Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Analyze and Distinguish Sources of Interest Risk

Caricato da

Agrey Evance0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

513 visualizzazioni3 pagineAnalyze and Distinguish Sources of Interest Risk

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoAnalyze and Distinguish Sources of Interest Risk

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

513 visualizzazioni3 pagineAnalyze and Distinguish Sources of Interest Risk

Caricato da

Agrey EvanceAnalyze and Distinguish Sources of Interest Risk

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

Analyze and distinguish sources of interest risk.

Interest rate risk. Is the risk to income or capital

arising from fluctuating interest rates. Changes in interest rates

affect a banks earnings by changing its net interest income

and the level of other earnings. Changes in interest rates also

affect the basic value of the banking corporations assets,

liabilities and off- balance sheet financial instruments because

the present value of future cash flows change when interest

rates change. Banking business face interest rate risk in several

ways, including repricing risk, yield curve risk, basis risk, and

optionality risk.

Repricing risk, this is the first and most discussed

form of interest rate risk arises from timing differences in the

maturity and repricing of banking business assets, liabilities

and off-balance sheet positions. Such repricing inequity may

expose a banks income and economic value to unexpected

fluctuations as interest rates differ.

Optionality risk, is the cause of interest rate risk

arising from a change in the outlook or timing of a financial

instruments cash flows caused by changing market interest

rates. This risk arises from the options planed in many banking

corporation assets and liabilities. These options provide the

holder the right, but not the obligation, to buy, sell or in some

way change the cash flow of the financial instrument.

Yield curve risk, yield curve risk arises when

unexpected shifts of the yield curve have negative effects on a

banking corporations income or economic value. The yield

curve may shift due to changing relationships between interest

rates for different maturities of the same index or market.

These changes will be evident in the slope or shape of the

curve.

Basis risk, this is the risk originating from imperfect

relation in the changes of interest rates in different financial

markets or on different instruments with otherwise similar

repricing characteristics. Differences in interest rate changes

can give rise to unpredicted changes in the cash flows and

earnings spread between assets, liabilities and off-balance

sheet instruments of similar maturities or repricing frequencies.

As the discussion above suggests, changes in interest

rates can have negative effects both on a bank's earnings and

its economic value. This has given rise to two separate, but

corresponding overview for assessing a bank's interest rate risk

liability. The perspectives are earnings perspective, In the

earnings perspective, the center of analysis is the effect of

changes in interest rates on accumulated or reported earnings.

This is the traditional approach to interest rate risk assessment

used by many banks. And economic value perspective, change

in market interest rates can also affect the economic value of a

bank's assets, liabilities and off-balance sheet positions.

REFERENCE;

http://ifci.ch/138860.htm

http://www.boi.org.il/en/BankingSupervision

https://www.occ.gov/publications

Potrebbero piacerti anche

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- Construction of Dormitory & Housing compounds in NorochcholaiDocumento33 pagineConstruction of Dormitory & Housing compounds in Norochcholaisaranga100% (1)

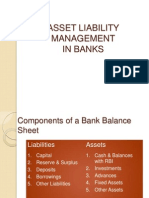

- Asset Liability ManagementDocumento18 pagineAsset Liability Managementmahesh19689Nessuna valutazione finora

- MockupDocumento1 paginaMockupJonathan Parra100% (1)

- Contract of Lease-Water Refilling StationDocumento4 pagineContract of Lease-Water Refilling StationEkeena Lim100% (1)

- Global Market Analysis of Interest Rate RiskDocumento4 pagineGlobal Market Analysis of Interest Rate RiskAnushree BumbNessuna valutazione finora

- Types of Risk in BanksDocumento6 pagineTypes of Risk in Bankssahil100% (2)

- FRM NotesDocumento13 pagineFRM NotesNeeraj LowanshiNessuna valutazione finora

- MARKET & LIQUIDITY RISK MANAGEMENT OVERVIEWDocumento84 pagineMARKET & LIQUIDITY RISK MANAGEMENT OVERVIEWmuhammadasadshamsiNessuna valutazione finora

- Types of Financial RisksDocumento5 pagineTypes of Financial RisksShaharyar QayumNessuna valutazione finora

