Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

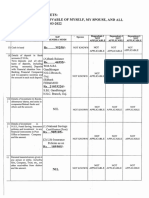

Duplication Asset Type Founded in Form No. II

Caricato da

pviveknaiduTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Duplication Asset Type Founded in Form No. II

Caricato da

pviveknaiduCopyright:

Formati disponibili

IGCAR-Assets and Liabilities Form Page 1 of 2

Welcome,NARAYANA RAO P. ! Tuesday,05 April 2016 11:47:17

Dashboard Help My Account Logout

Home Self Service

Asset Liability Return

Save | Submit_and_Forward_to_Admin |

Draft

Duplication Asset type founded in Form No. II

IC No 06239 Name NARAYANA RAO P.

Grade TO/C Group/Div/Sec FRTG/SGTF/SGTFOS

Designation Group Group A

Contact number 21111/22102/21113 Return year 2015

Get last year details Please click once and wait form to be reloaded with data.

Form No. I

Details of Public servant, his/her spouse and dependent children

Member name Relationship Public position Whether return

held, if any being filed by

him/her,

separately

1. NARAYANA RAO P. SELF

SELF No Yes

2. HYMA.P Spouse

Spouse No No

3. VIVEK BABU NAIDU.P Son

Son No No

4. VISHWA TEJA.P Son

Son No No

Form No. II Amount in Rupees / Weight in grams for jewellery

Statement of Movable property

Asset type Remarks, if any Self Spouse Dependent -1 Dependent -2 Dependent -3 Dependent -4

1. Cash in Bank Balance 21000 15000 0 0 0

2. Insurance Premia (paid) 0 0 0 0 0

3. Provident Fund / Pension Scheme 0 0 0 0 0

4. Loans / advances given 0 0 0 0 0

5. Gold jewellery (in grams) 0 0 0 0 0

6. Silver jewellery (in grams) 0 0 0 0 0

7. Motor vehicles 0 0 0 0 0

8. Motor vehicles 0 0 0 0 0

9. Motor vehicles 0 0 0 0 0

10. Silver jewellery (in grams) 0 0 0 0 0

11. --- None --- 0 0 0 0 0

Form No. III

Statement of Immovable property

Description of Precise location Area of land (in Nature of land in Extent of Interest If not in name of

Property (Name of District, case of land and case of landed (Percentage in public servant,

(Land/House/Flat/Shop/Industrial Division, Taulk buildings) property Share) state in whose

etc.) and village in name held and

which the property his/her

is situated and relationship, if any

also in distinctive to the public

number, etc.,) servant.

http://10.7.1.56/c/portal/layout?p_l_id=1204.1&hierarchy=Self Service -->O and M -->Asse... 4/5/2016

IGCAR-Assets and Liabilities Form Page 2 of 2

1.

2.

Note : Type Nill if no information is provided

Form No. IV

Statement of Debts and other liabilities

Debtor (Self / Relationship Amount Name and Details of Remarks

Spouse or Address of Transaction /

Dependent Creditor Loan

Children)

1. NARAYANA RAO P. SELF

SELF 0

I hereby declare that the return enclosed namely, Forms I to IV are complete, true and correct to the best of my knowledge and belief, in respect of information due to be furnished by me under

the Lokpal and Lokayuktas Act, 2013.

Remarks

History

User name Date Action Remarks

Note 1:This return shall contain particulars of all assets and liabilities of the public servant eiether in his/her own name or in the name of any other person. The return should include details in respect of assets/liabilities o

children as provided in section 44(2) of the Lokpal and Lokayuktas Act, 2013.

(Section 44(2): A public servant shall, within a period of thirty days from the date on which he makes and subscribes on oath or affirmation to enter upon his office, furnish to the competent authority the information

a)The assets of which he, his spouse and his dependent children are, jointly or severally, owners or beneficiaries;

b)His liabilities and that of his spouse and his dependent children.)

Note 2:If a public servant is a member of Hindu Undivided Family with co-parcenary rights in the properties of the family eiether as 'Karta' or as a member, he should indicate in the return in Form No. III the value of his s

where it is not possible to indicate the exact value of such share, its approximate value. Suitable explanatory notes may be added wherever necessary.

