Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Quiz 4 Fin 623

Caricato da

sajidhussain557Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Quiz 4 Fin 623

Caricato da

sajidhussain557Copyright:

Formati disponibili

Quiz #4 fin 623

MC080200627: Muhammad Naveed

Question # 1 of 15 (Start time: 01:31:23 PM)

Mr. Ali is an employee of ABC Co. the company has provided a driver and a gardener to

Mr. Ali. What will be the treatment of their salaries as per Income Tax Ordinance 2001?

The salaried paid to them added in the salary of MR. Ali

The salaried paid to them subtracted in the salary of MR. Ali

Have no relation with salary of Mr. Ali

The Salaried paid are exempted from Tax

Question # 2 of 15 (Start time: 01:32:45 PM)

Which of the following tax is paid in relation to how much you earn?

Income Tax

Inheritance Tax

Value added Tax

Sales Tax

Question # 3 of 15 ( Start time: 01:33:34 PM )

Mr. Afzal would like to compute the tax rate apply on the gratuity received the formula to

compute the tax rate is.

AxB/100

Ax100/B

A/Bx100

100XB/A

Question # 4 of 15 ( Start time: 01:35:03 PM )

Which of the following is the rate of tax for salaried Individuals for tax year 2009, where

the taxable income exceeds Rs. 650,000 but does not exceed Rs. 750,000?

3.50%

4.50%

6.00%

7.50%

Question # 5 of 15 ( Start time: 01:35:51 PM )

Which one of the following is the general definition of tax?

Compulsory contribution of wealth by persons

Optional contribution of wealth by persons

Compulsory contribution of wealth by state

Optional contribution of wealth by state

Question # 6 of 15 ( Start time: 01:36:32 PM )

Miss Sonia’s total taxable income for the year 2009 is Rs. 240,000. Which of the

following is the tax liability of Miss Sonia?

Nil

Rs. 500

Rs. 1,000

Rs. 1,500

Question # 7 of 15 ( Start time: 01:37:05 PM )

Which one of the following is excluded from the definition of capital asset?

A postage stamp

Jewelry

Stock-in-trade

A painting

Question # 8 of 15 ( Start time: 01:38:30 PM )

Gratuity pertaining to government employees received on retirement/ death of the

employee. Which of the following is the tax treatment of gratuity under the Income Tax

Ordinance 2001?

Wholly exempt

Partially exempt

Wholly taxable

None of the given options

Question # 9 of 15 ( Start time: 01:39:43 PM )

In the formula of computing the capital gains, A defines

Cost of the asset

FMV of asset

Consideration received on disposal

None of the given options

Question # 10 of 15 ( Start time: 01:40:29 PM )

A woman taxpayer shall be charged to tax if taxable income is:

Less than Rs. 100,000

Less than Rs. 200,000

More than Rs. 200,000

More than Rs. 240,000

Question # 11 of 15 ( Start time: 01:41:41 PM )

Loss from speculation business can be set off against

Business income

Income earned from resident company

Speculation business income

None of the given options

Question # 12 of 15 ( Start time: 01:42:49 PM )

Mr. X employed in Pakistan earned pension from Pakistan Government but received in

London Rs. 100,000. Which of the following is right for the above scenario?

Mr. X being resident of Pakistan Rs. 100,000 will be added in Gross total income

Mr. X being resident of Pakistan Rs. 100,000 will be subtracted in Gross total income

Mr. X being resident of Pakistan Rs. 100,000 will be added in total income after tax

Mr. X being non-resident of Pakistan Rs. 100,000 will be exempted

Question # 13 of 15 ( Start time: 01:44:12 PM )

Utilities were exempted up to which of the following tax year?

2004

2005

2006

2007

Question # 14 of 15 ( Start time: 01:44:57 PM )

Mr. A is an employee of Government of the Punjab, his data for the year 2009 is given

below. Salary: Rs. 60,000 per month Gratuity: Rs. 1,000,000 Calculate his taxable

income.

774,000

720,000

1,060,000

1,720,000

Question # 15 of 15 ( Start time: 01:46:09 PM )

Mr. A non-resident person employed in UK received Rs. 500,000 as salary. Which of the

following statement true for Mr. A?

Rs. 500,000 will be added in Gross total income being non resident person

Rs. 500,000 will be subtracted from Gross total income being non resident person

Rs. 500,000 will be exempt from tax being non resident person

None of the given options

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- American Express Gold CardDocumento6 pagineAmerican Express Gold CardashwaracingNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Invoice - Zoya Ali Traders LLC 2023-02-02Documento2 pagineInvoice - Zoya Ali Traders LLC 2023-02-02Bahar AliNessuna valutazione finora

- Value Added TaxDocumento6 pagineValue Added Taxarjohnyabut80% (10)

- Invoice: Order No.: 52113272 Order Placed On: 02/01/2023Documento1 paginaInvoice: Order No.: 52113272 Order Placed On: 02/01/2023Alexandru BadanauNessuna valutazione finora

- ALL Solved Data of FIN622 Corporate FinanceDocumento69 pagineALL Solved Data of FIN622 Corporate Financesajidhussain557100% (1)

- Map of VU Garden Town Office 2Documento1 paginaMap of VU Garden Town Office 2sajidhussain557Nessuna valutazione finora

