Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1704963067PC - Amul Con Call Update - Apr 2015 20150417100429

Caricato da

HIMANSHITitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

1704963067PC - Amul Con Call Update - Apr 2015 20150417100429

Caricato da

HIMANSHICopyright:

Formati disponibili

INSTITUTIONAL EQUITY RESEARCH

Indian Dairy Industry

Delivering growth & Generating livelihoods

17 April 2015

INDIA |FMCG | Conference Call Update

We hosted a conference call with MD of Gujarat Cooperative Milk Marketing Federation Ltd. (Amul),

Mr. Rupinder Singh Sodhi to understand the emerging trends, challenges & opportunities in dairy

industry. The key takeaways of the call are:

Indian Dairy Industry is the worlds largest: India is the worlds largest producer & consumer of milk.

While the annual production of milk in India has increased 7 fold in 45 years to 140 mn Tonnes

currently, the annual per capita consumption of milk has also increased threefold to 310 g currently.

The spectacular growth of milk industry can be attributed to supply expansion due to attractive

incentives to milk producers & demand expansion due to rise in per capita incomes.

Yield low in India because of lower yield of local cows as compared to cross breeds: The Local cow

breed produces 3.5 L of milk/day as against 5.5 L for a buffaloes & 10 L for cross breed cows. Since

small suppliers in India do not own high proportion of cross breeds, the overall yield in India is lower

compared to some other top milk producers.

Dairy Industry is still highly unorganized; Organized sector is dominated by Co-operatives: The

industry is majorly unorganized as organized sector accounts for only 20% of the total volumes. Out of

the 140 mn T of milk produced, 50% is consumed in villages itself. Out of the remaining 70 mn T, 28

mn T is sold by organized sector & rest by unorganized sector. The co-operatives dominate the

organized dairy industry, accounting for 80% of its revenue, because of raw material sourcing

dynamics working in their favor.

Co-operatives more favorable to small milk producers as the former buy milk at highest possible

prices: In contrast to private players which try to keep costs down to maximize profit, co-operatives

like Amul, have a mandate of buying milk from suppliers at as high prices as possible but at the same

time not incurring any losses. This benefits the millions of small suppliers of milk (3.5 million for

GCMMF) and they prefer selling milk to co-operatives than to private players. As a result, even though

Amul makes revenues of Rs 210 bn, the profit is a meager Rs 0.5 bn.

Government policies have an impact on dairy industry: The dairy sector was completely opened since

1991 and there are no restrictions on the entry and exit of private players. However, due to social &

health considerations, some states offer subsidies to milk consumers. For example, in the states of

Karnataka & Andhra Pradesh, the state sells milk at a subsidized rate of Rs 4/ litre through its channels.

This can create inefficiencies in the market & can impact the business models of private players.

Dairy industry is a very low profitability business: EBITDA in dairy industry does not exceed 6-7% for

most of the players due to high input prices & high other operational expenses. Also, it is not possible

to sell only value added products. Every player has to have a huge proportion of sales portfolio in the

base product - milk because of the economics & operational requirements of the dairy industry. This

impacts the profitability.

Milk Prices will continue to be subdued for next 1 year: The prices of dairy products have fallen

globally as a result of overall fall in commodity prices & also due to drastic reduction in growth of

purchases by emerging economies like China. As a result, since last 1 year, there has not been a

significant increase in milk prices and the prices are expected to be stagnant for coming few quarters.

Slowdown in Rural demand not seen in Dairy Industry: As compared to other FMCG categories, the

dairy industry has not seen a slowdown in demand in rural industry. The demand for milk as well as

value added products is very robust & is growing at a health rate.

Strong growth momentum of industry to continue, Amul to grow faster than the market: The Naveen Kulkarni (+ 9122 6647 9947)

nkulkarni@phillipcapital.in

domestic dairy industry is expected to show a robust growth in the next few years of 10-12%. Volume

growth for base milk is expected to be 4-5%, and that for branded milk & value added products like Jubil Jain (+ 9122 6647 9766)

ghee, cheese, etc. to be 10%. Amul due to its superior sourcing & marketing abilities will grow faster jjain@phillipcapital.in

than the market with a value growth of 15-16% (volume growth 10-12% & price growth 4-5%).

