Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

How To Boost Trading Profits

Caricato da

thava477cegTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

How To Boost Trading Profits

Caricato da

thava477cegCopyright:

Formati disponibili

How to Boost Trading Profits In Four Easy Steps 1

How to Boost Trading Profits

In Four Easy Steps

Hi, I am Apurva Sheth.

I would like to congratulate you for taking the first step to boosting your trading

profits.

I am confident that reading this report (worth Rs 950) is going to be an extremely

knowledgeable and profitable experience for you.

I have written this report keeping the busy professional/businessman in mind. I want

to keep this report short, simple, and free of jargon.

I have linked the technical concepts and principles to my past articles. Feel free to

click on them and read those articles wherever necessary. Those who know the basic

concepts can simply read through this report in one go.

Over the course of this report, you will learn one simple and proven strategy to boost

your trading profits substantially. This strategy has the potential to multiply ones

profits not one or two but up to four and five times within month.

Yes! You read that right. The strategy could potentially boost ones trading profits four

to five times and that too in just four simple steps.

Now I dont want to keep you waiting anymore. So without further ado, lets get going!

2 How to Boost Trading Profits In Four Easy Steps

I am sure youve heard that the trend is your friend or that you should trade with the

trend many times from technical analysts and traders. Thats because its good

advice. Most money is made when markets are trending. And to benefit from the

trend, you have to trade in its direction.

But thats only one side of the coin. Markets do not trend all the time. They move up

and down quickly, and a large part of the time is spent sideways, consolidating the

gains or losses. There are times when the markets or stocks simply do nothing and

trade choppily in a very tight range, giving no indication at all of the trend.

Thats why it is said that whenever you spot a trend you should befriend it and trade

with it. But the catch is trends do not last forever. The trend is your friend only until the

end.

And thats when you have to step aside from the herd. If you dont, youll be

butchered in the slaughterhouse. This is where most people get it wrong.

They think that a stock in an uptrend will continue moving higher and ones in a

downtrend will continue to move lower forever. This is a big mistake.

Price moves in a cyclical fashion. It rises, falls, and then rises again. Theres a reason

Benjamin Graham quoted Horace on the first page of his magnum opus, Security

Analysis

Many shall be restored that are now fallen and many shall fall that now are in honor.

Stocks move up and down in predictable cycles. It pays off very well if you can

identify turns in these cycles. You need to be a contrarian to do that.

A lot of people think contrarian trading is simply doing the opposite of what the

majority is doing. You cant make money if you do this all the time.

You have to be a contrarian only when the trend is nearing exhaustion and about to

reverse. Let me warn you beforehand: Contrarian trading isnt for everyone. It requires

nerves of steel to go against the majority. And you need to have a proper method and

the conviction and discipline to follow it fully.

How to Boost Trading Profits In Four Easy Steps 3

But if you can do it, then it can be very rewarding as you will enter the trend before

anyone else does and can potentially ride it all the way up till it peaks.

Dont worry! I will share with you a strategy I have used successfully over the years.

But before I tell you about it, lets focus on momentum.

What is momentum?

Momentum refers to the velocity of a price trend. Velocity is speed in a given

direction. Speed describes only how fast an object is moving, whereas velocity gives

both the speed and direction of the objects motion. Traders use various indicators

that help them measure the speed and direction of a security. These indicators help

them make their trading decisions.

The RSI or Relative Strength Index is one such indicator. It is used extensively by

traders. It shows how strongly a stock is moving in its current direction. The RSI does

this by comparing the magnitude of recent gains to recent losses, generally over the

last 14 days.

The RSI oscillates between zero and 100. A security is considered overbought when

the RSI is above 70. An overbought reading suggests that the stock has run up a lot

and could reverse direction or halt. A security is considered oversold when RSI is

below 30. An oversold reading suggests that the stock has fallen a lot and could

reverse direction or halt.

The RSI is generally plotted in the indicator panel below the price. You may use our

advanced charts tool to plot the RSI on the stock of your choice.

4 How to Boost Trading Profits In Four Easy Steps

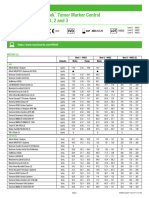

Overbought and Oversold Levels in RSI

Source:- Spider Software

I have plotted the 14-day RSI in green in the indicator panel in the above chart. Under

normal course of trading, the RSI oscillates between 30 and 70 and occasionally

exceeds to 20 and 80. And sometimes the RSI crosses even these levels. Whenever

the RSI dips below 20, you should step aside from the herd and look for contrarian

buying opportunities.

