Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Memo Circular Professional Taxes Mayors Permit

Caricato da

Katy SanchezCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Memo Circular Professional Taxes Mayors Permit

Caricato da

Katy SanchezCopyright:

Formati disponibili

Philippine Medical Association

ffi

Theme: One PMA, One Health, One Nation

Member World Medical Association (WMA)

Co-Founder Confederation of Medical Association in Asia and Oceania (CMAAO)

Medical Association of Southeast Asian Nations {MASEAN}

Secretariat PMA Bldg., North Avenue, Quezon City 1105

Telephone Nos-: {532} 929-7351; 929-6366; 926-2447 Fax: (632) 929-6951

Mobile: (Membership Hotline) O9t7 -8221357

Emails: info@philippinemedicalassociation.org; philmedas@vahoo.com

Website: www. philippinemedicalassociation.org

NATIONAL OFTICERS

201s-2015

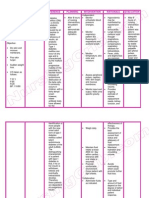

MARIA MINERVA P. CALIMAG, M.D. MEMORANDUM CIRCULAR NO. 2015-07-15-0O6

President

KAREN CONOL-SALOMON, M.D. TO PMA NATIONAL OFFICERS, BOARD OF GOVERNORS, COMPONENT

Vice President OFFICERS, SPECIALTY DIVISIONS, SPECIALTY AND AFFILIATE SOCIETIES

OSCART. CABAHUG, M,D.

National Treasurer SUBJECT PROFESSIONALTAXES AND MAYOR'S PERMIT FEES RELATIVETO

MARIANNE u oRDOfrEZ.OOBLES, M.D. THE PRACTICE OF THE MEDICAL PROFESS]ON

Secretary General

ALBERT C, GUEVARRA, M.D. DATE JULY 16, 2015

Assistant Secretary General

BOARD OF GOVERITIORS

Greetings!

JUDITH A. ALIAGA, M.D.

Northeastern Luzon

This is in connection with the controversy surrounding the assessment

JEISEI.A B. GAERTAN, M.D.

of business taxes/Mayo/s Permits fees imposed or being required from

Northwestern Luzon physicians for the practice of the medical profession.

PAUL RUEL c. cAurfta, nn.p.

Central Luzon Please be advised that physicians (and other professionals who have

LAIGNDUTA A. TI.AYDA, M.D. passed government licensure examinations) are not required to pay business

Manila

taxes for the exercise of the profession nor do they need to pay Mayor's

ROSARTO B. CRUZ-DALID& M.D.

Permit Fees for the practice of the profession pursuant to Section 139 of the

Quezon City

Local Government Code which provides as follows:

JOSE C. RABE, M.D.

Rizal

vlNcENTC. SANTO' M.D. Sec. 139. Professional Tax. - (a) The province

Central Tagalog may levy an annual professional tax on each

ANNfiTE M. MACAYAON, M.D. person engaged in the exercise or practice of his

Southern Tagalog

profession requiring govern ment exa mination at

RAMON C. ECHANOJR., M,D,

Bicol

such amount and reasonable cJassification as

FELMA R. DEIA CRUZ, M.D.

the sangguniang panlalawigan may determine

Western Visayas but shall in no case exceed Three hundred pesos

FTORENCIAT. MIEL, M.D.

(3oo.oo)

Central Visayas

ELIZA D. LAURENTE, M.D. (b) Every person legally authorized to practice

Eastern Visayas

his profession shall pay the professional tax to

EEGAR A. LEGAZPI, M.D.

Western Mindanao

the province where he practices his profession

orwhere he maintains his principaloffice in case

RUBEN O. GO, M.D.

Northern Mindanao he practices his profession in several places;

MARIA LOURDES G. MONTEVERDE, M.D. Provided, however, That such person who has

Southeastern Mindanao

OSOP MP,ABBAS, M.D.

Northcentral Mindanao

BERNARDO T. MORA JR., M.D.

Caraga

paid the corresponding professional tax shall be

entitled to practice his profession in any part of

the Philippines, without being subjected to any

other national or local tax, license, or fee for

the practice of such profession.

The above provision is quite clear. As long as a physician has secured

and paid the professional tax, he can practice his profession without being

subjected to any other tax, Iicense or fee for the practice of the medical

profession. Any imposition of business taxes would be illegal and will

contravene the above provision. lf there is an ordinance requiring doctors to

pay the business tax, such ordinance is null and void as the same will

contravene the Local Government Code. Between the Local Government

Code and a local ordinance, the provisions of the Local Government Code will

prevail.

