intellectual stimulation and

practical rigorous applications, through the security analysis project. The unit

emphasis is on the development of both quantitative analytic skills and

presentation skills

It provides a comprehensive coverage of basic concepts, theories,

applications and decision-making rules in financial investments. In particular,

the unit will focus on the analysis of stocks, bonds, options and other

derivative securities. Additionally, the unit will examine the role and

performance of portfolio managers, mutual funds and other investment

companies.

This unit provides students with crucial concepts of investment decision-

making, portfolio theory and valuation model of financial assets. Capital Asset

Pricing Model (CAPM) and Arbitrage Pricing Theory (APT) are emphasized.

3.0 Learning Outcomes

On successful completion of this unit, students will be able to:

1. Apply the basic principles and concepts related to investment and

portfolio analysis;

2. comprehend various valuation techniques of investments;

3. Undertake the management of portfolios and its measurements;

4. Value bond portfolio management and measurement.

5. Evaluate the various dimensions of a securities market.

6. Analyze the types of mutual funds and its performance;

7. Evaluate the Capital Asset Pricing Model and the Arbitrage Pricing

Theory;

8. Analyze the various dimensions of equity valuation;

9. Analyze the various dimensions of options market.

FIN701: Investment and Portfolio Analysis Trimester 1 2017 Page 2

Weeks Lectures Assessment

Dates

1 Introduction To Investments And

16 Jan 20th Jan

th

Portfolio Analysis

Investment Setting, Asset Classes And

2

Financial Instrument

23 Jan 27th Jan

rd

3 Security Trading/ Security Analysis

30 Jan 3rd Feb

th

4 Mutual Funds

6 Feb - 10th Feb

th

5 Efficient Diversification Single Factor

13 Feb - 17th Feb

th

Model

6 Mid Trimester

20 Feb 24th Feb

th

Exam (20%)

7

27 Feb 3rd Mar

th

Mid Trimester Break

Capital Asset Pricing And Arbitrage

8

Pricing Theory

6 Mar 10th Mar

th

Bond Characteristics And Managing Assignment Due

9

Bond Portfolio (15%)

13 Mar 17th Mar

th

10 Equity Valuation And Equity Portfolio Presentation

20 Mar 24th Mar

th

Management (5%)

11 Options Market And Valuation

27 Mar 31st Mar

th

12 Evaluation Of Portfolio Performance

3 Apr 7th Apr

rd

13 Sum Up/ Study Week

10 Apr 14th Apr

th

14 Study Week /Exam Week

17 Apr 21st Apr

th

15 Exam Week

24 Apr 28th Apr

th

FIN701: Investment and Portfolio Analysis Trimester 1 2017 Page 3

4.0 Unit Content and Reading References

TOPIC 1: INTRODUCTION TO INVESTMENTS AND PORTFOLIO

ANALYSIS

Learning Outcome

This topic is designed to be a standard introductory topic. As such, its

purpose is to introduce students to the subject of Investments, explain what

this topic is concerned with from a summary viewpoint, and outline what the

remainder of the unit will cover. It defines important terms such as

investments, security analysis, portfolio management, expected and realized

rate of return, risk-free rate of return, and risk.

Performance Criteria

After studying this topic, the students should be able to:

1.1Introduce students to the subject matter of Investments from an

overall viewpoint, including terminology

1.2The nature of investment.

1.3The importance of studying investments.

1.4Understand the investment decision making process.

1.5Explain the basic nature of the investing decision as a trade-of

between expected return and risk.

1.6Explain that the decision process consists of security analysis and

portfolio management and those external factors afect this decision

process. These factors include uncertainty, the necessity to think of

investments in a global context, the environment involving

institutional investors, and the impact of the Internet on investing.

1.7Understand the term investment and factors used to diferentiate

types of investments.

1.8 Discuss the principal types of investment vehicles.

1.9Describe the steps in investing and managing personal tax issues.

1.10 Discuss investing over the life cycle and in diferent economic

environments.

