Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

GE Nine Cell

Caricato da

Vandana SharmaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

GE Nine Cell

Caricato da

Vandana SharmaCopyright:

Formati disponibili

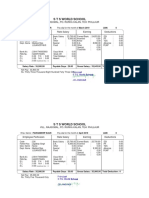

GE NINE CELL MATRIX

Another popular Corporate Portfolio Analysis technique is the result of

pioneering effort of General Electric Company along with McKinsey

Consultants which is known as the GE NINE CELL MATRIX.

GE nine-box matrix is a strategy tool that offers a systematic approach for the

multi business enterprises to prioritize their investments among the various

business units. It is a framework that evaluates business portfolio and

provides further strategic implications.

Each business is appraised in terms of two major dimensions

Market Attractiveness and Business Strength. If one of these

factors is missing, then the business will not produce desired

results. Neither a strong company operating in an unattractive

market, nor a weak company operating in an attractive market

will do very well.2

The vertical axis denotes industry attractiveness, which is a

weighted composite rating based on eight different factors. They

are:

1. Market size and growth rate

2. Industry profit margins

3. Intensity of Competition

4. Seasonality

5. Product Life Cycle Changes

6. Economies of scale

7. Technology

8. Social, Environmental, Legal and Human Impacts

What does the horizontal axis represent?

It indicates business strength or in other words competitive

position, which is again a weighted composite rating based on

seven factors as listed below:

1. Relative market share

2. Profit margins

3. Ability to compete on price and quality

4. Knowledge of customer and market

5. Competitive strength and weakness

6. Technological capability

7. Caliber of management

The two composite values for industry attractiveness and

competitive position are plotted for each strategic business unit

(SBU) in a COMPANYS PORTFOLIO. The PIE chart (circles) denotes

the proportional size of the industry and the dark segments

denote the companys respective market share.

The nine cells of the GE matrix are grouped on the basis of low to

high industry attractiveness, and weak to strong business

strength. Three zones of three cells each are made, indicating

different combinations represented by green, yellow and red

colors. So it is also called Stoplight Strategy Matrix, similar to the

traffic signal.

The green zone suggests you to go ahead, to grow and build,

pushing you through expansion strategies. Businesses in the

green zone attract major investment.

Yellow cautions you to wait and see indicating hold and maintain

type of strategies aimed at stability.

Red indicates that you have to adopt turnover strategies of

divestment and liquidation or rebuilding approach.

This matrix offers some advantages over BCG matrix in that, it

offers intermediate classification of medium and average ratings.

It also integrates a larger variety of strategic variables like the

market share and industry size.

Advantages

Helps to prioritize the limited resources in order to achieve

the best returns.

The performance of products or business units becomes

evident.

Its more sophisticated business portfolio framework than

the BCG matrix.

Determines the strategic steps the company needs to adopt

to improve the performance of its business portfolio.

Disadvantages

Needs a consultant or an expert to determine industrys

attractiveness and business unit strength as accurately as

possible.

It is expensive to conduct.

It doesnt take into account the harmony that could exist

between two or more business units.

Potrebbero piacerti anche

- Nine-Cell Matrix - StarbucksDocumento6 pagineNine-Cell Matrix - StarbucksNexhi Duka0% (1)

- GE MatrixDocumento6 pagineGE MatrixkhumiNessuna valutazione finora

- Case Study of Strategic EvaluationDocumento9 pagineCase Study of Strategic EvaluationFahad chowdhuryNessuna valutazione finora

- Chap3 SMBP KazmiDocumento15 pagineChap3 SMBP KazmiAnkit Verma100% (1)

- Chapter 11 Management Control System and CUP Corporation (Performance Measurement System) Insurance CompanyDocumento3 pagineChapter 11 Management Control System and CUP Corporation (Performance Measurement System) Insurance CompanyDwitya Aribawa100% (1)

- 13.management Accounting and Strategic ManagementDocumento496 pagine13.management Accounting and Strategic ManagementCA Deepak Ehn100% (2)

- Crafting Executing Strategy 19e PDFDocumento24 pagineCrafting Executing Strategy 19e PDFKhad Bakar100% (1)

- General Electric (Ge) Mckinsey & Company Boston Consulting Group (BCG) Portfolio AnalysisDocumento4 pagineGeneral Electric (Ge) Mckinsey & Company Boston Consulting Group (BCG) Portfolio AnalysisMaaryaAslamNessuna valutazione finora

