Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Why Have We Seen A Slowdown in Ipos and What Could Drive An Increase?

Caricato da

CrowdfundInsiderTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Why Have We Seen A Slowdown in Ipos and What Could Drive An Increase?

Caricato da

CrowdfundInsiderCopyright:

Formati disponibili

WHY HAVE WE SEEN A SLOWDOWN IN IPOS AND WHAT COULD

DRIVE AN INCREASE?

May 10, 2017

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE, SIPC

The Number of Public Companies Has Declined by Close to 50%

Number of Public Companies

9,000

8,090

7,905

8,000

7,487 7,499

7,229

6,917

7,000

6,177

6,000 5,685

5,295 5,226

5,145 5,133 5,109

5,000 4,666

4,401 4,369 4,381 4,331

4,279 4,171

4,102 4,180

4,000

3,000

2,000

1,000

-

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Source: World Bank.

Note: Includes SEC registered companies on a U.S. public exchange.

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE, SIPC 2

IPO Trends

Number of IPOs

900

812

800

700

The number of IPOs 597

600 553

has declined 534

materially from their 500

429

pace prior to 2000 400

377

281

300 244

209 208 221 219

200 163 155

130 136

92 86 83 99

100 63 48

34

0

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

IPOs Less Than $100 Million Market Cap as a % of Total IPOs

60.0%

52.1%

49.1%

50.0% 46.1%

40.0% 35.8%

Small cap has

become a smaller 30.0%

percentage of total

IPOs 20.0%

14.1% 15.1%

12.4% 12.4% 13.3%

10.6% 11.8% 11.0%

9.6% 9.0% 9.8%

10.0% 6.2% 7.3% 8.2%

5.8% 5.9% 4.8% 4.4%

2.1%

0.0%

Source: Dealogic. 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Note: Includes SEC registered IPOs. Excludes BCCs, SPACs and closed end funds.

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE, SIPC 3

Factors to Consider

Rise of private equity

Regulatory environment

The JOBS Act has been a homerun for emerging growth company IPOs

Stifling regulatory environment

Expense burden of being public

Costs / requirements of being a public company

Time to liquidity

Market risks

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE, SIPC 4

What is Needed for a Favorable IPO Market?

A healthy IPO market requires a confluence of:

Favorable Market Trends and Valuation Levels

Favorable Regulatory Environment

Post Deal Sponsorship

Getting public is half the battle

Research support is essential to provide information flow to investors

Trading support is essential to provide liquidity to investors, particularly for illiquid small cap companies

As of 2012, nearly 29% of exchange listed companies had no meaningful research coverage

This is most concentrated in sub $250 million market cap companies, where the lack of coverage is

north of 50%

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE, SIPC 5

Issues to Consider to Make Public Markets More Attractive

JOBS Act

Major positive for emerging growth companies

Limited evidence to support that Regulation A offerings are gaining traction

Based on our findings, there have been 171 Regulation A offerings filed(1)

Based on our findings, companies that have raised public capital through a Regulation A offering have not

developed a robust trading market for their stocks on U.S. public exchanges

Sponsorship post deal Essential to the success of an IPO

Role of sell side research continues to be eroded

More junior talent

Restricted roles on underwritings

More short term focus

Regulations (current/pending) are damaging the model for the firms that focus on small/mid cap companies

Glass-Steagall

Decimalization

Global settlement

Tying

Desk commentary

MiFID

Regulatory burden is impeding information flow

(1) Source: Morrison I Foerster. Data through December 2016.

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE, SIPC 6

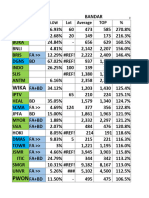

Regulation A Company Example

Reg A Company Comp Group(1)

2016 This Company completed a Ticker --- ---

$17.0 million capital raise

through a Regulation A Pricing Date --- ---

$17 Million offering

Offer Price $12.00 $15.00

The Companys shares

Market Cap

launched and began to 270.8 255.5

($mm)

trade on a public

exchange

Offering Method Regulation A Traditional IPO

A search of Regulation A

companies discloses this

Regulation A % Change Price

(47.9%) 24.8%

Company as one of the Offer / Current

Offering most successful in

developing an active Research NA 5

trading market for its stock

in U.S. public markets ADTV Since

6,899.7 106,628.2

Pricing

Price Performance Since Offering

450.0% Reg A S&P 500 Dow Jones NASDAQ

(47.9%) 25.1% 28.2% 35.5%

350.0%

250.0%

150.0%

50.0%

(50.0%)

(150.0%)

2/19/2016 4/19/2016 6/19/2016 8/19/2016 10/19/2016 12/19/2016 2/19/2017 4/19/2017

Source: FactSet.