Reading Resource Materials

1. Lecture Notes

2. Text: chapter 1; Understanding Investments

FIN701: Investment and Portfolio Analysis Trimester 1 2017 Page 4

TOPIC 2: INVESTMENT SETTING, ASSET CLASSES AND FINANCIAL

INSTRUMENT

Learning Outcome

The purpose of topic 2 is to provide an overview of the major types of

financial assets available to investors; these are discussed in later topics. It

also develops the important alternatives of direct and indirect investing. This

topic seeks to provide basic information about financial assets at the outset

so that students are prepared to handle basic discussions of investing during

the unit.

Performance Criteria

After studying this topic, the students should be able to:

2.1Provide an overview of the major financial assets available to investors

and discussed in subsequent chapters

2.2Explain in some detail the financial assets of importance to most

investors, bonds, and stocks

2.3Explain investors alternatives, which consist of direct investing,

indirect investing, or, as is often done, a combination of the two.

2.4Organize financial assets

2.5Analyze investing directly and indirectly in money market, capital

market and other types of securities

2.6Critically analyze why this is important in today's investing

environment

2.7Evaluate nonmarketable financial assets

2.8Evaluate money market securities

2.9Evaluate fixed-interest securities

2.10 Evaluate equity securities

2.11 Evaluate derivative securities

Reading Resource Materials

1. Lecture Notes

2. Text: chapter 2; Investment Alternatives

FIN701: Investment and Portfolio Analysis Trimester 1 2017 Page 5

TOPIC 3: SECURITY TRADING

Learning Outcome

Topic 3 is designed to cover the markets where financial assets trade, with

particular emphasis on equity markets. It provides an analysis of the

structure of secondary markets, with securities organized by where they are

traded. Terminology is explained, and the functioning of the markets,

primarily the SPSE are considered in some detail. Considerable attention to

the major aspects of brokerage transactions is placed in this topic.

Performance Criteria

After studying this topic, the students should be able to:

3.1Explain primary and secondary markets in terms of their components

and organizational structure

3.2Explain terminology (e.g. broker, specialist, etc) pertaining to markets

and participants

3.3Evaluate the structure and functioning of the secondary markets, with

emphasis on the SPSE.

3.4Analyze the changes that have occurred in the secondary markets and

that may occur in the next few years.

3.5Provide students with a good understanding of what brokers do, how

securities are traded.

3.6Explain the mechanics of securities trading, such as brokerage

transactions, margin trading, and short selling.

3.7Provide an overview of how markets are regulated without simply

describing the various federal acts.

Reading Resource Materials

1. Lecture Notes

2. Text: chapter 5; .How securities are traded

FIN701: Investment and Portfolio Analysis Trimester 1 2017 Page 6

TOPIC 5: MUTUAL FUNDS

Learning Outcome

Topic 5, covering indirect investing, is a logical sequence to Topic 2, which

focused on direct purchases and sales of assets by investors. Topic 3 begins

by showing how households have increasingly turned to indirect investing

through pension funds and mutual funds. The details of indirect investing are

considered next. What is involved when buying a mutual fund or closed-end

fund in terms of how to do it, the expenses involved, and so forth.

Performance Criteria

After studying this topic, the students should be able to:

5.1Emphasize the important alternative for all investors of indirect

investing, and how it fits in most investors overall plans when

investing

5.2Explain the various types of investment companies, including methods

of operation, objectives, expenses, and so forth.

5.3Discuss important issues such as fund performance and how to use

funds to invest internationally.

5.4Discuss important new developments in this area, primarily exchange-

traded funds.

5.5Distinguish between listed and unlisted trusts, and investment

companies.

5.6Evaluate the attractions and weaknesses of mutual funds.

5.7Evaluate Open and Closed end investmement companies.

Calculate :

5.8Net Asset value (NAV).

5.9Premium and Discount calculation.

5.10 Rate of Return.

5.11 Holding Period Return.

Reading Resource Materials

1. Lecture Notes

2. Text: chapter 3; Managed Funds

FIN701: Investment and Portfolio Analysis Trimester 1 2017 Page 7

TOPIC 6: EFFICIENT DIVERSIFICATION SINGLE FACTOR MODEL

Learning Outcome

Topic 6 provides discussion on analyzing the efficient frontier, the Single

Index Model simplification of the efficient frontier, how the efficient frontier is

changed by borrowing and lending, and the Separation Theorem. This

organisational structure allows students to concentrate on related ideas

together, and does not overwhelm them all at once with the complete details

of this important material.