- Volatility Index 75 Macfibonacci Trading PDFDocumento3 pagineVolatility Index 75 Macfibonacci Trading PDFSidibe MoctarNessuna valutazione finora

- GE Nine Cell MatrixDocumento21 pagineGE Nine Cell MatrixMadhuri Bhojwani67% (3)

- 23 - GE Nine Cell MatrixDocumento24 pagine23 - GE Nine Cell Matrixlali62100% (1)

- Note On Public IssueDocumento9 pagineNote On Public IssueKrish KalraNessuna valutazione finora

- Strategic Management - Analysing A Company's Resources and Copetitive PositionDocumento41 pagineStrategic Management - Analysing A Company's Resources and Copetitive PositionMangan88% (16)

- Final PPT Brand ValuationDocumento26 pagineFinal PPT Brand ValuationPradeep Choudhary50% (2)

- Strategic Advantage AnalysisDocumento21 pagineStrategic Advantage Analysisvaishalic100% (1)

- Ba5302 Strategic Management PDFDocumento1 paginaBa5302 Strategic Management PDFAbhinayaa SNessuna valutazione finora

- Presentation On OCP and SAP by Ritul TripathiDocumento30 paginePresentation On OCP and SAP by Ritul TripathiritulNessuna valutazione finora

- Strategic Management PPT by Akshaya KumarDocumento23 pagineStrategic Management PPT by Akshaya KumarAkshaya KumarNessuna valutazione finora

- Synergy and DysergyDocumento2 pagineSynergy and DysergyTitus ClementNessuna valutazione finora

- GE 9 Cell MatrixDocumento10 pagineGE 9 Cell MatrixMr. M. Sandeep Kumar0% (1)

- SAPM I Unit Anna UniversityDocumento28 pagineSAPM I Unit Anna UniversitystandalonembaNessuna valutazione finora

- Hoffers ModelDocumento10 pagineHoffers ModelPradnya SurwadeNessuna valutazione finora

- Chapter 5 - Strategy in ActionDocumento39 pagineChapter 5 - Strategy in ActionKristine Esplana ToraldeNessuna valutazione finora

- Chapter Five Institutionalizing StrategyDocumento75 pagineChapter Five Institutionalizing Strategybutwalservice100% (4)

- Financial Modelling: ObjectivesDocumento4 pagineFinancial Modelling: ObjectivesRohit BajpaiNessuna valutazione finora

- Nature and Significance of Capital Market ClsDocumento20 pagineNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- Mba-Iii-Investment Management Notes PDFDocumento121 pagineMba-Iii-Investment Management Notes PDFNaveen KumarNessuna valutazione finora

- Elements of Sales ManagementDocumento3 pagineElements of Sales ManagementThomas Niconar PalemNessuna valutazione finora

- EPM-Performance Evaluation Parameters For E-CommerceDocumento42 pagineEPM-Performance Evaluation Parameters For E-CommerceKhushali OzaNessuna valutazione finora

- Strategy Analysis and ChoiceDocumento10 pagineStrategy Analysis and ChoiceMichelle EsternonNessuna valutazione finora

- Grand StrategiesDocumento7 pagineGrand StrategiesSeher NazNessuna valutazione finora

- MCQ SFM Question BankDocumento7 pagineMCQ SFM Question BankDK FashionNessuna valutazione finora

- 1 Background To The StudyDocumento3 pagine1 Background To The StudyNagabhushanaNessuna valutazione finora

- BRM Measurement and ScalingDocumento28 pagineBRM Measurement and ScalingFarshan Sulaiman100% (2)

- Chapter - 12: Risk Analysis in Capital BudgetingDocumento28 pagineChapter - 12: Risk Analysis in Capital Budgetingrajat02Nessuna valutazione finora

- A Study On Analysis of Receivable ManagementDocumento16 pagineA Study On Analysis of Receivable ManagementGetsi ShanthiNessuna valutazione finora

- Strategy and Corporate EvolutionDocumento16 pagineStrategy and Corporate EvolutionSandeep Ghatuary100% (8)

- Presentation On Strategy Control and Operational ControlDocumento35 paginePresentation On Strategy Control and Operational ControlShreya VermaNessuna valutazione finora

- Osmania University Guideliness or Research For BbaDocumento17 pagineOsmania University Guideliness or Research For BbaattaullahNessuna valutazione finora

- Lecture Notes 1Documento8 pagineLecture Notes 1Michelle GoNessuna valutazione finora