Thats the time when you will get an opportunity to score big. Yes! Thats when you

will find extremely lucrative and profitable trades.

I have spent years in building and refining this strategy. And now I am going to reveal

it all to you in a step by step manner. Its so simple that you will understand it even if

you dont have any trading experience.

How to Boost Trading Profits In Four Easy Steps 5

Boosting Trading Profits

in Four Simple Steps

Booster #1 Grouping

First, select a group of stocks you want to trade. Some traders prefer to trade

only Nifty 50 stocks while others are open to trading a bigger universe and opt

for a bigger group such as CNX 500 or BSE 500. I follow strict volume-based

criteria to define our universe of stocks before recommending them to our

subscribers. You can select stocks that have an average daily turnover higher

than Rs 2 crore for the last six months. This is to ensure sufficient liquidity and

depth in stocks.

Booster #2 Sorting

Once we have our group of stocks, I find out their latest RSI values. I use 14 days

as my parameter. I also find out the lowest RSI level in the last one, two, three,

and ten years.

The real work starts once we have the RSI values for all the stocks across

different time frames. Now you can sort stocks in ascending order depending on

their most recent RSI values. We are looking for stocks whose current RSI value

is below 20. These stocks have been beaten down abnormally hard.

Once I have a list of stocks ready, I compare their RSI values across different

timeframes. I compare the current RSI with the lowest RSI value recorded across

multiple time frames. If the current RSI reading is closer to any of these readings,

then the stock is worth looking at. The closer the current RSI is to the previous

lows, the better. In fact, I would go one step ahead and look for stocks hitting a

ten or 20-year low on the RSI. I would keep these stocks in my radar.

6 How to Boost Trading Profits In Four Easy Steps

Booster #3 Filtering

Once I have a broad list ready, I filter stocks based on their chart patterns. I also

consider important support and resistance levels that can come into play and

halt the fall of the stock. Finally, I have a list of a select few stocks I would like to

enter near specific levels.

Stocks often do not move up immediately after the RSI has hit a fresh low.

Instead, they continue to drag lower, but the RSI moves up. The RSI forms a

higher low when the price hits a lower low. This is a diverging signal. Here the

momentum indicator does not conform with price. This is a sign that a reversal

could be coming anytime soon.

Booster #4 Execution

Finally, we can enter our position when everything is in place and the price

action gives an indication of a bottom reversal. We can look for confirmation

from candlesticks on lower time frame to enter the stock with a suitable initial

stoploss. (Trading with a stoploss is an absolute must. A lot of traders have gone

bust trading without a stop.)

Nobody knows for sure how long a trend will last. So the best way to ride the

trend till it peaks is to use a trailing stoploss. You can trail the stoploss higher

once the position moves in your favour. You can also set a trailing stoploss at a

fixed percentage below the most recent high.

For example, if you bought a stock at Rs 100 and it moves up to 150. You can

now keep a trailing stoploss at 135, 10% below 150. If the stock closes below 135,

then you exit. If it continues to move up, then you revise your trailing stoploss

higher. Simple, isnt it?

Revising the stoploss helps you to stay with the stock as long as it remains in an

uptrend. It also protects your profits in case the trend reverses.

How to Boost Trading Profits In Four Easy Steps 7

My Strategy Live in Action

Here are few examples of how to implement this strategy and capture large trends

and bigger profits. Now let me tell you beforehand that I have recommended all the

three stocks listed below to my Swing Trader subscribers.

[Editors Note: Swing Trader is my premium short-term stock recommendation service

where I guide subscribers to the best trading opportunities that could potentially

generate 6%-20% returns in just weeks.]

I have used the RSI extensively to book many short-term gains in the range of 6-20%.

But I believe that with some changes the same strategy can capture larger trends and

bigger profits.

Now heres the first stock in the list - Punjab National Bank. I recommended this stock

to my subscribers in May 2016.

