Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Analysis of Liquidity, Solvency and Profitability of Select Cement Companies in Andhra Pradesh

Caricato da

JuanDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Analysis of Liquidity, Solvency and Profitability of Select Cement Companies in Andhra Pradesh

Caricato da

JuanCopyright:

Formati disponibili

Research Paper Management Volume : 5 | Issue : 6 | June 2015 | ISSN - 2249-555X

Analysis of Liquidity, Solvency and Profitability of

Select Cement Companies in Andhra Pradesh

Correlation, Liquidity Ratios, Profitability Ratios, Regression Analysis and Solvency

Keywords Ratios.

N. Venkata Ramana V. Bhagyamma Professor. K. Ramakrishnaih

Assistant Professor, Dept of Assistant Professor Dept. of

Business Administration Business Administration

Annamacharya Institute of Annamacharya Institute of Principal S.V.U College of CM & CS

Technology and Sciences Technology and Sciences S.V. University, Tirupati

(Autonomous) New BoyanaPalle, (Autonomous) New BoyanaPalle,

Rajampet Rajampet

ABSTRACT The drive of this study is to analysis of liquidity, solvency and profitability of select cement companies

in Andhra Pradesh. The data was collected from financial statements of select cement companies for a

period of 10 year from 2003-04 to 2012-13, have selected financial ratios such as Current Ratio (CR), Quick Ratio (QR),

Absolute Liquid Ratio (ALR) for liquidity analysis, Debt-Equity Ratio (DER), Proprietary Ratio (PR)and Fixed Assets to

Proprietary Ratio (FATPR) for solvency analysis and Gross Profit Ratio (GPR), Net profit Ratio (NPR), Return on Capital

Employed (ROCE), Return on Investment (ROI) and Earnings per Share (EPS) for profitability analysis to meet objec-

tive of the study. The result of the study is liquidity, solvency and profitability position of select cement companies not

good, no significant impact of liquidity and solvency on ROCE, no correlation between ROCE and liquidity ratios and

positive correlation between ROCE and DER and PR and negative correlation with FATPR.

Introduction ity, as may be marked here it. Nor has any previous re-

Liquidity means ability of firm to meet short-term obli- search examined the liquidity position and the existence of

gations when they become due for payment can hardly liquidity and profitability relationship of private sector steel

be over-stressed. In fact, liquidity is a pre-requisite for companies in India.

the very survival of a firm. The short-term creditors of

the firm are interested in the short-term solvency or li- Ajanthan (2013) investigated the relationship between li-

quidity of a firm. But liquidity implies, from the view quidity and profitability of trading companies in Sri Lan-

point of utilisation of the funds of the firm that funds are ka. The study covered 08 listed trading companies in Sri

idle or they earn very little. A proper balance between Lanka over a period of past 5 years from 2008 to 2012.

the two contradictory requirements i.e. liquidity and Correlation& regression analysis and descriptive statistics

profitability is required for efficient financial manage- were used in the analysis and findings suggest that there

ment. is a significant relationship exists between liquidity and

profitability among the listed trading companies in Sri

The solvency generally refers to the capacity of the Lanka.

business to meet its short-term and long-term obliga-

tions. Short-term obligations include creditors, bank N.Venkata Ramana, S.MD. Azash and Pro. K. Ram-

loans and bills payable etc. long-term obligations con- akrishnaiah (2011) Profitability analysis measures how a

sists of debentures, long-term loans and long term firm will is performing in terms of its ability to gener-

creditors etc. ate profits. Profitability of the firm is highly influenced

by internal and external variables, i.e., size of organi-

The Profitability is a measure of the amount by which zations, liquidity management, growth of organiza-

a firms revenues exceeds its relevant expenses. Po- tions, component of costs and inflation rate. The pa-

tential investors are interested in dividends and ap- per made an attempt to know the profitability and to

preciation in market price of stock, so they pay more assess the impact of selected profitability ratios on

attention on the profitability ratios. Managers on the ROE of the company, for fulfilment of the objectives

other hand are interested in measuring the operat- the data collected from the annual report from 2001-

ing performance in terms of profitability. Hence, a low 2010. The data is analysed and computed to fit for

profit margin would suggest ineffective management drawing inferences .in this investigation correlation and

and investors would be hesitant to invest in the com- multiple regression analysis was used to find out im-

pany. pact of selected profitability ratios (Gross Profit, Oper-

ating Profit, Net Profit, Earning Per Share, Return on

Literature Review Total Assets) on ROE. The result reveals that selected

Singh and Pandey (2008) examined that, the management profitability ratios are not have significant impact on

of working capital is essential as it has a direct impact on ROE.

profitability and liquidity. Working capital components and

found a significant impact of working capital management

on profitability for Hindalco Industries Limited. Of this work

and reflects some decisive evidences that affirm its viabil-

INDIAN JOURNAL OF APPLIED RESEARCH X 165

Research Paper Volume : 5 | Issue : 6 | June 2015 | ISSN - 2249-555X

Research Methodology: Tools of Analysis

Objective

To investigate the liquidity, solvency and profitability posi-

tion of select cement companies in Andhra Pradesh.