Note 3:dependent children means sons and daughters who have no separate means of earning and are wholly dependent on the public servant for their livelihood. (Explanation below section 44(3) of Lokpal and Lokay

Form No. II

Note 1:For Cash in Bank Balance, Details of deposits in the foreign Bank(s) to be given separately.

Note 2:For Insurance/FD/RD/Shares/Bonds/Mutual Funds/Pension/Provident fund/other investments, Investments above Rs. 2 lakhs to be reported individually. Investments below Rs.2 lakhs may be reported together.

Note 3:For Personal Loans / advances given, Personal loans / advance given to any person or entity including Firm, Company, Trust, etc and other receivables from debtors and the amount (exceeding two

months basic pay or Rupees one lakh as the case may be).

Note 4:For Motor Vehicles, Details of Make / registration number / year of purchase and amount paid).

Note 5:For Jewellery, Value indicated in the first return need not be revised in subsequent returns as long as no new composite item had been acquired or no existing items had been disposed of, during the

relevant year. Give details of approximate weight (plus or minus 10 gms in respect of gold and precious stones, plus or minus 100 gms in respect of silver).

Note 6:For Any other Assets details of movable assets not covered in list above , only if the total current value of any particular asset in any particular category (e.g. Furniture, fixtures, electronic equipments, Antiques, Pa

others etc.) exceeding two months basic pay or Rs. 1 Lakh, as the case may be.

Form No. III

Note 1:For Purpose of column 8, the term lease would mean a lease of immovable property from year to year for any term exceeding one year or reserving a yearly rent.

Where, however, the lease of immovable property is obtained from a person having official dealings with the Government servant, such a lease should be shown in this column irrespective of the team of the lease

long term, and the periodicity of the payment of rent.

Form No. IV

Note 1:Individual items of loans not exceeding two months basic pay (where applicable) and Rs. 1 lakh in other cases need not be included.

Note 2:The statement should also include various loans and advances (exceeding the value in Note 1) taken from banks, companies, financial institutions, Central / State Government and from individuals.

http://10.7.1.56/c/portal/layout?p_l_id=1204.1&hierarchy=Self Service -->O and M -->Asse... 4/5/2016

Potrebbero piacerti anche

- Bit Welfare 200100293Documento1 paginaBit Welfare 200100293RITIKANessuna valutazione finora

- Place Mumbai: Annexure To Form 16 Part BDocumento3 paginePlace Mumbai: Annexure To Form 16 Part BsivaNessuna valutazione finora

- I Wayan BusmartanaDocumento5 pagineI Wayan BusmartanaNarayana SaskaraNessuna valutazione finora

- BIR Form 1604cfDocumento3 pagineBIR Form 1604cfMaryjean PoquizNessuna valutazione finora

- CDR SLIS JRDocumento33 pagineCDR SLIS JRMaria Kristel L PascualNessuna valutazione finora

- CDR SLIS May June AS ONEDocumento34 pagineCDR SLIS May June AS ONEMaria Kristel L PascualNessuna valutazione finora

- Annexure To Form 16 - TCS - 20202021Documento3 pagineAnnexure To Form 16 - TCS - 20202021Kritansh BindalNessuna valutazione finora

- Annexure To Form 16Documento3 pagineAnnexure To Form 16mohitverma.840Nessuna valutazione finora

- Loan Account Statement For 453Dpffd078248Documento3 pagineLoan Account Statement For 453Dpffd078248Rajan waghmareNessuna valutazione finora

- Unclaimed Dividend 2016-17Documento139 pagineUnclaimed Dividend 2016-17harkeshNessuna valutazione finora

- 968 Glass & Aluminum Co.Documento10 pagine968 Glass & Aluminum Co.Ben Carlo RamosNessuna valutazione finora

- Sbi Mutual Fund (Equity) - 042008Documento2 pagineSbi Mutual Fund (Equity) - 042008bapisroyNessuna valutazione finora