- aPPLICATION OF Operation ResearchDocumento3 pagineaPPLICATION OF Operation ResearchBrylle James BigorniaNessuna valutazione finora

- Strategic Evaluation and ControlDocumento21 pagineStrategic Evaluation and Controlsehlabakmnsnr92% (12)

- Question Bank Mba Iii Sem FT 301C Strategic Management Unit's Name No. of QuestionsDocumento51 pagineQuestion Bank Mba Iii Sem FT 301C Strategic Management Unit's Name No. of QuestionsTanmay SinhaNessuna valutazione finora

- Basic Concepts of MCSDocumento24 pagineBasic Concepts of MCSamit raningaNessuna valutazione finora

- Eic FrameworkDocumento37 pagineEic FrameworkABSDJIGY0% (1)

- Organizational AppraisalDocumento25 pagineOrganizational AppraisalMotiram paudelNessuna valutazione finora

- Budget Preparation MCSDocumento12 pagineBudget Preparation MCSmukeshkumar910% (1)

- Responsibility CentersDocumento6 pagineResponsibility CentersNitesh Pandita100% (1)

- Economic AnalysisDocumento12 pagineEconomic Analysisthushara2344650Nessuna valutazione finora

- Unit-Iii Fundamental AnalysisDocumento36 pagineUnit-Iii Fundamental Analysisharesh KNessuna valutazione finora

- Mba 4th Sem Syllabus....Documento5 pagineMba 4th Sem Syllabus....MOHAMMED SHEBEER A50% (2)

- Corporate Finance Current Papers of Final Term PDFDocumento35 pagineCorporate Finance Current Papers of Final Term PDFZahid UsmanNessuna valutazione finora

- Role of District Industrial Centers in Entrepreneurship DevelopmentDocumento5 pagineRole of District Industrial Centers in Entrepreneurship DevelopmentPinky KusumaNessuna valutazione finora

- Summary of Chapter 5: Strategies in Action: Long Term ObjectivesDocumento14 pagineSummary of Chapter 5: Strategies in Action: Long Term Objectivesnoor74900Nessuna valutazione finora

- SEBI Guidelines For IPOsDocumento13 pagineSEBI Guidelines For IPOssanketgharatNessuna valutazione finora

- Entrepreneurship Management (BBA 5TH SEM)Documento3 pagineEntrepreneurship Management (BBA 5TH SEM)SHUVA_Msc IB83% (6)

- GE Nine Cell MatrixDocumento1 paginaGE Nine Cell MatrixSunil Kakkar100% (4)

- GE Nine Cell & Strategic EthicsDocumento15 pagineGE Nine Cell & Strategic EthicsPratyay DasNessuna valutazione finora

- NotesDocumento10 pagineNotesvarun rajNessuna valutazione finora

- Unit 4 Notes Strategic ManagementDocumento14 pagineUnit 4 Notes Strategic ManagementPrabhanshu SinghNessuna valutazione finora

- (SBU) of A Corporation. It Analyzes Market Attractiveness and Competitive Strength ToDocumento3 pagine(SBU) of A Corporation. It Analyzes Market Attractiveness and Competitive Strength ToJite PiteNessuna valutazione finora

- Econ001 PDFDocumento3 pagineEcon001 PDFVandana SharmaNessuna valutazione finora

- Exchange Rate System in IndiaDocumento8 pagineExchange Rate System in IndiaVandana SharmaNessuna valutazione finora

- Fast Technological Changes, New Age Creativity, Increased Connectivity, Outsourcing, Offshoring, Supply Chain Management, Vast Digitalisation, LedDocumento1 paginaFast Technological Changes, New Age Creativity, Increased Connectivity, Outsourcing, Offshoring, Supply Chain Management, Vast Digitalisation, LedVandana SharmaNessuna valutazione finora

- ETOPDocumento11 pagineETOPVandana SharmaNessuna valutazione finora

- Organizational Change: © Ramakrishna KongallaDocumento22 pagineOrganizational Change: © Ramakrishna KongallaVandana SharmaNessuna valutazione finora

- Production FunctionDocumento15 pagineProduction FunctionVandana SharmaNessuna valutazione finora

- Important Questions 1 Mark Questions (To Be Answered in 1 Word or 1 Sentence)Documento3 pagineImportant Questions 1 Mark Questions (To Be Answered in 1 Word or 1 Sentence)Vandana SharmaNessuna valutazione finora

- 3.2 Macroeconomic Equilibrium - HandoutDocumento3 pagine3.2 Macroeconomic Equilibrium - Handoutdenny_sitorusNessuna valutazione finora

