Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Circulars Summary

Caricato da

sandipgarg0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

32 visualizzazioni4 pagineSummary of CBDT Circulars on reducing litigation

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoSummary of CBDT Circulars on reducing litigation

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

32 visualizzazioni4 pagineCirculars Summary

Caricato da

sandipgargSummary of CBDT Circulars on reducing litigation

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

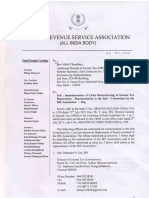

Circulars issued for reducing litigation and for withdrawing appeals on issues

accepted by the Department

No. Circular Date Section Issue

1 16/2015 06.10.15 Rule 9A Expenditure incurred in respect of abandoned films to be

allowed as revenue expenditure not to be treated as capital

expenditure

2 17/2015 06.10.15 2(14)(iii) Distance from municipal limits for ascertaining whether

agricultural land is capital asset is to be measured by shortest

road distance up to AY 13-14. Amendment to S.2(14)(iii) to

measure it aerially will be effective form 1.4.14.

3 18/2015 02.11.15 57(i) & Treatment of interest on non-SLR securities as business income

80P(2)(a)(i) and not as income from other sources may be accepted and

therefore expenses relatable to such investment to be allowed

u/s 57(i) and deduction u/s 80P(2)(a)(i) to be allowed.

4 21/2015 10.12.15 Revision of Appeals/ SLPs shall not be filed in cases where the tax effect

monetary does not exceed the monetary limits

limit for Before I.T.A.Tribunal 10,00,000/-

filing appeal Before High Court 20,00,000/-

Before Supreme Court 25,00,000/-

5 22/2015 17.12.15 43B(b) SC judgment accepted- Deletion of second proviso and

amendment of first proviso of section 43B(b) is curative and

applicable retrospectively w.e.f 1.4.88 . Accordingly, there will be

no disallowance u/s 43B, in respect of any sum payable by the

assessee as employer to any provident fund, superannuation

fund, gratuity fund etc.

6 23/2015 28.12.15 No 194A in Interest on FDRs, made in the name of Registrar General of the

FDRs with Court of the depositor of the fund on the directions of the Court

Court will not be subject to TDS till the matter is decided by the Court

7 24/2015 31.12.15 158BD/ SC judgment accepted For section 158BD recording of

153C satisfaction note is a pre-requisite. SN must be prepared by the

Recording AO before he transmits the record to the other AO having

Satisfaction jurisdiction over such person u/s 158BD. Even if the AO of the

searched person and the other person is same, then also he is

required to record his satisfaction.

8 25/2015 31.12.15 271(1)(c) Prior to 1.04.16, where income tax payable on total income as

MAT Tax> computed under the normal provisions of the Act is less than the

Tax tax payable on the book profit u/s 115JB, penalty u/s 271(1)(c)

determined not attracted with reference to additions/ disallowances made

under normal provisions.

9 1/2016 15.02.16 80IA An assessee who was eligible for claiming deduction u/s 80IA

has the option to choose the initial assessment year/ first year

out of the 15/20 years. He can claim deduction for ten

consecutive years beginning from the year in respect of which

he has exercised such option. Total number of years for claiming

deduction should not transgress the prescribed slab of fifteen or

twenty years, and the period of claim should be in continuity.

10 3/2016 26.02.16 115QA, Consideration received on buy-back of shares from 1.4.00 to

2(22)(iv), 31.5.13 would be taxed as capital gains in the hands of the

46A recipient in accordance with section 46A and no such amount

shall be treated as dividend in view of provisions of section 2

(22)(iv). Section 115QA which provide that any amount of

distributed income by a company on buy-back of unlisted shares

will be liable to additional Income-tax @ 20% of the distributed

income is operative from 1.6.13.

11 5/2016 29.02.16 194C TDS is not attracted on payments made by television channels/

newspaper companies to the advertising agency for booking or

procuring of or canvassing for advertisements. It is also further

clarified that commission referred to in Q.27 of the Boards

Circular No. 715 dated 8.8.95 does not refer to payments by

media companies to advertising companies for booking of

advertisements but to payments for engagement of models,

artists, photographers, sportspersons.

12 6/2016 29.02.16 Capital gain In addition to parameters laid down through Instruction no. 1827

or business dt 31.8.89 and Circular no. 4/2007 dt 15.6.07 to distinguish

income? shares held as investment from shares held as stock-in-trade,

following parameters added-

(a) When shares are stock-in-trade, the income on their transfer

would be business income irrespective of holding period.