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Da EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Nessuna valutazione finora

- Market RiskDocumento3 pagineMarket RiskPrasfutita Patnaik100% (1)

- Analyzing A Bank's Financial StatementsDocumento11 pagineAnalyzing A Bank's Financial StatementsnishantkoriaNessuna valutazione finora

- Interest Rate RiskDocumento8 pagineInterest Rate RiskP MajumderNessuna valutazione finora

- X Ay TFF XMST 3 N Avx YDocumento8 pagineX Ay TFF XMST 3 N Avx YRV SATYANARAYANANessuna valutazione finora

- Habawel V Court of Tax AppealsDocumento1 paginaHabawel V Court of Tax AppealsPerry RubioNessuna valutazione finora

- UNIT 4 Market Risk Mgmt.Documento4 pagineUNIT 4 Market Risk Mgmt.Ajay Prakash VermaNessuna valutazione finora

- OCC Interest Rate RiskDocumento74 pagineOCC Interest Rate RiskSara HumayunNessuna valutazione finora

- Asset Liability Management in Banks: Components, Evolution, and Risk ManagementDocumento29 pagineAsset Liability Management in Banks: Components, Evolution, and Risk Managementeknath2000Nessuna valutazione finora

- Interest Rate Risk Management: Learning OutcomesDocumento16 pagineInterest Rate Risk Management: Learning OutcomesAnil ReddyNessuna valutazione finora

- Analyzing A Bank's Financial StatementsDocumento8 pagineAnalyzing A Bank's Financial StatementsMinh Thu Nguyen100% (1)

- 6 Acop v. OmbudsmanDocumento1 pagina6 Acop v. OmbudsmanChester Santos SoniegaNessuna valutazione finora

- Restructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)Documento126 pagineRestructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)CliffhangerNessuna valutazione finora

- Porsche Scheduled Maintenance Plan BrochureDocumento2 paginePorsche Scheduled Maintenance Plan BrochureDavid LusignanNessuna valutazione finora

- Concept of Return and RiskDocumento6 pagineConcept of Return and Risksakshigo100% (7)

- Transfer Pricing - Pitfalls in Using Multiple Benchmark Yield CurvesDocumento6 pagineTransfer Pricing - Pitfalls in Using Multiple Benchmark Yield CurvesPoonsiri WongwiseskijNessuna valutazione finora

- En Cir 051 B 08 Appendix1Documento3 pagineEn Cir 051 B 08 Appendix1Kiran KatyalNessuna valutazione finora

- MCB AssignmentDocumento13 pagineMCB AssignmentTushar DiwakarNessuna valutazione finora

- Manage Interest Rate Risk with Sound PracticesDocumento10 pagineManage Interest Rate Risk with Sound PracticesAkhil SablokNessuna valutazione finora

- Banking Credit ManagementDocumento7 pagineBanking Credit ManagementashwatinairNessuna valutazione finora

- Financial Risk MGTDocumento20 pagineFinancial Risk MGTAmmar HassanNessuna valutazione finora

- Analysis On Islamic Bank On Rate of Return RiskDocumento25 pagineAnalysis On Islamic Bank On Rate of Return RiskNurhidayatul AqmaNessuna valutazione finora

- Overview of The Net Portfolio Value Model: What Is Interest Rate Risk?Documento9 pagineOverview of The Net Portfolio Value Model: What Is Interest Rate Risk?jeanbrNessuna valutazione finora

- Draft Guidance Notes On Interest Rate Risk Management Policies For BanksDocumento13 pagineDraft Guidance Notes On Interest Rate Risk Management Policies For BanksYelkeyNessuna valutazione finora

- Managing Interest Rate Risk: Gap and Earnings SensitivityDocumento50 pagineManaging Interest Rate Risk: Gap and Earnings SensitivityyeehawwwwNessuna valutazione finora

- BRM Session 8 Interest Rate RiskDocumento31 pagineBRM Session 8 Interest Rate RiskSrinita MishraNessuna valutazione finora

- Market Risk FactorsDocumento16 pagineMarket Risk FactorsSanthosh MSNessuna valutazione finora