Hypotheses

H01. There is no better liquidity position of select ce-

ment companies in Andhra Pradesh.

H02. There is no better solvency position of select ce-

ment companies in Andhra Pradesh.

H03. There is no better profitability position of select

cement companies in Andhra Pradesh.

H04. There is no significant impact of liquidity on

profitability of select cement companies in Andhra

Pradesh.

H05. There is no significant impact of solvency position

on profitability of select cement companies in Andhra

Pradesh.

Data Sources

The research is totally based on secondary data, from the

annual reports of sample companies. Data and informa-

tion have been collected form the websites of the sampled

companies, different articles and papers.

Period of Study

The data was collected for ten year period from 2003-04

to 2012-13.

The following cement companies selected for the study:

ACC Cements Ltd, India Cements Ltd, Kakatiya Cements

Ltd, NCL, Ramco Cements Ltd, Sagar Cements Ltd and

Zuari Cements Ltd.

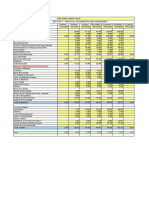

Table No 1 Liquidity, Solvency and Profitability Ratios of Select Cement Companies in Andhra Pradesh

Year CR QR ALR DER PR FATPF GPR NPR ROI ROCE EPS

2003-04 1.44 0.50 0.63 14.00 0.36 233.16 32.22 2.06 4.73 -7.02 0.10

2004-05 1.25 0.50 0.05 8.36 0.41 216.42 31.49 5.57 11.26 14.01 0.14

2005-06 1.06 0.65 0.05 4.60 0.45 148.87 41.46 7.00 15.78 17.57 0.22

2006-07 1.24 0.68 0.12 1.87 0.49 128.04 38.97 17.38 38.34 34.31 0.77

2007-08 1.14 0.63 0.16 2.50 0.51 111.35 42.00 14.01 25.03 19.57 0.724

2008-09 0.83 0.46 0.07 2.28 0.57 132.54 39.96 10.78 18.41 17.14 0.27

2009-10 0.86 0.49 0.02 2.13 0.57 144.41 40.96 8.04 12.98 12.60 0.23

2010-11 1.00 0.52 0.11 1.89 0.58 135.26 31.70 5.61 10.29 10.19 0.22

2011-12 0.98 0.42 0.14 0.62 0.74 114.01 38.63 8.59 14.59 21.68 0.23

2012-13 0.99 0.41 0.12 0.43 0.64 110.87 37.70 8.27 6.56 7.26 0.15

AVG 1.08 0.53 0.09 3.87 0.54 147.49 37.51 8.73 15.80 14.73 0.30

SD 0.19 0.09 0.04 4.23 0.12 42.97 4.14 4.40 9.82 10.66 0.23

CV 17.58 17.53 46.50 109.25 23.27 29.13 3.71 50.47 62.15 72.39 76.38

CGR 7.60 9.10 22.03 5.14 0.06 7.57 13.23 44.60 15.58 11.67 24.27

LGR 0.93 0.40 0.09 3.37 0.07; 139.83 38.18 8.96 16.30 14.81 0.32

SOURCE: Annual Reports of Select Cement Companies

166 X INDIAN JOURNAL OF APPLIED RESEARCH

Research Paper Volume : 5 | Issue : 6 | June 2015 | ISSN - 2249-555X

Table 1 Shows that the Current Ratio of select cement Pradesh return on investment is low.

companies in Andhra Pradesh during the period of 10 year

from 2003-04 to 2012-13. The average of the current ra- Return on Capital Employed of select cement companies

tio of select cement companies in Andhra Pradesh is 1.08. in Andhra Pradesh during the study period from 2003-04

Hence, the liquidity position of the select cement compa- to 2012-13. The average return on capital employed of

nies in Andhra Pradesh is not good because the current select cement companies in Andhra Pradesh is 14.73. It

ratio is not satisfy the standard ratio of current ratio is 2:1. indicates that the select cement companies not utilize the

capital employed in proper way to generate the revenue.

Quick Ratio of select cement companies in Andhra Pradesh

from 2003-04 to 2012-13. The average of quick ratio is Earnings per Share of select cement companies over a

0.53 which is not satisfy the standard norm of quick ratio is period of ten year from 2003-04 to 2012-13. The average

1:1. So, the liquidity position of the select cement compa- of earnings per Share of the select cement companies in

nies of Andhra Pradesh is not a satisfactory position. Andhra Pradesh 0.30. The select cement companies not

generate sufficient profit in order to pay equity sharehold-

Absolute Liquid Ratio of select cement companies in ers.