(b) In respect of listed shares and securities held for a period of

more than 12 months, if the assessee treats the income on their

transfer as Capital Gain, AO shall not dispute but it should be

followed consistently in following years.

Above not to apply in case of non-genuine transactions.

13 7/2016 07.03.16 Taxability of Consortium arrangement for executing EPC/ Turnkey contracts

consortium which has the following attributes may not be treated as an AOP:

members a. each member is independently responsible for executing its

as AOP part of work and also bears the risk of its scope of work

b. each member earns profit or incurs losses, based on

performance of the contract within its scope of work.

c. the men and materials used for any area of work are under

the risk and control of respective consortium members

d. control and management of the consortium is not unified and

common management is only for the inter-se coordination

between the consortium members;

14 8/2016 17.03.16 Audit Instruction no. 9/2006 dated 7.11.2006 modified - Remedial

objection action need not be taken where Pr.CIT does not accept the audit

objection. If after careful scrutiny, adverse order of the CIT(A) is

found to be justified on facts or on law, no appeal is required.

15 09/DV/ 26.04.16 Limitation in Formation on Departmental View on limitation for imposition of

2016 27ID, 27IE penalty under sections 27ID and 27IE - Such proceedings can

be set to have commenced with the issuance of notice by the

Joint Commissioner to the assessee to which he has filed his

reply and not on the passing of the order of assessment by the

AO which even though erroneously mentions that proceedings

u/s 271D and 271E are initiated.

16 10/2016 26.04.16 Limitation in Penalty u/s 271D and 271E is independent of the assessment.

27ID, 27IE Therefore, as per section 275(1((c), limitation period would be

the expiry of the F.Y. in which the proceedings in the course of

which action for the imposition of penalty has been initiated) are

completed, or six months from the end of the month in which

action for imposition of penalty is initiated, whichever period

expires later. The limitation period is not dependent on the

pendency of appeal against the assessment or other order

referred to in section 275(1)(a) of the Act.

17 11/2016 26.04.16 195 & 244A If resident deductor is entitled for refund of tax deposited u/s

195, interest has to be paid u/s 244A from the date of payment

of such tax

18 12/2016 30.05.16 36(1)(vii) No appeal to be filed, if bad debt is written off as irrecoverable in

the books of accounts of the assessee for that previous year and

it fulfills the conditions in sub section (2) of sub-section 36(2).

19 15/2016 19.05.16 32(1)(iia) Printing and publishing activity is a manufacturing activity and

therefore, assessee is eligible for grant of additional depreciation

u/s 32(l)(iia).

20 Letter F.No.225/ Capital gain Income arising from transfer of unlisted shares to be considered

12/2016/ITA-II dt. or business under the head 'Capital Gain', irrespective of period of holding.

2/5/2016 income? This will not apply in case of non-genuine transaction or in case

of transfer of control of management.

21 35/2016 13.10.16 194-I Payment of lump sum lease premium or one-time upfront lease

charges, which are not adjustable against periodic rent, paid or

payable for acquisition of long-term leasehold rights over land or

any other property are not payments in the nature of rent within

the meaning of S.194-I and are not liable for TDS u/s 194-I.

22 37/2016 02.11.16 Ch.VI-A Disallowances made under sections 32, 40(a)(ia), 40A(3), 43B,

deduction etc. of the Act and other specific disallowances, related to the

on business activity result in enhancement of the profits of the

enhanced eligible business, and that deduction under Chapter VI-A is

profits admissible on the profits so enhanced by the disallowance.

23 38/2016 22.11.16 37, Expl. to In case of a firm, premium paid by the firm on the Keyman

10(10D) Insurance Policy of a partner, to safeguard the firm against a

disruption of the business, is an admissible expenditure u/s 37.

24 39/2016 29.11.16 Ch.VI-A Revenue subsidies received from the Government towards

deduction reimbursement of cost of production/ manufacture or for sale of

on revenue the manufactured goods are part of profits and gains of business

subsidies derived from the Industrial Undertaking/ eligible business, and

are thus, admissible for deduction under Chapter VI-A of the Act.

25 5/2017 23.01.17 Clarification Even on issues mentioned in para 8 (challenge of validity of

of circular Section, Rule, Boards order, Notification, Instruction or Circular;

21/2015 Revenue Audit Objection not accepted by the Dept.; additions of

undisclosed foreign assets/ bank accounts), appeals against the

adverse judgment should only be filed on merits.