The above provision of law was clarified by the then Seretary of

Finance, the Honorable Edgardo Espiritu in his opinion dated December 6,

1999. The opinion was sought by a dentist. We quote below the pertinent

provisions of his opinion letter to wit:

"However, a person engaged in the practice of a

profession requiring government examination

such as a dentist, is, by express provision of the

Local Government Code, exempt from this

requirement. The code instead provides for a

professional tax on professionals belonging to

this class. Such professional who has paid the

corresponding professional tax to the province

where he practices his profession shall be

entitled to practice his profession in any part of

the Philippines without being subjected to any

other national or local tax, license or fee,

includins the Mavo/s Permit or license fee, for

the practice of such profession."

As to dental clinics. thev are established as a

direct consequence of the practice of the

dental profession. Thev are necessarilv. for the

exercise of such a orofession.

Therefore, to impose a graduated tax on a

dental clinic on the premise that it is a "business

establishment rendering or offering to render

professional services" would be to impose a

local tax on the practice of a profession. This

would be in contravention of the Local

Government Code.

Attached is a copy of the opinion of Secretary Espiritu.

ln view of the above, a physician does not need to pay a business tax

or pay Mayor's Permit fees for the practice of the medical profession for a

medical clinic as the same is a mere extension of a practice of medicine

provided you have paid the corresponding Professional Tax. However, if the

doctor's clinic is likewise used for other purposes such as a laboratory or

pharmacy, you have to pay the Mayor's Permit fees and/or pay business

taxes.

Please note that Section 139 of the Local Government Code only

applies to fees related to the practice of the profession. lf a local government

unit will impose fees such as sanitary fees, signage fees and others, you still

have to pay the same as they are imposed not for the practice of the

profession.

The association will coordinate with the Department of Local

Government so that the necessary circulars addressed to local government

units will be issued.

Very truly yours,

PHI LI PPI NE MEDICAL ASSOCIATION

MARIA MINERVA P. CALIM

President

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Pharmacovigilance SOPDocumento18 paginePharmacovigilance SOPKaty Sanchez100% (1)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Heuristic Cheat Sheet Clickable LinksDocumento2 pagineHeuristic Cheat Sheet Clickable Linksemily100% (1)

- Some Sunsickday - Kitchenro11Documento356 pagineSome Sunsickday - Kitchenro11Spencer HNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- EASA Part-66 Module 17 QBDocumento53 pagineEASA Part-66 Module 17 QBFaisal Ahmed Newon80% (5)

- Nursing Care Plan Diabetes Mellitus Type 1Documento2 pagineNursing Care Plan Diabetes Mellitus Type 1deric85% (46)

- Questions: BiochemistryDocumento3 pagineQuestions: BiochemistryKaty Sanchez100% (4)

- Introduction To Community Health and Environmental Sanitation PDFDocumento44 pagineIntroduction To Community Health and Environmental Sanitation PDFKaty SanchezNessuna valutazione finora

- Auction 547 Final Catalog April 14 2016Documento13 pagineAuction 547 Final Catalog April 14 2016Katy SanchezNessuna valutazione finora

- Pharmacovigilance and Risk ManagementDocumento22 paginePharmacovigilance and Risk ManagementKaty SanchezNessuna valutazione finora

- Deviation-Violation Reporting FormDocumento2 pagineDeviation-Violation Reporting FormKaty SanchezNessuna valutazione finora

- Ethics of Research With Evolving MethodsDocumento7 pagineEthics of Research With Evolving MethodsKaty SanchezNessuna valutazione finora

- SOP Supply ManagementDocumento4 pagineSOP Supply ManagementKaty SanchezNessuna valutazione finora

- CatalogueDocumento29 pagineCatalogueKaty SanchezNessuna valutazione finora

- FMEA TemplateDocumento54 pagineFMEA TemplateKaty SanchezNessuna valutazione finora

- Drugs Their Targets and The Nature PDFDocumento15 pagineDrugs Their Targets and The Nature PDFKaty SanchezNessuna valutazione finora

- Opd Meds Jgej PDFDocumento4 pagineOpd Meds Jgej PDFKaty SanchezNessuna valutazione finora

- Employee Cellphone PolicyDocumento9 pagineEmployee Cellphone PolicyKaty SanchezNessuna valutazione finora

- SBFZ Accredited Companies 2013-02-08 PDFDocumento22 pagineSBFZ Accredited Companies 2013-02-08 PDFKaty SanchezNessuna valutazione finora

- Attia General Surgery Review ManualDocumento158 pagineAttia General Surgery Review Manualbphage100% (2)

- Risk ManagementDocumento45 pagineRisk ManagementKaty SanchezNessuna valutazione finora