Page | 1 | PHILLIPCAPITAL INDIA RESEARCH

AMUL CONFERENCE CALL UPDATE

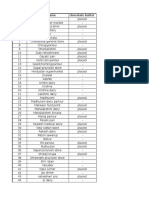

Management

Vineet Bhatnagar (Managing Director) (91 22) 2300 2999

Kinshuk Bharti Tiwari (Head Institutional Equity) (91 22) 6667 9946

Jignesh Shah (Head Equity Derivatives) (91 22) 6667 9735

Research

Automobiles Economics Retail, Real Estate

Dhawal Doshi (9122) 6667 9769 Anjali Verma (9122) 6667 9969 Abhishek Ranganathan, CFA (9122) 6667 9952

Priya Ranjan (9122) 6667 9965 Rohit Shroff (9122) 6667 9756

Infrastructure & IT Services

Banking, NBFCs Vibhor Singhal (9122) 6667 9949 Portfolio Strategy

Manish Agarwalla (9122) 6667 9962 Deepan Kapadia (9122) 6667 9992 Anindya Bhowmik (9122) 6667 9764

Pradeep Agrawal (9122) 6667 9953

Paresh Jain (9122) 6667 9948 Midcap Technicals

Vikram Suryavanshi (9122) 6667 9951 Subodh Gupta, CMT (9122) 6667 9762

Consumer, Media, Telecom

Naveen Kulkarni, CFA, FRM (9122) 6667 9947 Metals Production Manager

Jubil Jain (9122) 6667 9766 Dhawal Doshi (9122) 6667 9769 Ganesh Deorukhkar (9122) 6667 9966

Manoj Behera (9122) 6667 9973 Ankit Gor (9122) 6667 9987

Database Manager

Cement Oil&Gas, Agri Inputs Deepak Agarwal (9122) 6667 9944

Vaibhav Agarwal (9122) 6667 9967 Gauri Anand (9122) 6667 9943

Deepak Pareek (9122) 6667 9950 Sr. Manager Equities Support

Engineering, Capital Goods Rosie Ferns (9122) 6667 9971

Ankur Sharma (9122) 6667 9759 Pharma

Hrishikesh Bhagat (9122) 6667 9986 Surya Patra (9122) 6667 9768

Mehul Sheth (9122) 6667 9996

Sales & Distribution Corporate Communications

Ashvin Patil (9122) 6667 9991 Sales Trader Zarine Damania (9122) 6667 9976

Shubhangi Agrawal (9122) 6667 9964 Dilesh Doshi (9122) 6667 9747

Kishor Binwal (9122) 6667 9989 Suniil Pandit (9122) 6667 9745

Sidharth Agrawal (9122) 6667 9934 Execution

Bhavin Shah (9122) 6667 9974 Mayur Shah (9122) 6667 9945

Contact Information (Regional Member Companies)

SINGAPORE MALAYSIA HONG KONG

Phillip Securities Pte Ltd Phillip Capital Management Sdn Bhd Phillip Securities (HK) Ltd

250 North Bridge Road, #06-00 Raffles City Tower, B-3-6 Block B Level 3, Megan Avenue II, 11/F United Centre 95 Queensway Hong Kong

Singapore 179101 No. 12, Jalan Yap Kwan Seng, 50450 Kuala Lumpur Tel (852) 2277 6600 Fax: (852) 2868 5307

Tel : (65) 6533 6001 Fax: (65) 6535 3834 Tel (60) 3 2162 8841 Fax (60) 3 2166 5099 www.phillip.com.hk

www.phillip.com.sg www.poems.com.my

JAPAN INDONESIA CHINA

Phillip Securities Japan, Ltd PT Phillip Securities Indonesia Phillip Financial Advisory (Shanghai) Co. Ltd.

4-2 Nihonbashi Kabutocho, Chuo-ku ANZ Tower Level 23B, Jl Jend Sudirman Kav 33A, No 550 Yan An East Road, Ocean Tower Unit 2318

Tokyo 103-0026 Jakarta 10220, Indonesia Shanghai 200 001

Tel: (81) 3 3666 2101 Fax: (81) 3 3664 0141 Tel (62) 21 5790 0800 Fax: (62) 21 5790 0809 Tel (86) 21 5169 9200 Fax: (86) 21 6351 2940

www.phillip.co.jp www.phillip.co.id www.phillip.com.cn

THAILAND FRANCE UNITED KINGDOM

Phillip Securities (Thailand) Public Co. Ltd. King & Shaxson Capital Ltd. King & Shaxson Ltd.