Trade Recommended in PNB

Source:- Spider Software

8 How to Boost Trading Profits In Four Easy Steps

PNB had topped out near 230 in December 2014 and then fell into a vicious

downtrend for the next year and a half. It hit a seven-year low of 69.25 in February

2016.

By April 2016, it managed to bounce back about 30% from those lows, hitting a high

of 92.15. But it failed to sustain at those levels and moved close to the previous lows.

However, the daily RSI diverged sharply from the price. It hit an all-time low of 11.32 in

January 2016, but stayed above 30 levels in May. This was a classic example of a

bullish divergence, which suggested a reversal could be possible immediately. So I

recommended entry at a price of 74 to our subscribers.

Generated Profits of 18.24%

Source:- Spider Software

Our trade went live on 26 May at 74. Our stoploss for this trade was 69, 6.76% below

our entry price. And our initial target was 84, 13.51% above our entry price.

The stock caught momentum on 8 June and ended the session above 80. By then I

had revised our stoploss up to 75.45 and our target to 87.50.

On 14 June, the stock opened gap up and ended the session at 89.90. We closed this

trade at our revised target price of 87.50 for gains of 18.24%.

How to Boost Trading Profits In Four Easy Steps 9

Now 18.24% gains in nineteen days isnt bad at all. But I wasnt happy about it.

And thats because of what happened to the stock after we booked out. The stock

continued to rally even higher and hit a high of 137.85 on 18 July 2016. This was

almost 85% above our entry price of 74.

Does this mean that there was a fault in our process?

Absolutely not.

Our process at Swing Trader is designed to capture short-term swings ranging

anywhere between 6% and 20%. These swings can occur anywhere in an uptrend.

But if you want to boost your trading profits, then you will have to capture big

trends instead of small swings. And the best place to capture big trends is when they

are reversingfrom down to up.

As you know, stocks do not move in one direction for a long time. After a prolonged

downtrend, they consolidate and move up. This is an ideal place to get in a stock for

bigger returns.

Incidentally, we identified PNB just when it was about to reverse from a long-term

downtrend to an uptrend.

We identified the long-term reversal correctly but exited as our target was met. With

the help of RSI, you can identify a reversal easily, but you cant tell how long an

uptrend will last.

So the best way to benefit after identifying a long-term reversal is by using a trailing

stoploss and holding the stock as long as it stays above the trailing stoploss. If the

stoploss is hit, you can exit. If it doesnt, you can ride the whole uptrend.

Now lets use a trailing stoploss of 10% in PNB and see how it changes the equation.

10 How to Boost Trading Profits In Four Easy Steps

Triple Booster to Profits

Source:- Profit Hunter

I have plotted the daily closing price of PNB in blue in the above chart. The line in

orange is a 10% trailing stoploss calculated from the highest closing price. So as the

stock moves up the trailing stoploss moves up along with it.

We have marked an entry in PNB at a price of 74 based on our earlier

recommendation. But instead of holding it with a specific target, we could hold it with

a trailing stoploss of 10%.

This triples the profits from 18.24% to 61.41%. PNB touched a high of 137.85 on 18 July

2016 and closed below the trailing stoploss level of 122 on 22 July 2016.

One should exit the stock the day after it closes below the trailing stoploss level. In

this case, the next trading day was 25 July 2016. The stock opened at 119.45. That

becomes our new exit price, which is 61.41% above the entry price of 74.

Isnt this impressive?

How to Boost Trading Profits In Four Easy Steps 11

Now lets check out another trade I recommended to my Swing Trader subscribers. I

recommended Canara Bank on 28 May 2016, a few days after I recommended PNB.

Trade Recommended in Canara Bank

Source:- Spider Software

The stock hit a high of 217.40 in April 2016. The daily RSI hit an all-time low of 9.90 in

January 2016 and was recovering from those levels. The RSI was consistently forming

higher lows, suggesting improving momentum.

The stock was also forming an ascending triangle pattern on the daily charts. The

daily volumes over the last few days were above average, suggesting demand at

lower levels. Most of the technical parameters signaled a reversal from a medium to

long-term perspective.

The level of 210 to 220 acted as support in 2014. The same level could now act as a

resistance, so waiting for a dip to enter looked like a good strategy. I recommended a

buy at 196 when the CMP was 206.40 on May 31.