- OutputDocumento1 paginaOutputjinggoystudypartyNessuna valutazione finora

- Bir Form 2307Documento2 pagineBir Form 2307Geraldine BacoNessuna valutazione finora

- Vinay Talikoti-10-11Documento36 pagineVinay Talikoti-10-11pranita_pNessuna valutazione finora

- 4TH QTR 2018 2307 z1 PDFDocumento1 pagina4TH QTR 2018 2307 z1 PDFchristianNessuna valutazione finora

- Certificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroDocumento5 pagineCertificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroChristcelda lozadaNessuna valutazione finora

- Payroll: Migo Construction Alegria 4 StoreyDocumento7 paginePayroll: Migo Construction Alegria 4 StoreyLexid Pero GrisolaNessuna valutazione finora

- CHD 2Documento40 pagineCHD 2Yakshit JainNessuna valutazione finora

- Property StatementDocumento1 paginaProperty StatementSURYAKANTA9p ROUTNessuna valutazione finora

- 2307 LessorDocumento3 pagine2307 LessorPaul EspinosaNessuna valutazione finora

- Unclaimed 1st Interim Dividend 2009 10 PDFDocumento44 pagineUnclaimed 1st Interim Dividend 2009 10 PDFArvind R PissayNessuna valutazione finora

- BeneficiaryDetailForSocialAuditReport PMAYG 3203005 2019-2020Documento93 pagineBeneficiaryDetailForSocialAuditReport PMAYG 3203005 2019-2020Movies SpecialNessuna valutazione finora

- PARCORDocumento11 paginePARCORJdar Ronil I SastrilloNessuna valutazione finora

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocumento1 paginaCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasMARJONNessuna valutazione finora

- CARELIFT - BIR Form No. 1604E 2021Documento1 paginaCARELIFT - BIR Form No. 1604E 2021Jay Mark DimaanoNessuna valutazione finora

- Annexure Form BlankDocumento2 pagineAnnexure Form BlankAkash puriNessuna valutazione finora

- FY2022 23 Annexure To Form16Documento3 pagineFY2022 23 Annexure To Form16Joydip MukhopadhyayNessuna valutazione finora

- Simplified Return of in Come For ManufacturersDocumento4 pagineSimplified Return of in Come For ManufacturersSyed Faisal AhsanNessuna valutazione finora

- BeneficiaryDetailForSocialAuditReport PMAYG 2406008 2019-2020Documento3 pagineBeneficiaryDetailForSocialAuditReport PMAYG 2406008 2019-2020Gagan chandra ParidaNessuna valutazione finora

- Abayao-Worwor Furniture ShopDocumento4 pagineAbayao-Worwor Furniture ShopBen Carlo RamosNessuna valutazione finora

- Date of AGM : Dd-Mon-YyyyDocumento26 pagineDate of AGM : Dd-Mon-YyyyrNessuna valutazione finora

- Shri Narendra ModiDocumento4 pagineShri Narendra Modiaapka pyara lalitNessuna valutazione finora

- Sales - 5210Documento1 paginaSales - 5210sharlu80Nessuna valutazione finora

- ADMDocumento2 pagineADMJane BiebsNessuna valutazione finora

- Proposal - FINALDocumento13 pagineProposal - FINALADVISE WISENessuna valutazione finora

- Print - Udyam Registration CertificateDocumento4 paginePrint - Udyam Registration CertificateAmitkansal92Nessuna valutazione finora

- 404SPFFM480689 Repayment ScheduleDocumento3 pagine404SPFFM480689 Repayment ScheduleAnkurNessuna valutazione finora

- Balance Sheet Abstract & Company'S General Business Profile: I. Registration DetailsDocumento3 pagineBalance Sheet Abstract & Company'S General Business Profile: I. Registration Detailsravibhartia1978Nessuna valutazione finora

- Balance Sheet Abstract & Company'S General Business Profile: I. Registration DetailsDocumento3 pagineBalance Sheet Abstract & Company'S General Business Profile: I. Registration Detailsravibhartia1978Nessuna valutazione finora

- April FS AAA 14Documento47 pagineApril FS AAA 14Levi Lazareno EugenioNessuna valutazione finora

