Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)

Caricato da

Shyam SunderTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)

Caricato da

Shyam SunderCopyright:

Formati disponibili

SANKHYA INFOTECH LIMITED

8-2-686/DB/19 Mount View Enclave, Road No 12 Banjara Hills Hyderabad -500034

UN- AUDITED FINANCIAL RESULTS FOR THE QUARTER & NINE MONTHS PERIOD ENDED DEC 31ST 2016

Rs. In Lakhs except for EPS

Quarter Ended Nine Months Ended Year Ended

Sl. Un-Audited Un-Audited Un-Audited Un-Audited Un-Audited Audited

Particulars

No. 31.12.2016 30.09.2016 31.12.2015 31.12.2016 31.12.2015 31.03.2016

1 Income from Operations 3,835.24 3,631.40 3,973.44 11,607.93 11,441.72 15,293.78

Total Income from Operations 3,835.24 3,631.40 3,973.44 11,607.93 11,441.72 15,293.78

2 Total Expenditure 3,527.52 3,354.76 3,717.11 10,793.33 10,901.85 14,750.28

A) Staff Cost 1,976.12 1,918.49 2,040.41 6,216.92 5,945.69 8,322.95

B) Other Expenditure 1,194.50 1,102.81 1,343.62 3,556.13 3,972.56 5,107.39

C) R& D Expenditure 204.62 194.47 196.28 593.82 596.27 789.91

d) Depreciation and ammortization expense 152.28 138.99 136.80 426.46 387.33 530.03

3 Operating Profit before Other Income

307.72 276.64 256.33 814.60 539.87 543.50

& finance cost

4 Other Income 0.43 0.20 0.63 46.55 404.43 503.06

5

Operating Profit before finance cost 308.15 276.84 256.96 861.15 944.30 1,046.56

6 Financial Expenses 104.26 105.78 130.86 319.54 396.62 490.47

7 Profit/(Loss) before Taxation 203.89 171.06 126.10 541.61 547.68 556.09

8 Provision

- Taxation (Incl. FBT) 44.15 37.77 33.78 116.05 124.12 119.11

- Deferred Tax 16.33 15.68 7.91 34.82 26.75 (22.13)

- Other Provision - - - - - 62.00

9 Profit / (Loss) after Taxation 143.42 117.61 84.41 390.75 396.81 397.11

10 Prior Period Expenses - - - - - -

11 Profit / (Loss) after Prior Period Adj 143.42 117.61 84.41 390.75 396.81 397.11

12 Paid-up equity share capital 1,124.52 1,124.52 1,124.52 1,124.52 1,124.52 1,124.52

(Face value of Rs.10 per Share)

13 Reserves 6,698.07 6,554.65 6,307.03 6,698.07 6,307.03 6,307.32

14 Basic and diluted Earning per Share in Rs. 1.28 1.05 0.75 3.48 3.53 3.53

(On a par value of Rs.10 per share)

15 Aggregate of non-promoter shareholding

- Number of Shares 8533107 8553107 8518730 8533107 8518730 8538730

- Percentage of Shareholding 75.88 76.06 75.75 75.88 75.75 75.93

16 Promoters and promoter group

Share holding 2712098 2692098 2726475 2712098 2726475 2706475

a) Pledged / Encumbered

Number of shares - - 250000 - 250000 250000

Percentage of Shares ( as a % of total

shareholding of promoter & promoter group 24.12 23.94 24.25 24.12 24.25 24.07

Percentage of Shares ( as a % of total

share capital of the company - - 2.22 - 2.22 2.22

b) Non - encumbered

Number of shares 2712098 2692098 2476475 2712098 2476475 2456475

Percentage of Shares ( as a % of total

shareholding of promoter & promoter group 75.88 76.06 75.75 75.88 75.75 75.93

Percentage of Shares ( as a % of total

share capital of the company 24.12 23.94 22.03 24.12 22.03 21.85

UN AUDITED- SEGMENT WISE REVENUE, RESULTS FOR THE QUARTER & NINE MONTHS PERIOD ENDED AS ON DEC 31ST 2016 Rs.In Lacs

3 Months 9 Months Year Ended

Sl. Un-Audited Un-Audited Un-audited Un-audited Un-Audited Audited

Particulars

No. 31.12.2016 30.09.2016 31.12.2015 31.12.2016 31.12.2015 31.03.2016

1 Segment Revenue

Defense 1577.48 1426.10 1319.55 4539.98 3913.21 5202.17

Non Defense 2257.76 2205.30 2653.89 7067.95 7528.51 10091.61

Total 3835.24 3631.40 3973.44 11607.93 11441.72 15293.78

Less : Inter segment revenues - - - - - -

Net Segment Revenue 3835.24 3631.40 3973.44 11607.93 11441.72 15293.78

2 Segment Results

Defense 130.17 108.74 105.80 319.00 367.93 402.08

Non Defense 177.98 168.10 151.16 542.15 576.37 644.48

Total 308.15 276.84 256.96 861.15 944.30 1046.56

- - - - - -

Net Segment Results 308.15 276.84 256.96 861.15 944.30 1046.56

3 Segment Results before tax and interest

Total 308.15 276.84 256.96 861.15 944.30 1046.56

Less : Interest Expenses 104.26 105.78 130.86 319.54 396.62 490.47

Total Profit/(Loss) Before Tax 203.89 171.06 126.10 541.61 547.68 556.09

Notes:

1. Limited Review of the Financials has been carrried out by the auditors.

2. Foreign Exchange Transactions have been captured as per Accounting Standard 11.

3. The above financial results of the Company were reviewed by the Audit Committee, approved and taken on record by the Board of

Directors at its meeting held on January 28th, 2017

of Directors

4. Provision forat its meeting

employee held on

benefits for8th

the Feb, 2014.

current period has been made on estimated basis. Actual Provision for full year shall be considered

at the end of the year, in accordance with the revised Accounting Standard AS-15 (Employee Benefits).