12 How to Boost Trading Profits In Four Easy Steps

Generated Profits of 14.8%

Source:- Spider Software

The stock eventually touched 196 two days later on June 2. This trade went live with a

stoploss of I85, which was 5.61% below our entry price, and a target of 240, which

was 22.45% above our entry price.

The stock consolidated for a while initially and picked up momentum gradually. By 7

July, I revised our stoploss to 225 and target to 250.

This trailing stoploss was eventually triggered on 8 July, and this trade was closed at

225 with gains of 14.8%.

I kept a tight trailing stoploss as we were only interested in short-term swings. But

what if we would have kept a wider stoploss of 10% with an aim to ride the larger

trend?

How to Boost Trading Profits In Four Easy Steps 13

Profits Swell Three Times Once Again

Source:- Profit Hunter

Here again I have plotted the daily closing price of Canara Bank in blue and 10%

trailing stoploss level in orange.

We have marked an entry in Canara Bank at a price of 194 based on our signal. But

instead of holding it with a smaller stoploss, we keep a wider stoploss of 10% and trail

it higher as the stock moves up.

A wider trailing stoploss gives breathing space and keeps us in the trend for a longer

time. Minor fluctuations do not affect the long-term trend.

As a result, we get a new exit signal only after the stock closes below the stoploss

level of 302 on 2 November. We mark a new exit at the opening price of 294.25 on 3

November, one day after the trailing stoploss is hit.

This is 50% above our entry price of 196 and more than thrice the profit of 14.8%.

14 How to Boost Trading Profits In Four Easy Steps

Now lets check out one last example.

Trade Recommended in IDFC Bank

Source:- Spider Software

IDFC Bank was a new entity created by its parent IDFC in October 2015. IDFC Bank

listed on the bourses in November 2015. The stock quickly moved from its listing day

high of 68 to a low of 43.10 in January 2016.

Since then the stock was coiling in a large triangular pattern. However, it didnt break

below its previous low of 43.10. This level had acted as support in March and it

seemed like it could again help to the bulls in July.

The daily RSI was strengthening and forming bullish divergence with price. The daily

volumes were also on the higher side, indicating buying interest at lower levels.

Thus, I recommended a buy with an upper limit price of 46.45 and a target of 11.95%

and a stoploss of 5.27% on 4 July 2016.

How to Boost Trading Profits In Four Easy Steps 15

Generated Profits of 11.95%

Source:- Spider Software

Our trade went live on 5 July at 46.45. Our stoploss for this trade was 44 and our

target was 52.

The stock moved up to 48 levels by 11 July. But on 12 July, it took off. The stock was

up more than 12% on that day. It hit a high of 53.90.

Our target of 52 was achieved, so we closed for a handsome profit of 11.95% in just

seven days.

16 How to Boost Trading Profits In Four Easy Steps

Profits Amplified Five Times

Source:- Profit Hunter

Here again, you can see the price in blue and trailing stoploss level in orange. We

mark an entry at the same price of 46.45 in IDFC Bank and hold it with a trailing

stoploss of 10%.

The stock trades on a flattish note for two months after the initial spike in the first

week of July. But it shoots up again like a rocket in September and zooms up to the

stratosphere without any break in between.

The stock hits a high of 83.40 on 29 September for a jump of 40% in the month of

September alone. It traded sideways for the next few weeks and even came in kissing

distance of closing below the stoploss in October but held on above it.

Finally, it closed below the trailing stoploss level of 73 on 4 November. We mark a new

exit from the stock at the opening price of next trading day which is 74.6.

This is whooping 60% from the entry price of 46.45 and nearly five times our profit of

11.95%.

Isnt this a simple yet highly effective way to boost your profits?

If youre nodding in affirmation and excited to use this strategy, please read on before

you go and apply it.

How to Boost Trading Profits In Four Easy Steps 17

Boosting Profits in 2017

Now you have already seen what I have done in the year 2016. My recommendations

have generated returns like

18.24% in 19 days

15.79% in 6 days

11.15% in 10 days

And thats not all. We started 2017 on an excellent note as well. We have generated

returns like

13.29% in 12 days

8.8% in 20 days

10.77% in 4 days

But I am not happy with these returns. There is scope to generate even bigger

returns. I have shown you four simple steps using RSI to boost ones profits. I have

spent years in refining and building this strategy, and now you can use it right away.