Note: Price performance as of 5/8/17.

(1) Includes the median of 35 U.S. companies that completed an IPO since 2015 with a market cap between $200 million and $350 million.

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE, SIPC 7

Key Takeaways

The mission of the SEC is to protect investors, maintain fair, orderly and efficient markets and facilitate capital formation

Suggested areas of focus:

Protect Investors

Decline of equity research platforms and lack of small cap coverage is not a positive for investors or small/mid cap IPOs

Fair, Orderly & Efficient Markets

Tying is rampant which, is illegal and anti-competitive

Larger lenders continue to gain share at the expense of firms that are dedicated to small and mid cap companies

Continued concentration of market share in the allocation of capital will ultimately limit the ability of smaller investors to

participate

Capital Formation

JOBS Act has been great

Unsure Regulation A will create successful public companies

Continued efficiency and cost improvements are needed

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE, SIPC 8

Disclaimer

The foregoing material was prepared for informative purposes only and is not an offer to buy or sell any securities. The foregoing material is not

intended to recommend the purchase or sale of any securities or to provide information on which an investment decision to purchase or sell any

securities could be based. Information contained in the material was obtained or derived from sources considered reliable, but has not been

independently confirmed or verified. The foregoing material does not purport to contain all of the information that may be required to evaluate all

of the factors that would be relevant to any person considering entering into a transaction, and no representation is made that the information is

accurate or complete. Any person considering entering into a transaction should conduct its own investigation and analysis and should consult

such persons own professional advisors. Stephens and its directors, officers, employees, affiliates and representatives expressly disclaim any and all

liability based, in whole or in part, on any such information, errors therein or omissions therefrom. Stephens is not a legal advisor, accounting advisor

or tax advisor. Nothing in the foregoing material is intended, or should be construed, as legal, accounting, regulatory or tax advice. Any discussion

of tax attributes is provided for informational purposes only, and each recipient should consult such recipients own tax advisors regarding any and

all tax implications or tax consequences of any investment or any other transaction or course of action.

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE, SIPC 9

Potrebbero piacerti anche

- E 00175Documento114 pagineE 00175Lieven VermeulenNessuna valutazione finora

- MS EID CWJ Report Week 10Documento8 pagineMS EID CWJ Report Week 10abahaangNessuna valutazione finora

- GMA Network Inc.: A Presentation of The FinancialsDocumento14 pagineGMA Network Inc.: A Presentation of The FinancialsZed LadjaNessuna valutazione finora

- National Road Safety Commission - BILANDocumento24 pagineNational Road Safety Commission - BILANLe mauricienNessuna valutazione finora

- Foodservice Per Channel Performance - Q1Documento18 pagineFoodservice Per Channel Performance - Q1Virtus KenoiNessuna valutazione finora

- Teuer Furniture - Student Supplementary SheetDocumento20 pagineTeuer Furniture - Student Supplementary Sheetsergio songuiNessuna valutazione finora

- Budget Format V5 31-1-2017 DELDocumento99 pagineBudget Format V5 31-1-2017 DELravindranath_kcNessuna valutazione finora

- H1 FY09 Investor PresentationDocumento34 pagineH1 FY09 Investor PresentationansariakhterNessuna valutazione finora

- Teuer Furniture Students ExcelDocumento19 pagineTeuer Furniture Students ExcelAlfonsoNessuna valutazione finora

- Credit Risk - Default ProbabilityDocumento6 pagineCredit Risk - Default Probabilitymichael odiemboNessuna valutazione finora

- Flow Valuation, Case #KEL778Documento31 pagineFlow Valuation, Case #KEL778javaid jamshaidNessuna valutazione finora

- Case 1: Less: Reinvestment at 20%Documento4 pagineCase 1: Less: Reinvestment at 20%Vinay JajuNessuna valutazione finora

- Mayank BS Assignment01Documento30 pagineMayank BS Assignment01jamesNessuna valutazione finora

- Comparision SheetDocumento3 pagineComparision SheetGourav SharmaNessuna valutazione finora

- Company Name Company Name Ssi Fabricated IFC Connection Size Dimensions MM Connection Size Dimensions in MM Inlet Outlet A B C Inlet Outlet ADocumento3 pagineCompany Name Company Name Ssi Fabricated IFC Connection Size Dimensions MM Connection Size Dimensions in MM Inlet Outlet A B C Inlet Outlet AGourav SharmaNessuna valutazione finora