Performance Criteria

After studying this topic, the students should be able to:

6.1Supplement the brief analysis of portfolio theory in earlier topics by

showing the details of Markowitz portfolio theory, and the Single Index

Model

6.2Outline and describe the steps involved in building a portfolio, starting

with the efficient set and then allowing for borrowing and lending

possibilities

6.3Present the Separation Theorem

Reading Resource Materials

1. Lecture Notes

2. Text: chapter 6; Understanding and managing risk and return

TOPIC 7: CAPITAL ASSET PRICING AND ARBITRAGE PRICING THEORY

Learning Outcome

Topic 7 follows topic because capital market theory builds on portfolio theory

by examining how asset prices are determined in a world of Markowitz

diversifiers.

The topic outlines the necessary assumptions to derive capital market theory

and introduces the concept of equilibrium in the capital markets. Important

related concepts are introduced and discussed, primarily the market portfolio.

Performance Criteria

After studying this topic, the students should be able to:

7.1Develop the concept of asset pricing theory as a natural extension of

portfolio theory

7.2Develop the concepts of the CML and SML, explain what they mean,

and consider how they can be used

FIN701: Investment and Portfolio Analysis Trimester 1 2017 Page 8

7.3Consider related issues such as what beta measures and the problems

with estimating beta, systematic and nonsystematic risk, problems in

testing asset pricing models, and so forth

7.4Provide the necessary information about APT, including what it means

and how it could be used to make investment decisions

Reading Resource Materials

1. Lecture Notes

2. Text: chapter 19; Capital market theory

1. Text: chapter 21; Evaluation to investment performance

5.0 Resources

The recommended texts are:

Jones, P, C; Shamsudin, A; Naumann, K (2007), Investments- Analysis and

Management, 2nd edition, John Wiley & Sons, Australia.

Students must also read the listed readings after every topic.

Supplementary

Gitman and Joehnk (2008), Fundamentals of Investing, 10th edition, Pearson

Education, Inc, USA.

Gordon J. Alexander, William F. Sharpe, and Jefery V.

Bailey(2007),Fundamentals of Investments, 3rd Edition, Pearson Education,

Inc, USA.

Zvi Bodie, Alex Kane and Alan Marcus, (2009) Investments 8th edition,

Irwin/McGraw Hill, 2008.

6.0 Assessment

6.1 Grades

(a) The overall mark for the unit depends on performance during the

trimester (40%) and performance in the final examination (60%).

In Class Assessment

)b Research/Assignment/Presentations 20%

(Write up 15% & Presentation 5%)

)c Mid -Trimester test 20%

Final Examination 60%

(b) In order to pass the unit, that is, to obtain a grade of C- or better, it is necessary to score at

least 40% (ie 20/50) in the final examination. It is highly recommended that students

attend all tutorials/labs/workshops

6.2Letter Grade Scale The following grading scales would be used:

1. Grade Marks GPA

FIN701: Investment and Portfolio Analysis Trimester 1 2017 Page 9

A+ 90-100 4.33- High

5.00 Distinction

A 85-89 4.00- Distinction

4.27

A- 80-84 3.73- Distinction

3.93

B+ 75-79 3.33- High Credit

3.60

B 70-74 3.00- Credit

3.27

B- 65-69 2.67- Credit

2.93

C+ 60-64 2.33- Pass

2.60

C 55-59 2.00- Pass

2.27

C- 50-54 1.67- Pass

1.93

D+ 45-49 1.33- Fail

1.60

D 40-44 1.00- Fail

1.27

D- 35-39 0.67- Fail

0.93

E Below 35 0-0.60 Fail

DNQ Did Not Qualify; student received over 0 Fail

50% of total marks but did not meet

other specified conditions for a pass

W Withdrawn from Unit 0

CT Credit Transfer 0 Cross credit

(CT)

NV Null & Void for Dishonest practice 0

I Result withheld/Incomplete assessment 0

X Continuing course 0

DNC Did Not Complete 0

CP Compassionate Pass 0

Aeg Aegrotat Pass 0

PT Pass Terminating 0

P Pass 0

NP Not Passed 0

7.0 Programme Regulations and Dissatisfaction with Assessment

The academic conducts of the students are governed by the University

Academic and Students Regulation (UASR). All students must obtain a copy of

the UASR from the FNU academic office and familiarize themselves with all

academic matters.