But that doesnt mean its all you should look at. If you want to pick stocks that can

boost your profits, you have to pick stocks on the cusp of a long-term reversal.

And that requires a lot of work and knowledge of how the strategy works. Apart from

this you should also have the time and be willing to put in those efforts to generate

this type of returns.

A lot of people may be lacking knowledge or time or even both. If you are amongst

them then you should not worry. I am currently working on something that will help

you with this. I will share the details very soon.

Meanwhile, continue reading the Profit Hunter

Happy Trading.

18 How to Boost Trading Profits In Four Easy Steps

Disclaimer:

Equitymaster Agora Research Private Ltd (Equitymaster) is the owner of the copyright in this Report. The read-

ers are requested to note that this Report is only meant for personal use of the readers of Equitymaster. Any

act of copying, reproducing or distributing this Report whether wholly or in part, for any purpose without the

permission of Equitymaster is strictly prohibited and shall be deemed to be copyright infringement.

This Report is for information purposes and is not providing any professional/investment advice through it and

Equitymaster disclaims warranty of any kind, whether express or implied, as to any matter/content contained

in this Report, including without limitation the implied warranties of merchantability and fitness for a particular

purpose. Information contained in this Report is believed to be reliable but Equitymaster does not warrant its

completeness or accuracy. Equitymaster will not be responsible for any loss or liability incurred by the user as

a consequence of his taking any investment decisions based on the contents of this Report. Use of this Report

is at the users own risk. The user must make his own investment decisions based on his specific investment

objective and financial position and using such independent advisors as he believes necessary.

SEBI (Research Analysts) Regulations 2014, Registration No. INH000000537.

Equitymaster Agora Research Private Limited. 103, Regent Chambers, Above Status Restaurant,

Nariman Point, Mumbai - 400 021. India.

Telephone: +91-22-6143 4055. Fax: 91-22-2202 8550. Email: support@dailyprofithunter.com.

Website: www.dailyprofithunter.com. CIN:U74999MH2007PTC175407

How to Boost Trading Profits In Four Easy Steps 19

Potrebbero piacerti anche

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Da EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Nessuna valutazione finora

- Multiple Time Frame Analysis for Beginner TradersDa EverandMultiple Time Frame Analysis for Beginner TradersValutazione: 1 su 5 stelle1/5 (1)

- Trend Qualification and Trading: Techniques To Identify the Best Trends to TradeDa EverandTrend Qualification and Trading: Techniques To Identify the Best Trends to TradeValutazione: 2 su 5 stelle2/5 (1)

- The Encyclopedia Of Technical Market Indicators, Second EditionDa EverandThe Encyclopedia Of Technical Market Indicators, Second EditionValutazione: 3.5 su 5 stelle3.5/5 (9)

- Profitable Forex Trading Using High and Low Risk Strategies: Book 1, #4Da EverandProfitable Forex Trading Using High and Low Risk Strategies: Book 1, #4Nessuna valutazione finora

- The Empowered Forex Trader: Strategies to Transform Pains into GainsDa EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNessuna valutazione finora

- MACD Histogram StrategyDocumento12 pagineMACD Histogram Strategyscreen1 recordNessuna valutazione finora

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeDa EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNessuna valutazione finora

- How to make money right away as a Beginner Futures TraderDa EverandHow to make money right away as a Beginner Futures TraderNessuna valutazione finora

- Chronicles of a Million Dollar Trader: My Road, Valleys, and Peaks to Final Trading VictoryDa EverandChronicles of a Million Dollar Trader: My Road, Valleys, and Peaks to Final Trading VictoryNessuna valutazione finora

- The MACD Indicator - How To Use The MACD CorrectlyDocumento9 pagineThe MACD Indicator - How To Use The MACD CorrectlyMOHAN SNessuna valutazione finora

- Simple, Exponential, and Weighted Moving AveragesDocumento10 pagineSimple, Exponential, and Weighted Moving Averagesaman jemalNessuna valutazione finora

- Trading With RSI (2) Marke..Documento8 pagineTrading With RSI (2) Marke..pderby1Nessuna valutazione finora

- Trading Regime Analysis: The Probability of VolatilityDa EverandTrading Regime Analysis: The Probability of VolatilityValutazione: 3 su 5 stelle3/5 (1)