- BNCM - JM L UhlnygkfDocumento28 pagineBNCM - JM L UhlnygkfReckon IndepthNessuna valutazione finora

- FB Earnings Presentation Q1 2021Documento24 pagineFB Earnings Presentation Q1 2021ZerohedgeNessuna valutazione finora

- Historical TrendsDocumento15 pagineHistorical TrendsHaseebAshfaqNessuna valutazione finora

- Jindal Star Price List 16-08-22Documento1 paginaJindal Star Price List 16-08-22Pradeep SharmaNessuna valutazione finora

- 2022 General Conference Session Statistical ReportDocumento10 pagine2022 General Conference Session Statistical ReportJonathanpc2216Nessuna valutazione finora

- Book 1Documento5 pagineBook 1vineet_verma_11Nessuna valutazione finora

- Cikarang Listrindo Web Presentation FY2015Documento10 pagineCikarang Listrindo Web Presentation FY2015Eka HimawanNessuna valutazione finora

- M-Pesa Tariffs - May 2021Documento1 paginaM-Pesa Tariffs - May 2021david karasilaNessuna valutazione finora

- FisDes ReviewerDocumento23 pagineFisDes ReviewerSharon CarilloNessuna valutazione finora

- Flow Valuation, Case #KEL778Documento20 pagineFlow Valuation, Case #KEL778SreeHarshaKazaNessuna valutazione finora

- Nothing To See Pls QiiuteDocumento3 pagineNothing To See Pls QiiuteJingle BellNessuna valutazione finora

- Variable: Ipc (2005-2018)Documento4 pagineVariable: Ipc (2005-2018)gan dhiNessuna valutazione finora

- MDKA SucorDocumento6 pagineMDKA SucorFathan MujibNessuna valutazione finora

- The Companies Act, 2017 (Section 227 (2) (F) ) Pattern of Shareholding Balochistan Glass Limited 30-06-2019Documento3 pagineThe Companies Act, 2017 (Section 227 (2) (F) ) Pattern of Shareholding Balochistan Glass Limited 30-06-2019Khalid MahmoodNessuna valutazione finora

- New - Customer Tariff New2 - (F)Documento1 paginaNew - Customer Tariff New2 - (F)Collins MghaseNessuna valutazione finora

- Annual Report - 2012Documento284 pagineAnnual Report - 2012Elena LópezNessuna valutazione finora

- SMSM 1H2019 IR PresentationDocumento26 pagineSMSM 1H2019 IR PresentationLidianaNessuna valutazione finora

- Rumus SahamDocumento41 pagineRumus SahamONYNessuna valutazione finora

- Xls307 Xls EngDocumento13 pagineXls307 Xls EngvhgomezrNessuna valutazione finora

- Josephine J. Francisco: PhilippinesDocumento48 pagineJosephine J. Francisco: PhilippinesLloyd DiazNessuna valutazione finora

- Pipe+06 02 23Documento1 paginaPipe+06 02 23AmanNessuna valutazione finora

- Final Project: Submitted ToDocumento15 pagineFinal Project: Submitted Toaadil saeedNessuna valutazione finora

- Analysis of Financial Statement: Khurram Mansoor Muhammad Noman Shaf Mubasher RehmanDocumento31 pagineAnalysis of Financial Statement: Khurram Mansoor Muhammad Noman Shaf Mubasher RehmanNandakumarDuraisamyNessuna valutazione finora

- Year GDP at Market Prices (Rs Million)Documento4 pagineYear GDP at Market Prices (Rs Million)S Priya MohurNessuna valutazione finora

- Final Required Pipe DataDocumento4 pagineFinal Required Pipe Datadishant ChaudharyNessuna valutazione finora

- 2023 ADB Asia SME Monitor - PhilippinesDocumento15 pagine2023 ADB Asia SME Monitor - PhilippinesCyrishNessuna valutazione finora

- SolvingDocumento15 pagineSolvingManoo ValievNessuna valutazione finora

- Antropometri Projectti21fDocumento27 pagineAntropometri Projectti21fFalahal MajidNessuna valutazione finora

- Restando Cruzando Al Cero: MatemáticasDocumento3 pagineRestando Cruzando Al Cero: MatemáticasDanielaTroncosoRiveraNessuna valutazione finora