5. Figures have been regrouped / reclassified wherever necessary.

6. Details of number of investor complaints for the quarter ended 31st Dec, 2016

Beginning - , 0 Received - , 3 Disposed off - 3 , Pending - 0

7. The Company's results are posted on the website http://www.sankhya.net.

Sd/-

Place: Hyderabad N.Sridhar

Date: 28.01.2017 Chairman & Managing Director

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- PDF Processed With Cutepdf Evaluation EditionDocumento3 paginePDF Processed With Cutepdf Evaluation EditionShyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento11 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento3 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 pagineTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNessuna valutazione finora

- Investor Presentation For December 31, 2016 (Company Update)Documento27 pagineInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Annisa Putri Ariyanto - Lembar Kerja Buku Besar - PT AC NOL DERAJATDocumento12 pagineAnnisa Putri Ariyanto - Lembar Kerja Buku Besar - PT AC NOL DERAJATannisa putriNessuna valutazione finora

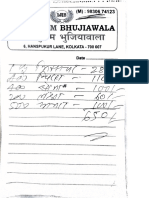

- Sweets BillDocumento3 pagineSweets BillSagar AgarwalNessuna valutazione finora

- Cary Conger Debunks Adam Ledford's Sac City Street Improvement Project Explanation Letter in The January 8, 2013 Sac SunDocumento3 pagineCary Conger Debunks Adam Ledford's Sac City Street Improvement Project Explanation Letter in The January 8, 2013 Sac SunthesacnewsNessuna valutazione finora

- Asian Paints DCF ValuationDocumento64 pagineAsian Paints DCF Valuationsanket patilNessuna valutazione finora

- Kalpataru Power Transmission Limited Tender Opening Result - KPTL/BD-TD-T5Documento2 pagineKalpataru Power Transmission Limited Tender Opening Result - KPTL/BD-TD-T5Sachin WaniNessuna valutazione finora

- Final Details For Order #111-4892021-7769015: Shipped On November 29, 2013Documento1 paginaFinal Details For Order #111-4892021-7769015: Shipped On November 29, 2013alfredop71Nessuna valutazione finora

- Repayment Receipt MK64AA635EID46896934Documento1 paginaRepayment Receipt MK64AA635EID46896934Apka Apna SaimNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceGanesh EnterprisesNessuna valutazione finora

- Income Tax AuthoritiesDocumento3 pagineIncome Tax AuthoritiesWaqas AjmeryNessuna valutazione finora

- Taxau316 CSGDocumento732 pagineTaxau316 CSGBb 8Nessuna valutazione finora

- Aec10 - Business Taxation Solution Tabag CH4Documento8 pagineAec10 - Business Taxation Solution Tabag CH4EdeksupligNessuna valutazione finora

- Chapter 4 Taxation of TRUSTs-2Documento5 pagineChapter 4 Taxation of TRUSTs-2NaikNessuna valutazione finora

- Motor Bill 97cDocumento2 pagineMotor Bill 97cShahNessuna valutazione finora

- 10 Easy Steps To Bir Business Registration and A Complete List of Bir Registration RequirementsDocumento6 pagine10 Easy Steps To Bir Business Registration and A Complete List of Bir Registration RequirementsJohn ManahanNessuna valutazione finora

- Bill 05 04 2021Documento2 pagineBill 05 04 2021Marcelo RivellinoNessuna valutazione finora

- Conveyancing Project WorkDocumento3 pagineConveyancing Project WorkBenjamin Brian NgongaNessuna valutazione finora

- GSTR1 29exrpb9972c1zv 122023Documento4 pagineGSTR1 29exrpb9972c1zv 122023Vinay KalagarlaNessuna valutazione finora

- Bibliography: BooksDocumento17 pagineBibliography: BooksRaj SomaniNessuna valutazione finora

- NVPI1167676 - ForeClosure Archna VajeDocumento2 pagineNVPI1167676 - ForeClosure Archna VajeVARUN KALENessuna valutazione finora

- Screenshot 2024-02-18 at 3.12.37 AMDocumento1 paginaScreenshot 2024-02-18 at 3.12.37 AMraheemtimo1Nessuna valutazione finora

- RMC No. 73-2019 - Annex CDocumento2 pagineRMC No. 73-2019 - Annex CLeo R.Nessuna valutazione finora

- Depreciation For ClassDocumento23 pagineDepreciation For ClasscheeriosNessuna valutazione finora

- Form 16Documento4 pagineForm 16Aruna Kadge JhaNessuna valutazione finora

- Flipkart Labels 19 Jun 2019-08-09Documento10 pagineFlipkart Labels 19 Jun 2019-08-09Shakti MalikNessuna valutazione finora

- JOHN H. OSMEÑA, Petitioner, vs. OSCAR ORBOS, in His Capacity AsDocumento2 pagineJOHN H. OSMEÑA, Petitioner, vs. OSCAR ORBOS, in His Capacity AsMonikkaNessuna valutazione finora

- 15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176Documento1 pagina15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176DHANU DANGINessuna valutazione finora

- Proforma InvoiceDocumento1 paginaProforma Invoicegattikars100% (2)

- R2 NotesDocumento15 pagineR2 NotesAmar Guli100% (2)

- TX-CYP Dec 21 AnswersDocumento8 pagineTX-CYP Dec 21 AnswersKAM JIA LINGNessuna valutazione finora

- Lesson 2 Tax Accounting PrinciplesDocumento39 pagineLesson 2 Tax Accounting PrinciplesakpanyapNessuna valutazione finora