- Repair ReleaseDocumento1 paginaRepair ReleaseRocketLawyerNessuna valutazione finora

- (CAP 2) Modern-Urban-and-Regional-EconomicsDocumento24 pagine(CAP 2) Modern-Urban-and-Regional-EconomicsMaria Belen Torres DiazNessuna valutazione finora

- Felted Makeup Bag: Buy Yarn and Supplies HereDocumento5 pagineFelted Makeup Bag: Buy Yarn and Supplies HereLangónéBaloghJuditNessuna valutazione finora

- 、Documento2 pagine、jying ngNessuna valutazione finora

- Pneumatic CylinderDocumento34 paginePneumatic Cylinderbishop15972Nessuna valutazione finora

- SA2 G8 Sample Paper MathDocumento5 pagineSA2 G8 Sample Paper MathXkasper GamingNessuna valutazione finora

- Microeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDocumento13 pagineMicroeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDrMichelleHutchinsonwdimp100% (18)

- Effect of Fluctuations in The Value of Philippine Peso in Terms of Cost of ProductionDocumento5 pagineEffect of Fluctuations in The Value of Philippine Peso in Terms of Cost of Productionminerva morilloNessuna valutazione finora

- Teori Akuntansi: (Accounting Theory Construction - Chapter 2)Documento13 pagineTeori Akuntansi: (Accounting Theory Construction - Chapter 2)Sarah Laras WitaNessuna valutazione finora

- Assume The Same Information For The Pacific Boat Company As in Problem 10Documento2 pagineAssume The Same Information For The Pacific Boat Company As in Problem 10Elliot RichardNessuna valutazione finora

- Syllabus-Strategic Behavior-Summer2023 - BlockweekDocumento8 pagineSyllabus-Strategic Behavior-Summer2023 - BlockweekKanishk PatelNessuna valutazione finora

- Agency-List-24 10 19Documento44 pagineAgency-List-24 10 19ankitipsNessuna valutazione finora

- S T S World School: Vill. Rajgomal, Po. Rurka Kalan, Teh: PhillaurDocumento3 pagineS T S World School: Vill. Rajgomal, Po. Rurka Kalan, Teh: Phillaursunny singhNessuna valutazione finora

- 1077 1992 Reff2021Documento6 pagine1077 1992 Reff2021Suman ChatterjeeNessuna valutazione finora

- Foskett V McKeown (2000) # All ER 97Documento34 pagineFoskett V McKeown (2000) # All ER 97AaronAlwynNessuna valutazione finora

- Qmlr-Unit-I: Profit & Loss Example PDFDocumento6 pagineQmlr-Unit-I: Profit & Loss Example PDFAchary BhaswanthNessuna valutazione finora

- IPWEA Asset - Management - Plan - 2014Documento284 pagineIPWEA Asset - Management - Plan - 2014KhairahMukhlisahHertantoNessuna valutazione finora

- Tourism Master PlanDocumento12 pagineTourism Master PlanReymond Bodiao60% (5)

- Marginal Costing NotesDocumento7 pagineMarginal Costing NotesJul 480weshNessuna valutazione finora

- Advantages and Disadvantates of PartnershipDocumento3 pagineAdvantages and Disadvantates of PartnershipMyo Kyaw SwarNessuna valutazione finora

- 05 - Network Design in Supply ChainDocumento21 pagine05 - Network Design in Supply ChainAfnanNessuna valutazione finora

- (In Re: BIR Official Receipt) : Atty. Joecle Reyna DonglaDocumento2 pagine(In Re: BIR Official Receipt) : Atty. Joecle Reyna Donglablack stalkerNessuna valutazione finora

- 3.1 3.3. Volume With Pinbar CandleDocumento5 pagine3.1 3.3. Volume With Pinbar CandleJardel QuefaceNessuna valutazione finora

- Supply of Flanges Full TenderDocumento294 pagineSupply of Flanges Full TenderApna time aayegaNessuna valutazione finora

- GP English 2015 PDFDocumento436 pagineGP English 2015 PDFwolfwbearwNessuna valutazione finora

- Student Data Model - CompleteDocumento8 pagineStudent Data Model - Completemailo castroNessuna valutazione finora

- TC Application Form PatnaDocumento1 paginaTC Application Form Patnashresthnarsaria78Nessuna valutazione finora

- SectionDocumento11 pagineSectionNorhan AlboussilyNessuna valutazione finora