- Stock Trading Made Simple: How to Trade on the Stock Market: The Beginner's GuideDa EverandStock Trading Made Simple: How to Trade on the Stock Market: The Beginner's GuideNessuna valutazione finora

- How to Develop a Kill Everyone Trading MentalityDa EverandHow to Develop a Kill Everyone Trading MentalityValutazione: 4 su 5 stelle4/5 (1)

- BB MacdDocumento65 pagineBB MacdAvinash MudaliarNessuna valutazione finora

- The Fat Cat : A Modern Day Forex StrategyDa EverandThe Fat Cat : A Modern Day Forex StrategyNessuna valutazione finora

- Day Trading GuideDocumento27 pagineDay Trading GuideArif Shahir Mohd Asri100% (1)

- WWW Investopedia Com MACD PrimulDocumento10 pagineWWW Investopedia Com MACD PrimulAvram Cosmin GeorgianNessuna valutazione finora

- Advanced Technique #9 (System Selection Technique) - Forex Strategies & Systems RevealedDocumento4 pagineAdvanced Technique #9 (System Selection Technique) - Forex Strategies & Systems RevealedVivek KumarNessuna valutazione finora

- BreakoutDocumento57 pagineBreakoutM Zaid ASNessuna valutazione finora

- Savvy MACD IndicatorDocumento10 pagineSavvy MACD IndicatorCapitanu IulianNessuna valutazione finora

- 6 Best Books On Intraday Trading - Financial Analyst Insider PDFDocumento8 pagine6 Best Books On Intraday Trading - Financial Analyst Insider PDFAbhishek MusaddiNessuna valutazione finora

- The Insider's Guide to Trading: Strategies for ProfitabilityDa EverandThe Insider's Guide to Trading: Strategies for ProfitabilityNessuna valutazione finora

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketDa EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketNessuna valutazione finora

- The Strategic Trade Master: How to win the Global MarketDa EverandThe Strategic Trade Master: How to win the Global MarketNessuna valutazione finora

- Moving Average Convergence/divergenceDocumento5 pagineMoving Average Convergence/divergenceSudershan ThaibaNessuna valutazione finora

- A Practical Guide To Technical Indicators Moving AveragesDocumento9 pagineA Practical Guide To Technical Indicators Moving Averagesfarangeston100% (4)

- Quotex Success Blueprint: The Ultimate Guide to Forex and QuotexDa EverandQuotex Success Blueprint: The Ultimate Guide to Forex and QuotexNessuna valutazione finora

- Moving Average Trading Rules For NASDAQ Composite PDFDocumento13 pagineMoving Average Trading Rules For NASDAQ Composite PDFKatlego MalulekaNessuna valutazione finora

- Trading Summit: A Modern Look to Trading Strategies and MethodsDa EverandTrading Summit: A Modern Look to Trading Strategies and MethodsNessuna valutazione finora

- Intraday Strategy Combining AroonDocumento8 pagineIntraday Strategy Combining AroonRoopesh Kumar Tirupathi100% (1)

- Wouldn't You Like to Know Where the Stock Market is Heading?Da EverandWouldn't You Like to Know Where the Stock Market is Heading?Nessuna valutazione finora

- Simple one-indicator trading method for currency trendsDocumento14 pagineSimple one-indicator trading method for currency trendsfuraitoNessuna valutazione finora

- Trading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsDa EverandTrading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsValutazione: 1 su 5 stelle1/5 (1)

- Tales of the Profitable Trader: The User's Guide To Modern Price Action From Theory To PracticeDa EverandTales of the Profitable Trader: The User's Guide To Modern Price Action From Theory To PracticeNessuna valutazione finora

- BreakOut TradingDocumento16 pagineBreakOut Tradingbigtrader2100% (2)

- Magicbreakout+: Forex Trading StrategyDocumento30 pagineMagicbreakout+: Forex Trading StrategyConstantineNessuna valutazione finora

- 8 Reasons Not To Daytrade Altucher ConfidentialDocumento30 pagine8 Reasons Not To Daytrade Altucher ConfidentialAndre MavroNessuna valutazione finora

- A New Look at Exit Strategies: A Presentation by Charles Lebeau For The Melbourne, Australia - October, 2006Documento33 pagineA New Look at Exit Strategies: A Presentation by Charles Lebeau For The Melbourne, Australia - October, 2006pthomas82Nessuna valutazione finora