26 16/2017 25.04.17 Rental or In the case of an undertaking which develops, develops and

business operates or maintains and operates an industrial park/SEZ, the

income- income from letting out of premises/ developed space in an

80IA(4)(iii) industrial park/SEZ is to be treated as business income provided

the conditions proscribed under the schemes are met.

Potrebbero piacerti anche

- Sid For Bharat Bond Etf - April 2030Documento61 pagineSid For Bharat Bond Etf - April 2030Akhil AggarwalNessuna valutazione finora

- Quant Finance BooksDocumento1 paginaQuant Finance BookssandipgargNessuna valutazione finora

- Guidelines for Special Counsel EngagementDocumento2 pagineGuidelines for Special Counsel Engagementsandipgarg100% (1)

- Implementation of Cadre Restructuring 1Documento1 paginaImplementation of Cadre Restructuring 1sandipgargNessuna valutazione finora

- Print ForewordDocumento3 paginePrint ForewordsandipgargNessuna valutazione finora

- RS22689Documento11 pagineRS22689sandipgargNessuna valutazione finora

- Bob PPT Q2 18Documento58 pagineBob PPT Q2 18sandipgargNessuna valutazione finora

- TDS Challan 06-05-18Documento1 paginaTDS Challan 06-05-18sandipgargNessuna valutazione finora

- Ashok Leyland Q3Documento7 pagineAshok Leyland Q3sandipgargNessuna valutazione finora

- Form DIR-3 PDFDocumento1 paginaForm DIR-3 PDFsandipgargNessuna valutazione finora

- Inv No.88 - Sandip Garg (INR 12,000)Documento1 paginaInv No.88 - Sandip Garg (INR 12,000)sandipgargNessuna valutazione finora

- Bhasin Group Typical Plan: Sector 143, NoidaDocumento1 paginaBhasin Group Typical Plan: Sector 143, NoidasandipgargNessuna valutazione finora

- CM Drought ReliefDocumento10 pagineCM Drought ReliefsandipgargNessuna valutazione finora

- Interpretation of Statutes-BCASDocumento49 pagineInterpretation of Statutes-BCASsandipgargNessuna valutazione finora

- IAP Draft Instruction 2 MarchDocumento37 pagineIAP Draft Instruction 2 MarchsandipgargNessuna valutazione finora

- AnnualReport2015 16Documento397 pagineAnnualReport2015 16sandipgargNessuna valutazione finora

- Casual Labourers Scheme Provides Temporary StatusDocumento3 pagineCasual Labourers Scheme Provides Temporary StatussandipgargNessuna valutazione finora

- Sbi Q3 16Documento7 pagineSbi Q3 16sandipgargNessuna valutazione finora

- Reducing Litigation ThaneDocumento38 pagineReducing Litigation ThanesandipgargNessuna valutazione finora

- Pune Furniture Stores ListingDocumento4 paginePune Furniture Stores ListingsandipgargNessuna valutazione finora

- KundliDocumento20 pagineKundlisandipgargNessuna valutazione finora

- An 1 Instrcution No.21 of 2015Documento3 pagineAn 1 Instrcution No.21 of 2015sandipgargNessuna valutazione finora

- Facts and Issue: The Assessee Following Mercantile System of Accounting, Did NotDocumento4 pagineFacts and Issue: The Assessee Following Mercantile System of Accounting, Did NotsandipgargNessuna valutazione finora

- Reducing Litigation NashikDocumento28 pagineReducing Litigation NashiksandipgargNessuna valutazione finora

- CCI DG Advt. 31 01 14Documento5 pagineCCI DG Advt. 31 01 14sandipgargNessuna valutazione finora

- Grievance SGDocumento41 pagineGrievance SGsandipgargNessuna valutazione finora

- GSTDocumento6 pagineGSTsandipgargNessuna valutazione finora

- Cenvat Credit PDFDocumento38 pagineCenvat Credit PDFsaumitra_mNessuna valutazione finora

- IIS Civil ListDocumento19 pagineIIS Civil Listsandipgarg100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Physical Science - q3 - Slm3Documento15 paginePhysical Science - q3 - Slm3Boyet Alvarez AtibagosNessuna valutazione finora

- Inu 2216 Idt - Question PaperDocumento5 pagineInu 2216 Idt - Question PaperVinil JainNessuna valutazione finora