- Spring 2010 - FINI619 - 1Documento1 paginaSpring 2010 - FINI619 - 1RanibuttNessuna valutazione finora

- MCB 2005 Annual Report Highlights Customer Focus, 8.4% GDP GrowthDocumento139 pagineMCB 2005 Annual Report Highlights Customer Focus, 8.4% GDP GrowthAbdul MajeedNessuna valutazione finora

- Semester "Spring 2010": "Financial Statement Analysis (FIN621) "Documento3 pagineSemester "Spring 2010": "Financial Statement Analysis (FIN621) "sajidhussain557Nessuna valutazione finora

- Kra Pin PDF EditDocumento1 paginaKra Pin PDF EditFrancis KorirNessuna valutazione finora

- Proforma Invoice - POWERGEAR - 0506Documento2 pagineProforma Invoice - POWERGEAR - 0506சக்கரவர்த்தி செNessuna valutazione finora

- Hindustan Petroleum Corporation Limited: Price ListDocumento10 pagineHindustan Petroleum Corporation Limited: Price ListVizag Roads33% (3)

- Retirement Option Form: Declaration and Specimen Signature of Accont Holder (S)Documento1 paginaRetirement Option Form: Declaration and Specimen Signature of Accont Holder (S)Salman ArshadNessuna valutazione finora

- Taxing Power of LGU NotesDocumento2 pagineTaxing Power of LGU NotesEkie GonzagaNessuna valutazione finora

- Invoice ScissorsDocumento1 paginaInvoice ScissorsAlex ClunieNessuna valutazione finora

- RHB Bank Berhad CashXcess Program TermsDocumento3 pagineRHB Bank Berhad CashXcess Program TermsAmy GarrettNessuna valutazione finora

- RMC No 7-2014, Re Marginal Income WorkersDocumento2 pagineRMC No 7-2014, Re Marginal Income WorkersDenzel Edward CariagaNessuna valutazione finora

- Super Sonic Merchant Payout ReportDocumento5 pagineSuper Sonic Merchant Payout ReportSupersonic MobilesNessuna valutazione finora

- Agricultural Income (C)Documento4 pagineAgricultural Income (C)Geetika RajputNessuna valutazione finora

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocumento1 paginaTax Invoice: Billing Address Installation Address Invoice DetailsKuladeep Naidu PatibandlaNessuna valutazione finora

- Partnership Formation and Income DistributionDocumento6 paginePartnership Formation and Income DistributionNJZFINEST5013100% (1)

- Model Test Paper - 1 IPCC Group-I Paper - 4 Taxation May - 2017Documento28 pagineModel Test Paper - 1 IPCC Group-I Paper - 4 Taxation May - 2017Kshitij AgrawalNessuna valutazione finora

- Book IRCTC Retiring Room TicketDocumento2 pagineBook IRCTC Retiring Room TicketAkshay RachakondaNessuna valutazione finora

- Transaction Dispute FormDocumento1 paginaTransaction Dispute FormKvvPrasadNessuna valutazione finora

- Solved Latesha A Single Taxpayer Had The Following Income and DeductionsDocumento1 paginaSolved Latesha A Single Taxpayer Had The Following Income and DeductionsAnbu jaromiaNessuna valutazione finora

- Statement 69764798 GBP 2023-10-21 2023-11-20Documento1 paginaStatement 69764798 GBP 2023-10-21 2023-11-20B HamzaNessuna valutazione finora

- Contoh Soalan Seksyen C Bomba KB41 & KB29Documento9 pagineContoh Soalan Seksyen C Bomba KB41 & KB29Aqilah HamzahNessuna valutazione finora

- Salaried For June 2021Documento2 pagineSalaried For June 2021Iway SheenaNessuna valutazione finora

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento5 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSurya PrakashNessuna valutazione finora

- OMC Computer: 127 Masotsha Ndlovu Way CNR Seke RD, Hatfield, Harare, ZimbabweDocumento1 paginaOMC Computer: 127 Masotsha Ndlovu Way CNR Seke RD, Hatfield, Harare, ZimbabweBrighton MarizaNessuna valutazione finora

- NR PropertiesDocumento30 pagineNR PropertiesHari Harul VullangiNessuna valutazione finora

- Taxation For Decision Makers 2016 1st Edition Escoffier Test BankDocumento25 pagineTaxation For Decision Makers 2016 1st Edition Escoffier Test Bankmonicamartinezaekngtcimj100% (12)

- Donors Tax FAQs: Exemptions, Valuation, Adopted ChildrenDocumento3 pagineDonors Tax FAQs: Exemptions, Valuation, Adopted ChildrenMariela LiganadNessuna valutazione finora

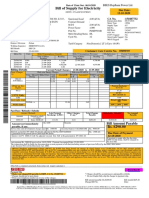

- Bill of Supply For Electricity: Due Date: 12-10-2020Documento1 paginaBill of Supply For Electricity: Due Date: 12-10-2020Priya RanjanNessuna valutazione finora

- Chapter 1: Introduction To Consumption TaxesDocumento11 pagineChapter 1: Introduction To Consumption TaxesJoody CatacutanNessuna valutazione finora