Andhra Pradesh for a period of 10 year from 2003-04 to

2012-13. The average of absolute liquidity ratio is 0.09. From the above all profitability ratios, I found that profita-

It is not also satisfy the standard norm of absolute quick bility position of the select cement companies is not good.

ratio is 1:2. It means that the select cement companies in Hence, the null hypothesis H03 is accepted i.e. there is

Andhra Pradesh liquidity position is worst. no better profitability position of select cement companies

in Andhra Pradesh.

From the above liquidity ratios, there is no better liquidity

position of select cement companies in Andhra Pradesh. Table2 Correlation between ROCE and Liquidity Ratios

Hence,the null hypothesis (H01) is accepted i.e. there is ROCE CR QR ALR

no better liquidity position of select cement companies in Pearson Correlation 1 -.064 .101 .050

Andhra Pradesh. ROCE Sig. (2-tailed) .600 .405 .679

N 70 70 70 70

Debt-equity ratio of select cement companies of Andhra Pearson Correlation -.064 1 .597** .546**

Pradesh during the period of ten year from 2003-04 to CR Sig. (2-tailed) .600 .000 .000

2012-13. The average debt-equity ratio is 3.87 which is N 70 70 70 70

Pearson Correlation .101 .597** 1 .546**

more than the standard norm of 1:1. It means that the se-

QR Sig. (2-tailed) .405 .000 .000

lect cement companies solvency position is good. N 70 70 70 70

Pearson Correlation .050 .546** .546** 1

Proprietary ratio of select cement companies in Andhra ALR Sig. (2-tailed) .679 .000 .000

Pradesh over a ten year period. The average proprietary N 70 70 70 70

ratio is 0.54 which indicates that weak financial position

and not security for creditors. A large portion of debt in **. Correlation is significant at the 0.01 level (2-tailed).

capital may reduce creditors interest, increase interest ex-

penses and also the risk of bankruptcy. Table 2 depicts that the correlation between ROCE and

liquidity ratios of select cement companies in Andhra

Ratio of fixed assets to proprietary funds of select cement Pradesh. There is no correlation between ROCE and li-

companies over a period of ten year from 2003-04 to quidity ratios at 0.01 level of significant.

2012-13. The average of fixed assets to proprietary funds

ratio is 147.49 which states that the select cement compa- Table 3 Correlation between ROCE and Solvency Ratios

nies are using more debt than the fixed assets and equity ROCE DER PR FATPR

is less than the fixed assets.

Pearson Correlation 1 .260* .377** -.254*

From the above solvency ratios, found that there is no ROCE Sig. (2-tailed) .030 .001 .034

better solvency position of select cement companies in N 70 70 70 70

Andhra Pradesh. Since, the null hypothesis H02 is ac- Pearson Correlation .260* 1 .082 -.109

cepted i.e. there is no better solvency position of select DER Sig. (2-tailed) .030 .498 .369

cement companies in Andhra Pradesh.

N 70 70 70 70

Gross profit ratio of select cement companies in Andhra Pearson Correlation .377** .082 1 -.668**

Pradesh over a period of ten year from 2003-04 to 2012- PR Sig. (2-tailed) .001 .498 .000

2013. The average gross profit ratio is 37.51 which is N 70 70 70 70

very low. The overall select cement companies in Andhra Pearson Correlation -.254* -.109 -.668** 1

Pradesh gross profit position is low. FATPR Sig. (2-tailed) .034 .369 .000

N 70 70 70 70

Net Profit Ratio of select cement companies in Andhra

Pradesh from 2003-04 to 2012-13. The average net profit

of select cement companies in Andhra Pradesh is 8.73, it *. Correlation is significant at the 0.05 level (2-tailed).

means that net profit position of select cement companies **. Correlation is significant at the 0.01 level (2-tailed).

are not good.

Table 3 shows that correlation between ROCE and solven-

Return on Investment Ratio of select cement companies cy ratios of select cement companies in Andhra Pradesh.

in Andhra Pradesh from 2003-04 to 2012-13. The average Positive correlation between ROCE and DER and PR at

return on investment of select cement companies is 15.80 0.05 and 0.01 level of significant and negative correlation

percent. The overall select cement companies in Andhra between ROCE and FATPR at 0.05 level of significant.

INDIAN JOURNAL OF APPLIED RESEARCH X 167

Research Paper Volume : 5 | Issue : 6 | June 2015 | ISSN - 2249-555X

Table 4 Regression Analysis between Liquidity Ratios ALR significance value is p = 0.696 which is more than the

and ROCE 0.05 (p>0.05) and t = 0.392 which shows that any change

Table 4a Model Summary in ALR will bring a positive change in profitability. The val-

ue of B for ALR is 9.505, it means that one crore change in

R Square Adjusted R Square Std. Error of

Model R ALR, it will bring 9.505 crore change in ROCE.

the Estimate

1 .191 .036 -.007 21.18487

Table 5 Regression Analysis between Solvency Ratios and

a. Predictors: (Constant), ALR, CR, QR ROCE

Table 4a reveals the R value is 0.191 which shows that Table 5a Model Summary

there is a low correlation between dependent variable Adjusted R Std. Error of

(ROCE) and independent variables. Model R R Square Square the Estimate

1 .442 .195 .158 19.36361

R square value (Coefficient of Determination or Re-

gression Coefficient) is 3.60 percent of variation in ROCE a. Predictors: (Constant), FATPR, DER, PR

is caused by predictors.