15th Floor, Vorawat Building, 849 Silom Road, 3rd Floor, 35 Rue de la Bienfaisance 6th Floor, Candlewick House, 120 Cannon Street

Silom, Bangrak, Bangkok 10500 Thailand 75008 Paris France London, EC4N 6AS

Tel (66) 2 2268 0999 Fax: (66) 2 2268 0921 Tel (33) 1 4563 3100 Fax : (33) 1 4563 6017 Tel (44) 20 7929 5300 Fax: (44) 20 7283 6835

www.phillip.co.th www.kingandshaxson.com www.kingandshaxson.com

UNITED STATES AUSTRALIA SRI LANKA

Phillip Futures Inc. PhillipCapital Australia Asha Phillip Securities Limited

141 W Jackson Blvd Ste 3050 Level 37, 530 Collins Street Level 4, Millennium House, 46/58 Navam Mawatha,

The Chicago Board of Trade Building Melbourne, Victoria 3000, Australia Colombo 2, Sri Lanka

Chicago, IL 60604 USA Tel: (61) 3 9629 8380 Fax: (61) 3 9614 8309 Tel: (94) 11 2429 100 Fax: (94) 11 2429 199

Tel (1) 312 356 9000 Fax: (1) 312 356 9005 www.phillipcapital.com.au www.ashaphillip.net/home.htm

INDIA

PhillipCapital (India) Private Limited

No. 1, 18th Floor, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel West, Mumbai 400013

Tel: (9122) 2300 2999 Fax: (9122) 6667 9955 www.phillipcapital.in

Page | 2 | PHILLIPCAPITAL INDIA RESEARCH

AMUL CONFERENCE CALL UPDATE

Disclosures and Disclaimers

PhillipCapital (India) Pvt. Ltd. has three independent equity research groups: Institutional Equities, Institutional Equity Derivatives and Private Client Group. This report has been

prepared by Institutional Equities Group. The views and opinions expressed in this document may or may not match or may be contrary at times with the views, estimates, rating,

target price of the other equity research groups of PhillipCapital (India) Pvt. Ltd.

This report is issued by PhillipCapital (India) Pvt. Ltd. which is regulated by SEBI. PhillipCapital (India) Pvt. Ltd. is a subsidiary of Phillip (Mauritius) Pvt. Ltd. References to "PCIPL" in

this report shall mean PhillipCapital (India) Pvt. Ltd unless otherwise stated. This report is prepared and distributed by PCIPL for information purposes only and neither the

information contained herein nor any opinion expressed should be construed or deemed to be construed as solicitation or as offering advice for the purposes of the purchase or sale

of any security, investment or derivatives. The information and opinions contained in the Report were considered by PCIPL to be valid when published. The re port also contains

information provided to PCIPL by third parties. The source of such information will usually be disclosed in the report. Whilst PCIPL has taken all reasonable steps to ensure that this

information is correct, PCIPL does not offer any warranty as to the accuracy or completeness of such information. Any person placing reliance on the report to undertake trading

does so entirely at his or her own risk and PCIPL does not accept any liability as a result. Securities and Derivatives markets may be subject to rapid and unexpected price movements

and past performance is not necessarily an indication to future performance.

This report does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors must

undertake independent analysis with their own legal, tax and financial advisors and reach their own regarding the appropriateness of investing in any securities or investment

strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. In no circumstances it be used or

considered as an offer to sell or a solicitation of any offer to buy or sell the Securities mentioned in it. The information contained in the research reports may have been taken from

trade and statistical services and other sources, which we believe are reliable. PhillipCapital (India) Pvt. Ltd. or any of its group/associate/affiliate companies do not guarantee that

such information is accurate or complete and it should not be relied upon as such. Any opinions expressed reflect judgments at this date and are subject to change without notice

Important: These disclosures and disclaimers must be read in conjunction with the research report of which it forms part. Rec eipt and use of the research report is subject to all

aspects of these disclosures and disclaimers. Additional information about the issuers and securities discussed in this research report is available on request.