- Kawasaki Ultra 250x Manual de Taller PDFDocumento477 pagineKawasaki Ultra 250x Manual de Taller PDFAntonio Jose Planells100% (3)

- 02-Plant Morphology (Exercise)Documento5 pagine02-Plant Morphology (Exercise)varshavishuNessuna valutazione finora

- Clean Room Laboratory ReportDocumento6 pagineClean Room Laboratory ReportHaider IftikarNessuna valutazione finora

- Establishment of Retirement PlanDocumento3 pagineEstablishment of Retirement PlanVioleta StancuNessuna valutazione finora

- Non Ferrous AlloysDocumento45 pagineNon Ferrous AlloysDeepak NegiNessuna valutazione finora

- Prof. J.L. HumarOffice: HP 3051Phone: 613-520-2600 ext. 3051Email: jhumar@cmail.carleton.caOffice Hours: Tuesdays and Thursdays, 2:00-3:00 pmDocumento2 pagineProf. J.L. HumarOffice: HP 3051Phone: 613-520-2600 ext. 3051Email: jhumar@cmail.carleton.caOffice Hours: Tuesdays and Thursdays, 2:00-3:00 pmBhind NijjarNessuna valutazione finora

- Ethylene Glycol PDFDocumento2 pagineEthylene Glycol PDFAngela0% (1)

- Natalia Mooting QDocumento1 paginaNatalia Mooting QPok Nik LiNessuna valutazione finora

- Job's Method of Continuous VariationDocumento11 pagineJob's Method of Continuous Variationalex3bkNessuna valutazione finora

- Precision Forging Processes GuideDocumento35 paginePrecision Forging Processes GuideRiski RamadhanNessuna valutazione finora

- Tunnels: Rock TunnellingDocumento4 pagineTunnels: Rock TunnellingAndrés García CaseroNessuna valutazione finora

- Low Back Pain Anatomy of Thoracolumbar SpineDocumento10 pagineLow Back Pain Anatomy of Thoracolumbar SpineMNessuna valutazione finora

- LESSON 1 PREPARE VEGETABLE DISHES OverviDocumento12 pagineLESSON 1 PREPARE VEGETABLE DISHES OverviKeym Garcia Galvez IIINessuna valutazione finora

- Course Planning: Unity CurriculumDocumento3 pagineCourse Planning: Unity CurriculumpriyankaNessuna valutazione finora

- Kovach 1987Documento10 pagineKovach 1987Quyen ta thi nhaNessuna valutazione finora

- Marital Rape in IndiaDocumento8 pagineMarital Rape in IndiaSHUBHANK SUMANNessuna valutazione finora

- Explorations in PersonalityDocumento802 pagineExplorations in Personalitypolz2007100% (8)

- 01 PROT4xx PowerSystemFaults r4Documento84 pagine01 PROT4xx PowerSystemFaults r4Raul MistaNessuna valutazione finora

- DC72D MK2 Genset Controller User Manual V1.5Documento61 pagineDC72D MK2 Genset Controller User Manual V1.5Cristobal AvecillaNessuna valutazione finora

- ADA Concept GuideDocumento10 pagineADA Concept GuidemoalpohoNessuna valutazione finora

- Rules of SungazingDocumento2 pagineRules of SungazingaustralexdiNessuna valutazione finora

- Ventilation SystemDocumento13 pagineVentilation SystemSaru BashaNessuna valutazione finora

- Corrosion and Its Objective QuestionsDocumento2 pagineCorrosion and Its Objective QuestionsSrinivasan Alagappan100% (4)

- Tan Trok Tam Devi Suk TamDocumento4 pagineTan Trok Tam Devi Suk Tamtejasg82Nessuna valutazione finora

- Numerical Modelling of Drying Kinetics of Banana Flower Using Natural and Forced Convection DryersDocumento5 pagineNumerical Modelling of Drying Kinetics of Banana Flower Using Natural and Forced Convection DryersMuthu KumarNessuna valutazione finora

- QCVN 162019BXD National Technical Regulation On Products, Goods of Building Materials (Eng)Documento41 pagineQCVN 162019BXD National Technical Regulation On Products, Goods of Building Materials (Eng)lwin_oo2435Nessuna valutazione finora

- Effects of Climate ChangeDocumento10 pagineEffects of Climate ChangeJan100% (1)

- Climate and Cultural IdentityDocumento2 pagineClimate and Cultural IdentityCha AbolucionNessuna valutazione finora