Table 5a reveals the R value is 0.442 which shows that

Adjusted R square -0.70 percent variation is caused by there is a low correlation between dependent variable

predictors considering number of observations and the (ROCE) and independent variables.

number of predicted variables.

R square value (Coefficient of Determination or Re-

Table 4b ANOVA gression Coefficient) is 19.50 percent of variation in ROCE

Sum of Mean is caused by predictors.

Model Df Square F Sig.

Squares

Regression 1120.428 3 373.476 .832 .481 Adjusted R square 15.80 percent variation is caused by

predictors considering number of observations and the

1 Residual 29620.725 66 448.799

number of predicted variables.

Total 30741.154 69

Table 5b ANOVA

a. Predictors: (Constant), ALR, CR, QR Sum of Mean

b. Dependent Variable: ROCE Model Df F Sig.

Squares Square

Regression 5994.500 3 1998.167 5.329 .002

Table 4b indicates that the calculated value of F is less 1 Residual 24746.654 66 374.949

than the table value of F. It indicates that there is no sig- Total 30741.154 69

nificant effect of liquidity management ratios on ROCE.

Therefore, the null hypothesis (H04) is accepted i.e.

There is no significant impact of liquidity on profitability of a. Predictors: (Constant), FATPR, DER, PR

select cement companies in Andhra Pradesh. b. Dependent Variable: ROCE

Table 4c Coefficients Table 5b depicts that the calculated value of F is more

Standard- than the table value of F. It indicates that there is signifi-

Unstandardized ized Coef- cant effect of solvency ratios on ROCE. Therefore, the null

Model

Coefficients ficients hypothesis (H05) is rejected. i.e. There is no significant

B Std. Error Beta t Sig. impact of solvency position on profitability of select ce-

(Constant) 11.819 5.866 2.015 .048 ment companies in Andhra Pradesh.

CR -5.743 4.287 -.214 -1.340 .185

1

QR 15.313 12.459 .196 1.229 .223 Table 5c Coefficients

ALR 9.505 24.219 .060 .392 .696 Standard-

Model Unstandardized ized Coef-

Coefficients ficients t Sig.

a. Dependent Variable: ROCE B

Std. Error Beta

Table 4c shows the constant value is 11.819 which shows (Constant) -5.281 10.729 -.492 .624

that when the all predictors (CR, QR and ALR) are happen DER .401 .192 .232 2.086 .041

1

to be zero, then the amount of ROCE is 11.819 and the PR 32.866 13.202 .370 2.489 .015

FATPR .003 .028 .018 .120 .905

constant is also significant as is P < 0.05(p = 0.048).

CR significant value is p = 0.185 which is more than the a. Dependent Variable: ROCE

0.05 (p = 0.05) and t = -1.340 which shows that any

change in CR will bring a negative change in profitabil- Table 5c shows the constant value is -5.281 which shows

ity. The value of B for CR is -5.743 which shows that if CR that when the all predictors (DER, PR and FATPR) are hap-

changes by one crore, it will bring -5.743 crore change in pen to be zero, then the amount of ROCE is -5.281 and

profitability (ROCE). the constant is not significant as is P > 0.05(p = 0.624).

QR significant value is p = 0.223 which is more than the DER significant value is p = 0.041 which is less than the

0.05 (p >0.05) and t = 1.229 which shows that any change 0.05 (p < 0.05) and t = 2.086 which shows that any change

in QR will bring a positive change in profitability (ROCE). in DER will bring a positive change in profitability. The val-

The value of B for QR is 15.313 which indicates that if QR ue of B for DER is 0.401 which shows that if DER changes

changes by one crore, it will bring 15.313 crore changes in by one crore, it will bring 0.401 crore change in profitabil-

profitability (ROCE). ity (ROCE).

168 X INDIAN JOURNAL OF APPLIED RESEARCH

Research Paper Volume : 5 | Issue : 6 | June 2015 | ISSN - 2249-555X

PR significant value is p = 0.015 which is less than the 0.05 CONCLUSION

(p <0.05) and t = 2.489 which shows that any change in PR Conclude that from the above study, the liquidity position,

will bring a positive change in profitability (ROCE). The val- solvency position and profitability position are not good.

ue of B for PR is 32.866 which indicates that if PR changes There is no correlation between Return on Capital Em-

by one crore, it will bring 32.866 crore changes in profit- ployed and Current Ratio, Quick Ratio and Absolute Liquid

ability (ROCE). Ratio. There is a positive correlation between ROCE and

Debt-Equity Ratio and Proprietary ratio and negative cor-

FATPR significance value is p = 0.905 which is more than relation with Fixed Assets to Proprietary Ratio.

the 0.05 (p>0.05) and t = 0.120 which shows that any

change in FATPR will bring a positive change in profitabili- I also found that there is no impact of liquidity and sol-

ty. The value of B for ALR is 0.003, it means that one crore vency on profitability (Return on Capital Employed).

change in FATPR, it will bring 0.003 crore change in ROCE.