Certifications: The research analyst(s) who prepared this research report hereby certifies that the views expressed in this research report accurately reflect the research analysts

personal views about all of the subject issuers and/or securities, that the analyst have no known conflict of interest and no part of the research analysts compensation was, is or will

be, directly or indirectly, related to the specific views or recommendations contained in this research report. The Research Analyst certifies that he /she or his / her family members

does not own the stock(s) covered in this research report.

Independence/Conflict: PhillipCapital (India) Pvt. Ltd. has not had an investment banking relationship with, and has not received any compensation for investment banking services

from, the subject issuers in the past twelve (12) months, and PhillipCapital (India) Pvt. Ltd does not anticipate receiving or intend to seek compensation for investment banking

services from the subject issuers in the next three (3) months. PhillipCapital (India) Pvt. Ltd is not a market maker in the securities mentioned in this research report, although it or its

employees, directors, or affiliates may hold either long or short positions in such securities. PhillipCapital (India) Pvt. Ltd may not hold more than 1% of the shares of the

company(ies) covered in this report.

Suitability and Risks: This research report is for informational purposes only and is not tailored to the specific investment objectives, financial situation or particular requirements of

any individual recipient hereof. Certain securities may give rise to substantial risks and may not be suitable for certain investors. Each investor must make its own determination as to

the appropriateness of any securities referred to in this research report based upon the legal, tax and accounting considerations applicable to such investor and its own investment

objectives or strategy, its financial situation and its investing experience. The value of any security may be positively or adversely affected by changes in foreign exchange or interest

rates, as well as by other financial, economic or political factors. Past performance is not necessarily indicative of future performance or results.

Sources, Completeness and Accuracy: The material herein is based upon information obtained from sources that PCIPL and the research analyst believe to be reliable, but neither

PCIPL nor the research analyst represents or guarantees that the information contained herein is accurate or complete and it should not be relied upon as such. Opinions expressed

herein are current opinions as of the date appearing on this material and are subject to change without notice. Furthermore, PCIPL is under no obligation to update or keep the

information current.

Copyright: The copyright in this research report belongs exclusively to PCIPL. All rights are reserved. Any unauthorized use or disclosure is prohibited. No reprinting or reproduction,

in whole or in part, is permitted without the PCIPLs prior consent, except that a recipient may reprint it for internal circulation only and only if it is reprinted in its entirety.

Caution: Risk of loss in trading in can be substantial. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources

and other relevant circumstances.

For U.S. persons only: This research report is a product of PhillipCapital (India) Pvt Ltd. which is the employer of the research analyst(s) who has prepared the research report. The

research analyst(s) preparing the research report is/are resident outside the United States (U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore

the analyst(s) is/are not subject to supervision by a U.S. broker-dealer, and is/are not required to satisfy the regulatory licensing requirements of FINRA or required to otherwise

comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public appearances and trading securities held by a research analyst

account.

This report is intended for distribution by PhillipCapital (India) Pvt Ltd. only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S. Securities and Exchange Act,

1934 (the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major

Institutional Investor as specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied, duplicated and/or

transmitted onward to any U.S. person, which is not the Major Institutional Investor.

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct certain business with Major

Institutional Investors, PhillipCapital (India) Pvt Ltd. has entered into an agreement with a U.S. registered broker-dealer, Marco Polo Securities Inc. ("Marco Polo").Transactions in

securities discussed in this research report should be effected through Marco Polo or another U.S. registered broker dealer.

PhillipCapital (India) Pvt. Ltd.

Registered office: No. 1, 18th Floor, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel West, Mumbai 400013

Page | 3 | PHILLIPCAPITAL INDIA RESEARCH

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Living Temple Class NotesDocumento73 pagineLiving Temple Class NotesMichael Haskins100% (7)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Individual Finance PDFDocumento575 pagineIndividual Finance PDFshivam vajpai100% (1)

- Hbs Case - Ust Inc.Documento4 pagineHbs Case - Ust Inc.Lau See YangNessuna valutazione finora

- Assessment of Working CapitalDocumento55 pagineAssessment of Working CapitalShivam Goyal0% (1)

- MTKNG DashboardDocumento16 pagineMTKNG DashboardDageeshNessuna valutazione finora

- Questionnaire For AmulDocumento4 pagineQuestionnaire For AmulLeena Sarma47% (17)