- Chapter 4: The Structure of Interest Rate: M OneyDocumento14 pagineChapter 4: The Structure of Interest Rate: M OneyReignNessuna valutazione finora

- Analyzing A BankDocumento7 pagineAnalyzing A BanktasleemshahzadNessuna valutazione finora

- Financial CIMA F3 CalculationsDocumento23 pagineFinancial CIMA F3 CalculationsQasim DhillonNessuna valutazione finora

- Interest Rate Risk Management Procedure - 2022 - 12Documento17 pagineInterest Rate Risk Management Procedure - 2022 - 12Ilirjan LigacajNessuna valutazione finora

- Module 10 Quiz-Interest Risk Management - Treasury ManagementDocumento2 pagineModule 10 Quiz-Interest Risk Management - Treasury ManagementAira Denise TecuicoNessuna valutazione finora

- Lecture No.3: Losses Caused by Market, Credit or Liquidity RisksDocumento12 pagineLecture No.3: Losses Caused by Market, Credit or Liquidity RisksSheikh Mohammad Sagor AhmmedNessuna valutazione finora

- Explain and Describe With Examples Systematic Risk and Unsystematic Risk For A Bank?Documento3 pagineExplain and Describe With Examples Systematic Risk and Unsystematic Risk For A Bank?fnajwa55Nessuna valutazione finora

- IRR Overview CompileDocumento25 pagineIRR Overview CompileDarmosoewito LunaNessuna valutazione finora

- Analyzing A Bank's Financial Statements: by Hans WagnerDocumento6 pagineAnalyzing A Bank's Financial Statements: by Hans WagnerMustafaNessuna valutazione finora

- Risk Model BlocksDocumento19 pagineRisk Model BlocksjessicashergillNessuna valutazione finora

- Risk Assessment Methods in The Banking Sector 1711464428Documento10 pagineRisk Assessment Methods in The Banking Sector 1711464428junaidNessuna valutazione finora

- Banking Strategies and Risk ManagementDocumento4 pagineBanking Strategies and Risk ManagementFred DuhagaNessuna valutazione finora

- Banking and FMCG stock performance analysisDocumento57 pagineBanking and FMCG stock performance analysisSuman ArNessuna valutazione finora

- Back To Basics: Non-Determinant DepositsDocumento4 pagineBack To Basics: Non-Determinant DepositskalamayaNessuna valutazione finora

- Risk Management in Banks00001Documento52 pagineRisk Management in Banks00001Neha DhuriNessuna valutazione finora

- Mismatch of Assets and Liabilities: ET Nterest NcomeDocumento1 paginaMismatch of Assets and Liabilities: ET Nterest Ncomeraju vermaNessuna valutazione finora

- Determinants of Spanish Bank Interest Rate ExposureDocumento38 pagineDeterminants of Spanish Bank Interest Rate ExposureAleXyya AlexNessuna valutazione finora

- Guide to Asset and Liability ManagementDocumento18 pagineGuide to Asset and Liability ManagementRuhi KapoorNessuna valutazione finora

- Chapter - 1 Risk ManagementDocumento9 pagineChapter - 1 Risk ManagementShakeelkhanNessuna valutazione finora

- Analysis of Risk and ReturnDocumento38 pagineAnalysis of Risk and ReturnSattagouda PatilNessuna valutazione finora

- Interest Risk ManagementDocumento29 pagineInterest Risk ManagementDannyNessuna valutazione finora

- Types of Risk in BanksDocumento6 pagineTypes of Risk in BankssahilNessuna valutazione finora

- Chapter Eight Interest Rate Risk I: Chapter Outline The Level and Movement of Interest Rates The Repricing ModelDocumento27 pagineChapter Eight Interest Rate Risk I: Chapter Outline The Level and Movement of Interest Rates The Repricing ModelMuhammad Uzair ShahNessuna valutazione finora

- Chapter 008Documento25 pagineChapter 008Muhammad Bilal TariqNessuna valutazione finora

- Impact of Intrest Rate On Profitbility of BanksDocumento26 pagineImpact of Intrest Rate On Profitbility of Bankschashfaq15178% (9)