- Moneylife 1 September 2016 PDFDocumento68 pagineMoneylife 1 September 2016 PDFthava477ceg0% (1)

- Moneylife 10 November 2016Documento68 pagineMoneylife 10 November 2016thava477cegNessuna valutazione finora

- SEBI committee confirms NSE lapses; Australian law firm to help PACL investors; FD holders' plight continuesDocumento68 pagineSEBI committee confirms NSE lapses; Australian law firm to help PACL investors; FD holders' plight continuesthava477cegNessuna valutazione finora

- Moneylife 28 April 2016Documento68 pagineMoneylife 28 April 2016thava477cegNessuna valutazione finora

- Moneylife 9 June 2016Documento68 pagineMoneylife 9 June 2016thava477cegNessuna valutazione finora

- Moneylife 2 February 2017Documento68 pagineMoneylife 2 February 2017thava477cegNessuna valutazione finora

- Moneylife 4 February 2016Documento68 pagineMoneylife 4 February 2016thava477cegNessuna valutazione finora

- 8 December 2016 MoneylifeDocumento68 pagine8 December 2016 Moneylifethava477cegNessuna valutazione finora

- Equity Derivatives OverviewDocumento22 pagineEquity Derivatives Overviewthava477cegNessuna valutazione finora

- 20 Best Stocks From 30 Equity SchemesDocumento16 pagine20 Best Stocks From 30 Equity Schemesthava477cegNessuna valutazione finora

- Safal Niveshak's Lecture On Value Investing - Goa Institute of ManagementDocumento154 pagineSafal Niveshak's Lecture On Value Investing - Goa Institute of ManagementVishal Safal Niveshak Khandelwal100% (3)

- 1989 Batch Ias OfficersDocumento1 pagina1989 Batch Ias Officersthava477cegNessuna valutazione finora

- GolombDocumento17 pagineGolombthava477cegNessuna valutazione finora

- A Cash Flow Mapping ProcedureDocumento2 pagineA Cash Flow Mapping Procedurethava477cegNessuna valutazione finora

- Peter CarrDocumento29 paginePeter CarrLori GuerraNessuna valutazione finora

- IFC Investment Analyst ProgramDocumento2 pagineIFC Investment Analyst Programthava477cegNessuna valutazione finora

- Indian Foreign Exchange Market - Recent Developments and The Road AheadDocumento13 pagineIndian Foreign Exchange Market - Recent Developments and The Road Aheadthava477cegNessuna valutazione finora

- Lectures On Stochastic Calculus With Applications To FinanceDocumento135 pagineLectures On Stochastic Calculus With Applications To Financethava477cegNessuna valutazione finora

- Hull Chapter 1Documento28 pagineHull Chapter 1thava477cegNessuna valutazione finora

- Brochure MIF 2015 BDDocumento13 pagineBrochure MIF 2015 BDFlorianNessuna valutazione finora

- ValuationDocumento40 pagineValuationTamjid AhsanNessuna valutazione finora

- Monetary Policy Report: September 2014Documento36 pagineMonetary Policy Report: September 2014Network18Nessuna valutazione finora

- Hedge FundsDocumento166 pagineHedge Fundsthava477cegNessuna valutazione finora

- RBI Post Policy Conference Call With Researchers and AnalystsDocumento10 pagineRBI Post Policy Conference Call With Researchers and Analyststhava477cegNessuna valutazione finora

- Advanced Financial Management Test 1 May 2024 Solution 1701932012Documento15 pagineAdvanced Financial Management Test 1 May 2024 Solution 1701932012shauryagupta20013007Nessuna valutazione finora

- 00 r5kl1 g2 CPBJ 2022.stpDocumento4.747 pagine00 r5kl1 g2 CPBJ 2022.stp1573183290Nessuna valutazione finora

- FESCO July BILLDocumento2 pagineFESCO July BILLacademic.kashifNessuna valutazione finora

- VN STEEL INDUSTRY ANALYSISDocumento2 pagineVN STEEL INDUSTRY ANALYSISThanh Nguyen NgocNessuna valutazione finora

- Aditya Birla Sun Life Insurance SecurePlus Plan LeafletDocumento5 pagineAditya Birla Sun Life Insurance SecurePlus Plan LeafletMohanraj GNessuna valutazione finora