FIN701: Investment and Portfolio Analysis Trimester 1 2017Page 10

Should a student be dissatisfied with either the internal or external

assessment, they can take the following steps to get redress of their

grievance.

Internal Assessment: The student can refer the work back to the unit

coordinator for checking and reassessment. Following this reassessment, if

the student is still dissatisfied, the student may refer the work to the HOD.

The HOD will then appoint another lecturer to examine the work and result

will then stand.

Final Exam: The student can apply for re-check of the grade as per the

procedures laid down in the UASR.

8.0 Plagiarism and Dishonest Practice Regulation

Plagiarism and dishonest practices are serious ofences for which ofenders

shall be penalized. Students must read the relevant section of UASR to

understand the various types of cases defined as dishonest practices in

academic work and to also know the penalties associated with these kinds of

practices.

FIN701: Investment and Portfolio Analysis Trimester 1 2017Page 11

Potrebbero piacerti anche

- Saim NotesDocumento120 pagineSaim NotesJagmohan Bisht0% (1)

- Investment ManagementDocumento28 pagineInvestment ManagementseemaagiwalNessuna valutazione finora

- BAC3684 SIPM March 2011Documento7 pagineBAC3684 SIPM March 2011chunlun87Nessuna valutazione finora

- MBA-III- Investment Management NotesDocumento131 pagineMBA-III- Investment Management NotesasadNessuna valutazione finora

- Fin204 Isd ElmDocumento25 pagineFin204 Isd Elm黄于绮Nessuna valutazione finora

- ECON - F412 - 1566 - 1 SapmDocumento3 pagineECON - F412 - 1566 - 1 SapmAvNessuna valutazione finora

- Investment Analysis and Portfolio Management Course Description/ObjectiveDocumento2 pagineInvestment Analysis and Portfolio Management Course Description/ObjectiveDaud BilalNessuna valutazione finora

- Investment Management Module BreakdownDocumento120 pagineInvestment Management Module BreakdownTilak RokrNessuna valutazione finora

- BA5012 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Reg 17 Question BankDocumento5 pagineBA5012 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Reg 17 Question BankB MonishaNessuna valutazione finora

- SAPM Course OutlinelDocumento7 pagineSAPM Course OutlinelNimish KumarNessuna valutazione finora

- School of Management Internship Diary: Strategy SpecializationDocumento10 pagineSchool of Management Internship Diary: Strategy SpecializationRohit YadavNessuna valutazione finora

- Mba-Iii-Investment Management Notes PDFDocumento121 pagineMba-Iii-Investment Management Notes PDFNaveen KumarNessuna valutazione finora

- MBA Católica Finance - 2 Term 2005/2006 Prof. Nuno FernandesDocumento4 pagineMBA Católica Finance - 2 Term 2005/2006 Prof. Nuno FernandesShukri Abdi YakubNessuna valutazione finora

- Investment Management 2015-16Documento6 pagineInvestment Management 2015-16Udayan BhattacharyaNessuna valutazione finora

- Investment Analysis and Portfolio ManagementDocumento5 pagineInvestment Analysis and Portfolio ManagementNajam Us SaharNessuna valutazione finora

- NUS FIN3102 Syllabus Sem 2 2019Documento6 pagineNUS FIN3102 Syllabus Sem 2 2019Shawn TeoNessuna valutazione finora

- FM 05Documento3 pagineFM 05roshandd2001Nessuna valutazione finora

- Mba III Investment Management (14mbafm303) NotesDocumento119 pagineMba III Investment Management (14mbafm303) NotesSyeda GazalaNessuna valutazione finora

- Sapm Full Unit Notes PDFDocumento112 pagineSapm Full Unit Notes PDFnandhuNessuna valutazione finora

- FINN 454-Portfolio Management-Salman KhanDocumento5 pagineFINN 454-Portfolio Management-Salman KhanMalik AminNessuna valutazione finora