FINDINGS

Current ratio, quick ratio and absolute liquid of select

cement companies are not maintained at standard

norms of current ratio, quick ratio and absolute liquid

ratio. So the liquidity position of select cement compa-

nies in Andhra Pradesh is not good.

The average debt equity ratio of select cement com-

panies in Andhra Pradesh is 3.87 which is more than

the standard norm of 1:1. It means the select cement

companies are maintain more debt in capital structure.

The proprietary ratio of select cement companies is

very low. The select cement companies have more

debt and less equity in capital and very weak financial

position.

Fixed assets to proprietary funds ratio of select cement

companies in Andhra Pradesh is also low. It is indicates

that more debt using than the fixed assets.

From the above all profitability ratios, I found that prof-

itability position of the select cement companies are

not good.

REFERENCE Ajanthan. A. (2013) A Nexus Between Liquidity & Profitability: A Study Of Trading Companies In Sri Lanka. European Journal of Business

and Management. ISSN 2222-1905. 5(7). | | Afeef M.(2011) Analysing the Impact of Working Capital Management on the Profitability

of SMEs in Pakistan International Journal of Business and Social Science. | | Singh, J.P. and Pandey, S. (2008), Impact of Working Capital Management in the

Profitability of Hindalco Industries Limited, The ICFAI University Journal of Financial Economics, Vol. 36, pp. 64-79 | | N. Venkata Ramana, S. Md. Azash and

Prof. K. Ramakrishnaiah. (2011) Impact of Liquidity Management on Profitability: A Case study of Lanco Industries Limited (LIL). Srikalahasti (AP), Asian Journal

of Management. ISSN 0976-495X, Volume No 02, Issue No 04, October-December 2011, pp. 182-185. | | Raheman A. and Nasr M. (2007) Working Capital

Management and Profitability Case of Pakistani Firms International Review of Business Research PapersVol.3 No.1. | | Saleem Q. &Rehman R.U. (2011) Impacts of

liquidity ratios on profitability (Case of oil and gas companies of Pakistan) Interdisciplinary Journal of Research in Business Vol. 1, Issue. 7. | | Narware, P.C. (2004).

Working Capital and Profitability - An Empirical Analysis, The Management Accountant, Vol. 39(6), pp. 120-127. | | Eljelly, A. (2004) Liquidity-Profitability Tradeoff:

An Empirical Investigation in an Emerging Market. International Journal of Commerce & Management. Vol. 14, No 2, pp. 48-61. | | Reheman .A and Nasr .N (2007).

Working Capital Management And Profitability A case of Pakistani firms. International Review Business Research Papers. PP. 279-300. | | Chakraborty, K. (2008).

Working Capital and Profitability: An Empirical Analysis of Their relationship with reference to selected companies in the Indian Pharmaceutical Industry The Icfai

Journal of Management. | | | Garcia-Teruel P.J and Martinez-Solano PM, (2007). Effects of working capital management on SME profitability. International Journal of

Managerial Finance. | | www.moneycontrol.com |

INDIAN JOURNAL OF APPLIED RESEARCH X 169

Potrebbero piacerti anche

- IJRASETDocumento5 pagineIJRASETAnonymous QdPNnb7JDeNessuna valutazione finora

- 591-599-Ieteh200 IjetsrDocumento9 pagine591-599-Ieteh200 IjetsrBhumika BiyaniNessuna valutazione finora

- A Study On Financial Performance Using Ratio Analysis of Shree Cement LimitedDocumento8 pagineA Study On Financial Performance Using Ratio Analysis of Shree Cement Limitedtamiltop886Nessuna valutazione finora

- IJCRT2104464Documento11 pagineIJCRT2104464Kshama KadwadNessuna valutazione finora

- Project Report On 7Documento8 pagineProject Report On 7Abhishek Koundal 29Nessuna valutazione finora

- A Study On Financial Performance of Indian Oil Corporation LimitedDocumento3 pagineA Study On Financial Performance of Indian Oil Corporation LimitedYASHWANTH PATIL G JNessuna valutazione finora

- Impact of Working Capital Management On Profitability of The Select Car Manufacturing Companies in IndiaDocumento10 pagineImpact of Working Capital Management On Profitability of The Select Car Manufacturing Companies in IndiaHargobind CoachNessuna valutazione finora

- An Empirical Study of Profitability Analysis of Selected Steel Companies in IndiaDocumento17 pagineAn Empirical Study of Profitability Analysis of Selected Steel Companies in Indiamuktisolia17Nessuna valutazione finora