- Systematic RisksDocumento3 pagineSystematic RisksJavaid NasirNessuna valutazione finora

- Exchange Rates Profitability: Exchange Risk Inflation Risk Exposure Risk Exchange Rate Inflation Rate RevenueDocumento17 pagineExchange Rates Profitability: Exchange Risk Inflation Risk Exposure Risk Exchange Rate Inflation Rate Revenue조안나Nessuna valutazione finora

- Risk Management in Islamic BankingDocumento3 pagineRisk Management in Islamic BankingAfnan FaisalNessuna valutazione finora

- Chapter 3 ALM 1Documento56 pagineChapter 3 ALM 1Niloy AhmedNessuna valutazione finora

- Risk and ReturnDocumento12 pagineRisk and ReturnVeral AgarwalNessuna valutazione finora

- Risk Management For MBA StudentsDocumento28 pagineRisk Management For MBA StudentsMuneeb Sada50% (2)

- Chapter 2 FlywheelDocumento24 pagineChapter 2 Flywheelshazwani zamriNessuna valutazione finora

- WebquestDocumento3 pagineWebquestapi-501133650Nessuna valutazione finora

- Virtual Content SOPDocumento11 pagineVirtual Content SOPAnezwa MpetaNessuna valutazione finora

- 2019-03-30 New Scientist PDFDocumento60 pagine2019-03-30 New Scientist PDFthoma leongNessuna valutazione finora

- KCC Strategic Plan 2020-2023Documento103 pagineKCC Strategic Plan 2020-2023Kellogg Community CollegeNessuna valutazione finora

- Manual Mue Home RGBDocumento8 pagineManual Mue Home RGBJason OrtizNessuna valutazione finora

- FINAL Session 3 Specific GuidelinesDocumento54 pagineFINAL Session 3 Specific GuidelinesBovelyn Autida-masingNessuna valutazione finora

- BS en 12951-2004Documento26 pagineBS en 12951-2004Mokhammad Fahmi IzdiharrudinNessuna valutazione finora

- Wasbi Bank AnalysisDocumento18 pagineWasbi Bank AnalysisHamadia KhanNessuna valutazione finora

- Midterm Exam SolutionsDocumento11 pagineMidterm Exam SolutionsPatrick Browne100% (1)

- Counsel For Plaintiff, Mark Shin: United States District Court Northern District of CaliforniaDocumento21 pagineCounsel For Plaintiff, Mark Shin: United States District Court Northern District of CaliforniafleckaleckaNessuna valutazione finora

- Manual Circulação Forçada PT2008Documento52 pagineManual Circulação Forçada PT2008Nuno BaltazarNessuna valutazione finora

- Product Datasheet ASSA ABLOY DL6120T enDocumento28 pagineProduct Datasheet ASSA ABLOY DL6120T enAbin RajuNessuna valutazione finora

- HBL Power Systems Rectifier Division DocumentsDocumento8 pagineHBL Power Systems Rectifier Division Documentsmukesh_kht1Nessuna valutazione finora

- IT ManagementDocumento7 pagineIT ManagementRebaz Raouf Salih MohammedNessuna valutazione finora

- Dynamics of Fluid-Conveying Beams: Governing Equations and Finite Element ModelsDocumento22 pagineDynamics of Fluid-Conveying Beams: Governing Equations and Finite Element ModelsDario AcevedoNessuna valutazione finora

- 341 BDocumento4 pagine341 BHomero Ruiz Hernandez0% (3)

- CIGB B164 Erosion InterneDocumento163 pagineCIGB B164 Erosion InterneJonathan ColeNessuna valutazione finora

- Distribution Requirements PlanningDocumento8 pagineDistribution Requirements PlanningnishantchopraNessuna valutazione finora

- Coronary artery diseases reviewDocumento43 pagineCoronary artery diseases reviewKeputrian FKUPNessuna valutazione finora

- Identifying Community Health ProblemsDocumento4 pagineIdentifying Community Health ProblemsEmvie Loyd Pagunsan-ItableNessuna valutazione finora

- Family health assessment nursing problemsDocumento8 pagineFamily health assessment nursing problemsMari MazNessuna valutazione finora