- Investments Course Outline FinalDocumento4 pagineInvestments Course Outline FinalHamza Nasir ChathaNessuna valutazione finora

- Pondicherry University MBA Paper on Investment and Portfolio ManagementDocumento285 paginePondicherry University MBA Paper on Investment and Portfolio ManagementYonas Tsegaye HaileNessuna valutazione finora

- ECON - C412 - 2011-12 HydDocumento3 pagineECON - C412 - 2011-12 HydNisanth DsNessuna valutazione finora

- Investment Analysis, Portfolio Management & Wealth ManagementDocumento5 pagineInvestment Analysis, Portfolio Management & Wealth Managementkonica chhotwaniNessuna valutazione finora

- Investment Analysis and Portfolio ManagementDocumento7 pagineInvestment Analysis and Portfolio ManagementrossNessuna valutazione finora

- Investment Banking SyllbusDocumento2 pagineInvestment Banking SyllbusAaditya JhaNessuna valutazione finora

- BMT6135 - Security-Analysis-And-Portfolio-Management - TH - 1.0 - 55 - BMT6135 - 54 AcpDocumento2 pagineBMT6135 - Security-Analysis-And-Portfolio-Management - TH - 1.0 - 55 - BMT6135 - 54 AcpM AnuradhaNessuna valutazione finora

- JJKDocumento5 pagineJJKEmiraslan MhrrovNessuna valutazione finora

- THREE-5540-Investment and Securities ManagementDocumento7 pagineTHREE-5540-Investment and Securities ManagementNabeel IftikharNessuna valutazione finora

- BF SyllabusDocumento6 pagineBF Syllabusnghiep tranNessuna valutazione finora

- PAM Outlines 07012021 042154pmDocumento7 paginePAM Outlines 07012021 042154pmzainabNessuna valutazione finora

- Mqasyllabus-Bwfn 3013 1 - For Student 2aDocumento4 pagineMqasyllabus-Bwfn 3013 1 - For Student 2atrevorsum123Nessuna valutazione finora

- Ba7021 Security Analysis and Portfolio Management 1Documento113 pagineBa7021 Security Analysis and Portfolio Management 12203037Nessuna valutazione finora

- Intro to Investments & Stock TradingDocumento2 pagineIntro to Investments & Stock TradingMr. Sharath Harady BBA - IADCANessuna valutazione finora

- Build an Ideal MF PortfolioDocumento46 pagineBuild an Ideal MF PortfolioNitesh MadhaviNessuna valutazione finora

- M19MC3250 - Sapm UNIT 2 - 00365Documento60 pagineM19MC3250 - Sapm UNIT 2 - 00365ashishNessuna valutazione finora

- Financial Markets Course OutlineDocumento2 pagineFinancial Markets Course OutlineDawit NegashNessuna valutazione finora

- Investment ManagementDocumento3 pagineInvestment Management29_ramesh170Nessuna valutazione finora

- School of Business & Economics Department of Accounting & FinanceDocumento4 pagineSchool of Business & Economics Department of Accounting & FinanceMd JonaidNessuna valutazione finora

- Part A: Content Design: Birla Institute of Technology & Science, Pilani Work Integrated Learning Programmes DigitalDocumento12 paginePart A: Content Design: Birla Institute of Technology & Science, Pilani Work Integrated Learning Programmes DigitalSivasankar ANessuna valutazione finora

- Directorate of Distance EducationDocumento400 pagineDirectorate of Distance EducationShalini.RNessuna valutazione finora

- Program Course 3Documento2 pagineProgram Course 3Naren SamyNessuna valutazione finora

- Course Outline Financial Markets & InstitutionsDocumento6 pagineCourse Outline Financial Markets & Institutionskonica chhotwaniNessuna valutazione finora

- Investment Analysis and Portfolio Management: Pre-Requisite: None Course ObjectivesDocumento3 pagineInvestment Analysis and Portfolio Management: Pre-Requisite: None Course ObjectivesAmit SrivastavaNessuna valutazione finora

- Sip Report (Final)Documento51 pagineSip Report (Final)anzalan arshiNessuna valutazione finora