- 234am - 63.EPRA Journals-4137Documento12 pagine234am - 63.EPRA Journals-4137veerabhadraveerabhadra150Nessuna valutazione finora

- 1252am - 140.EPRA Journals - 4180Documento7 pagine1252am - 140.EPRA Journals - 4180Kishore ThirunagariNessuna valutazione finora

- Working Capital Management of Nestle IndiaDocumento4 pagineWorking Capital Management of Nestle IndiaPravin SinghNessuna valutazione finora

- (A Study With Reference To Bajaj Finance Limited) : Profitability Analysis of Lease Financing CompanyDocumento8 pagine(A Study With Reference To Bajaj Finance Limited) : Profitability Analysis of Lease Financing CompanybhupNessuna valutazione finora

- A Study On Financial Performance Analysis of Sakthi Finance LimitedDocumento25 pagineA Study On Financial Performance Analysis of Sakthi Finance Limitedwasim musthaqNessuna valutazione finora

- Paper TitleDocumento18 paginePaper TitleJayashree KowtalNessuna valutazione finora

- Profitability Analysis of Lease Financing Company (A Study With Reference To Bajaj Finance Limited)Documento9 pagineProfitability Analysis of Lease Financing Company (A Study With Reference To Bajaj Finance Limited)bhupNessuna valutazione finora

- 1118pm - 32.EPRA JOURNALS 8069Documento3 pagine1118pm - 32.EPRA JOURNALS 8069Shivam SinghNessuna valutazione finora

- Impact of Liquidity On Profitability in Telecom Companies: Dr. Mohmad Mushtaq Khan Dr. K. Bhavana RajDocumento11 pagineImpact of Liquidity On Profitability in Telecom Companies: Dr. Mohmad Mushtaq Khan Dr. K. Bhavana RajSavy DhillonNessuna valutazione finora

- 13 Dr. Davendra Kumar Sharma Set S S M Page 08Documento8 pagine13 Dr. Davendra Kumar Sharma Set S S M Page 08Gokul krishnanNessuna valutazione finora

- A Study On Financial Performance Analysis of Bharti Airtel LimitedDocumento6 pagineA Study On Financial Performance Analysis of Bharti Airtel LimitedInternational Journal of Business Marketing and ManagementNessuna valutazione finora

- Determinants of Liquidity of The Select Indian Tractor CompaniesDocumento3 pagineDeterminants of Liquidity of The Select Indian Tractor CompaniesRamasamy VelmuruganNessuna valutazione finora

- 303am 62.EPRA Journals-4113Documento6 pagine303am 62.EPRA Journals-4113Amogh AroraNessuna valutazione finora

- 1 SMDocumento9 pagine1 SMAnisa nurmawatiNessuna valutazione finora

- 17 Sugar ManufacturingDocumento9 pagine17 Sugar ManufacturingSindhu GNessuna valutazione finora

- Leasing Companies ComparisonDocumento6 pagineLeasing Companies ComparisonAli Raza SultaniNessuna valutazione finora

- A Study On Financial Performance of Nestle India LTD: Mr. A. David, Ms. T. DharaniDocumento3 pagineA Study On Financial Performance of Nestle India LTD: Mr. A. David, Ms. T. DharaniAntima RajvanshiNessuna valutazione finora

- Profitability Analysis of Select Automobile Companies in India - With Special Reference To Tata Motors and Mahindra and MahindraDocumento9 pagineProfitability Analysis of Select Automobile Companies in India - With Special Reference To Tata Motors and Mahindra and MahindraKshama KadwadNessuna valutazione finora

- Study of Financial Performance of Cement Industry by Using Du-Pont AnalysisDocumento5 pagineStudy of Financial Performance of Cement Industry by Using Du-Pont AnalysisAhmad IbrarNessuna valutazione finora

- IJCRT1812572Documento5 pagineIJCRT1812572buviaroNessuna valutazione finora

- 191Documento4 pagine191Kshama KadwadNessuna valutazione finora

- Working Capital Management in Indian Pap 2 PDFDocumento11 pagineWorking Capital Management in Indian Pap 2 PDFBiniam NegaNessuna valutazione finora

- 1487 Israt Jahan 5105Documento10 pagine1487 Israt Jahan 5105Shahnewaj ShaanNessuna valutazione finora

- 905pm - 10.EPRA JOURNALS 13145Documento3 pagine905pm - 10.EPRA JOURNALS 13145Mohammed YASEENNessuna valutazione finora

- Ratio AnalysisDocumento79 pagineRatio Analysisanjali dhadde100% (1)

- An Overview of The Financial Performance of Indian Tyre Industry - Comparison Among Leading Tyre CompaniesDocumento3 pagineAn Overview of The Financial Performance of Indian Tyre Industry - Comparison Among Leading Tyre CompaniesLucky khandelwalNessuna valutazione finora

