Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Modelo Brazos LBO CoMark - F Colin

Caricato da

Paco ColínTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Modelo Brazos LBO CoMark - F Colin

Caricato da

Paco ColínCopyright:

Formati disponibili

By Francisco Coln Valds March 2017

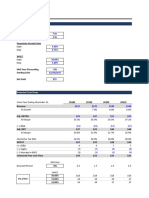

LBO projections for CoMark

P&L ($ in millions) 1998P 1999P 2000P LTM 2001E 2002P 2003P 2004P 2005P 2006P CAGR % 2001-2006

Revenue $11.7 $15.6 $30.0 $35.0 $37.3 $50.5 $56.0 $60.9 $64.8 $69.1 13.1%

Gross Margin $3.2 $5.1 $11.4 $14.9 $15.3 $19.8 $21.0 $22.8 $24.1 $25.7 10.9%

Adjusted EBITDA $1.7 $3.3 $8.1 $10.6 $10.9 $14.7 $16.3 $17.7 $18.8 $19.9 12.8%

EBIT $1.4 $2.9 $7.7 $10.4 $10.7 $14.4 $16.0 $17.3 $18.3 $19.4 12.6%

CAPEX $0.1 $0.1 $0.1 $0.1 $0.1 $0.5 $0.5 $0.5 $0.5 $0.5

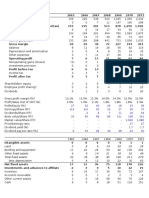

Balance Sheet EoY

($ in millions) 1998P 1999P 2000P LTM 2001E 2002P 2003P 2004P 2005P 2006P

NWC (excl cash) $1.0 $0.5 $2.3 $2.9 $5.3 $5.8 $6.3 $6.8 $7.1

Cash $0.7 $2.0 $1.2 $0.0 $0.0 $0.0 $3.7 $14.4 $26.1

Bank Loan (6.25%) $16.0 $10.6 $4.0 $0.0 $0.0 $0.0

Sellers note (8%) $9.0 $9.7 $10.5 $11.3 $12.2 $13.2 *Increases due to accrued interest

Total Debt $0.0 $0.0 $0.0 $25.0 $20.3 $14.5 $11.3 $12.2 $13.2

Shareholders Equity $2.0 $2.7 $3.8 $15.0 $22.5 $31.1 $40.8 $51.4 $62.8

Cash Flow to Equity

($ in millions) 1998P 1999P 2000P LTM 2001E 2002P 2003P 2004P 2005P 2006P

EBIT $14.4 $16.0 $17.3 $18.3 $19.4

(-) Interest expenses $1.4 $1.1 $0.9 $1.0 $1.1

(-) Taxes (@40%) $0.6 $0.4 $0.4 $0.4 $0.4

(-)Capex $0.5 $0.5 $0.5 $0.5 $0.5

(+) Changes in NWC ($2.4) ($0.5) ($0.5) ($0.5) ($0.3)

(+) New debt $0.0 $0.0 $0.0 $0.0 $0.0

(-) Debt repayment $5.4 $6.6 $4.0 $0.0 $0.0

FCFE $4.1 $6.9 $11.0 $15.9 $17.1

Potrebbero piacerti anche

- Company Name: Financial ModelDocumento13 pagineCompany Name: Financial ModelGabriel AntonNessuna valutazione finora

- Private Equity Model Template For InvestorsDocumento12 paginePrivate Equity Model Template For InvestorsousmaneNessuna valutazione finora

- Lady M DCF TemplateDocumento4 pagineLady M DCF Templatednesudhudh100% (1)

- Complete Private Equity ModelDocumento16 pagineComplete Private Equity ModelMichel MaryanovichNessuna valutazione finora

- LBO (Leveraged Buyout) Model For Private Equity FirmsDocumento2 pagineLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaNessuna valutazione finora

- $ in Millions, Except Per Share DataDocumento59 pagine$ in Millions, Except Per Share DataTom HoughNessuna valutazione finora