- Management Management Management ManagementDocumento94 pagineManagement Management Management Managementalizah khadarooNessuna valutazione finora

- Sapm SyllbusDocumento2 pagineSapm SyllbusAaditya JhaNessuna valutazione finora

- Investment Analysis and Portfolio ManagementDocumento237 pagineInvestment Analysis and Portfolio ManagementKannan RNessuna valutazione finora

- Blackbook - BFM ProjectDocumento65 pagineBlackbook - BFM ProjectSheldon DsouzaNessuna valutazione finora

- FIN301 Outline FinalDocumento13 pagineFIN301 Outline FinalArsalan AqeeqNessuna valutazione finora

- FI Course OutlineDocumento2 pagineFI Course Outlinetamiratg24Nessuna valutazione finora

- 5540-Investment & Securities ManagementDocumento8 pagine5540-Investment & Securities ManagementMariam LatifNessuna valutazione finora

- BMA5309 - Fund Management PDFDocumento2 pagineBMA5309 - Fund Management PDFNikhilNessuna valutazione finora

- Investment Management TLPDocumento5 pagineInvestment Management TLPGayathri VijayakumarNessuna valutazione finora

- Investment and Portfolio Management MGT531 Module Handbook: Department of Management SciencesDocumento5 pagineInvestment and Portfolio Management MGT531 Module Handbook: Department of Management SciencesMeenaRajpootNessuna valutazione finora

- Dr Gupta's Faculty Security Portfolio Evaluation CourseDocumento6 pagineDr Gupta's Faculty Security Portfolio Evaluation CourseYeshwanth BabuNessuna valutazione finora

- Investment & Portfolio Mgt. SyllabusDocumento7 pagineInvestment & Portfolio Mgt. SyllabusEmi YunzalNessuna valutazione finora

- MC-4 2Documento129 pagineMC-4 2Sukanya Shridhar 1 9 9 0 3 5Nessuna valutazione finora

- MF0010Documento308 pagineMF0010Abdul Lateef KhanNessuna valutazione finora

- Wealth Global Navigating the International Financial MarketsDa EverandWealth Global Navigating the International Financial MarketsNessuna valutazione finora

- Assignment - Evening StudentsDocumento3 pagineAssignment - Evening StudentsBimal KrishnaNessuna valutazione finora

- Vedic Mathematics Techniques MultiplicationDocumento13 pagineVedic Mathematics Techniques MultiplicationBimal Krishna100% (1)

- The Lean Mass DietDocumento92 pagineThe Lean Mass Dietmortless83% (6)

- EOI Supply Goods ServicesDocumento1 paginaEOI Supply Goods ServicesBimal KrishnaNessuna valutazione finora

- Tels Policy FinalDocumento14 pagineTels Policy FinalBimal KrishnaNessuna valutazione finora

- t1 2014 Units OfferredDocumento9 paginet1 2014 Units OfferredBimal KrishnaNessuna valutazione finora

- Tutorial 1Documento1 paginaTutorial 1Bimal KrishnaNessuna valutazione finora

- Cash Flow Statement - Indirect MethodDocumento5 pagineCash Flow Statement - Indirect MethodBimal KrishnaNessuna valutazione finora

- AF304 Introduction and AssignmentsDocumento49 pagineAF304 Introduction and AssignmentsBimal Krishna0% (1)

- Weekly Meal Planner: Breakfast Snack 1 Lunch Snack 2 Dinner Snack 3Documento1 paginaWeekly Meal Planner: Breakfast Snack 1 Lunch Snack 2 Dinner Snack 3Bimal KrishnaNessuna valutazione finora

- 403 Producer TheoryDocumento63 pagine403 Producer TheorylaotuNessuna valutazione finora

- International Economics Theory and Policy 10th Edition Krugman Test BankDocumento26 pagineInternational Economics Theory and Policy 10th Edition Krugman Test BankMatthewRosarioksdf100% (51)

- Traders CodeDocumento7 pagineTraders CodeHarshal Kumar ShahNessuna valutazione finora

- Practical Project Execution Alloy Wheels Manufacturing PlantDocumento5 paginePractical Project Execution Alloy Wheels Manufacturing PlantSanjay KumarNessuna valutazione finora