- Corporate Governance and Financial Performance An Empirical Study of IndianDocumento239 pagineCorporate Governance and Financial Performance An Empirical Study of IndianFaisal ArifNessuna valutazione finora

- Credit Risk Management. KsfeDocumento71 pagineCredit Risk Management. KsfeJith EG86% (7)

- Jasmin's Black Book ProjectDocumento67 pagineJasmin's Black Book ProjectJasmin John Sara83% (12)

- Credit Risk Management at State Bank of India Project Report Mba FinanceDocumento104 pagineCredit Risk Management at State Bank of India Project Report Mba FinanceNilam Pawar67% (3)

- SuratDocumento2 pagineSuratHIMANSHINessuna valutazione finora

- New Microsoft Excel WorksheetDocumento5 pagineNew Microsoft Excel WorksheetHIMANSHINessuna valutazione finora

- New Microsoft Word DocumentDocumento11 pagineNew Microsoft Word DocumentHIMANSHINessuna valutazione finora

- 7110 Specimen Paper 2010 P2msDocumento8 pagine7110 Specimen Paper 2010 P2msfgaushiya67% (3)

- National Income Determination: (Three Sector Model)Documento12 pagineNational Income Determination: (Three Sector Model)Yash KumarNessuna valutazione finora

- ©2011 Pearson Education, Inc. Publishing As Prentice HallDocumento72 pagine©2011 Pearson Education, Inc. Publishing As Prentice HallSimon SebastianNessuna valutazione finora

- Iron and Steel Industry: Economics AssignmentDocumento10 pagineIron and Steel Industry: Economics Assignmentsamikshya choudhuryNessuna valutazione finora

- Delinquent ShareholderDocumento6 pagineDelinquent ShareholderQuinxNessuna valutazione finora

- Advanced Finance, Banking and Insurance SamenvattingDocumento50 pagineAdvanced Finance, Banking and Insurance SamenvattingLisa TielemanNessuna valutazione finora

- Atlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003Documento4 pagineAtlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003babe447Nessuna valutazione finora

- Jurnal 2017 - YUDIDocumento3 pagineJurnal 2017 - YUDIIbrahim DoruNessuna valutazione finora

- Kota Fibres ExhibitsDocumento13 pagineKota Fibres ExhibitsHaemiwan FathonyNessuna valutazione finora

- JP A Kun Tans Igg 160040Documento21 pagineJP A Kun Tans Igg 160040IkadekcandrayanaNessuna valutazione finora

- Tutorial Answers - Topic 5: Q1: Mcdonalds (Based On A Past Exam Question)Documento8 pagineTutorial Answers - Topic 5: Q1: Mcdonalds (Based On A Past Exam Question)technowiz11Nessuna valutazione finora

- Week 3Documento25 pagineWeek 3Jared Bressler0% (1)

- What You Should Know About PMP FormulasDocumento23 pagineWhat You Should Know About PMP FormulasNicole MartinezNessuna valutazione finora

- Met Smart GoldDocumento10 pagineMet Smart GoldyatinthoratscrbNessuna valutazione finora

- Sri Sairam Institute of Technology Department of Management StudiesDocumento11 pagineSri Sairam Institute of Technology Department of Management StudiesAbhinayaa SNessuna valutazione finora

- Sec FunctionsDocumento105 pagineSec Functionsfolatunde2001Nessuna valutazione finora

- 2.guess Questions - Problems - QuestionsDocumento34 pagine2.guess Questions - Problems - QuestionsKrishnaKorada67% (9)

- Spanish Migration PlanDocumento22 pagineSpanish Migration PlannauizNessuna valutazione finora

- Introducing LetsVenture-CA FinalDocumento13 pagineIntroducing LetsVenture-CA FinalsreewealthNessuna valutazione finora

- Masterskill Education Group Berhad: Public Issue of 41.0m New Shares, Offering 205.0m Shares in Total - 4/5/2010Documento6 pagineMasterskill Education Group Berhad: Public Issue of 41.0m New Shares, Offering 205.0m Shares in Total - 4/5/2010Rhb InvestNessuna valutazione finora

- Tutorial - The Time Value of MoneyDocumento6 pagineTutorial - The Time Value of MoneyFahmi CANessuna valutazione finora