- BofA Q2 2017Documento28 pagineBofA Q2 2017ZerohedgeNessuna valutazione finora

- Millions of Dollars Except Per-Share DataDocumento17 pagineMillions of Dollars Except Per-Share DataWasp_007_007Nessuna valutazione finora

- Victoria Chemicals PLC (B) - The Merseyside and Rotterdam Projects (SPREADSHEET) F-1544XDocumento4 pagineVictoria Chemicals PLC (B) - The Merseyside and Rotterdam Projects (SPREADSHEET) F-1544XPaco ColínNessuna valutazione finora

- Andreessen Horowitz - F ColinDocumento3 pagineAndreessen Horowitz - F ColinPaco Colín50% (4)

- Andreessen Horowitz - F ColinDocumento3 pagineAndreessen Horowitz - F ColinPaco Colín50% (4)

- Earn-Out TemplateDocumento9 pagineEarn-Out Templatevaibhav sinhaNessuna valutazione finora

- Rumus Lot FXCL Rumus Lot Insta ForexDocumento4 pagineRumus Lot FXCL Rumus Lot Insta ForexMuhammad Husain AbdillahNessuna valutazione finora

- Aurora Textile Company (SPREADSHEET) F-1536X - FCVDocumento15 pagineAurora Textile Company (SPREADSHEET) F-1536X - FCVPaco ColínNessuna valutazione finora

- Outreach NetworksDocumento3 pagineOutreach NetworksPaco Colín50% (2)

- Groupe Ariel CaseDocumento9 pagineGroupe Ariel CasePaco Colín86% (7)

- Groupe Ariel CaseDocumento9 pagineGroupe Ariel CasePaco Colín86% (7)

- Economy Shipping Co Case SolutionDocumento7 pagineEconomy Shipping Co Case SolutionPaco Colín100% (2)

- Tugas 1 - Problem 1-12Documento2 pagineTugas 1 - Problem 1-12cemkudaNessuna valutazione finora

- Tottenham Case HBS Financials ValuationDocumento14 pagineTottenham Case HBS Financials ValuationPaco Colín0% (2)

- Outreach Networks Case DardenDocumento3 pagineOutreach Networks Case DardenPaco Colín100% (1)

- Outreach Networks Case DardenDocumento3 pagineOutreach Networks Case DardenPaco Colín100% (1)

- Genzyme and Relational Investors - Science and Business Collide (SPREADSHEET) F-1660XDocumento35 pagineGenzyme and Relational Investors - Science and Business Collide (SPREADSHEET) F-1660XPaco ColínNessuna valutazione finora

- Final Sheet DCF - With SynergiesDocumento4 pagineFinal Sheet DCF - With SynergiesAngsuman BhanjdeoNessuna valutazione finora

- Sneaker 2013 ExcelDocumento8 pagineSneaker 2013 ExcelMehwish Pervaiz67% (6)

- Centennial Pharmaceutical Corporation (SPREADSHEET) F-1446XDocumento14 pagineCentennial Pharmaceutical Corporation (SPREADSHEET) F-1446XPaco ColínNessuna valutazione finora

- Wildcat Capital Case M&A Invesment Real EstateDocumento7 pagineWildcat Capital Case M&A Invesment Real EstatePaco Colín8% (12)

- Wildcat Capital Case M&A Invesment Real EstateDocumento7 pagineWildcat Capital Case M&A Invesment Real EstatePaco Colín8% (12)

- Bsim - Op - Per 11Documento63 pagineBsim - Op - Per 11Paco ColínNessuna valutazione finora

- City of Lansing - General Fund Budget - Revision - FY10Documento1 paginaCity of Lansing - General Fund Budget - Revision - FY10api-25946258Nessuna valutazione finora

- CLW Analysis 6-1-21Documento5 pagineCLW Analysis 6-1-21HunterNessuna valutazione finora

- Apple Return of Capital and Net Cash Position: $ in BillionsDocumento1 paginaApple Return of Capital and Net Cash Position: $ in BillionsseanNessuna valutazione finora