- Perú: Formación Bruta de Capital Fijo Público Y Privado, 1994-2016Documento3 paginePerú: Formación Bruta de Capital Fijo Público Y Privado, 1994-2016Saúl Coari RiosNessuna valutazione finora

- Unit-2 Part 15 Solved Question Deviations Taken From Arithmetic Means of X and YDocumento2 pagineUnit-2 Part 15 Solved Question Deviations Taken From Arithmetic Means of X and YSumit BainNessuna valutazione finora

- Sixty First Annual Report 2012-13Documento131 pagineSixty First Annual Report 2012-13Ishanvi AgarwalNessuna valutazione finora

- Copia de Liquidacion MarzoDocumento2.884 pagineCopia de Liquidacion MarzoErick ViayraNessuna valutazione finora

- ROTODocumento13 pagineROTOmslamh981Nessuna valutazione finora

- Chapter 5 - Forecasting Chapter 5 BEDocumento26 pagineChapter 5 - Forecasting Chapter 5 BEFadhila Nurfida HanifNessuna valutazione finora

- Exide PresentationDocumento17 pagineExide Presentationwasifur1230% (2)

- Principe L'essai de Cisaillement: Deplacment en MMDocumento1 paginaPrincipe L'essai de Cisaillement: Deplacment en MMAmine FachaNessuna valutazione finora

- Jindal+star+price+list+03 10 23Documento1 paginaJindal+star+price+list+03 10 23vsrivastava742gmail comNessuna valutazione finora

- Natasha Kingery CaseDocumento5 pagineNatasha Kingery CaseAlan BublathNessuna valutazione finora

- Relationship Between Hedge Profit and Jet Fuel PriceDocumento4 pagineRelationship Between Hedge Profit and Jet Fuel PriceThomasNessuna valutazione finora

- Jindal+Star+Price+List+08 01 24Documento1 paginaJindal+Star+Price+List+08 01 24marketingabsairtechpvtltd1Nessuna valutazione finora

- Demand Forecasting DataDocumento8 pagineDemand Forecasting Dataanirudh.vyasNessuna valutazione finora

- Bacia de CamposDocumento7 pagineBacia de CampospoisonboxNessuna valutazione finora

- 2020 Queens Awards Enterprise Press BookDocumento126 pagine2020 Queens Awards Enterprise Press BookCrowdfundInsiderNessuna valutazione finora

- UK Cryptoassets Taskforce Final Report Final WebDocumento58 pagineUK Cryptoassets Taskforce Final Report Final WebCrowdfundInsiderNessuna valutazione finora

- Annual Report and Consolidated Financial Statements For The Year Ended 31 March 2018Documento47 pagineAnnual Report and Consolidated Financial Statements For The Year Ended 31 March 2018CrowdfundInsiderNessuna valutazione finora

- House of Commons Treasury Committee Crypto AssetsDocumento53 pagineHouse of Commons Treasury Committee Crypto AssetsCrowdfundInsider100% (1)

- Cooperation Agreement Asic CSSF 4 OctoberDocumento6 pagineCooperation Agreement Asic CSSF 4 OctoberCrowdfundInsiderNessuna valutazione finora

- Monzo Annual Report 2019Documento92 pagineMonzo Annual Report 2019CrowdfundInsider100% (2)

- 2020 Queens Awards Enterprise Press BookDocumento126 pagine2020 Queens Awards Enterprise Press BookCrowdfundInsiderNessuna valutazione finora

- Annual Report and Consolidated Financial Statements For The Year Ended 31 March 2018Documento47 pagineAnnual Report and Consolidated Financial Statements For The Year Ended 31 March 2018CrowdfundInsiderNessuna valutazione finora

- Token Alliance Whitepaper WEB FINALDocumento108 pagineToken Alliance Whitepaper WEB FINALCrowdfundInsiderNessuna valutazione finora

- Bank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34Documento19 pagineBank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34CrowdfundInsiderNessuna valutazione finora

- OCC Fintech Charter Manual: Considering-charter-Applications-fintechDocumento20 pagineOCC Fintech Charter Manual: Considering-charter-Applications-fintechCrowdfundInsiderNessuna valutazione finora

- Crowdcube 2018 Q2 Shareholder Update 2Documento11 pagineCrowdcube 2018 Q2 Shareholder Update 2CrowdfundInsiderNessuna valutazione finora

- A Financial System That Creates Economic Opportunities Nonbank Financi...Documento222 pagineA Financial System That Creates Economic Opportunities Nonbank Financi...CrowdfundInsiderNessuna valutazione finora