- DOH Phil Drug Price Ref Index 2013Documento23 pagineDOH Phil Drug Price Ref Index 2013maxicap73Nessuna valutazione finora

- Gastrointestinal PhysiologyDocumento39 pagineGastrointestinal PhysiologyKaty SanchezNessuna valutazione finora

- RMPDocumento55 pagineRMPKaty Sanchez100% (1)

- Instrumentation Design BasicsDocumento28 pagineInstrumentation Design BasicsCharles ChettiarNessuna valutazione finora

- Study of Noise Mapping at Moolchand Road Phargang New DelhiDocumento10 pagineStudy of Noise Mapping at Moolchand Road Phargang New DelhiEditor IJTSRDNessuna valutazione finora

- Year 10 English Unit Plan AdvertisingDocumento5 pagineYear 10 English Unit Plan Advertisingapi-333849174Nessuna valutazione finora

- Declaration of Absence of Conflict of InterestDocumento1 paginaDeclaration of Absence of Conflict of InterestJvhelcoronacondat CondatNessuna valutazione finora

- EL2 - Raise Organic Small RuminantsDocumento62 pagineEL2 - Raise Organic Small RuminantsButch Demayo100% (1)

- DRUG STUDY (Erythromycin)Documento3 pagineDRUG STUDY (Erythromycin)Avianna CalliopeNessuna valutazione finora

- Computer Forensics ReportDocumento7 pagineComputer Forensics ReportMatias IacobuzioNessuna valutazione finora

- DIFFERENCE BETWEEN Intrior Design and DecorationDocumento13 pagineDIFFERENCE BETWEEN Intrior Design and DecorationSadaf khanNessuna valutazione finora

- KITZ - Cast Iron - 125FCL&125FCYDocumento2 pagineKITZ - Cast Iron - 125FCL&125FCYdanang hadi saputroNessuna valutazione finora

- Colombo Port City Causing Unimaginable Environmental HarmDocumento6 pagineColombo Port City Causing Unimaginable Environmental HarmThavam RatnaNessuna valutazione finora

- Reading in MCJ 216Documento4 pagineReading in MCJ 216Shela Lapeña EscalonaNessuna valutazione finora

- Implementasi Sistem Pengenalan Candi Kecil Di Yogyakarta Menggunakan BerbasisDocumento7 pagineImplementasi Sistem Pengenalan Candi Kecil Di Yogyakarta Menggunakan BerbasisRivan AuliaNessuna valutazione finora

- The Status of The Translation ProfessionDocumento172 pagineThe Status of The Translation ProfessionVeaceslav MusteataNessuna valutazione finora

- Boomer L2 D - 9851 2586 01Documento4 pagineBoomer L2 D - 9851 2586 01Pablo Luis Pérez PostigoNessuna valutazione finora

- PE 12 Q3 WK1-2 Understanding On Health Related FitnessDocumento8 paginePE 12 Q3 WK1-2 Understanding On Health Related FitnessEmarkzkie Mosra OrecrebNessuna valutazione finora

- Concor PI CCDS 11 All StrengthsDocumento10 pagineConcor PI CCDS 11 All Strengthsgigid afandiNessuna valutazione finora

- Hitachi-HRL SeriesDocumento13 pagineHitachi-HRL SeriesJose LopezNessuna valutazione finora

- FS1 Worksheet Topic 6Documento2 pagineFS1 Worksheet Topic 6ALMALYN ANDIHNessuna valutazione finora

- 311762en WDocumento36 pagine311762en WOprisor CostinNessuna valutazione finora

- Erp FinalDocumento33 pagineErp FinaltenetchatNessuna valutazione finora

- The Duty To Warn in Products Liability: Contours and CriticismDocumento115 pagineThe Duty To Warn in Products Liability: Contours and CriticismArun HiroNessuna valutazione finora

- Debug and AssemblerDocumento9 pagineDebug and AssemblerManoj GurralaNessuna valutazione finora

- A Review of Automatic License Plate Recognition System in Mobile-Based PlatformDocumento6 pagineA Review of Automatic License Plate Recognition System in Mobile-Based PlatformadiaNessuna valutazione finora

- Eps 400 New Notes Dec 15-1Documento47 pagineEps 400 New Notes Dec 15-1BRIAN MWANGINessuna valutazione finora

- Operating Instructions: Vacuum Drying Oven Pump ModuleDocumento56 pagineOperating Instructions: Vacuum Drying Oven Pump ModuleSarah NeoSkyrerNessuna valutazione finora

- Tasha Giles: WebsiteDocumento1 paginaTasha Giles: Websiteapi-395325861Nessuna valutazione finora