- Annual Statement of Provident Fund Accounts For The Year Ended 2003Documento3 pagineAnnual Statement of Provident Fund Accounts For The Year Ended 2003ଜିଲ୍ଲା ମୂଖ୍ୟ ଚିକିତ୍ସାଧିକାରୀ, ମାଲକାନଗିରିNessuna valutazione finora

- Bir Form 2307Documento3 pagineBir Form 2307Salve Dela Cruz100% (5)

- Certificate of Creditable Tax Withheld at Source: Redil, AngelikaDocumento2 pagineCertificate of Creditable Tax Withheld at Source: Redil, AngelikaAngelika Plaza RedilNessuna valutazione finora

- 1st Quarter Manpower 2021Documento1 pagina1st Quarter Manpower 2021julnaser s. akmadNessuna valutazione finora

- Wda Smartforms 2 - UolDocumento5 pagineWda Smartforms 2 - UolMahboobUlHasanNessuna valutazione finora

- Statement of GPF Accounts For The Year Ended: (Rupees One Lakh Seventy-Three Thousand Two Hundred Fifty-Four Only)Documento12 pagineStatement of GPF Accounts For The Year Ended: (Rupees One Lakh Seventy-Three Thousand Two Hundred Fifty-Four Only)Nani Gopal SahaNessuna valutazione finora

- 2023-24 12baDocumento3 pagine2023-24 12baiammouliNessuna valutazione finora

- Civil Core Projects India PVT LTD: Salary Slip For The Month of Jan 2021Documento6 pagineCivil Core Projects India PVT LTD: Salary Slip For The Month of Jan 2021Dhanush DMNessuna valutazione finora

- Search Report - SSEPLDocumento6 pagineSearch Report - SSEPLCA Swamyreddy MvNessuna valutazione finora

- Cif Opg Form ENTITY Full Kyc Annexure 3Documento1 paginaCif Opg Form ENTITY Full Kyc Annexure 3Vibhu Sharma JoshiNessuna valutazione finora

- 406GDFFB883219 SoaDocumento10 pagine406GDFFB883219 SoaVishal Vijay SoniNessuna valutazione finora

- Claimspaid Fir 20Documento39 pagineClaimspaid Fir 20sNessuna valutazione finora

- Sec Header Tax Component Declarations (INR) Proof (INR) Cleared (INR) Rejected (INR) RemarksDocumento2 pagineSec Header Tax Component Declarations (INR) Proof (INR) Cleared (INR) Rejected (INR) RemarksJogesh KumarNessuna valutazione finora

- Payroll - BNS NewDocumento3 paginePayroll - BNS Newjacqueline subidoNessuna valutazione finora

- Centralaized ReportDocumento2 pagineCentralaized ReportMelvin AppaduraiNessuna valutazione finora

- PC Square2307Documento3 paginePC Square2307SirManny ReyesNessuna valutazione finora

- Cash Disbursements Record: Entity Name: Fund Cluster: Sheet No.Documento1 paginaCash Disbursements Record: Entity Name: Fund Cluster: Sheet No.Joshua Ponce ToñacaoNessuna valutazione finora

- PTCL Bill New Format PDFDocumento1 paginaPTCL Bill New Format PDFmuneebNessuna valutazione finora

- CBSE Class 7 Social Science Question Paper Set CDocumento6 pagineCBSE Class 7 Social Science Question Paper Set CpviveknaiduNessuna valutazione finora

- WishesDocumento1 paginaWishespviveknaiduNessuna valutazione finora

- WritingDocumento35 pagineWritingpviveknaiduNessuna valutazione finora

- Gem Availability Report & Past Transaction SummaryDocumento9 pagineGem Availability Report & Past Transaction SummarypviveknaiduNessuna valutazione finora

- CBSE Class 7 Social Science Question Paper Set ADocumento6 pagineCBSE Class 7 Social Science Question Paper Set Asiba padhy100% (2)

- Class7 - Bio - Nutrition in AnimalsDocumento6 pagineClass7 - Bio - Nutrition in AnimalspviveknaiduNessuna valutazione finora