- UST Debt Policy Spreadsheet (Reduced)Documento9 pagineUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonNessuna valutazione finora

- Sbux, Peet, and Pro-Forma Pete-DdrxDocumento12 pagineSbux, Peet, and Pro-Forma Pete-DdrxfcfroicNessuna valutazione finora

- LORL Write UpDocumento5 pagineLORL Write UpAIGswap100% (1)

- Gopher - Drugs - Modeling Net Present ValueDocumento2 pagineGopher - Drugs - Modeling Net Present ValueAqib abdullahNessuna valutazione finora

- FM and Dupont of GenpactDocumento11 pagineFM and Dupont of GenpactKunal GarudNessuna valutazione finora

- BOLT DCF ValuationDocumento1 paginaBOLT DCF ValuationOld School ValueNessuna valutazione finora

- Manitoba School Funding 2024-25Documento2 pagineManitoba School Funding 2024-25ChrisDcaNessuna valutazione finora

- Bottom Fishing in Cyclicals: Valuex Vail - June 2011 Dante AlbertiniDocumento26 pagineBottom Fishing in Cyclicals: Valuex Vail - June 2011 Dante AlbertiniKevinSunNessuna valutazione finora

- Top NM-3rd Export of Goods To Korea in 2016Documento2 pagineTop NM-3rd Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)Nessuna valutazione finora

- Lesson 3Documento29 pagineLesson 3Anh MinhNessuna valutazione finora

- Irving Budget Update 2010-07-07Documento22 pagineIrving Budget Update 2010-07-07Irving BlogNessuna valutazione finora

- 22.03.10 - Modelo CIBC Adaptado MH - V3 - INCLUDING 3rd Parties Ore PurchasesDocumento148 pagine22.03.10 - Modelo CIBC Adaptado MH - V3 - INCLUDING 3rd Parties Ore PurchasesCarlos Enrique Rodrìguez FloresNessuna valutazione finora

- Q1 24 Return of Capital TimelineDocumento1 paginaQ1 24 Return of Capital Timelinemustabshirah.nayerNessuna valutazione finora

- Gestão de Banca TraderDocumento6 pagineGestão de Banca TraderAnderson DevNessuna valutazione finora

- New York - 9Documento2 pagineNew York - 9Korea Economic Institute of America (KEI)Nessuna valutazione finora

- Base CaseDocumento9 pagineBase Casechanapa klongpobsukNessuna valutazione finora

- Top OK-4th Export of Goods To Korea in 2016Documento2 pagineTop OK-4th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)Nessuna valutazione finora

- GTY Getty ImagesDocumento2 pagineGTY Getty Imagesinanimation100% (1)

- OB - Gerenciamento de Banca - 3 AnosDocumento52 pagineOB - Gerenciamento de Banca - 3 AnosAcauã Suassuna DutraNessuna valutazione finora

- Top NY-9th Export of Goods To Korea in 2016Documento2 pagineTop NY-9th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)Nessuna valutazione finora

- Mini-Case - Banana Inc (2023)Documento1 paginaMini-Case - Banana Inc (2023)hubery200011Nessuna valutazione finora

- Class Exercise Fashion Company Three Statements Model - CompletedDocumento16 pagineClass Exercise Fashion Company Three Statements Model - CompletedbobNessuna valutazione finora

- DCF Template: Start StepDocumento11 pagineDCF Template: Start StepBrian DongNessuna valutazione finora

- Wild Wood Case StudyDocumento6 pagineWild Wood Case Studyaudrey gadayNessuna valutazione finora

- AmstedamfollyDocumento1 paginaAmstedamfollyflippinamsterdamNessuna valutazione finora

- Hill Country Snack Foods CompanyDocumento14 pagineHill Country Snack Foods CompanyVeni GuptaNessuna valutazione finora

- Rosetta Stone FinancialsDocumento2 pagineRosetta Stone FinancialsAvaSeaveNessuna valutazione finora