- Bitcoin Foundation Letter To Congressman Cleaver 5.1.18Documento7 pagineBitcoin Foundation Letter To Congressman Cleaver 5.1.18CrowdfundInsiderNessuna valutazione finora

- EBA Report On Prudential Risks and Opportunities Arising For Institutions From FintechDocumento56 pagineEBA Report On Prudential Risks and Opportunities Arising For Institutions From FintechCrowdfundInsiderNessuna valutazione finora

- Speech by Dr. Veerathai Santiprabhob Governor of The Bank of Thailand July 2018Documento6 pagineSpeech by Dr. Veerathai Santiprabhob Governor of The Bank of Thailand July 2018CrowdfundInsiderNessuna valutazione finora

- Mueller Indictment of 12 Russian HackersDocumento29 pagineMueller Indictment of 12 Russian HackersShane Vander HartNessuna valutazione finora

- HR 5877 The Main Street Growth ActDocumento10 pagineHR 5877 The Main Street Growth ActCrowdfundInsiderNessuna valutazione finora

- Initial Coin Offerings Report PWC Crypto Valley June 2018Documento11 pagineInitial Coin Offerings Report PWC Crypto Valley June 2018CrowdfundInsiderNessuna valutazione finora

- Let Entrepreneurs Raise Capital Using Finders and Private Placement Brokers by David R. BurtonDocumento6 pagineLet Entrepreneurs Raise Capital Using Finders and Private Placement Brokers by David R. BurtonCrowdfundInsiderNessuna valutazione finora

- AlliedCrowds Cryptocurrency in Emerging Markets DirectoryDocumento20 pagineAlliedCrowds Cryptocurrency in Emerging Markets DirectoryCrowdfundInsiderNessuna valutazione finora

- Virtual Currencies and Central Bans Monetary Policy - Challenges Ahead - European Parliament July 2018Documento33 pagineVirtual Currencies and Central Bans Monetary Policy - Challenges Ahead - European Parliament July 2018CrowdfundInsiderNessuna valutazione finora

- FINRA Regulatory-Notice-18-20 Regarding Digital AssetsDocumento4 pagineFINRA Regulatory-Notice-18-20 Regarding Digital AssetsCrowdfundInsiderNessuna valutazione finora

- Ontario Securities Commissionn Inv Research 20180628 Taking-Caution-ReportDocumento28 pagineOntario Securities Commissionn Inv Research 20180628 Taking-Caution-ReportCrowdfundInsiderNessuna valutazione finora

- Funding Circle Oxford Economics Jobs Impact Report 2018Documento68 pagineFunding Circle Oxford Economics Jobs Impact Report 2018CrowdfundInsiderNessuna valutazione finora

- The OTCQX Advantage - Benefits For International CompaniesDocumento20 pagineThe OTCQX Advantage - Benefits For International CompaniesCrowdfundInsiderNessuna valutazione finora

- Robert Novy Deputy Assistant Director Office of Investigations United States Secret Service Prepared Testimony Before the United States House of Representatives Committee on Financial Services Subcommittee on Terrorism and Illicit FinanceDocumento7 pagineRobert Novy Deputy Assistant Director Office of Investigations United States Secret Service Prepared Testimony Before the United States House of Representatives Committee on Financial Services Subcommittee on Terrorism and Illicit FinanceCrowdfundInsiderNessuna valutazione finora

- Cryptocurrencies and The Economics of Money - Speech by Hyun Song Shin Economic Adviser and Head of Research BISDocumento5 pagineCryptocurrencies and The Economics of Money - Speech by Hyun Song Shin Economic Adviser and Head of Research BISCrowdfundInsiderNessuna valutazione finora

- Testimony On "Oversight of The U.S. Securities and Exchange Commission" by Jay Clayton Chairman, U.S. Securities and Exchange Commission Before The Committee On Financial Services June 21 2018Documento25 pagineTestimony On "Oversight of The U.S. Securities and Exchange Commission" by Jay Clayton Chairman, U.S. Securities and Exchange Commission Before The Committee On Financial Services June 21 2018CrowdfundInsiderNessuna valutazione finora

- Bill - 115 S 2756Documento7 pagineBill - 115 S 2756CrowdfundInsiderNessuna valutazione finora

- VIR - Reform in TelecommunicationsDocumento10 pagineVIR - Reform in TelecommunicationsNgu HoangNessuna valutazione finora

- Undergraduate Course: University of MadrasDocumento137 pagineUndergraduate Course: University of MadrasPrabhakaran ArumugamNessuna valutazione finora