- CBSE Class 7 Social Science Question Paper Set B PDFDocumento1 paginaCBSE Class 7 Social Science Question Paper Set B PDFpviveknaidu0% (1)

- Sharma 1Documento5 pagineSharma 1pviveknaiduNessuna valutazione finora

- Mtech Material Science Engg 1Documento18 pagineMtech Material Science Engg 1sujit_sekharNessuna valutazione finora

- Read The Poem CarefullyDocumento4 pagineRead The Poem CarefullypviveknaiduNessuna valutazione finora

- 06 MatDocumento4 pagine06 MatpviveknaiduNessuna valutazione finora

- 06 - SST QPDocumento4 pagine06 - SST QPpviveknaiduNessuna valutazione finora

- Class7 - Bio - Nutrition in AnimalsDocumento6 pagineClass7 - Bio - Nutrition in AnimalspviveknaiduNessuna valutazione finora

- Fifth Sep Oct 14Documento17 pagineFifth Sep Oct 14pviveknaiduNessuna valutazione finora

- 06 - SST QPDocumento4 pagine06 - SST QPpviveknaiduNessuna valutazione finora

- Elec 2013Documento20 pagineElec 2013pviveknaiduNessuna valutazione finora

- 1.1 Sodium Cooled Fast Breeder ReactorsDocumento31 pagine1.1 Sodium Cooled Fast Breeder ReactorspviveknaiduNessuna valutazione finora

- Mechanical-Engineering Gate2016.InfoDocumento3 pagineMechanical-Engineering Gate2016.InfoHenryNessuna valutazione finora

- Cil Exam PaperDocumento37 pagineCil Exam PaperpviveknaiduNessuna valutazione finora

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Materials Science and Engineering - A First Course - V. RaghavanDocumento53 pagineMaterials Science and Engineering - A First Course - V. Raghavanpviveknaidu60% (5)

- Hindi Book ManuSmritiDocumento649 pagineHindi Book ManuSmritigovind1329887% (23)

- Procedures For Uninterruptible Power Supply (UPS) Systems: BangorDocumento5 pagineProcedures For Uninterruptible Power Supply (UPS) Systems: BangorpviveknaiduNessuna valutazione finora

- Class 4 Unit 10 Worksheet For Sa2 EnglishDocumento3 pagineClass 4 Unit 10 Worksheet For Sa2 EnglishpviveknaiduNessuna valutazione finora

- 4th STD Unit 6 Worksheet For Revision in EnglishDocumento3 pagine4th STD Unit 6 Worksheet For Revision in EnglishpviveknaiduNessuna valutazione finora

- Ws Cl4 Eng GR U 6 2016-17 Word DocumentDocumento5 pagineWs Cl4 Eng GR U 6 2016-17 Word DocumentpviveknaiduNessuna valutazione finora

- CL 3 ENG SD Worksheet 2016-17Documento5 pagineCL 3 ENG SD Worksheet 2016-17pviveknaiduNessuna valutazione finora

- Class 4 Unit 10 Worksheet For Sa2 EnglishDocumento3 pagineClass 4 Unit 10 Worksheet For Sa2 EnglishpviveknaiduNessuna valutazione finora

- 4 Maths Ws Kss2017Documento6 pagine4 Maths Ws Kss2017pviveknaiduNessuna valutazione finora

- Class 4 Unit 9 Worksheet For Sa2 EnglishDocumento3 pagineClass 4 Unit 9 Worksheet For Sa2 EnglishpviveknaiduNessuna valutazione finora

- Is Content Commerce Really Working For IndiaDocumento11 pagineIs Content Commerce Really Working For IndiaPriti RajputNessuna valutazione finora

- Shrem InvIT Investor Data Sheet Nov 23 2023Documento40 pagineShrem InvIT Investor Data Sheet Nov 23 2023Amber GuptaNessuna valutazione finora

- Maryland State Retirment An Pension System - 2009 CAFRDocumento118 pagineMaryland State Retirment An Pension System - 2009 CAFRWashington ExaminerNessuna valutazione finora