- Earnings Release (FY22 Q3) FINALDocumento12 pagineEarnings Release (FY22 Q3) FINALIra BanksNessuna valutazione finora

- StockDelver CalculatorDocumento11 pagineStockDelver CalculatorAhtsham AhmadNessuna valutazione finora

- Top NY-7th Export of Goods To Korea in 2016Documento2 pagineTop NY-7th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)Nessuna valutazione finora

- MacabacusEssentialsDemoComplete 210413 104622Documento21 pagineMacabacusEssentialsDemoComplete 210413 104622Pratik PatwaNessuna valutazione finora

- Johnson & Johnson JNJ Stock-Sample Analysis Report Intrinsic ValueDocumento12 pagineJohnson & Johnson JNJ Stock-Sample Analysis Report Intrinsic ValueOld School Value100% (2)

- Historical ProjectionsDocumento2 pagineHistorical ProjectionshekmatNessuna valutazione finora

- Monthly DividendDocumento19 pagineMonthly DividendtomasvonparquerNessuna valutazione finora

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Documento6 pagineSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNessuna valutazione finora

- Jones Electrical SolutionDocumento21 pagineJones Electrical SolutioneduardoNessuna valutazione finora

- Florida - 18Documento2 pagineFlorida - 18Korea Economic Institute of America (KEI)Nessuna valutazione finora

- CPRT Us Equity - Model - ZCK - Mar 15 2023Documento23 pagineCPRT Us Equity - Model - ZCK - Mar 15 2023Ekambaram Thirupalli TNessuna valutazione finora

- Simple One Page LBO 10-18-08Documento3 pagineSimple One Page LBO 10-18-08Adam WuegerNessuna valutazione finora

- Micro-Econ Signature Assignment - Gavin WestDocumento4 pagineMicro-Econ Signature Assignment - Gavin Westapi-531246385Nessuna valutazione finora

- CDL Ar2013Documento224 pagineCDL Ar2013lizNessuna valutazione finora

- Session 03: CFP: Capital Investment Analysis: Calenda R Location CR 180 Details Class 3 - Aug 29Documento2 pagineSession 03: CFP: Capital Investment Analysis: Calenda R Location CR 180 Details Class 3 - Aug 29Paco ColínNessuna valutazione finora

- Session 02: CFP: Discounted Cash Flow and Management CompensationDocumento1 paginaSession 02: CFP: Discounted Cash Flow and Management CompensationPaco ColínNessuna valutazione finora

- Session 01 CFP Investor RelationsActivist InvestorsDocumento1 paginaSession 01 CFP Investor RelationsActivist InvestorsPaco ColínNessuna valutazione finora

- Norfolk SC Prep Q-S Case BondsDocumento20 pagineNorfolk SC Prep Q-S Case BondsPaco ColínNessuna valutazione finora

- 915 529 Supplement Landmark XLS ENGDocumento32 pagine915 529 Supplement Landmark XLS ENGPaco ColínNessuna valutazione finora

- Springfield Case SolDocumento7 pagineSpringfield Case SolPaco ColínNessuna valutazione finora

- Demand For Kodak Case EconomicsDocumento14 pagineDemand For Kodak Case EconomicsPaco ColínNessuna valutazione finora

- Using The Equity Residual Approach To Valuation - An Example F-1267Documento3 pagineUsing The Equity Residual Approach To Valuation - An Example F-1267Paco ColínNessuna valutazione finora

- Antenour Team 1 Solution NetworkDocumento4 pagineAntenour Team 1 Solution NetworkPaco ColínNessuna valutazione finora

- Do's & Dont's en Una Venta de Tu EmpresaDocumento3 pagineDo's & Dont's en Una Venta de Tu EmpresaPaco ColínNessuna valutazione finora

- The Fashion Channel - Calculations HBS CaseDocumento2 pagineThe Fashion Channel - Calculations HBS CasePaco ColínNessuna valutazione finora

- Care Four Case StudyDocumento3 pagineCare Four Case StudyPaco ColínNessuna valutazione finora