- A Study On Saving Pattern and Investment Opportunities Awareness at Rural LevelDocumento8 pagineA Study On Saving Pattern and Investment Opportunities Awareness at Rural LevelarcherselevatorsNessuna valutazione finora

- GFMP Brochure PDFDocumento16 pagineGFMP Brochure PDFLewyyNessuna valutazione finora

- Investment Banking Course NotesDocumento44 pagineInvestment Banking Course NotesPenn CollinsNessuna valutazione finora

- Understanding Client Situation & Asset AllocationDocumento20 pagineUnderstanding Client Situation & Asset AllocationAbhijeet PatilNessuna valutazione finora

- Fundamental and Technical Analysis of Sharesof Automobile Industry - A Case StudyDocumento6 pagineFundamental and Technical Analysis of Sharesof Automobile Industry - A Case StudyappachuNessuna valutazione finora

- 03 - Litreature Review PDFDocumento17 pagine03 - Litreature Review PDFFathimaNessuna valutazione finora

- Project TopicsDocumento2 pagineProject TopicsDeepa SinghNessuna valutazione finora

- Creating Value Beyond The DealDocumento26 pagineCreating Value Beyond The DealTung NgoNessuna valutazione finora

- Investment in Turkey 2019Documento144 pagineInvestment in Turkey 2019ngwaNessuna valutazione finora

- SC Guidelines On SukukDocumento69 pagineSC Guidelines On SukukTeam JobbersNessuna valutazione finora

- Management Convergence: (An International Journal of Management)Documento13 pagineManagement Convergence: (An International Journal of Management)Dr. Pabitra Kumar MishraNessuna valutazione finora

- Confirmatory Order in The Matter of Mr. Mansoor Rafiq Khanda and Mr. Feroz Rafiq KhandaDocumento6 pagineConfirmatory Order in The Matter of Mr. Mansoor Rafiq Khanda and Mr. Feroz Rafiq KhandaShyam SunderNessuna valutazione finora

- Investment in Associate-HandoutDocumento9 pagineInvestment in Associate-HandoutPhoeza Espinosa VillanuevaNessuna valutazione finora

- US Treasury Report On The Financial System - 10.9Documento19 pagineUS Treasury Report On The Financial System - 10.9tabbforum100% (1)

- Preliminary ProspectusDocumento229 paginePreliminary ProspectusSteve LadurantayeNessuna valutazione finora

- Arthigamya E-Brochure PDFDocumento12 pagineArthigamya E-Brochure PDFAbhinav AnandNessuna valutazione finora

- Masterplan 30.10.2018Documento30 pagineMasterplan 30.10.2018Raihan WorldwideNessuna valutazione finora

- JLL Proptech Report 2017Documento39 pagineJLL Proptech Report 2017vpsrpuchNessuna valutazione finora

- Pitchbook 2020 Private Equity OutlookDocumento15 paginePitchbook 2020 Private Equity Outlookmichael zNessuna valutazione finora

- Aviva Hy2021 Analyst PackDocumento119 pagineAviva Hy2021 Analyst PackIan McConnochieNessuna valutazione finora

- What's Your Investing IQDocumento256 pagineWhat's Your Investing IQAmir O. OshoNessuna valutazione finora

- Aehi Stock DocumentDocumento6 pagineAehi Stock Documentfng0312Nessuna valutazione finora

- Anchoring Effect Affect The Decision Making On Stock Market: Jialin Guo, Yuhan Wang, Ruohan XueDocumento7 pagineAnchoring Effect Affect The Decision Making On Stock Market: Jialin Guo, Yuhan Wang, Ruohan XueyiyangNessuna valutazione finora

- Merchant BankingDocumento25 pagineMerchant BankingLMT indiaNessuna valutazione finora

- Press Release Leox Holding 120202Documento2 paginePress Release Leox Holding 120202Torsten2012Nessuna valutazione finora

- The Change of Harm or Loss (PROBLEMA) Na Pwedeng Mangyayari Sa Business MoDocumento6 pagineThe Change of Harm or Loss (PROBLEMA) Na Pwedeng Mangyayari Sa Business MoAii Lyssa UNessuna valutazione finora

- Investment in Associate Module 5 Part CDocumento8 pagineInvestment in Associate Module 5 Part CmmNessuna valutazione finora

- Dabur Marketing Strategy of Dabur Vatika Hair Oil & Dabur CHDocumento58 pagineDabur Marketing Strategy of Dabur Vatika Hair Oil & Dabur CHNitin Solanki100% (1)