- Cash Flow Problems and SolutionsDocumento23 pagineCash Flow Problems and SolutionsSangetaSinghNessuna valutazione finora

- Introduction To Corporate Finance 4th Edition Booth Test BankDocumento36 pagineIntroduction To Corporate Finance 4th Edition Booth Test Bankinclined.coax.06kqNessuna valutazione finora

- F. No. 117ADocumento6 pagineF. No. 117ADipak Prasad100% (1)

- Bank of The Philippine Islands (Bpi) : Company BackgroundDocumento4 pagineBank of The Philippine Islands (Bpi) : Company BackgroundJanefer MagistradoNessuna valutazione finora

- A Comparative Study On Investment Pattern...Documento9 pagineA Comparative Study On Investment Pattern...cpmrNessuna valutazione finora

- 4) Audit of InvestmentsDocumento178 pagine4) Audit of Investmentsgolgola123Nessuna valutazione finora

- Duties and Responsibilities of Finance ManagerDocumento2 pagineDuties and Responsibilities of Finance ManagerPATRICK EDWARDNessuna valutazione finora

- Asset-Liability Management in BanksDocumento42 pagineAsset-Liability Management in Banksnike_4008a100% (1)

- SARIE Payment ProcessDocumento45 pagineSARIE Payment Processsheik abdullahNessuna valutazione finora

- Cambridge Assessment International Education: This Document Consists of 19 Printed PagesDocumento19 pagineCambridge Assessment International Education: This Document Consists of 19 Printed Pagestecho2345Nessuna valutazione finora

- 2016 Bar ExaminationsDocumento37 pagine2016 Bar ExaminationsPingotMagangaNessuna valutazione finora

- Fair Value Accounting and Reliability - The Problem With Level 3 Estimates - CPA JournalDocumento7 pagineFair Value Accounting and Reliability - The Problem With Level 3 Estimates - CPA JournalranamuhammadazeemNessuna valutazione finora

- Larry Williams - Trading Patterns For Stocks and CommoditiesDocumento8 pagineLarry Williams - Trading Patterns For Stocks and CommoditiesAlex Grey83% (6)

- Managerial Economics (BCOM) - Module VDocumento7 pagineManagerial Economics (BCOM) - Module VshamilpokkavilNessuna valutazione finora

- 12 Capital Budgeting v2Documento3 pagine12 Capital Budgeting v2kris mNessuna valutazione finora

- DCF Valuation - Aswath DamodaranDocumento60 pagineDCF Valuation - Aswath DamodaranUtkarshNessuna valutazione finora

- Azgard Nine Limited-Internship ReportDocumento102 pagineAzgard Nine Limited-Internship ReportM.Faisal100% (1)

- Optimised Funds Fairbairn Capital's Investment Frontiers From Old MutualDocumento2 pagineOptimised Funds Fairbairn Capital's Investment Frontiers From Old MutualTiso Blackstar GroupNessuna valutazione finora

- Chapter 16 Advanced Accounting Solution ManualDocumento94 pagineChapter 16 Advanced Accounting Solution ManualVanessa DozonNessuna valutazione finora

- Analysis On Islamic Bank On Rate of Return RiskDocumento25 pagineAnalysis On Islamic Bank On Rate of Return RiskNurhidayatul AqmaNessuna valutazione finora

- S9 - XLS069-XLS-ENG MarriottDocumento12 pagineS9 - XLS069-XLS-ENG MarriottCarlosNessuna valutazione finora

- Quiz Investment Appraisal - GeorgeDocumento16 pagineQuiz Investment Appraisal - GeorgeGABRIELLA GUNAWANNessuna valutazione finora

- 20181122Documento1 pagina20181122Brian HuangNessuna valutazione finora

- Ammann Tracking Error Variance Decomposition FinalDocumento37 pagineAmmann Tracking Error Variance Decomposition Finalswinki3Nessuna valutazione finora

- A Summer Internship Project Report OnDocumento138 pagineA Summer Internship Project Report OnVineet Kumar80% (5)

- Option Pricing TheoryDocumento5 pagineOption Pricing TheoryNadeemNessuna valutazione finora