- Major types of Retail Lending and Consumer Credit AnalysisDocumento12 pagineMajor types of Retail Lending and Consumer Credit AnalysisGooby PlsNessuna valutazione finora

- CFAP SYLLABUS SUMMER 2023Documento31 pagineCFAP SYLLABUS SUMMER 2023shajar-abbasNessuna valutazione finora

- Books On Africa and Related Issues Published by The UNU: Library@hq - Unu.eduDocumento29 pagineBooks On Africa and Related Issues Published by The UNU: Library@hq - Unu.eduPawar SachinNessuna valutazione finora

- 420jjpb2wmtfx0 PDFDocumento19 pagine420jjpb2wmtfx0 PDFDaudSutrisnoNessuna valutazione finora

- Chapter 7Documento42 pagineChapter 7Apef Yok100% (1)

- ANNUAL Report Sardar Chemical 2014Documento44 pagineANNUAL Report Sardar Chemical 2014Shabana KhanNessuna valutazione finora

- Direct and indirect manufacturing costsDocumento11 pagineDirect and indirect manufacturing costsAhmad HafidzNessuna valutazione finora

- How To Win The BSGDocumento29 pagineHow To Win The BSGβασιλης παυλος αρακας100% (1)

- FNCE 101: DR Chiraphol New Chiyachantana Problem Set # 6 (Chapter 14)Documento2 pagineFNCE 101: DR Chiraphol New Chiyachantana Problem Set # 6 (Chapter 14)Vicky HongNessuna valutazione finora

- Market SegmentationDocumento21 pagineMarket SegmentationMian Mujeeb RehmanNessuna valutazione finora

- Columbus Custom Carpentry HR IssuesDocumento5 pagineColumbus Custom Carpentry HR IssuesWendy Aden SaputraNessuna valutazione finora

- Accounting Cycle Work SheetDocumento32 pagineAccounting Cycle Work SheetAbinash MishraNessuna valutazione finora

- Experienced Sales and Marketing Professional Seeking New OpportunitiesDocumento2 pagineExperienced Sales and Marketing Professional Seeking New OpportunitiesAshwini KumarNessuna valutazione finora

- Business CrosswordDocumento1 paginaBusiness CrosswordJHON PAEZNessuna valutazione finora

- Faq C855 PDFDocumento6 pagineFaq C855 PDFKaren TacadenaNessuna valutazione finora

- Definition of 'Multinational Corporation - MNC'Documento1 paginaDefinition of 'Multinational Corporation - MNC'runaap9_307684415Nessuna valutazione finora

- Trade Journal - DitariDocumento43 pagineTrade Journal - DitariNexhat RamadaniNessuna valutazione finora

- Chapter-1 (NP)Documento28 pagineChapter-1 (NP)Prachiti PatilNessuna valutazione finora

- NoitesDocumento4 pagineNoitesEdwinJugadoNessuna valutazione finora

- Measuring Effectiveness of Airtel's CRM StrategyDocumento82 pagineMeasuring Effectiveness of Airtel's CRM StrategyChandini SehgalNessuna valutazione finora

- Deutsche BrauereiDocumento24 pagineDeutsche Brauereiapi-371968780% (5)

- Strama Paper FinalDocumento31 pagineStrama Paper FinalLauren Refugio50% (4)

- Retail Technology Management: Presented by Kumar Gaurav Harshit KumarDocumento19 pagineRetail Technology Management: Presented by Kumar Gaurav Harshit KumarKumar GauravNessuna valutazione finora

- Change in Demand and Supply Due To Factors Other Than PriceDocumento4 pagineChange in Demand and Supply Due To Factors Other Than PriceRakesh YadavNessuna valutazione finora

- Porsche Changes TackDocumento8 paginePorsche Changes TackMahendra Singh DhoniNessuna valutazione finora

- Question Bank1Documento357 pagineQuestion Bank1xerxesNessuna valutazione finora

- International Macroeconomics 4th Edition Feenstra Test BankDocumento100 pagineInternational Macroeconomics 4th Edition Feenstra Test BankGabriel Hill100% (28)