Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Amazon Project Reflection

Caricato da

api-315907770Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Amazon Project Reflection

Caricato da

api-315907770Copyright:

Formati disponibili

Amazon

Project Reflection

The purpose of this paper is to analyze the productivity of Amazon from one year to

another using ratios and other information from their financial statements. I will be analyzing

them based on five areas which will be 1) the ability to pay current liabilities 2) the ability to sell

merchandise inventory and collect receivables 3) the ability to pay long term debt 4)

profitability and 5) evaluating stock as an investment.

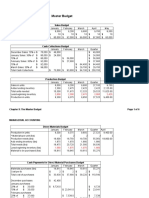

1. Ability to Pay Current Liabilities

Amazons ability to pay their current liabilities decreased from 2011 to 2012. In 2011, their acid-

test ratio was at 0.82 and went down to 0.78 in 2012. Even though this isnt a drastic change, it

is something to be careful of because you do not want a negative trend to be happening. From

this ratio, we can see that if all of Amazons liabilities came due immediately, they would not

have enough cash or cash equivalents to pay everything. They have 0.78 in cash and cash

equivalents to every liability they have.

2. Ability to Sell Merchandise Inventory and Collect Receivables

The ability to sell merchandise for Amazon over these two years has decreased. One obvious

way of knowing this is with the inventory turnover that can be calculated. In 2011, this was at

9.1. This went down to 8.3 in 2012. The industry average is around 4.8 which means that

Amazon is still above the average for its competitors. Their drop was actually not too much. As

for collecting on receivables, the days sales in receivables that can be calculated shows a

decline in this area as well. In 2011, this was at 16 days and went up to 18 in 2012. This

difference of two days is not too bad.

3. Ability to Pay Long Term Debt

This area can be analyzed using the times interest earned ratio. This allows us to see how well a

business can pay interest expenses. In 2011, they could pay their interest expense 15.18 times,

but in 2012 it dropped down to 5.23 times. This is a very significant drop but still puts them at

about where the industry average is. You do not want this to get much lower as this could mean

that it is harder to pay interest on assets that are financed with debt.

4. Profitability

Comparing the two years for Amazon, we can see a significant drop in their profitability. In

2011, their profit margin was 1.31% which means that a little over 1% of every dollar of net

sales they make goes towards their net income. In 2012, this changed drastically for Amazon as

their profit margin went down to (0.06) % which means that they were actually losing the

tiniest bit of money on every sale. They must work out a way to get back to where they were or

they will not be a profitable company.

5. Evaluating Stock as an Investment

Investing in Amazons stock in 2012 would have been a very poor choice. Using the

price/earnings ratio, it becomes very apparent that this was not good stock to invest in. Going

from 2011 to 2012, this ratio went from 131.37 all the way down to (2854.70). The value of

their stock dropped extremely quickly and drastically. This is why anyone who had invested in

Amazons stock during this time would have been very disappointed.

In conclusion, during this two year span Amazon decreased in every category. Even

though some areas looked better than others, looking at the overall picture, it is easy to see

how much they declined from one year to the next. This gives them a lot of room to improve

and learn from their mistakes.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Acct 2020 Master Budget Jared OstlerDocumento6 pagineAcct 2020 Master Budget Jared Ostlerapi-315907770Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Mexican American Research PaperDocumento9 pagineMexican American Research Paperapi-315907770Nessuna valutazione finora

- Amazon Project Part 1Documento9 pagineAmazon Project Part 1api-315907770Nessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Accounting Cycle 2Documento9 pagineAccounting Cycle 2api-315907770Nessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Exploring p01 Grader A1Documento6 pagineExploring p01 Grader A1api-253891317Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Exploring w04 Grader A1Documento7 pagineExploring w04 Grader A1Hemal PatelNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- My ResumeDocumento2 pagineMy Resumeapi-315907770Nessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Excel AssignmentDocumento2 pagineExcel Assignmentapi-315907770Nessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- HandbookDocumento6 pagineHandbookAryan SinghNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Edunsol@gmail - Com, 09996522162, Career Counseling, Direct Admissions, MBBS, BDS, BTECH, MBA, Pharmacy, New Delhi, Mumbai, Pune, Bangalore....Documento377 pagineEdunsol@gmail - Com, 09996522162, Career Counseling, Direct Admissions, MBBS, BDS, BTECH, MBA, Pharmacy, New Delhi, Mumbai, Pune, Bangalore....Education SolutionsNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Infographic Humanistic PsychologyDocumento2 pagineInfographic Humanistic Psychologyvivain.honnalli.officialNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Responsibility Accounting Practice ProblemDocumento4 pagineResponsibility Accounting Practice ProblemBeomiNessuna valutazione finora