- Chapter 9 12Documento91 pagineChapter 9 12Trisha Anne ClataroNessuna valutazione finora

- EC112 Bonus Paper 1Documento2 pagineEC112 Bonus Paper 1BRIAN GODWIN LIMNessuna valutazione finora

- Module 3 - The Marketing EnvironmentDocumento34 pagineModule 3 - The Marketing EnvironmentBùi Thị Thu HồngNessuna valutazione finora

- Busoga's Development Agenda Needs Serious Government AttentionDocumento3 pagineBusoga's Development Agenda Needs Serious Government AttentionWoira MichaelNessuna valutazione finora

- Ricardo Pangan Financial StatementsDocumento4 pagineRicardo Pangan Financial StatementsMAXINE CLAIRE CUTINGNessuna valutazione finora

- Trends 2021 Report RetailDocumento23 pagineTrends 2021 Report Retailmonica ogatNessuna valutazione finora

- Wollo Smart Bus Transportation ServicesDocumento28 pagineWollo Smart Bus Transportation Servicesbruk tadesseNessuna valutazione finora

- Franklin Fan Company Case StudyDocumento6 pagineFranklin Fan Company Case StudyImani ImaniNessuna valutazione finora

- Managing: Jonathan Liebenau MG 305 LSE, 20 OCT 2020Documento36 pagineManaging: Jonathan Liebenau MG 305 LSE, 20 OCT 2020Prakash SinghNessuna valutazione finora

- Valores de Referencia Tumorales Bio RadDocumento3 pagineValores de Referencia Tumorales Bio RadorthincoatzaNessuna valutazione finora

- International Financial Management - Notes MR - MatovuDocumento48 pagineInternational Financial Management - Notes MR - Matovujonas sserumagaNessuna valutazione finora

- StatementOfAccount 50373717340 16072023 154959Documento19 pagineStatementOfAccount 50373717340 16072023 154959Ajay GuptaNessuna valutazione finora

- Comfort Class Transport: Submitted To: Prof. Aravind Panicker Submitted By: Team MobileatyDocumento10 pagineComfort Class Transport: Submitted To: Prof. Aravind Panicker Submitted By: Team MobileatyYash Umang ShahNessuna valutazione finora

- Demand and Law of DemandDocumento19 pagineDemand and Law of DemandAnindya BatabyalNessuna valutazione finora

- Investment PolicyDocumento16 pagineInvestment PolicyNonoNessuna valutazione finora

- Law - Insider - As Indenture Trustee Exchange Administrator and - Filed - 05 05 2020 - Contract PDFDocumento96 pagineLaw - Insider - As Indenture Trustee Exchange Administrator and - Filed - 05 05 2020 - Contract PDFBunny Fontaine100% (2)

- MG321 Mid Semester Test, Semester 2, 2021 InstructionsDocumento5 pagineMG321 Mid Semester Test, Semester 2, 2021 InstructionsSanket PatelNessuna valutazione finora

- SHUBHANGI-TM2120309 Siyaram Silk Mills LimitedDocumento13 pagineSHUBHANGI-TM2120309 Siyaram Silk Mills LimitedShubhangi KesharwaniNessuna valutazione finora

- FMCG Audit Questions For Self EvaluationDocumento11 pagineFMCG Audit Questions For Self EvaluationMoorthy EsakkyNessuna valutazione finora

- Chinese ForeignRelations Power Policy SinceCWDocumento447 pagineChinese ForeignRelations Power Policy SinceCWThanh ThảoNessuna valutazione finora

- Advantages of GlobalizationDocumento8 pagineAdvantages of GlobalizationKen Star100% (1)

- Customer Attitude Research Project LoanDocumento58 pagineCustomer Attitude Research Project LoanPulkit SachdevaNessuna valutazione finora

- Business Organisation ProjectDocumento8 pagineBusiness Organisation ProjectGAME SPOT TAMIZHANNessuna valutazione finora

- Final Income Taxation Module for AEC 004Documento21 pagineFinal Income Taxation Module for AEC 004Van De LeonNessuna valutazione finora

- 2.3.8 Macro RedoDocumento5 pagine2.3.8 Macro Redobuiclara07Nessuna valutazione finora