- Impact of Working Capital Management On ProfitabilityDocumento23 pagineImpact of Working Capital Management On ProfitabilityharnishaNessuna valutazione finora

- SSRN Id3525666Documento17 pagineSSRN Id3525666v1v1subrotoNessuna valutazione finora

- Analyzing Financial Soudness of Tata CommunicationsDocumento14 pagineAnalyzing Financial Soudness of Tata CommunicationsIJAR JOURNALNessuna valutazione finora

- Final Ratio AnalysisDocumento40 pagineFinal Ratio AnalysisShruti PatilNessuna valutazione finora

- Document 2 yL5R 25032016Documento8 pagineDocument 2 yL5R 25032016Dhiraj SinghaNessuna valutazione finora

- Analisis Rasio Likuiditas, Rasio Leverage, Dan Rasio Profitabilitas Terhadap Perubahan LabaDocumento20 pagineAnalisis Rasio Likuiditas, Rasio Leverage, Dan Rasio Profitabilitas Terhadap Perubahan LabaSuganda SlowNessuna valutazione finora

- A Study On Ratio Analysis of J.K Cement Limited CompanyDocumento7 pagineA Study On Ratio Analysis of J.K Cement Limited Companyparika khannaNessuna valutazione finora

- A Study of Financial Analysis On FMCG Companies of IndiaDocumento8 pagineA Study of Financial Analysis On FMCG Companies of Indiaviral ChavdaNessuna valutazione finora

- Profitability Performance of Selected Two Wheeler Companies in India: An Analytical StudyDocumento4 pagineProfitability Performance of Selected Two Wheeler Companies in India: An Analytical StudyrahulNessuna valutazione finora

- Financial Statement Analysis of Ashok Leyland Limited, IndiaDocumento9 pagineFinancial Statement Analysis of Ashok Leyland Limited, IndiaShubham NamdevNessuna valutazione finora

- A Study On The Financial Analysis of Reliance InduDocumento14 pagineA Study On The Financial Analysis of Reliance InduSukhmanNessuna valutazione finora

- A Research On What Impact Cash Management Has On The Financial Performance With Specific Refrence To Itc LimitedDocumento10 pagineA Research On What Impact Cash Management Has On The Financial Performance With Specific Refrence To Itc LimitedPrajwalNessuna valutazione finora

- A Study On The Financial Analysis of Reliance Industries LimitedDocumento13 pagineA Study On The Financial Analysis of Reliance Industries LimitedIJAR JOURNAL100% (1)

- Working Capital Management in Indian PapDocumento11 pagineWorking Capital Management in Indian PapSaurabh NevNessuna valutazione finora

- A Study On Capital Structure Analysis of Tata Motors LimitedDocumento5 pagineA Study On Capital Structure Analysis of Tata Motors LimitedAntora HoqueNessuna valutazione finora

- 13 PDFDocumento6 pagine13 PDFs.muthuNessuna valutazione finora

- Effect of Cash Conversion Cycle On Profitability: Listed Plantation Companies in Sri LankaDocumento6 pagineEffect of Cash Conversion Cycle On Profitability: Listed Plantation Companies in Sri LankaBlok ProgramNessuna valutazione finora

- ANALYTICAL STUDY ON FINANCIAL PERFORMANCE OF HINDUSTAN UNILEVER LIMITED Ijariie5525Documento8 pagineANALYTICAL STUDY ON FINANCIAL PERFORMANCE OF HINDUSTAN UNILEVER LIMITED Ijariie5525Avishi KushwahaNessuna valutazione finora

- Analysis The Effect of Fundamental Financial Ratio of CAR, LDR, LAR, Bank Size, OPE and NIM On NonPerforming Loans (NPL) of Banking Listed On The Indonesia Stock Exchange in 2012 - 2018Documento8 pagineAnalysis The Effect of Fundamental Financial Ratio of CAR, LDR, LAR, Bank Size, OPE and NIM On NonPerforming Loans (NPL) of Banking Listed On The Indonesia Stock Exchange in 2012 - 2018International Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- ASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014Da EverandASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014Nessuna valutazione finora

- Aayu's RPDocumento11 pagineAayu's RPVaishnavi KNessuna valutazione finora

- 120113-Performance Evaluation of Co-Op. Banks-Sunil CDocumento10 pagine120113-Performance Evaluation of Co-Op. Banks-Sunil Cmahathi bokkasamNessuna valutazione finora

- Rolls-Royce Plc. - An AnalysisDocumento18 pagineRolls-Royce Plc. - An AnalysisNikhil ChandrasekharNessuna valutazione finora

- CCC and ProfitabilityDocumento6 pagineCCC and ProfitabilityNelida GavidiaNessuna valutazione finora

- 517pm - 2.EPRA JOURNALS 7618Documento3 pagine517pm - 2.EPRA JOURNALS 7618Vikram RajputNessuna valutazione finora

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveDa EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNessuna valutazione finora