- Ceilcote 222HT Flakeline+ds+engDocumento4 pagineCeilcote 222HT Flakeline+ds+englivefreakNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- தமிழ் உணவு வகைகள் (Tamil Cuisine) (Archive) - SkyscraperCityDocumento37 pagineதமிழ் உணவு வகைகள் (Tamil Cuisine) (Archive) - SkyscraperCityAsantony Raj0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Simple CASC StationsDocumento74 pagineSimple CASC Stationssherief marouf100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Unsaturated HydrocarbonsDocumento84 pagineUnsaturated HydrocarbonsHey itsJamNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- WP DeltaV Software Update Deployment PDFDocumento8 pagineWP DeltaV Software Update Deployment PDFevbaruNessuna valutazione finora

- Radial Lead Varistors LA Varistor SeriesDocumento13 pagineRadial Lead Varistors LA Varistor SeriesLeman SihotangNessuna valutazione finora

- BURNS GeneralDocumento59 pagineBURNS GeneralValluri MukeshNessuna valutazione finora

- PC110R 1 S N 2265000001 Up PDFDocumento330 paginePC110R 1 S N 2265000001 Up PDFLuis Gustavo Escobar MachadoNessuna valutazione finora

- Theoretical Background: Theories Relevance To The Study SourcesDocumento3 pagineTheoretical Background: Theories Relevance To The Study SourcesAdelfa Mae BerdonNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Copy of HW UMTS KPIsDocumento18 pagineCopy of HW UMTS KPIsMohamed MoujtabaNessuna valutazione finora

- Ryder Quotation 2012.7.25Documento21 pagineRyder Quotation 2012.7.25DarrenNessuna valutazione finora

- Kmart PDFDocumento105 pagineKmart PDFkaranbhayaNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Babok Framework Overview: BA Planning & MonitoringDocumento1 paginaBabok Framework Overview: BA Planning & MonitoringJuan100% (1)

- Shawarma Refers To The Middle Eastern Method Cooking Where Thin Slices of MeatDocumento3 pagineShawarma Refers To The Middle Eastern Method Cooking Where Thin Slices of MeatColai's BcdNessuna valutazione finora

- Hotel ClassificationDocumento10 pagineHotel ClassificationRonelyn Boholst100% (1)

- Unit 18: Calculating Food Costs, Selling Prices and Making A ProfitDocumento4 pagineUnit 18: Calculating Food Costs, Selling Prices and Making A Profitkarupukamal100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Evaluation of Whole-Body Vibration (WBV) On Ready Mixed Concrete Truck DriversDocumento8 pagineEvaluation of Whole-Body Vibration (WBV) On Ready Mixed Concrete Truck DriversmariaNessuna valutazione finora

- Consolidation of ClayDocumento17 pagineConsolidation of ClayMD Anan MorshedNessuna valutazione finora

- Inversor Abb 3 8kwDocumento2 pagineInversor Abb 3 8kwapi-290643326Nessuna valutazione finora

- Continuous Microbiological Environmental Monitoring For Process Understanding and Reduced Interventions in Aseptic ManufacturingDocumento44 pagineContinuous Microbiological Environmental Monitoring For Process Understanding and Reduced Interventions in Aseptic ManufacturingTorres Xia100% (1)

- Unit 5.4 - Incapacity As A Ground For DismissalDocumento15 pagineUnit 5.4 - Incapacity As A Ground For DismissalDylan BanksNessuna valutazione finora

- Eric CHE326 JournalpptDocumento33 pagineEric CHE326 JournalpptRugi Vicente RubiNessuna valutazione finora

- D2C - Extensive ReportDocumento54 pagineD2C - Extensive ReportVenketesh100% (1)

- Optimization Process of Biodiesel Production With Ultrasound Assisted by Using Central Composite Design MethodsDocumento47 pagineOptimization Process of Biodiesel Production With Ultrasound Assisted by Using Central Composite Design MethodsMiftahFakhriansyahNessuna valutazione finora

- Aits 2324 Ot I Jeea TD Paper 2 OfflineDocumento14 pagineAits 2324 Ot I Jeea TD Paper 2 OfflineAshish SharmaNessuna valutazione finora

- MPX-200 Service Manual PDFDocumento90 pagineMPX-200 Service Manual PDFvivijaNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)