- The Cost of Survival: A Case Study On Debt Management and Solvency of SmesDocumento1 paginaThe Cost of Survival: A Case Study On Debt Management and Solvency of SmesJuanNessuna valutazione finora

- Strategy: BriefDocumento8 pagineStrategy: BriefJuanNessuna valutazione finora

- YinDocumento3 pagineYinJuanNessuna valutazione finora

- JitDocumento6 pagineJitJuanNessuna valutazione finora

- Merrill Edge Guided Investing Program BrochureDocumento30 pagineMerrill Edge Guided Investing Program Brochurecole_borNessuna valutazione finora

- Difference Between Profitability Vs LiquidityDocumento5 pagineDifference Between Profitability Vs LiquidityAbdul KhanNessuna valutazione finora

- India: Deutsche Bank Group inDocumento3 pagineIndia: Deutsche Bank Group inNeelu AggrawalNessuna valutazione finora

- CH 4 - in ClassDocumento3 pagineCH 4 - in ClassJOSEPH MICHAEL MCGUINNESSNessuna valutazione finora

- Accounting PoliciesDocumento5 pagineAccounting PoliciesNanya BisnestNessuna valutazione finora

- P5 4Documento3 pagineP5 4Monica HutagaolNessuna valutazione finora

- Differenciation of Commercial Bank and Savings BankDocumento3 pagineDifferenciation of Commercial Bank and Savings BankShane TabunggaoNessuna valutazione finora

- Principles of Economics MCQsDocumento51 paginePrinciples of Economics MCQsSathish Kumar MagapuNessuna valutazione finora

- COA Unit 2 Issue of Shares - ProblemsDocumento3 pagineCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNessuna valutazione finora

- New York Stock Exchange - Nyse: Financial DerivativesDocumento18 pagineNew York Stock Exchange - Nyse: Financial DerivativesAdityakondawar575Nessuna valutazione finora

- Determining The Target Cash Balance: Appendix 27ADocumento8 pagineDetermining The Target Cash Balance: Appendix 27AEstefanīa Galarza100% (1)

- Financial Accounting Syllabus KNEC DiplomaDocumento4 pagineFinancial Accounting Syllabus KNEC DiplomaEsther SaisiNessuna valutazione finora

- MKT MixDocumento18 pagineMKT MixRezki PerdanaNessuna valutazione finora

- CMA Data Analysis - BranchDocumento9 pagineCMA Data Analysis - BranchKunal SinghNessuna valutazione finora

- BookkeepingDocumento14 pagineBookkeepingCristel TannaganNessuna valutazione finora

- Financial Analysis of - Toys "R" Us, Inc.Documento30 pagineFinancial Analysis of - Toys "R" Us, Inc.Arabi AsadNessuna valutazione finora

- P1 Cash FlowDocumento2 pagineP1 Cash FlowBeth Diaz LaurenteNessuna valutazione finora

- Limitation of Ratio AnalysisDocumento5 pagineLimitation of Ratio AnalysisMir Wajahat AliNessuna valutazione finora

- Bab 03 Sheet 01Documento44 pagineBab 03 Sheet 01HalimArif XI MIPA 1Nessuna valutazione finora

- CH3 Derivatives PPDocumento61 pagineCH3 Derivatives PPvincenzo21010Nessuna valutazione finora

- Brealey. Myers. Allen Chapter 20 TestDocumento11 pagineBrealey. Myers. Allen Chapter 20 TestSaleh Kattarwala100% (5)

- Laporan Keuangan FarIndo Investments (Mauritius) LTD Per 30 Juni 2014Documento1 paginaLaporan Keuangan FarIndo Investments (Mauritius) LTD Per 30 Juni 2014AngelaNessuna valutazione finora

- Finance Assignment 2Documento3 pagineFinance Assignment 2vish100% (1)

- Tybaf Sem5 Fm-Ii Nov18Documento5 pagineTybaf Sem5 Fm-Ii Nov18rizwan hasmiNessuna valutazione finora

- Barry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Documento11 pagineBarry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Akuw AjahNessuna valutazione finora

- BUS 510 Course OutlineDocumento2 pagineBUS 510 Course OutlineNoor NabiNessuna valutazione finora

- PR - ACEN Sub Issues USD400M in FFL Green Bonds Final VersionDocumento3 paginePR - ACEN Sub Issues USD400M in FFL Green Bonds Final VersionPaulNessuna valutazione finora

- Union Bank of India 22-01-2023 MotiDocumento10 pagineUnion Bank of India 22-01-2023 MotiNimesh ShahNessuna valutazione finora

- Assignment #1 Jordan Hardware & Construction SupplyDocumento9 pagineAssignment #1 Jordan Hardware & Construction SupplyME Valleser100% (1)

- FA2 - SFP and SCI-Answers 1Documento5 pagineFA2 - SFP and SCI-Answers 1Angel AtirazanNessuna valutazione finora